An audit of financial statements is a set of special procedures that allow us to formulate an opinion on the reliability of the reporting information. What is the meaning of an audit, how its results are presented, and what are the requirements for auditors, find out from our material.

The essence of the audit of financial statements

Purpose of the financial statements audit

Independence and professional skepticism in the audit of financial statements

Additional requirements for the auditor

The main objectives of the audit of financial statements

Registration of audit results

Results

The essence of the audit of financial statements

Financial reporting is a concentrated set of indicators that characterize the work of a specific business entity for a certain period of time. On its basis, various types of economic and financial analysis are carried out, and management decisions are made. The more reliable the reporting information, the more useful it is for users and the higher the degree of effectiveness of decisions made on its basis.

Read about algorithms for using reporting data for analysis in the following materials:

- “Methodology for analyzing the balance sheet of an enterprise”;

- “Features of analysis of consolidated statements”.

To ensure that users of reporting do not have doubts about the quality of the information presented in the reporting, and that its compilers are not tempted to modify this data for their own purposes, an independent assessment of the reliability of financial reporting is required.

This task can be achieved through an audit - a set of special verification activities, as a result of which independent specialists express in the prescribed form an opinion on the degree of reliability of the data presented in the reporting.

The audit makes it possible to:

- the audited entity can see its accounting from the inside through the eyes of professional specialists, receive the necessary recommendations and correct identified distortions, eliminate errors;

- management and owners of the audited entity - evaluate the work of the accounting personnel and the company as a whole and make appropriate organizational conclusions;

- other users of reporting - to receive a qualified professional assessment of the reliability of reporting, on the basis of which effective decisions can be made.

For information about what types of decisions of owners may depend on reporting data, read the article “Decision on payment of dividends to an LLC - sample and order .

Purpose of the financial statements audit

The purpose of the audit of financial statements is deciphered in 2 regulatory legal acts (LLA):

- Law “On Auditing Activities” dated December 30, 2008 No. 307-FZ (clause 3 of Article 1);

- Federal rule (standard) of auditing activities No. 1 “The purpose and basic principles of the audit of financial (accounting) statements”, approved by Decree of the Government of the Russian Federation of September 23, 2002 No. 696 (clause 2).

It is formulated as follows: expressing an opinion on the reliability of reporting and compliance of the accounting procedure with the legislation of the Russian Federation.

In the process of taking actions to achieve the main purpose of the audit, auditors are required to:

- maintain independence;

- apply professional skepticism;

- follow ethical principles (honesty, objectivity, etc.).

“Procedure for conducting an audit of the balance sheet” will tell you about the main stages of the audit .

Tax audit

Tax audit is not considered a mandatory type of audit. It involves studying plus analysis of the existing tax payment scheme, accounting and reporting scheme of the enterprise. In the process of generating tax reports, any organization can make mistakes and miss certain nuances. Tax legislation changes frequently, and keeping up with its intricacies can be difficult. At the same time, tax structures annually tighten control over strict adherence to current regulations.

A timely tax audit will help reduce the risk of penalties for non-compliance with relevant regulations. Its results make it possible to eliminate revealed shortcomings and improve the quality of reporting.

Order a tax audit

Independence and professional skepticism in the audit of financial statements

Compliance with the principle of independence is given particular importance in the audit environment. This aspect is covered both in separate articles of a number of regulatory legal acts and documents entirely devoted to issues of auditor independence, for example:

- Art. 8 of Law No. 307-FZ;

- rules for the independence of auditors and audit organizations, approved by the Auditing Council (minutes No. 6 dated September 20, 2012);

- codes of ethics and independence of auditors of the Russian Federation and individual self-regulatory organizations (SROs) of auditors;

- sections of internal auditing standards.

If there is a threat to independence and appropriate precautions to eliminate them cannot be taken (or do not exist), the auditor is required to refuse the engagement (stop performing it).

The auditor is required to:

- be independent of the audited entity during the audit and the period covered by the audited statements;

- reflect your findings on compliance with independence in working documents;

- carry out other actions based on the requirements established by the legal acts.

The concept of “professional skepticism” refers to the category of special audit terms and consists of the following:

- the auditor is obliged to critically evaluate the weight of evidence obtained during the audit;

- Audit evidence that contradicts information obtained from other sources (any documents or management statements) or casts doubt on the reliability of such documents and statements is subject to careful examination;

- When planning audit procedures and preparing conclusions based on audit results, it is important:

- do not ignore suspicious circumstances;

- do not make unjustified generalizations;

- do not use erroneous assumptions when determining the nature, timing and scope of audit procedures (including when assessing audit results).

During the audit process:

- the auditor should not assume that the management of the audited entity is dishonest, but cannot evaluate it as unconditionally honest;

- Management statements (written and oral) are not a substitute for obtaining sufficient appropriate audit evidence.

It is important for the management of the audited entity, as well as specialists who directly provide auditors with the necessary information (preparing and providing documents, drawing up explanations and responses to requests), to correctly understand the content of the terms “independence” and “professional skepticism” - this will allow them to adequately respond to the procedures carried out by the auditor and the clarifications requested by him during the audit of financial statements.

Organization and conduct of tax audit: procedure and participants

- Tax audit is an initiative procedure

- The scope and format of the planned audit is established by the client

- As part of a tax audit, a thorough examination of all aspects of the organization’s activities that affect its taxation system is carried out

- The audit is carried out by licensed audit organizations

The tax audit procedure conventionally consists of several stages:

- examination of the tax system

- checking the correctness of tax calculations and payments

- drawing up a report describing errors identified during the inspection and proposals for eliminating them

At the first stage, auditors analyze all aspects of the organization’s taxation system and identify problem areas that require more detailed study.

Next, specialists check the correctness of tax reporting and filling out tax returns, and analyze the tax bases for each type of tax being audited.

Additional requirements for the auditor

The audit profession has a special distinctive feature - the auditor is obliged to act in the public interest, and not limit himself solely to meeting the needs of his clients or the audit company.

This “public” responsibility requires the auditor to comply with professional ethics.

In addition to maintaining the principle of independence and applying professional skepticism, the auditor must meet a combination of the following requirements:

- Be honest - act openly and honestly in all professional and business relationships, deal fairly and be truthful;

- ensure objectivity - do not allow bias, conflicts of interest or other persons to influence the objectivity of his professional judgments;

- be professionally competent and perform their duties with due care - constantly maintain knowledge and skills at a level that ensures the provision of qualified professional services (based on the latest developments in practice and legislation), and also act in good faith in the provision of professional services in accordance with professional standards;

- not to violate the requirement of confidentiality - not to use confidential information obtained during the audit to obtain any advantages for him or third parties, and also not to disclose such information;

- ensure professional behavior - comply with the requirements of legal regulations and avoid actions that discredit the auditing profession.

To find out whether accounting specialists must comply with the code of professional ethics, read the article “Job description of the deputy chief accountant” .

Audit procedure

Before starting work, the audit company notifies the organization about the timing and purpose of the audit, unless it is unscheduled and related to the detection of a violation.

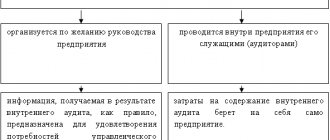

An audit can be proactive - carried out only by decision of an economic entity. For example, a manager wants to check the quality of work of certain employees, the accuracy of information and reports. In such cases, verification can be carried out selectively, in the specified areas.

First of all, the auditing auditor examines the correctness of the preparation and execution of reporting. It must comply with the requirements of the Tax Code according to the following provisions:

- whether tax returns comply with approved forms;

- During the audit, the quality of filling out documents, the necessary details, and the signatures of responsible persons are checked;

- meeting deadlines for filing tax returns.

The requirements of the Federal Law on Accounting must also be taken into account in the following areas:

- documents (including primary accounting registers) related to cash flow, that is, settlement documents, must be certified by the signature of the chief accountant, otherwise they will not be accepted for accounting;

- availability of primary documents, data from which enters accounting registers.

The requirements of the Accounting Regulations are checked as follows:

- reports must be drawn up on standard forms, the auditor checks the composition and content of the reports;

- explanatory notes should take into account information about the presence of certain types of intangible assets and fixed assets, changes in capital and investments of financial resources, emergency events and their impact on the results of the enterprise’s work;

- compliance of indicators of assets and liabilities with inventory results.

Studying the provided documents, the auditor carries out arithmetic calculations and also checks the interrelation of reporting indicators. The numbers characterizing the same indicators in different reports must match.

The main objectives of the audit of financial statements

To achieve the main goal of the audit described in the first section of our material, it is important to solve the following tasks:

- during an audit, obtain independent and reliable initial information about the financial activities of the audited entity;

- based on the obtained audit evidence, form conclusions about the reliability of the financial statements of the audited entity;

- state in a separate document the identified comments and recommendations for their correction;

- formulate an audit report that corresponds to the actual level of reliability of the audited statements, taking into account regulatory requirements and that is understandable to users;

- other tasks (specified in the contract and audit assignment).

Read about the objectives of other control measures in the material “Financial control: concept, meaning and objectives” .

Registration of audit results

Registration of the results of an audit of financial statements is a multi-operation procedure, including:

- preparation of a set of working documents for the auditor for the audit and other necessary papers (in accordance with the requirements of federal and internal auditing standards and rules);

- formulating the text of the audit report and written information to the management and owners of the audited entity based on the audit results;

The auditor's working documents are stored in the audit company and are subject to quality control by the SRO and Rosfinnadzor (if the audit was carried out in relation to the reporting of particularly significant business entities).

Providing management and owners with written information containing the auditor’s comments and recommendations is a separate procedure regulated by a special auditing standard, which outlines the requirements for:

- the auditor's identification of the appropriate recipients of such information;

- content of the information;

- timing and form of its presentation.

The auditor's report (AZ) is a final and general document drawn up in accordance with the Federal Auditing Standard (FSAD) 1/2010 “Audit report on accounting (financial) statements and forming an opinion on their reliability” (approved by order of the Ministry of Finance of the Russian Federation dated May 20, 2010 No. 46n), defining the requirements:

- to the form and content of AZ;

- algorithms for signing and presenting conclusions;

- scheme for expressing an opinion on the reliability of accounting (financial) statements.

To find out whether there is interaction between auditors and tax authorities regarding audit data, read the material “Tax authorities will have access to audit data.”

Tax audit in modern Russia Tax audit: object, goals, objectives

Tax audit is a separate area in the domestic audit system. The article discusses the main tasks and areas of application of this audit, and also shows its differences from the services related to the audit on tax issues.

The term “tax audit” appeared relatively recently, and there are still disputes regarding both the right to exist of such a term and the content of this term.

Currently, the Audit Methodology “Tax audit and other related services on tax issues” is in effect. Communication with tax authorities”, approved by the Commission on Auditing Activities under the President of the Russian Federation on July 11, 2000, protocol No. 1 (hereinafter referred to as the Methodology). In accordance with the Methodology, a tax audit is understood as the performance by an audit organization of a special audit assignment to review the accounting and tax reports of an economic entity in order to express an opinion on the degree of reliability and compliance in all significant aspects with the norms established by law, the procedure for the formation, recording and payment by an economic entity taxes and other payments to budgets of various levels and extra-budgetary funds. Apparently, the definition given in the Methodology most clearly reflects the essence of a tax audit.

The object of a tax audit is the accounting and tax reporting of an economic entity, as well as its primary documents, tax registers, contracts and other documents.

Tax audit has three main goals:

determining the correctness of calculation of the amount of taxes payable;

prevention of possible claims and penalties related to violation of tax and duty legislation (preventive protection of the client-taxpayer);

providing the client's management with the necessary information for subsequent optimization of taxation of the client organization.

When conducting a tax audit, the following tasks are solved:

audit of tax obligations to ensure compliance of calculated and paid taxes with tax legislation;

tax optimization and planning;

diagnostics of taxation problems when carrying out financial and economic activities;

analysis of the methodology for calculating tax payments and the use of tax benefits, taking into account the corporate structure and legal relations with counterparties;

checking the correctness of the client’s declarations and calculations for all or certain types of taxes paid by him.

At the same time, during the tax audit the following are assessed:

compliance of the tax accounting of an economic entity with the documents and requirements of regulations governing the procedure for maintaining tax accounting and preparing tax reporting in the Russian Federation;

compliance of the tax reporting of an economic entity with the data of primary accounting and the information about the activities of the entity that the audit organization has during the audit;

financial consequences of distortions found in tax accounting and ways to eliminate them;

the need to make changes to the tax accounting methodology used by the entity.

According to clause 2.9.3 of the Methodology, the stage of checking and confirming the correctness of calculation and payment by an economic entity of taxes and fees to the budget and extra-budgetary funds can be carried out both for all taxes and fees, and for individual types and issues that are of interest to the person who ordered the tax audit. Thus, a tax audit can be classified as a comprehensive tax audit and a thematic tax audit.

A comprehensive tax audit is a check of the correctness of the preparation of declarations and calculations for all taxes paid by an enterprise for the year.

A thematic tax audit is a check of the correctness of the preparation of declarations and calculations for individual taxes paid by an enterprise for a certain period.

In addition to the above two types of tax audit, in practice there is also a so-called structural tax audit, which means checking the correctness of the preparation of declarations and calculations for individual taxes paid by a legal entity at the location of its separate divisions. The latter type of audit is especially relevant for large enterprises or financial and industrial groups with an extensive network of separate divisions.

Taking into account the above, in our opinion, we can talk about the existence and further development of a separate independent area of audit in the Russian Federation - tax audit.

Currently, research is being conducted regarding the relationship between general and tax audits. In particular, according to a number of authors, the two indicated areas of audit intersect and a tax audit is also carried out in the process of a general audit.

At the same time, it seems to us that this formulation of the question is not entirely correct. Well, not for us, but for the author of the article, by the way - read carefully, there is a lot of stuff here. Of course, during the audit of accounting (financial) statements, the auditor checks the correctness of calculation and payment of taxes, however, unlike a tax audit, these issues are checked in a selective manner, and sometimes the sample size acceptable for expressing an opinion on the reliability of the accounting (financial) statements is not presentable for expressing an opinion on the reliability of tax reporting. It is for this reason that many organizations for which a general audit is mandatory separately indicate the scope of tax audit work in contracts with audit firms. This approach may be justified for relatively small organizations that are characterized by insignificant tax risks. For economic entities with large turnover and an extensive network of structural divisions, this approach can hardly be considered justified, since such entities have a need to conduct a full-fledged tax audit. Thus, in our opinion, a tax audit can be both part of a “general” audit and an independent area.

In addition to differences from an audit of financial statements, a tax audit should be clearly distinguished from tax consulting services accompanying a tax audit.

Related services in the field of tax consulting include (an approximate list of related services is given in the Methodology):

development of proposals and recommendations for improving the existing tax system of an economic entity;

development of optimal mechanisms for calculating taxes, taking into account the characteristics of an economic entity;

development of recommendations for the full and correct use of tax benefits by an economic entity;

development of a set of measures aimed at optimizing taxes and reducing tax risks within the framework of current legislation;

preliminary calculation of tax payments for various options for contractual relations of an economic entity and types of activity;

development of recommendations for achieving compliance of tax accounting principles applied by individual divisions and branches with the unified tax planning system in force for an economic entity;

development of proposals for the creation of an economic entity’s system of internal control over the correct calculation of taxes and fees;

development of proposals for adapting the current tax planning and accounting system to possible changes in tax legislation requirements;

setting up tax accounting;

tax planning and tax optimization;

tax support in the form of ongoing consulting on the application of tax legislation, etc.

The above related services differ in essence from the tax audit itself in that a tax audit involves carrying out verification activities regarding the correctness of calculation, completeness and timely payment of taxes, while other services related to the audit are aimed primarily at optimizing tax payments of an economic entity, building tax accounting and internal control systems, as well as consulting on certain tax issues.

In addition, the results, as well as the procedure for completing a tax audit and related services on tax issues, also differ.

The result of providing related services on tax issues can be:

indications of the presence of tax offenses and tax consequences for an economic entity in cases of detection of violations of tax legislation;

practical recommendations for eliminating negative consequences associated with established violations of tax legislation;

development of new projects for constructing both a general system of taxation of an economic entity and its individual elements;

making recommendations for adapting accounting elements and registers (including when using computer data processing) to the chosen concept of tax management, the developed set of tax projects, changes in tax legislation and other factors that have a significant impact on the level of completeness, accuracy and timeliness of calculation and transfers of payments to the budget and extra-budgetary funds;

development of a set of organizational, legal and operational management measures aimed at creating a permanent tax planning system;

calculations confirming the effectiveness of tax planning and one or another optimization model.

The result of the tax audit will be the auditor’s conclusion and report. Despite the fact that these two documents are not regulated at the legislative level, they are, as a rule, drawn up by audit firms to document the results of a tax audit. In the conclusion on the results of a tax audit, auditors express an opinion on the degree of completeness and correctness of calculation (including the correct application of tax benefits and preferences), reflection and timeliness of the transfer of tax payments by an economic entity to the budget and extra-budgetary funds. At the same time, the conclusion on the results of the tax audit cannot be considered as an audit opinion on the reliability of the financial statements as a whole.

The report on the results of the tax audit contains recommendations for correcting identified significant violations and their further prevention, recommendations regarding the procedure for calculating taxes, including the correct application of benefits, a list of issues that require special attention from the management of the organization, proposals for optimizing taxation and improving the accounting system and tax accounting from a tax perspective.

Thus, there are certainly differences between tax audit and related services in the field of taxation, despite the fact that these two areas are quite close. At the same time, it should be borne in mind that a positive result from the provision of related services in the field of tax consulting can be achieved only if these services were preceded by a tax audit as such. Otherwise, auditors will not be able to operate with the entire volume of information about the organization and its activities, and therefore find the most acceptable and effective solution to the problem posed.

The place of tax audit in the modern system of economic relations, as well as its role in the near future, raise many questions and proposals. A tax audit, perhaps, is exactly the tool that will allow, on the one hand, to relieve the audit of financial statements from a huge array of information analyzed as part of audits of compliance with legislation in the preparation and preparation of financial statements, and on the other hand, to provide regulatory authorities with audit reports specifically on issues of compliance with tax legislation.

Results

An audit is a socially significant and multi-part procedure aimed at confirming by independent specialists the reliability of the financial statements of the audited entity.

The specialists conducting it, as well as the process itself, are subject to certain requirements, the fulfillment of which allows us to consider the audit procedure carried out in compliance with the established rules. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.