Who needs to fill out a certificate confirming activity in the Social Insurance Fund

Confirmation of the main type of activity must be carried out at the end of the year when the enterprise’s financial statements are compiled.

This action must be done by all persons registered with the Federal Tax Service as legal entities, even if they were created at the end of the year (FSS order No. 55 of January 31, 2006). In a situation where a business entity does not carry out any economic activity, it is still required to send a confirmation certificate in accordance with current legislation.

A certificate confirming the main type of economic activity in 2017 is not submitted only by legal entities that will be registered in 2020. For this category of company, the injury code is assigned according to the type of activity that was indicated during registration as the main one.

Current legal norms determine for individual entrepreneurs (with and without employees) a different process for confirming their activities. These persons can carry out this procedure at their own discretion. If the individual entrepreneur does not send a confirmation certificate, then the FSS considers the main type of activity to be the one indicated in the registration documents.

When an entrepreneur changes the direction of his business, he can send a similar application to social insurance. However, such an obligation is not provided for him. In this case, the entrepreneur must understand that if the production risk decreases due to a change in the direction of activity, the Social Insurance Fund will not independently recalculate the previously established injury rate. To reduce it if necessary, you need to submit a confirmation certificate for the new main type to social insurance.

Attention! PE insurance is mandatory only in relation to employment agreements. If a company has contracts for contract work or the provision of services, then it should make deductions only if they expressly indicate this obligation.

Confirmation of the main activity in 2020

An application for confirmation of the main type of economic activity and a certificate for establishing an insurance rate must be submitted by 04/15/2020.

You can submit documents in the following ways:

- via Contour.Extern;

- in person to the territorial Social Insurance Fund or through the MFC;

- in electronic form in the policyholder’s Personal Account or through State Services;

- send the application and certificate to the FSS by mail.

In general, the law does not prohibit submitting this confirmation electronically.

3 months free use all the features of Kontur.Externa

Try it

Deadlines for submitting certificates in 2019

The provisions of legislative acts establish that a confirmation certificate for the main activity must be submitted no later than the fifteenth of April following the reporting year. This is due to the fact that when compiling it you will need to use the information contained in the annual financial report.

Thus, companies must send documents for 2018 to the Social Insurance Fund no later than April 15, 2020. At the same time, no transfers of dates due to them falling on rest days or holidays are provided. This deadline in 2020 does not fall on a weekend, so the deadline for submitting a confirmation certificate next year will also be April 15, 2019.

However, this is the opinion of representatives of the FSS. And if the company sends the certificate on April 16, it will most likely be able to defend its point of view in court.

Attention! The confirmation certificate can be sent earlier, starting from the very beginning of the year. After receiving it, if the FSS body decides to change the tariff, it must notify the policyholder about this by May 1.

Discounts and surcharges in the tariff

Discounts

The FSS of Russia can set a tariff for an organization taking into account a discount or surcharge. To do this, labor safety indicators in the organization are compared with industry average values. Industry averages for 2020 were approved by Resolution of the Federal Social Insurance Fund of Russia dated May 31, 2020 No. 67. Specialists from the Social Insurance Fund take into account (clause 3 of the Rules approved by Resolution of the Government of the Russian Federation dated May 30, 2012 No. 524):

- the ratio of the expenses of the Federal Social Insurance Fund of Russia for the payment of all types of provisions for all insured events with the employer and the total amount of accrued contributions for insurance against accidents and occupational diseases;

- number of insurance cases per 1000 employees;

- number of days of temporary disability per insured event.

In addition to the main indicators specified in paragraph 3 of the Rules, approved by Decree of the Government of the Russian Federation of May 30, 2012 No. 524, when determining the amount of a discount or allowance, the results of a special assessment of working conditions are also taken into account.

The discount amount is calculated based on the results of the organization’s work over three years.

Methods for submitting documents

You can submit an application for confirmation of activity and a certificate in one of the following ways:

- Personally to the FSS employee by the head or his authorized representative;

- Send documents by post or courier service;

- Submit in electronic format using the State Services website.

You might be interested in:

Reporting to statistics: list of forms and deadlines for submission in 2018

If the documents are submitted by a representative of the organization, then he needs to have a power of attorney in hand to perform this action. Submission of these documents in electronic format is not provided through the popular EDI systems - “Sbis”, “Kontur-Extern”, etc. For these purposes, you only need to use the “State Services” website.

If the organization does not yet have an account on it, then you must first register the director as an individual, confirm it, and only after that register the company from under him.

Confirmation of registration can be performed using an enhanced digital signature, which can be issued at the nearest certification center. In the future, you will be able to access the portal using it.

Attention! Several organizations can be registered on one manager account. However, for each of them there must be a separate digital signature key.

A certificate in paper form can be submitted only when the average number of people is no more than 20 people. Companies with a higher number of employees must transfer a package of documents only electronically. In this case, paper forms will not be accepted, and ignoring this fact will be regarded as failure to provide a certificate with corresponding consequences.

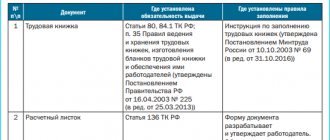

Documents that need to be sent to the FSS

To carry out the procedure for confirming the type of activity, you need to prepare the following documents:

- Certificate confirming the main type;

- Application for confirmation of type of activity.

- A copy of the explanatory note to the balance sheet.

If the organization does not have the status of a small enterprise, then an explanatory note to the reporting is also attached to the application.

The forms for the confirmation certificate and application have not changed. Therefore, in 2020, the same document formats must be used to complete the procedure.

An economic entity can determine the form of explanation for itself independently. It can be in the form of a text document or a table.

Attention! Since 2020, new OKVED2 codes have been used in the country. Despite the fact that the documents mention the old directory, when confirming the type for 2020, it is necessary to use the new one.

Is it necessary to confirm the OKVED ID of an individual entrepreneur in the Social Insurance Fund with and without employees, the procedure and deadline for confirmation

The obligation to annually confirm the main OKVED ID in the Social Insurance Fund (FSS) is assigned to employers with the status of an organization or enterprise. However, in some cases, individual entrepreneurs must also do this. Therefore, it will be useful for everyone to know when they should undergo such a procedure and how it is done.

Why confirm OKVED and who should do it in 2018

The main code according to the All-Russian Classifier of Types of Economic Activities (OKVED) is important for calculating contributions to the Social Insurance Fund. Different types of activities have their own rates of contributions for injuries and occupational diseases.

Their size depends on the occupational risk class. There are 32 such classes in total, all of them are designated in the order of the Ministry of Labor of Russia dated December 30, 2016 N 851n. The higher the class, the larger the contributions, and their size ranges from 0.2 to 8.5% of the total amount of payments due to employees.

In 2020, the Social Insurance Fund remains the administrator of contributions for industrial injuries and occupational diseases

When registering, the founders of the organization and entrepreneurs have the right to choose an unlimited number of OKVEDs and indicate them in the application for registration. But the main one will be only one at the applicant’s choice. So it needs to be confirmed by the FSS.

The amount of contributions is calculated according to the main OKVED. In other words: an individual entrepreneur or company has the right to engage in different types of activities and have several codes. But contributions for injuries and occupational diseases will be calculated only according to the basic amount. If, among others, OKVED will be with a higher or, conversely, low risk class, this does not matter.

Who is required to confirm OKVED in the FSS

Legal entities are clearly required to confirm their main OKVED. Moreover, they should do this annually.

The obligation to register with the Social Insurance Fund arises for an individual entrepreneur as soon as he has at least one employee, including under a civil law contract

But with entrepreneurs the situation is different.

They are obliged once after passing the state registration procedure to notify the FSS about the code of their main activity, and further actions in this regard are required of them only if they change this OKVED.

In other cases, the FSS determines the contribution rate for individual entrepreneurs based on publicly available data from the Unified State Register of Individual Entrepreneurs (USRIP).

There is a widespread belief that individual entrepreneurs with employees must annually confirm the main OKVED in the FSS. But this conclusion is wrong.

The presence of employees does not impose additional responsibilities on entrepreneurs, which follows from clause 1 of the Order of the Ministry of Health and Social Development of Russia dated January 31.

2006 No. 55, which establishes the procedure for confirming the main type of activity of the insured - namely a legal entity.

The procedure for confirming the main type of activity in the Social Insurance Fund

To confirm OKVED, you need to submit the necessary package of documents to your territorial division of the FSS.

Since 2020, the main administrator of contributions to extra-budgetary funds, including the Social Insurance Fund, has become the Federal Tax Service (FTS) of Russia. But contributions for injuries and occupational diseases remained under the jurisdiction of the Social Insurance Fund.

Required documents

This package includes:

- application for confirmation of OKVED (form);

- OKVED confirmation certificate, which is an appendix to the application (form);

- calculation of the amount of insurance premiums, performed independently in any form;

- balance sheet (for legal entities only).

In the confirmation certificate, the employer indicates the income for each code under which he actually operated, the number of employees and the share of income for a specific type of activity in the total profit of the individual entrepreneur or organization. This information is used to justify the choice of the main code.

The application must indicate in the appropriate columns the following information:

- name of the territorial body of the fund;

- name of the organization or individual entrepreneur in accordance with an extract from the Unified State Register of Legal Entities (USRIP) or a certificate of state registration;

- registration number;

- subordination code;

- year of OKVED confirmation;

- main OKVED code;

- number of sheets in the application;

- applicant's signature.

The following methods of submitting documents to the FSS are available:

- directly at the fund branch;

- by mail;

- on the public services portal through the personal account of a legal entity.

Due dates

Confirmation of OKVED is submitted to the FSS at the end of the year - until April 15.

For 2020, this must be done before April 16, 2020 (since April 15 is a day off, the end of the period is transferred to the next working day), a similar date in 2020 is provided for in the Social Insurance Fund and based on the results of 2020.

Since the deadline for submitting supporting documents in 2018 falls on a weekend, it is postponed to the next weekday - Monday, April 16

FSS response

A response from the fund should be expected two weeks after submitting the documents. At the applicant's choice, it can be obtained:

- when visiting your territorial FSS office;

- by mail.

The response will contain the calculation of payments for the main OKVED code according to the FSS version, which will be used to guide the calculation of contributions.

Responsibility for violations

There are no penalties for failure to confirm the main OKVED ID after its change. But without notifying the FSS about the change in the main code, you will have to pay contributions at the highest rate provided for the codes contained in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs.

If a company or entrepreneur is nevertheless punished, and they consider this sanction to be unlawful, then they have the right to apply for protection of their rights to a higher division of the Social Insurance Fund and the court. In a complaint or lawsuit, it is necessary to refer to the provisions of the current legislation that, in their opinion, have been violated.

Confirming the main OKVED code is not particularly difficult. All you have to do is not forget about your obligations and the deadlines within which they must be fulfilled. And then the state will not have unnecessary reasons for inconvenient questions.

- Ruslan Tsarev

Source: https://ozakone.com/predprinimatelskoe-pravo/nalogooblozhenie-i-buhgalterskij-uchet/nuzhno-li-podtverzhdat-okved-ip-v-fss.html

Sample of filling out the certificate

First, let's look at how to fill out a certificate confirming the type of activity. Using the information specified in it, an application will then be drawn up.

After the designation of the document with which the form was entered, the date of preparation of the certificate is recorded.

Further, after the title of the form, information about the enterprise is indicated line by line: full name, date of registration, start date of activity, full name. responsible persons and others. All lines are numbered from 1 to 8 and contain a description of what information to record.

In lines 1-7 you must indicate information according to the constituent documents:

- Company name and tax identification number.

- Registration date.

- Start date of business.

- Legal address of the company.

- Information about the director and chief accountant.

In line 8 you need to indicate the average number of employees for the reporting year.

Then comes a table in which you need to break down income by type of activity:

- Column 1 indicates the code of the activity type, and column 2 indicates its text name.

- Column 3 records revenue for this type for the past year excluding VAT.

- In column 4 you need to enter the amounts of target revenue for each type, if any.

- Column 5 indicates the share of revenue for this type of the total amount as a percentage.

- Column 6 should only be completed by non-profit organizations.

You might be interested in:

Unified simplified tax return: sample completion in 2019

After filling out the table, the result is summed up - the total amount of revenue, which will be 100%.

Attention! Based on this data, line 10 records the name and code of the type for which the greatest revenue was received. If two or more species have the same share, then the organization itself can choose which OKVED to indicate.

The certificate is signed by the manager and chief accountant. If there is a seal, you need to put its imprint on the document.

Application form

Based on the certificate, an application to confirm the main type of activity is filled out.

After the name of the document by which the form was put into effect, the date of completion is indicated.

Then you need to indicate the name of the social insurance authority to which the certificate is sent.

After the title of the form, write down the full name of the organization according to the constituent documents, social insurance registration number and subordination code.

Attention! The next field is not checked - it is necessary to indicate the fact that the certificate was submitted by the government agency.

Next, on the form you need to indicate the year for which the type of activity is confirmed, its name and code according to the certificate.

On the form you must indicate the number of sheets of attachments in the application. After this, the manager signs it.