An appeal to a higher tax authority or in court against an inspection decision that does not suit the taxpayer is provided for in Art. 138 Tax Code of the Russian Federation. At the same time, the applicant cannot immediately appeal the decision in court, that is, go there directly - his application will simply not be accepted. Decisions of the tax office or its officials can be appealed to a higher tax authority or to the same authority that issued the tax act.

You can appeal to a higher tax authority any documents that are signed by the head or deputy head of the tax authority.

You can appeal to the same tax authority that issued the tax act documents signed by other employees of the tax authority, for example, an inspector or the head of a department.

The procedure for appealing a tax decision can include from one to three stages.

Drawing up an objection to claims contained in a tax audit report

First, the taxpayer must draw up objections to the claims contained in the tax audit report and send them to the Federal Tax Service within a month from the date of receipt of the tax audit report. You can submit written objections to the specified act as a whole or to its individual provisions.

The date of receipt of the act is considered to be the date that the taxpayer himself indicated when receiving it, so you need to make sure that the actual date of delivery is indicated in the act, and not an earlier date, otherwise the period for filing objections may be reduced. If the act was sent by mail, then the date of its delivery is considered to be the 6th day from the date the Federal Tax Service Inspectorate sent the registered letter. In objections, you must indicate the number and date of the audit report and state in as much detail as possible why the taxpayer does not agree with the act as a whole or with its individual provisions, and, if possible, support your arguments with documents. Subsequently, when filing a claim in court, this will be evidence that the taxpayer actively defended his position. Also, each attached document must be indicated in the list of attachments to avoid disputes about the composition of the application.

The taxpayer is informed where and when the audit and objection report will be considered - he can be present, give oral explanations and submit supporting documents. In this case, the taxpayer’s arguments must be indicated in the protocol, which is kept during the consideration (clause 4 of Article 101 of the Tax Code of the Russian Federation).

As a rule, based on the results of consideration of the act and objections, one of the following decisions is made:

- on holding the taxpayer accountable;

- on refusal of liability;

- about additional control.

Decisions to prosecute and refuse can be appealed to a higher tax authority and later in court. And the results of additional tax control measures may themselves be the subject of filing objections (clause 6.1 of Article 101 of the Tax Code of the Russian Federation).

A sample objection to a tax audit report can be downloaded from the Federal Tax Service Information “Submission of objections to tax audit reports.”

What should the head of the tax authority do before considering the tax audit materials in accordance with clause 3 of Art. 101 Tax Code of the Russian Federation:

- announce who is involved in the case, the materials of which tax audit will be considered;

- establish the fact of attendance of persons invited to participate in the consideration;

- if necessary, check the powers of the representative of the person in respect of whom the tax audit was carried out;

- explain to those involved in the procedure their rights and obligations (Articles 21, 23 of the Tax Code of the Russian Federation);

- make a decision to postpone the consideration of materials if a person whose participation is important does not appear.

If the tax authority does not reject the claim, its decision can be appealed to a higher tax authority and later in court.

How to file an objection:

- to the office of the tax authority or the window for receiving documents of the tax authority;

- by mail;

- personally or through a representative.

Where to send?

To the tax authority that drew up the act. But for this you will need the number, address and details of this tax office. The necessary details can be found using the “Address and payment details of your inspection” service.

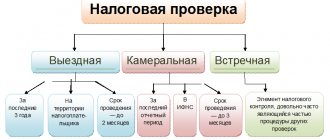

Appealing the desk inspection report

A desk audit, unlike an on-site audit, is carried out without notifying the organization being audited. In cases where violations of tax legislation are detected, based on the results of the audit, a tax audit report is drawn up, which is transferred to the taxpayer company no later than 10 days after the completion of the desk audit.

There are cases when an organization does not receive an inspection report. In this case, if the company’s management can prove that the reason for not receiving the document is valid, for example, the fiscal authority did not notify that after an inspection of the enterprise an act was drawn up, and the postal item was lost, they have the opportunity to restore the deadline for challenging the act. If the taxpayer was deprived of the opportunity to submit objections to the audit report due to the fault of the tax authority, this may become a basis for canceling the tax authority’s decision on such an audit.

There are often cases when taxpayer organizations avoid receiving the report in every possible way. That is, they know that such an act has been drawn up, but they do not pick it up themselves and avoid receiving the mail. In this case, the date of receipt of the act will be considered the sixth day after sending it by registered mail. As a result, the tax audit report is considered delivered and comes into force within the time limits established by law.

It is important to know: What is the basis for suspending the limitation period?

But even in this case, the company can challenge the decision that has entered into force by appealing to a higher organization with an appeal within a month from the date of receipt of the decision or with a regular complaint - within a year after the inspection decision is made.

Filing a complaint or appeal

A complaint is filed when acts of the tax authority or actions/inactions of its officials have already entered into force and violate the rights of the taxpayer. It can be sent within a year to a higher tax authority through the same authority, whose decision must be appealed.

An appeal is filed if the tax authority’s decision to prosecute a person for a tax offense has not yet entered into force. The filing deadline is within 10 days from the moment the tax authorities’ decision is received. At the end of this period it comes into force (clause 2 of article 101.2 of the Tax Code of the Russian Federation).

A complaint can be submitted in writing or electronically, including through the taxpayer’s personal account. It must be signed by the manager or representative. If it is filed by authorized representatives of the taxpayer, a power of attorney must be submitted along with the complaint.

Only legal representatives of an organization (general director, manager, chairman) or an individual (parents, guardians, trustees) can represent the interests of a taxpayer without a power of attorney.

An authorized representative of a taxpayer (individual or legal entity) can represent the interests of the taxpayer on the basis of a power of attorney (Articles 185-189 of the Civil Code of the Russian Federation). To represent the interests of an individual entrepreneur, you need to notarize the power of attorney (Clause 3, Article 29 of the Tax Code of the Russian Federation).

There are decisions that cannot be appealed on appeal, but only in court. We are talking about decisions made by the federal executive body authorized for control and supervision in the field of taxes and fees.

Information to be included in the complaint and appeal

This information is specified in Art. 139.2 Tax Code of the Russian Federation:

- Full name and address of the applicant or name and address of the applicant organization;

- the act being appealed against, actions or inactions of its officials;

- name of the tax authority whose actions are being appealed;

- the grounds on which the applicant’s rights were violated;

- requirements of the person filing the complaint;

- method of obtaining a decision on a complaint: on paper, electronically or through the taxpayer’s personal account.

In addition, it is permissible to include additional circumstances in the complaint that may mitigate or eliminate the taxpayer’s liability. The complaint may also indicate other information necessary for timely consideration of the complaint, including telephone numbers, fax numbers, email addresses, etc.

The deadline for making a decision on a complaint is within a month after filing (clause 6 of Article 140 of the Tax Code of the Russian Federation), but it can be extended by another 15 days if the head or deputy head of the tax authority decides so.

Within another three working days, the taxpayer will be informed of the decision made. From the day the decision on the appeal is made, the decision of the tax authority based on the results of the audit comes into force.

The appeal is filed with the same tax authority that made the decision. He must transfer the complaint to a higher tax authority within 3 days. While the complaint is being considered by a higher tax authority, accrued payments are not collected.

A decision of a tax authority that has entered into force, which has not been appealed, may be appealed to a higher tax authority in the general manner within a year from the date of the appealed decision.

If you missed the deadline for filing a complaint for a good reason, you can restore it by filing a petition with the tax authority.

Why do you need to file a complaint?

- so that your application is subsequently considered by the court;

- it's free;

- it is simple and does not require the help of lawyers;

- you do not need to be present at the hearing of the complaint;

- if an appeal is denied, you can understand why this happened and prepare more thoroughly to defend your position in court;

- If the decision of the tax authorities or officials has been appealed to a higher tax authority, it will be suspended.

How to file a complaint

A complaint can be filed against the decision of the tax authority as a whole, or against its individual parts. The complaint must indicate the reasons why you do not agree with the tax office’s decision and state your demand - for a complete or partial cancellation of the decision, an additional audit or a change in the decision, otherwise it will not be accepted.

A sample complaint can be downloaded from the Federal Tax Service website.

Under what conditions is it possible to challenge a tax act?

To appeal a tax audit report, certain grounds are required. If you file a complaint without such grounds, it will be rejected, in most cases - without even consideration. Therefore, it is very important to know under what conditions it is possible to file a complaint. Here are the most common grounds for challenge:

- tax inspectors committed certain violations during the audit - quite often you can encounter situations where inspectors violate the law during business inspections. Violations can be either very serious or minor, however, even the most insignificant violation (for example, they forgot to indicate the date of the inspection, did not put a signature or seal, etc.), if it is recorded on time and correctly, makes it possible to challenge the final inspection report or parts of it. Therefore, it is very important that during the inspection there is a lawyer present who can monitor compliance with the law by inspectors;

- the deadlines for conducting audits have been violated - both desk and field tax audits have legally limited periods of implementation. However, in practice, deadlines are often violated, which makes it possible to challenge the tax audit report. It does not matter of fundamental importance whose fault the delay occurred: if the deadlines are violated, you can file a complaint, because the law has already been violated;

- unlawful or groundless application of sanctions - almost any inspection, especially an on-site inspection, ends with the imposition of penalties or additional tax payments. However, there are not always sufficient reasons for this. If you find out that additional tax assessments, fines or other restrictive actions on the part of the Federal Tax Service (for example, blocking of accounts) were applied without proper grounds, this may serve as grounds for challenging such a tax audit act. But in order to discover the groundlessness of the sanctions, one cannot do without consulting a professional tax lawyer ;

- other violations that could in one way or another affect the result of the audit - this includes more rare situations, for example, when third-party organizations are involved in the audit that do not have the appropriate certification, if documents and equipment were seized that are not related to the current audit, if they were used information that does not correspond to reality, etc. All this information, with proper preparation, can be used as arguments to challenge the results of a tax audit.

This is important to know: The statute of limitations for the recovery of damages

When preparing to challenge, pay enough attention to preparing the justification, because often it is the insufficient motivational part that serves as the reason for refusing to satisfy the complaint. support of tax audits is also very important - this increases the likelihood that all violations will be recorded.

Filing a claim in court

If the taxpayer does not agree with the decision of the higher tax authority or the higher tax authority did not consider the complaint within the prescribed period, you can file a claim in court (Clause 2 of Article 138 of the Tax Code of the Russian Federation). To do this, you need to pay a fee of 3,000 rubles. (Article 333.21 of the Tax Code of the Russian Federation).

Information to be included in the claim

- name of the arbitration court to which the claim is filed;

- for organizations - name of the plaintiff, location; for individual entrepreneurs - place of state registration, telephone number and e-mail;

- the name of the body or person that adopted the contested act and the higher tax authority;

- name, number and date of adoption of the contested act;

- the cost of the claim (if the claim is subject to assessment);

- what rights of the applicant were violated;

- references to laws and regulations that do not comply with the decision of the tax authority;

- the applicant's demand to recognize a non-normative legal act as invalid, decisions and actions (inaction) of officials as illegal.

How to sue the tax authorities based on the results of an audit?

Going to court is the final stage of challenging a tax audit report. The statement of claim is submitted to the arbitration court at the place of registration of the company. The defendant is the Federal Tax Service department, whose decision is being challenged. The text of the claim must indicate the specific inspection report, the date of the audit, and all identified violations. In addition, it must be indicated that the complaint procedure for resolving the dispute was followed - complaints were filed against the actions of the tax authorities. The claim is accompanied by documents that can confirm the plaintiff’s position.

The documents are then submitted to the court for review. A copy must be sent to the Federal Tax Service in order to notify them of the filing of a lawsuit. During the hearings, the main goal is to convince the court that violations actually occurred and could affect the decisions made based on the results of the audit. In this case, the judge may satisfy the applicant's demands and cancel the act or its individual provisions. An experienced tax lawyer can help you prepare and file your claim and can represent your company during the claim.

Conclusion

If a tax audit act violates the rights of your company, imposes unreasonable penalties, or violations were committed during the tax audit, you can file a complaint and have the Federal Tax Service’s decision reversed. There are pre-trial and judicial options for resolving the dispute, and going to court without the pre-trial stage is impossible. A competent, specialized lawyer will help with the appeal and ensure that the dispute is resolved in your favor.

Consideration of the application

The procedure for considering a claim filed by a taxpayer is regulated by internal departmental regulations approved by order of the Minister of Taxes and Duties of 2001. The procedure for consideration in this case depends on the nature of the application submitted:

- A complaint from a private person who is not the head of an organization or a private entrepreneur.

- From an individual holding a leadership position in a commercial organization about disagreement with bringing them to administrative responsibility for violations of the provisions of the NKRF.

- From organizations and individuals about disagreement with the sanction measures applied to them - fines, penalties.

The time allotted to Federal Tax Service employees to investigate a filed complaint is no more than 30 calendar days from the date of its filing. After analyzing the application and making a legal decision on it, the submitter must be notified of the decision made no later than within three days. In exceptional cases, the period may be extended by another two weeks by decision of the government agency’s management. Based on the results of the internal departmental proceedings regarding the petition filed by the citizen, one of the following decisions may be made:

- Dismiss the taxpayer's request.

- Cancel the controversial decision of the employees of the lower-level department of the Federal Tax Service.

- Stop proceedings initiated against the taxpayer in accordance with the unlawful act.

- Change a previously made decision by adjusting its operative part.

If, during the consideration of the complaint, serious or deliberate violations of current legislation are revealed on the part of a certain employee, all disciplinary measures may be applied to those responsible. If the violations caused significant damage to the state, organization or private taxpayer, then the actions of the unscrupulous employee fall under the jurisdiction of administrative or criminal law. The procedure for appealing a tax act provides for cases when the application cannot be accepted for consideration:

- The deadlines provided by law for appealing the decision of tax officials have been missed.

- The petition does not contain a specific requirement, an indication of the disputed tax act, or does not provide justification for the requirements or the accompanying evidence base.

- When an application is submitted by a person who is not directly related to the resolution adopted by the tax authorities. If this citizen represents the interests of a third party, he must have a notarized power of attorney to perform certain actions of a legal nature.

- If a judge’s verdict has already been issued on the contested act and has entered into force.

Protesting acts through the courts

When filing a claim in court, the applicant has the right to choose as a defendant both the territorial body of the Federal Tax Service and a specific employee directly involved in the issuance of an unlawful decision. Sometimes a taxpayer is not able to make a claim against a certain tax inspector - for example, this person no longer works for the Federal Tax Service, or the plaintiff does not know the details of the employee who made a mistake when drawing up the document.

Article No. 138 of the NKRF determines that legal entities - companies and individual entrepreneurs - protest unlawful decisions of tax authorities in arbitration court. Citizens acting as individuals (who are not individual entrepreneurs and do not represent a commercial organization) must apply to district or city courts to resolve disputes with government agencies.

Based on the application submitted by the plaintiff to the court office, proceedings are initiated. The claim is filed with the court no later than three months from the date of adoption of the controversial tax act. The procedure for drawing up an application is prescribed in Article No. 125 of the Administrative Code of the Russian Federation.

It states:

- Full name of the institution to which the protest is being sent.

- The name of the disputed document, its number, date of adoption.

- A list of rights and interests, in the opinion of the applicant, violated by this regulatory document.

- A list of articles of tax or other legislation that are in direct conflict with the resolution adopted by the tax authorities.

- The plaintiff's demands to cancel a document adopted by employees of the Federal Tax Service, or to force employees to perform their duties.

All available evidence must be added to the submitted application. After accepting the taxpayer’s request for consideration, the judge has the right, at the request of the plaintiff, to temporarily suspend the execution of the controversial decision of the tax authorities. The maximum time frame for consideration of a petition in the courts is no more than 60 days from the date the case was accepted for execution.

The procedure for appealing is pre-trial

Appealing a decision based on the results of an inspection includes a mandatory pre-trial stage. That is, it is impossible to challenge the decision directly in court; first, a complaint against the decision must go to the regional department of the Federal Tax Service of Russia.

As a rule, the tax department rarely takes the side of the taxpayer, and they have to defend their case in court. Moreover, the tax inspectorate usually writes off additional charges for collection, without waiting for the court. Inspectors must make a decision on debt collection within two months from the date of expiration of the period for voluntary payment of tax upon request.

However, it is possible to suspend the execution of the tax authority’s decision by requesting, as part of a judicial appeal, interim measures in the form of prohibiting the inspectorate from taking actions to forcibly collect additional assessments and suspending transactions on bank accounts.

The difference between appealing actions and acts of tax authorities

According to Article 2 of the Tax Code of the Russian Federation, relations in the tax sphere are of a subordinate nature, that is, taxpayers are subordinate to representatives of the Federal Tax Service. In order for the subordinate party to have a certain degree of protection, the state provides for the protection of individuals and legal entities from unlawful actions of tax officials, as well as abuse of existing powers.

Important! As one of the possibilities for protecting the rights of taxpayers, the legal right to appeal against actions or inactions of representatives of tax authorities, as well as decisions and acts made by them unreasonably, is considered.

If a person believes that the actions of tax officials contradict the norms of the current legislation, which leads to a violation of his rights, then he has the right to appeal them (137 of the Tax Code of the Russian Federation). The right to exercise the possibility of appeal is provided for by Chapters 19 of the Tax Code of the Russian Federation and 20 of the Tax Code of the Russian Federation. These chapters contain a step-by-step appeal procedure. In addition, the appeal procedure is also considered in the procedural code (Chapter 22 of the CAS RF).

Taking into account these legislative norms, the following features of the appeal can be highlighted:

| What is the subject of the complaint? | · Actions of tax authorities representatives · Non-normative legislative acts issued by employees of the Federal Tax Service · Inaction of tax officials. |

| Conditions and factors for appeal | · Illegality of non-normative legislative acts issued by employees of the Federal Tax Service · Timeliness (the complaint must be filed within the deadlines established by law) · Personal interest of the complainant |