Almost every company sooner or later undergoes an inspection by the State Labor Inspectorate (GIT). This structure monitors compliance with workers' rights. Based on the results of the inspection, if violations are detected, an order is issued. It is a document that sets out the requirements for correcting the offense. After a certain period of time, a re-inspection is carried out. During this process, it is determined whether the offense has been corrected. However, the manager may not agree with the prescription. In this case, it can be appealed.

How did the appeal happen in the past?

Previously, the judicial authorities did not have a consensus on appealing the order. It took place on the basis of the Code of Civil Procedure of the Russian Federation. At the same time, the rules of procedure in cases concerning public legal relations were taken into account. However, this became irrelevant after September 15, 2015. The CAS came into force on this date. After this, appeals began to be carried out on the basis of this code.

But disagreements remained. In particular, some courts believed that the appeal should be carried out on the basis of the CAS, while others believed that the procedure was carried out on the basis of the Code of Civil Procedure of the Russian Federation. Throughout 2015-2016, the courts could not come to a common position.

How to appeal a GIT order through court

The employer retains the right to appeal the GIT order through the court. As in the case of an appeal to the Chief State Inspector, the period for filing an appeal to the court against unlawful actions of the State Tax Inspectorate is limited to 10 days from the date of delivery of the corresponding order to the representative of the organization.

Within the established period, the employer must:

- prepare a statement of claim;

- collect documents confirming the validity of the claims;

- pay the state fee.

Currently, disputes are raging among lawyers regarding where to file a claim to appeal the order of the State Tax Inspectorate.

On September 15, 2020, the decision of the Supreme Court of Appeal came into force, according to which cases challenging decisions of the State Tax Inspectorate are considered in accordance with the CAS of the Russian Federation, that is, the statement of claim should be filed with the court of appeal. Subsequently, the courts received an explanation from the Supreme Court, according to which the orders of the State Tax Inspectorate are being challenged in a court of general jurisdiction on the basis of the State Register of the Russian Federation.

Thus, the statement of claim and supporting documents in order to invalidate the order of the State Tax Inspectorate should be submitted to the district court of general jurisdiction at the location of the State Tax Inspectorate.

After the applicant applies, the complaint is considered within the framework of standard judicial proceedings. At the end of the consideration of the case, the court makes a decision, which is subject to immediate execution. If there are sufficient grounds and evidence from the plaintiff, the court may take the employer’s side and declare the order invalid based on the relevant court decision.

The situation with the appeal now

The situation was resolved by the Supreme Court. In particular, determination No. 75-KG16-14 dated December 19, 2020 was issued. It contains these provisions:

- The function of the labor inspectorate is to detect violations in the field of labor. However, inspectors do not have the right to resolve labor disputes.

- The inspection order is an administrative document. Therefore, its appeal is carried out on the basis of the CAS. It does not matter whether the regulation concerns the rights of employees or not.

That is, now the position of the courts is completely defined. The legality of the inspector's decision is established administratively. What does this give to the employer? The administrative procedure is more beneficial for the company, as it simplifies the process of proving its position. In particular, in this case the employer does not need to prove the illegality of the decision. It is the labor inspectorate that must prove that the order was lawful and in compliance with all laws.

Fine for failure to comply with the order of the state labor inspector on time

Failure to comply with the order of the state labor inspector on time entails liability for the employer under the Code of Administrative Offenses of the Russian Federation (hereinafter referred to as the Code of Administrative Offenses of the Russian Federation). So, according to Part 23 of Art. 19.5 of the Code of Administrative Offenses of the Russian Federation, the employer faces a fine for failure to comply with the order of the state labor inspector in the following amount:

- 30,000–50,000 rub. in relation to individual entrepreneurs;

- 100,000–200,000 rub. in relation to organizations.

The head and other officials (hereinafter referred to as DL) of the organization may also be held liable in the form of a fine for failure to comply with the instructions of the state labor inspector in the range of 30,000–50,000 rubles. or disqualified for 1–3 years.

In addition, if the detected violations had signs of an administrative offense and a corresponding protocol was drawn up, failure to carry out procedures to eliminate the reasons that caused the violations entails liability for the DL under Art. 19.6 of the Code of Administrative Offenses of the Russian Federation, namely a fine of 4,000 to 5,000 rubles.

However, failure to comply with an order may not always depend on the employer. Thus, the employer does not face sanctions if:

- the order does not contain specific actions that the employer must perform;

- or they may be interpreted differently.

In the above cases, if the employer appeals the labor inspector’s order, it may be declared unlawful (see the resolution of the Moscow District Arbitration Court dated March 23, 2016 No. F05-2080/2016 in case No. A41-36515/2015).

In some cases, if there are extenuating circumstances, the employer may request a deferral of execution of the order. To do this, he needs to send a corresponding petition.

Thus, the response to the labor inspector’s order is drawn up by the employer in free form and includes information about the implementation of measures to comply with the inspector’s requirements. The response must be accompanied by copies of documents confirming the implementation of these activities. Sending a response helps to avoid an additional unscheduled inspection by Rostrud after the expiration of the period allotted for the execution of the order.

Appeal options

The possibility of appeal is stipulated in Article 361 of the Labor Code of the Russian Federation. The same article states that the procedure can be carried out in two ways:

- Appeal to a superior person. In particular, the employer needs to file a complaint with the head of the State Tax Inspectorate carrying out the inspection. If this does not help, you can send your complaints to the country's chief labor inspector.

- Through the court. It is necessary to file a claim in court after paying a fee.

The employer has the right to choose the method of appeal independently. However, if the inspector makes a decision to suspend the activities of the entity, then it can only be challenged in court.

Appealing the decision of Rospotrebnadzor

We are engaged in appealing decisions of Rospotrebnadzor on administrative violations.

This government organization checks the activities of individual entrepreneurs and legal entities: checks documents, looks for violations, receives customer complaints in the areas of sanitary and epidemiological control, consumer protection, and compliance with energy saving legislation. If, as a result of the inspection, a violation order was issued, our lawyers will be able to challenge it in a higher authority or in an arbitration court. You can appeal a decision of Rospotrebnadzor if it contradicts the law. Therefore, any mistakes made by employees during the inspection lead to the cancellation of the inspection result or the order as unfounded.

| Initial consultation by phone | For free |

| Oral legal advice in the office | 1000 rubles |

| Written legal advice | From 5000 rubles depending on the complexity of the situation |

| Support of Rospotrebnadzor inspection | From 10,000 rubles depending on the field of activity and size of the company |

If you need to appeal the decisions of Rospotrebnadzor or support an inspection, the lawyers of the Intellectual firm will protect you. Services for appealing a decision of Rospotrebnadzor in an arbitration court include:

- Collection of documents

- Drawing up and submitting a statement of claim to the Arbitration Court

- Participation in court hearings, filing requests for additional evidence

Our lawyers have extensive experience challenging decisions of government bodies. They will help you restore your violated rights in the shortest possible time.

Deadlines

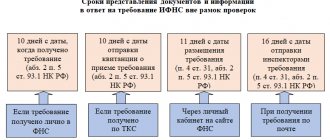

The deadlines for appealing the orders of the State Tax Inspectorate are not defined by law. This means that the standard procedure will be relevant. You can file a complaint with the court within 10 days from the date the order is issued. If you need to challenge a document about an administrative violation, the procedure is also carried out within 10 days from the date of receipt of the document. The corresponding period is stipulated in Article 30.3 of the Code of Administrative Offenses of the Russian Federation.

If the employer forwards the complaint to a superior inspector, it must be considered within 30 days from the date of its filing. If after this period no response has been sent, a claim must be filed with the court within 3 months. In addition, if the superior inspector refuses to appeal, the employer can also refer to the judicial authority.

Procedure for filing a complaint

When submitting an application to the court, you must comply with all formalities - filing deadlines, application format, payment of state fees. When challenging a resolution to eliminate violations, the state fee will be 200 rubles. (Article 333.19, clause 1, clause 7 of the Tax Code of the Russian Federation). If an appeal is submitted to cancel a fine for an administrative offense, the state duty is not paid (Article 30.2 of the Code of Administrative Offenses of the Russian Federation, Part 5).

Deadlines

Let's consider the issue of time intervals for appealing the orders of the labor inspectorate. In the case of filing an appeal on the principle of subordination, the law does not stipulate clear requirements for deadlines. But here lawyers recommend not to delay filing. And the reason is this: when a complaint is considered by the management of the State Inspectorate, the period for eliminating violations based on the results of the inspection is not extended.

Failure to fulfill obligations within the prescribed period may subject the employer to a fine . In addition, if the inspector’s decision does not bring the desired result, there is a risk of missing the deadline for appealing the application in court.

If there is clear evidence of an illegal order, it is better to immediately file a statement of claim. In this case, it will be possible to write a request to suspend the decision of the State Tax Inspectorate during the trial.

As for the timing of appealing the inspectorate’s decision through the court, experts do not have a clear opinion on this matter. According to Article 256, paragraph 1 of the Code of Civil Procedure of the Russian Federation, the employer is given a period of 90 days to appeal this document . However, this article is only valid if the inspection was scheduled. If the inspection was carried out based on a complaint from a trade union employee or group of employees, then no more than 10 days are given to appeal the inspector’s order.

Based on this, practicing lawyers advise appealing the results of the inspection within 10 days.

Where do we send applications?

The law does not prohibit filing an application with the court and the State Tax Inspectorate. However, there is no point in sending the application to two authorities at once . According to Article 30.1 of the Code of Administrative Offenses of the Russian Federation, if a complaint is filed in court and in the order of subordination, the case will still be considered only by the court.

An appeal against an order to eliminate violations is considered in a court of general jurisdiction at the location of the inspection body - inspection or at the location of the employer.

Although the law provides the right to choose to submit an application without reference to the location, lawyers still advise applying to the court, which is territorially related to the location of the inspectorate that carried out the inspection.

But filing an application to cancel a decision on an administrative violation still causes a lot of controversy. The fact is that these applications must be considered in an arbitration court (Part 3 of Article 30.1 of the Code of Administrative Offenses of the Russian Federation).

However, according to the explanation of the Constitutional Court, since the violation is not related to entrepreneurial and economic activities, the arbitration court does not have the right to consider the case . Therefore, the claim to declare the decision illegal is also considered in a court of general jurisdiction.

Drawing up a complaint

When filing a complaint, you must provide the following information:

- Name (full name) of the structure or person to whom the document is sent.

- Address and details of the employer (full name, company name).

- Details of the order that is being disputed.

- Employer's argument. In particular, you must provide evidence that the order was issued illegally.

- Formulation of the request. For example, the request may be to cancel the order or declare the actions of the State Tax Inspectorate illegal.

The complaint must be made in two copies. The first is sent to the office, the second remains with the employer. On the second copy, the receiving party puts down the incoming number.

IMPORTANT! The document can be sent in various ways. You can give it in person or send it by mail. In the second case, a registered letter with delivery notification is used. You can also use the content inventory service.

Complaint against the order of the State Tax Inspectorate in the order of subordination

If the head of the organization has received an order from the State Labor Inspectorate, but does not agree with its content due to objective reasons and circumstances, then the employer is initially recommended to file a complaint in accordance with the order of subordination, namely to the Chief State Labor Inspector. Instructions for preparing and filing a complaint are provided below.

Preparation of documents

Before contacting the Chief Labor Inspector with a complaint, the employer should take care to prepare documents that will serve as the basis for a subsequent appeal against the actions of the inspector who issued the order.

If, in the opinion of the employer, the order contains false information, then the company management must prepare documents refuting this information. Such documents can be:

- copies of local regulations;

- payroll records;

- orders, instructions;

- logs of instructions, etc.

If the essence of the complaint is a violation by the inspector of the inspection procedure, then this fact can be confirmed:

- lack of notification of an unscheduled inspection (if this type of inspection requires notification);

- the presence of an inspection report without the employer’s signature, which confirms the fact that the inspector was not familiar with the results of such an inspection;

- absence of written requests for the provision of documents (if the essence of the complaint is the uncontrolled actions of the inspector regarding the disposal of documents and property of the employer during the inspection period).

Important

The list required for preparing a complaint is strictly individual and depends entirely on the characteristics and circumstances of a particular situation.

Drawing up a complaint

The form in accordance with which the employer must file complaints against the order of the State Labor Inspectorate is not approved by law, so the document can be drawn up in free form, indicating the required details:

- full name and details of the body to which the complaint is filed;

- information about the applicant (name of organization, address);

- details of the employer's representative (position, full name);

- date of document preparation.

In the text of the complaint, the applicant should indicate:

- details of the document that is subject to appeal (number and date of the order);

- circumstances and facts confirming the illegality of the order issued by the State Tax Inspectorate, supported by references to regulatory documents and local acts;

- the requirements of the applicant, which may be the cancellation of the issued order or recognition of the actions (inaction) of the inspector who issued it as illegal or not in compliance with regulatory requirements.

Appeal to the Chief State Labor Inspector

The employer has the right to file a complaint with the Chief Labor Inspector within 10 days from the date of issuance of the order. We emphasize that the date of the report is determined precisely on the basis of the date the employer received the order (signature in the “Acquainted” column), and not on the date the document was drawn up.

This is also important to know:

Being late for work, which is considered late under the Labor Code

When contacting the Chief Inspector, the applicant submits a complaint drawn up in 2 copies and supporting documents listed in the complaint as attachments. Appeals from a representative of the organization are subject to registration, after which one copy of the complaint is returned to the employer with a note indicating acceptance of the documents (date, signature of the GIT representative).

Getting a response

Within 30 days from the date of application, GIT employees must provide the applicant with an official response to the complaint in writing. If the applicant's arguments are considered objective, the employer's demands are satisfied.

If the Chief State Inspector found the applicant to be right and the order to be unlawful, then such an order loses its force at the time the relevant notice is issued to the employer.

If we are talking about unlawful actions on the part of the GIT inspector, then if the employer is recognized as correct, the Chief State Inspector orders an internal investigation against the violating inspector, the results of which he notifies the applicant in writing.

Argumentation for appeal

The success of appealing an order depends on correctly constructed argumentation. The employer must provide specific reasons for the challenge. They may be as follows:

- The offenses that the inspector identified do not actually exist.

- As part of the GIT inspection, the accompanying documents were drawn up incorrectly or the procedure for control checks was ignored.

The second line of argument is more promising. It is relevant even if there is actually an offense.

Inspection of State Tax Inspectorate involves drawing up documents by inspectors. For example, if an administrative offense is discovered, you need to draw up a corresponding protocol. The procedure requires adherence to a certain order. For example, the employer is explained his rights and obligations. He is given the right to submit explanations regarding the violations found. The employer must be familiar with the protocol against signature. If this order was ignored by the inspector, the violator can take advantage of this and draw up an appropriate argument.

The GIT prescription can be canceled on these grounds:

- The employer was not notified about the preparation of the protocol.

- The person was not given the right to explanation.

- There is no order from the State Tax Inspectorate to conduct an inspection, which indicates the timing of the event and its goals.

- The order to conduct an inspection does not contain a registration number, date of publication, or signature of a representative of the State Tax Inspectorate.

- The information contained in the service ID does not correspond to the information specified in the order.

That is, the order can be appealed based on any significant shortcomings on the part of the inspector.

Procedure for appealing orders

The inconsistency of documents issued and drawn up by officials of the State Traffic Safety Inspectorate is one of the formal reasons for appealing orders . During the inspection, the State Tax Service authorities issue various documents that may be drawn up with violations. Such documents may be:

- an order to conduct an inspection by the State Fire Service body, the form of which is approved by Order of the Ministry of Economic Development of Russia N 141;

- inspection report, the form of which is also established by order of the Ministry of Economic Development of Russia N 141:

- protocols for sampling products, samples;

- protocols (conclusions) of studies (tests), measurements and examinations.

First of all, it is necessary to pay attention to the direct availability of these documents: a certified copy of the order and the inspection report must be handed over to the authorized person of the protected object during any inspection. Selection protocols and research protocols (examinations) must be handed over if they are carried out.

It is important to carefully study these documents, as they may contain inconsistencies such as:

- discrepancy between the scheduled date of the inspection and its actual implementation

- discrepancy between the names of officials indicated in the documents and the names of persons who actually presented their IDs

- lack of information in measurement reports about measuring instruments and their verification

- lack of instructions about the experts to be involved in the order to conduct the inspection

- other inconsistencies.

If a violation of fire safety requirements is detected, the inspector must make a note about this in the order. At the same time, he must indicate which paragraph and which legal act the identified violation contradicts. At this stage, reasons also arise for appealing the order , since if a violation is actually correctly identified, the inspector may refer to the wrong paragraph or the wrong document when justifying it. The presence of a wide range of regulatory framework in the field of fire safety, limited periods of validity of specific laws, regulations, SNiPs, codes of rules and other documents, the entry into force of some documents instead of old ones and at the same time maintaining the validity of old documents, but only for previously constructed objects , often causes confusion and is the reason for the most common errors in State Fire Supervision regulations.

Regarding unscheduled inspections, it is important to note that when carrying out an unscheduled inspection in order to monitor compliance with the order to eliminate violations (non-compliance), compliance only with those fire safety requirements, the implementation of which was prescribed by a previously issued order to eliminate violations (non-compliance), is checked. At the same time, if violations are detected that were committed during the period of time between the completed scheduled inspection and this unscheduled inspection, measures are taken to bring the persons who committed the identified violations to justice. In addition, measures are taken to conduct a general unscheduled inspection if such violations pose a threat of harm to life, human health, the environment, property or a fire threat.

Article sent by: inzhener

I like (54)

Articles on the topic

0 45

Inspection of the Ministry of Emergency Situations: what firefighters check when inspecting organizations

Published: March 6, 2018

Legal regulation

Practice

As already mentioned, the employer can appeal the order through a higher-ranking inspector or through the court. In practice, they usually go directly to court. What is this connected with? The fact is that when you appeal to a higher authority, the time allotted for solving the problem through the court does not stop flowing.

Let's look at an example. The employer sends an application for appeal to a higher-ranking inspector. They must respond to him within 30 days. For example, a person received a refusal after 20 days. In this case, the period for going to court, equal to 10 days, has already expired.

However, the employer can go to court to challenge the decision of a superior inspector. He will need to pay a fee based on paragraph 1 of Article 333.19 of the Tax Code of the Russian Federation. The claim is filed in court at the actual address of the State Tax Inspectorate, which issued the decision.

How to appeal decisions of the labor inspectorate

As follows from Article 361 of the Labor Code, orders of state labor inspectors (as well as decisions on the imposition of administrative penalties) can be appealed. However, when appealing them, the employer must not only have evidence confirming the unfoundedness of the decision, but also comply with the procedure for filing a complaint established by law. Today we will tell you in what time frame and in what order this can be done.

Methods of appeal

Decisions of state labor inspectors can be appealed in two ways: by subordination and (or) in court (Article 361 of the Labor Code of the Russian Federation)*. In the order of subordination, a complaint against the decision of the state labor inspector may be filed with the head of the relevant state labor inspectorate or the chief state labor inspector of the Russian Federation. At the same time, filing a complaint based on subordination does not prevent a simultaneous appeal of the same decision of the state labor inspector in court. Although it should be noted that simultaneously filing a complaint with both authorities does not make sense, since in this case it will only be considered in court (Part 2 of Article 30.1 of the Code of Administrative Offenses of the Russian Federation). When a superior official or judge receives a complaint, they are not bound by its arguments and check the case in full.

Let's talk in more detail about the procedure for appealing orders of state labor inspectors and decisions to impose a fine. Since these are the documents that are most often issued based on the results of inspections.

Protocol on administrative offense

When violations of labor legislation are identified during an inspection, the state labor inspector, as a rule, first of all draws up a protocol on the administrative violation**. It is this document that can serve as the basis for bringing the employer (his representative) or other official in respect of whom the protocol has been drawn up to administrative liability.

Therefore, this document must be treated very carefully. Carefully study the violations recorded in it. If you do not agree with them, do not rush to give an explanation immediately. In the column provided for explanations, you can write when they will be submitted. And by this deadline, having a copy of the protocol in hand, prepare written explanations on a separate sheet. In the future, these explanations can be used by you when appealing the decision to impose an administrative penalty. The protocol on an administrative offense must be drawn up in compliance with the requirements provided for in Art. 28.2 Code of Administrative Offenses of the Russian Federation.

Resolution on imposing administrative punishment

Based on the protocol, as stated above, a decision is made to impose an administrative penalty (according to Form No. 5-GIT)***. If you consider the punishment to be illegal and unfounded, then you have the right to appeal it within 10 days from the date of delivery of a copy of the decision to you or receipt of it by mail (Article 30.3 of the Code of Administrative Offenses of the Russian Federation). At the same time, we draw your attention to the fact that only in court complaints against the inspector’s decision imposing punishment in the form of administrative suspension of activities (for up to ninety days) are considered.

This is also important to know:

What to do if the employer does not pay wages

As for fines for violation of labor laws, they can be challenged (as we noted above) both in court and to the head of the state labor inspector in the order of subordination. If within 10 days from the date of delivery of the decision on the imposition of an administrative penalty it is not appealed, then the decision shall enter into legal force. And from this moment on the countdown of days to pay the fine will begin. The fine must be paid no later than 30 days from the date the resolution came into force (Article 32.2 of the Code of Administrative Offenses of the Russian Federation). After the specified period, the materials are sent to the bailiff for forcible collection****. If the deadline for an appeal is missed for a good reason, the specified period can be restored by a judge or official authorized to consider the complaint (Part 2 of Article 30.3 of the Code of Administrative Offenses of the Russian Federation).

Procedure for appealing an order

In order to eliminate identified violations of labor legislation, state labor inspectors present mandatory instructions to the employer's representative. This document contains requirements for eliminating identified violations, indicating deadlines for implementation. It should be noted that the deadlines for appealing orders in the order of subordination are not defined by law. The Labor Code (Article 357) only talks about appealing in court. You can challenge the order within 10 days from the date of receipt.

Requirements for filing a complaint

The complaint must generally contain the following information:

- name of the body or official to whom the complaint is filed;

- name of the employer (full name of the official) appealing the decision of the state labor inspector (indicating the location (postal address));

- details of the appealed decision (instruction, resolution) indicating the circumstances on the basis of which the applicant considers the said decision illegal;

- a request to the body (official) to make a decision on this complaint (for example, to declare the appealed decision illegal or to cancel the decision on imposing an administrative penalty).

Important

The complaint must be dated and signed by an authorized person (the legal representative of the employer or the official against whom the decision was made in the case). Supporting documents may be attached to the complaint in support of the stated requirements.