Letter of the Federal Tax Service dated October 31, 2020 No. ED-4-9/ [email protected] “On recommendations for the application of the provisions of Article 54.1 of the Tax Code” on how the tax authorities will apply the provisions of the new article and what evidence the tax authorities will use when accusing taxpayers of illegal tax savings. The letter contains examples of typical violations that taxpayers may commit.

Separately, in the letter, the Federal Tax Service indicated that Article 54.1 of the Tax Code of the Russian Federation, introduced by Law No. 163-FZ, is aimed at preventing the use of “aggressive” tax optimization mechanisms. The new term, according to the Federal Tax Service, should apparently replace the good old concept - unjustified tax benefit.

The Federal Tax Service indicates that Article 54.1. The Tax Code of the Russian Federation is not a codification of the rules formulated in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 N 53 “On the assessment by arbitration courts of the validity of a taxpayer receiving a tax benefit” (hereinafter referred to as PP SAC No. 53), but represents a new approach to the problem of abuse of the taxpayer with your rights.

All norms, concepts and all practice according to PP VAS No. 53 remain a thing of the past. The main points of practice have been taken into account, but the approach will be new, emphasized in the letter. In other words, the Federal Tax Service has set a course for the formation of new judicial practice, taking into account the framework established by Art. 54.1 of the Tax Code of the Russian Federation, which specifies specific actions of the taxpayer that constitute an abuse of rights, and the conditions that must be met in order to be able to take into account expenses and claim tax deductions for transactions. Norms Art. 54.1. like many norms of the Tax Code of the Russian Federation, they contain the possibility of a broad interpretation, so tax specialists now have a real opportunity to “reformat” judicial practice.

The text of the commented letter in conjunction with other letters from the Federal Tax Service (including Letter of the Federal Tax Service dated August 16, 2017 No. SA-4-7 / [email protected] that the calculation method does not apply in case of violation of the requirements of Article 54.1 of the Tax Code of the Russian Federation) allows us to conclude that the concept of “real amount of tax benefit” (first voiced in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 3, 2012 N 2341/12 in case N A71-13079/2010-A17) may be forgotten. This conclusion is the saddest for taxpayers - after all, tax reconstruction made it possible to at least partially fight off the claims of tax authorities regarding income tax, taking into account the costs incurred for the actual implementation of the transaction.

The Letter contains a declarative digression stating that proof of the circumstances provided for in Art. 54.1. Tax Code of the Russian Federation, is carried out by the tax authority when carrying out tax control measures in accordance with sections V, V-1, V-2 of the Tax Code of the Russian Federation. Consequently, the principle of the presumption of good faith of the taxpayer remains in force as one of the most important elements of the constitutional and legal regime for regulating tax relations and public law and order in general. But we all understand that such declarations are unlikely to significantly ease the lot of taxpayers.

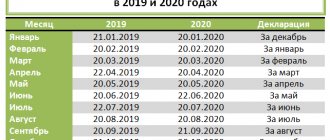

Despite the fact that the Federal Tax Service has repeatedly pointed out that the provisions of Article 54.1. The Tax Code of the Russian Federation applies only to audits ordered after the day the article came into force (August 19, 2017); the taxpayer needs to remember that tax audits for the period 2017-2016-2015 will be carried out based on new rules for assessing and collecting evidence of the illegality of the taxpayer’s actions.

Grounds for recognizing an unjustified tax benefit

In some cases, the grounds for obtaining tax benefits are artificially created for organizations. An unjustified tax benefit is a benefit for which the organization acted intentionally. There are reasons for receiving it, but they are not real.

If, during a tax audit, schemes were identified by which an organization creates conditions for obtaining a tax benefit, such a benefit is considered unjustified, and the tax is recalculated (additionally assessed).

The study of documented transactions and acts of the economic life of an organization leads the tax authorities to a decision on the unjustification of the tax benefit in the following cases:

- Affiliation of counterparties for various reasons.

- Understatement of the tax base

- Errors when calculating tax

- Application of a reduced tax rate

- Overpriced transaction

- The unreality of the deal

The reasons can be completely different, and it depends on the conditions for the organization to receive tax benefits.

HEALTHY:

What will the tax office check and prove?

The Federal Tax Service ordered tax audits for VAT and income tax to be carried out in two stages and disclosed the circumstances to be established in each:

1) Identification of the direct intention of the taxpayer to obtain an unjustified tax benefit through a system of counterparties

1) The facts of legal, economic and other control are established, including on the basis of the interdependence of the disputed counterparties to the inspected taxpayer,

2) Circumstances are established that indicate the coordination of the actions of the parties to the transaction (transactions), as well as (or) evidence of the unreality of the business transaction (operations) for the supply of goods (performance of work, provision of services),

If control is not established, the tax office moves on to the next stage of the audit:

2) Identification of tax minimization through the use of ephemeral documents by the taxpayer himself:

1) Establishing the dishonesty of the actions of the taxpayer himself in choosing a counterparty;

2) Establishment of circumstances indicating failure to carry out the relevant business transaction by the taxpayer’s counterparty (at the first level).

According to the Federal Tax Service, in the latter case, negative consequences cannot be imposed on the taxpayer if he showed due diligence in choosing a counterparty, subject to the reality of business transactions.

At the same time, the establishment, based on the results of a tax audit, of the fact of signing documents on behalf of counterparties by persons who deny their signing and the presence of their authority as a manager, through interrogations and handwriting examinations, is not an unconditional and sufficient basis for the conclusion that the taxpayer failed to exercise due diligence and caution when concluding a transaction with a disputed counterparty and cannot be considered as a basis for recognizing a tax benefit as unjustified.

The position of the Supreme Court set out in the letter by the Federal Tax Service should not mislead taxpayers. The reservation made by the Supreme Court: is not an unconditional and sufficient basis for the conclusion..., does not guarantee against refusal of deductions and withdrawal of expenses.

The Federal Tax Service uses this clause in the letter and instructs local inspections not to limit themselves only to the specified evidence, and indicates the need to collect other evidence, in addition to interrogating managers and handwriting examinations. What kind of evidence the tax office will collect will be discussed below.

Due diligence again!

The use of VAT deductions and expenses when calculating income tax is a tax benefit for the taxpayer from the application of the rules of the Tax Code of the Russian Federation. The Supreme Court, in its ruling dated November 29, 2016 No. 305-KG16-10399, recalled:

According to paragraph 10 of Resolution No. 53, a tax benefit may be recognized as unjustified if the tax authority proves that the taxpayer acted without due diligence and caution, and he should have been aware of violations committed by the counterparty.

From which the Supreme Court concluded: the motives for choosing a counterparty only by the terms of the transaction and commercial attractiveness are not sufficient to recognize the actions of the taxpayer with due diligence .

According to the Supreme Court, in addition to conditions and commercial attractiveness, it is necessary to evaluate:

1) business reputation,

2) solvency of the counterparty,

3) the risk of non-fulfillment of obligations by the counterparty and the provision of security for their fulfillment,

4) the counterparty has the necessary resources (production capacity, technological equipment, qualified personnel)

5) the counterparty has relevant experience

The Supreme Court considers these criteria to be known since 2010. and refers to the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 25, 2010 N 15658/09.

Consequences of an unjustified tax benefit

The consequences of identifying tax schemes for obtaining benefits in paying taxes are refusal to use tax deductions and benefits, recalculation of the tax base.

In addition, the actions of an organization can be assessed as a tax offense, liability for which is provided for in Chapter 16 of the Tax Code of the Russian Federation.

Thus, for gross violation of accounting rules, if they resulted in an underestimation of the tax base, they face liability in the form of a fine in the amount of 20% of the amount of additional tax assessed.

How to prove the tax justification of a tax benefit?

The grounds on which the tax burden is reduced may be assessed by the inspector as improper grounds if the tax reduction is illegal. In addition, the identification of unjustified tax benefits may serve as a reason for refusal to receive tax benefits and deductions.

To assess the right to a tax reduction, deduction or benefit, inspectors use the recommendations set out by the Federal Tax Service in letter No. ED-5-9/547 dated March 23, 2017:

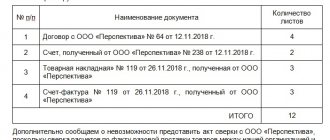

- Keeping records of acts of economic life . The transaction is formalized by contracts, its execution by primary accounting documentation. If the documentation is signed by an unauthorized person, the transaction may be considered an illegal basis for obtaining a tax benefit.

- Transactions with counterparties . When examining a taxpayer's documentation, the creation of a formal document flow with a chain of counterparties and the conclusion of a transaction with affiliated parties may be revealed. Both signs are grounds for additional tax assessment or refusal of a tax deduction.

In addition, the inspector must not only identify, but also prove that the organization formalized business transactions in order to obtain tax benefits. In other words, the taxpayer acted intentionally.

Such evidence in practice is the facts of affiliation of persons or control of persons. Affiliation or control can be legal (one director or founder, division of business, etc.), economic (common trademark, etc.), or other. Facts of interdependence of organizations indicate the consistency of their actions; on their basis, the inspector will prove the unreality of the transaction.

To prove this, the inspection may request documents confirming the actions taken to conclude the transaction. Among them:

- Documents indicating due diligence when choosing a counterparty and market research. This is any documentation that records the results of a search for employees of the contractor’s or customer’s organization.

- Business correspondence.

It is also possible to prove the unreality of a transaction by presenting facts indicating the impossibility of counterparties to execute the transaction. For example, the lack of necessary inventory at the time of the transaction.

If there are no facts that indisputably indicate control, the inspectorate can prove the taxpayer’s bad faith when concluding a transaction. This is indicated by imprudence in choosing a counterparty, failure to carry out the corresponding business transaction by the counterparty.

Unreasonable benefit: how to defend against accusations?

Many companies greeted Article 54.1 of the Tax Code of the Russian Federation with optimism, but over time it began to raise more and more questions among lawyers, accountants and entrepreneurs. To confirm your integrity, you need to be careful and know the jurisprudence. Vadim Kosyakov spoke in detail about the prospects and risks of litigation over unjustified tax benefits in his article.

Consequences of receiving an unjustified tax benefit

On August 19, 2020, Article 54.1 of the Tax Code of the Russian Federation[1] came into force, establishing the limits for the exercise of rights to calculate the tax base and the amount of taxes, fees, and insurance contributions. In other words, this article established the possibility of obtaining tax benefits only if the taxpayer’s transactions are real. According to the article, the main purpose of the taxpayer’s transaction must be a specific reasonable economic (business) purpose, and not tax savings. If the tax reduction only formally complies with the law, then we are talking about obtaining an unjustified tax benefit, which implies enrichment at the expense of the budget.

Having recognized the tax benefit as unjustified, the Federal Tax Service has the right to withdraw expenses, refuse to deduct VAT, not confirm the benefit, not return or charge additional taxes, and charge penalties and fines[2].

Criteria for the validity of a tax benefit

Now in paragraph 2 of Art. 54.1 of the Tax Code establishes clear criteria for the validity of tax benefits while simultaneously complying with them:

– non-payment/incomplete payment and/or offset/refund of the tax amount was not the main purpose of the transaction;

– the obligation under the transaction is fulfilled by a person who is a party to the agreement and/or by a person to whom the obligation is transferred under the agreement or law.

According to the letter of the Federal Tax Service of Russia dated August 16, 2017 No. SA-4-7/ [email protected] “On the application of the norms of the Federal Law dated July 18, 2017 No. 163-FZ” “... when the tax authorities establish the presence of transactions (operations) concluded by the taxpayer, although would be one of the two circumstances defined in paragraph 2 of Art. 54.1 of the Tax Code of the Russian Federation, he should be denied the right to account for expenses incurred, as well as applications for them to deduct (offset) VAT amounts in full.”

In the absence of the circumstances specified in paragraph 1 of this article, the tax base and (or) the amount of tax are considered unlawfully reduced.

Limits of application of judicial practice and norms of Article 54.1 of the Tax Code of the Russian Federation

Before the adoption of this article, controversial legal relations had no legal interpretation and were explained only by legal positions developed by the highest judicial authorities. As a result, the permitted limits of tax optimization had to be sought in judicial acts summarized from the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 53 of October 12, 2006.

Most of the provisions of Article 54.1 of the Tax Code of the Russian Federation, when compared with Resolution of the Supreme Arbitration Court of the Russian Federation No. 53, are not something new. The resolution established similar provisions that prevent the receipt of unjustified tax benefits.

It must be remembered that the rules of Art. 54.1 of the Tax Code of the Russian Federation are subject to application only for inspections appointed after August 19, 2017, when they entered into legal force. And according to the results of audits for 2016–2017, taxpayers have to operate only with the concepts and principles of the old norms established by Resolution of the Supreme Arbitration Court of the Russian Federation No. 53. This argument is also confirmed by judicial practice[3].

At the same time, the Federal Tax Service of Russia in Letter dated October 31, 2017 No. ED-4-9/ [email protected] noted that the concepts reflected in the Resolution of the Plenum No. 53 and developed in the established judicial practice formed before the entry into force of Art. 54.1 of the Tax Code of the Russian Federation, are not used within the framework of:

- desk tax audits of tax returns (calculations) of taxpayers submitted to the tax authorities after the entry into force of Art. 54.1 Tax Code of the Russian Federation;

- on-site tax audits and audits of the completeness of calculation and payment of taxes in connection with transactions between related parties, decisions on the appointment of which were made after the day Art. 54.1 Tax Code of the Russian Federation.

However, the courts believe that the adoption of Art. 54.1 of the Tax Code of the Russian Federation do not cancel either Resolution No. 53, nor the possibility of applying the legal positions of higher courts, which were developed during its action and continue to mention Resolution No. 53 along with references to Art. 54.1 Tax Code of the Russian Federation[4].

For example, the Arbitration Court of the Kemerovo Region heard a case in which the tax authority expressed the position that the taxpayer’s arguments about the exercise of due diligence and caution when choosing contractors, about the economic justification of the expenses incurred, the absence of a goal of understating corporate income tax, the fact and amount of expenses incurred expenses have no legal significance due to the provisions of Article 54.1 of the Tax Code of the Russian Federation.

The tax authority considered that this article was a legislative novelty and assumed that in the absence of real relations with the declared counterparties, even if the reality of the movement of goods from third parties and the reality of the expenses incurred, the taxpayer does not have the right to take them into account. But in its decision dated September 25, 2019 in case No. A27-17275/2019, the Arbitration Court of the Kemerovo Region indicated that the norms of tax legislation, on the basis of which the highest courts developed legal positions, have not changed, including with the entry into force Art. 54.1 of the Tax Code of the Russian Federation: the appearance of this article in the Code was not accompanied by a change in the principles of legal regulation in the field of taxation, the introduction of additional tax offenses, or a narrowing of the powers of tax authorities.

In another case, also considered in the Arbitration Court of the Kemerovo Region, the court, in its decision dated October 21, 2019 in case No. A27-18448/2019, also sided with the taxpayer and indicated that he showed due diligence when choosing contractors, carried out standard competitive procedures, received the proper documents from them. At the time of entering into economic relations with counterparties, the taxpayer was not aware that the tax authority had identified circumstances in their regard that characterized them as unscrupulous taxpayers.

From the case materials it followed that the company carried out coal enrichment during the period under review. This process goes on around the clock, and waste is generated. Since the taxpayer did not have its own trucks, it hired contractors to remove the said waste to a dump.

In assessing additional income tax to the company, the inspectorate, without disputing the technological necessity of transport services and the fact of incurring expenses, proceeded from the impossibility of accounting for them on the basis of Art. 54.1 of the Tax Code of the Russian Federation, since they were incurred in transactions with disputed counterparties, in the presence of formal document flow. However, during the trial it was established that all business transactions took place. Witnesses confirmed that the contractors had employees and rented vehicles. Interaction on the substance of the provision of services was carried out directly with the management of the counterparties, and there was no evidence that the provision of services was organized by the taxpayer himself in direct interaction with vehicle owners and drivers. The tax authority did not prove the dishonesty of the counterparties. Taking into account the above, the applicant’s income tax expenses were found by the court to be justified; additional assessment of corporate income tax, corresponding penalties and fines are illegal.

In another case No. A14-15705/2018 dated May 17, 2019, considered by the Arbitration Court of the Voronezh Region, the court considered that the taxpayer showed sufficient diligence because before concluding the agreement, he requested from the counterparty a charter, an extract from the Unified State Register of Legal Entities, a certificate of registration, a certificate on assignment of TIN. In addition, the counterparty provided the taxpayer with an advertising brochure indicating the facilities it had previously built. All this, according to the court, confirmed the real nature of the counterparty’s construction activities.

All of the above decisions of the higher courts were upheld.

Thus, from the analysis of judicial acts it is clear that, despite the new norms of Article 54.1 of the Tax Code of the Russian Federation, the courts continue to take the side of the taxpayer in situations controversial with the tax authorities, when it comes to doubt about the reality of business transactions, if the taxpayer showed evidence before concluding the transaction due diligence when choosing a counterparty.

Positions of the courts when resolving controversial situations under the new rules

As stated above, paragraphs. 1 item 2 art. 54.1 of the Tax Code of the Russian Federation establishes a prohibition for a taxpayer to reduce the tax base and (or) the amount of tax payable in the case where the main purpose of the transaction (operation) is non-payment (incomplete payment) and (or) offset (refund) of the tax amount.

According to the tax authority[5], the prohibition on a taxpayer reducing the tax base and (or) the amount of tax payable should be applied in case of proof of deliberate actions of the taxpayer himself, expressed in deliberate distortion of information about the facts of economic life (the totality of such facts), about objects of taxation subject to reflection in tax and (or) accounting or tax reporting of the taxpayer for the purposes of:

- reduction by the taxpayer of the tax base and (or) the amount of tax payable;

- incorrect application of the tax rate, tax benefit, tax regime;

- manipulation of taxpayer status;

- intentional actions of a tax agent in non-withholding (incomplete withholding) of tax amounts subject to withholding by the tax agent.

The tax authority also notes that typical examples of “distortion” are:

- creation of a “business fragmentation” scheme aimed at the unlawful use of special tax regimes;

- taking actions aimed at artificially creating conditions for the use of reduced tax rates, tax benefits, and tax exemptions;

- creation of a scheme aimed at the unlawful application of the norms of international agreements on the avoidance of double taxation;

- unreality of execution of the transaction (operation) by the parties (lack of fact of its completion).

Methods of distorting information about objects of taxation may include: non-reflection by the taxpayer of income (revenue) from the sale of goods (work, services, property rights), including in connection with the involvement of controlled persons in business activities, as well as reflection by the taxpayer in the accounting registers and tax accounting of obviously unreliable information about taxable objects. In these situations, the tax authority will assess whether the conditions for their application have been artificially created in order to reduce taxes.

Judicial practice on these disputes has just begun to take shape, but even taking this into account, it is possible to analyze the most interesting, in our opinion, court cases and consider the reasons why the court sided with the taxpayer.

Let us consider several court decisions on these disputes.

Application of a business division scheme

Tax evasion under the scheme of artificial business fragmentation consists in maintaining or obtaining the status of a tax payer under a special tax regime by simulating the work of several persons who in reality act as one person.

In the case considered by the Arbitration Court of the Volgograd Region, the tax authority pointed to the interdependence of the companies as signs of applying a business fragmentation scheme and, as a result, obtaining unjustified benefits; being at the same address; use of the same production equipment; availability of part-time employees.

But the court pointed out that the implementation by companies of one type of activity is not a valid argument in favor of the existence of a “business fragmentation scheme”, since it does not contradict the law and this circumstance in itself cannot indicate that the company has received an unjustified tax benefit.

Based on the analysis of the current judicial practice in the category of cases related to business fragmentation, it follows that the legally significant circumstance to be clarified, both as part of the audit and when considering the case in court, is the main purpose of these actions of the taxpayer. This goal should be to reduce the tax burden on the taxpayer by applying a special regime to one of the friendly companies and receiving its main income from business activities.

In this case, the taxpayer was able to provide evidence that both companies actually and independently carried out their activities in accordance with the business purpose and type of economic activity for which they were created: they have separate current accounts, maintain separate accounting records, and make payments based on the results of independent economic activities taxes and fees, have a different client base.

The taxpayer was also helped by the fact that initially one company was created, which was on the simplified tax system from its very inception, while until 2020 it was managed by another person, and 9 years later another company was created using the simplified tax system.

In its decision dated April 29, 2019 in case No. A12-2866/19, which was supported by the appellate instance, the Arbitration Court of the Volgograd Region considered that the tax authority did not establish a beneficiary “according to the business splitting scheme”, no evidence was provided of financing from each other’s companies, as well as evidence that the funds received by these legal entities were pooled by them by transferring them to one of the taxpayers, or that these organizations, having received net profit, used it jointly for certain purposes; the inspection did not provide evidence that the interdependence of the organizations affected the conditions or economic results of the transactions and activities of the participants. At the same time, the fact of affiliation in itself does not indicate receipt of a tax benefit[6].

Unrealistic execution of the transaction (operation) by the parties

Business transactions through counterparties who do not have labor resources and fixed assets to perform work or services, as well as the lack of due diligence when checking the counterparty before concluding a transaction, allows the tax authority to conclude that the transaction is unrealistic.

The Fifth Arbitration Court of Appeal in its ruling[7] took the side of the taxpayer and pointed out that the inspection did not prove the presence of all the conditions under which a tax benefit can be considered unjustified, as explained in paragraphs 1, 10 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 53. The appellate instance noted that when confirming the reality of the delivery of goods, the company showing due diligence in choosing a counterparty and the absence of evidence of dishonest behavior of the taxpayer, there were no legal grounds for recognizing the tax benefit received by the company, which was not justified by the tax authority and the court of first instance.

The court pointed out that all these circumstances were reflected in Article 54.1, newly introduced into the Tax Code of the Russian Federation, which establishes that if a business transaction is real and the taxpayer does not have the goal of non-payment (incomplete payment) and (or) offset (refund) of the tax amount identified by the tax violations of tax legislation by the taxpayer's counterparty cannot be considered as an independent basis for recognizing the taxpayer's reduction of the tax base and (or) the amount of tax payable as unlawful.

Thus, tax claims are possible only if the tax authority proves that the transaction (operation) was not executed by the taxpayer’s counterparty and the taxpayer failed to comply with the conditions established by paragraph 2 of Article 54.1 of the Code.

The taxpayer was helped to prove his right to receive tax benefits by the following facts that he was able to present to the court:

- the terms of the agreement for the supply of goods were agreed upon by telephone and e-mail, the conclusion (signing) of the agreement took place in the applicant’s office, at the time of the conclusion of the agreement the applicant was presented with documents such as TIN, OGRN certificates, the charter of the counterparty, the decision to establish, the order to appoint a director, a copy of the director’s passport, a power of attorney in which this person is authorized to represent the interests of the counterparty, with the right to sign any financial documents on behalf of the company;

- invoices are signed by an authorized person. At the same time, the absence of information from the inspectorate on a certain date about the new manager does not indicate that the invoice was signed by an unauthorized person;

- the reality of the execution of the supply agreement was confirmed by the invoices submitted by the taxpayer during the audit, which is consistent with the terms of the agreement, as well as the actual payment for the goods to the account of the counterparty.

In addition, the taxpayer indicated that the reason for choosing this counterparty was the provision of a deferred payment for the supplied goods, as well as the reasonableness of prices and delivery of goods by the supplier.

The Arbitration Court of the Nizhny Novgorod Region did not support the position of the tax authority, based on similar facts.[8] The inspectorate did not agree with the VAT deduction made for transactions between the taxpayer and two counterparties. These counterparties also did not have sufficient labor resources, one of the organizations was not located at the place of registration and had a nominee manager, the second counterparty was a related person with the taxpayer. The drivers of these organizations denied supplying goods to the taxpayer.

All of the above circumstances, in the opinion of the tax authority, together indicated that there were no real financial and economic relationships between the taxpayer and the counterparties; the documents on the basis of which the taxpayer claimed VAT tax deductions did not comply with the requirements of the law and contained unreliable information.

But the court found that business transactions with counterparties are reflected in the taxpayer’s accounting and tax reporting. Taxes have been paid by the taxpayer.

According to the court, the inspection did not provide evidence that the applicant was aware of the violations committed by his counterparties, nor that the applicant acted in concert with them - solely for the purpose of obtaining unjustified tax benefits. Moreover, the taxpayer showed reasonable care and prudence by requesting and receiving copies of the constituent, registration and administrative documents of its counterparties.

The fact that counterparties do not have personnel, fixed assets, production assets, property, vehicles, storage facilities necessary to achieve the results of the relevant economic activity does not mean that the work was not performed, nor does it mean that the counterparties are “unscrupulous organizations” and transactions with them were carried out only to obtain an unjustified tax benefit.

The court also did not take into account the inspectorate’s argument that the counterparties did not submit documents at the request of the tax authority, since the taxpayer is not responsible for the actions or inactions of its counterparty.

The interrogation protocols of the counterparties' drivers were not taken into account on formal grounds, and the testimony of other witnesses confirmed that the transactions with the counterparties were real. The court also did not accept the inspector’s argument about the affiliation of the taxpayer and the counterparty and the nominee of the head of the other counterparty.

The court took into account the fact that the inspection carried out an audit to determine whether the taxpayer was correctly charged not only value added tax, but also income tax. However, the inspection, having assessed additional value added tax, did not make additional assessments of income tax, thereby agreeing with the supply of goods and the provision of transportation services to the disputed contractors.

At the same time, the court noted that the taxpayer showed reasonable care and prudence. Requested and received a registration certificate, TIN certificate, founder’s decision to create, order to appoint a director, list of participants, extract from the Unified State Register of Legal Entities, client questionnaire, charter, copy of the director’s passport, accounting statements, VAT returns, lease agreement.

Based on the foregoing, the court concluded that the applicant submitted all the necessary documents, properly executed, to obtain tax benefits.

The appellate court upheld this decision.

The Twentieth Arbitration Court of Appeal, in its ruling dated October 23, 2018 No. 20AP-5530/2018 in case No. A23-8752/2017, also sided with the taxpayer. He pointed out that formal claims against counterparties (violation of the legislation on taxes and fees, signing of documents by an unidentified person, etc.) in the absence of facts disproving the reality of transactions and operations carried out by the declared taxpayer by the counterparty are not an independent basis for refusal to account for expenses and in tax deductions for transactions (operations).

The provisions of paragraph 2 of Article 54.1 of the Tax Code of the Russian Federation do not provide for negative consequences for taxpayers for unlawful actions of counterparties of the second, third and subsequent links.

Consequently, tax claims are possible only if the tax authority proves the unreality of the transaction by the taxpayer’s counterparty and the taxpayer’s failure to comply with the conditions established by paragraph 2 of Article 54.1 of the Tax Code of the Russian Federation.

The fact that the counterparty does not own fixed assets does not affect its ability to fulfill contractual obligations. This circumstance does not deprive the specified person of the opportunity to exercise the right to lease (sublease) the necessary funds.

Thus, the courts came to the conclusion that the counterparty’s lack of necessary funds cannot be recognized as a circumstance indicating the unreality of business transactions within the framework of the concluded agreement.

The services provided by the company's counterparty were accepted by the applicant for accounting on the basis of the submitted documents. This fact was not disputed by the tax authority.

As we see, in this case, the taxpayer had indisputable documentary evidence of the reality of the transaction.

The Arbitration Court of the Sverdlovsk Region dated May 13, 2019 in case No. A60-75291/2018 in a similar situation also made a decision in favor of the taxpayer, and higher authorities upheld it. In fact, the tax authority's claims to the taxpayer's deductions were due to the counterparty's lack of property and labor resources.

As it was found out from the documents submitted by the taxpayer, the director (aka participant of the counterparty) was registered in only one organization. The main activity of the counterparty corresponded to the work performed under the contract. There were no records of unreliability regarding the counterparty. One of the convincing grounds for the court was the fact that the taxpayer presented the primary documents for the transaction (invoices, acts of acceptance of work performed (form KS-2, certificates of the cost of work performed, etc.).

Although the counterparty did not provide information about payments to employees, according to the court, this did not mean that there were no employees at all, since he could attract them, but not submit reports in Form 2-NDFL.

Thus, the courts, in both the first and second cases, concluded that the activities of organizations cannot be made dependent on the presence or absence of a sufficient number of employees, technical personnel, property, expenses for utilities, wages, communication services, since Current legislation does not oblige an organization to have its own fixed assets and appropriate staff when carrying out business activities.

To summarize, I would like to note that despite the fact that the established judicial practice regarding the application of the provisions of Art. 54.1 of the Tax Code of the Russian Federation is virtually absent, however, the arguments, motivation and justification regarding the facts of the presence or absence of an unjustified tax benefit, currently formed within the framework of law enforcement practice in the context of Resolution No. 53, will be used by the courts in the context of Art. 54.1 Tax Code of the Russian Federation.

At the same time, the taxpayer’s position in a legal dispute with the tax inspectorate will be more advantageous if he takes all necessary actions to check the counterparty before concluding a transaction, transactions with him will correspond to economic sense and their business purpose will be confirmed.

[1] Introduced by Federal Law No. 163-FZ of July 18, 2017 “On Amendments to Part One of the Tax Code of the Russian Federation”

[2] Art. 122 Tax Code of the Russian Federation; clauses 2 and 11 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53 “On the assessment by arbitration courts of the validity of the taxpayer’s receipt of a tax benefit”

[3] Resolution of the Arbitration Court of the Moscow District dated November 8, 2019 No. F05-18947/2019 in case No. A40-315815/2018; Resolution of the Tenth Arbitration Court of Appeal dated November 29, 2019 No. 10AP-17521/2019 in case No. A41-40264/2019

[4] Resolution of the Arbitration Court of the West Siberian District dated July 22, 2019 No. F04-2979/2019 in case No. A27-24569/2018

[5] Letter of the Federal Tax Service of Russia dated October 31, 2017 No. ED-4-9/ [email protected]

[6] Determination of the Constitutional Court of the Russian Federation dated 04.06.2007 No. 320-O-P

[7] Resolution of the Fifth Arbitration Court of Appeal dated May 18, 2018 No. 05AP-1916/2018 in case No. A51-30566/2017

[8] Decision of the Arbitration Court of the Nizhny Novgorod Region dated December 24, 2018 in case No. A43-27187/2018

Tax court for tax benefits

The judicial procedure for resolving tax disputes consists of applying sections of the Arbitration Procedure Code of the Russian Federation on challenging a non-normative tax act. This may be a decision on additional tax assessment, refusal of a tax deduction, etc.

Such cases are considered in the manner of claim proceedings. At the same time, the pre-trial procedure for challenging the tax decision is mandatory.

You can go to court after a higher tax authority refuses to satisfy an appeal.

It is necessary to submit a statement of claim to the court at the location of the tax office with demands to cancel the decision of the tax authority. The statement of claim must indicate the grounds on which the decision is illegal, as well as the regulatory basis for the plaintiff’s conclusions and evidence.

If the court refuses to cancel the decision of the tax authority, the court decision may be appealed.

Split and lose the right to simplification

The use of a business fragmentation scheme creates conditions for obtaining savings in the form of a difference in tax obligations, but as a consequence - the loss of the right to use a simplified taxation system. For example, the Constitutional Court of the Russian Federation in its Ruling dated July 4, 2017 No. 1440-O concluded that tax legislation does not exclude the principle of discretion in tax legal relations and allows the taxpayer to choose one or another method of accounting policy (application of tax benefits or refusal of them , application of special tax regimes, etc.).