Constantly 30 Passports of buildings, structures 15 years 31 Agreements, acts on acceptance, transfer of buildings, structures Constantly 32 Passports of equipment 5 years 33 Books, magazines of impressions and casts of seals and stamps of a credit organization Constantly 34 Acceptance and delivery acts and appendices to them, drawn up during change of financially responsible persons 10 years 35 Registers of persons allowed to open, close, seal cash vaults, storerooms, safes, books of registration of the transfer of seals and keys 5 years 36 Audit reports of storerooms and cash registers of operating departments 5 years 37 Books of records of accepted and issued cash, valuables and valuable forms, notebooks for recording the receipt and expenditure of cash currency 5 years 38 Documents on the inventory of property and inventory, contracts, acts of acquisition, write-off of fixed assets and inventory 5 years VI.

How long is the history of transactions in Sberbank online saved?

Important

During this period, be prepared to present them to the inspectors at any time. Also see “Retention periods for invoices from October 1, 2017: what has changed.”

Is a bank statement primary? Typically, the retention period of a document depends on its legal status. For example, is it primary or not. Here is the recent opinion of the Supreme Court of the Russian Federation regarding bank statements on the movement of funds in accounts (determination dated January 30, 2017 No. 307-ES16-19374 in case No. A56-73410/2015): Bank statements are not primary accounting documentation within the meaning of the Accounting Law , therefore, society is not obliged to store them.

Attention

The company does not prepare these statements; the director and chief accountant of the organization do not sign them. These statements are provided by banks.

Purpose of bank statements and payment orders

Bank statement (abbreviated as BV) is a document reflecting the movement of funds of an organization or entrepreneur through a current account opened with a bank for a certain period of time. BV can be provided both at the request of the client or regulatory authority, and in accordance with the terms of the agreement on servicing the settlement account.

Payment orders (or PP) are documents on the basis of which a banking organization is obliged to transfer client funds to a certain person. The PP indicates the details of the payer and recipient, as well as the amount that should be debited from the manager’s account.

Bank statements confirm that the client's payment orders have been executed. In addition, both documents are often requested by tax authorities when conducting audits.

How to prove the fact of transfer after time?

Documents on letter of credit transactions: letter of credit counterfoils, control sheets, client applications for payment 5 years 62 Documents on settlement and target checks: check counterfoils, paid checks, client statements about the loss of checks, confirmations, letters of guarantee 5 years 63 Documents on the opening of settlement, current , correspondent, budget and other accounts, cards with sample signatures and seal imprints 5 years 64 Personal accounts for closed accounts of legal entities 5 years 65 Payment orders, checks, memorial orders and other documents of credit and expense transactions for the accounts of legal entities 5 years 66 Confirmations balance on current, settlement, correspondent accounts, mutual settlements, acts of reconciliation of mutual settlements and documents for them 5 years VIII.

https://youtu.be/szMChAkrf4s

Requirements for registering a cash book

When drawing up a document in form KO-4, you should not forget to comply with the following rules:

- Cash orders must be attached to the cash book, which must be signed by the cashier himself, the chief accountant, and also the manager on the expense document. All this primary information must be certified by the seal of the organization.

- The book must be kept daily. At the same time, it is also mandatory to check the document by an accountant: the correctness of the cash documentation is reviewed, and the executed transactions are also checked. After this, the signature of the inspector is affixed to the cash book.

- The cashier must daily count the balance of funds in the organization's cash register and compare them with the data in the book.

- If there are no cash transactions, the person in charge is not required to enter anything into the cash book.

- The cash book must be maintained for a calendar year. After which it is checked, certified and archived. And from the first working day of the new year they begin maintaining a new cash book KO-4.

Important ! From July 1, 2014, it is allowed to make changes to the cash book. In this case, the amendments must be accompanied by information about the person who corrected the error, certified by his signature. The date of correction must also be indicated.

Announcement

Statistical reports on lending to the population and legal entities Constantly 75 Credit files of borrowers: loan applications, loan agreements, urgent obligations to repay the loan and pay interest on it, additional agreements, documents to verify the intended use of the loan, cards with sample signatures and seals, correspondence; documents giving the right to receive a loan and confirming the solvency of legal entities (copies of charters, licenses, registration certificates, certificates of the composition of working capital, accounting reports and balance sheets with attachments, statistical reports) 5 years 76 Daily information on turnover on loan accounts of borrowers 5 years 77 Monthly information on balances on borrowers’ loan accounts 5 years 78 Statements of urgent and overdue loans 5 years 79 Logs of registration of loan agreements, incl.

Cash documents: types, registration, storage, corrections

According to the legislation of the Russian Federation, enterprises and organizations are required to keep accounting records of all business transactions. To solve this problem, primary documents are used. Confirmation of the fact of cash transactions at the cash desk of the enterprise is also carried out using primary documents.

Types of cash documents

Let's consider the main types of cash documents (hereinafter referred to as CD) and what mandatory details they can and should contain.

Types depending on the nature of operations:

- receipts;

- consumables;

- accounting registers containing registration and summarized information from the primary CDs listed above.

At the legislative level (Resolution of the Russian Statistics Committee No. 88), these types of design documentation have been approved:

- cash receipt order - No. КО1 (hereinafter referred to as PKO);

- expense cash order - No. KO2 (RKO);

- cash book - No. KO4 (КК);

- journal for registering incoming and outgoing cash documents - No. KO3 (ZhR);

- book of accounting of funds accepted and issued by the cashier - No. KO5 (KVD).

The main mandatory details of the documents listed above are highlighted , namely:

- Name;

- date of its preparation;

- the name of its compiler, in other words, the name of the organization/enterprise;

- Contents of operation;

- quantitative and monetary measurements of the transaction;

- position of the persons who committed and executed;

- signatures of the persons mentioned above.

Basic design requirements

Due to the fact that the approved and mentioned above design documentation differ from each other, let us consider the rules for drawing up each.

Design features of the PKO:

- the essence of the operation is entered in the line “Base”;

- the total amount of VAT is entered in the line “Incl.” in digital terms. This line cannot be empty. If tax is not applied, enter the phrase “without (VAT)”;

- data on additional supporting documents (if any) are entered into the PQR in the “Appendix” line.

When filling out the cash register, you must take into account the following nuances::

- the presence of additional documents (for example, a power of attorney) is entered in the “Appendix” line with the obligatory indication of the date and number;

- the line “Base” suggests reflecting the content of the expense transaction;

- the signature of the manager is not necessary if it is present on the attached document. For example, if the signature of the director of the enterprise is present on the order along with the resolution “I authorize” or “Agreed,” then the RKO can be accepted for work without his signature.

We will separately consider the issue of requirements for affixing stamps to RKO and PKO. According to the Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014 on the conduct of cash transactions, there are no mandatory requirements for stamp imprinting, as was previously the case until 2014.

Previously, the stamps “Paid” on the incoming order and “Repaid” on the outgoing order were used. The current rules only imply the mandatory affixing of a stamp on the tear-off receipt for the PKO. Thus, the “Paid” stamp can be affixed to the receipt for the PKO.

The presence of the “Paid” stamp is confirmation of the actual deposit of money and its posting.

https://youtu.be/imCiInK6xmw

As for the “Redeemed” stamp:

- it is placed on statements, for example, when issuing salaries to employees;

- can be used instead of “Paid”, for example, if the stamp is lost or missing for another reason.

There are 3 basic rules for registering a CC:

- Sew.

- Number. The bottom line: each sheet is numbered (consecutive number).

- Seal. The bottom line: you need to indicate how many sheets are contained in the CC according to the numbering and certify this inscription. This inscription is placed at the end of the book and is considered certified if there are signatures of the director and chief accountant.

The QC form assumes the presence of 2 parts. Moreover, the second part is detachable. It serves as the cashier's report at the end of the day and can only be torn off after all transactions have been completed.

Journal of registration of incoming and outgoing cash documents

The name itself answers the question of what this form is intended for, namely the assignment of serial registration numbers to cash documents.

Involves filling out such information:

- No. PKO/RKO, date and amount in Russian rubles in digital terms;

- The “Note” columns are filled in if necessary.

Filling out the KVD is justified if the organization has several cashier positions on its staff, including a senior one.

Features of the design of the KVD:

- the amount transferred by the senior cashier to the subordinate employee is reflected in the line “Issued” or “Transferred”;

- It is mandatory to put the signatures of both persons in the lines “Money received”.

What mandatory rules and requirements must be followed when drawing up primary CDs:

- Signatures of the chief accountant and cashier are mandatory.

- The mandatory stamp on the tear-off receipt is “Paid.”

- A seal (stamp) is not affixed to the cash register, but the recipient’s signature is required.

- The design documentation can be completed on paper or electronically.

- The electronic version of the document is prepared using special equipment (computer, printer).

- The paper version is filled out manually with a ballpoint pen, ink or using a typewriter.

- Blank lines that do not contain information are marked with a dash.

The chief accountant is the responsible person in the matter of drawing up the design documentation. In his absence, the manager becomes the person responsible for the preparation of cash documents, which is carried out under his control.

Corrections in CD

The main rule or requirement for CDs that should be highlighted is the absence of corrections in accounting registers.

The CD should not contain corrections or blots. In practice, it is common for performers to make changes to a document using correction fluids. Such actions are not permitted.

Let's consider the main options for how corrections can be made to cash documents:

- A mistake was made in the PKO or RKO.

It is prohibited to make corrections in any way (manually, crossing out, covering up). The only solution in this case would be to cross out the PKO/RKO with errors and draw up a new one. The spoiled (crossed out) order is added to the cash register report for the day. It is prohibited to carry out the operation of spending or receiving money on the basis of a damaged document.

- An error was made in the Journals or Cash Book.

The use of correction fluid or erasers is prohibited.

Corrections made as follows are allowed:

- an incorrectly entered inscription is crossed out so that the erroneous inscription can then be read;

- Corrections are made above the crossed out inscription by writing the correct amount or text;

- near the corrected document or in the free fields of the document the following inscription is placed: “Corrected” and must be signed by all persons responsible for maintaining and forming the CD;

- signatures are deciphered, and the date of the edit is indicated;

- corrections are made to all copies.

CD storage

The manager organizes and carries out the process, determines storage locations and approves the procedure for the formation and storage of cash documents in the organization. He must ensure such storage conditions that the documents are safe for the entire period established by law.

General requirements regarding storage periods are established in the Federal Law “On Bukh. accounting”, according to which primary documents and CD registers are stored in the archive for at least 5 years. After the expiration of the established period, they can be destroyed, but provided that there are no disputes or ongoing legal proceedings regarding them.

It should be noted that the period of 5 years is counted from the date of creation of the document, but from the date of the reporting year in which they were generated.

Storage can be organized both in the archive at the enterprise and with the involvement of specialized companies. They provide storage on a contractual and paid basis for as many years as you need.

The above-mentioned law establishes that when conducting cash transactions in electronic form, the shelf life of electronic media should also be the same as that of paper media - no less than 5 years. The exception is payroll, according to which employees receive their salaries. They are stored for 75 years.

CD storage must be carried out on the basis of the following rules:

- Documents must be stapled on a daily basis. The deadline for stitching is no later than the next working day.

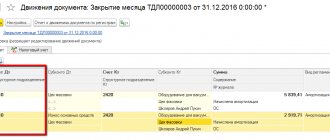

- Inside the stitching, CDs must be selected according to the following order: in ascending order of accounting account numbers. In the sequence, first of all, according to Dt of the account, and then according to Kt.

- All sheets of stitching are subject to numbering.

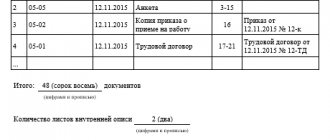

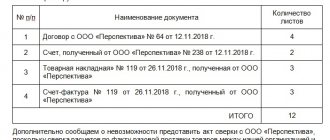

- When transferred to the archive, an inventory is generated indicating the quantity and name of the CD stitching; an article can be entered in accordance with the nomenclature approved by the organization.

Source: https://IPprof.ru/buhgalteriya/kassa/kassovye-dokumenty.html

Online magazine for accountants

- Info

Home - Legal Resources

- Collections of materials

- Storage periods for bank documents

A selection of the most important documents upon request. Storage periods for banking documents (regulatory acts, forms, articles, expert consultations and much more). Regulatory acts: Storage periods for banking documents Reference information: “Storage periods for documents of organizations” (Material prepared by ConsultantPlus specialists) Banking “Regulations on the Chart of Accounts for credit institutions and the procedure for its application” (approved.

Documents (calculations, information, statements, decisions, lists, statements, correspondence) on exemption from payment of taxes, provision of benefits, loans, deferred payment or refusal of payment of taxes, excise and other duties 5 years Documents on the transfer of tax revenues to budgets at various levels and to extra-budgetary funds, debts on them for 5 years Reports on the implementation of cost estimates: consolidated annual Continuously annual Continuously quarterly 5 years In the absence of annual ones - permanently Other documentation on the conduct of production and economic activities: Synthetic, analytical, material accounting accounts 5 years Documents (plans, reports, protocols, acts, certificates, memos, correspondence) on conducting documentary audits of financial and economic activities, control and audit work, including checking the cash register, the correctness of tax collection, etc.

Responsibility for maintaining a cash book

All organizations carrying out activities for which payments are made in “real” money are required to keep records of cash transactions. In order to exercise control over cash accounting, a document such as a cash book has been developed and approved. It reflects all cash inflows and outflows during the working day.

The responsibility for maintaining the cash book, as a rule, is assigned to the cashier or accountant by the corresponding approved order of the manager. In small organizations, this function can be performed by the manager himself.

Retention period for bank statements

EPC contracts on financial liability 5 years after the dismissal of the financially responsible person documents (minutes of meetings of inventory commissions, statements) on the inventory of fixed assets, property, buildings and structures, inventory 5 years, subject to completion of the audit (inspection). In the event of disputes, disagreements, investigative and judicial cases, documents (invoices, certificates, correspondence, etc.) on financial issues of charitable activities are preserved until the final decision is made. 5 years EPC For personnel records, wages, etc.

personal accounts of employees 75 years of EPK provisions on bonuses for employees 5 years of EPK. These documents are stored for five years after replacement with new documents (consolidated settlement (settlement and payment) statements (tabulagrams) for the issuance of wages, benefits, fees, financial assistance, etc.

Responsibility for improper storage of cash books

As mentioned earlier, filling out and storing cash books is mandatory for many companies. But what will happen if, for some reason, a tax audit reveals damage to this document or its absence?

Improper storage of cash books, leading to their loss or damage, as well as violation of the required storage periods can lead to unpleasant consequences in the form of fines. Moreover, such a measure of punishment can be applied both to the official guilty of the crime and to the organization as a whole.

Thus, if a specific person is guilty of improper storage, he will be punished. In this case, he will be charged with a fine of up to 10 thousand rubles for the first violation, and up to 20 thousand rubles for repeated violations. If the guilt of a specific person could not be proven, or if the company’s management is guilty, a fine for failure to comply with cash accounting is imposed on the organization as a whole. The amount of such punishment can vary from 50 thousand rubles for a single violation, to 200 thousand rubles for repeated incidents.

Storage period for bank documents in the organization

Problems may also arise if inspectors request extracts as part of an audit. We talk about deadlines and how to prevent them from being violated.

Subscribe to the accounting channel in Yandex-Zen!

- 1 Concept and meaning of statements

- 2 How long does the bank keep statements?

- 3 How long to keep statements in the organization’s accounting department

- 4 Is a bank statement primary?

The concept and meaning of statements As a general rule, a bank statement is a document of a financial nature that is issued to a client by a credit institution.

Emerging problems with document storage periods

When determining the storage period, you need to be guided not only by the approved lists, but also by other legal documents. During an audit, for example, tax authorities may request documents that have already been destroyed.

Their absence will entail the imposition of fines and penalties, since the employer will not be able to confirm the legality of certain financial transactions without them.

If difficult situations arise with the storage periods of documents, you can seek advice from specialists.

Didn't find the answer {q} Ask your question to lawyers

8788 lawyers are waiting for you Quick response, free!

Published on September 20, 2010 in the Bulletin of regulatory acts of federal executive authorities N 38

How long should you keep bank statements?

The main purpose of the examination:

- Determining or changing the period for further storage of a document.

- Selection of documents to be destroyed that are of no value or the practical content of the information in them has lost its relevance.

- Determining the storage period for documents that do not have scientific or historical value, but are of practical importance.

- Evaluation of documentation that has:

- political;

- economic;

- scientific;

- cultural, etc.

value

The issues of storage, acquisition, recording and further assignment of documents are regulated by the Law on Archival Affairs.

Storage period for cash documents at the enterprise

The tax official invites the person from whom documents and items are being seized to voluntarily hand them over, and in case of refusal, he makes the seizure forcibly.

If the person from whom the seizure is being made refuses to open the premises or other places where documents and objects subject to seizure may be located, the tax official has the right to do this independently, avoiding causing unnecessary damage to locks, doors and other objects.

5. Documents and items that are not related to the subject of the tax audit are not subject to seizure.

6. A protocol on the seizure, seizure of documents and objects is drawn up in compliance with the requirements provided for in Article 99 of this Code and this article.

7. Seized documents and items are listed and described in the seizure protocol or in the inventories attached to it, with a precise indication of the name, quantity and individual characteristics of the items, and, if possible, the value of the items.

8. In cases where there are not enough copies of the documents of the person being inspected to carry out tax control activities and the tax authorities have sufficient grounds to believe that the original documents may be destroyed, hidden, corrected or replaced, the tax authority official has the right to seize the original documents in the manner prescribed this article.

When such documents are confiscated, copies are made of them, which are certified by a tax official and handed over to the person from whom they are confiscated. If it is impossible to make or transfer the copies made simultaneously with the seizure of the documents, the tax authority transfers them to the person from whom the documents were seized within five days after the seizure.

9. All seized documents and objects are presented to witnesses and other persons involved in the seizure, and, if necessary, are packed at the site of seizure.

Seized documents must be numbered, laced and sealed or signed by the taxpayer (tax agent, fee payer). If the taxpayer (tax agent, fee payer) refuses to affix a seal or signature to the seized documents, a special note is made about this in the seizure protocol.

10. A copy of the protocol on the seizure of documents and objects is handed over against receipt or sent to the person from whom these documents and objects were seized.

Clause 4.4 of the Regulations

It has been determined that enterprises, subject to proper storage of cash documents,

can maintain a cash book in electronic form

using computer means.

The software used to maintain the cash book must provide a visual reflection and printing of each of the two parts of the cash book sheet (“Insert sheet of the cash book” and “Cashier’s report”), which in form and content must reproduce the form and content of the cash book in paper form. Entries in the cash book are made on the basis of relevant information from cash documents. Entries in the cash book must be made before the beginning of the next working day (i.e., with balances at the end of the previous day), and also contain all the details provided for in the cash book form. The pages of the cash book should be numbered automatically in ascending order from the beginning of the year

. In the case of printing the “Inset sheet of the cash book” at the end of the month, the total number of sheets of the cash book for this month should be automatically printed, and in the case of printing at the end of the year, their total number for the year.