What types of remuneration systems are there and when are they used?

What is hourly wages and what are its forms?

When is hourly wages beneficial?

What are the nuances of establishing an hourly wage rate in accordance with the Labor Code of the Russian Federation and how to calculate wages for hourly wages in 2020

How hourly wages are reflected in the staffing table - sample

What features need to be taken into account in an employment contract for hourly wages - sample

Results

What types of remuneration systems are there and when are they used?

For each group of workers in an enterprise and even for each specific person, the payment system for performing labor functions may vary. Let us highlight the following types of such systems:

- Time-based - an employee’s payment is directly dependent on the time he or she works. In this case, the employee is set an hourly or tariff rate and salary.

- Piecework - the amount of earnings depends on the amount of work performed. Piece rates must be approved here.

- Commission - when it is established, the employee receives a commission (percentage) on a certain indicator, for example, 5% of the store’s daily revenue.

- Variable salary system - an employee's salary is subject to periodic review, for example once a quarter or month. Such a review can be influenced by such an indicator as the completion of the planned amount of work.

- Chord - involves establishing a relationship between the amount of an employee’s salary and the package of work he performs in accordance with the chord assignment for a specific period.

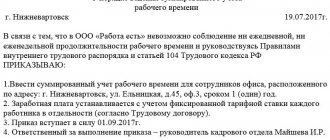

The payment system is approved either in a local regulatory act at the enterprise, for example in the regulations on remuneration, or in a collective or labor agreement.

If you have access to ConsultantPlus, go to the Ready Solution and find out the features of payroll calculation in each wage system. If you do not have access to the legal system, get a trial demo access for free.

https://youtu.be/SZze_28F1-8

Salary calculation for April 2020 “payment by salary (hourly)”

I won't beat around the bush. I will try to describe the client’s situation as closely as possible and I will be very grateful if, after reading the article, you tell me a more beautiful way or method of solving the problem. I admit that my option is not the best.

So. A couple of months ago, for this client, I set up a “monthly bonus as a percentage of the employee’s total hours worked and paid.” Calculation of the monthly bonus as a percentage of the employee’s total hours worked and paid. ZUP 3.1

Everything worked well for two months. I even corrected the number of hours in the Payslip. They made comments to me in that article and I corrected them. I especially thank those who participated in the discussion for this.

But suddenly the coronavirus (idiotic name in my opinion) came and ruined everything. I'm not joking now.)

The fact is that by Decree of the President of the Russian Federation of March 25, 2020 No. 206 “On declaring non-working days in the Russian Federation,” we were all forced to self-isolate (another strange word!), and of our own free will. According to the decree, non-working days will not reduce the time limit. Working time according to the employee’s work schedule, coinciding with non-working days, will be designated by a special type of time “ON” and paid as regular working days with regular accruals (payment at a salary, at an hourly rate, piecework wages).

The 1C developers promptly responded to these changes and filed (For which many thanks to them. They are really trying and have their finger on the pulse of the country... or on the pulse of a dying business. Oh, what am I saying? Well, at least they definitely help in some way to keep us afloat) the new release of ZUP 3.1.13.146, and apparently the other configurations also had to be quickly adjusted taking into account the current state of affairs in the country and the world.

And in this release we added this setting.

So here it is. Here ITS has detailed instructions on how to enable the setting in the ZUP and apply this beautiful calculation for all types of accruals for those employees who worked de facto or did not work.

Well, I applied it all. Everything is strictly according to the instructions. But my accruals don’t work.

To understand what the client’s task is, I will have to show you in screenshots the settings of these accruals, which worked perfectly in the previous 2 months. I will show an example on the 1st accrual, although there are only 4 of them. But they are all of the same type. It also participated in this article Calculation of the monthly bonus as a percentage of the total number of hours worked and paid by the employee. ZUP 3.1

As soon as the Production Calendar was updated, non-working days were immediately added to all charts (although there wasn’t even a checkbox for “automatic update according to the production calendar”) and my accruals immediately stopped working. I suspect that a similar situation may arise for many people - that’s why I decided to write an article.

Background:

Actually, only the formula was changed and 2 types of time were added in the “Time Accounting” tab = Holidays and Overtime (This is the setting that affects the display of the correct calculation information in the “Pay Sheet”). Everything else was copied by default. I specifically showed the accrual in full so that there was no doubt.

Now I will show how the calculation took place before April 2020, for example for February 2020:

In March 2020 there is a similar correct picture. But in April everything broke:

Calculation for April:

Moreover, this type of accrual “Monthly bonus as a percentage (accrued by hours)” breaks down only for those employees who have the “payment by salary (by hours)” accrual.

In May, everything returns to its normal course and accrual continues to work out correctly and I begin to understand that the whole problem is with the Production Calendar, which in turn affects the work schedule of employees.

I will say that I just tried, and changed the indicators in accrual, and created an individual schedule for the employee, and did everything according to the instructions described by ITS, and changed other types of time, created a time sheet, etc., etc. But everything is in vain.

I kept one option in my head all this time, but did not want to use it at first in the hope of unearthing my mistake in setting up the accrual and correcting it in a standard way.

When I had already tried all my ideas, I came to the conclusion that there was only one standard option left and I will now describe it. If you find a better way and let me know in the comments, I, as always, will be very grateful to you for it.

I’ll take a step back and remind you again. This method of maintaining wages during a non-working week on the recommendation of ITS did not help in my case. I suspect there is an unfinished joint sitting somewhere. But I don’t scold 1sniks. They're great anyway. ZUP3 is cut very quickly. Seriously. Thank you guys.

So! My way of solving the problem:

I understand that the whole problem with the coronavirus, be it wrong, the production calendar has changed and the whole of April began to burn red (non-working days).

This means that you need to copy the production calendar and mark the entire month of April for workers, as it was before the calendar update. I specifically don’t want to touch the typical one, so as not to touch something old in case something happens or break the future, which may still be updated.

1. Copy the Production calendar:

2. Next, I find out the list of all problem employees who have the “Payment by salary (hourly)” accrual. To do this, I’ll create a “Salary accrual for April” and filter my accrual by the empty amount column:

3. For each problematic employee on this list, having entered the employee card, I wrote out his work schedule.

4. Next, in order not to touch the already used graphs, and they will still be useful to us in May, and they can also be used by other employees whose calculations are carried out correctly, I begin to copy these graphs strictly according to the list. I got 4 of them in total:

In the same way, I copy all the involved schedules from problem employees.

5.Next. Now we need to apply these graphs. I am creating 4 documents “Changing the work schedule by list”. Each document has its own new, just copied schedule. Inside the document I set the validity period of this new schedule from April 1 to April 30, so that from May 1 employees will automatically return to their previous work schedules:

That's the whole method! All!

Next I start checking. I am creating “Salary accrual for April”. Everything is filled out correctly:

So May will also be filled out correctly, because from May employees will automatically be returned to their schedules and accruals will work correctly:

At the same time, we have preserved the standard Production calendar (in case of any future changes, it will be successfully updated again), and we have preserved the work schedules of employees.

I won’t say that I’m absolutely delighted with all this, but I couldn’t come up with anything better using typical methods with similar accruals. And this method works and perhaps it will make life easier for someone and save time and nerves.

Next, I will tell you what should be according to the ITS instructions here: Maintaining wages during a non-working week on the current date.

1. I tried to test it on other clients and everything worked. But they do not have the types of accruals that were in the previous example. Those. There are standard accruals “Payment by salary”, “Payment by salary (hourly)”, “Piecework wages”. Basically, “Payment by salary” is used.

First of all, it should be noted that 1C developers came up with it. Following the current instructions, we see that the production calendar has been updated automatically if the client has a monitor portal connected or, in other words, Internet support. It also happens that there is no connection, not because the client is breaking the law, but because inexperienced users or beginners simply do not know about this opportunity. They rarely use it in their work or are just starting to maintain their database. This means the first condition = connection to the monitor portal. Done. If, nevertheless, for some reason (well, at least the lack of Internet), the production calendar has not been updated, then we step by step change all the days to non-working days. And thus we change it manually. Let's move on.

2. Go to settings and see that the production calendar has been updated. What does it mean? This means that the whole of April lit up with red dates, i.e. all days became non-working days.

I must immediately say separately that I tried it on myself. If we immediately go to the settings and enable a new setting in accordance with the decree, then all the work schedules that have the “automatic update according to the production calendar” checkbox will immediately update a similar work schedule, set to March 30, 31 and April 1, 2, 3 an hour in the “Paid non-working days” line, but will not put anything on all other days. I did not like it. What did I do?

3. First, go to all work schedules and uncheck the “automatic update according to the production calendar” checkbox and write them down.

4. Then in Settings => Salary calculation => Check the box “Presidential Decree No. 206 dated March 25, 2020 “On declaring non-working days in the Russian Federation””

When enabled, working days in employee schedules falling on the period from 03/30/2020 to 04/03/2020 are automatically filled in using the new type of time “Paid non-working days” (ON) in hours according to the schedule filling settings. Charts are automatically filled in this way, in the settings of which it is specified “When filling out, take into account holidays” and the automatic update according to the calendar checkbox is selected. If necessary, these hours can be set manually. But since we turned off the checkbox in step 3 , our charts will not update the time automatically, but only an additional line will appear in each month “Paid non-working days”.

5. Now an important point to understand:

- For those employees who actually have days off , you need to copy into the “Paid non-working days” line those hours or enter them manually (OH 8) that you currently have in the “Attendance” line

- For those employees who still continue to work or the entire enterprise as a whole is working, then the schedules must be left as they are without changing anything. Those. "eights", or whatever you have, should be in "Appearance"

Next, such a graph, of course, needs to be “written down and closed”

6. Separately, it is necessary to note this point with the schedules. If before this the employee had the lines “evening hours” or “night”, i.e. was Ya8 and Ya1 (evening), then if you need to enter hours in the line “Paid non-working” => then you need to sum up both numbers and pay him 10 hours on that day. This is how the standard mechanism that was included in this release works for now. (3.1.13.146). I can’t guarantee you that the employee will receive the same amount, but who promised that it would be easy? Therefore, of course, pay special attention to such graphs and manually calculate at least a couple of similar graphs in the document “Calculation of salaries and contributions”

7. Next, all that remains to be done is to create and calculate the document “Calculation of salaries and contributions” for April 2020 and make sure that everything worked fine. If so = sleep well.

That's all for now. If there are any other changes that I try on myself, I will finish the article. I will try to keep my finger on the pulse and do it on time.

If you have your own more correct option that you have already tried = write in the comments. I will be grateful.

What is hourly wages and what are its forms?

The hourly wage system is one of the varieties of the time-based system. Here, wages are calculated depending on the amount of time worked - hours - and the established hourly rate.

NOTE! With a time-based system, salaries or tariff rates may also be set, but these are usually tied to a month.

At enterprises, depending on the specifics of production and other factors, the hourly system can take the following forms:

- Standard hourly - when a fixed rate is set for one hour of work. At the same time, the volume and quality of work do not affect wages. This form is typical for the positions of security guard, operator, administrator, etc.

- Premium hourly wage - here the volume and quality of work performed will affect wages. That is, the time worked is paid and to this amount is added the amount of the bonus, the amount of which must be indicated in the regulations on remuneration, employment contract or in other regulations or agreements.

- Standardized hourly rate - in this case, in addition to the hourly rate, an additional payment is guaranteed for strict compliance with the conditions established by the employer. This form is convenient to use when exceeding production standards is undesirable.

Due to the 2020 coronavirus pandemic, the payment procedure has changed in a number of cases. We wrote more about this in the material “New in Payroll in 2020.”

Concept, essence and features

The hourly wage system is one of the varieties of the time-based form of awarding remuneration for work.

It is used when it is difficult to standardize an employee’s work.

When calculating wages, not only the number of hours worked is taken into account, but also the qualifications of the employee. For example, it is used for teachers.

What it is?

There is no legal interpretation of the concept “hourly wage system” in the legislation. In practice, this term refers to a special way of calculating employee salaries.

Hourly wages can be of different types:

- simple - when the cost of one hour is a fixed amount that does not depend on the result achieved by the employee;

- with a standardized task - when an employee receives additional payment for completing the task that was assigned to him.

What does it depend on?

The amount of payment will depend on the number of hours actually spent by the employee on performing the job function.

This method is very convenient for part-time workers, as well as people performing a job function part-time or on a flexible schedule.

As we have already said, an employer can stimulate an employee by setting special tasks, the completion of which is encouraged by additional payment.

In what cases is it used?

This system is applied when it is provided for in the employment contract concluded between the employee and the employer.

Recently, this method has become very popular among entrepreneurs who hire employees. It is suitable for the following workers: teachers, tutors, nannies, bartenders, waiters, cleaners.

Hourly pay is ideal for part-time employees. It is suitable for workers whose workload differs on different working days.

Advantages and disadvantages

Pros of the hourly payment system:

- for the employer - cost savings when employees receive money only for the time actually worked, the ability to track and monitor the effectiveness of working hours, the convenience of settlements with part-time workers;

- for workers – convenient for employees of certain professions, as it allows them to take into account their uneven workload.

Minuses:

- for employers - the complexity of financial calculations of wages, the need to strictly control the amount of time worked by employees;

- for employees - lack of bonuses and bonuses, the possibility of abuse by an unscrupulous employer who will assign unrealistic amounts of work per hour.

When is hourly wages beneficial?

The benefit for employers when setting hourly wages is obvious: they only have to pay for the time worked. This type of payment is especially popular for those employees who do not work full time. Examples include:

- workers with an uneven workload involved in performing work at a specific facility;

- workers whose working hours cannot be regulated (for example, teachers who teach additional classes in educational institutions);

- employees employed on a flexible schedule;

- workers whose labor productivity is very difficult to determine.

However, this system has certain disadvantages. For example, in the absence of bonus payments, employees are usually not interested in working faster and more, i.e. production efficiency decreases. In addition, the employer needs to monitor every hour the employee works, which may require an additional employee to keep track of time, leading to new costs.

How to calculate hourly salary

Important

Other rights established by the current legislation of the Russian Federation. 6. Rights and obligations of the Employer

6.1. The employer is obliged:

6.1.1. Comply with laws and other regulations, local regulations, and the terms of this employment contract.

6.1.2.

Provide the Employee with work stipulated by the Agreement.

6.1.3. Provide the Employee with equipment, technical documentation and other means necessary to perform his job duties.

6.1.4. Pay the full amount of wages due to the Employee on time.

6.1.5.

Carry out compulsory social insurance for the Employee in the manner established by federal laws.

6.1.7. Perform other duties established by the current legislation of the Russian Federation.

6.2.

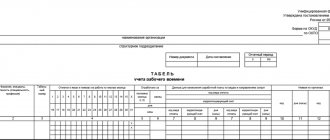

How hourly wages are reflected in the staffing table - sample

The staffing table is an internal document of the company, which collects all the information about the personnel structure, composition and number of employees, as well as the monthly payroll. When an employee is hired on an hourly basis, the staffing table must contain a corresponding note about this.

If we take as a basis the unified form T-3, put into circulation by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1, the hourly rate should be indicated in column 5 “Tariff rate (salary), etc., rubles,” and in column 10 “Notes » register “Hourly wages” with reference to the normative act establishing the payment system.

Use the link below to see how the staffing table is drawn up for those employees for whom the hourly form is approved.

Answer Profbukh8

Olga Gribel Profbuh8.ru

Good afternoon

The salary is calculated in days; the calculation takes into account days, not hours.

If the salary is in hours, then absence will be reflected correctly.

natali_m08

Now we are working in 1C ZUP 2.5, we plan to switch to 1C ZUP 3.0 in the near future. It turns out that it is better to set up planned accrual for employees on a five-day shift not as Payment by salary, but as Payment by salary by hour - so that it would be possible to provide, for example, a 4-hour day off or leave without pay for part of the shift?

What features need to be taken into account in an employment contract for hourly wages - sample

When employing an employee, all aspects relating to the calculation and payment of wages are usually discussed between him and the employer, which must then be formalized in writing by signing an employment contract. In it (or an additional agreement to it), the Labor Code obliges to prescribe the conditions for hourly wages, if one is established for the employee.

NOTE! When transferring employees to hourly pay from another salary system, the employer must notify them of this no later than 2 months before introducing the planned changes. Such changes, by the way, should be reflected in orders and other regulatory documents of the organization.

It is advisable to stipulate in the employment contract:

- the amount of the hourly wage rate (salary);

- the procedure for calculating wages for the month;

- bonus conditions;

- terms of payment for holidays, weekends and night hours;

- deadlines for issuing wages;

- other conditions, which may include a probationary period, social guarantees, etc.

Download a sample extract from an employment contract regarding the establishment of an hourly wage system and hourly rate from the link below.

How to calculate hourly wages

The number of shifts for February is 14, of which 7 are night shifts. The night shift lasts from 20.00 to 8 am, including an hour break for lunch.

The number of daily working hours according to the norm : 7 * 11 + 7 * 4 = 77 + 28 = 105 hours (of which 28 hours are part of the night shifts, not included in the period from 22 to 6 am). Number of night working hours according to the norm: 7 * 7 = 49. Number of hours at the rate of 150% - 3 hours, at the rate of 200% - 1 hour.

The salary is:

150 * 105 + 150 * 49 * 120% + 150 * 3 * 150% + 150 * 1 * 200% = 15750 + 8820 + 675 + 300 = 25545 rubles.

It is necessary to take into account that the employer will withhold a tax of 13% from the final calculated monthly salary amount.

Daily salary calculation

The daily salary is calculated when determining the amount of vacation, sick leave or maternity pay, as well as when paying for additional shifts.

Results

Hourly wages are one of the types of time-based systems, when, to calculate wages for each specific employee, a rate is set for one hour of work and the number of hours worked is calculated. In this case, the rate should be such that when working out the monthly quota, the employee is accrued no less than the minimum wage, which in 2020 is equal to RUB 12,130.00.

All conditions relating to the calculation and payment of wages under the agreed system are included in the text of the employment contract or local regulations of the company. That is, the employee must be familiar with the principles on which his monthly earnings are calculated.

Sources:

- Labor Code of the Russian Federation

- Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Answer Profbukh8

Elena Gryanina Profbuh8.ru

The schedule affects the calculation of payroll only if it is part-time or hourly/daily payment.

natali_m08

Thank you!

The fact is that during the transfer, many types of accruals were doubled. The new ones in 1C ZUP 3.0 coincided with those transferred from 1C ZUP 2.5.

In addition, users created similar accruals in the Main and Additional. accruals. And all this was uploaded to 1C ZUP 3.0.

Please rate this question:

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

How is hourly wage calculated?

Depending on the standard working hours per month

The formula used is:

If you want to find out how to solve your particular problem, please contact us through the online consultant form or call :

- Moscow.

- Saint Petersburg.

T/h = monthly tariff rate: standard hours (per month)

The norm of hours per month must be taken from the production calendar.

Example:

In order to calculate wages, it is necessary to take into account overtime.

- First, the hourly rate is calculated using the formula: 20,000 rubles: 160 hours = 125 rubles per hour.

- We calculate the overtime: 166 – 160 = 6 hours.

For these six hours worked overtime, Inshina must receive a salary supplement.

Is there a minimum

At the legislative level, a minimum hourly wage has not yet been established. But nevertheless, calculations are being made. The hourly tariff rate is taken as a basis and multiplied by the time worked. Let's give an example of an employment contract with an hourly wage - a sample for a university: a German language teacher receives 300 rubles for 1 hour of individual work with a student.

In addition, it should be taken into account that no matter what prices are provided in the organization, if a citizen has worked the production quota for a month, he cannot receive less than the subsistence minimum.

How to calculate an hourly salary in three days

The employee must also be familiar with local regulations that regulate the new procedure for calculating wages.

Calculation

The calculation is made taking into account the time worked, which is multiplied by the tariff rate. Special counting methods may be established by local regulations.

For example, this could be a complex bonus system depending on the results achieved and the overall performance of a particular employee.

Formulas

The specific calculation formula will be approved in a local act adopted by the enterprise.

For example, it might look like this:

wages = Tch*Wh, where

- Tch – tariff established for a specific employee;

- HF – actual time worked.

Examples

Here's an example of a calculation:

Ivanova A.P. works as a waitress.

How to calculate hourly salary calculator

Thus, his tax deduction will be 3,000 rubles.

Personal income tax is calculated for it as follows:

(14,000 – 3,000)*0.13= 1430 rubles. This is the amount that must be withheld when receiving wages.

Thus, he will receive in his hands: 14,000 – 1430 = 12,570 rubles.

Second example:

Alla Petrovna is the mother of two minor children. Her salary is 26,000 per month. By December, the total amount of wages paid to her will be 286,000 rubles, therefore, no tax deduction will be applied to her.

How to correctly calculate your hourly salary

The procedure for applying this system can be established in a special local act, which is issued by the head of the enterprise and is valid within its borders.

An order is also issued, which directly reflects the size of tariff rates for certain types of professions.

Conditions of use

This remuneration regime can only be used when it is provided for in the employment contract with a specific employee.

If the enterprise has local documents (regulations, orders) that determine the procedure for using the hourly system, then the employee must be familiar with them against signature.

Is there a minimum size?

There is currently no uniform minimum wage per hour.