Business lawyer > Accounting > Cash discipline > What is the penalty for cashing out money in various ways for LLCs and individual entrepreneurs

Along with other financial violations, cashing out funds to evade taxes provides for penalties before the law. What is the penalty for violators for cashing money? If the participant in the operation is an individual (IP), then the act will be determined by Article 198 of the Criminal Code of the Russian Federation. When the money supply was cashed through a banking or other financial institution, the actions of the criminals fall under Article 199 of the Criminal Code of the Russian Federation.

The meaning of cashing out finances

To replenish the state treasury, tax structures exercise control over the cash payments of organizations. After all, based on the turnover or profit received by a legal entity, tax revenues to the budget are calculated.

Permitted methods of cash circulation are established by the standards of civil legislation of the country. Thus, mutual settlements between partners should be carried out in non-cash form. This provision is enshrined in Art. 286 of the Civil Code of the Russian Federation.

In most cases, the use of funds on the balance sheet of a legal entity is allowed only after the tax collection has been transferred to the budget. But in order to avoid paying taxes and mislead the fiscal services, some business entities use various tax evasion schemes.

The meaning of cashing out

The rules for the circulation of money in the accounts of legal entities and individual entrepreneurs are described in the articles of the Civil Code. For example, Art. 286 contains a rule on mandatory non-cash payments to counterparties. This was introduced, inter alia, for the purpose of monitoring the turnover of each individual enterprise that is a taxpayer. After all, the fee to the budget is calculated on the basis of turnover or profit.

Illegal cashing consists of withdrawing money from the company’s balance sheet. Without an objective justification, the operation is illegal. Transferring money is only allowed for:

- production development (to contractors);

- organizing the work of the administration;

- dividend payments;

- carrying out other legal transactions.

Important: every expense of a legal entity or individual entrepreneur must be documented. Otherwise, the inspection authorities may suspect cashing.

The management of company funds is so strictly regulated in order to avoid hiding them from taxation. After payments to the budget, the owner can distribute profits in any way. Offenders are trying to get as much money as possible out of the sight of the tax inspectorate. The methods by which illegal cash withdrawals are carried out are varied. Let's look at the most popular ones.

Is the operation legal?

Based on current legislation, cash withdrawals from the balance sheet of a legal entity are allowed only in the following situations:

- to ensure the labor activity of the administrative apparatus of the company

- for transfer of dividends

- to modernize the production activities of partners

- for other lawful purposes

In other cases, withdrawing cash from the organization’s accounts is contrary to the law. This fraud contributes to the development of corruption, the lack of a pension account for citizens who receive earnings in envelopes, and an insufficient amount of money to implement government programs at the federal and regional levels.

If in its activities a legal entity interacts with authorities at various levels, then cash withdrawal will be considered an act subject to criminal law. The organization will be accused of theft.

Illegality of the operation

Illegal circulation of funds leads to the spread of corruption schemes in the country, impoverishment of regional or federal budgets, and a lack of pension money for those who received wages in cash “in envelopes.”

For businesses that cooperate with municipal and government services, cashing is theft of federal funds, although the law establishes criminal liability for this crime.

Inspection organizations cannot completely prohibit the issuance of money, but regulatory authorities carefully check banking transactions to ensure that they are carried out in accordance with the law of the Russian Federation.

Private entrepreneurs and company managers justify their illegal machinations by the tax burden and the desire to pay employees wages on time and in the required amount, since hired people work without official registration.

Cash is also spent on the uninterrupted supply of production materials and resolving issues in the bureaucratic environment.

Regulatory regulation

Offenses in the field of cash withdrawal are regulated by the tax legislation of the country. Article 174 of the Code defines illegal legalization, lists transactions that are considered criminal and penalties for violators.

In addition to the Criminal Code, the procedure for cashing out money is regulated by the Federal Law of the Russian Federation “On Combating the Laundering of Income.” This legal act defines the main methods to prevent crime.

For example, information about all major contracts must be sent to Rosfinmonitoring. This procedure is also mandatory for small companies. The purpose of such state control is to prevent the material supply of terrorist groups.

What are the charges?

Article 198 of the Criminal Code of the Russian Federation contains information about what charges are brought against the suspect. These include:

- illegal cash withdrawal;

- falsification of official documentation;

- conducting business without registering a company or individual entrepreneur;

- participation in a fraudulent scheme.

If owners of other companies or private entrepreneurs are involved in cashing out money, then during the investigation they are held accountable. For them, the punishment is chosen depending on what actions they performed.

Operation schemes

Today, several schemes for illegal cash withdrawal are the most common. One of them is the so-called “Foreign system”. Its essence is that a deal is drawn up between two companies. In this case, one of the organizations is located outside the country. The terms of the signed agreement determine the procedure for the parties to act in the event of controversial situations. After the transaction is completed, funds are transferred to the account of the domestic company, but the service (product) determined by the terms of the agreement to the counterparty is not provided.

Next, the foreign counterparty applies to the court to obtain a penalty and wins the case. At the next stage, a certain amount of money in the form of a penalty must be sent by bailiffs to the country of registration of the foreign legal entity. As a result, the money was withdrawn from the country and ended up in a foreign account. Further, both parties to the transaction can use the funds at their own discretion.

Cash withdrawals with the help of foreign companies can also be carried out using the transit corridor. The essence of the methodology is to formalize a transaction between financial structures and other business entities on the territory of the Russian Federation with foreign organizations.

Under the terms of the agreement, funds are transferred to the accounts of foreign companies for certain goods or services. But in the end, the procedure is a withdrawal of money to accounts uncontrolled by the country’s fiscal structures.

Another common method is the banking method. The management of a financial institution persuades unqualified personnel to sign an agreement to receive a large loan amount. This need is explained by the existence of obligations only on paper. In addition, impressive bonuses are paid for signing the document. As a result, the bank's management receives money, the organization's balance sheet shows an outstanding debt, and the employee of the financial structure is a debtor on the loan.

Video about the dangers of illegal cash withdrawal:

There are many other methods for cashing out finances:

- with the help of IP

- with the participation of banking structures

- through illegal use of payment terminals

- using someone else's documentation

- cash withdrawal from maternity capital funds, etc.

Who uncovers illegal cash-out schemes and how?

First of all, we are talking about tax control carried out by specialists of the Federal Tax Service. Tax authorities see a company to which the audited organization regularly transfers significant amounts, and conduct a counter-inspection. As a result, it turns out that this counterparty does not conduct business, does not pay taxes, and is not present at the place of registration. Everything is clear here.

But on-site inspections are not ordered just like that. To select a company for such an inspection, inspectors conduct monitoring and identify suspicious aspects in its activities. These include connections with one-day events. Information from the provided reporting and various databases are used for analysis. First of all, this is the ASK “VAT3”, which contains information about all transactions subject to VAT.

An example is the case of Komplekt-Service LLC that reached the Supreme Court of the Russian Federation (determination of the Supreme Court of the Russian Federation dated February 1, 2018 No. 304-KG17-21566). The court indicated that the documents provided by the company do not confirm the reality of business transactions with a number of counterparties. Therefore, based on the results of the tax audit, the exclusion of income tax costs and VAT deductions in terms of settlements with these counterparties is legal.

If the cashing scheme is not visible from declarations and is not tied to VAT payers, then banks come to the aid of controllers. Financial institutions, in accordance with the law of August 7, 2001 No. 115-FZ “On Combating Legalization...” are required to identify suspicious transactions of their clients and report them to regulatory authorities.

Law enforcement officers can uncover such schemes without the participation of tax officials. To do this, they use methods of operational investigative activities: interviews with witnesses, inspections of premises, test purchases, etc. But the police, of course, also do not neglect the information received from the Federal Tax Service and banks.

We should not forget that inspectors can also obtain information from company employees. After all, not only the management, but also the direct executors usually know about the schemes used: employees of the legal department, accounting and other departments. Some of them may, for example, be offended by what they consider to be an unfair dismissal, and “tell” the tax authorities (or the police) the necessary information.

In the future, if signs of a crime are identified, the case materials are transferred to the Investigative Committee.

Differences between legal and illegal actions

The most important difference between illegal withdrawal of cash from an account and legal actions is the criminal liability of participants in the crime for tax evasion. During investigative measures, all cashed funds are subject to confiscation, which will entail significant losses.

The legal procedure for withdrawing cash does not involve complete tax evasion, but a reduction in the tax burden.

In order to avoid problems with the law, you can cash out through a loan without accruing interest for a long period by transferring money to an individual’s bank account. If a legal entity has a first founder, issuing such a loan will not be considered illegal. In this case, you will not have to use the services of third parties. As a result, money transferred to a citizen’s own account will not have to pay income tax, since the money is issued as a loan.

Illegal cash withdrawal through shell companies and punishment for it

The scheme using so-called shell companies is completely illegal.

In this case, the company enters into a fictitious agreement with a one-day company for the supply of goods, provision of services, etc. In fact, the goods are not supplied and services are not provided. The one-day company then cashes out the money transferred under the agreement, using one of the methods discussed above. As a result, the received cash is transferred to the organizer of the scheme minus commissions for services.

This option may entail punishment under a number of articles of the Criminal Code of the Russian Federation:

- Articles 199 “Tax evasion” and 199.1 “Failure to fulfill the duties of a tax agent.” Inspectors exclude from expenses all payments under one-day contracts and charge additional taxes.

- Article 327 “Forgery of documents”. Since transactions made with one-day companies are fictitious, the documents drawn up in this regard are considered to be counterfeit.

- Article 171 “Illegal entrepreneurship”. Under this article, the head of the “one-day company” is involved.

- Article 172 “Illegal banking activities”. The reasons for its application to “one-day” companies that are not credit institutions are highly controversial, but inspectors sometimes try to do so.

- Articles 174 and 174.1 “Legalization (laundering) of funds or other property acquired by criminal means.”

Next, we will consider the sanctions under these articles and the conditions for their application.

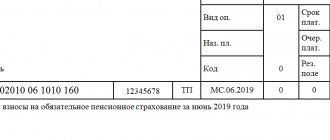

| Article of the Criminal Code | Minimum amount of violation for application, million rubles. | Maximum penalty (aggravated) | |||

| fine, thousand rubles | disqualification, years | forced labor, years | imprisonment, years | ||

| 199, 199.1 | 5,0 | up to 500 | until 3 | up to 5 | until 6 |

| 327 | — | up to 80 | — | up to 4 | up to 4 |

| 171 | 2,25 | up to 500 | — | up to 5 | up to 5 |

| 172 | 2,25 | up to 1000 | — | up to 5 | up to 7 |

| 174, 174.1 | 1,5 | up to 1000 | up to 5 | up to 5 | up to 7 |

In practice, we are primarily talking about the director’s responsibility for cashing out money, because It is the head of the company who signs the documents and is responsible for the activities of the organization. Other persons (for example, the founder or chief accountant) may be involved if their guilt is proven: incitement, complicity, etc.

Through IP

A legal entity can cash out the required amount of money through an individual entrepreneur by concluding a contractual relationship, where the business entity acts as a customer, and the individual entrepreneur acts as a contractor. The subject of the transaction should be a service, the provision of which in a couple of months will be almost impossible to prove (for example, consultations, cargo transportation, equipment adjustment, etc.).

A certain amount of money is transferred to the individual entrepreneur’s account, which is then cashed out by the entrepreneur. He takes his commissions and transfers the rest of the money to the management of the organization.

Cash withdrawal through individuals responsibility

It’s not uncommon to see such phrases in advertisements: “I sell credit cards with PIN codes...”, “... transfer to your bank card or current account...” or “we sell cards with balances of 50,000 rubles, the cost of the card is 10,000 rubles...”, etc. d. Each of us reads and understands - what a freebie! This is where you can make good money quickly and well, but is it really so?! All this activity is called cashing out.

if a legal entity cashed out money through one-day companies LLC in the interests of doing business (it is necessary to pay the customer, performers, workers in cash, and pay part of the salary). Amounts for the year - 5 million rubles. one by one Yu.L. and 1 million rubles. in another way Yu.l. And here Art. 198 and 199.1. The question clearly states that it is a legal entity. Not a word about the tax agent at all. Please don't think of a question for me. Regarding questions on air, I asked a paid question.

We recommend reading: New exams 2020 traffic rules as in traffic police

Through LLC

The management of the LLC can carry out a cash-out operation without involving third parties, which will save money on commissions. But the procedure itself is a little more complicated.

One way to generate cash is to increase the organization's expenses. As an example, consider purchasing fuel coupons for company vehicles. Subsequently, a significant number of them are sold for cash. This procedure allows you to significantly reduce the tax base. But fiscal structures are well aware of this technique, therefore, if such operations occur, the organization will face inspection and penalties.

Cash withdrawal through LLCs and individual entrepreneurs:

In order not to attract the attention of the Tax Service, the director of the organization may order the payment of dividends. This operation is legal and will reduce the amount of tax collection.

Semi-legal withdrawal schemes: loans and reporting

Semi-legal options include cashing out money through an LLC using a loan. Formally, a legal entity has the right to issue a loan to anyone, including its founder.

If necessary, the debt can be forgiven (Article 415 of the Civil Code of the Russian Federation). In this case, you will also need to pay 13% personal income tax on the “forgiven” amount. In addition, when issuing a loan at an interest rate below 2/3 of the Central Bank key rate, personal income tax is charged on material benefits at a rate of 35%.

It makes sense to use cash through a loan in special cases, when there is a one-time need for money. Regular issuance of loans to own founders will undoubtedly attract the attention of controllers, especially if the amounts issued exceed 600 thousand rubles.

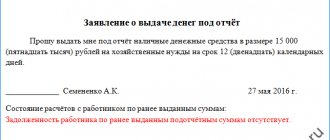

Also sometimes used is the option of cashing out through issuance to a sub-report. The funds issued to the owners are then registered as travel, entertainment and other similar expenses. The consequences here depend on the work of the legal and accounting department, i.e. from the correct execution of supporting documents.

The risks in this case are associated with a possible tax audit. Responsible persons may be subject to criminal prosecution if inspectors prove that certain expenses are unjustified, and the total tax arrears exceed the limit established by Article 199 of the Criminal Code of the Russian Federation (5 million rubles over three years).

More details

Via debit cards

The essence of the technique is to purchase working plastic cards or issue them to dead or homeless citizens using false documents. A large amount of money is distributed through debits and withdrawn through an ATM.

To carry out an operation using fake documentation, a shell organization is created, to whose account the required amount of money is transferred. Next, the fictitious director, from the funds received, charges wages to the purchased cards owned by the company’s “employees.” If you have 20 debits per day, you can cash out up to 10 million rubles. This operation can be performed more than once.

Options for illegally withdrawing money from an account

During the withdrawal process, the head of the company signs payment slips, creating the appearance of legality of withdrawing money from the account.

At the same time, the company’s expenses for paying for imaginary work and services increase, and profits, naturally, decrease. Accordingly, taxes are paid on a smaller amount.

A shell company takes part in this scheme and the funds are transferred to its account. The money is cashed, the company receives its interest. The company takes the rest.

Most of the withdrawal schemes have long been known to regulatory authorities. Such schemes involve:

- shell companies;

- bank employees;

- fictitious individuals.

Options for illegally withdrawing money from accounts include the creation of fake documents and the use of maternity (family) capital certificates.

All these acts fall under the article providing for liability for illegal withdrawal of funds.

Withdrawal via IP

Quite often, individual entrepreneurs who have their own interest in this participate in illegal cash-out schemes.

Companies enter into contracts with them for the provision of a number of services or work, the implementation of which cannot be verified later.

Since individual entrepreneurs can also be held accountable for participating in a transaction, they do not give evidence in court if fraud is discovered.

To ensure that the transaction has a legal appearance and cannot be verified later, contracts are concluded on:

- transportation of various cargoes;

- equipment setup;

- provision of information services.

Since an individual entrepreneur is a private person, he can later cash out from his account virtually the entire amount received for the provision of imaginary services.

Withdrawal via legal entities

Some LLCs illegally cash out money from the account without involving third parties and without paying the latter their due share.

This is done as follows:

- gross costs and amounts transferred to individual entrepreneurs and firms are deliberately inflated;

- inflated dividends are paid to the company's management;

- a loan is issued to the head of the LLC;

- finances are transferred to debit cards;

- cashing is carried out with the help of accountable employees.

All this is realized through various financial transactions. Let's look at each scheme in more detail.

Overestimation of expenses

No matter what industry a company is in, there will always be ways to fictitiously increase costs.

For example, gasoline by trucking companies can be purchased by bank transfer and later sold for cash. All these options are not new and have been well studied by regulatory authorities.

Dividends

LLC participants are legally allowed to pay dividends to themselves and the company's management.

As a result of this procedure, the company's profit decreases and, accordingly, less taxes go to the budget.

Loans for a long period

Another way to cash out a company’s money is to issue a long-term loan to the manager.

As a rule, the loan is issued at minimal interest or no interest at all. Afterwards the borrower must return this money to the company.

It's not that simple here. In principle, this method of cashing out does not violate the law. No income tax is paid on the cashed amount, since the money already belongs to the manager, and not to the company.

When returning the money, the value of the funds will fall due to inflation, or the company itself may cease to exist, and there will be no one to return the money.

Cashing out using accountable employees

Another way to cash out money is to issue a loan to an employee.

In this case, the money is returned by issuing a new loan to close the first loan. And so on ad infinitum. Moreover, Russian laws are not violated.

Debit cards

In this option, the bank issues debit cards for fictitious employees through their person at the financial institution.

With the help of cards, large amounts are withdrawn in parts so as not to come to the attention of regulatory authorities.

Sometimes this method is used by shell companies with fictitious staff. Quite large sums are withdrawn this way (up to 10 million rubles)

Legal methods of cashing out for individual entrepreneurs and LLCs

In addition to paying dividends and taking out a long-term loan, another legal way to cash out funds is to pay salaries to the manager. If the activities of a business entity are successful, then the founder’s earnings can be large.

But it will not be possible to completely avoid taxation, since you will need to transfer income tax and contributions to the Social Insurance Fund to the state. Earnings can be transferred to debit or issued from the cash register in cash.

With the involvement of an individual entrepreneur, legal cashing out of money may involve the transfer of an advance payment for certain services provided by the entrepreneur. According to the terms of the agreement, they must be long-term in nature with an advance payment. The amount stipulated by the agreement is transferred to the individual entrepreneur’s account, after which he withdraws all the cash and declares himself bankrupt. Such actions do not raise questions for the fiscal structure, but work as an individual entrepreneur will have to be stopped.

Illegal cash withdrawal through debit and credit bank cards

Today, plastic cards replacing cash are widespread. With their help, it is convenient to pay for purchases, pay for various types of services and orders in online stores. In addition, credit cards, unlike debit cards, make it possible to use not only your own money (available in the account), but also to borrow funds from the bank.

Many people are looking for a way to make money quickly and easily. Knowing about this human weakness, scammers often use it for their own selfish purposes. Perhaps one of the most common ways of making money offered on the Internet today is cashing out other people’s cards as a way of laundering illegally obtained money.

Percentage for legal withdrawal

The business entity from whose accounts cash is withdrawn takes a commission for the transaction. Their size may vary depending on the subject of the country and the field of activity of the company.

In addition, a commission will be charged by the banking institution when withdrawing cash from any legal entity account. The fee depends on the withdrawal amount and can vary from 1 to 10%.

When withdrawing money from an ordinary citizen's account, you will not have to pay bank fees, but you will need to wait a certain period of time during which the money cannot be withdrawn.

What schemes are used?

Schemes for cashing out LLC funds are numerous, but almost all such methods are illegal. The most commonly used illegal options are:

- a shell company is opened through which funds are transferred;

- other owners of shell companies are brought in to carry out the illegal operation for a certain fee;

- the owner of the organization uses false documents, and such actions are a serious crime;

- attracting fake individuals who withdraw money from their accounts;

- giving bribes to employees of banking institutions;

- use of a certificate for maternal capital.

Each method has its own characteristics and nuances. But in any case, criminal penalties are provided for cashing out funds using illegal methods. Therefore, business owners must be prepared for negative consequences, which can include not only significant fines, but even imprisonment.

Responsibility for illegal cash withdrawal

What is the penalty for cashing out? Offenses relating to the withdrawal of cash from company accounts are regulated by Chapter No. 22 of the criminal law. Further, depending on the type of act, an article of the Criminal Code is determined for each offense.

An offense is established by employees of the fiscal authority. Their responsibilities include transferring the detected act to the prosecutor's office for further investigation. After studying the data, a preliminary investigation may be ordered to determine the crime. After identifying it, the prosecutor's office begins to investigate and identify all participants. Each of them may be held criminally liable.

Increased costs

Every industry has its own ways of creating fictitious cost increases. For example, trucking companies can buy fuel coupons for cashless payments and then sell them for cash.

The problem is that such schemes are very old and well known to the tax service.

Calculation of dividends

The law allows LLC participants to pay dividends to themselves and the company's management. That is why this scheme is popular, because as a result, the amount of profit decreases, which means the amount of taxes decreases.

Taking out a long-term loan

It is difficult to be charged under an article of the Criminal Code of the Russian Federation for cashing out money if the head of the company was given a long-term loan for this purpose. He receives money in cash at minimal interest or no interest at all. Subsequently, he must return this money to the company’s account. From the point of view of the law, this operation is ambiguous, but it cannot be called illegal either.

You will not have to pay income tax on such money, since it is already considered the personal money of the manager, and not the company.

As for the future return of funds, by that time a significant part of their value may be eaten up by inflation or the company itself may go bankrupt.

Conclusion with the help of accountable employees

Another option with borrowed money is issuing a loan to an employee. When the time comes to repay the money, he is given a second loan, which covers the first, and so on. Such operations do not contradict Russian laws.

Use of debit cards

This scheme involves a direct violation of the law. The company purchases bank cards or issues them for non-existent employees. A bank employee usually helps her with this. As a result, money is withdrawn in small amounts. And by law, the bank is obliged to report to Rosfinmonitoring about the cash withdrawal of money in the amount of at least 600 thousand rubles.

That is, to carry out such monetary transactions, a shell company with a whole staff of employees, usually fictitious, is often used. The amount of money cashed can reach 10 million rubles.

Criminal prosecution

When cashing out a large amount of money to evade paying a tax fee reaching the amount of 900 thousand rubles. for 3 years, the offender will face one of the following punishments:

- penalties in the amount of 100-300 thousand rubles.

- forced labor for up to 12 months

- arrest for up to 6 months

- imprisonment for up to 12 months

Depending on the amount of cashing out, the penalties may vary. So, if the amount of arrears for the country’s budget is 4.5 million rubles, the citizen will face one of the following punishments:

- imposition of a fine in the amount of 200 to 500 thousand rubles.

- forced labor for up to 3 years

- stay in prison for up to 3 years

If a violation of the law is detected initially, then the citizen may not be held criminally liable if he repays the debt incurred to the budget in full.

If the arrears exceed 5 million rubles. the violator can go to prison for up to 6 years. The fine will increase to 500 thousand rubles.

In the course of one criminal case involving cash withdrawal, a citizen may be accused of violating several articles of the Criminal Code:

- for falsifying documentation

- laundering of money

- illegal work in the status of individual entrepreneur

- false entrepreneurship

During the investigation, all participants in the illegal operation are also identified. In the future, they will also be responsible for participating in the concealment of income.

Personal practice

A study of criminal cases under Article 172 of the Criminal Code, in which the author personally participated on the defense side, leads to the conclusion that in cases where the accused and their lawyers took an active defense position, the courts had difficulty passing sentences. The courts returned such criminal cases to prosecutors in accordance with Article 237 of the Code of Criminal Procedure.

Example 1.

By resolution of the Izmailovsky District Court of Moscow dated January 13, 2016, the criminal case was returned to the prosecutor. The court indicated in its ruling that, according to Art. 171, 73 of the Code of Criminal Procedure, the resolution to bring an accused must describe the crime, indicating the circumstances to be proven, including the event of the crime (place, time, method and other circumstances), the form of guilt, motives, nature and extent of the harm caused, as well as circumstances characterizing the personality of the accused.

Qualification of thefts using bank and other payment cards

In accordance with Article 220 of the Code of Criminal Procedure of the Russian Federation, the same circumstances are indicated in the indictment. The investigating authorities did not specify the charges regarding the collection of unaccounted for cash and settlement documents, cash services for individuals and legal entities; opening and maintaining bank accounts for individuals and legal entities; transfers of funds on behalf of individuals without opening bank accounts.

The court further noted that the investigative authorities charged the citizens with:

- collection of unaccounted funds and cash services for individuals and legal entities;

- settlements on behalf of individuals and legal entities by using as an instrument the services of legally operating credit institutions, as well as processing companies.

However, the investigation did not indicate what banking transactions the accused carried out, but only mentioned the total amount of income, which deprives the accused of the opportunity to defend themselves against the charges and is a violation of their right to defense.

In addition, according to the court, the charge in terms of the qualifying feature of illegal banking activities committed by an “organized group” was not specified. While describing the addresses in the indictment, the preliminary investigation authorities did not determine what banking transactions the accused carried out at them.

The foregoing indicated that the investigative authorities did not comply with the requirements of Art. 73 Code of Criminal Procedure. It is noteworthy that after the return of the criminal case, the investigation was terminated.

Example 2.

The Presnensky District Court of Moscow, in a ruling dated September 09, 2019, granted the defense’s request to return the criminal case to the prosecutor. The court described in detail the procedural violations committed. He indicated:

“An indictment that sets out all the circumstances provided for by law, including the substance of the charge brought against a specific person, with the obligatory full indication of the data that is subject to establishment, proof and relevant to the case, will be considered to meet the requirements of the criminal procedural law. At the same time, the absence of the specified information in the indictment excludes the possibility of considering a criminal case on the basis of such an indictment, since the lack of specificity of the charged charge prevents the determination of the exact limits of the trial in accordance with the requirements of Art. 252 of the Code of Criminal Procedure of the Russian Federation and deprives the accused of the guaranteed right to know what he is specifically accused of, as well as to carry out his defense against the charges brought.”

Describing the events of the crime in the indictment, the investigation indicated that an organized criminal group opened and maintained bank accounts of legal entities and individuals, carried out transit and transfer of funds without opening bank accounts. At the same time, the accused attracted clients - heads of organizations interested in illegal banking activities - the “transit” of funds and illegal tax optimization. However, none of the listed banking transactions are described in the indictment.

Specific criminal activity, based on the circumstances of the accusation, was expressed in the use of details of companies registered under dummy persons, to whose settlement accounts clients transferred non-cash funds for insignificant transactions. But at the same time, the indictment states only the amounts received into the accounts of companies over a certain period of time, as well as amounts amounting to 0.5% of these receipts. However, the indictment does not contain references to the counterparties named by the investigative body as clients of illegal banking activities, as well as references to the amounts and dates of specific banking transactions related to at least the transfer of funds.

The court found the reference in the indictment to cash flow statements and the expert's opinion to be insufficient. These documents were only evidence on the basis of which the specific circumstances of the crime were established and which were evaluated along with other evidence.

The court also noted that the defendants received income in the form of commissions from received funds in the amount of 0.5% of the amounts sent by clients to the personal (current) accounts of controlled organizations. But in terms of determining the amount of criminal income, the indictment contains a reference to the exclusion of certain “other transactions” from the amount of funds received. However, there is no description of the nature and substance of these operations in the indictment. There is only a link to the expert's opinion.

The court concluded that the charges brought against the citizens were vague. The investigative authorities did not indicate the circumstances that are of significant importance and subject to proof, characterizing the objective side of the crime, in the decisions on implicating them as accused and in the indictment. This not only violates the right of the accused to defense, but also does not allow establishing the limits of the trial.

Example 3.

In its ruling dated June 8, 2017, the Simonovsky District Court of Moscow noted:

“To the circumstances subject to proof for the crime provided for in Part 2 of Art. 172 of the Criminal Code, which is important for a criminal case, includes establishing the time for carrying out banking transactions without registration and without special permission. The prosecution must also indicate the nature and extent of the harm caused by the crime of each of the accused.”

The court noted that the objective side of the crime provided for in Article 172 of the Criminal Code is expressed:

- in carrying out banking operations without registration;

- without special permission (license) to conduct relevant banking operations, in accordance with Article 5 of the Law “On Banks and Banking Activities”.

The investigator outlined only a general theoretical scheme for committing a crime, indicating the expected roles of each accomplice in the organized group.

While charging the accused with the systematic provision of services for maintaining bank accounts of legal entities, cash services for legal entities, collection of funds, the investigation did not establish the method, place and time of these operations (Article 71 of the Code of Criminal Procedure). In particular, it did not provide actual data on which banking operations requiring special permission (license) or registration were carried out by each of the “fictitious” organizations, with reference to the relevant provision of the law on banking activities. It is also not stated what the amount of income each defendant received from these operations. The investigation did not specify exactly when the money transfers were made, with what payment documents, between which legal entities or individuals and in what amount, or how collection took place.

The investigator described only the general joint actions of the accused in registering legal entities, opening bank accounts, and attracting fictitious commercial organizations to the accounts. Then the investigation summed up all the transferred funds and considered this to be the total income received by the accused.

Such a charge, according to the court, did not contain information about the method of committing the crime of illegal banking activities by each of the accused, which made it impossible to determine their roles and the degree of participation in the crime. This significantly violates their right to defense.

How the operation is exposed

Fiscal and law enforcement agencies have permission to monitor the accounts of entrepreneurs and business entities. Therefore, if doubts arise regarding the operations being carried out, it will not be difficult to identify a violation.

Regulatory authorities can track any account, determine the source of funds and the purpose of their use. The level of earnings is checked for the presence of salaries issued in envelopes. The manager or individual entrepreneur may be invited to the Federal Tax Service office to give explanations and provide documentation confirming the legality of concluded contracts for large amounts.

Illegal cash withdrawal through debit and credit bank cards

For example, lawyers say: “Let’s sue!” No, you can't do that. You must not enter into contradiction. This must be remembered and understood. There is a very high probability that the court will take the side of the tax authorities in the dispute and believe them, not you.

- The director of an enterprise who wants to cash out funds creates a one-day company (most often an individual entrepreneur). Further, this company hires several dozen of the same one-day employees. A real company transfers a certain amount to a “fly-by-night company” supposedly for the provision of some services. It is the services that are used (consulting, repairs, equipment setup, etc.). The fact is that in the event of any proceedings, it is almost impossible to prove the actual absence of a service; this is exactly what cashers take advantage of. At the same time, the fly-by-night company pays its many employees and the payments are withdrawn from their accounts. If you recruit several dozen people, then the amount of instant cash withdrawal can amount to millions of rubles. At the time of transfer and withdrawal, such transactions may be of interest only if one operation exceeds 600 thousand in size, which is why the company should have as many employees as possible, and the size of the payment should not be conspicuous.

- The director of the enterprise opens an individual entrepreneur for a dummy person. Further, according to the papers, the individual entrepreneur provides the company with any services, the absence of which is subsequently difficult to prove. An individual entrepreneur, in the absence of a current account (and this is quite legal), receives funds on a personal debit card. Then he withdraws the money, and the required amount has already been cashed out.

Who checks cash?

Many structures within their competence can check accounts to identify illegal cash withdrawals:

- Tax authorities through on-site and desk audits.

- Customs specialists.

- Banking institutions where accounts are opened for individual entrepreneurs and business entities. Their responsibility is to provide all necessary information to fiscal and law enforcement agencies.

- Employees of the Department of Internal Affairs and the prosecutor's office, after identifying an offense of illegal cash withdrawal, transfer the case to the Investigative Committee.

Therefore, all concerned departments and financial institutions can track cash withdrawals.

Known cashing methods

The number of transactions carried out by firms in the legal field is limited. On their basis, a tax shelter mechanism is built. Therefore, illegal financial transactions (cash out) are usually disguised as legal ones. The most common are the following:

- use of shell companies;

- transferring funds through banks;

- transfer to individual entrepreneurs;

- dividend payment;

- raising maternal capital funds;

- creation of fake counterparties.

The scheme through shell companies is that a market participant registers another enterprise under the name of a real person. A contract is concluded with a company for the supply of goods or services. Funds are transferred based on it. The money is withdrawn from the account and the company is closed. In addition, the accountant contributes the amount to the company’s losses. And this reduces the tax base. In such a situation, the owners of both enterprises may be held liable. The difficulty lies in collecting evidence to support the cashing out.

It is similar in essence and form to the above-described illegal cashing out of a company’s money through a shell company. An individual entrepreneur or LLC is registered using a “fake” passport. That is, the document is quite real. But it belongs either to a deceased person or to a robbed person. The fraudster transfers money from the company’s account to a fake counterparty as part of an agreement. Then they are removed and spent on their own needs. And a fake LLC doesn’t even need to be closed. After all, it was issued on a false passport.

Banking institutions are used in criminal schemes only with the consent of managers. Without the participation of an employee of a financial organization, cash withdrawal is impossible. Transactions are carried out by a specialist. He tries to transfer the amount through the accounts of a large number of banks so that it is difficult to track transactions. Currently, such schemes are used quite rarely. Bank transactions are controlled extremely strictly. In addition, if fraud is detected, the unscrupulous financier will also be punished.

Previously, criminals illegally transferred money to the accounts of individuals. But such an operation requires documentation. For example, a company can purchase materials, information, and other things from people. The operation is carried out in the name of dummies. Money is transferred to them for the “goods”. The amount is thus split up. And for a minor violation the offender is not subject to criminal liability. To punish him for cashing out, you need to prove the illegality of all transfers, which is not so easy.

The following scheme is implemented through a criminal conspiracy with an individual entrepreneur. An organization (legal entity) enters into an agreement with an individual entrepreneur for the provision of services (most often). The money is sent to the entrepreneur’s account and divided in agreed proportions. The “legality” of the operation is confirmed by the contract and the certificate of completion of work. Counterparties sign documents, considering themselves completely safe.

Paying dividends is a completely legal operation. But only if they are deducted from after-tax profits. In addition, shareholders are also required to make a contribution to the budget from the income of individuals. The crime in this case is an attempt to evade taxation. That is, dividends are transferred to individuals without charging them a contribution to the treasury.

Since 2009, the maternity capital scheme has been in practice. Cashing out occurs by executing a fake purchase and sale transaction for residential premises. Based on the agreement, the Pension Fund transfers money, which is subsequently withdrawn from the account by the criminal.

There are other cashing schemes, they are less common. But from the examples described above it is clear that criminal offenses fall under various articles of the Criminal Code. Therefore, the legislator decided not to introduce separate rules describing cashing out. Each individual violates the norm described in Chapter 22 of the Criminal Code, dedicated to the description of crimes in the economic sphere.

How to eradicate illegal cash withdrawals

To more effectively prevent offenses in this area, it would be useful to take the following steps:

- Bring to criminal liability the management of the banking institution through which money earned illegally is cashed out.

- Today, based on the imprint, citizens can order the production of any seal or stamp of a legal entity (IP). For a more effective fight against illegal cash withdrawals, state control over the stamp production process is necessary.

- The media should publish materials regarding punishments and the stay of prisoners in places of deprivation of liberty for crimes of an economic nature. Information about the fact of conviction is not enough for future offenders to understand the gravity of responsibility.

- Introduction of restrictive measures and increased control over the activities of citizens who have 2 or more legal entities registered. You can call businessmen to the Tax Service for a conversation and explanation.

- Accept the proposal of the Ministry of Finance regarding increasing the minimum amount of the authorized capital of organizations. It is necessary to increase the thresholds to such limits that the creation of shell companies becomes expensive and does not bring benefits to potential violators.

Consequently, the state, in some cases and for the purposes established by law, allows you to cash out money on the balance sheet of an organization with a relief from the tax burden. But there is no way to avoid paying taxes legally. Such actions may result in criminal liability and confiscation of cash.

Top

Write your question in the form below

What does criminal law indicate?

Article 198 regulates step-by-step actions when an individual evades paying taxes, relevant fees, and contributions. These measures are confirmed in the ed. Federal Law No. 162, 250.

The points that are included in this norm are the following:

- evasion by an individual from payments to the state treasury on a large scale is punishable by a fine or serving correctional or forced labor;

- if the same acts are committed on a particularly large scale, then the fine and time spent in a colony increases, this is stated within the framework of the wording of Federal Law No. 420.

If we talk about comments, it can be noted that a private individual is a person acting as a payer of insurance premiums and fees to the state treasury. A large amount in this law is recognized as a value within three financial years, amounting to over 900,000 rubles.

If a person committed an act for the first time and paid the arrears in full, the norms of criminal law do not apply to him. serious punishment for cashing out funds

Article 199 implies talking about legal entities - organizations that also evade paying contributions. These facts have been fully confirmed within the framework of the wording of legislation No. 250 Federal Law, 162. This norm also contains several relevant positions:

- evasion of replenishing the state treasury is punishable by a fine, since payment of taxes and fees is a mandatory event;

- fines depend on the degree of violation and the size of arrears in the state budget from a particular organization;

- if a similar act is committed by a group of persons on the basis of a preliminary conspiracy or on a particularly large scale, then fines and the length of stay in correctional institutions are subject to increase, and there is also the possibility of imposing additional prohibitions and restrictions (Federal Law No. 420);

- in the notes to this article there is an indication that an especially large amount is an amount amounting to more than 5,000,000 rubles within 3 financial years in a row;

- The second comment is that if a person has committed a criminal activity for the first time, he can be released from liability if he pays the required amounts of taxes and fees in the amount of arrears.

For illegal cash withdrawal, the article of the Criminal Code of the Russian Federation implies serious punishment, which can be avoided only if certain conditions are met.

Cash withdrawal article of the Criminal Code of the Russian Federation

Since, by law, all such transactions are carried out by bank transfer, illegal transactions have been reduced to a minimum. However, there are certain transactions that may no longer be legal. For example, payment of dividends. Since a 9 percent tax is withheld, scammers are trying to run the whole scheme by assigning money to the founders. Also, money for business needs is often written off from the current account, so unscrupulous individuals have room for maneuver here. Another scheme is to issue a loan from a current account, which is issued to one of the founders. And so the period is assigned to the LLC, and it can be even 50 years.

Attackers create a duplicate of an individual’s card after learning the basic details of his card. After this, in fact, access to the money of an unsuspecting person is already open. At the same time, the cashing out process itself most often takes place through intermediaries, who are promised a percentage for withdrawing cash with or without a commission. The issue of criminal liability is not addressed by criminals, so individuals who are intermediaries may not be aware of the illegality of the entire scheme.

Is it possible to legally cash out?

Illegal cash withdrawal, although it promises considerable profits, has one significant drawback - it threatens all participants in this scheme with criminal liability. In addition, the seized money will be confiscated, and this implies the loss of several million rubles for each transaction performed.

Can cashing out be made completely legal? If we are not talking about tax evasion of an organization, but about minimizing the amount of taxes, then this is quite realistic.

At the moment, the least controversial, from the point of view of the law, cashing out can be done through a long-term interest-free loan with a subsequent transfer of funds to a deposit account in a bank. It is not necessary to use dummies or family members for this. If we are talking about an organization with one founder, then issuing a loan to purchase an apartment or house for a period of up to 20 years will not be in conflict with the law. And since legally these will be loan funds deposited in a personal bank account, and not income subject to taxation, you will not have to pay 13% income tax on them.

Of course, after 20 years the loan will have to be repaid. However, it is difficult to judge what the real value of this money will be by that time, taking into account inflation and the ruble exchange rate. In addition, within 20 years the company itself may go bankrupt or close for other reasons.

About business

The main way to illegally “cash out” funds is to carry out an imaginary transaction, the subject of which is the obligation of the contractor to perform work, provide services or deliver inventory to the customer, which is not actually fulfilled. In this case, the customer of the cashing service prepares fictitious primary accounting documents (acts of completion, invoices, etc.) confirming the execution of the main agreement (contract). Based on these documents, deliberately false information is entered into the customer’s tax reporting data. The customer transfers the funds to the settlement account of the contractor, who, using fictitious documents (for example, for the purchase of products), converts them into cash. The cash is then transferred to the customer, minus the remuneration amount.

Slightly less common are various options for the dishonest use of civil legal remedies, in particular the acquisition from individuals of illiquid bills of exchange (the actual price of which is equal to the price of a form in the established form) at face value, issued specifically for the illegal cashing out of funds. In this case, either fictitious data of individuals or lost passports are used.

What are illegal cash-out schemes used for?

In practice, there is an opinion that cashing out is always accompanied by legalization (laundering) of income. It's not like that at all. Very conscientious companies want to reduce the state’s “pressure” on the revenue side and withdraw some funds for their own use in a simple way.

It should be noted that cashing out may be associated with false entrepreneurship or fraud and does not necessarily have the ultimate goal of diverting money from the tax burden.

Therefore, when qualifying a crime, if it is discovered, investigators study:

- all essential features of an unlawful act;

- special attention is paid to optional characteristics;

- entities that acted in a single financial chain;

- what related crimes were committed.

Thus, illegal schemes can only be a “screen” for other more complex crimes that pose a serious threat to society.