What is inventory

This term refers to the verification and calculation of fixed assets listed on the balance sheet of the enterprise. In turn, fixed assets include all the property of the company that is used to carry out its activities. In particular, these are: equipment, machinery, instruments, transport, buildings and structures, etc. One of the main features of an object, in order to classify it as a fixed asset, must be the period of its use: at least one year, as well as a certain minimum value threshold (which is established at the legislative level and changes over time).

https://youtu.be/cYoXwscZf7M

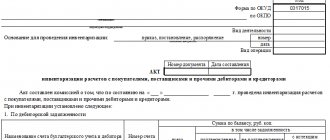

Inventory results report f 0504835 (sample)

The act on the results of the inventory (a sample of filling out by a budgetary institution) can be viewed below:

In the real economy, not all business owners and simply heads of organizations think about the need to conduct an inventory of the property and liabilities of the enterprise in their own interests or in accordance with legal requirements. Since there is no fine for failure to carry out mandatory control measures, many, especially small enterprises, often do not carry them out. Such actions directly contradict the position of the state, which obliges all business entities to carry out accounting and control of the reliability of financial statements, which is impossible without internal control measures.

The main regulatory documents defining the procedure for conducting inventory are:

- Federal Law No. 402-FZ “On Accounting”.

- Order of the Ministry of Finance dated July 29, 1998 No. 34n (regulations on accounting).

- Order of the Ministry of Finance dated June 13, 1995 No. 49 (methodological instructions for comparing property and liabilities).

The procedure for determining the actual availability of objects with comparable data is not very popular due to the labor intensity and complexity of the process, but it allows:

- objectively assess the procedure for recording and storing property;

- identify possible thefts and accounting irregularities;

- establish the causes of accounts payable and receivable;

- control the process of managing assets, liabilities, etc.

Reasons for verification actions

The reasons for inventory activities can be very different: upcoming annual reports on accounting and taxes, a change in financially responsible employee, theft, theft, other abuses of the organization’s property, the upcoming transfer of fixed assets to a tenant or a new owner.

In addition, property inspection is carried out during the reorganization of the company and its impending liquidation, as well as in force majeure circumstances (fires, floods, accidents, etc.). Inventory can be carried out both on a voluntary basis and compulsorily, both one-time and regularly, and its duration can vary from several hours to several days. At large enterprises, inventory is carried out separately for each structural unit.

Unified form No. INV-17 - form and sample

Purpose of the INV-17 form

Before preparing financial statements, organizations need to take an inventory of their assets and liabilities. This facilitates not only the correct completion of the balance sheet, but also the timely identification of inconsistencies between accounting data and information available to counterparties.

To learn about what accounting data needs to be inventoried before starting to compile annual reporting, read the material “How to conduct an inventory before annual reporting.”

The need for an inventory also arises in the following cases:

- when changing materially responsible persons;

- theft at an enterprise and other unusual situations;

- liquidation of the organization.

The unified form INV-17 is used to document the results of the inventory of receivables and payables. It was put into effect by Decree of the State Statistics Committee of Russia “On approval of unified forms of primary accounting documentation for recording cash transactions and recording inventory results” dated August 18, 1998 No. 88. But it is not mandatory for use since 2013. It is possible to use a self-developed form of similar content instead. However, the INV-17 form contains fields for filling in all the information that must be reflected in such a form, and therefore continues to be actively used.

Where to download INV-17

The INV-17 form is available for download on our website.

The inventory report in form INV-17 is accompanied by a certificate (appendix to form INV-17), detailing (by counterparties) the data on existing debt and reflecting information on the availability of documents confirming its amount. In the INV-17 form itself, if there is a significant number of counterparties, consolidated total data on accounting accounts can be entered without breakdown by counterparties. And if there are few counterparties, then INV-17 may also contain their names.

A sample of filling out an act in form INV-17 is available for download on our website.

Download a sample of filling out an act in form INV-17

How is debt inventory carried out?

The beginning of the inventory process is preceded by the presentation of reconciliation reports to counterparties, and these documents serve as the main (although not the only) source of data for conducting a debt inventory. Then management issues an order and appoints an inventory commission. This body, based on documentary checks, must verify the accuracy of the following information:

- settlements with suppliers and customers;

- settlements with regulatory authorities, including the Federal Tax Service, Social Insurance Fund;

- calculations for wages;

- settlements with accountants;

- other calculations of the organization.

The INV-17 form report reflects data confirmed and unconfirmed by counterparties, as well as amounts with an expired statute of limitations.

The purpose of the inventory is to identify possible inconsistencies and confirm the accuracy of accounting information. The latter is one of the most important conditions for the preparation of reliable accounting reports.

About the deadlines established for submitting the main form of accounting to the Federal Tax Service, read the article “When is the balance sheet submitted (deadlines, nuances)?”

Results

To document the results of the inventory of receivables and payables, you can use a self-developed form, or you can use the unified form INV-17. Filling it out is not difficult, as we showed in our article.

What goals are set and what results can be

Based on the above, it is not difficult to understand the main goals and objectives of this event.

- First of all, this is a certification that all fixed assets credited to the organization’s balance sheet are safe and sound, there are no surpluses or shortages, and that all factual data fully corresponds to what is reflected in the documents.

- Thanks to the inventory, management gets the opportunity to get a real picture of the enterprise’s property, as well as to carry out timely write-off of fixed assets (broken, obsolete or lost).

- This procedure also has a disciplinary nature: knowing about its implementation (especially if it is carried out regularly), materially responsible employees perform their job duties with greater care and reliability, avoiding negligence and deliberate violations.

Inventory procedure

In terms of structure, inventory can be divided into three main stages.

The first stage is preparation, during which a plan is developed, the availability of documentation for fixed assets is checked and its content is examined, and a corresponding order is issued on behalf of the director of the enterprise. By means of the above order, an inventory commission is appointed (it can be permanent), which should include employees from different departments, then the financially responsible employee writes a receipt, and the balances of fixed assets are determined using the accounting data.

The second stage is the inventory itself. Here everything is measured and calculated, an inventory list is drawn up, into which all the material assets actually available in the enterprise are entered. At the same stage, an assessment of previously unaccounted for objects occurs, a description of the degree of their wear and condition.

And finally, the third stage : the final one. During this process, the received information is compared with accounting information, deviations are identified, as well as their causes, and a statement of discrepancies is compiled. At the end, preparations are made for entering all detected discrepancies into accounting.

What are the matching statements for inventory f. 0504092, INV-18 or INV-19?

A comparison sheet must be filled out if, at the end of the inventory procedure, a larger or smaller number of inventory objects is discovered.

There are 2 types of matching statements for commercial structures:

- statement of results of inventory of fixed assets and intangible assets (INV-18);

- statement of inventory inventory results (INV-19).

IMPORTANT! The company has the right to use independently developed forms of matching statements, taking into account the requirements for the preparation of primary documents in accordance with Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

In budgetary institutions, form 0504092 is used.

Document format and design

Today, the statement of discrepancies can be made in any form or according to a template that is developed and approved within the company. However, many businesses still prefer to use the previously unified form because it is convenient and includes all the necessary fields, rows and cells. The format of the statement must be fixed in the local regulations of the organization.

The statement is made in two copies identical in content, each of which is certified by the signatures of responsible employees. There is no need to stamp the form.

How is the INV-18 form used?

Form INV-18, introduced into business circulation by Decree of the State Statistics Committee dated August 18, 1998 No. 88, is used to reflect discrepancies between the results of the inventory of fixed assets and intangible assets and the data available to the accounting department. It is one of 2 existing types of matching statements.

For a similar statement compiled based on the results of an inventory of inventory items that revealed discrepancies, read the article “Unified Form No. INV-19 - Form and Sample.”

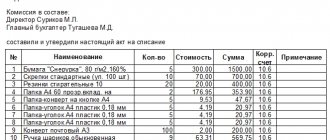

Sample statement of discrepancies based on inventory results

- At the beginning of the document, standard data is filled in: date of formation of the statement, name of the organization, name of the structural unit and information about the financially responsible employee.

- Next comes the main part, which is presented in the form of a table. It contains the name of the inventory object, its inventory sign (number), the unit of measurement in the form of a code and its decoding (pieces, liters, meters, etc.), and the accounting account number.

- Then the table contains data regarding the actual results of the event: first, what is the shortfall. Here you write the book value of the object, information about natural losses (quantity and amount), the price at the time of inventory, loss in excess of the established norm of natural loss, the difference between the price on the balance sheet and the market value (plus or minus).

- Then, if surpluses are identified, information about them is entered: their quantity and cost.

- In conclusion, the document must be signed by the materially responsible employee, as well as the accountant.

Appearance of the document, content and description of its fields

Inventory activities are initiated by order of the enterprise management, its results are entered into the inventory (IVN), and an inventory act is drawn up.

An inventory report is drawn up when recalculating:

- intangible assets (rights to software products, brands, etc.);

- cash (INV-15);

- commodity and material assets (INV-4 or 6);

- expenses of the future period (INV-11);

- settlements of debts (creditors and receivables) (INV-17);

- fixed assets (buildings, transport, equipment).

Basic documents regulating the rules for conducting an inventory and recording its results:

- Federal Law No. 402 On accounting dated December 6, 2011;

- Orders of the Ministry of Finance No. 49 of 06.13.95 and No. 34n of 07.29.98.

Please note: when filling out an inventory report, the inventory is signed by all members of the commission and the person bearing financial responsibility. The absence of even one signature makes the document unreliable.

The act is usually filled out on an A4 sheet (the sheet can be oriented according to the type of book or the type of album).

The document can be roughly divided into three parts:

- introductory part (header);

- main (informative part);

- legal part (signatures of the commission and seal of the organization).

The water part of the document indicates the name and form of ownership of the enterprise, the name of the document and the date of its preparation, the basis for the inventory (number of the order, directive, director’s resolution and the date of its publication).

In the header of the document on the right side in the table indicate the codes for OKUD and OKPO (for accounting for inventory items), the start and end date of the inventory process.

The main part of the document indicates the type of assets subject to inventory (inventory, cash, etc.), the location of their actual location (for example, the number of the workshop where the equipment is located or the number of the warehouse where the inventory is stored).

Next, there is a receipt from the responsible person stating that the valuables are in proper order (for the inventory report for goods and materials and cash).

When filling out an act on the results of an inventory of funds, indicate the amount that should be in the cash register and the actual cash (in bills, securities). If inventory records are kept, a table containing the following columns is filled in:

- Number in order.

- List of goods and materials.

- Their number (code) according to the nomenclature.

If the goods are in transit, additional fields must be filled in:

- Provider.

- Quantity of goods according to invoices.

- Quantity of goods according to accounting data.

Next, indicate the number of groups, types of values described and indicate the results of the inventory (excess/shortage of goods and materials or cash). Then move on to the legal part of the document:

- signature of the chairman of the commission;

- signatures of commission members;

- signature of the financially responsible person;

- document date;

- seal.

If you are using the INV form developed for your company, the mandatory details indicated in the header of the company and the legal part must be present.