The ruble is falling, prices are rising, but the same people work in stores and pharmacies, the same buyers come. How to reduce costs? How to reduce misgrading and avoid shortages? Olga Kuznetsova, founder and head of ORRLA, talks about independent inventory, its advantages and the risks of doing it yourself.

Inventory is one of the main methods of financial control, which involves recounting goods (or other company property) and reconciling the results of this recalculation with accounting data. As a rule, the inventory is carried out by company employees, but practice shows that this solution is far from the most effective. Firstly, financially responsible employees, as well as employees with access to accounting data on inventory balances, should not participate in the inventory. Secondly, not every company can provide the required level of technology and number of employees. For example, we can process 2.5 million units over the weekend! How many full-time employees and in how many shifts will they cope with this volume? Third, the inventory must be unexpected. In this case, everything should be done in one step, without splitting the process into parts. This is one of the most important conditions; if it is met, the inspectors are guaranteed to see a real, reality-corresponding state of affairs at the enterprise.

Due to my work, I know the internal statistics of many retail chains. According to them, even in those stores where records are kept without violations, the error can reach 10–15%. Let me explain this fact using the example of the inventory of a household appliances store, in which boxes of goods are counted without opening. In such cases, the product itself may no longer be in the store (if it was taken by an employee or it was sold without packaging). In this case, the empty packaging will be counted, and the product will continue to be listed on the balance sheet.

One of the main advantages of an independent inventory is the reduction to zero of the risks associated with intentional distortion of inventory results. So, if the calculation of inventory balances is carried out by employees of a pharmacy or store, there is a high probability that the results of the recalculation will be “adjusted” to the accounting balance. Situations often arise when shortages are not detected at an enterprise, but there is a shortage of goods or money. In such cases, we may be talking about dishonesty of employees.

When is a warehouse inventory required?

A scheduled inspection is performed once a year. Unscheduled inventory - in the presence of special circumstances. The list of these circumstances is given in Federal Law No. 402 “On Accounting” dated December 6, 2011:

- Change of director, transfer of property to another person, transfer of an organization from state to unitary.

- Dismissal of more than 50% of state employees.

- Detection of theft, damage to property, and its illegal exploitation.

- Damage to property as a result of emergencies (fires, floods, hurricanes).

Inventory is also carried out before preparing annual reports. The event is regulated by Order of the Ministry of Finance No. 49 “On approval of instructions for inventory” dated June 13, 1995.

FOR YOUR INFORMATION! Once a year is the minimum number of events. But in practice, checks are carried out more often. This is necessary for timely detection of theft.

In what ways can inventory results be distorted?

Each inventory directly affects the interests of financially responsible employees. In order to hide existing shortages, they may distort the inventory results in such a way as to avoid the financial consequences of the audit.

Each hut, as they say, has its own rattles. I will give examples of fraud from practice.

Barcode swapping is a common method of fraud. A sales consultant at a branded clothing store really liked the expensive leather jacket they sold. He goes home in it, and attaches the barcode to socks or an inexpensive shirt, which is honestly paid for by the swindler and written off. There are no questions asked when taking inventory, since the barcode for the more expensive item is scanned as if it were still in stock. We check product barcodes, so such discrepancies will be immediately detected.

Direct replacement of goods. In these cases, the place of the taken (or sold) product is replaced by a cheaper product of the same group (for example, expensive men's shoes are replaced by cheap ones). During inventory, a cheap product is taken into account as a more expensive one, and the shortage turns out to be undetected. Again, our employees open the boxes, checking the presence and compliance of the included goods with the declared ones.

“Adjusting” the results. If employees conducting inventory have access to data on accounting balances, inventory results can simply be manipulated (for example, the same unit of goods is scanned as many times as there should be according to accounting data).

Composition of the commission

A special commission is appointed to conduct the event. Its minimum composition is 6 employees. The commission should include these specialists:

- Chief Accountant.

- The head of the company or his deputy.

- Head of departments.

- The person responsible for ensuring compliance with the labor rights of employees.

- Logistics service representatives.

Sometimes the commission may include other professionals. Each employee must ensure the effectiveness of the event. The composition of the commission is approved by the manager of the company by issuing an order.

ATTENTION! The manager must ensure the availability of all the necessary tools: equipment for weighing, counting, transportation.

IMPORTANT! The number of employees participating in the commission must be strictly observed. Otherwise, the inventory is considered invalid.

Types of inventory

Let's look at the main types of inventory in a warehouse:

- Full. Involves examining all property located in the warehouse. Rented properties are also inspected.

- Partial. Only part of the objects is checked. Verification allows the event to be carried out quickly. If a shortage is identified, the event is expanded.

- Selective. Only certain values are analyzed.

- Planned. The list of inspected property is established by the manager.

A full inspection must be carried out once a year.

Preparatory work

It is recommended to clean the warehouse before the event. Representatives of the commission are provided with all documents relating to recent transactions with items in the warehouse. For example, these could be papers about receipt, loss, damage, and expense. Previous reports were marked “before inventory”. Highlighting documents completed before the event will help identify missing objects.

Those responsible for the property are required, before starting the inventory, to sign a document stating that all papers for the products have been handed over to the commission. Another signature is affixed, which confirms that the disposed property is written off as an expense. A write-off document is attached to all inventories.

ATTENTION! There are two forms of commissions: counting and inventory. The second includes employees responsible for counting property in the warehouse.

Documentation of inspection results

Based on the results of the inventory, a matching statement (INV-19) is formed, which reflects the shortage or surplus of goods. For each fact of deviation in any direction, the commission is obliged to conduct an inspection and enter the results into the final statement (INV-26):

- shortage due to natural attrition;

- due to oversight or negligence;

- due to malicious intent (if the inspection was initiated in order to prevent the theft or damage to inventory items).

The reasons will help the manager identify the culprit and recover damages from him in monetary terms. Identify the presence of units of obsolete or expired goods and write them off at a loss.

Upon completion of the inspection, the inventory act is signed by all members of the commission, the manager and chief accountant, as well as employees responsible for the movement of inventory items.

Table 2: accounting for inventory results in accounting

| № | What are we writing off/coming | Where do we write off/arrive? | |

| debit | credit | ||

| 1 | Surplus goods | 41 | 91.1 |

| 2 | Shortage of goods | 94 | 41 |

| 3 | Within the limits of natural loss | 44 | 94 |

| 4 | Loss due to the guilty employee | 73.2 | 94 |

| 5 | Loss at the expense of the organization's profit | 91.2 | 94 |

| 6 | VAT on goods written off at a loss | 91.2 | 19.3 |

Postings that reflect the results of the inventory are generated in the period to which the date of the inspection relates (the date the inventory was compiled).

Inventory procedure

You need to start with the formation of matching statements. These documents document the discrepancy between the papers and the real situation in the warehouse. For example, the accounting report indicates 100 units of goods, but only 98 units are found in the warehouse. That is, a shortage of 2 units was established. It is indicated in the matching statement. During the inventory process, a conclusion is formed. To prepare it, you need to create a single register that contains inventories and statements.

If there are temporarily stored products in the warehouse, a separate statement will be required for it. For convenience, an electronic document can be generated. The absence of property in the warehouse must be recorded. This is done exclusively in the presence of the person responsible for the goods.

Inventory of products in the warehouse is carried out in accordance with this algorithm:

- Formation of the commission.

- Formation of a plan for upcoming events.

- The head approves the members of the counting commission.

- An order is issued prohibiting all actions with property in the warehouse.

- Accounting documents are being prepared.

- The responsible employee confirms that the provided accounting information is current.

- Representatives of the counting commission are instructed to create inventories.

- The property is being counted.

- The correctness of filling out the inventory is checked after the calculations are completed.

- At the end of the event, the availability of products in the warehouse is re-established, if the corresponding provision is in the documents.

- Formation of the statement.

- Sending reports to accounting. Department.

If there are ambiguous points, you need to compare the generated reports and the units of goods in the warehouse.

ATTENTION! During the procedure, moving property and any other manipulation with it is prohibited. Compliance with this rule will prevent errors and inaccuracies in the report. If new goods arrive at the warehouse during the inventory process, they are reflected in the register in the presence of representatives of the commission.

The prepared statements contain only the identified discrepancies between the indicators according to accounting data and inventory data. When drawing up statements, discrepancies are taken into account not only in the quantity of material assets, but also in their assessment (according to accounting data and the actual one, revealed by the results of the work of the inventory commission)

Excess property is accounted for at market value on the date of inventory and the corresponding amount is included in the non-operating income of the organization by an entry in the debit of accounts 10 “Materials”, 41 “Goods” (according to the corresponding subaccounts of accounting), etc. and the credit of account 91, subaccount “Other” income."

For income tax purposes, excess inventories and other property (including cash) identified during the inventory increase the tax base as part of non-operating income on the basis of clause 20 of Art. 250 Tax Code of the Russian Federation.

At retail trade enterprises, the amounts of the accrued trade markup on identified goods are recorded in the debit of account 41, subaccount “Goods in retail trade” and the credit of account 42 “Trade markup”.

Shortages and damage to material assets identified by the results of the inventory within the limits of natural loss norms are attributed to production (circulation) costs, and in excess of the norms - to the account of the guilty persons. It should be borne in mind that before determining the shortage, it is possible to offset surpluses and shortages by regrading.

Re-grading of inventory means a simultaneous shortage of one type of product and a surplus of another type of product of the same name. As a rule, the reasons for misgrading are insufficient control over the compliance of the grade of goods released from the warehouse with the grade specified in the primary documents that serve as the basis for the release of goods from the warehouse. Misgradings are identified during inventories and other established control measures.

In accounting, the identified amounts of misgrading (using the example of goods) are recorded in the following entries in the accounting accounts:

debit of account 94 “Shortages and losses from damage to valuables” credit of account 41 - the shortage of goods of one type is reflected (at the organization’s discount prices);

debit of account 41 credit of account 94 - surplus of goods of a different type;

debit of account 41 credit of account 41 - offset of shortage of goods by mis-grading;

debit of account 73 “Settlements with personnel for other operations” credit of account 94 - attribution at the expense of the guilty parties of the difference in the value of missing values over the cost of excess values;

debit of account 91, subaccount “Other expenses” credit of account 94 - write-off by organizing the difference in the cost of missing values over the cost of excess values.

The cost of missing valuables is reflected in accounting records as follows:

debit of account 94 credit of accounts 10, 41, 50 - shortage of inventory at discount prices, as well as cash;

Shortages of property and its damage within the limits of natural loss are included in the accounts for recording production costs (distribution costs) - debit account 44 credit account 94

31. Features of conducting an inventory of goods and containers that were in custody, in transit, received for processing when accepted for commission, and shipped goods. Inventory assets are entered in the inventory for each individual item, indicating the type, group, quantity and other necessary data (article, grade, etc.).

An inventory of inventory items should, as a rule, be carried out in the order in which the assets are located in a given room. When storing inventory items in different isolated premises with one materially responsible person, the inventory is carried out sequentially by storage location. After checking the valuables, entry into the room is not allowed (for example, it is sealed), and the commission moves on to work in the next room.

Inventory assets received during the inventory are accepted by financially responsible persons in the presence of members of the inventory commission, are included in the register or commodity report after the inventory and are entered into a separate inventory under the name “Inventory assets received during the inventory.” The inventory indicates the date of receipt, name of the supplier, date and number of the receipt document, name of the product, quantity, price and amount. At the same time, on the receipt document signed by the chairman of the inventory commission (or on his behalf, a member of the commission), a note is made “after the inventory” with reference to the date of the inventory in which these values are recorded.

During a long-term inventory, in exceptional cases and only with the written permission of the head and chief accountant of the organization during the inventory process, inventory items can be released by financially responsible persons in the presence of members of the inventory commission. These values are entered in a separate inventory under the name “Inventory assets released during inventory.” An inventory is drawn up by analogy with documents for inventory items received during the inventory. A note is made in the expenditure documents signed by the chairman of the inventory commission or, on his instructions, a member of the commission.

Inventory of inventory items that are in transit, shipped, not paid for on time by buyers, and located in the warehouses of other organizations consists of checking the validity of the amounts listed in the relevant accounting accounts. Goods stored in warehouses of other organizations are entered into the inventory on the basis of documents confirming the delivery of these goods for safekeeping.

The inventories indicate their name, quantity, grade, cost (according to accounting data), date of acceptance of the cargo for storage, storage location, numbers and dates of documents.

Inventories are compiled separately for inventory items that are in transit, shipped, not paid on time by buyers, and located in the warehouses of other organizations.

The inventories of inventory items in transit for each individual shipment contain the following data: name, quantity and value, date of shipment, as well as the list and numbers of documents on the basis of which these assets are recorded in the accounting accounts.

In inventories of inventory items shipped and not paid for on time by buyers, for each individual shipment the name of inventory items, amount, date of shipment, date of issue and number of the payment document are indicated. Data on inventory items stored in warehouses of other organizations are entered into inventories on the basis of documents confirming the delivery of these assets for safekeeping.

The results of the inventory must be reflected in the records of the month in which the inventory was completed.

Let's consider the procedure for reflecting the results of inventory of goods in the accounting records of an organization. When accounting for goods at purchase prices, the correspondence scheme of accounts for recording the results of inventory of goods is as follows.

| Record number and contents | Corresponding accounts (sub-accounts) | |

| D | TO | |

| 1. Surplus goods are capitalized | 91-1 | |

| 2. The shortage of goods is reflected in the accounting | ||

| 3. Shortage of goods written off: within the limits of loss norms above the loss norms above the loss norms | 44 (96) | |

| at the expense of the perpetrators | 73-3 | |

| at the expense of the organization | 91-2 | |

| 4. The amount of VAT relating to goods for which losses are written off is written off at the expense of the organization | 91-2 | 19 (68) |

If goods are accounted for at sales prices, then in addition to the above, additional entries are made:

for the amount of the trade markup relating to

a) for excess goods (entry I):

D 41 “Goods” K 42 “Trade margin”;

b) for missing goods (entry 2):

D 41 “Goods” K 42 “Trade margin” (red reversal methods).

When reflecting in the accounting records of an organization a shortage of goods accepted for commission identified during an inventory, the account correspondence scheme will be as follows.

| Record number and contents | Corresponding accounts (sub-accounts) |

| D | TO |

| The shortage of goods is reflected in the accounting: at accounting prices in the amount payable to the principal | |

| The shortage of goods was written off at the expense of the guilty parties | 73-2 |

| The shortage of goods was written off at the expense of the organization | 91-2 |

| Money was received at the cash desk from the guilty persons to repay the debt due to the shortage | 73-2 |

| Money was issued to the principal |

32. The procedure for reflecting in accounting accounts discrepancies identified during inventory between the actual availability of goods and containers and accounting data in wholesale, retail and commission trade. (I think this is a general rule for all types of trading.)

Guidelines for accounting of inventories (approved by order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n) 29. Based on the results of inventories and inspections, appropriate decisions are made to eliminate deficiencies in the storage and accounting of inventories and compensation for material damage.

Discrepancies identified during the inventory between the actual availability of property and accounting data are reflected in the following order:

a) surplus inventories are accounted for at market prices and at the same time their value is included:

— in commercial organizations — on financial results;

- in non-profit organizations - to increase income;

b) amounts of shortages and damage to inventories are written off from accounting accounts at their actual cost, which includes the contractual (accounting) price of the inventory and the share of transportation and procurement costs related to this inventory. The procedure for calculating the specified share is established by the organization independently. In accounting, this operation is reflected in the debit of account 94 “Shortages and losses from damage to valuables” and the credit of inventory accounts - in terms of the contractual (accounting) price of the inventory and the debit of the account “Shortages and losses from damage to valuables” and the credit of account 16 “Deviation in cost of materials”, when used in the accounting policy of the organization of accounts for the procurement and purchase of materials or the corresponding subaccount to the inventory accounts in terms of the share of transportation and procurement costs.

In the event of damage to inventories that can be used in the organization or sold (at a markdown), the latter are simultaneously accounted for at market prices, taking into account their physical condition, with losses from spoilage reduced by this amount.

30. Shortages of inventories and their damage are written off from account 94 “Shortages and losses from damage to valuables” within the limits of natural loss rates to the accounts of production costs and/or sales expenses; above the norm - at the expense of the perpetrators. If the perpetrators are not identified or the court refuses to recover damages from them, then losses from shortages of inventories and their damage are written off to the financial results of a commercial organization or to the increase in expenses of a non-profit organization. Attrition rates can only be applied in cases where actual shortages are identified.

The shortage of inventories within the established norms of natural loss is determined after offsetting the shortage of inventories with surpluses by misgrading. In the event that, after a re-grading offset made in the prescribed manner, there is still a shortage of inventories, then the norms of natural loss should be applied only for the name of the inventories for which the shortage was established. In the absence of norms, the loss is considered as a shortage in excess of the norms.

31. The materials submitted to the management of the organization to formalize the write-off of stock shortages and spoilage in excess of the norms of natural loss must contain documents confirming appeals to the relevant authorities (the Ministry of Internal Affairs of Russia, judicial authorities, etc.) regarding the facts of shortages and the decisions of these authorities, as well as a conclusion on the fact of inventory damage received from the relevant services of the organization (technical control department, other similar service) or specialized organizations.

32. Mutual offset of surpluses and shortages as a result of regrading can be carried out by decision of the organization’s management only for the same audited period, from the same audited person, in relation to stocks of the same name and in identical quantities.

Materially responsible persons provide detailed explanations to the inventory commission about any misgrading.

In the case when, when offsetting shortages with surpluses by re-grading, the value of the missing inventories is higher than the value of the inventories that are in surplus, then the specified difference is attributed to the guilty parties.

If the specific culprits of the shortage are not identified, then the differences are considered as a shortage in excess of loss norms and are written off against the financial results of a commercial organization or an increase in expenses for a non-profit organization.

33. Proposals for regulating discrepancies between the actual availability of inventories and accounting data identified during the inventory are submitted for consideration to the head of the organization. The final decision on the classification is made by the head of the organization.

34. The results of the inventory must be reflected in the accounting and reporting of the month in which the inventory was completed, and for the annual inventory - in the annual financial statements.

35. Material inventories lost (destroyed) as a result of natural disasters, fires, accidents and other emergencies are written off from the credit of inventory accounts to the debit of account 94 “Shortages and losses from damage to valuables” at the actual cost of these inventories with subsequent reflection on the accounting account financial results as extraordinary expenses.

Insurance indemnities received as compensation for losses from natural disasters, fires, accidents and other emergencies are taken into account as part of the organization's emergency income.

33. Accounting for commodity losses due to natural loss

Natural loss is the loss of goods caused by changes in their physical and chemical properties (shrinkage, shrinkage, spraying, leakage, etc.). They are standardized, i.e., a loss rate in percentage) is established for each product separately.

The rates of natural loss during transportation depend on the type of goods and transport, transportation distance, time of year and other factors.

The amount of commodity losses during transportation due to natural loss is determined by finding the rate of loss based on the value of each type of product (in some cases, based on their weight). These standards apply only if, upon receipt of goods, a shortage is detected.

If, upon delivery of the cargo to the consignee, a shortage of goods is detected within the limits of natural loss norms, the representative of the transport organization is obliged to make a corresponding note in the transport document. If the shortage of goods identified upon acceptance exceeds the established standards, a corresponding report is drawn up.

Normalized losses during transportation (but not more than the amount of shortage identified upon acceptance of goods from transport authorities) are written off at the expense of the consignee. The cost of missing goods in excess of the specified standards must be recovered from the culprits.

The rates of natural loss during storage of goods depend on various factors: climate zone (first and second), storage conditions, etc.

The specified norms are not used for goods that are accepted and released without weighing (by counting units or by weight indicated on the container), which are written off under acts of damage, breakage, scrap, as well as for piece goods.

The amount of losses due to natural loss (E) is determined by the formula:

E = T • H: 100,

where T is the cost (weight) of the goods sold (dispensed);

N is the rate of natural loss, %.

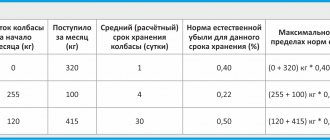

Commodity losses during storage and sale due to natural loss are written off only if the inventory reveals a shortage of goods based on established standards, but not more than the amount of the shortage established during the inventory. For example:

| Indicators | Option 1 | Option 2 |

| Shortages of goods identified during inventory | ||

| Commodity losses based on natural loss rates | ||

| Losses written off at the expense of the organization | ||

| Saving natural loss | — | |

| Losses recovered from financially responsible persons | — |

In warehouses, the norms of natural loss also depend on the storage period of the goods (except for the factors listed above).

With the batch method of storing goods, the shelf life is calculated according to the batch card based on the date of receipt of the goods and the date of its release.

With the varietal storage method, the average shelf life of the product (C) is determined using the formula:

C = O : P,

where O is the average daily balance of goods for the period between inventories;

P - one-day turnover of goods for the inter-inventory period.

The average daily balance of goods is calculated using the formula:

O = O : n,

where O is the balance of goods for each day of storage;

n is the number of days in the inter-inventory period.

One-day turnover is calculated using the formula:

S = T: n,

where T is the turnover of goods during the inter-inventory period.

Example. At the warehouse located in the first zone, an inventory of boiled and smoked sausage was carried out as of April 15. The previous inventory was carried out on October 11, i.e. the inter-inventory period is 180 days.

Receipts, releases and remaining sausages based on accounting data amounted to (kg):

| date | Balance at the beginning of the day | Received within a day | Released per day | Balance at the end of the day |

| October 12 | — | — | ||

| October 13 | — | |||

| October 14 | ||||

| April 15, etc. | — | |||

| Total for the inter-inventory period | — | — | 41 420 | 171 050 |

The average daily balance is 950 kg (171,050: 180).

One-day turnover - 230 kg (41,420: 180).

The average shelf life is 4 days. (950 : 230).

The rate of natural loss of boiled-smoked sausage during storage period

4 days - 0.086%.

The maximum amount of natural loss of sausage with a turnover of 41,420 kg and a 4-day shelf life will be 35.6 kg (41,420 • 0.086): 100).

In retail trade, turnover for the sale of individual types of goods is, as a rule, impossible to directly identify, since analytical accounting of goods by type is usually not maintained. Therefore, the turnover for the sale of a particular product for the inter-inventory period is determined by calculation based on the indicators of the commodity balance:

ZN + C = R + V + ZK,

where

P = ZN + P - V - ZK,

where ZN is the balance of goods at the beginning of the inter-inventory period (according to the previous inventory data);

P - the goods were received during the inter-inventory period (according to receipt documents);

B - the product was retired during the inter-inventory period ( according to the data of expenditure documents);

ZK - the balance of goods at the end of the inter-inventory period according to the latest inventory data).

Having determined the turnover for the sale of a particular product during the inter-inventory period and multiplying it by the rate of natural loss, we obtain the amount of natural loss for this product. Then we determine the total amount of natural loss for all goods sold during the inter-inventory period.

Natural loss for goods sold during the inter-inventory period can be calculated as follows: natural loss for the balance of goods at the beginning of the inter-inventory period plus for received goods for the inter-inventory period minus for retired goods for this period minus natural loss for the balance of goods at the end of the inter-inventory period.

For stores with a stable turnover structure, you can set the average rate of natural loss in general for all goods. In this case, the amount of natural loss is determined by finding the average rate of loss from the total turnover of the store for the period between inventories.

Losses of goods during transportation due to natural loss are written off at the purchase price by debiting account 44 “Sales expenses” and crediting account 94 “Shortages and losses from damage to valuables.”

Losses of goods during storage and sale due to natural loss are written off in the month in which the inventory was carried out. Inventory of goods is extremely rarely carried out monthly, therefore, it would be wrong to attribute the entire amount of losses incurred during the inter-inventory period to the distribution costs of one month, since this would artificially reduce expenses in those months in which there was no inventory, which would distort profit figures for a certain reporting period.

Since losses of goods due to natural loss occur over the entire period between inventories (several months), they must be distributed among all months of this period. To distribute them more evenly, the planned amount of these losses is written off monthly as distribution costs, i.e., a reserve for natural loss is added. After the inventory, the shortage of goods resulting from natural loss is written off against the previously accrued reserve. Since the actual amount of shortage of goods due to natural loss and the accrued reserve, as a rule, are not equal to each other, adjustment entries are made for the difference between these indicators.

Accrual of reserve for write-off of losses (monthly):

D 44 “Sales expenses”

K 96 “Reserves for future expenses.”

Write-off of lost goods from the reserve (at the purchase price):

D 96 “Reserves for future expenses”

K 94 “Shortages and losses from damage to valuables.”

To adjust the reserve, an entry is made according to its accrual (for the difference between the amount of shortage of goods due to natural loss and the accrued reserve): in ordinary numbers - if the amount of the reserve is less than the amount of shortage of goods; negative (red reversal) - if the amount of the reserve is greater than the amount of the shortage.

In accordance with clause 72 of the Regulations on accounting and financial reporting, in order to evenly include future expenses in the production or circulation costs of the reporting period, the organization can create reserves.

The formation of reserves not listed in this paragraph is possible only with the permission of ministries and departments in agreement with the Ministry of Economy and the Ministry of Finance. In connection with this, letter of the Committee of the Russian Federation on Trade dated March 16, 1993 No. 1-435/32-2 provides for the creation of a reserve for writing off the natural loss of goods in trade organizations with warehouses, vegetable and food product depots, refrigerators and cold storage plants. The same is stated in paragraph 2.17 of the Methodological recommendations for accounting of costs included in the costs of distribution and production, and financial results at trade and public catering enterprises, approved by the Committee of the Russian Federation on Trade in agreement with the Ministry of Finance of Russia on April 20, 1995 No. 1- 550/32-2. However, it is puzzling that these regulatory documents do not contain permission to create a similar reserve in retail trade. The presence of losses of goods in stores during storage and sale due to natural loss is an objective reality, and it is necessary to create a reserve to write off these losses. In accordance with the Regulations on accounting and financial reporting in the Russian Federation, natural loss norms can be applied only in cases where actual shortages are identified, i.e. after an inventory of goods. Since inventory in stores is carried out, as a rule, no more than twice a year, in order to evenly include expenses for writing off product losses due to natural loss, it is necessary to create a reserve for this purpose. The regulatory documents of the USSR Ministry of Trade have always provided for the creation of such a reserve.

In connection with the problem under consideration, I would like to draw attention to the following sentence of paragraph 2.17 of the Methodological Recommendations: “At the end of the reporting year, if the actually accrued reserve exceeds the amount of the calculation confirmed by the inventory, a reversal entry of distribution and production costs is made.” This instruction appeared due to the fact that many tax inspectors demanded that the amount of all accrued reserves be adjusted at the end of the year.

However, such a requirement indicates a misunderstanding of one of the most important principles of accounting - the accrual principle, according to which all expenses related to a given reporting period should be written off as the distribution costs of this period. Reversing the balance of the unused reserve for natural loss at the end of the year without conducting an inventory of goods violates this accounting principle, especially since it is practically impossible to carry out an inventory of goods at the end of the year (precisely on January 1) in all trading organizations. The reserve for natural loss should be carried over to the next year and adjusted only at the time of the inventory.

As mentioned above, by order of the USSR Ministry of Trade dated 04/02/87 No. 88, the norms for losses from broken glass containers with food products and empty glassware during transportation, storage and release were approved.

In addition, for non-food products (perfumery and cosmetics; household, haberdashery and cultural goods made of plastic; household chemical goods; household mirrors; porcelain and earthenware, majolica and pottery; Christmas tree glass decorations, etc.) a number of orders of the Ministry of Trade of the RSFSR established norms of losses from combat during transportation, storage and sale. These norms have the same status as the norms of natural loss for food products and the norms of losses from broken glass containers with food products and empty glassware.

In conclusion, it should be noted that for the purposes of calculating the taxable profit of an organization, material expenses that reduce the amount of taxable profit in accordance with paragraphs. 3 and 5 tbsp. 254 of the Tax Code of the Russian Federation, includes losses from shortages and (or) damage during storage and transportation of inventory items within the limits of natural loss norms approved in the manner established by the Government of the Russian Federation.

34. Accounting for losses when preparing goods for sale in retail trade. In accordance with the Rules for the sale of certain types of food products, approved by Decree of the Government of the Russian Federation dated January 19, 1998 No. 55, some goods must be prepared for sale before entering the sales area (freed from containers, wrapping and binding materials, contaminated surfaces, weathered sections cleaned , upper yellowed layer of fat, etc.). The resulting waste must be written off either at the expense of an additional discount from the supplier or at the expense of the trade organization. Therefore, in supply contracts it is advisable to indicate the norms of such waste reimbursed by suppliers of goods.

The above goods immediately arrive minus waste according to established standards (sausage without ropes, beaten poultry without paper, etc.).

Some waste (ham bones, fish heads and tail fins, etc.) are sold at prices set by the trade organization.

When preparing for sale by weight of animal butter and margarine, they are cleaned of the top yellowed layer. These strippings are usually handed over for processing, and processing organizations pay for them at prices established by agreement of the parties.

The procedure for writing off losses in the preparation of goods for sale not reimbursed by suppliers is determined by clause 2.13 of the Methodological Recommendations for Accounting for Costs Included in Distribution and Production Costs and Financial Results at Trade and Public Catering Enterprises, according to which distribution costs reflect regulated waste, formed during the preparation for retail sale of sausages, smoked meats and fish in pure mass (weight), as well as losses from stripping butter, crumbling caramel and refined sugar.

At present, the corresponding norms approved by the USSR Ministry of Finance remain in force.

We will show the reflection in accounting for losses when preparing goods for sale using the example of writing off oil stripping.

Example. The cost of losses (cleansing) incurred in the store when preparing oil for sale at accounting (sale) prices is 13,000 rubles. (including 2000 rubles - trade allowance). They are sold to a processing organization at a price of 6,600 rubles. (including VAT - 10%).

In this case, the sale of oil at prices below purchase prices for tax purposes should be considered as a situation where the organization could not sell products at prices above cost due to a decrease in its quality.

We will reflect these facts of economic activity in the store records.

| Record number and contents | Corresponding accounts (sub-accounts) | Amount, rub. |

| D | TO | |

| Reflects the identification of losses when preparing oil for sale | 11000(13000-2000) | |

| 2000 (red reversal) | ||

| The fact of sale of oil strippings to a processing organization is reflected | 90-1 | |

| Sold goods are written off | 90-2 | |

| VAT is charged to the budget | 90-3 | 600 (6600 • 9,09 %) |

End of the event

Upon completion of the inventory, these documents are drawn up:

- Inventory of products in the warehouse.

- Statement of any discrepancies between inventory data and accounting data.

- Conclusion about the event.

It is also necessary to create a paper describing the property that was missing during the inspection. If the source of the shortage has not been identified, the following entries are made:

- DT2 CT1.

- DT94 KT1.

- DT91/2 KT64.

If the source of the shortage is found, the following entries are made:

- DT73 KT94.

- DT50 KT73.

If excesses are found and the culprit is found, these entries are made: DT1 KT91/1.

ATTENTION! If the scale of the shortage is within the established limits, then it relates to the costs of commodity circulation. If it is impossible to attribute the shortage to costs, it is necessary to look for the culprit. For this purpose, an investigation is ordered.

Features of inventory in trade organizations

The inventory lists the products for each item, indicating the quantity, grade, cost, date of acceptance for storage, location, number and date of the supporting document.

Inventory of shipped goods is carried out on the basis of shipping and settlement and payment documents. The purpose of the inventory of shipped products is to establish the validity of the amounts listed on account 45 “Goods shipped.” Only amounts supported by properly executed documents can remain in this account.

When checking documents and records in accounting registers, you should find out whether this account contains amounts whose payment is reflected in other accounts, for example, on account 62 “Settlements with buyers and customers” as advances received or account 76 “Settlements with various debtors and creditors "

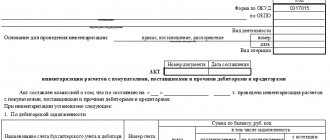

An inventory report of commodity and material assets is drawn up for the shipped products (form N INV-4). For each buyer it indicates the name, characteristics (type, grade, group), item number, unit of measurement, date of shipment, data on quantity and cost according to commodity-transport, settlement-payment documents and accounting. An inventory report is drawn up separately for products for which payment is not due and for products not paid on time.

Buyers' debts are subject to verification. It is carried out on the basis of settlement and payment documents and a certificate drawn up by the accounting department on the basis of a statement (machine diagram) for account 62 “Settlements with buyers and customers”. The accounting certificate contains: the name of the buyer and his address, the reasons and date of the debt, the amount of the debt and the document confirming it (name, number and date). The inventory act (form N INV-17) for each buyer indicates the debt, both confirmed and not confirmed by the buyers, as well as debt with an expired statute of limitations.

If organizations that determine revenue from the sale of products at the time of their shipment and presentation of settlement documents to the buyer create a reserve for doubtful debts, then such a reserve is also inventoried. During this check, attention is paid to amounts not repaid within the time limits established under the agreements and not provided with guarantees of their receipt. A separate inventory report is drawn up for doubtful debts.

Based on the inventory records, matching statements are compiled (form N INV-19), in which the results of the inventory are revealed, i.e. discrepancies between accounting and actual data. For finished products in the warehouse, only those items for which deviations are identified (surplus or shortage) are entered into the list. The matching statement is compiled for each warehouse separately. It provides the following information: the result of the inventory (surplus, shortage); regrading (surplus credited to cover shortages, shortages covered by surpluses); surpluses subject to capitalization; final shortages written off within the limits of natural loss, subject to recovery from the guilty parties and written off to financial results.

The surpluses identified during the inventory are accounted for. At the same time, other income increases. An accounting entry is prepared:

Dt sch. 43 “Finished products”

K-t sch. 91 “Other income and expenses.”

An entry is made for the cost of the shortage of finished products: debit to account 94 “Shortages and losses from damage to valuables” and credit to account 43 “Finished products”. The inventory commission determines the reasons for the shortage and makes a decision to write it off. Identified shortages can be written off as production costs, perpetrators, and financial results.

For production costs, the shortage of finished products is written off within the limits of natural loss by an entry to the debit of account 26 “General business expenses” and the credit of account 94 “Shortages and losses from damage to valuables” at the actual or accounting cost.

If the amount of the shortage exceeds the norms of natural loss, then its excess is attributed to the guilty persons. Identified shortages of products for which natural loss rates have not been established are subject to full compensation by financially responsible persons.

The shortage of finished products applies to the perpetrators if they bear full financial responsibility or if the employee is found guilty by a court decision. Collection of shortages of products is carried out at market prices. Accounting records are prepared:

Dt sch. 73 “Settlements with personnel for other operations”, subaccount “Settlements for compensation of material damage” - for the cost of products at market prices

K-t sch. 94 “Shortages and losses from damage to valuables” - at the actual cost or cost at accounting prices,

K-t sch. 98 “Deferred income”, subaccount “The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables” - for the difference between the cost at market prices and the actual cost (cost at accounting prices).

The shortage can be compensated by depositing cash into the cash register or deducting from the wages of the guilty person. As the debt is repaid, the following is recorded:

Dt sch. 50 “Cashier” (70 “Settlements with personnel for wages”)

K-t sch. 73 “Settlements with personnel for other operations”, subaccount “Settlements for compensation of material damage” - for the amount of deductions.

Simultaneously with this entry, account 98 “Deferred income”, subaccount “Difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables”, and account 91 “Other income and expenses” is credited.

If there are no specific culprits or the court refuses to collect due to the claim being unfounded, the cost of the shortage of products is written off as other expenses. In accounting, an entry is made to the debit of account 91 “Other income and expenses” and the credit of account 94 “Shortages and losses from damage to valuables.”

The cost of goods shipped and debts of buyers with an overdue statute of limitations after three years is written off to other expenses: debit to account 91 “Other income and expenses” and credit to accounts 45 “Goods shipped” and 62 “Settlements with buyers and customers”. If an organization creates a reserve for doubtful debts, then customer debt that is unrealistic to be collected is written off to reduce the reserve in the debit of account 63 “Provisions for doubtful debts” and the credit of account 62 “Settlements with buyers and customers.”

Debt written off from the balance sheet account with an overdue statute of limitations is taken into account over the next five years in off-balance sheet account 007 “Debt of insolvent debtors written off at a loss.” If funds are received from an insolvent debtor, other income increases. The amount of funds received is reflected in the debit of account 51 “Current accounts” and the credit of account 91 “Other income and expenses” and is removed from off-balance sheet accounting. In this case, the amount accepted for off-balance sheet accounting is reflected in the debit of account 007 “Debt of insolvent debtors written off at a loss,” and the amount withdrawn is reflected in the credit of this account. Analytical accounting for account 007 “Debt of insolvent debtors written off at a loss” is maintained for each debt written off at a loss.

Date added: 2016-12-08; ;

Inventory automation

Automation involves replacing manual number reconciliation with collecting numbers using special equipment. In particular, a mobile reader is used. Recalculation of balances is performed through the data collection terminal. The advantages of automation are obvious:

- Save time, reduce the time for checking by 2 times.

- Elimination of the human factor.

- Reducing expenses on employee salaries.

- There is no need to suspend warehouse operations.

- Spending on automation pays off within 1-2 years.

- Preventing data corruption.

Stages of automation implementation:

- Formation of the database. It brings together all the property stored in the warehouse.

- Marking. All units are equipped with barcode stickers.

- Reading. The scanner reads data from barcodes. They are processed and stored.

- Fixation. The matches of the received information with the database are recorded.

- Conclusion. The information received is placed in the electronic system. They are used in further data processing.

The terminal itself reports the detected shortage.

How to take inventory of balances in a multi-million dollar warehouse?

Indeed, how to take inventory of the remains in a giant storage facility? To the answer: warehouse audit and control over the movement of materials in a multi-million dollar warehouse complex will be much more effective if the inspection process is automated. Applying barcodes to goods and the presence of data collection terminals for inspectors will help speed up the process.

WMS management systems allow the use of special services that compare real data with accounting figures, have the ability to draw up an inventory list, using a sample inventory report for goods and materials in a warehouse, and carry out capitalization and write-off of products. As an example, we can cite the commodity accounting programs that have appeared today, which can be selected on the manufacturers’ websites.