Business lawyer > Accounting > Accounting and reporting > Losses of previous years - all entries in accounting

All commercial organizations strive to make a profit from all activities carried out. For each reporting period, the accountant must prepare appropriate documents reflecting profits and losses. But when, after double-checking previously compiled and approved papers, a previously unrecorded loss is identified, it must be recorded for the current year using special postings. Below you will find postings of losses from previous years.

Determination of loss at the end of the year

Throughout the calendar year, the company uses entries to record the following transactions:

- Score 90 reflects profitability

- Account 91 – expenses incurred

To summarize the financial results of the company, it is necessary to close both of these accounts. For the past year, those economic activities whose account 90 is less than the amount in account 91 are considered unprofitable - i.e. expenses exceeded income.

The Tax Code itself does not contain an exact list of documents that confirm the write-off of losses for early years. This is usually evidenced by primary documentation:

- invoices

- accounts

- statements

Therefore, all accounting documents are suitable. The exceptions are:

- accounting cards

- tax registers

Company losses in trading on video:

Taxpayers are not required to justify losses (Article 252 of the Tax Code). To recognize expenses when calculating tax, two conditions must be present:

- Economic feasibility of this circumstance

- Confirmation of losses in company documentation

The amount of income tax to be paid in the coming reporting periods depends on whether losses are recorded correctly in accounting. In accounting it is calculated at the end of the period. To determine it, it is necessary to compare the costs incurred with the amount of cash receipts received. The final result is calculated from the sum of the results for all types of activities carried out by the enterprise, and other receipts and disposals.

https://youtu.be/r64hUuDPjCg

Regulatory regulation of loss write-off

| Tax Code of the Russian Federation part 2 | Procedure for calculating income tax |

| Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n | Approves PBU |

| Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n | Approves PBU 18/02 |

| Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n | Approves the chart of accounts and its application |

| Order of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3/ [email protected] | Income tax return form |

Reflection of losses in accounting

To correctly reflect all financial results, it is necessary to use special account 99 (Order of the Ministry of Finance of the Russian Federation No. 94). During the year, periods are gradually closed, after which interim reports are drawn up. As a result, a short-term reduction in the current tax base may be established.

It is possible to determine exactly how much the tax burden is allowed to be reduced only at the end of the year, when the final size of the tax base is established. To reflect losses in accounting records, the entries described in Table 1 are made.

| Debit | Credit | The essence of wiring |

| 90.9 | 99 | Reflects the profit received from all normal types of company activity |

| 91.9 | 99 | Shows “cons” for other, non-core activities |

| 99 | 90.9 | Demonstrates losses across the entire list of main types of economic activity |

| 99 | 91.9 | Fixes the resulting loss for other activities |

To transfer losses to other periods, you will need to close account 99. For this purpose, use the posting Dt 94 Kt 99.

Important! All results of the enterprise’s activity in subaccounts of accounts 90 and 91 are reflected throughout the year. Therefore, the resulting values will increase in ascending order.

An exception is the balance sheet reform carried out at the end of the reporting year. In this case, they are reset using the entries:

- Dt 90.1 Kt 90.9

- Dt 90.9 Kt 90.2 (90.3)

In account 91, the reformation is carried out in a similar way. Therefore, the loss accumulated at the end of the interim reporting periods remains untouched - all financial results are simply reflected in account 99.

Errors when carrying forward losses

- When transferring losses that have arisen in the activities of an organization when operating under other tax regimes (special), the income tax base is not reduced, that is, if losses were incurred when applying the simplified tax system until the end of 2013, since 2014 the organization has been operating under the OSNO, then it is possible transfer losses incurred since 2014 (according to letter of the Ministry of Finance of Russia dated September 25, 2009 No. 03-03-06/1/617). At the same time, losses during the transition from OSNO to the special regime are not transferred.

- With regard to losses generated during periods of application of the 0% profit tax rate, it should be noted that they cannot be carried forward to the future (medical, educational organizations and social service organizations, agricultural producers, participants in the Skolkovo project).

Current year losses

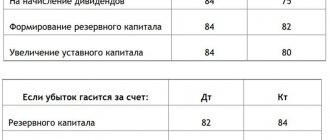

If at the end of the year it becomes known that the credit of account 99 is less than the debit of 99, this indicates that the past year was unprofitable for the company. Summarizing the results, the accumulated balance of account 99 is included in the array of retained earnings or unclosed losses, making 2 entries (Table 2).

| Dt | CT | Description |

| 84 | 99 | Reflects an unclosed loss |

| 99 | 84 | Shows profit in the amount of unspent profit |

Losses from previous years: postings

If a company has found an error in the documents in the current year, due to which the amount of profit was previously overestimated or the amount of loss was underestimated, then the methods for correcting such a deficiency depend on:

- moment of discovery of the defect

- how critical is the error itself?

Video lesson on reflecting losses from previous years:

There are two options for action here (Table 3).

| When the flaw was discovered | Wiring used | When to make a recording | ||

| After signing the accounting statements | Dt 91 | Kt 62 | In the month the error was discovered | |

| After approval of accounting reports | Dt 84 | Kt 62 | In the month when errors were discovered | |

In Art. 54 of the Tax Code establishes the following conditions for recalculating the tax base:

- If you were able to determine the period of occurrence of the error, you need to recalculate the database exactly for this time interval

- When the period has not been established for certain, amendments are made to the base of the current

Covering losses from the reserve fund

Having decided to pay off arrears from the company’s reserve capital, notes are made (Table 4).

| Dt | CT | Operation description | Which document reflects this action? |

| 84 | 99 | Shows outstanding losses for the past year | Profit and Loss Statement |

| 82 | 84 | The loss identified over the past year is being closed using the company’s reserve capital. | Resolution of the board of directors or other document issued on behalf of senior management |

At the end, information about all uncovered losses for a certain year is included in the declaration in line 1370 (its value is written in parentheses).

Postings for writing off losses

The decision on the method of writing off losses is made by the founders of the company themselves. Depending on the chosen method, different account assignments will be used (Table 5).

| Wiring | The essence of the operation | |

| Debit | Credit | |

| 97 | 99 | Losses are carried forward to future expenses |

| 99 | 84 | Part of the losses is written off in the current year |

| 83 | 84 | Part of the losses is compensated from additional capital |

| 82 | 84 | Losses are covered from reserve capital |

A company can take several different actions to write off last year's losses. Let's say, cover one part from current profits, and the other from future profits.

Special postings are needed to record coverage in foreign currency. So, if euros are received into the account, an entry is made: Dt 52 Kt 57. The commission paid to the bank for the transfer of funds is reflected by the posting Dt 91 Kt 76.

Remember! If the date of crediting foreign currency to the company’s foreign currency account and the date of acquisition of the currency do not coincide, then a difference in rates will arise.

It also needs to be reflected by making the appropriate entry:

- If the cost has increased – Debit 57 Credit 91

- If it has decreased – Debit 91 Credit 57

Losses in a consolidated group of taxpayers

A special procedure for writing off losses from previous periods is provided for by tax legislation for former participants in consolidated groups of taxpayers. This procedure depends on whether the former member was reorganized (recreated during the reorganization) while it was part of the consolidated group.

For profit tax purposes, losses of previous years are taken into account by the former member of the consolidated group according to general rules, taking into account the provisions of Article 50 of the Tax Code of the Russian Federation. The only exception: the maximum period for carrying forward losses is increased by the number of years of being part of the consolidated group.

An organization that is a former group member can reduce the tax base of the current tax period by the amount:

- its losses incurred before joining the consolidated group;

- losses of liquidated organizations of which it is a legal successor, if the organization, being part of a consolidated group, was reorganized in the form of a merger or accession. In this case, only those losses that the liquidated organizations incurred before joining the consolidated group are accepted;

- losses of a liquidated (reorganized) organization, the legal successor of which is an organization that is a former member of a consolidated group, if during the period of participation in such a group it was newly created as a result of reorganization in the form of division. In this case, only those losses that the liquidated organization incurred before joining the consolidated group are accepted.

This procedure is provided for in paragraph 6 of Article 283 of the Tax Code of the Russian Federation.

Based on materials from open sources

The concept of losses from previous years is used in all types of accounting - accounting, management and tax. The amount of loss in accounting is taken into account on an accrual basis over several years. The result is reflected by postings to account 99 “Profits and losses”.

Net profit, like loss, refers to the financial results of the enterprise. Accounting profit (loss) is associated with the sale of goods (own products) and affects the formation of taxes.

Losses identified in the current year relating to previous periods are taken into account in the financial result of the current year. In accounting, these amounts form a loss. An uncovered loss is the amount of loss that is not covered by relevant sources.

Income and expenses of the current period are reflected in account 99. When closing the year, these values are transferred to the accounts of retained earnings (uncovered loss), reserve or additional capital. If the current year balance is not enough to cover losses, the balance is transferred to account 97 “Deferred expenses”.

Losses from previous periods are taken into account in chronological order, and must be counted in the same order - the oldest first, but not “older” than 10 years.

Postings to reduce last year's losses

To reduce losses from previous years, account assignment is required Dt 99.01.1 Kt 68.12 - the entry reflects the accrual of tax with a decrease based on the results of the year. Then the calculation is carried out on the basis of reducing the tax base by the amount of the written-off loss.

To confirm this operation, you can draw up a tax calculation certificate, which will present:

- The maximum amount of loss by which the tax base is allowed to be reduced

- Amount of loss recorded

- Balance of outstanding losses to be closed in subsequent periods

These data are also recorded in Appendix No. 4 of sheet 02 of the declaration.

Tax Code of the Russian Federation on the transfer of losses

The Tax Code has granted taxpayers the right to reduce the tax base due to losses received in previous years by the amount (part thereof) of the loss incurred.

From 01/01/2017 to 31/12/2020, the limit on the amount of write-off has changed - the maximum of the tax base of the reporting period should be 50% (that is, the current taxable profit can be reduced by no more than 2 times).

This procedure is used to write off losses for the previous 10 years. Thus, in declarations for 2020, you can write off losses from 2007 and later, in 2020 - from 2008 and later, etc.

At the same time, it is possible to write off losses both at the end of the year and at the end of the reporting period, that is, the declaration assumes the calculation of advance payments based on the results of the reporting periods, taking into account past losses.

Losses incurred in different periods should be carried forward in the sequence in which they were received, that is, losses for 2009 can be carried forward only after they have been repaid for 2008 (in 2020).

Losses on transactions taxed at a rate of 20% reduce the income tax base at the corresponding rate.

How to carry forward losses from previous years

The Tax Code gives any enterprise the right to transfer losses from the next tax payment period to future ones, distributing them in the desired way (Article 283). Thus, you can reduce the amount of income tax by the amount of calculated losses in subsequent time periods - in full or in parts.

New regulations for the transfer of losses incurred in past reporting periods were introduced in 2020. Federal Law No. 401 stipulates that it is allowed to distribute the entire amount for the future if it is no more than ½ of the tax amount for the current period. The duration of the transfer itself does not play a big role.

But this rule applies if the transfer is carried out during the tax period (i.e. year) - it does not apply to reporting periods. It is allowed to carry forward losses for any period over the next 10 years from the date of discovery of arrears.

Important! In Art. 283 of the Tax Code states that the transfer should be carried out in order of priority.

So, if the activity was carried out in the “minus” not in one, but in different tax periods, then when transferring it is necessary to proceed as follows:

- The loss for the first year is transferred first

- Further, in ascending order, the remaining periods that became unprofitable are recorded.

How to transfer losses in the 1C program, watch the video:

The taxpayer must keep all documents confirming the existence of losses for past years until the final write-off. This is necessary to resolve controversial situations with tax authorities until it is written off in full. If the write-off is carried out over several years, then each time before the tax burden is reduced, all evidence will be rechecked. Even after repaying the entire amount, they must be kept for another 4 years (Letter of the Ministry of Finance of the Russian Federation No. 03-03-06/1/278) in case of repeated inspections from the Federal Tax Service.

Previous years expenses for income tax

Losses of previous years identified in the reporting period - expenses (losses) of previous periods that were identified and recognized in the reporting period.

A comment

The term “Losses of previous years identified in the reporting period” is used both in accounting and tax accounting.

Tax accounting

For income tax, losses received by the taxpayer in the reporting (tax) period are equated to non-operating expenses:

— in the form of losses from previous tax periods identified in the current reporting (tax) period (clause 1, clause 2, article 265 of the Tax Code of the Russian Federation);

In practice, the application of such damages is very limited.

The fact is that the losses in question essentially represent errors that the taxpayer identified in the current period, but these are expenses that relate to previous periods (for example, it was revealed that expenses for 1 month of rent were not included in expenses last year). The Tax Code of the Russian Federation requires that identified errors be reflected in the tax period to which they relate (clause 1 of Article 54 of the Tax Code of the Russian Federation). It is allowed to reflect errors from previous periods in the current period only in the following cases:

— impossibility of determining the period of errors (distortions);

- in cases where errors (distortions) have led to excessive payment of tax.

In the above cases, the taxpayer who has identified expenses (losses) from previous periods has the right to reflect them in accounting in the current period as a loss from previous years. Moreover, the first of the above situations practically never occurs in practice.

If the taxpayer cannot confirm the period of the error, then it is unlikely that he will be able to justify and confirm such an expense.

The conclusion that only in the above cases the taxpayer has the right to recognize expenses relating to past periods is also formulated in Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 09.09.2008 N 4894/08 in case N A40-6295/07-118-48.

In all other cases, the taxpayer must correct errors in the period to which the errors relate, that is, submit an updated tax return for the previous tax period.

Accounting

In accounting, other expenses are recognized as “ losses of previous years recognized in the reporting year ” (clause 11 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n).

In accordance with the Chart of Accounts, losses of previous years recognized in the reporting year are reflected in account 91 “Other income and expenses” in correspondence with the accounts of calculations, depreciation, etc.

In accounting, losses from previous years recognized in the reporting year are usually caused by errors from previous periods (for example, failure to record expenses).

In accounting, the correction of such errors is carried out in a completely different manner (compared to tax accounting).

In cases where an organization reveals in the current reporting period that business transactions were incorrectly reflected in the accounting accounts last year, corrections are not made to the accounting records and financial statements for the previous reporting year (after the annual financial statements have been approved in the prescribed manner).

Income and expenses incurred last year, when correcting an error that is not significant, are recognized in the current year as part of other income or expenses as profits or losses of previous years (clause 14 PBU 22/2010, clause 7 and clause 16 PBU 9/99, clause 11 PBU 10/99).

Additionally

Carrying forward losses to the future (profit tax) - for profit tax, it is possible to carry forward losses to future tax periods (Article 283 of the Tax Code of the Russian Federation)

taxslov.ru

Expenses from previous tax periods can be taken into account in the current one only if there is profit

The Russian Ministry of Finance clarified that an organization has the right to include in the tax base of the current reporting period the amount of an identified error that led to excessive payment of tax in the previous reporting period only if a profit was made in the current reporting period. If, based on the results of the current reporting period, a loss is received, then it is necessary to recalculate the tax base for the period in which the error occurred (letter of the Department of Tax and Customs Policy of the Ministry of Finance of Russia dated March 24, 2020 No. 03-03-06/1/17177).

Let us recall that if errors are detected in the calculation of the tax base relating to previous tax periods, in the current tax period the tax base and tax amount are recalculated for the period in which these errors were made (clause 1 of Article 54 of the Tax Code).

Representatives of the Russian Ministry of Finance emphasized that this is possible in two cases: when it is impossible to determine the period of errors (distortions) and when the mistakes made led to excessive payment of tax.

Thus, a taxpayer who made errors that led to excessive payment of tax in the previous tax period has the right to adjust the tax base for the tax period in which the errors were identified.

https://youtu.be/nYO3ZL4zYhM

Failure to reflect, for the purpose of taxing the profits of organizations, expenses that arose in previous tax periods, but were identified in the current reporting period as a result of receiving primary documents, is a distortion of the tax base of the previous tax period; therefore, the provisions of Art. 54 Tax Code of the Russian Federation.

In turn, the tax base for calculating income tax is the monetary expression of profit determined in accordance with Art. 247 of the Tax Code of the Russian Federation, subject to taxation (clause 1 of Article 274 of the Tax Code of the Russian Federation).

If in the reporting period the taxpayer incurred a loss, then in this reporting period the tax base is recognized as equal to zero (clause 8 of Article 274 of the Tax Code of the Russian Federation). In this regard, recalculation of the tax base of the current reporting period is impossible.

Consequently, expenses related to previous tax periods, identified as a result of receiving primary documents in the current reporting period, can be taken into account in the tax period of their discovery, subject to the conditions established by Art. 54 of the Tax Code of the Russian Federation, taking into account the provisions of Art. 78 Tax Code of the Russian Federation.

As an example, we can cite a situation where primary documents for communication services provided in October of the previous year were received by the organization only in February of the current year, after the annual accounting and tax reports for the previous year had been submitted.

The amount of the identified unaccounted expense resulted in an excessive payment of income tax in the previous year.

Accordingly, a correction in tax accounting can be made in the current tax period by reflecting the unaccounted expense in the tax reporting for the first quarter of the current year.

Financiers also drew attention to the fact that an application for offset or refund of the amount of overpaid tax, including due to recalculation of the tax base that resulted in excessive payment of tax, can be submitted within three years from the date of payment of the tax (clause 7 of article 78 Tax Code of the Russian Federation).

www.garant.ru

The Tax Service has posted on its website the first batch of information that was previously recognized as a tax secret.

A law was signed establishing the standard VAT rate at 20% (instead of the current 18%).

Source: https://niitek.ru/post/rashody-proshlyh-let-dlja-naloga-na-prib/

Comparison of accounting and tax accounting

If in the accounting system the amount of losses is recorded at a time, then the principles for entering losses into the accounting system are different. In tax documentation they are transferred to subsequent reporting periods, and in accounting, deductible differences are formed. Then tax assets deferred for a certain period appear.

If the accounting system takes into account all income and expenses, then some of them may or may not be indicated in the accounting system. The difference between accounting is called permanent and temporary. It forms deferred ones:

- Tax assets (TA)

- Tax obligations (NO)

The firm's performance determines the value used. If a debt to the tax authorities has accumulated, IT increases, which is reflected in account 77. The calculated debt provides information in IT.

Note! IT and ONA are determined based on the percentage of the accrued payment for the established temporary differences. The rate itself varies for each industry.

Most often, to hide identified losses, they are transferred to account 97. But not all costs are allowed to be transferred to subsequent periods. Tax legislation allows you to write off those costs that are considered direct expenses; transferring indirect expenses to account 97 will not be entirely correct. This method will not make it possible to reduce losses in the declaration - in it all other expenses are written off in full (Article 318 of the Tax Code).

Accounting for losses and their reflection in reporting

One of the criteria for selecting companies to conduct on-site inspections is the organization’s unprofitable activities for two or more calendar years (Appendix No. 2 to the order of the Federal Tax Service of May 30, 2007 No. MM-3-06/333). Considering this circumstance, the accountant can resort to his favorite method of concealing the losses incurred - attributing part of the expenses to account 97 “Deferred expenses”. Indeed, in some cases this method can be resorted to. But caution will not hurt here, since not all costs can be safely left for the future. In tax accounting, expenses that, according to accounting policies, are classified as direct expenses are gradually written off. Therefore, it is not entirely correct to attribute indirect expenses to account 97, since in the tax return it will not be possible to reduce the loss in this way - indirect expenses are written off in full (clause 2 of Article 318 of the Tax Code of the Russian Federation).

In this article, we will consider the option when the accountant nevertheless decided to reflect a lawfully received loss in the reporting at the end of the financial year and is ready to defend it.

First, it should be said that the tax authorities require the company to justify the occurrence of a loss and specific reasons will have to be given as arguments. If we talk about this requirement of the tax authorities, then we can also pay attention to the fact that not a single regulatory act requires taxpayers to justify the loss. Article 252 of the Tax Code of the Russian Federation sets two conditions for recognizing expenses when calculating income tax: economic justification and documentary evidence. However, it is better to stock up on well-formulated explanations that will satisfy the interests of the tax authorities, rather than argue and spoil relations with inspectors.

The following arguments can be used as reasons for the loss at the end of the year.

Reason one: suppose an organization is experiencing difficulties in selling its products. But the expenses of such an organization, as a rule, decrease more slowly than the revenue decreases.

Reason two: another reason for the deterioration of performance is that the company, due to a drop in demand, is forced to reduce prices for its products, and sometimes even lower them below cost.

Reason three: the argument can also be used that the company carried out expensive repairs to production facilities and immediately took its cost into account as part of the costs; that is why the loss occurred.

As you know, enterprises can be small, medium, large, in addition, they can use different taxation systems, such as the general system, simplified system and UTII.

First, let's look at accounting for losses when applying the general taxation system and PBU 18/02. When closing the reporting period, the balance formed on subaccount 90-9 is written off to account 99 “Profits and losses”, subaccount “Profit (loss) before tax”. When a loss is received, the following entry can be generated:

Debit 99 subaccount “Profit (loss) before tax” Credit 90-9

– loss on ordinary activities for the reporting period is reflected.

Also, if a loss is received, the account 91-9 can be closed. The wiring will be like this:

Debit 99 subaccount “Profit (loss) before tax” Credit 91-9

– loss on other transactions for the reporting period is reflected.

As of January 1 of the next year, the balance in subaccounts 90-1, 90-2, 90-3, 90-4, 90-9, 91-1, 91-2 should be zero. For this purpose, at the end of the reporting year, the balance sheet is reformed. Accounting programs for maintaining records provide for the reformation of the balance sheet at the close of the year.

If an organization applies PBU 18/02, then at the same time as closing the reporting period, it is necessary to record conditional income tax income. Conditional income for income tax arises when a company incurs a loss. To calculate this indicator, the accounting loss for the reporting period must be multiplied by 20 percent (income tax rate). The amount of conditional income for profit tax is reflected in accounting in the subaccount of the same name, which is opened to account 99 “Profits and losses” (clause 20 of PBU 18/02).

In accounting, the amount of conditional income must be reflected by writing:

Debit 68 subaccount “Calculations for income tax” Credit 99 subaccount “Conditional income for income tax”

— accrued amount of conditional income for the reporting period.

Next you need to make one more entry:

Debit 09 Credit 68 subaccount “Calculations for income tax”

— a deferred tax asset is reflected from the loss, which will be repaid in the following reporting (tax) periods.

You can learn more about this by re-reading paragraph 14 of PBU 18/02, Article 283 of the Tax Code of the Russian Federation and letter of the Ministry of Finance dated July 14, 2003 No. 16-00-14/219. This letter indicates that Article 283 of Chapter 25 of the Tax Code of the Russian Federation qualifies the resulting loss for tax purposes as a loss carried forward, which will reduce the taxable base of the following reporting periods. Thus, the loss of the reporting period, carried forward for tax purposes, is a deferred tax asset and is reflected in accounting as the debit of account 09 “Deferred tax assets” in correspondence with the credit of account 68 “Calculations for taxes and fees”.

Let's consider the reflection of financial results (profit and loss) for an organization that calculates monthly advance payments for income tax based on the actual profit received and applies PBU 18/02. The accountant will record the following entries:

January 2011:

Debit 90-9 91-9 Credit 99

– reflects the financial result (profit) for January in the amount of 50,000 rubles;

Debit 99 Credit 68

– reflected a conditional income tax expense in the amount of RUB 10,000. (50,000 x 20%).

February 2011:

Debit 68 Credit 51

– an advance payment for income tax for January in the amount of 10,000 rubles was transferred;

Debit 90-9 91-9 Credit 99

– reflected the financial result (profit) for February in the amount of 120,000 rubles;

Debit 99 Credit 68

– reflected a conditional income tax expense in the amount of RUB 24,000. (120,000 x 20%).

March 2011:

Debit 68 Credit 51

– an advance payment for income tax for February in the amount of 24,000 rubles was transferred;

Debit 99 Credit 90-9, 91-9

– reflects the financial result (loss) for March in the amount of 280,000 rubles;

Debit 68 Credit 99

– reflected conditional income for income tax in the amount of 56,000 rubles. (280000 x 20%);

Debit 09 Credit 68

– a deferred tax asset in the amount of RUB 22,000 is reflected. ((50,000 + 120,000 – 280,000) x 20%).

As a result, the balance of account 99 as of April 1, 2011 is debit and amounts to 88,000 rubles. Account 68 also has a debit balance - 34,000 rubles.

The profit and loss statement regarding the formation of calculations for income tax and net profit (loss) in this case will look like this (in thousands of rubles):

Formation of calculations for income tax and net profit (loss)

in the Profit and Loss Statement

| Title of report articles | Line codes | For the first quarter of 2011 |

| Profit (loss) before tax | 2300 | (110) |

| Current income tax | 2410 | – |

| including permanent tax liabilities (assets) | 2421 | – |

| Change in deferred tax liabilities | 2430 | – |

| Change in deferred tax assets | 2450 | 22 |

| Other | 2460 | – |

| Net income (loss) | 2400 | (88) |

Organizations using UTII are required to keep accounting records (Article 4 of the Law of November 21, 1996 No. 129-FZ). This means that they must prepare and submit financial statements to the tax office in full (subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). Such organizations may also experience losses at the end of the reporting period.

Let’s assume that the organization incurred a loss in the amount of 100,000 rubles, and the single tax on imputed income amounted to 35,000 rubles. In this case, the Profit and Loss Statement will look like this:

(Income Statement Continued)

| Title of report articles | Line codes | For the first quarter of 2011 |

| Profit (loss) before tax | 2300 | (100) |

| Current income tax | 2410 | – |

| including permanent tax liabilities (assets) | 2421 | – |

| Change in deferred tax liabilities | 2430 | – |

| Change in deferred tax assets | 2450 | – |

| Other | 2460 | 35 |

| Net income (loss) | 2400 | (135) |

In addition to taking into account the current loss, when calculating income tax, you can take into account losses received in previous tax periods (clause 1 of Article 283 of the Tax Code of the Russian Federation). In this case, only those losses that are formed according to the rules of Chapter 25 of the Tax Code of the Russian Federation are taken into account. To carry forward losses from previous periods to the future, two rules must be applied (established in paragraphs 2 and 3 of Article 283 of the Tax Code of the Russian Federation):

The first rule: the loss can be carried forward for no more than 10 years.

Second rule: losses are repaid in the order in which they were received.

Losses can be carried forward not in every tax period, but at intervals over time. In any case, the period of time during which a loss in a particular year can reduce the tax base must not exceed 10 years. Any loss not written off during this period remains outstanding. This follows from the provisions of paragraph 3 of paragraph 2 of Article 283 of the Tax Code.

According to the letter of the Ministry of Finance of Russia dated September 21, 2009 No. 03-03-06/2/177, the amount of loss arising from transactions that are subject to income tax at a rate of 20 percent, when carried forward to the future, does not need to be reduced by the amount of income received from transactions , which are subject to income tax at rates of 9 or 15 percent.

One more circumstance should be paid attention to: profits from certain types of activities can be used to pay off certain types of losses. This rule applies to losses incurred from the activities of service industries and farms. Such losses can only be covered by profits received from the activities of these industries and farms. The same applies to losses incurred on transactions with securities traded on the organized securities market, to losses on transactions with securities not traded on the organized securities market, as well as losses received on transactions with financial instruments of futures transactions, not traded on the organized market.

Let's move on to enterprises that use a simplified taxation system. If at the end of the year the organization’s expenses exceeded taxable income, then instead of a single tax, the minimum tax must be transferred to the budget. It is 1 percent of taxable income for the year. In addition, based on paragraph 6 of Article 346.18 of the Tax Code of the Russian Federation, upon receipt of a loss, the amount of the minimum tax paid can be written off as expenses over the next 10 years. And here, as in the general taxation system, there are certain rules for accounting for losses from previous years:

The first rule: the amount of loss can be carried forward to the future, but no more than 10 years in advance.

Second rule: the amount of the loss and its amount, which reduces the tax base in each tax period, must be documented (for example, by primary documentation (acts, invoices, copies of tax returns, a book of income and expenses, etc.). Keep documents confirming the amount of loss incurred and the amount accepted for reduction for each year is required throughout the entire period of using the right to transfer it.

Let's consider an example of accounting for losses from previous years for an organization that uses a simplified taxation system with the object “income minus expenses.”

Example

For 2008, the organization received a loss in the amount of 300,000 rubles. The budget includes a minimum tax of 10,000 rubles. (from income received RUB 1,000,000 × 1%).

In 2009, the tax base was reduced by the amount of the minimum tax paid for 2008 in the amount of 10,000 rubles. Thus, at the end of 2009, the organization received a loss in the amount of 6,000 rubles. (income in the amount of 1,150,000 rubles – expenses in the amount of 1,146,000 rubles – 10,000 rubles).

A minimum tax of 11,500 rubles will be transferred to the budget.

In 2010, the tax base was reduced by the amount of the minimum tax paid for 2009 in the amount of 11,500 rubles. The tax base for the single tax for 2010 amounted to 1,388,500 rubles. (income in the amount of 2,550,000 rubles – expenses in the amount of 1,150,000 rubles – 11,500 rubles).

At the beginning of 2010, the amount of outstanding losses from previous years amounted to RUB 306,000. The single tax payable at the end of 2010 will be:

RUB 162,375 ((RUB 1,388,500 – RUB 306,000) × 15%).

The offset of the loss of previous years in the tax return for the single tax for 2010 in this case will look like this.

The amount of taxable income for 2010 (2,550,000 rubles) is indicated on line 210 of section 2 of the declaration, approved by order of the Ministry of Finance dated June 22, 2009 No. 58n. The amount of taxable expenses including the amount of the minimum tax paid for 2009 (RUB 1,150,000 - RUB 11,500) is indicated on line 220 of the same section. Since the tax base for 2010 is positive (there are more incomes than expenses), the amount of losses from previous years in an amount not exceeding the tax base for 2010 is indicated on line 230. The total amount of income (line 240) for 2010 is calculated as the difference between the lines 210, 220 and 230. Thus, the tax base for 2010 will be reduced by the amount of losses from previous years.

If the tax base for 2010 was negative (there were less income than expenses), then the loss of the current tax period should have been reflected in line 250. In this case, the organization does not have a source to cover losses from previous years, so their amount does not need to be indicated in the declaration (Section V of the Procedure approved by Order of the Ministry of Finance dated June 22, 2009 No. 58n).

To summarize the above, we draw the readers’ attention to the changes that were introduced by Order of the Ministry of Finance dated July 2, 2010 No. 66n. This document approves the forms of financial statements of organizations: balance sheet and profit and loss statement, as well as forms of a statement of changes in capital, a statement of cash flows and a report on the intended use of funds received.

In the standard form of the Profit and Loss Statement, the lines are not numbered. The codes for the lines are given separately in Appendix 4 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. Lines must be numbered in accordance with approved codes when an organization submits reports to statistical authorities and other executive authorities. If reporting is prepared for shareholders or other users who are not executive authorities, it is not necessary to number the balance sheet lines. This follows from paragraph 5 of the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. You will need to use the new forms only when submitting financial statements for 2011.

PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT Everything an accountant needs to do bookkeeping. Everything will be found.

Connect berator

Reflection of loss in accounting statements

In the declaration, losses for past years are confirmed in accordance with the provisions of Art. 315 NK. The tax is calculated with an increasing total - from the beginning of the reporting year for all periods of filing papers and paying taxes. Next, you need to make notes in Appendix No. 4 of the second sheet of the declaration:

- Line 140 indicates the amount of income tax received, which is payable, but can be reduced by the amount of the loss (in whole or in part)

- Line 010 records the remaining part of the loss, which could not be transferred to subsequent time intervals, and it fell at the start of the subsequent tax payment periods

The intolerable loss is formed during the previous 10 years.

The amount from line 010 is additionally recorded in lines 040-130 - a corresponding entry is made based on the year in which a certain part of the loss occurred. The number indicated in line 140 is duplicated with the value in line 100 of the second sheet.

The amount of loss by which the tax array will be reduced is recorded in line 150. In the current payment period, it should not exceed the value in line 140. It is also transferred to line 110.

If, when viewing the accounting and accounting records, a profit is revealed, and the figures in both statements are equal, then calculating and reflecting the amount of the tax burden in the accounting documents will not be a problem. If the financial results differ in them, then PBU 18/02 must be applied. This can happen in the future, resulting in a deductible difference in the tax and reporting periods.

If you find a loss at the end of the year, watch the video:

So, when a loss appears in an accounting or accounting system, you need to use PBU 18/02 to reflect it. This provision regulates the accounting of permanent and temporary differences that record different results of activities reflected in the reporting. The entries used are determined based on the period of discovery of the error over the past years and which type of activity it was formed from - main or indirect. Plus you will need to enter the appropriate values into your tax return.

Top

Write your question in the form below

Algorithm for transferring losses in the accounting database

Currently there is no automatic transfer of losses in the programs. Therefore, we will transfer the loss using manual entries. Please note that the manual loss carry forward operation is carried out on December 31, after the close of the tax period, but before the balance sheet reformation.

Closing the tax period in which the loss was incurred

- We will forward the documents for December;

- We close the month, but skip the “balance sheet reform” operation. D 99.01 – K 90.09 The program must generate the posting independently.

- We create a manual loss transfer operation: D 97.21 – K 99.01 – the amount of loss carried forward to future periods. 97.21 “Other deferred expenses” 99.01 “Profits and losses from activities with the main tax system”

- For account D 97.21, we create the subaccount “Loss ... year” and configure this subaccount correctly. Type for NU - Losses of previous years Type of asset in the balance sheet - Other current assets Amount - Amount of loss Recognition of expenses - In a special order Write-off period - from XX.XX.XXXX

We are carrying out the “balance sheet reform” document

D 84.02 – K 99.01 D 90.01 – K 90.09

The program must generate the postings independently. The transfer of losses is carried out after the regulatory operation “Calculation of income tax”.

Write-off of losses from previous years

Now, in the new tax period, starting from the date specified in Subconto, if an organization makes a profit in tax accounting, it will automatically be reduced by part of the loss of the previous period or the entire amount. The write-off will take place monthly until the entire loss is written off. The operation can be seen in Menu – Closing the month – Write-off of losses from previous years. D 99.01 – K 97.21 – the amount of the written off part of the loss.

We reflect the transferred loss in the income tax return

On Sheet 02 of Appendix 4, you must indicate the year from which we are transferring the loss and the amount of the loss Total; the amount of the tax base; the amount of loss, but not more than 50% of the profit; the balance of the unwritten loss. We go to Sheet 02; the amount of the transferred loss should be automatically transferred to page 110.

—

Carrying forward a loss using an example

When calculating income tax for 2020, Mega LLC received a loss of 350,000 rubles. This loss can be carried forward to the future, forming from December 31, 2017. manual wiring operation D 97.21 – K 99.01 = 350,000 rub. In the 1st quarter of 2020, when calculating income tax for Mega LLC:

Income 1,200,000 rubles, Expenses 1,000,000 rubles.

The tax base was 200,000 rubles. (1,200,000 – 1,000,000), we can reduce it by the amount of loss, but not more than 50% of the profit. In our case, we reduce by 100,000 rubles. In the income tax return on Sheet 02, Appendix 4, we indicate: - the year from which we transfer the loss = 2020; — amount of loss Total = RUB 350,000; — tax base amount = 200,000 rubles; - amount of loss, but not more than 50% of profit = 100,000 rubles; — balance of unwritten loss = 250,000 rubles (350,000 – 100,000)

Deferred loss carryforward

There are situations when organizations do not want to reduce the tax base for losses from previous years in the current tax period, because carrying forward losses to the future is a right. But then a situation may arise when management needs to reduce the tax base, thereby reducing the tax.

Important! — If you do not apply PBU 18/02 and are sure that you will never carry forward the resulting loss, then you do not have to create a manual “Loss Transfer” operation at the end of the year. — If you apply PBU 18/02, then this operation will have to be created, otherwise the program will not allow you to close the first month of the next year.

In this case, we still recommend creating an operation to transfer the loss, but then without indicating the start date for writing off this loss.

How to do this: In a manual operation to transfer a loss, for account 97.21, we create a subaccount “Loss ... year” Type for NU - Losses of previous years Type of asset in the balance sheet - Other current assets Amount - Amount of loss Recognition of expenses - In a special order Write-off period - LEAVE LINE IS EMPTY Later, when you decide to reduce your tax base by the amount of the loss, you will need to indicate in the “write-off period” field the first date of the tax period from which you want to start writing off.

We suspend the write-off of losses for a while

It happens that an organization has written off a loss over a certain period of time, but this year does not want to reduce the tax profit for the loss of previous years and needs to stop writing off the loss for a while.

In this case, it is necessary to create a transaction entered manually with the posting: D 97.21 (sub-account “Balance of loss 2017”) - K 97.21 (sub-account “Loss 2017”) - the amount of the balance of the loss not transferred. We set up the subconto “Remaining loss 2017” as described above, i.e. We leave the dates of the write-off period blank.

Then, when write-off is required again, it will be necessary to post back:

D 97.21 (sub-account “Loss 2017”) - K 97.21 (sub-account “Balance of loss 2017”) - the amount of the balance of the loss not transferred.