Analysis of an organization's financial activities is a very important tool for monitoring and assessing the quality and efficiency of its work. All indicators are of great importance. But special attention is paid to income and profit. The analysis of these factors is carried out in the context of various types of income according to economic and marketing content. In many modern enterprises, income analysis is carried out not only for the purpose of evaluation. It is done to successfully make further strategic decisions. In this case, marginal income is used for analysis as an approach to determining the profit necessary to make responsible business decisions.

The concept of marginal income

In addition to the important profit indicator, which shows the main result of activity, other equal concepts are used. One of them is marginal income. This term comes from a consonant English phrase translated in its pure form as “ultimate return.” Used in several cases:

- It means the amount of additional profit resulting from the sale of an additional unit of production.

- Means calculated revenue minus variable costs.

The main economic significance of marginal income lies in determining the impact of management decisions on the amount of profit and the receipt of fixed assets. Thanks to this, it becomes possible to set sales levels so that there is maximum profit, so that there is no profit, or so that there are losses at all.

The relationship between marginal income, profit and costs

Profit generation and distribution are important processes of entrepreneurial activity. Therefore, in the analysis of financial activity, consideration of the profit received from the factors influencing it plays a very important role. Marginal income and profit are two interrelated indicators. The first, after calculation, determines the marginal value of the second. Both indicators play a very important role for analyzing the financial performance of the organization, its prospects and making decisions for break-even operation.

Also, these two economic terms are closely related to the costs of operating an enterprise. After all, marginal income shows how much profit is able to cover variable costs, which are directly included in the cost of production. In general, all enterprise expenses represent direct and variable costs. It is variable costs that have a great influence on the production process and profit. They are directly related to the volume of goods produced.

Accounting formulas

To determine the marginal profit, you will need internal accounting information for revenue, as well as fixed and variable costs.

Some of this can be taken from the public income statement, but it is difficult to separate out fixed and variable expenses in operating expenses. MS = ВрР – PerZ, where

ВрР – revenue from product sales;

PerZ – variable costs.

Reference! Often, as part of marginal analysis, specific MD or MD per unit of production is calculated, which involves dividing MS by the number of units of goods produced in physical terms.

MP=V-PZ

Here MP is the amount of marginal profit,

B – revenue from sales of products,

PV – variable production costs.

In accordance with the marginal profit formula, data on revenue and the entire amount of variable costs are used.

B = Q*P

Here B is the amount of revenue of the enterprise,

Q is the quantity of goods produced (sold),

P – product price (per unit).

Often, when comparing the profitability of several types of products (product units), a specific indicator of marginal profit is used. Specific contribution margin is the contribution margin on each unit of production (margin per unit).

All marginal profit values are considered absolute and are expressed in conventional monetary units (rubles, dollars, etc.). If a company produces several types of goods, then it is rational to use a margin coefficient.

The marginal profit ratio shows the ratio of margin to revenue (relative value).

Kmp=MP/V

Here Kmp is the marginal profit coefficient,

MP – marginal profit,

B is the company’s revenue.

Pmarj. = Vr – Rper.

- Pmarj. – marginal profit;

- Вр – the amount of revenue from sold goods, services, works;

- Rper. – variable expenses.

When calculating marginal profit, it is important to remember some accounting features:

- Revenue for this formula is taken excluding VAT and excise taxes.

- Variable expenses are those expenses that are directly related to the volume of products produced and the quantity sold.

- If during some accounting period the products were not sold or produced, this means that at that time the organization did not incur variable costs.

- Variable costs do not react in any way to changes in pricing policy, expansion of assortment, technological modernization and other factors. The decisive factors are solely the volume of production and/or sales.

M = Pmargin. / Time x 100

- M – margin;

- Pmarj. – marginal profit;

- Вр – the amount of revenue from sold goods, services, works.

This indicator highlights the percentage share of marginal profit in sales revenue.

Vn-PZn=MPn, where:

- MPn is the level of marginal income from the sale of n units of commercial products.

- Вн – level of revenue from the sale of n units of commercial products.

- PZn is the level of variable costs associated with the production of n units of marketable products.

Н*Сн=Вн, where:

- N – quantity of products sold (pieces).

- Сн – cost of one unit of commercial products.

- Ext – total amount of revenue.

It is important to pay attention to the fact that the level of income of an enterprise is determined by the volume of products sold. This means that the level of marginal profit is calculated based on this indicator.

Marginal profit is one of the main indicators that is used to evaluate business performance. How to calculate marginal profit and for what reasons you need to analyze this indicator, we will consider in this article.

Calculation of marginal profit (formula)

Contribution Margin Analysis

Marginal profit rates and ways to increase them

When compiling an income statement, an accountant traditionally calculates several types of profit: gross, from sales, before taxes and net. In management accounting, another type is used - marginal.

The formula for calculating marginal profit is simple, but its application is ambiguous. This is due to different understandings of foreign terms.

The indicator received the prefix “margin” due to the principle of subtraction, which is used for calculation and was originally incorporated into the essence of margin.

Margin is the difference between the selling price of a specific product (work, service) and its cost. It comes in two types:

- Absolute – in monetary terms as a financial result per unit of production;

- Relative – as a percentage of the sales price as a profitability ratio.

For example, in the banking industry, margin is the difference between interest rates on deposits and loans, and in marketing activities, it is a markup.

To calculate margin, you can use several formulas:

- Margin = (Revenue – Cost): Quantity of products sold in natural units

- Margin = Price – Unit cost

- Margin (%) = (Price – Unit Cost) : Price

Marginal profit (income) is the part of the enterprise’s net income remaining after compensation for the variable costs it has incurred. In the future, marginal profit will be used to finance fixed costs and generate profits.

The calculation of this indicator implies a mandatory division of costs into two groups:

- Variables are costs that are linearly dependent on the scale of activity (the more products need to be produced, the larger they will be);

- Fixed costs are costs whose changes do not directly depend on production volumes. They will take place even if the company cannot produce or sell anything.

The separation method is determined by the accountant based on the technological characteristics of the enterprise and industry.

Contribution Margin = Net Income – Variable Costs

Marginal profit = (Net income - Variable costs) : Sales volume in physical units = Price - Variable costs per unit

Marginal profit ≠ Gross profit

Many accountants, when talking about profit, equate the concepts of “gross” and “margin”. In fact, they differ from each other in essence and in the calculation method.

Gross profit is revenue minus all production costs that relate to products sold in the reporting period.

Contribution margin is revenue minus all variable costs that were incurred to produce the products sold.

As you can see, to determine the gross financial result, you need to divide costs into production and non-production. This involves calculating the full production cost.

To achieve marginal profit, you need to separate costs into variable and fixed. In this case, the variables will make up the cost of specific types of products.

Sometimes an accountant assumes that manufacturing costs are variable and non-production costs are fixed. But that's not true. For example, production costs include depreciation and equipment maintenance costs, which are constant in nature. And non-production costs include salesperson bonuses as a percentage of sales and are definitely variable.

Therefore, in order to correctly find the marginal profit, it is important to divide all the costs of the enterprise into variable and constant parts, regardless of the stage at which they arose.

Contribution margin shows how much money a company has left to:

- Cover fixed costs;

- Make a profit (before tax).

Marginal profit = Fixed costs Profit

In fact, this is the upper limit of profit when the value of fixed costs changes over time, namely:

- The larger the fixed costs, the lower the profit;

- The company will incur losses if the level of fixed costs exceeds the marginal profit;

- Profit reaches its maximum when fixed costs tend to zero.

Δ MP = Δ BH – ΔZperem and ΔOP = ΔBH – (ΔZperem ΔZpost)

where BH is net income; Let's start with variable costs;

Postage – fixed costs.

When the scale of production and sales changes, Zpost remains at the same level, that is, ΔЗpost = 0.

ΔOP = ΔBH – (ΔZperem 0) = Δ MP

Conclusion: by assessing the dynamics of marginal profit, we can say how much the entire profit will increase or decrease.

(KMP) = Marginal profit : Net income

(VMC) = Variable costs per unit: Price

ΔOP = ΔBH × KMP

For example, if with KMP = 0.3 it is planned to increase sales volume by 120,000 rubles, then we should expect an increase in profit by 36,000 rubles. (120,000 × 0.3).

The break-even point (profitability threshold) is the level of production at which the enterprise's expenses are at the level of income and profit is zero.

Calculation of marginal income

According to one of its values, marginal income is a calculated indicator intended for analyzing activities, but above all for making the right marketing decisions. This income is calculated by determining the difference between total revenue and variable costs. It should be noted that price and fixed costs are not involved in influencing contribution margin. The formula (below) for its definition shows the possibility of covering costs that directly depend on production volumes and the profit received from the sale of these volumes.

TRm = TR - TVC,

where TRm - Marginal income;

TR—revenue (total revenue);

TVC—variable costs (total variable cost).

An important role is played by the calculation of this indicator in an enterprise where several types of goods are produced simultaneously. In this case, it is very difficult to understand which type of product takes the largest share of total revenue.

https://youtu.be/MglDH9SeV3g

What is it for

So, you already know that marginal income is the difference between the income received from the sale of a company's goods/services and its variable costs. To calculate it, you can use a simple formula, which we gave a little higher. Knowing the marginal profit ratio allows you to determine the following nuances:

- Does it make sense to produce a product and sell it, or is it better to switch to something new?

- Does it make sense to increase production volume, or is it easier to stay at the current level?

- Is it possible to reduce variable costs by reducing the cost of purchasing raw materials, saving on wages or logistics?

Knowing these points, you can decide how efficiently your enterprise operates and whether it makes sense to change the product range. We hope our article will be useful to you.

https://youtu.be/iIBbaSifGcc

Options for calculating marginal income

In order to calculate the amount of revenue required to cover costs, two indicators are used in practice: the coefficient and the amount of marginal income. In this case, most often they try to define marginal income as the dependence of the effectiveness of management decisions on covering variable costs.

Two calculation methods are used:

- Variable costs are minus from total revenues.

- Variable costs and profit margins are added up.

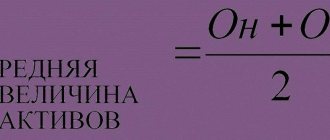

Many analysts take into account the average value of this income. It is derived by subtracting the average variable cost from the product price. And also in parallel they calculate the coefficient of such income by determining its share in the proceeds from product sales.

Advantages and disadvantages of using the method

Depending on the information received, the company management can:

- assess your situation;

- take the right path to solve the problem;

- if necessary, close the enterprise.

How to increase?

You can increase your marginal profit using the following methods:

- taking part in various tenders;

- carrying out advertising campaigns;

- expansion of the sales market;

- revision of pricing policy (often this occurs as a percentage per unit of production);

- introduction of bond issues, as well as entering the stock market.

The key principles of factor analysis are considered to be:

- the need to select a control variable;

- calculation of marginal profit, which provides for the degree of increase in gross income with a parallel increase in the control variable by 1 unit;

- the ability to compare several indicators;

- calculation of marginal costs, which can show the level of modification of costs with a parallel increase in the control variable by 1 unit.

It is important to remember: when marginal profit increases over marginal costs, it is permissible to increase the control variable, otherwise it is inappropriate.

The advantages include:

- the ability to obtain a clear picture of numerous varieties of goods;

- simplicity of calculations;

- you can find out which product needs to be increased in volume.

Disadvantages:

- unusual method of calculation;

- inability to know the lower price range of prices.

Looking at the shortcomings, we can confidently talk about the need to calculate marginal profit.

Contribution Margin Analysis

The company is characterized by regular analysis of its activities as a whole and its individual indicators. Analysis of contribution margin is necessary, since its value has a direct impact on profit. Based on the results of its calculation, the following conclusions are drawn:

- The indicator is zero. Consequently, revenue covers only variable costs, and the company experiences a loss in the amount of fixed costs.

- The indicator is greater than zero, but less than the value of fixed costs. Consequently, revenue covers variable costs and part of fixed costs, and the loss is equal to the amount of the uncovered part.

- The indicator is equal to the sum of fixed costs. Consequently, the revenue is enough to operate without loss, but also without profit. This situation in the economy is called the break-even point.

- The indicator is higher than the value of fixed costs. Consequently, revenue allows you to cover all expenses and make a profit.

Determining marginal income plays an important economic role in the financial analysis of an enterprise. Thanks to this indicator, it is possible to establish the relationship between revenue, profit and costs. This relationship is of particular importance when making financial decisions in the field of production.

The role of specific (coefficient) marginal profit in business planning

When comparing the profitability of several different products, specific indicators are used. To determine the profitability of producing one product, the specific marginal profit indicator is used.

Let's look at all this using a specific example.

Calculation of the indicator

- For shampoos: revenue from the sale of 1 unit - 50 rubles, variable costs - 35 rubles. The specific marginal profit is: 50 – 35 = 15 rubles.

- For balms: revenue – 40 rubles, variable costs – 30 rubles. The specific marginal profit is: 40 – 30 = 10 rubles.

As you can see, the highest margin is obtained in the production of shampoos. But this is an example of determining the margin of only one unit of production. With the increase in production of the same shampoos, the situation may change, since it often happens that with an increase in production output, variable costs decrease by 1 unit:

- When producing 1,000 units: revenue – 50,000 rubles, variable costs – 35,000 rubles. Marginal profit – 15,000 rubles.

- When producing 1,300 units: revenue – 65,000 rubles, variable costs – 30,000 rubles. Marginal profit – 35,000 rubles.

Specific marginal profit is important for analyzing and understanding which products are not profitable and should be excluded from production at the enterprise.

Drawing up a business plan involves a wide range of areas for work. This includes conducting marketing analysis, drawing up a production program, calculating an investment plan, and analyzing expenses and income. At the same time, all this needs to be organically combined into a single document that consistently reveals the essence of the project.

But no less important is identifying what real, “net” income you can get from the project. For these purposes, a marginal analysis of the project is carried out. Determining the marginal profit will allow you to assess whether, with the available resources, you can cover fixed and variable costs, how the cost structure will change depending on the increase in production volumes and sales (sales) of goods.

Calculation of marginal profit along with such indicators as payback period, break-even point, net present value and other investment parameters allows you to understand how appropriate it will be to invest effort and money in the creation and development of the project. Determining the possible marginal profit and break-even production volume will allow you to understand whether your company will be able to compete with other enterprises in the industry.

When choosing a project to develop your own business, you can pay attention to the business plan for a bakery cafe with calculations. This would be a great idea for a profitable project with a good level of marginal profit.

Kmp=MP/V

(KMP) = Marginal profit : Net income

(VMC) = Variable costs per unit: Price

ΔOP = ΔBH × KMP

For example, if with KMP = 0.3 it is planned to increase sales volume by 120,000 rubles, then we should expect an increase in profit by 36,000 rubles. (120,000 × 0.3).

The break-even point (profitability threshold) is the level of production at which the enterprise's expenses are at the level of income and profit is zero.

Break-even point = Fixed costs: KMP

This formula is convenient in that it allows you to calculate the break-even level of sales even for enterprises that produce a wide range of products, since you do not need to take into account the price of each individual unit.

The coefficient (KMP) will allow the company:

- Determine the critical level of production and control it;

- When planning the expansion of activities, predict changes in profit with high accuracy;

- If financial indicators are negative, calculate a new break-even point and adjust the production and sales plan.

The main disadvantage: this only works ideally when the products are fully sold, that is, there is no work in progress and no leftover finished goods at the end of the month.