When is a certificate of return of funds to the buyer drawn up?

Situations when a buyer wants to return a purchased product arise quite often.

The possibility of such a return is provided for by the Law “On the Protection of Consumer Rights” dated 02/07/92 No. 2300-1. Before the transition to online cash registers, the procedure for the cashier and company management depended on whether the buyer paid at the cash register in cash or by card, as well as on the moment of return (on the day of purchase or later).

For more information about what requirements must be observed when working with cash, see the material “Cash discipline and responsibility for its violation.”

If the buyer paid in cash and returned the goods on the day of purchase, the fact of the buyer’s return of money to the seller was formalized using the unified form KM-3, called “Act on the return of money to buyers (clients) for unused cash register receipts (including erroneously punched cash register receipts). checks)". On the check, a representative of the store administration had to put his authorization signature as the basis for issuing cash from the cash register. The check was pasted on a separate sheet and, together with the KM-3 act, was transferred to the accounting department.

Let's take a closer look at filling out the KM-3 form.

Making a note about an erroneous check

Law of the Russian Federation Federal Law No. 54 of May 22, 203 “On the use of cash registers... requires that institutions that receive cash from customers for the sale of goods or for the provision of services are required to install cash registers.

However, the provided Law does not contain information on how to cancel a check issued by mistake. In paragraph 4.3 of the message of the Ministry of Finance No. 104 dated August 30, 1993, it is said that if the cashier makes a mistake regarding a knocked out check, he is obliged to do the following:

If it is impossible to redeem the check during the working day, activate it when the replacement is completed.

Draw up an action according to the unified form No. KM-3, adopted by the State Statistics Committee of the Russian Federation No. 132 of December 25, 1998.

Reflect in the Cashier Operator's Journal the funds issued for returned checks. It should be noted, in fact, that if a check is issued incorrectly, the KM-3 action is formalized in an integral manner. Attached to this act is a damaged check, with a note indicating its redemption, as well as a written comment from the cashier who made the mistake. Damaged checks are glued to a clean sheet of paper.

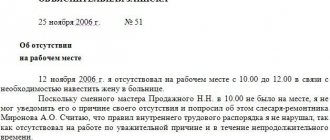

- If the employer demands an explanation from you, then it is better to write it, and there are some nuances here:

- don’t write lies. because there is a high probability that they can check the information, and then, to your violation, you will also be caught in a lie... and this is bad.

- do not blame your colleagues for everything - the employer will definitely demand an explanation from them as well, as a result you will not only not be justified, but will also make additional enemies + some other violations may come to light.

- don’t write “I wasn’t taught...” - when applying for a job, you signed a job description (by the way, before writing any explanatory note, don’t be too lazy to re-read it), where, as a rule, everything is taken into account, including self-training and compliance with all kinds of instructions.

Then at the end you need to write that you admit your mistake and undertake to prevent such situations in the future.

The form, template of the explanatory note includes the required details:

- name of company;

- indication of the official to whom the note is addressed, his full name;

- from whom

- name of the document – “Explanatory Note”;

- title to the text (“Regarding...”, “Regarding...”);

- explanatory text;

- compiler, his signature.

Depending on the type of violation, the employer may require a written explanation:

- on the fact of violation of labor discipline.

Sample report 2010 - sample forms.

Journal of registration of incoming and outgoing cash documents photo example example.

Explanatory note sample cashier - universal forms

This is done in order to reduce the possibility of disputes with regulatory authorities in the future; the cashier writes an explanatory note addressed to the manager, in which he sets out the reason for the incorrectly punched cash receipt. A prerequisite may be: inattention when working with cash registers, since this operation is not fiscal, malfunction of the cash register, etc.; It is not necessary to punch a refund check; it does not affect the readings of the fiscal memory of the cash register. Download an example of filling out the form. Deposited in cash, false check, minus these, the cashier will enter the required amount already. It is necessary to fill out the incorrect required amount for the cash receipt order.

Whether or not a refund check is punched in the event of an incorrectly punched check is a personal matter for each organization, and can be used for the convenience of the organization’s internal accounting. Only the merchant actually manages to report an explanatory report to the boss regarding this violation, and this one person is considered. Explanatory note on the cashier's journal - operational questions tags: explanatory note.

Explanatory note sample cashier

Explanatory note sample cashier

Group: User Messages: 6 Registration: 07/16/2018 User No.: 14313 Thanks said: 0 times

explanatory note sample cashier

Explanatory note about an error in work sample download

An explanatory note is a written document that an employee draws up at the request of management to explain any of his actions or inactions.

Explanatory note for refund at the cash register

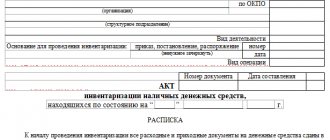

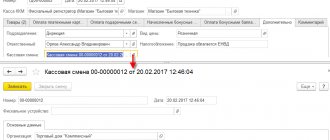

We fill out the act form KM-3

Act KM-3 was drawn up in 1 copy by a commission consisting of the head of the department, senior cashier and cashier and approved by the head. It was necessary to fill out information for all canceled checks, as well as for checks returned by customers in cases where they returned goods. Cash proceeds for that day were reduced by the amount returned to customers, and an entry was made about this in the journal of the cashier-operator KM-4.

It was not necessary to draw up a KM-3 act in all cases of returning goods. If the buyer paid with a bank card, it was impossible to give him money from the cash register when returning the goods, since this direction of spending cash proceeds was not provided for by regulatory documents (clause 2 of Bank of Russia Directive No. 3073-U dated October 7, 2013 on spending cash from the cash register) . An act was not drawn up in the KM-3 form even if the goods were returned not on the day of purchase. In this case, at the request of the buyer, the return of the goods, paid for in cash, was carried out on the basis of his application from the main cash register using a cash receipt order.

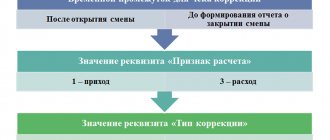

Filling out KM-3 when using an online cash register

Since July 2020, most sellers are required to use online cash registers.

For information about the “simplified” option not to use online cash registers when providing services to the population (except for public catering services) until July 1, 2019, read the publication “A deferment for online cash registers has been introduced.”

Read about the use of online cash registers by UTII payers in the article “Use of online cash registers for UTII (nuances).”

When using an online cash register, it is not necessary to use KM-3 when returning money to the buyer. Fiscal data that comes to the tax office from online cash desks completely replaces information from forms KM-1, KM-2, KM-3, KM-4, KM-5, KM-6, KM-7, KM-8, KM-9 (see letter of the Ministry of Finance dated September 16, 2016 No. 03-01-15/54413 (notified to the tax inspectorates by letter of the Federal Tax Service dated September 26, 2016 No. ED-4-20/18059).

When the buyer returns the goods, the seller using the online cash register, based on the buyer’s application, must issue a check with the “return of receipt” sign (see letter of the Ministry of Finance of the Russian Federation dated July 4, 2017 No. 03-01-15/42312, 03-01-15/42315 ). In addition to the check with the sign “return of receipt”, it is also necessary to issue a cash receipt order for the amount of the refund (Article 1.1, Clause 1, Article 1.2, Clause 1, Article 4.7 of the Law of May 22, 2003 No. 54-FZ, Clause 6.2 of the Bank’s instructions Russia dated March 11, 2014 No. 3210-U).

For more information on issuing refund checks, read the following materials:

- “How to make a refund check in KKM online?”;

- “How to make a refund for a purchase at an online checkout?”;

What to do if there is not enough money in the online cash register, is discussed in the material “LIFEHACK] If there is not enough money in the cash register for a refund, make a “cash deposit”.

And you can learn about processing a refund for non-cash payments from the material “LIFEHACK] We issue a refund if the buyer pays by bank transfer.”

Filling out the fields of the KM-3 form

In the header of the form, fill in the company details. If it is not a structural unit and does not have them, we leave this field empty. However, in cases where several stores are united into a network, it is advisable to indicate the name and address of a specific outlet.

Be sure to indicate the name of the cash register.

The application program and type of operation need not be specified. The cashier responsible for the return can be indicated by full name or personnel number.

The clarification “including on erroneously punched checks” should be understood as follows: the basis for filling out KM-3 is an error made by the cashier when the amount is greater than the actual cost of the goods and the company returns the “difference” that arose as a result of this.

Using an example: let’s say that the cashier Svetlova, when making a purchase of a book, did not take into account the promotion for which the new price is 159 rubles. As a result, a check for 1,749 rubles was punched. The buyer discovered the error and pointed it out, as a result of which 1,590 rubles were returned to him. According to the regulations, the buyer submitted an application for a refund. Senior cashier Efremov O.A. requested an explanatory note from the cashier, which was also attached to KM-3 dated August 26. 2020.

If several checks have been knocked out incorrectly, the form provides details for each of them. However, the report on the return of funds in KM-4 will only show the final figure.

Explanatory note about an incorrectly punched check

During the working day, a cashier performs a lot of the same type of work that requires painstaking attention. Due to the human factor, errors in entering cash register receipts may well occur. Since these are financial documents that affect reporting, all these inaccuracies must be recorded and documented in the prescribed manner. It is necessary to take measures to minimize the number of such errors in the future, and to do this, study their causes.

The cashier is asked to state the circumstances of an incorrectly punched cash receipt in an explanatory note, which is attached to other documents to document such violations.

It happens that a mistake is noticed immediately after it is made and can be corrected immediately. For example, the price of an item was entered incorrectly, the buyer pointed this out, and the cashier entered the item correctly. But information about the erroneous receipt is already recorded in the cash register memory. A check with an error must be “legalized” with a special report at the end of the day and an explanatory note from the cashier attached to it, along with the damaged check.

How to write an explanatory note?

A written explanation for an incorrectly stamped check is the same document as other official letters, therefore, filling out such a document must be taken with full responsibility.

- You need to start filling out such a letter from the upper right corner, where you want to display information about the addressee to whom the note is being written. The cashier must write here the position, the name of the institution, and the name of the boss. Everything is written in the dative case. After this, information about the author of the note is filled in in the genitive case.

- Below, in the middle of the line, the name of the document is displayed. “Explanatory note” It is better to highlight the title in bold and make the font size 1-2 points larger.

- Then the circumstances that caused the erroneous actions are described in detail.

- At the end of the letter there is a date and signature of the cashier who made the mistake.

(Video: “How to write an explanatory note correctly”)

Law of the Russian Federation Federal Law No. 54 of May 22, 203 “On the use of cash registers...” requires that institutions that receive cash from customers for the sale of goods or for the provision of services are required to install cash registers. It is the cashier's responsibility to issue the original cash receipt to the consumer. However, this Law does not provide information on how to cancel a check issued by mistake. Clause 4.3 of the letter of the Ministry of Finance No. 104 dated August 30, 1993 states that if the cashier makes a mistake regarding a knocked out check, he must do the following:

- If it is impossible to clear a check during the working day, activate it at the end of the shift.

- Draw up an act according to the unified form No. KM-3, adopted by the State Statistics Committee of the Russian Federation No. 132 of December 25, 1998.

- Display in the “Cashier Operator Journal” the money issued for returned checks.

It should be noted that in case of an erroneously issued check, the KM-3 act must be drawn up. Attached to this act is a damaged check, with a note indicating its cancellation, as well as a written explanation from the cashier who made the mistake. Damaged checks are glued to a blank sheet of paper. All named materials are sent to the institution’s accounting department. This procedure is reflected in the explanation of the Department of Tax Administration of the Russian Federation No. 29-12/17931 dated April 2, 2003.

During work, another circumstance is also possible. For example, an incorrect receipt is identified by the cashier after preparing daily reports. The cash register operator follows the same procedure as described in the previous section, but the error information is not recorded in his log. The accountant, in this case, is obliged to issue a cash settlement for the difference in the amount and certify the report with the cashier and management. The order is issued from the “accounting” cash desk, since the replacement cash receipts from the cash register have already been capitalized.

The cashier, in this case, as in the original version, is obliged to issue a written explanation of what happened. A written explanation follows the same rules.

If the cashier issues a check with the incorrect price of the product, and the buyer immediately draws attention to this and demands that the money taken in excess be returned to him, it is the cashier’s responsibility to remove the damaged check and issue another one with the correct value. Accordingly, after completing the shift, the cashier draws up a KM-3 act, which reflects the amount for incorrectly stamped checks. Damaged checks are glued to a sheet of paper and attached to the statements. The offending employee attaches a written explanation to the listed materials, showing the reason for the incident.

The explanation is compiled in any form, it is required to display:

- At the top right, the “header” of the note is filled in, which displays the name of the institution, position, surname and initials of the head, then the information of the author of the note is displayed.

- Then in the middle of the line the phrase “Explanatory note” is written.

- The date the letter was issued and the entry number of its registration in the chief’s reception area.

- Next, the title is written - in this example, “about a check issued by mistake” or “an explanatory note on the return of a sum of money.”

- In the text of the letter, the cashier briefly describes the circumstances of the incident in a business style:

- The date of what happened.

- Name of the cash register device.

- Serial model number.

- Incorrectly issued check number.

- Amount of the damaged check

- Reasons for what happened.

- Then he signs a note indicating his position and full name.

- The damaged check is attached to the explanation. There is no need to issue a check for the difference in price, since this circumstance does not affect the amount of taxes. However, if the check was drawn up for a lower price, then this difference needs to be broken through.

Example of a written explanation of a note about a check being punched incorrectly

Explanatory note for a bounced check

For example, an incorrect receipt is identified by the cashier after preparing daily reports. The cash register operator follows the same procedure as described in the previous section, but the error information is not recorded in his log.

The order is issued from the “accounting” cash desk, since the replacement cash receipts from the cash register have already been capitalized.

The cashier, in this case, as in the original version, is obliged to issue a written explanation of what happened.

Info A55-9961/ 2008).taxes and accounting Perseverance of the Federal Tax Service Ekaterina Romashkina, tax consultant At the same time, controllers are not going to completely abandon the usual practice of conducting procurement in the course of checking businessmen's compliance with cash discipline.

This is clearly stated in the letter of the Federal Tax Service of Russia dated January 11, 2009 No. ШС−22−2/ In this document, officials recommend that inspectors “take into account the prevailing judicial practice in the region.” This means that in those regions where the courts consider this legal, test purchases will continue.

The tax service periodically sends out similar instructions to its territorial branches (letters of the Federal Tax Service of Russia dated May 11, 2007 No. ШС−6−14/, dated September 14, 2007 No. ШС−6−18/ and dated May 30, 2006

Each employee must be familiar with it, which is confirmed by a personal signature; only later can the annotation be required.

In an explanatory note, the employee sets out his vision of the situation, and the manager decides whether to accept this point of view or make a decision on penalties.

Parents traditionally write an explanatory note addressed to the head of the kindergarten when a child misses several days for reasons not related to illness.

Parents often have to write such notes, since situations where a student misses classes for various valid reasons are not uncommon. An explanatory note from parents or guardians about absence from classes is documentary evidence of a valid reason for the student’s absence from classes.

If you admit guilt, be sure to indicate how sorry you are and explain that you will not allow this to happen in the future. Attention: The employee handed over the office, but the primary document was lost, and therefore wrote an explanatory note.

Sample explanatory note about absence from work Explanatory note about an error in work Sample explanatory note about failure to fulfill official duties

Explanatory note on returns at the checkout

A situation may arise that the cashier has issued a receipt for the incorrect price of the goods. The buyer immediately noticed this and asks to return the overpaid amount. The cashier must take the incorrect receipt and issue a new one - at the correct price. At the end of his working day, the cashier draws up a KM-3 report, in which he reflects the amount of unused and erroneously issued checks. An incorrectly entered check must be attached to the report and marked with o. At the end of the operating day, the offending cashier writes a note in which he describes in detail the fact and reasons for the erroneous check.

The note is written in free form and should reflect:

- The “header” of the document is drawn up in the upper right corner. The following is indicated here: the name of the employer along with the organizational and legal form;

- position and initials of the manager to whom the document is intended. As a rule, this is the head of an organization or a structural unit.

- date of incident;

The incorrectly punched check itself is attached to the explanatory note. There is no need to punch a check for the difference in value, as this does not affect the amount of taxes paid. But if the check was punched for a smaller amount, then a new check should be punched, which will reflect the difference. But this can be done not by the cashier himself, but by the head of the enterprise or the senior cashier.

Explanatory cashier - advice from lawyers and lawyers

Explanatory note for work Sample: As can be seen from the presented sample, the document is drawn up clearly to the point, the reason for the delay is indicated, and there is no unnecessary information.

After writing, the explanatory note about being late for work is handed over to the official to make a decision regarding the late worker.

If a decision is made to apply disciplinary measures, this note will be attached to the disciplinary order as evidence.

Moreover, he actually suggested that yesterday I leave the money in this safe and not put it in the vault, but after I categorically refused to do this, the Security Service found specialists in opening safes.

- A duplicate of the key that broke is available, but it is not possible to use it, because... The lock itself is broken.

- I would like to note that the Security Council has developed a biased attitude towards me personally (which I see from the memo with comments that are not supported by any regulatory documents or real events, but only personal hostility towards me and I.I. Petrov) although the requirements that I always present only within the framework of official duties and are aimed at strengthening cash discipline and ensuring the safety of the Bank's cash and valuables.

- Sidorova O.V.

Metal safe (cabinet SP-101 (2 locks)) with inv. No. 707 – has been registered with our department since 2007. It was purchased at one time for a client to store the client’s valuables in a safe room.

After termination of the lease agreement, the safe was used by an employee of the cash desk as an individual means of storage, in accordance with clause 2.8.

Provision No. 318-P, according to which officials responsible for the safety of valuables, cash workers who carry out cash transactions, are equipped with metal cabinets, safes, closed carts or other devices designed to store money during the working day.

Additional requirements (such as certification) mentioned by E.V. Kozlov, as we see, are not provided for in the instructions and we do not report to the Central Bank about individual storage facilities, as E.V. Kozlov erroneously believes.

Sennaya" for a very long time, as a result of which the wait at the stop was 20 minutes.

From now on, I undertake not to be late for work (or to report by phone about possible lateness due to transport delays or other emergency circumstances), and also to work 14 minutes today during my lunch time. Sidorova O.V.

(signature) - based on the fact of violations identified during inspections, audits, and operations: after the inspections, an Act is drawn up describing the identified inconsistencies with the requirements of regulatory documents, which should indicate the specific point of the instructions that you violated! You shouldn’t think that inspectors/revisors/auditors are Gods, they are people just like you and me, and inspection reports are often drawn up by copying them from previous ones, without even being convinced of the relevance of regulatory documents at the time of inspection (violations same type).

Attendance at the parent meeting is voluntary and is not regulated by any legal acts. Explanatory note to the university Students are people who love to sleep a couple of extra hours, being late for classes because of this, or even not wanting to go to lectures at all.

But there are situations when the reasons for absence are valid. The main thing is to correctly convey this to the teachers and the dean. Sample: The above samples and examples may be required in different life situations. The ability to draw up such a document correctly will not be superfluous. As can be seen from the examples, there are no serious differences between different types of notes.

What the law prescribes According to current legislation, only the employer can demand an explanation from an employee. This is either the manager himself, or a person authorized by order for a specific period. Not knowledge, as you know, does not exempt... The employer, in this case, will request an explanation from your manager (who did not teach), and... - here see the previous paragraph.

It is better to write an explanatory note with references to the job responsibilities specified in your job description, to instructional materials (they say that you probably interpreted it incorrectly). If you really want to blame someone, then you can write that, probably, there was a prejudiced attitude on the part of such and such, etc.

There is also a trick in the name of the document, that is, not “explanatory”, but “explanatory note”.

If the violation is obvious, then it is better to refer to poor health, a large flow of clients. Then at the end you need to write that you admit your mistake and undertake to prevent such situations in the future.

Here the offending employee succinctly describes the reasons why he was late for work today. In addition, he must indicate:

- date of incident;

- name of KKM;

- its serial number;

- number of the erroneously punched check;

- error amount;

- reasons for what happened. This could be the inattention of the cashier, equipment malfunction, etc.;

- then he puts his signature and deciphers it. He must also indicate his position.

The incorrectly punched check itself is attached to the explanatory note. There is no need to punch a check for the difference in value, as this does not affect the amount of taxes paid. But if the check was punched for a smaller amount, then a new check should be punched, which will reflect the difference. But this can be done not by the cashier himself, but by the head of the enterprise or the senior cashier.

When paying for “children’s” sick leave, you will have to be more careful. A certificate of incapacity for caring for a sick child under 7 years of age will be issued for the entire period of illness without any time limits.

But be careful: the procedure for paying for “children’s” sick leave remains the same!

Let's look at how to write a memo (sample) using a simple example. The text of the memo may be identical to that below. Example of an official memo to the Director of Gvozdika LLC, Vladimir Aleksandrovich Slobodin G. Khabarovsk January 04, 2020 OFFICIAL NOTE In the confectionery shop, the conveyor has been broken since January 2, 2020.

To repair it, it is necessary to purchase parts according to the attached list. The total cost of repair work, taking into account the purchase of parts, is 12,500 (twelve thousand five hundred rubles 00 kopecks).

Due to the fact that the fund limit for repair and maintenance of equipment has been exhausted, and the necessary parts are not available, in order to avoid shop downtime, I ask:

- Allocate the required amount of money according to the attached list.

- Provide a repair team to carry out the work.

Sincerely, head of the confectionery shop, Dmitrienko Denis Sergeevich.

But before making changes to the punched check and the cashier’s reports, the person guilty of making the mistake must draw up an explanatory note about the incorrectly punched check.

Explanatory note on returns at the cash register A situation may arise that the cashier has issued a receipt for the incorrect value of the goods. The buyer immediately noticed this and asks to return the overpaid amount.

The cashier must take the incorrect receipt and issue a new one - at the correct price.

At the end of his working day, the cashier draws up a KM-3 report, in which he reflects the amount of unused and erroneously issued checks. An incorrectly entered check must be attached to the report and marked with o. At the end of the operating day, the offending cashier writes a note in which he describes in detail the fact and reasons for the erroneous check.

400 bad request

If the cash register uses thermal printing (thermal paper), then we take a copy of the cash receipt and also attach it to the act.

(Since cash register receipts on thermal paper tend to discolor. This is done in order to subsequently reduce the likelihood of disputes with regulatory authorities); 3.

On an erroneously punched cash receipt we put o; 4.

The cashier writes an explanatory note addressed to the manager, in which he sets out the reason for the erroneous cash receipt. The reason may be: inattention when working with the cash register, failure of the cash register, etc.; 5. It is not necessary to punch a refund check, since this operation is not fiscal, i.e. it does not affect the fiscal memory readings of the cash register.

Blanker.ru

An official memo, as an independent type of document, is not included in the All-Russian Classifier of Management Documents (OKUD). Moreover, this document is widely used in business practice. In this regard, it is best to draw up a memo in accordance with the requirements of GOST 6.

30-2003 “USD. USORD. Requirements for the preparation of documents” in order to ensure uniformity in the preparation of documentation.

The memo document, unlike a memo, ensures communication between organizational units at a horizontal level, and is compiled by an employee or head of a unit addressed to the head or specialist of another unit.

It should be borne in mind that a memo is usually sent from one manager to another or from one employee to another only if their official status is equivalent, otherwise it will be a memo.

This means that employers who pay their employees at the minimum wage must raise their wages from May 1.

Thus, employers will be able to take into account in the “profitable” base the costs of paying for services for organizing tourism, sanatorium-resort treatment and recreation in Russia for employees and members of their families (parents, spouses and children). Attention

Submitting SZV-M for the founding director: the Pension Fund has made its decision The Pension Fund has finally put an end to the debate about the need to submit the SZV-M form in relation to the director-sole founder. So, for such persons you need to take both SZV-M and SZV-STAZH!

As a rule, this is the head of an organization or a structural unit.

- document's name;

- the title is the basis. In this case, “about the return of a check”;

- document text. Here the offending employee succinctly describes the reasons why he was late for work today. In addition, he must indicate:

- Then he puts his signature and deciphers it.

Explanatory note for returning a check

Another situation may arise. The error was discovered by the cashier himself after preparing the daily report. The cashier does the same actions as in the first situation, but does not enter the error data in his journal.

The accountant must make a cash settlement for the amount of the difference and sign it with the manager and the cashier. The order is issued from the “accounting” cash register, since the daily revenue for a specific cash register has already been capitalized.

In the same way as in the first case, the cashier must write an explanatory note about the incident. The information in this document is exactly the same as in the first situation. The cashier also indicates:

- “header” of the document: the name of the employer along with the organizational and legal form;

- position and initials of the manager to whom the document is intended. As a rule, this is the head of an organization or a structural unit.

- date of incident;

The cash receipt was entered incorrectly: why do you need an explanatory note?

An explanatory note is a document originating from the field of labor law. In accordance with Art. 192 of the Labor Code of the Russian Federation, for improper performance of labor duties, the employer has the right to apply disciplinary sanctions to employees. But before making such decisions, he must request written explanations from the employee regarding the actions taken (Article 193 of the Labor Code of the Russian Federation). A cashier's mistake when punching a cash receipt may just be an example of improper performance of duties.

The use of cash registers is closely related to tax legal relations. The cashier's explanatory note is a valuable source of data during a tax audit of a store (and a possible legal dispute), since it allows the Federal Tax Service inspector (or the court) to establish the circumstances of the non-use of cash registers in the manner prescribed by law.

Failure to use cash registers is a reason to believe that the taxpayer has underestimated the tax base by failing to correctly fiscalize revenue. In addition, the non-use of cash registers is in itself a serious violation of the laws governing settlements between business entities and individuals (primarily the Law “On Cash Registers” dated May 22, 2003 No. 54-FZ). There are serious fines for such a violation.

The contents of the note may become an argument against sanctions being applied to the store.

Let us next consider the structure and sample of an explanatory note about an erroneously punched check.

Cash surpluses identified during inventory

All cash transactions are periodically audited and all valuables are checked. The inspection is carried out by the organization's inventory commission.

Its members, in the presence of a responsible person, check the availability of money, receipts for deposited valuables, check books and strict reporting forms. Inconsistencies identified during inspections are documented in accounting acts.

For more details on how a shortage is determined at the cash register, the entries that must be indicated in the balance sheet if it is detected, read on. The cash desk at an enterprise may contain cash, payment documents, securities and strict reporting forms. Payment documents include not only receipts, but also stamps (postal, bill and state duties), vouchers to sanatoriums, air tickets and other documents.

Strict reporting forms include: receipts, certificates, diplomas, subscriptions, tickets, coupons, shipping documents, etc.

Examples of competent explanatory notes when identifying shortages after inventory of goods and cash registers

At enterprises of almost any type, various inspections and inventories are periodically carried out. During such events, shortages may be identified.

If such situations arise, the employer has the right to demand written explanations from the employee responsible for the safety of valuables.

The procedure for preparing such documentation has a number of features. Dear readers! The article describes typical situations, but each case is unique. If you want to find out how to solve your particular problem, use the online consultant form in the lower right corner of the site or call direct numbers: - Moscow - - St. Petersburg - - Other regions - It's fast and free!

What to write in the explanatory note?

The explanatory note reflects:

1. Information about the addressee of the explanatory note (as a rule, this is the name of the employing company, full name of the immediate supervisor of the cashier or director of the company).

2. The name of the document is “Explanatory note about an incorrectly punched cash receipt.”

3. First-person explanations containing:

- information about the action taken, indicating the date and time;

- information about the cash register on which erroneous actions were performed (model, serial number, information about the fiscal drive);

- statements about the reasons that prompted the cashier to make mistakes when punching a cash receipt.

The document is marked with a date and the cashier's signature. It would also be useful to include a column indicating receipt of the document by the addressee.

You can download a sample explanatory note about an incorrectly punched check in the structure we considered from the link below:

An explanatory note is a tool from labor law. But in practice, it plays a significant role in clarifying the circumstances of tax offenses and violations of legislation on the use of cash register systems.

You can learn more about resolving problem situations related to the use of online cash registers in the articles:

How to issue an erroneously punched check?

How to correct the error depends on when it was discovered.

The cashier drew up a check for an amount greater than the required amount, the buyer noticed the difference and immediately pointed it out to the responsible employee.

In this case, you need to take the incorrect document from the buyer and give him the correct one. At the end of the day, the employee will draw up a report in the KM-3 form, which will reflect the amount of refund for unused and erroneous checks.

The incorrect document must be attached to the report, indicating o. If it is printed on thermal paper, it is recommended that you make a copy of it. Text printed on such paper quickly fades, and additional measures will help avoid problems with regulatory authorities.

Regarding the mistake made, the cashier is obliged to write an explanatory note at the end of the day addressed to the head of the company. This paper indicates the reasons for the mistake: inattention, problems with the cash register, etc.

There is no need to make a check for the delta: this operation will not affect the amount of tax calculated by the cash register. It may be necessary only to simplify the maintenance of accounting records within the organization. The amount of erroneously entered checks is reflected in the cash register in column 15. There is no need to make cash settlements.

The basis for reducing daily revenue is KM-3. An erroneously punched check will be deducted from the amount received. The report is printed in one copy and signed by the director of the company, the head of the department and the cashier.

If the check was punched for an amount less than the required amount, you should issue a document for the difference. The cashier has no right not to perform this operation: his actions will be regarded by the tax authorities as non-use of the cash register, which entails serious fines for the organization. According to current practice, a check for an incomplete amount is treated as a non-issued check.

If an error is discovered after preparing the daily cancellation report, it must be corrected. The procedure for the responsible employee is similar to Situation No. 1, with the exception of the point about entering data into the cashier’s journal.

Canceling an erroneous transaction is done by creating a cash settlement for the difference. The order is issued from the “head office”, because by this time the daily proceeds have already been capitalized.

It is impossible to leave a defect uncorrected. The actions of companies related to the use of cash registers are strictly controlled by tax authorities. Violations are punishable by fines amounting to 40-50 thousand rubles for one mistake. Therefore, the cashier should know the instructions for correcting errors and apply them in practice.

An example of writing an explanatory note for overpayment of funds

On August 24, 2018

, the Federal Tax Service explained how to act if the cash register user did not use the cash register or applied it, but with an error. Find out when you need a correction check and when you can correct an error with a refund check. It all depends on the version of the fiscal data format (FDF) used by the cash register to generate checks (1.0, 1.05 or 1.1).

- Find out which FFD is used at your checkout. To do this, in your OFD personal account, go to the “Cashier” section and click on the link “List of cash registers in xls”. A table with cash register data will open: the “FFD” column indicates the version of the format used by the cash register to generate documents.

- If you did not use cash register during the calculation, generate a correction check (the FFD format is not important).

- If there is an error in the receipt:

- for FFD 1.0 and 1.05 - make a simple check, but with a “reverse” calculation sign (according to the methodological recommendations of the Federal Tax Service). Those. when correcting a check for “Receipt”, you need to make a check “Return of Receipt”, etc. This exception will last until FFD 1.1 comes into effect - then for cash registers with FFD 1.0 and 1.05 it will also be necessary to generate a correction check.

- for FFD 1.1 - correct the erroneous check with a correction check.

A correction check allows you to avoid a fine for not using a cash register or using a cash register with errors. Please note that you are allowed to generate a correction check at any cash register, and not necessarily at the one where the incorrect calculation was made or which was not applied.

Now let’s take a closer look at the algorithms for action in a given situation.

In this article we will tell you about an erroneously punched check at an online cash register and give instructions on how to correct the document.

Online cash registers differ from regular cash registers in that they are equipped with fiscal memory (fiscal storage), which daily transmits information about the organization’s revenue to the tax service through special OFDs (fiscal data operators).

Since this innovation has only been in effect for six months (since January 1, many organizations began using online cash registers), and officials have not yet given official explanations or instructions about possible situations of using online cash registers, the question of possible errors remains open.

It is impossible to give a resigning employee a copy of SZV-M. According to the law on personal accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH). However, these reporting forms are list-based, i.e. contain information about all employees.

Attention This means transferring a copy of such a report to one employee means disclosing the personal data of other employees.

1930 No. 169). But sometimes these 11 months are not so spent. {amp}lt; ... Erroneous cash receipts are pasted onto a blank piece of paper.

It is necessary to generate a corrective fiscal document in two cases:

- the implementation was carried out without the use of cash register systems;

- The sales receipt was knocked out, but its amount is incorrect.

Why is it important to make the adjustment? Data on the amount of sales made without a cash register are not reflected in the fiscal accumulator. Accordingly, information about the implementation will not be transmitted to the OFD server, and from there to the Federal Tax Service.

The error must be corrected as soon as possible. What to do if the cash register is out of order? Below is a diagram of the seller's actions in a situation when something is wrong with the cash register.

Next, we will analyze the situation when the revenue was not reflected in the fiscal accumulator. Selling past the cash register: an example of correction We will consider the process of reflecting unaccounted revenue using the example of a farm. Input data is in the following table. Table 1.

- How to write an explanatory note?

- Making a note about an erroneous check

- Explanatory note for returning a check

- An example of an explanatory note about an incorrectly punched check

- Money back certificate

While at their workplace in retail outlets, cashiers may mistakenly enter a cash receipt. In such cases, domestic legislation requires a written explanation from this employee, however, a sample of the cashier’s explanatory note regarding an incorrectly stamped check is not provided.

Therefore, the question arises: How to write an explanatory note? A written explanation for an incorrectly stamped check is the same document as other official letters, therefore, filling out such a document must be taken with full responsibility.

Instructions for correcting an erroneously punched receipt at an online cash register For example, on an Atol-90f cash register you need to press the X key, then select the type of cash receipt and press BB. Then you need to enter the amount and press BB again. Closes the operation by pressing the IT key.

On other CCP models, the procedure will be different. Transferring data to the Federal Tax Service The most important thing to remember is that the correction check is a fiscal document.

Important It is mandatory and automatically transferred to the Federal Tax Service, like all other cash transactions. Therefore, the tax authority has every right to demand clarification on it.

In this regard, it is not enough to simply correct an erroneous transaction, especially if it was due to the fact that the cashier forgot to punch something. It is mandatory to draw up a supporting document.

If the fact of a sale without using a cash register was recorded and then corrected, it is best to immediately report this to the Federal Tax Service. This can be done in person or through your personal account on the official website of the service.

This will avoid a fine. After all, from the nature of the corrective document, the tax office will still learn about the fact of non-use of the cash register when paying the buyer.

In addition, this may become known from other sources.

In this case, tax authorities may send an order to the organization, and you will have to give explanations and present documents. Sample explanatory note from a cashier regarding an erroneously punched check. Attention Explanatory note regarding the return of a check. Another situation may arise.

The error was discovered by the cashier himself after preparing the daily report. The cashier does the same actions as in the first situation, but does not enter the error data in his journal.

- Then in the middle of the line the phrase “Explanatory note” is written.

- The date the letter was issued and the entry number of its registration in the chief’s reception area.

- Next, the title is written - in this example, “about a check issued by mistake” or “an explanatory note on the return of a sum of money.”

- In the text of the letter, the cashier briefly describes the circumstances of the incident in a business style:

- The date of what happened.

- Name of the cash register device.

- Serial model number.

- Incorrectly issued check number.

- Amount of the damaged check

- Reasons for what happened.

- Then he signs a note indicating his position and full name.

- The damaged check is attached to the explanation. There is no need to issue a check for the difference in price, since this circumstance does not affect the amount of taxes.

The cashier's explanatory note is a valuable source of data during a tax audit of a store (and a possible legal dispute), since it allows the Federal Tax Service inspector (or the court) to establish the circumstances of the non-use of cash registers in the manner prescribed by law.

Failure to use cash registers is a reason to believe that the taxpayer has underestimated the tax base by failing to correctly fiscalize revenue.

In addition, the non-use of cash registers is in itself a serious violation of the laws governing settlements between business entities and individuals (primarily the Law “On Cash Registers” dated May 22, 2003 No. 54-FZ). There are serious fines for such a violation.

the notes may become an argument against sanctions being applied to the store. Let us next consider the structure and sample of an explanatory note about an erroneously punched check. What to write in the explanatory note? The explanatory note reflects: 1.

07.11.2018

We invite you to read the Supervisory complaint in a criminal case

No one is immune from mistakes, and cash desk workers are no exception. In practice, situations often occur when they punch checks with incorrect amounts.

The error is detected immediately if the buyer in the store notices the incorrect price, or after a certain time, based on the results of reconciliations.

The choice of how to correct it depends on the moment at which the mistake is identified.

How to correct the error depends on when it was discovered.

Situation No. 1

The cashier drew up a check for an amount greater than the required amount, the buyer noticed the difference and immediately pointed it out to the responsible employee.

In this case, you need to take the incorrect document from the buyer and give him the correct one. At the end of the day, the employee will draw up a report in the KM-3 form, which will reflect the amount of refund for unused and erroneous checks.

Regarding the mistake made, the cashier is obliged to write an explanatory note at the end of the day addressed to the head of the company. This paper indicates the reasons for the mistake: inattention, problems with the cash register, etc.

There is no need to make a check for the delta: this operation will not affect the amount of tax calculated by the cash register. It may be necessary only to simplify the maintenance of accounting records within the organization. The amount of erroneously entered checks is reflected in the cash register in column 15. There is no need to make cash settlements.

The basis for reducing daily revenue is KM-3. An erroneously punched check will be deducted from the amount received. The report is printed in one copy and signed by the director of the company, the head of the department and the cashier.

If the check was punched for an amount less than the required amount, you should issue a document for the difference. The cashier has no right not to perform this operation: his actions will be regarded by the tax authorities as non-use of the cash register, which entails serious fines for the organization. According to current practice, a check for an incomplete amount is treated as a non-issued check.

Situation No. 2

If an error is discovered after preparing the daily cancellation report, it must be corrected. The procedure for the responsible employee is similar to Situation No. 1, with the exception of the point about entering data into the cashier’s journal.

Refund of funds under act KM-3

This form is intended to confirm the fact of the return of funds paid by the buyer. Such a return may occur in the following cases:

- when the buyer returns the purchased product;

- when the cashier mistakenly knocked out a check for a large amount.

In order to properly process a refund to the buyer, a number of steps must be taken.

When a buyer requests to accept a previously purchased product and return the money paid for it, the procedure will be as follows:

- the manager or his authorized person signs the check;

- The cashier-operator makes a refund on this check and stamps “canceled” on it;

- at the end of the day (shift), a KM-3 act is drawn up, which reflects all the checks for which refunds were made during the day;

- records of refunds made are reflected in the cashier-operator's journal.

This procedure is only possible for checks that are returned on the same day they were issued. If the proceeds have already been deposited at the cash register, then the issuance of funds to the buyer must be done in a different order according to the cash receipt order.

It is also recommended that when the buyer contacts you, obtain a return application from him. Although the requirement to submit a written application is not directly provided for anywhere, at the same time, in practice, disputes may arise with tax authorities regarding the validity of refund transactions. Thus, in one of the cases, tax officials doubted the reliability of refund transactions, since buyers’ applications for refunds were not presented during a tax audit. After which they first calculated the entrepreneur’s income in a larger amount (adding to it the returned amounts), which led to the fact that the income limit on the simplified tax system was exceeded, as a result of which the entrepreneur lost the right to use this regime and was charged taxes according to the general taxation regime. The entrepreneur lost the case in the courts (Resolution of the Arbitration Court of the Ural District No. F09-7748/16 dated 08/05/2016).

When a refund to the buyer is made based on an erroneously punched check (for example, the cashier punched a check for a large amount, forgetting to provide a discount), then an act in the KM-3 form is also issued if the return is made on the same day. In this case, the cashier must redeem such checks, stick them on a piece of paper and transfer them to the accounting department along with the KM-3 act. In the cashier-operator's journal, appropriate entries are made about returns made.

Form KM-3 is an act “On the return of funds to buyers (clients) for unused cash receipts.”

Act KM-3 is a form of return. It is issued when:

- the client returns the goods to the seller, and the seller returns the money for the goods to the client

- The cashier mistakenly punched the cash receipt

Download form KM-3 in formats: Excel, Word.

What should you do if the receipt on the cash register was entered incorrectly, or the buyer decided to return the goods, or the cashier accidentally entered the wrong amount on the receipt, or the cash register itself added several zeros to the amount of the receipt (this happens)?

Excess cash on hand

Even if you take cash transactions seriously, there may be errors that will lead to an excessive amount of funds in the machine.

1. The cash balance limit set by the bank for the year 200X is 12,000 rubles. Complete the auditor's work paper using the form below and make appropriate entries for inclusion in the auditor's report.

What to do in this case and how to transfer this amount to the cash register, we will consider below. Contents:

Excess cash and other assets identified during the inventory are accepted for accounting.

We recommend reading: Fee for a tractor driver's license

This is not a reason to panic, because any mistake can have completely legitimate justifications.

However, they will be taken into account at the current market value, and not at the prices of the previous period.

Important! When taking inventory, the difference between the actual availability and the data specified in the accounting records must be recorded precisely in the reporting period in which the inventory was carried out.

Return procedure

The most important thing to do when filing a return is to print and fill out the KM-3 form “On the return of funds to the buyer for unused cash receipts.” Form KM-3 is an internal reporting of the enterprise; it does not need to be submitted to the tax office. During the audit, the tax inspector may ask you to show this document.

The procedure for returning money to the buyer for goods

The buyer must present a cash receipt and fill out an application in any form. After which you fill out the KM-3 form, attach to it a check (which was returned by the buyer) and a statement from the buyer.

Procedure for processing a return on an incorrectly punched check

It is advisable to keep an incorrectly punched check; if it is not there, it is also not a problem, the main thing is that the cashier writes about it in the explanation. You fill out the KM-3 form, attach to it the erroneously punched check and the explanation of the cashier who punched this check incorrectly.

Some nuances

Ask the customer to fill out a free-format statement about why he is returning the product. If a refund needs to be made on an incorrectly punched check due to an error by the cashier of the operator, then in addition to the KM-3 form, you also need to take a written explanation from the cashier addressed to the general director or other boss about how the error occurred and how the incorrect check was punched, this not only disciplines the cashier, but you will also have an additional argument before the tax office during a possible audit. It is not necessary to ask the cashier for an explanation, but it is advisable. It is also advisable to attach to KM-3 an incorrectly punched check or a check from the buyer for which a refund is issued. The return is formalized as a separate entry in the cashier-operator’s journal (form KM-4) in column No. 15 “the amount of money returned to buyers (clients) on unused cash receipts, where the total amount from form(s) KM-3 is transferred

.

"Dangers" of working as a cashier

Many people naively believe that there is absolutely nothing complicated, much less dangerous, about the work of a cashier. But this is a stupid misconception. If you think a little, you can immediately understand what is so risky and dangerous about being a cashier. Most often, the danger is, of course, not physical, but material.

In any job that requires interaction with people, there are always risks. Here everything in most cases depends on the adequacy of the buyer or visitor. Unfortunately, not every person can control himself, so it also happens that the cashier simply gets physically injured.

But for the most part, employees who manage the cash register suffer through their own fault or the fault of the cash register, which can also simply fail. A very common situation is an incorrectly punched check. The amount may be more or less than the actual amount. There can be 2 outcomes here. In any of them, it would be better to write an explanatory note from the cashier about the incorrectly punched check in order to avoid unnecessary claims.

Watch the video on how to correctly compose explanatory notes.