Accounting for cash transactions

Every organization that handles cash must have a cash register. The room for it must be made in such a way as to ensure complete safety of cash. The cashier is responsible for carrying out cash transactions. An agreement on financial liability must be concluded with him.

All companies are required to store their funds in credit institutions. Cash received at the cash desk can only be spent on the purposes for which it was received. A company can only keep money on hand within a certain limit set by the director of that company. As soon as the cash exceeds this limit, it must be handed over to a credit institution.

To record cash transactions, the “cash” account (50) is used. He is active. It means that:

- its balance indicates how much free cash is in the cash register at the beginning of the month:

- loan turnover shows the amounts that were disbursed from the cash desk;

- debit turnover - amounts that were deposited into the cash register.

In the last two cases, monetary documents, both accepted and issued, are also indicated.

The following subaccounts exist in the cash register account:

- organization's cash desk (50-1) - needed to take into account cash in the cash register when the company makes cash transactions using a non-national currency. In order to be able to separately account for each foreign currency, it is necessary to open the appropriate number of sub-accounts.

- operating cash desk (50-2) - used to take into account the availability and movement of money in the cash desks of ports, train stations, post offices, and so on.

- monetary papers (50-3) – necessary to take into account monetary documents stored in the cash register. Such documents are: tickets for various transport, vouchers, forms, stamps and others.

The following receipts can be recorded in the cash account:

- from an account with a credit institution;

- return of balances of amounts issued on account;

- founders' contributions;

- debt repayment by debtors;

- return of loans and credits;

- income from product sales;

- compensation for shortages and damage to property;

- surpluses identified during the inventory;

- funds from buyers for shipment of products;

- income from the sale of intangible and tangible assets.

The following expenses are also taken into account in this account:

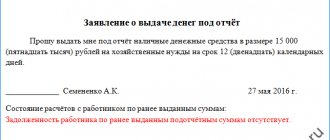

- money given to accountable employees;

- payment to sellers;

- payment of duties and taxes;

- depositing money into an account with a credit institution;

- shortages identified during the inventory;

- issuance of various benefits and scholarships;

- issuing wages to employees;

- transferring cash to the bank through collection;

- issuance of deposited salaries.

Documentation of cash transactions

Accounting for cash and documents involves the preparation of certain documents for each transaction. The following document forms are used:

- Receipt cash order PKO (f. No. KO-$1$).

This document reflects the receipt of funds and documents at the cash desk of the enterprise. Such operations can be:

- receipt of revenue for the sale of goods and services;

payment of balances on advances issued;

- compensation for damages by those responsible;

- and so on.

The PQS specifies:

- Name and OKPO code of the enterprise itself;

- Date and document number;

- Full name of the individual or representative of the organization from which the funds are received;

- Correspondence of accounting accounts reflecting the nature of the transaction;

- Grounds for accepting funds and documents at the cash desk;

- The amount of funds accepted into the company's cash desk.

The PCO is signed by the cashier and the chief accountant of the enterprise. A receipt with duplicated data from the PKO itself is separated from it and transferred to the person who deposited the funds or documents into the enterprise’s cash desk.

The PKO is issued for each transaction of receipt of funds and documents separately.

This document reflects transactions for the issuance of funds and documents from the enterprise's cash desk. such operations can be:

- payment to suppliers for purchased goods and services;

payment of wages;

etc.

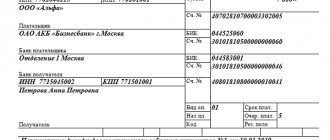

The RKO specifies:

- Name and OKPO code of the enterprise itself;

- Date and document number;

- Full name of the person to whom the funds and documents are issued;

- Correspondence of accounting accounts reflecting the nature of the transaction;

- Grounds for issuing funds and documents from the cash desk;

- The amount of funds to be disbursed from the enterprise's cash desk.

- Applications (for example, payroll for wages).

In addition to the cashier and the Chief Accountant, the cash register is signed by the recipient of funds and the head of the organization. The recipient of the funds must present an identification document and the details of such a document are also entered into the cash register.

RKO is issued for each individual transaction for the issuance of funds from the cash desk of the enterprise.

This document reflects all executed PKOs and RKOs, indicating the document numbers and the date of preparation.

The cash book reflects all transactions that are reflected in PKO and RKO. The cash book is maintained for each operational day of operation. The cash book records the balance of funds in the cash register at the beginning of the day, all transactions regarding the receipt and expenditure of funds and documents with correspondence of accounts and amounts. At the end of the working day, the cash book reflects the turnover and cash balance. The amount of funds for payment of wages is indicated separately.

The sheets of the cash book are numbered, and the book itself is stitched and sealed with the seal of the enterprise.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

The procedure for performing cash transactions

Each cash transaction must be carried out in compliance with the following order:

- Preparation of primary documentation (receipt or expense).

- Registration of cash documents in a special registration journal.

- Making entries in the cash book (made using carbon copies and in duplicate).

- Calculation of cash balance in the cash register at the end of each working day.

- Transferring the cashier's report (the second copy of the sheet from the cash book) to the accounting department along with documents on receipts and expenses. This is done against signature.

Read more about the procedure for conducting cash transactions in the article.

Cash payments. Organization of cash management

Cash in cash is not used so often in the modern economic world, but the following options are possible:

- payroll calculations;

- issuance of accountable amounts for expenses related to business trips;

- for the purchase of inventories;

- acquisition of other valuables for cash, etc.

The procedure for ensuring the safety of cash and accounting for their movement is regulated by the regulatory document Directive of the Bank of Russia “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses” N 3210-U” approved by the Chairman of the Central Bank of the Russian Federation E.S. Nabiullina. dated March 11, 2014 as amended June 19, 2020.

Responsibility for the implementation of primary accounting rests with the financially responsible person - cashier/senior cashier, chief accountant, individual entrepreneur, head of the enterprise. When applying for a job, a financially responsible person enters into an agreement on full financial responsibility with the administration of the enterprise. The agreement is printed in two copies:

- remains at the enterprise;

- The cashier picks it up.

The primary accounting of cash transactions at the cash desk is kept by a cashier or another employee from among the employees of the enterprise, with the imputation of official rights and responsibilities to him, with which he, in turn, must be familiarized with signature.

Main cash flow PDs:

- cash receipt order (PKO form);

- expense cash order (RKO form).

Other primary documents can be attached to PKO and RKO, or they can be independent documents confirming the movement of money at the cash desk:

- Payrolls;

- Cash receipt counterfoil;

- Announcement for cash contribution;

- Register of deposited wages;

- Postal receipts;

- Acts;

- Agreement;

- Sheets of free form, etc.

The PKO is filled out simultaneously with the receipt, which is torn off and handed over to the person who hands over the money to the cashier. The PKO is endorsed by the chief accountant and cashier.

RKOs are endorsed by the head of the organization, the chief accountant, the person to whom the money is handed over, and the cashier.

When maintaining records in a journal-order form, the accounting department provides for maintaining a journal of incoming and outgoing cash documents. However, at present, this accounting register in most cases has lost its relevance, since with an automated form of accounting it is generated automatically and its maintenance is left to the discretion of the organization.

Information from primary cash documents is entered into the cash book (cash book form). A copy of the cash book is the cashier's report of the cash flow for the day. With all primary documents attached, this report is verified at the end of the day with the cash balance in the cash register, certified by the financially responsible person (cashier) and submitted to the chief accountant (deputy chief accountant), according to the enterprise’s document flow schedule.

The chief accountant oversees the maintenance of the cash book. When accepting the cashier's report, the chief accountant reconciles the report data and the cash balance in the cash register. After this, he makes the appropriate entry in the cashier’s report and in the cash book: “He checked the entries in the cash book and received documents in the amount of 26 receipts and 13 expenses (date, signature).”

If during the day there was no movement of documents at the cash desk and no transactions were carried out, then entries in the cash book are not made.

Speaking about the organization of cash management, it can be noted that at present, measures to ensure the safety of cash in the cash register are left to the discretion of a legal entity or individual entrepreneur.

Previously, this issue was regulated by the regulatory document Letter of the Bank of Russia dated October 4, 1993 N 18 (as amended on February 26, 1996) “On approval of the “Procedure for conducting cash transactions in the Russian Federation” (together with the “Procedure ...", approved by the Bank of Russia on September 22, 1993 N 40) and determined a set of specific conditions for maintaining the cash register.

Necessary for accounting. accounting documents

For accounting of cash transactions, the following primary documentation is used:

- arrival orders;

- expenditure orders;

- a journal in which all orders for receipts and expenses are recorded;

- cash book;

- a book in which a record of all money issued and accepted by the cashier is kept.

The cashier's reporting is the basis for entries in the "cash" account.

To record cash transactions, statement No. 1 is used, as well as order journal No. 1. They are filled out in accordance with the information from the cashier's reports. One line is allocated for each report in the registers. Moreover, the period for which the report was compiled does not matter. The number of reports submitted and the number of lines written in the journal must match exactly. If a small number of documents are received at the cash desk every day, entries in the register can be made not every day, but every three to five days, according to several cashier reports at once. With this filling method, the start and end dates for which entries are made are written in the “date” field.

The results for one working day (or several days at once) are calculated by calculating the amounts of identical transactions specified in the reporting or other papers attached to it.

The balance of cash in the cash register is recorded in the statement at the end and beginning of the month. To control cash during the month, information about cash balances indicated in the cashier’s report is used.

Accounting. Question #41

The procedure for conducting cash transactions provides for: • the presence of a cash register and maintaining a cash book; • storage of available funds in banking institutions; • spending cash received from banks for the purposes specified in the check; • storage of cash at the cash desks of organizations within the limits established by the banking institutions servicing them in agreement with the heads of the organizations. The exception is funds borrowed from the bank to pay employees, pay social security benefits and scholarships. Funds intended for these purposes can be kept at the organization's cash desk for three working days, including the day they are received at the bank. When conducting cash transactions, the following is drawn up: Receipt cash order (PKO). Used when cash is received at the cash desk. Compiled by the cashier, must be numbered in order from the beginning of the reporting year. To confirm the receipt of money, a receipt is issued to the PKO, which is proof of receipt of money. When funds arrive at the cash register from other sources, the person who deposited the money into the cash register is issued a cash register receipt. 1. Revenue from cash sales was received Dt 50 Kt 91-1 2. Cash was received from the current account Dt 50 Kt 51 3. Cash was received from buyers Dt 50 Kt 62 4. The balance of accountable amounts was returned Dt 50 Kt 71 5. Receipts from employees of the organization Dt 50 Kt 73 6. Cash received from a foreign currency account Dt 50 Kt 52 7. Cash received from a special account in the bank Dt 50 Kt 55 Expenditure cash order (RKO). Used when dispensing cash from a cash register. The deposited amounts are handed over to the bank, for the deposited amounts 1. Salaries are paid from the cash register - Dt 70 Kt 50 2. Issued for reporting for business expenses - Dt 71 Kt 50 3. Dividends are issued to the founders Dt 75 Kt 50 4. Money is transferred to the collector Dt 57 Kt 50 5. Paid debt to suppliers Dt 60 Kt 50 Cash book. It takes into account all receipts and withdrawals of cash. Each enterprise maintains only one cash book. Before starting work, the sheets are numbered, laced and sealed. The number of sheets is certified by the head of the enterprise and the chief accountant. Can be done in an automated way, and sheets should be printed daily. Entries in the cash book are made by the cashier immediately after receiving or issuing money for each order or other document replacing it. Every day at the end of the working day, the cashier calculates the results of transactions for the day, withdraws the balance of money in the cash register for the next date and transfers to the accounting department as a cashier's report a second tear-off sheet with incoming and outgoing cash documents against a receipt in the cash book. Payroll Journal of registration of incoming and outgoing cash orders. Cash received at the organization's cash desk should be handed over to banking institutions for subsequent crediting to the account. The timing and procedure for depositing cash into the bank are determined individually for each organization. The cash balance limit for each organization is determined by the banking institution. Cash proceeds from the cash desk can only be used with the consent of the bank. Upon expiration of the established period for issuing funds for wages, the cashier must: • put a stamp or make an o in the payroll against the names of the persons to whom the specified payments have not been made; • draw up a register of deposited amounts; • at the end of the payroll, make an inscription about the amounts actually paid and subject to deposit, check them with the total total on the payroll and seal the inscription with your signature • write down the actually paid amount in the cash book and put a stamp on the statement: “Cash outgoing order No...”. Accounting for cash in the cash register is carried out on the basis of cash documents in account 50 “Cash”. The receipt of funds to the cash desk is shown as a debit of the account, and the expense - as a credit. If necessary, on account 50, the organization can open special sub-accounts to account for: • cash at the organization's cash desk, including for accounting for the availability and movement of Russian currency, -50-1; • for each foreign currency used, - 50-2; • monetary documents - 50-3.

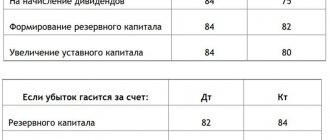

Basic entries in accounting

It is worth considering the main standard entries for accounting for cash transactions used in accounting:

- D50 – K51 – cash was received at the cash desk from the company’s account with a credit institution.

- D50 – K91 – the company’s partner paid the rent.

- D50 - K62 - the cash register received cash from customers for the goods they purchased.

- D50 - K71 - the reporting employee returned the unused cash.

- D50 - K73-2 - a company employee deposited money into the cash register as repayment of a debt on a loan received or as repayment of damage caused.

- D50 – K75-1 – the founder contributed cash to the cash desk as a contribution to the organization’s management company.

- D50 – K91-1 – the person paid for the temporary use of the company’s property.

- D50 - K91-1 - during the inventory of the cash register, excess cash was discovered.

- D50 - K66 - the company received a short-term loan.

- D51 - K50 - the organization deposited cash to a credit institution, to its own account.

- D60 - K50 - the company has repaid its debt to the supplier; The organization made an advance payment to its supplier for the future supply of any products.

- D69 - K50 - the company paid its employees any benefits from the Insurance Fund.

- D70 - K50 - the organization paid wages or advance payments for the first half of the month.

- D 71 - K50 - the organization issued cash to the reporting employee for any purpose.

- D75-2 - K50 - the company paid its founders the dividends due to them.

- D76 - K50 - the organization paid deposited salaries and other deposited amounts.

Transactions with foreign currency

Organizations can carry out cash transactions both in national currency and in foreign currency. Basically, accounting for transactions with foreign money is associated with payment for business trips abroad.

To receive currency for this purpose, you must have the following documents:

- Order for the purchase of currency;

- An order that sets out the rate of expenses per day;

- An order stating that the employee was sent on a business trip;

- Application for receiving currency.

The credit institution issues currency along with a certificate confirming the purchase, drawn up in a special form. It must be issued in the name of the employee sent on a business trip.

If an organization carries out cash transactions in foreign currency, the accountant must take into account these transactions in rubles in the amounts received when converting the currency at the official exchange rate of the Bank of Russia. Recalculation must be carried out on the day of the transaction.

What is a cash register in an enterprise?

In order to understand how cash transactions are carried out, you need to know what a cash desk at an enterprise is. This is the room in which the receipt and issuance of cash for reporting is directly carried out. It is at the cash desk that employees can receive cash in their hands as a salary or advance, as well as for the needs of the enterprise. Revenue, money from customers and other cash are deposited at the cash register. Accounting for transactions must be kept in accordance with the regulatory and legislative acts “On the conduct of cash transactions at the enterprise.” Each individual state has its own legislative standards and regulations.

For the conduct of operations, provisions are made that help to carry out these activities in an orderly manner. One of the main elements of accounting is the cash limit, which is set to ensure that there is a certain amount of cash, or rather no more than a set amount. Cash in excess of the norm must be submitted to the bank on a mandatory basis and within the established time frame for crediting to a current or other account.

Cash on hand can be in both national and foreign currency. Accounting for the movement of funds is recorded in a cash book, for which a specific form is provided. One book should be opened for the national currency, and another for the foreign currency. It is prohibited to make erasures or corrections in such books. If it is necessary to make changes, they are certified by the signature of the cashier himself and the chief accountant of the enterprise. The books are kept in 2 copies, the first remains in the cash register, and the second has a tear-off form, and is the employee’s report.

Postings for foreign currency transactions

Accounting for cash transactions with currency involves the following typical entries:

- D50-1 - K52-22 - the organization received foreign currency cash from the bank for the expenses of employees on a business trip. The primary document will be the receipt order.

- D71 - K50-1 - the company issued foreign currency cash to the reporting employee for his expenses on a business trip. The operation is accompanied by the execution of an expense order.

- D50-1 - K71 - the reporting employee returned money in foreign currency that was not used on a business trip to the cash desk. The primary documentation will be advance reporting, as well as a receipt order.

- D91-2 – K50-1 – a negative exchange rate difference was received. Documentation – certificate from an accountant.

- D50-1 – K91-1 – a positive difference in rates was obtained. The documentation is the same as in the previous case.

- D52-22 - K50-1 - the company deposited foreign currency cash into its account with a credit institution. For this operation, an order for the expense and a statement for the foreign currency account must be issued.

Accounting for monetary securities

Companies can store not only cash, but also banknotes in their cash registers. Such papers will be various stamps, transport tickets, vouchers, coupons and others. They must be accounted for at their actual price. The organization must store such documents in a fireproof cash safe.

The employee who is responsible for the safety of these documents is the cashier.

Read more about accounting for cash documents in the article.

Typical transactions for monetary securities

The main entries made when accounting for monetary documents are:

- D50-3 - K71 - monetary documents purchased for cash are credited to the company's cash desk. To carry out the operation, advance reporting and an invoice are prepared.

- D50-3 – K60 (76) – monetary securities purchased by bank transfer were entered into the cash register. The primary documentation is the invoice.

- D73-1 – K50-3 – a company employee received a tourist voucher in part of the money he contributed. In this case, documents such as an order from the manager of the company, a statement on the issuance of vouchers, and a certificate from an accountant must be drawn up.

- D91-2 - K50-3 - the employee received a voucher, which was fully paid for by his employer. The primary documentation is the same as in the previous case.

- D71 - K50-3 - an employee going on a business trip received travel tickets. This operation is recorded in the cash register.

- D71 – K50-3 – the employee received various stamps from the company’s cash register for their intended use. The operation is recorded in a special journal.

- D94 - K50-3 - an inventory was carried out, during which a shortage was discovered. An accountant's certificate and an inventory list must be prepared.

- D99 - K50-3 - during emergency incidents, some of the monetary documents were lost. The same documents are drawn up as in the previous case.

Postings according to reporting forms

- D006 - K - the organization received reporting forms from the printing house. An invoice from the printing house and a receipt order must be issued.

- D – K006 – forms used to sell tickets were written off. An accountant's statement and a cashier's report on tickets sold are prepared.

Similar articles

- Cash discipline in 2016-2017

- Cash transactions in 2020

- The procedure for conducting cash transactions in 2016-2017

- Accounting of cash transactions

- Maintaining and recording cash transactions in foreign currency

GLAVBUKH-INFO

Synthetic accounting of the availability and movement of funds and monetary documents at the cash desk is maintained on active account 50 “Cash Office”.The debit of account 50 “Cash” reflects the receipt of funds and monetary documents at the organization’s cash desk. The credit of account 50 “Cash” reflects the payment of funds and the issuance of monetary documents from the organization’s cash desk.

Sub-accounts can be opened for account 50 “Cashier”:

- 50–1 “Organization cash desk”;

- 50–2 “Operating cash desk”;

- 50–3 “Cash documents”, etc.

Accounting for funds in the cash desk of the organization itself is carried out in subaccount 50–1 “Cash desk of the organization.”

Subaccount 50–2 “Operating cash desk” takes into account the availability and movement of funds in the cash desks of commodity offices (piers) and operational areas, stopping points, river crossings, ships, in ticket and baggage offices of ports (piers), train stations, in ticket storage offices , at the cash desks of post offices, etc. It is opened by organizations (in particular, transport and communications organizations) if necessary.

Subaccount 50–3 “Cash documents” takes into account postage stamps, state duty stamps, bill stamps, paid air tickets and other monetary documents in the organization’s cash desk. Cash documents are accounted for on account 50 “Cash” in the amount of actual acquisition costs. Analytical accounting of monetary documents is carried out by their types.

If an organization carries out cash transactions with foreign currency, then corresponding subaccounts must be opened to account 50 “Cash Office” for separate accounting of the movement of each cash foreign currency (for example, subaccount 50–4 “Cash Office in Foreign Currency”).

From September 1, 2008, according to the Directive of the Central Bank of the Russian Federation dated ..2008 No. 2054-U “On the procedure for conducting cash transactions with cash foreign currency in authorized banks on the territory of the Russian Federation”, acceptance of cash foreign currency for crediting (transferring) to the client’s bank account, the issuance of cash foreign currency from the client’s bank account must be carried out according to an incoming cash order (form No. 0402008) and an outgoing cash order (form No. 0402009).

Cash foreign currency can be issued to an organization for travel and entertainment expenses.

An expenditure cash order (form No. 0402009), according to which cash foreign currency is issued to an organization, is issued on the basis of a letter to receive cash foreign currency, drawn up by the organization in any form.

The letter to receive cash foreign currency shall indicate: name of the organization; date of writing the letter; date of receipt of cash foreign currency; Bank account number; surname, name, patronymic of the person receiving cash foreign currency; details of his identity document; name of cash foreign currency. The amount of cash foreign currency to be issued is indicated in the letter in numbers and words.

A letter to receive cash in foreign currency is signed by a person with the right of first signature and a person with the right of second signature (if any), with a seal imprint (if any) stated in the card with sample signatures and seal imprint,

At the bank, in confirmation of the acceptance or issue of cash foreign currency, the client must be given a copy of the cash receipt order or cash outflow order signed by the bank's cashier with a cash register stamp stamped

If there are transactions in cash foreign currency, accounting entries are made in rubles in amounts determined by converting foreign currency at the exchange rate of the Central Bank of the Russian Federation effective on the date of the transaction. At the same time, these entries are made directly in foreign currency.

When accounting for funds in foreign currency, you should be guided by the rules of the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” PBU 3/2000,

All completed cash transactions are reflected in the cash book. At the last stage of the accounting process, cash book data is transferred to systematic (synthetic) accounting registers, where they are posted to accounting accounts.

Depending on the form of accounting used, the posting of cash book data is carried out in the main journal, order journal No. 1, the General Ledger or the book (journal) for recording the facts of economic activity in Form No. K-1. When using an automated form of accounting, all data reflected in the cash register is automatically recorded in the journal of transactions or business transactions.

In conclusion, we note that the process of accounting for cash transactions, as a rule, consists of the following stages:

- drawing up primary accounting documents reflecting cash transactions carried out (cash inflow or outflow);

- registration of primary accounting documents in the journal of registration of incoming and outgoing cash documents;

- systematization and processing of primary accounting documents and drawing up accounting entries (for cash transactions, accounting entries can be made on the primary accounting documents themselves);

- reflection in chronological order in the cash book of completed cash transactions, confirmed by primary accounting documents;

- transfer of cash book data to systematic (synthetic) accounting registers, where they are posted to accounting accounts.

Finally, the accounting process involves conducting an inventory of funds by comparing accounting data with the actual balance of cash in the organization's cash desk.

| Next > |