Differences in calculating dividends under different tax regimes

Comparative table combining all tax regimes for LLCs:

| simplified tax system | UTII | Unified agricultural tax | BASIC | |

| Dividend calculation | Dividends are paid from profits after paying a “simplified” tax - depending on the regime - 6% or 5–15%; Payment of dividends for the second type of regime is not a reason to include it in the “expenses” column and thereby reduce the tax base | Dividends are distributed among the founders based on the accounting report data | Taxation of dividends occurs according to Articles 346.5–346.15 of the Tax Code of the Russian Federation | Dividends are accrued based on the results of the first three months, half a year and year. Source: net income. Distributed among the founders according to the charter, otherwise - according to the share in the authorized capital of the LLC |

| Calculation of personal income tax and income tax | For a resident (individual, organization) – 13% of the amount; For other persons (foreign citizens and enterprises) – 15% | |||

Important! If a Russian company owns half a share or more of it in the authorized capital of a company for 365 days before the order to pay dividends, then no tax is paid on the amount of profit.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Should payments from the net profit of previous years be recognized as dividends?

Payments from the profits of previous years, in all likelihood, can also be classified as dividends. The fact is that the legislation (tax and civil) does not contain a ban on the issuance of dividends from past profits (Article 43 of the Tax Code of the Russian Federation, Article 28 of Law No. 14-FZ, Article 42 of Law No. 208-FZ).

The regulatory authorities in their explanations also adhere to this point of view. Confirmation is contained in letters from the Ministry of Finance of Russia dated 03/20/2012 No. 03-03-06/1/133, dated 04/06/2010 No. 03-03-06/1/235 and the Federal Tax Service of Russia for Moscow dated 06/08/2010 No. 16-15 / [email protected] , dated June 23, 2009 No. 16-15/063489.

The Ministry of Finance clarifies that such payments are considered dividends if one condition is met: the net profit was not sent to the reserve fund or the employees' corporatization fund. And the tax service believes that such a procedure for distributing profits should be reflected in the company’s charter.

However, if you look at the previous explanations of the financial department, you will find some inconsistency there. Thus, the Ministry of Finance in letters dated 06/17/2010 No. 03-03-06/1/415, dated 03/17/2008 No. 03-04-06-01/60 and dated 02/06/2008 No. 03-03-06/1/83 approves that such issues are not his competence. And the letter dated 08/23/2002 No. 04-02-06/3/60 states that if an organization needs to pay dividends, then this can only be done at the expense of profits generated in the just past tax period.

Judicial practice shows: arbitrators are in favor of paying dividends from past profits (resolutions of the FAS North Caucasus District dated January 23, 2007 No. F08-7128/2006, FAS East Siberian District dated August 11, 2005 No. A33-26614/04-S3- Ф02-3800/05-С1). That is, the decisions contain indirect confirmation: such dividends should be taxed.

Read in this material how accounting policies are structured under the simplified tax system.

Is it possible for an individual entrepreneur to pay dividends?

This type of payment is the prerogative of the LLC. Consequently, they have nothing to do with individual entrepreneurs, regardless of the tax system (OSN, Unified Agricultural Tax, simplified tax system, UTII). At the same time, an individual entrepreneur can receive and distribute dividends if he is also the founder of the company. The profit of an individual entrepreneur is taxed within its own regime and, unlike an LLC, the entrepreneur can freely dispose of it without waiting for an order to pay dividends.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

The concept of dividends and conditions for their accrual

Any commercial structure is created to make a profit. But the procedure for receiving it by owners may be different.

For an individual entrepreneur (IP), all business assets, including cash, are personal property. He can dispose of them arbitrarily: withdraw cash, transfer to his bank account, etc. Of course, one should not get carried away with this, because responsibilities to staff, counterparties and the payment of taxes do not disappear anywhere. But for our topic, it is important that individual entrepreneurs do not have a special mechanism for generating profit, that is, the concept of dividends does not apply to it.

Calculation of dividends under the simplified tax system

The procedure for paying dividends is determined by the following documents:

- Tax code.

- Federal Law No. 14 “On LLC”.

- Charter of the enterprise.

- Minutes of the meeting of the founders of the company.

When preparing the charter, participants must take care to draw up the following points:

- restrictions on the distribution of dividends (additional conditions not specified in the law under which payment cannot be made);

- the procedure for dividing profits - taking into account the proportionality of investments or according to another scheme.

On the balance sheet, dividends are distributed in the column “Retained income” (1370). According to simplified accounting reports, the company’s net income on the simplified tax system can be found out by the balance of account 84 “Uncovered loss, Retained income.” Data for this year – “Net income/loss” (line 2400). When paying dividends to participants, the company, which is on the simplified tax system, is considered a tax agent in relation to profits and personal income tax. Consequently, the enterprise must withhold and transfer these taxes to the state budget.

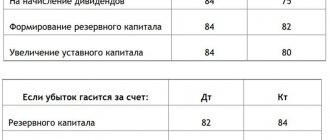

Accounting entries

Let's consider how an accountant should record the payment of dividends in accordance with the current chart of accounts.

| Debit | Credit | Operation |

| 84 | 75 | Dividends were accrued to persons who do not work in the organization |

| 84 | 70 | Dividends were accrued to the company's employees |

| 75 | 68 | Tax was withheld from dividends from persons not working in the company |

| 70 | 68 | Tax was withheld from dividends from company employees |

| 75 | 50, 51 | Dividends were paid to persons who do not work in the organization |

| 70 | 50, 51 | Dividends were paid to company employees |

| 68 | 51 | Personal income tax on dividends has been paid |

| 75 | 84 | Unpaid dividends to non-employees are written off to retained earnings |

| 70 | 84 | Unpaid dividends accrued to the company's employees were written off to retained earnings. |

Payments that are not dividends

By law, dividend payments cannot be:

- Shares that are the property of the founder.

- Investments in a non-profit company necessary for statutory activities not related to entrepreneurship.

- Amounts paid upon liquidation of a company, if they do not exceed the amount of the founder’s contribution to the authorized capital of the LLC.

Important! Dividend payments are exclusively amounts from the net profit of the LLC, proportional to the participant’s share.

Payment of dividends for various groups of individuals and organizations

The differences relate only to the amount of taxation:

| Category | Withholding tax amount | |

| Private person (Russian citizen) | Personal income tax – 13% | |

| Private person (non-resident) | ||

| IP | ||

| Russian company with: half or more of the share in the authorized capital; 50% of depositary receipts from the deposit amount | Income tax | 0% |

| Other Russian companies | 13% | |

| Foreign corporations | 15% | |

Important! A resident is an individual who resides on the territory of the Russian Federation for more than 183 days during the year.

Tax rate in 2020

Tax on the payment of dividends is levied on both individuals and legal entities.

The calculation of tax for individuals depends on whether they are considered residents of the country or not:

- Personal income tax for residents - 13%;

- Personal income tax for non-residents - 15%.

The status is determined based on the number of days over the last year the person was on the territory of Russia (the days do not necessarily have to be consecutive). If the number is at least 183, then the person is considered a resident.

In addition, legal entities can also be recipients of dividends. The procedure for calculating tax for them is established by the Tax Code.

The tax amount is set as follows:

- For a Russian company - 13%;

- For a Russian company, if it owned at least 50% of the number of shares at least 365 days before the date of the decision to pay dividends - 0%;

- Foreign company - 15% or another rate when it is established by foreign tax legislation in order to avoid double taxation.

To confirm a Russian company’s right to a benefit, it must submit one of the forms included in the following list of documents:

- Purchase and sale agreement;

- Deciding on division, conversion, etc.

- Court decisions;

- Memorandum of association;

- Transfer certificate

- Etc.

Attention! Dividend tax must be paid not only by persons on OSNO, but also by those using special regimes (under the simplified tax system, UTII, UST). This is indicated in the relevant chapters of the Tax Code.

Liability for non-payment of dividends

Dividends may not be paid in two cases:

- No charges, no payments. If there was no order to accrue dividends, then failure to pay dividends in this tax period does not have any consequences for the LLC.

- There is accrual, no payment. Such dividends cannot be considered received. Therefore, taxes cannot be charged on them. The founders have the right to appeal this state of affairs in court.

Despite the fact that, according to Article 28 of Federal Law No. 14-FZ, the procedure for paying dividends is established directly by the founders, the waiting time for payments should not exceed 60 days after the order for the accrual of funds is issued. If the company does not pay the money within this period, then by law the participants have the right to demand 1/360 of the refinancing rate for each overdue day. Read also the article: → “Tax on dividends for individuals and legal entities. 2 calculation examples”

If the LLC fails to pay the funds due to its own fault, then the head of the enterprise can be held administratively liable. The fine for the enterprise will be 500–700 thousand rubles.

How can a founder withdraw profits from an LLC: dividends - Elba

When it is necessary to withdraw profits from a business, the owner can resort to a variety of tricks, sometimes not entirely legal. But those entrepreneurs who do not want problems with the law or do not have access to cash-out companies ask a lot of questions about how they can legally get money from their LLC.

Why can't you just take the money and spend it?

Every expense of the company must be justified and supported by documents. You, as a founder, do not have the right to take the organization’s money for personal needs, because you are not their owner (yes, even though you are the owner of the company). The property of an organization is separate from the property of its founder.

You can borrow company money for three reasons:

- For reporting - for example, if you want to purchase something for your company in cash;

- Loan - it will have to be returned to the company;

- Dividends are your income from the activities of the organization, which you can dispose of as you wish.

Kontur.Elba will help you easily keep track of income and expenses, even if you have never heard of accounting.

We will dwell on dividends in more detail, but we will not consider loans and issuance of money for reporting purposes, because they are repayable and are not considered income.

How often can dividends be paid?

How often an organization can distribute dividends is determined in its charter. According to the law, this can be done no more often than once a quarter . It is safer to pay dividends based on the results of the year, because... only then can the final net profit be calculated.

Example

Let's say that you received good income during the quarter and paid dividends from the net profit. Then, at the end of the year, the profit turned out to be less.

Payment of dividends will be reclassified as remuneration to an individual, and you will have to pay all insurance premiums and resubmit related reporting to the Funds.

Therefore, you can pay quarterly profits only if you are confident in the stability of your income.

When you can't pay dividends

Before deciding to pay dividends, you need to check whether there is net profit and whether restrictions established by law have been violated. Dividends cannot be paid if:

- the authorized capital has not been fully paid;

- the company did not pay the cost of the share in certain cases;

- the company at this moment meets the signs of bankruptcy or after paying dividends may become so;

- the value of net assets is less than the authorized and reserve capital or will become less after the payment of dividends;

- According to accounting data, there is an uncovered loss.

In order to make sure that everything is in order, you need to keep accounting, close periods (all documents and numbers on the accounting accounts must be in order - this is an accounting trick) and draw up financial statements at the end of the year.

Calculate dividends with Elba

In Elbe, accounting for income and expenses is simple and understandable to everyone. Try it and see for yourself!

We calculate net assets and determine the amount of dividends

The organization has the right to pay dividends if the value of net assets exceeds the authorized capital. You know the authorized capital, all that remains is to calculate the value of net assets and compare these indicators.

https://youtu.be/orofPUyi4zk

Net assets are determined according to accounting data - since 2013, all organizations are required to maintain it. We have already told you how to properly conduct accounting using the simplified tax system. If you do not understand accounting, you can contact an accountant or get free advice from accounting experts in Elbe. Financial statements will confirm the correctness of dividend calculations.

So, let’s calculate net assets: to the balance sheet line “Capital and reserves” we add gratuitous receipts and government assistance (if there were any, we take the balance under the credit of account 98 “Deferred income”).

If the resulting net asset value is less than your authorized capital, then you should return to paying dividends later, when the financial position of the company improves.

The amount of dividends that you can pay is the amount in the balance sheet line “Capital and reserves” minus your authorized capital. You can use all of this amount or only part of it to pay dividends.

We decide on the payment of dividends

After you are convinced that the company has made a profit based on the results of the period and has the right to pay dividends, a general meeting of the founders is held.

It approves the financial statements, makes a decision on the distribution of profits and determines the period for paying dividends. Profit is distributed in proportion to the founders' shares in the authorized capital.

To calculate dividends for each founder, you need to multiply the distributed profit by his share in the authorized capital as a percentage. The results of the meeting are documented in minutes. Protocol template

If you are the only founder, you can simply make a decision on the distribution of profits, and based on this decision, pay dividends. Profit distribution decision template

The period for paying dividends should not exceed 60 days from the date of the decision. The term can be changed downward at a meeting of founders or fixed in the organization’s charter.

We pay dividends and withhold personal income tax

Within the period determined by the founders, dividends must be paid from the current account or from the cash register of the LLC and personal income tax must be withheld. For residents of the Russian Federation (those who stay in Russia for more than 183 days within 12 months), the personal income tax rate is 13%, and for non-residents - 15%.

Personal income tax must be transferred to the state budget no later than the day following the payment of dividends. Don’t forget to include information about the amounts paid and tax in the quarterly 6-NDFL report and the annual 2-NDFL report.

Insurance premiums are not charged .

The article is current as of May 15, 2019

Source: https://e-kontur.ru/enquiry/164

Example 1: how to calculate dividends in an LLC using the simplified tax system-6%

LLC "Alpha" operates on the simplified tax system-6%. The company's income, taken into account in the tax base under the simplified tax system in 2020, amounted to 1,850,000 rubles.

The company does not take into account expenses for tax accounting purposes, however, the amount of expenses for personnel wages, purchase of goods and materials, rental of office space, services of third-party organizations and other expenses paid within the framework of the LLC’s activities amounted to 1,370,000 rubles in the reporting year.

Of these, wages to staff amounted to 450,000 rubles, and the amount of contributions paid in this regard for employees to the funds was 135,900 rubles. The amount of tax, taking into account the possibility of reducing it due to contributions paid for employees, amounted to 55,500 rubles.

Thus, the amount of net profit according to accounting data will be:

1,850,000 - 1,370,000 - 55,500 = 424,500 rubles.

If the “simplifier” receives dividends

Dividends received by a Russian organization are taxed at rates of 0% or 9%. According to paragraph 3, paragraph 1, Article 346.

15 of the Tax Code of the Russian Federation, when determining the object of taxation on the simplified tax system, the income of an individual entrepreneur, subject to personal income tax at the rates provided for in paragraph 4 of Article 224 of the Tax Code of the Russian Federation, is also not taken into account.

This paragraph refers to dividends received by an individual – a tax resident of the Russian Federation, which are taxed at a rate of 9%.

Source: https://atorcenter.ru/dividendy-pri-usn/

Features of dividend payments under the simplified tax system

When paying dividends to simplified companies, you should pay attention to the following nuances:

- Such payments are made no more often than once a quarter. The recommended period is once a year (this makes it easier to calculate the company’s profit).

- Payment is made only by decision of all participants. A general meeting cannot be held earlier than two months after the close of the previous reporting period.

- The basis for payment is accounting data.

- Payments are made only when the authorized capital is fully paid.

- If the amount of the authorized capital does not “reach” the net income, the payment of dividends is impossible.

- If the company is declared insolvent, then the accrual of dividends is prohibited.

- For an enterprise using the simplified tax system, net profit is the difference in income under accounting and the single tax.

Participant's refusal to pay dividends

The period within which a participant can demand accrued dividends from the LLC is from 60 days to three years, counted from the date of expiration of the two-month period. If the founder does not apply for money, then the unclaimed funds go to the item of undistributed income of the enterprise.

However, the fact of refusal from them is not provided for by law. But the recipient of dividends has the right to relieve himself of all obligations if this does not violate the rights of the other founders. Such a step should be recorded in writing, where the founder renouncing his rights must specify the purposes to which funds from his share should be directed. The company can spend this amount on these needs without waiting for the expiration of three years.

Despite the fact that there is no fact of receipt of income, personal income tax or income tax on this amount is withheld on the day when the founder signed the document on refusal. If a participant ignores the payment of profits, no tax is charged on them.

Enter the site

RSS Print

Category : Accounting Replies : 334

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev. ... ... Next. → Last (34) »

| Tananda// [email hidden] Wrote 13007 messages Write a private message Reputation: 2378 | #211[821913] May 16, 2020, 15:20 |

Malinka wrote:

Scroll: This is what I dug up, although the info is a bit old

...in case of ignorance of accounting We note that for organizations that keep records in the accounting book under the simplified tax system, the procedure for calculating net profit for the purpose of calculating dividends is not established by regulatory documents. True, even during the period of transition of an individual entrepreneur to a private unitary enterprise according to Decree No. 302 dated June 28, 2007 “On approval of the Regulations on the procedure for creating a private unitary enterprise by an individual entrepreneur and its activities” (hereinafter referred to as Decree No. 302) in a letter from the Ministry of Finance and the Ministry of Taxes dated January 19, 2008 No. 15-3/45/1/23 “On keeping records of private unitary enterprises and their use of profits” (hereinafter referred to as letter No. 15-3/45/1/23) rules were developed for enterprises keeping records in the accounting book under the simplified tax system calculating net profit. And although letter No. 15-3/45/1/23 is not a normative document and is intended for private enterprises registered under Decree No. 302, it may well be used by other organizations that use the simplified tax system and do not maintain accounting. After all, there are no other explanations for them, and in general, this method of calculating profit is similar (with some exceptions) to calculating net profit by accounting organizations. So, according to letter No. 15-3/45/1/23, the net profit of an organization is defined as the amount of revenue from the sale of goods (works, services), property rights and non-operating income minus tax under the simplified tax system and incurred and documented expenses for: • payment purchased goods, raw materials, materials and other production resources; • payment for work (services) performed (rendered) by third-party organizations, individual entrepreneurs and individuals; • wages; • payment of other taxes, fees (duties); • payment of payments to the Social Security Fund; • repayment of interest for the use of bank loans and loans from other organizations; • payment for acquired fixed assets and intangible assets; • payment of other expenses related to the production activities of the private unitary enterprise. As you can see, the list of expenses that take part in the formation of net profit is not limited: almost all amounts paid during the reporting period reduce the amount of net profit of the enterprise. Note that organizations operating without accounting, when calculating dividends in each subsequent reporting month (quarter), should subtract from the profit the amount of dividends accrued in previous periods (months, quarters), because accounting is carried out on an accrual basis, and this arithmetic operation makes it possible to avoid reusing profits to receive dividends.

Read the continuation in the magazine “Simplified Taxation System” No. 4, 2012 February 20, 2012

Surely this applies to my situation?!??!!?

Don't you think you're being too clever? 1st period: Income-expenses = PROFIT - dividends (use of profit in the reporting period) = balance of profit for distribution 2nd period: Income from the beginning of the year - expenses from the beginning of the year = profit from the beginning of the year - used profit until the current reporting period (in .including dividends) = profit (remainder) for distribution - dividends in the current reporting period within the limits of profit for distribution = balance of profit for distribution in a given reporting period 3rd period... and so on ad infinitum... naturally when calculating the current profit to distribution, we take into account the previously distributed profit and distribute only the remainder

, i.e. accrues dividends from the remaining profit as of the current date

Notification is being sent...

all women are angels, but when their wings are clipped, they have to fly on a broom| Malinka [email hidden] Belarus Wrote 4658 messages Write a private message Reputation: | #212[821948] May 16, 2020, 15:50 |

Notification is being sent...

According to the receipt, there is only one red cow, we took it alone, we will hand it over alone, so as not to violate the reporting.| Tananda// [email hidden] Wrote 13007 messages Write a private message Reputation: 2378 | #213[821959] May 16, 2020, 15:58 |

Malinka wrote:

Well, that means I understood correctly that accrued and paid dividends are deducted????? for example, if for 2020 I received 480 million on my account, 490 million was written off from my account for 2020 (in which dividends paid for 2012, 2013, January-April 2020 amounted to 70 million) = that means my result = - 10 million (i.e. loss)!?!??!?

no...if you really think so, then there should be income for 2012 + 2013 + 2014 + 2015 - all expenses for 2012, 2013, 2014, 2020 - dividends paid in the current year (including for previous years) = profit / loss... dividends (as an element of expenses) relate to the year for which they are paid, and not to the one in which they are paid... an exception is only if, as a result of payment in one year, a loss is obtained, which is carried forward to the following years... i.e. for 2020... you income 2020 - expenses 2020 a = profit for distribution... dividends for previous years are NOT minus here, this is the profit of the previous period

I want to draw the moderator's attention to this message because:Quote:

came to the account 480 million, written off from the account for 2020 - 490 million (in which dividends paid for 2012, 2013, January-April 2020 in the amount of 70 million) = means my result = - 10 million (i.e. e. loss)!?!??!?

Notification is being sent...

all women are angels, but when their wings are clipped, they have to fly on a broom| Malinka [email hidden] Belarus Wrote 4658 messages Write a private message Reputation: | #214[821964] May 16, 2020, 16:04 |

Notification is being sent...

According to the receipt, there is only one red cow, we took it alone, we will hand it over alone, so as not to violate the reporting.| Olga Nikolaevna [email hidden] Belarus, Grodno Wrote 13398 messages Write a private message Reputation: 3085 | #215[822050] May 16, 2020, 17:30 |

= 0... Our “rule makers” themselves do not understand WHAT they are talking about... And after them, in the simplified tax system magazine, someone is trying to “comb” their stupidity.

Therefore, be CALM about both this letter and the amount of calculated dividends. Let's look at an example. Let’s say that for the year it turned out like this at the enterprise - quarter No. 1: 100 revenue and 80 expenses, profit = 20. All of it was sent to dividends, which were accrued and paid in the next quarter. quarter No. 2: 200 revenue and 170 (expenses, excluding paid dividends), quarter No. 3: 300 revenue and 290 (expenses, excluding paid dividends), quarter No. 4 - no activity was carried out, at the end of the year the company was liquidated. Question - WAS THERE ANY PROFIT based on the results of the enterprise’s activities? When doing accounting - WAS! We calculate the profit in this case: quarter No. 1: 100 revenue - 80 expenses

= 20 profit, quarter No. 2: 200 revenue -

170 (expenses, excluding dividends paid)

= 30, quarter No. 3: 300 revenue -

290 (expenses, excluding dividends paid)

= 10, quarter No. 4: revenue 0, expenses 0, profit 0. For the year, profit = 20+30+10=60 million. Now let the enterprise have KUDiR. Does this AFFECT the amount of annual profit - with the SAME expenses and the same revenue? “According to the mind” - DOES NOT AFFECT... Let’s try to calculate “profit under the simplified tax system with KUDiR” as indicated in the simplified tax system journal (dividends are expenses that REDUCE profit, “accounting is carried out on an accrual basis”). Let all accrued expenses (except for dividends, which we must “determine”) BE PAID IN THE SAME quarter (in order to compare “accounting profit” - taking into account ACCRUED expenses - and “profit under KUDiR” - taking into account PAID expenses). So, A (profit) = B (income) - C (expenses) - X (? perhaps these are dividends paid and income from them paid to the budget). In total for 3 quarters B (income) = 100 + 200 + 300 = 600, C (expenses, excluding dividends paid) = 80 + 170 + 290 = 540. So, in the 1st quarter 100 revenue -

80

expenses =

20

million profit, we send it to dividends - we pay it in the 2nd quarter, - in the 2nd quarter: accruing for the 1st..2nd quarter (100+200=300 revenue) - (

80+170

+

20 dividends

= 270 expenses with dividends) = 30 million profit accruing. Taking into account the profit for the 1st quarter of 20 million, we get for the 2nd quarter “profit at KUDiR” = 10 million, we send it to dividends - we pay ONLY 10 million in the 3rd quarter??? — in the 3rd quarter: increasing (100+200+300=600 revenue) — (

80+170+290=540 expenses without dividends

+20+10=30 dividends = total “KUDiR expenses” = 570) and “KUDiR profit” = 30 accruing for the 1st...3rd quarter, but also for the 1st...2nd quarter - the SAME, so for the 3rd quarter profit = 0? THERE ARE NO REASONS FOR THE PAYMENT OF DIVIDENDS??? — in the 4th quarter: increasing (100+200+300+0=600 revenue) — (

80+170+290=540 expenses without dividends

+20+10+0=30 dividends, and total “KUDiR expenses” = 570), so accruing profit for the 1st…4th quarter = 30 million, but also the same amount of 30 for the first 3 quarters, so profit for the 4th quarter too = 0 and there is NO REASON for paying dividends... nonsense? I want to draw the moderator's attention to this message because:

Notification is being sent...

| Malinka [email hidden] Belarus Wrote 4658 messages Write a private message Reputation: | #216[822168] May 17, 2020, 10:49 |

Notification is being sent...

According to the receipt, there is only one red cow, we took it alone, we will hand it over alone, so as not to violate the reporting.| Malinka [email hidden] Belarus Wrote 4658 messages Write a private message Reputation: | #217[822187] May 17, 2020, 11:16 |

Notification is being sent...

According to the receipt, there is only one red cow, we took it alone, we will hand it over alone, so as not to violate the reporting.| Malinka [email hidden] Belarus Wrote 4658 messages Write a private message Reputation: | #218[822195] May 17, 2020, 11:46 |

Notification is being sent...

According to the receipt, there is only one red cow, we took it alone, we will hand it over alone, so as not to violate the reporting.| Svet [email protected] Republic of Belarus, Borisov Wrote 4980 messages Write a private message Reputation: 826 | #219[822200] May 17, 2020, 11:56 |

Quote:

Well, judge for yourself, we sold goods worth 100 million rubles. with their current cost of 70 million rubles and costs of 20 million rubles, and with the remaining 10 million they bought a new product. There is “payment” - there are expenses and what, THEREFORE profit = 0?

Quote:

No, this is an INCREASE IN THE REMAINING OF FREE CASH = 0... Our “rule makers” themselves do not understand WHAT they are talking about... And after them, in the simplified tax system log, someone is trying to “comb” their stupidity.

Under the simplified tax system, there is no accounting. And what you are trying to prove from an accounting point of view is that there is profit on paper - that is what it is. And the letter for the simplified tax system (with a book), with an approximate calculation, was made in order to pay dividends from profits (with minus expenses), so as not to get into “other people’s” money, but to pay from your own. And the fact that there is no increase in free cash is only because the company purchased goods from the profit received - i.e. its profit was minus this quarter, and in reality there is no money for the account, so how will you be able to pay dividends in this case?

Quote:

For the year profit = 20+30+10=60 million.

- true for the general understanding for the year. and here you are already confused:

Quote:

So, in the 1st quarter 100 revenue-80 expenses = 20 million profit, we send it to dividends - we pay in the 2nd quarter, - in the 2nd quarter: increasing for the 1st..2nd quarter (100+200=300 revenue) - (80+ 170+20 dividends = 270 expenses with dividends) = 30 million profit accruing. Taking into account the profit for the 1st quarter of 20 million, we get for the 2nd quarter “profit at KUDiR” = 10 million, we send it to dividends - we pay ONLY 10 million in the 3rd quarter???

1st quarter profit = 20 - it was sent for payment in the 2nd quarter.

Quote:

about 2nd quarter: accruing for 1..2 quarter (100+200=300 revenue) - (80+170+20 dividends =270 expenses with dividends) = 30 million profit accruing.

you minus 20 - profit, and received a cumulative profit for 2 quarters of 30 million, why are you minus again:

Quote:

Taking into account the profit for the 1st quarter of 20 million, we get for the 2nd quarter “profit at KUDiR” = 10 million

? For 2 quarters, the profit was 30 million - and we can send it for distribution, not 10. You withdrew 20 million twice.

Quote:

in the 3rd quarter: increasing (100+200+300=600 revenue) - (80+170+290=540 expenses without dividends+20+10=30 dividends = total “KUDiR expenses” = 570) and “KUDiR profit” = 30 growing for the 1st...3rd quarter, but also for the 1st...2nd quarter - the SAME, so for the 3rd quarter profit = 0? THERE ARE NO REASONS FOR THE PAYMENT OF DIVIDENDS???

in the 3rd quarter 600 revenue - 540 expenses (increasing) = 60 profit, but since profit in the 2nd quarter was paid 20 million, in the 3rd 30 million = the balance of profit 10 - which we have the right to pay in the 4th quarter.

Quote:

in the 4th quarter: increasing (100+200+300+0=600 revenue) - (80+170+290=540 expenses without dividends+20+10+0=30 dividends, and total “KUDiR expenses” = 570), therefore accruing profit for the 1st...4th quarter = 30 million, but also the same amount of 30 for the first 3 quarters, so the profit for the 4th quarter is also = 0 and there is NO REASON for paying dividends...

in the 4th quarter we pay 10 million. profits for the 3rd quarter. And we calculate: 600 revenue - 540 expenses - use of profit 20 - use of profit 30 - use of profit 10 = 0. Yes, no payout, everything was paid, no activity was carried out.

I want to draw the moderator's attention to this message because:Notification is being sent...

| Malinka [email hidden] Belarus Wrote 4658 messages Write a private message Reputation: | #220[822211] May 17, 2020, 12:14 |

Notification is being sent...

According to the receipt, there is only one red cow, we took it alone, we will hand it over alone, so as not to violate the reporting.« First ← Prev. ... ... Next. → Last (34) »

In order to reply to this topic, you must log in or register.