A freelance employee of the organization is not listed among the staff, but a civil or employment contract has been concluded with him. In one of the companies where I worked, freelancers were specialists who were officially registered in the company, but worked not in the office, but from home. However, according to an honest Hamburg account, it is correct to call such workers remote - this is one of the convenient formats of cooperation beneficial for enterprises, but it differs from hiring freelancers.

Freelance employees are required by organizations to perform certain types of work. Most often we are talking about tasks that arise only from time to time, but sometimes out-of-staff employees perform regular tasks and remain on call full-time, so that they are distinguished from full-time specialists only by the contract format and tax payment scheme. How to hire a freelancer and not regret it?

Freelance status: rights and responsibilities

I’ll say right away: the Labor Code of the Russian Federation does not provide for such a form of hiring as an out-of-state specialist. Therefore, if you have entered into an employment contract with an employee, he is subject to the same rights and obligations as specialists who come to the office five days a week.

In practice, the difference comes down to the fact that his position is not included in the staffing table, or you are looking for a specialist to help full-time employees. For example, you have two locksmiths, but from time to time they cannot cope with the volume of tasks, so you attract a third specialist.

In such cases, the rights and responsibilities of a freelancer are no different from the rights and responsibilities of other employees in your company.

Maximum number of employees

The compiled staffing table must be signed by the chief accountant and the head of the personnel department ( or the employee responsible for personnel records

). After this, the staffing table must be approved by the head of the organization by order. This is stated in section 1 of the instructions approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

This is interesting: What are the correct names for wheelchair users?

Is the wording in the Accounting Regulations fair: The structure and staffing of the accounting department is approved by the head of the organization upon the recommendation of the chief accountant and in agreement with the founder. The phrase of interest is: “in agreement with the founder.” The standard form suggests “in agreement with the head of the personnel service.” Our institution does not have a personnel service; there is a document specialist who conducts personnel work.

Pros and cons of out-of-state specialists

The advantages of hiring out-of-state workers include:

- Reducing the burden on accounting. However, this is only true if you outsource some functions - you enter into an agreement with the company, for example, on cleaning, eliminating the need to hire a permanent cleaner. Also, cooperation with individual entrepreneurs reduces the burden on accounting.

- Reducing the burden on the HR department. Again, this is not always true. In addition to cases of searching for specialists through outstaffing, the load on the HR department is reduced if the head of the department or a responsible specialist is looking for a freelancer to perform a certain task.

- Saving money. The work of freelancers is often paid on an actual basis; it is not necessary to accrue a monthly salary and advance payment. Another type of savings is the ability to rent a smaller office or purchase fewer tools (depending on the specifics of the business). A freelancer does not have to be allocated a permanent place, and he often has his own tools.

- Possibility to hire an unlimited number of freelancers. The customer’s hands are free: the law does not prohibit hiring as many out-of-state specialists as you want.

The disadvantages include higher risks associated with specialists performing their duties. For example, such employees often do not feel like full members of the team, so they do not strive to establish communication with other employees, and treat their duties negligently.

But even if the specialist is responsible, the lack of communication can make work difficult - it often creates an additional burden on the manager, because even small issues go through him, as through an intermediary. Non-staff specialists often do not have the bonuses and privileges of full-time employees, so they easily lose motivation. That is, you still need to be able to work with such employees.

Is it promising to work as a freelancer?

People often ask in what areas you can be a freelancer. In short: in all cases, you can even become a freelance employee of the FSB or Interpol.

Most often, freelancers are hired by companies related to information, marketing and IT: online publications actively cooperate with freelance authors, entrepreneurs are looking for freelance specialists for technical support of sites, freelance marketers are involved in individual promotions and events.

Another in-demand area is finance: companies are often looking for freelance accountants and auditors. However, you should not assume that you cannot get a job, for example, as a freelance electrician or plumber. More and more companies are entering into contracts with freelancers.

Where to go?

The term “freelance employee” on a certificate is of little interest to anyone if you work for a truly prestigious company. There is a need for freelancers in almost all areas. You can get a job in a bank or a publishing house of a reputable newspaper, in a fisheries department, or even in NASA. It all depends on desire, perseverance, and the ability to prove that your talents and skills will be useful in this industry. Therefore, feel free to contact the employer directly. The rules here are the same as when submitting a regular resume for a job.

How promising is it to become a freelancer?

It’s difficult to give a definite answer: it depends on your specialization and the specifics of the industry. If you are looking for a way to arrange a shift work schedule in order to devote time to some important things other than work, this will be, if not promising, then profitable for you.

In the future, a freelancer can really turn into a permanent specialist and even take a leadership position. Because any company prefers an already verified person to a stranger who came through an advertisement. But it's not that simple.

You may come across companies that save money by hiring freelancers. They are looking for smart, qualified, but insufficiently experienced specialists, offering a low rate, but with the prospect of being hired as a staff member.

Since no one gives specific deadlines, such a specialist can work for several years for ridiculous money, counting on the future.

Just remember: if you don't get paid well out of state, you're unlikely to get paid well once you get your own desk and chair in the office.

The concepts of “Outstaffing” and “Outsurfing”

In the modern world, there is a term “Outstaffing”, which implies the removal of personnel from the company’s staff and the hiring of a provider who assumes obligations in relation to this personnel. As for employees, everything remains the same for them, except for the entry in the work book.

An organization that orders outstaffing pays the provider an agreed amount for the provision of such services, and it also pays all necessary expenses for the provider’s work related to the maintenance of employees. Outstaffing is widespread because it makes the business easier to manage and reduces the workload for the organization. Tax optimization occurs legally, outstaffing is a convenient method for management.

Outstaffing services are often provided by recruitment agencies involved in personnel selection. In frequent situations, they are faced with fired employees: the agency can easily employ them in any other organization that they have as a client. Outsurfing involves an agency searching for employees to temporarily work in a specific organization. In this case, workers provide their services for a specified period.

Many organizations need non-staff personnel. Temporary staff are often needed for seasonal work, for example, in the hotel business, trade, and construction. In the medical industry, employers are not confident that the provider will be able to provide employees whose quality of work will be at the highest level.

Freelance employee: how to apply correctly

And now the most slippery moment: how to guide a freelancer through accounting and legitimize your relationship with the employee? Concluding an employment contract is usually unprofitable for the employer, because then he will be required to pay a salary, advance payment, vacation, paid sick leave, etc. Therefore, a freelance contract is usually a civil law form, which implies that one party acts as a customer, and the other as a contractor.

Specifics of a civil contract:

- The work can be paid at any frequency, but the contractor is not subject to your work schedule.

- The contractor has no right to social guarantees, but personal income tax is withheld for each payment to him.

- Mandatory insurance contributions are only to the Pension Fund of the Russian Federation and the Federal Compulsory Compulsory Medical Insurance Fund, but if the contract provides for payments for injuries, then the contractor may be entitled to them too.

As you already understand, taxes must be paid for a freelance employee. The customer becomes a tax agent and is obliged to withhold personal income tax from all payments. Exception: if you have entered into an agreement with an individual entrepreneur, then he must pay taxes on his own.

I recommend that contractors themselves pay attention to the clause in the contract “compensation for damages for uncompleted work or damage to the company,” if there is one.

Because under this clause of the contract you may be given extra responsibility. Also carefully re-read the terms and amounts of payments, the possibility of receiving additional payment. If your work involves health risks, your contract should include a clause on compensation for medical expenses. From the site pravsiila.ru

How to remove foreign workers from the state

The procedure for concluding a fixed-term contract is regulated by Art. 59 Labor Code of the Russian Federation. The article establishes a circle of persons with whom contracts of limited duration are concluded outside the state by virtue of the rights granted by law or by agreement of the parties. Employers have the right to conclude a fixed-term contract if necessary:

- Replacement of a temporarily absent employee.

- Carrying out temporary, seasonal work.

- Implementation of work that is not related to the usual activities of the enterprise or beyond the capabilities of specialists. Work or services are temporary.

- Carrying out urgent work related to the prevention of accidents or accidents or the elimination of their consequences.

Moreover, since HR responsibilities are assigned to the contractor, the firm's resources are freed from non-essential business processes. They can be directed to solving priority problems, which will lead to increased efficiency and profitability of core activities.

In particular, its use for the purpose of material incentives for full-time employees was prohibited, which seems quite logical in the conditions of an administrative economy. There were also hidden hints of its existence in other industry regulations, but such a category was not directly indicated.

Labor contracts are not concluded with them. How to hire a freelancer correctly, what documents to fill out? An employer may need full-time employees when it is necessary to carry out certain work of a limited scope or perform it over a certain period of time.

Firstly, the staffing table is still necessary for accounting and tax reporting - this document will definitely be requested by the tax authorities along with payroll records, employment contracts and other documents as part of the audit. Also, the staffing table plays a vital role in the organization, formalizes its structure, reflects the subordination system, and official salaries.

This system provides for the distribution of the general wage fund throughout the company (or its division) among the relevant employees. In this case, the general fund depends on the performance of the company (division) in a particular period of time (for example, a month). At its core, the salary of a particular employee is his share in the wage fund of the entire team.

Civil law. Most often, it is concluded if an organization requires a person to perform work that it is not able to perform on its own.

The transition of a part-time worker to the main position in the same company can be formalized through dismissal or through the conclusion of an additional agreement to the employment contract. Filling out the work book depends on when and by whom the entries on the hiring of a part-time worker and his dismissal were made.

Who is a freelancer?

A freelancer is a hired worker who is involved in the general work process to perform some specific work.

There can be a variety of qualifications in this area, from ordinary workers to professionals in the field of creating a website and assessing the development strategy of an organization. In other words, a freelancer has the name “freelancing”, which has become very popular and is being actively embraced by the market, both from employees and from organizations.

At first, freelancing was considered to be workers who come, do work and leave. Now a freelancer can be a permanent freelance worker whose activities are aimed at performing various company tasks and at the same time he has the opportunity to be at home.

Terminology

According to labor law, the term “freelance employee” simply does not exist. There are only two concepts in it - employee or employer. A freelancer can be called a specialist who performs work that is not directly included in his official duties.

Each employer has its own need for hiring freelancers. For example, a person is needed to provide specific services or a certain type of work. Often such people are hired for a short period of time, but sometimes freelancers work permanently.

Recruitment

In order to hire a non-staff employee, just follow a couple of steps:

- Ask the citizen to bring the necessary package of documents.

- Make an agreement with him.

It is worth making a few additions to this instruction for hiring a non-staff employee to make everything clear:

- The required package of documents includes: a passport or any other document confirming identity (TIN, SNILS and work book are not required). This item also includes a document indicating or confirming the registration address on the territory of Russia (as a rule, this document is required for foreign citizens).

- There is no need to conclude an employment contract with a citizen; in this case, it is enough to use a civil agreement. In addition, it has a division: a contract agreement (involving that a worker is hired to perform a certain amount of work) or a contract for services (in which case it is assumed that a non-staff representative will provide certain services).

As for the very content of the agreement on hiring a non-staff employee, it must necessarily contain the following points:

- Describe all the items and the scope of work performed or the type of services (this means a detailed description, taking into account all the specifics, features and important points; you should not try to shorten this item).

- The exact deadlines for completing the work must be indicated (the number of hours worked or even the work schedule can similarly be attributed to this).

- The responsibilities of the freelance worker must be indicated in terms of reporting on the work done (usually in this case the need to provide a certificate of work performed is indicated).

- The amount of remuneration that the employee will receive is indicated.

- It must be noted when payment will be received and in what way it will be made.

- The rights and main responsibilities of each of the parties who sign must be outlined.

- Special conditions are noted under which the agreement may be terminated.

- Data must be provided regarding the complete information of the organization (indicating the manager), as well as information about the employee himself (passport details, place of residence and full name).

A special condition of this agreement is that it can be terminated early, but only if a situation arises that must be specified in the document. In addition, other conditions may be included in the document, but only with the consent of both parties.

Features of remuneration

The employer is responsible for violation of providing the employee with the conditions specified in the contract necessary for the performance of duties, as well as for violation of the deadlines for payment of remuneration. A civil contract with a freelance worker may be terminated early.

Possible conditions for termination must be stated in the contract itself. In addition to the main provisions, other conditions may be included in the contract at the discretion of the parties.

For example, working hours, days off, workplace, additional incentive methods, employer guarantees and other points that are significant for the employer and employee.

When drawing up an agreement, you must provide information about the company hiring an out-of-state employee (name, full name of the manager) and about the employee himself (full name, passport details, place of residence in the Russian Federation).

You can enter into either a fixed-term employment contract or a work contract (contract agreement) with a freelance worker.

It is not difficult to draw up such an agreement, but it should be borne in mind that if the employee wishes, a fixed-term contract can easily turn into an open-ended one, for example, if after the end of the contract the freelancer continues to work or, by contacting the labor inspectorate, proves that the work is permanent.

In this case, the organization will have to change the staffing table and take a number of other measures. To avoid these problems, it is better to conclude a civil contract with a freelance worker.

A direct indication of the possibility of concluding a fixed-term employment contract with a freelancer is contained, for example, in Art. 341 Labor Code of the Russian Federation. So, part 3 of Art.

Attention

A person hired temporarily must be warned by order that his activities, concluded under a temporary employment contract, are of a non-permanent nature, indicating a specific date for its completion. The document regulating the hiring of such a specialist should indicate the exact factors that serve as the basis for signing a temporary contract.

If the employer tries to conclude a temporary contract for a longer period, or the work performed is of a specialized nature, such actions are considered unlawful; the essence of the temporary employment contract does not allow this. A fixed-term employment contract can be concluded for a period of up to five years; the duration of the minimum period is not regulated. At the end of its term, in the absence of initiative from one of the parties to terminate it, the status of such an agreement changes to unlimited.

We invite you to read: Persons working under an employment contract

Reasons for conclusion by agreement of the parties:

- doing part-time work;

- medical indications;

- the employer is a small business entity (SMB);

- carrying out work to eliminate the consequences of natural disasters;

- competitive election to office;

- work in the creative field;

- work in senior management positions (director, chief accountant);

- full-time employee training.

Reasons for terminating a fixed-term employment contract:

- the contract period ends upon completion of this work,

- the contract ends when the permanent employee returns to work,

- the contract expires with the end of seasonal work.

Termination of a temporary employment contract at the initiative of the employee is permissible on any day.

If you resign of your own free will, you only need to notify your employer in writing.

The preparation of documentation when concluding a temporary contract occurs on the general basis specified in labor legislation; a sample document regulating hiring is presented below: The employer must enter into a fixed-term temporary employment contract only in writing, with an entry in the employment record, with registration through the personnel department .

The main difference between a temporary contract and a fixed-term one is the non-permanent nature of the work performed, for the performance of which a specific person is involved, which means that the condition on the time and terms of the employment contract remains fundamental. The specific period for hiring a temporary employee is possible in less than two months; it is negotiated by both parties and documented.

Career

The nuances of entering into contracts with different categories of citizens Minors Employment under a fixed-term employment agreement can be concluded with teenagers under the following conditions:

- from 14 years of age in free time from school, with the consent of one of the parents or guardian with the consent of the guardianship authorities;

- from 16 years of age to perform light work, subject to receipt of general education or combining work with continued education in the evening or by correspondence;

- Until the age of 14, only cinematography, circus, etc. enterprises have the right to enter into employment agreements with teenagers.

Pregnant women The short-term employment contract with the expectant mother is not terminated until the birth of the child. Termination is possible only within 1 week after the end of pregnancy. Pensioners The employer has the right to enter into an agreement with pensioners for a specified period.

That is, the provisions of the Labor Code of the Russian Federation do not apply to them, but the norms of the Civil Code of the Russian Federation are mandatory. These are employees who have undertaken to perform one-time work for an organization in need without being included in the regular payroll.

At the same time, freelance workers do not have the right to the social guarantees that are provided to full-time employees working under an employment contract. A freelancer is not entitled to leave.

Freelance workers also include freelancers who offer their services via the Internet, but their work does not require a written relationship with the customer.

In some cases, such employees may be registered as remote workers with an employment contract.

Fixed-term employment contract Among the agreements that can be concluded with a hired freelancer is a fixed-term employment contract, which differs from a standard employment contract in the established employment period (up to five years according to Article 58 of the Labor Code of the Russian Federation).

As a rule, an agreement of this type is concluded with seasonal workers or employees replacing the main employee, however, Article 58 of the Labor Code of the Russian Federation provides for the possibility of concluding fixed-term contracts with any categories of workers.

The institution itself determines under what type of contract it will accept a freelance employee.

When concluding an employment contract with a freelance worker, the employer issues a corresponding order on his employment, which must indicate, as well as in the contract itself, that the employee is hired temporarily.

The work book is also properly prepared.

You can read how to correctly make an entry in your work book here.

We recommend reading: What is an easement?

A fixed-term employment contract - any employer may need a sample of it - is concluded for a certain period.

58 of the Labor Code of the Russian Federation indicates 2 possible options for the validity of employment contracts:

- for an indefinite period of time;

- within the specified period.

The situation of concluding a fixed-term employment contract becomes special for the following reasons: Hiring for a certain period, in the same way as with an open-ended contract, is formalized by order.

58 Labor Code of the Russian Federation)

Office work Fixed-term employment contract Labor relations are regulated by Art.

58 Labor Code of the Russian Federation. The concluded agreement is defined as fixed-term if it is executed for a certain period of time, and indefinite when the end of the agreement is not defined.

The most common reasons for drawing up a temporary contract are the following:

- during seasonal work;

- for the period of absence of a permanent employee;

- to perform any temporary, for 2 months, work;

- if an employee is accepted into an organization whose functioning has a time frame, etc.

The conclusion of a temporary contract is also possible by agreement of the parties, Part.

Employment contract

hereinafter referred to as the “Employee” have entered into this agreement as follows: (without a probationary period / duration of the probationary period) (form of payment time-based, piece-rate, salary) bonus payments to the Employee are established ………………………………………… ….

1.1.4.

Page updated: 09/28/2015 Rules for concluding and sample The contract can be transformed into an open-ended one in other cases.

For example, if, when concluding an agreement, the restrictions established by the legislator were not taken into account (LC, Article 59), or there was an evasion of the provision of guarantees and various rights provided for employees employed for an indefinite period.

In accordance with the Labor Code, a fixed-term employment contract is concluded in the following cases: The employer must remember that the fixed-term contract must contain mandatory conditions and indicate certain information (Labor Code, Article 57).

First of all, the validity period of the contract and the grounds for its conclusion must be indicated. Currently, there is a list of mandatory and optional grounds established by the legislator for concluding a fixed-term contract.

Sample of a fixed-term employment contract MCOU Zhigalovskaya Secondary School No. 1 named after. G.G. Malkova, hereinafter referred to as the “Employer”, represented by the Director, acting on the basis of the Charter of the Establishment, with one, hereinafter referred to as “Employee”, passport: series _______________№___________, issued ______________________________ _______________________________________________________________________________, on the other hand, have concluded this fixed-term employment Agreement on the following : 1.

We invite you to familiarize yourself with: Commercial representation agreement (option 2), 2020, 2020 - Agency, representative agreement - Samples and forms of agreements

“On joint activities to organize and conduct temporary employment of minor citizens aged 14 to 18 years in 1.

Situations when the need for a temporary worker arises may be different. Let’s say some work needs to be done, but there is no person with the proper qualifications on staff.

Or, say, a specialist fell ill for a long time, an employee went on maternity leave. The solution is to hire a temporary worker.

But what kind of agreement can be concluded? There are two options: draw up a civil contract (for example, a contract) with a temporary employee or a fixed-term employment contract. All recommendations given in this article are relevant both for companies using the general regime and those using a simplified system.

- Requirements for the employee;

- Liability for failure to fulfill duties or for causing damage to the enterprise, which the temporary worker is obliged to compensate 100% of, plus lost opportunities for the enterprise to make a profit from damaged products;

- Conditions for early termination - both parties have the right to this option, and the clause must be included in the text of the agreement.

- home

- Accounting for settlements with personnel

- It is necessary to carefully draw up this agreement and try to comply with all the details.

- Any inaccuracy can be exploited by the employee.

- You should not try to deceive the employee; it is better to do everything honestly and taking into account all the features of a specific focus.

- You should not try to violate the terms of the contract, since judicial practice in this area has extensive experience and employers often lose cases (in fact, employees rarely try to deceive the employer).

- Remember that in addition to the terms of the contract, you should not forget about the legislative framework of the Russian Federation, which must be observed in any case, regardless of the type of contract.

- You should be extremely careful when employing foreign citizens, since this aspect may have a lot of “pitfalls”, and to understand this, you just need to carefully read all the conditions and features of hiring foreign citizens.

Hiring order

An interesting point is the situation regarding the need to issue an order to hire a freelance representative. If a civil contract is concluded with such an employee, then there is no need to create an order, since an employee of such a plan is not subject to the internal charter and rules.

And if a fixed-term employment contract is concluded with such an employee for a short period due to the absence of the main employee, then in this case the creation of an order is simply necessary.

It is published in the usual way, however, it indicates a shorter period of activity and the main reason why a freelance worker is hired.

In what areas can you work outside of the state?

Each organization has its own staff, which can range from several people to more than one thousand employees. Thanks to the assigned staff of specialists in various fields, the labor process has been streamlined. In addition to core employees, organizations often use the services of freelance specialists.

Typically, the services of a freelance specialist are sought in certain situations:

- Short-term work that is not part of the general scope of the company. For example, hiring a specialist to update computer programs, or a repairman for the premises.

- Temporary assistant for backlogs of cases, analysis of documentation, additional “hands” for solving assigned tasks. For example, an assistant in the HR department for sorting out paperwork, or a recruiter for mass recruitment of applicants for a short-term project.

- Consultations on running a business, project, legal issues, etc., i.e. a person whose opinion will be important for solving various business problems

- Business development by attracting new clients. This could be a network marketing option or freelance journalists and public relations specialists. The task of such people is advertising and ensuring an influx of new users.

There are some areas in which freelance workers can most often be found: information technology, consulting agencies, creative studios, design workshops, advertising agencies, communications and television.

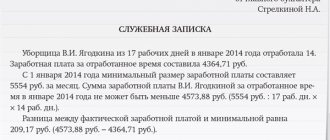

Sample documents for hiring

For a more clear example related to drawing up a contract and checking documents, we attach to the article a sample and a copy of documents that can become the basis for hiring an employee. This is purely visual information that will help you understand what the documents look like and what the main document contains. From the site citize.ru

In this article, you learned what a freelancer is. If you have any questions or problems that require the participation of lawyers, then you can seek help from the specialists of the Sherlock information and legal portal.

Editor: Igor Reshetov

How is the staffing level of an organization determined?

Sooner or later, an entrepreneur hires employees for the company. As the business grows, the organization's staffing levels also increase. The more staff you have, the more difficult it becomes to determine how many employees you actually have. You need to figure out why this indicator is needed and how to calculate it for 1 reporting period.

It often happens that the actual number of employees at an enterprise is greater than the full-time number. This is due to the involvement of temporary employees whose work is needed only periodically. Exceeding the staffing level is unacceptable only for entrepreneurs who work on the simplified taxation system (STS) or patent (PSN). On the simplified tax system the number of employees should not exceed 100, and on a patent – 15.