Power of attorney form from an individual entrepreneur: basic details

A power of attorney from an individual entrepreneur to an individual must contain the following information:

- date and place of execution of the document;

- information about the principal and the authorized person;

- powers transferred by the principal to the authorized person;

- signature of the principal.

According to Art. 186 of the Civil Code of the Russian Federation, the power of attorney must indicate the date of its preparation, otherwise the document is considered void.

The validity period is determined by the principal himself. Unless otherwise specified in the power of attorney, it is valid for 1 year from the date of preparation.

A proxy's signature is not required.

In accordance with paragraph 6 of Art. 61 of the Arbitration Procedure Code of the Russian Federation, a power of attorney from an individual entrepreneur must contain his signature and seal. If there is no seal, then the interests of an individual entrepreneur can be represented only on the basis of a notarized power of attorney.

Registration of a power of attorney from an individual entrepreneur to an individual

According to the current legislation of the Russian Federation, an individual entrepreneur should be considered an individual engaged in business. Based on this, the form of powers of attorney for individual entrepreneurs is identical to powers of attorney for other individuals.

Most powers of attorney are in simple written form and must include the following information:

- Full name of the principal.

- Number issued to the individual entrepreneur upon registration.

- Full name of the authorized person.

- An exact indication of the actions entrusted to the authorized person to perform on behalf of the individual entrepreneur.

- Duration of the power of attorney.

- An example of a principal's signature.

- IP seal (if any).

To simplify the preparation of a power of attorney, you can download a pre-prepared form by filling out the fields and indicating a number of actions under the power of attorney. This example of a power of attorney to represent the interests of an individual entrepreneur in the tax authorities will also help you write a power of attorney for an individual.

Power of attorney from an individual entrepreneur: when to use

A representative of an individual entrepreneur can contact the tax authorities only if he has a notarized power of attorney (paragraph 2, paragraph 3, article 29 of the Tax Code of the Russian Federation).

Individual entrepreneur as an employer in accordance with Part 2 of Art. 53 of the Civil Code of the Russian Federation can certify a power of attorney, including in situations where the principal as a citizen is himself (determined by the Kostroma Regional Court of June 17, 2013 in case No. 33-1047).

In this case, the individual entrepreneur’s power of attorney certificate must contain not only the individual entrepreneur’s signature, but also a seal.

Thus, in the resolution of the deputy chairman of the Sverdlovsk Regional Court dated March 7, 2014 No. 4a-257, it was noted that the magistrate legally considered the case in the absence of the offender, since the power of attorney submitted by the defense attorney, signed by the individual entrepreneur, was not sealed.

A sample power of attorney can be downloaded from the link: Power of attorney from an individual entrepreneur - sample.

What does a general power of attorney from an individual entrepreneur give? - Individual entrepreneur

Why do you need a general power of attorney from an individual entrepreneur? A power of attorney from the owner of the company is permission in writing, through which the representative has the right, on behalf of the individual entrepreneur, to carry out any activities in relation to a third party. The powers that an entrepreneur grants to his deputy can have a wide range of actions. The concept of general powers, i.e. transfer of rights is fixed at the legislative level, Art. 185 of the Civil Code of the Russian Federation.

This could be concluding a one-time transaction or receiving one-time financial resources, or permission from an individual entrepreneur to independently conclude various types of contracts on the basis of a growing company, for example, representation on a commercial basis.

Documents for resolving the interests of an individual emergency

Having in hand an authority form from the individual entrepreneur, the deputy has the right, on behalf of his boss, to carry out various schemes, receive various types of financing and material assets or finances, sign contracts and agreements and other papers necessary for the work.

An individual entrepreneur’s representative, through his competence, can receive and submit the necessary papers for any action, draw up certificates and registers, represent the interests of his boss in court, at the tax office or other institutions.

The deputy director of the company has every right to perform all necessary actions that do not contradict the law and are prescribed in the authority to represent the interests of the private owner.

Depending on the type and extent of authority, an individual entrepreneur can provide his deputy with a general power of attorney, according to which he is endowed with certain rights to carry out any transactions. General powers give the power to the trustee to perform any actions that fall within the scope of the private owner's activities.

In addition, according to the papers, the deputy can engage in commercial activities on behalf of his boss. That is, to sign and conclude commercial agreements, conduct banking transactions, and present private equity to other business partners and clients.

The deputy private entrepreneur, on the basis of the issued papers, has the right to apply on behalf of the individual entrepreneur to various government agencies and other organizations.

In addition, a general power of attorney for an individual entrepreneur provides an excellent opportunity to represent the interests of an individual entrepreneur in various authorities.

A businessman performs various legal actions every day, but sometimes there are times when he physically cannot be in some places at once. In such situations, a deputy can help him out.

The deputy will be able to personally attend various meetings or sign contracts.

But no matter how the responsibilities of the individual entrepreneur are transferred to the deputy, he is still responsible for everything that happens and completely controls the actions of his subordinate.

Registration of the State Duma

A general power of attorney from an individual entrepreneur, after approval, is drawn up by a notary; in order to receive it and other papers, you must submit the following documents, and their sample should be specified:

- certificate issued by the entrepreneur during the period of registration of the individual entrepreneur;

- a document indicating that the person is registered with the tax office;

- excerpt from the Unified State Register of Individual Entrepreneurs, the date of issue on which the document is dated, no later than a month ago.

During the procedure for registering powers, the notary checks the necessary documents, especially those that certify the identity of the individual entrepreneur, that is, passport data.

His capacity is also checked. If all indicators are normal, then the corresponding document is signed, i.e. the power of attorney itself.

The notary also officially certifies the individual entrepreneur’s signature. The person who is the authorized representative of the company owner may not be present when the paper is issued.

This is interesting: Sample objection to a court order regarding debt

Requirements for drawing up a general power of attorney

A general power of attorney from an individual entrepreneur, a sample of which can be viewed in Appendix No. 1, must meet the requirements for it. First of all, this concerns the content of such a document.

The general power of attorney document contains the following data:

- last name, first name, patronymic of the person who will perform fiduciary duties;

- all information about the preparation of the power of attorney, the place of its issuance, the time and date of execution of the document;

- tax payer identification number, as well as his state registration certificate number;

- passport details of the trustee;

- types of work and powers vested in the trustee;

- validity period of the issued paper, at least 1 year, unless another date is specified;

- emergency signature and seal, if available.

Typically, this document is issued by a businessman to a second party to manage all affairs and business, and that is why it must be formalized and in accordance with the requirements of current legislation.

But there are some nuances in the power of attorney itself, which do not need to be certified by a notary. This could include a trust document for some minor actions, an example of this is receiving finance from a partner. In this case, the document is drawn up by the individual entrepreneur himself, recorded with his signature and personal seal.

Those bosses who are involved in business need to know that the issuance of a general document gives the trustee the right to conduct any affairs and actions regarding the company. Therefore, if a trust document is needed for a specific transaction, i.e. transactions on bank accounts, then in the text of the power of attorney it is necessary to indicate exactly this action and leave a sample signature.

Do errors in a power of attorney always mean it is invalid?

The counterparty who comes into contact with the authorized person must make sure that this person is indicated in the power of attorney.

In accordance with the Decree of the Government of the Russian Federation “On approval...” dated 07/08/1997 No. 828, to identify a citizen of the Russian Federation, his full name, gender, date and place of birth are entered in the passport. Therefore, this information must be reflected in the power of attorney without errors.

As for other information, for example, the series of the passport or the date of its issue, the Presidium of the Supreme Arbitration Court of the Russian Federation in its resolution dated June 16, 2009 No. 750/09 in case No. A43-3182/2008-5-74 indicated that the list of required information (specified above ), allowing you to verify your identity using a passport, is exhaustive.

Discrepancies in the data (in particular, the date of issue) specified in the passport and the power of attorney will not be considered grounds for invalidating the document.

Thus, if the power of attorney (except for full name, gender, date and place of birth) contains passport information or any other data is unreliable, the authorized person is not deprived of his powers.

A power of attorney from an individual entrepreneur gives any adult citizen the right to represent the interests of an entrepreneur, perform 1 or several actions during the entire validity period of the document or until it is revoked. The power of attorney is drawn up in writing, and in some cases it must be notarized. A sample document and the procedure for its preparation are described in the article.

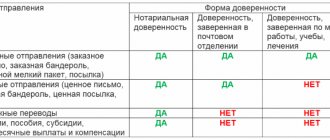

When is notarization required?

A notarized power of attorney from an individual entrepreneur is necessary in a number of cases:

- assignment of claims;

- concluding a loan agreement;

- to perform any actions that must undergo state registration;

- To draw up a transfer of power of attorney under a general power of attorney, certification by a notary is required;

- interaction with the tax authority;

- if this is a mandatory requirement of the client or organization itself.

The procedure for drawing up a paper with a notary does not take much time. It is important to immediately prepare a complete package of documents. It includes:

- passports of individual entrepreneurs and authorized representatives;

- Businessman's TIN;

- a certificate of registration of an individual entrepreneur or a record sheet from the Unified State Register of Individual Entrepreneurs for a period of no more than two months.

Source: ppt.ru

Legislative framework, purpose and types of power of attorney

According to current legislation, an individual entrepreneur is an individual, not a legal entity. This means that any citizen can register as an entrepreneur, even without the name of his own office with his own postal address. This means that a power of attorney from an individual entrepreneur is issued as a power of attorney from an individual .

In fact, an individual entrepreneur can entrust any powers or part of them to his representative. Depending on this, there are 3 types of documents - a power of attorney can be general, special and one-time.

| type | appointment | example |

| one-time | to perform 1 specific action | for example, submit a tax return once; After completing this action, the document becomes invalid |

| special | systematic execution of 1 or several actions within a specified period | regular submission of declarations for 1 year, acceptance of goods, right to sign certain financial documents |

| general | the right to perform any action on behalf of the individual entrepreneur | The individual entrepreneur transfers the entire scope of his powers to the representative for the duration of a long business trip; the person actually replaces the entrepreneur, represents his interests in all instances and before all partners |

As a rule, the following are listed as specific types of actions/authorities that an entrepreneur trusts his performer to perform:

- transfer of any reporting documents to the tax office;

- receiving goods and other valuables from the supplier;

- conclusion of any or specific types of contracts;

- receiving funds;

- the right to sign in specific documents;

- interaction with banks and other credit institutions;

- interaction with authorities, public structures;

- speaking on behalf of the individual entrepreneur, defending his position in the courts.

general power of attorney of an individual entrepreneur

from an individual entrepreneur is issued in cases where his representative will represent the interests of an individual entrepreneur in government or other organizations. from individual entrepreneurs are a special topic for consideration, since it is not entirely clear what type they belong to - powers of attorney from individuals or legal entities. The intricacies of issuing such papers will be discussed below.

General power of attorney

Visitors to the legal consultation asked 4,200 questions on the topic “General IP”. On average, the answer to a question appears within 15 minutes, and to a question we guarantee at least two answers that will begin to arrive within 5 minutes!

Good morning! The individual entrepreneur is openly trading in textiles, a general power of attorney has been written for me, I can trade on my own without getting a job at the individual entrepreneur, help is free of charge (without salary) 06.

General power of attorney from an individual entrepreneur: receipt and use

The concept of a general power of attorney, or more precisely, the transfer of rights, is contained in Article 185 of the Civil Code of the Russian Federation.

It is a written authority to perform any actions or represent interests issued by one citizen or organization to another.

Such authority can be considered general when the range of application of this document is as wide as possible. That is, a power of attorney for a car cannot be considered a general power of attorney.

General power of attorney from an individual entrepreneur

An individual entrepreneur can perform legally significant actions either personally or authorize another person to perform these actions. The powers of such a person are determined by the relevant.

The written authority of one person (principal) for representation on his behalf, issued by him to another person (attorney), is recognized.

Power of attorney to represent the interests of an individual entrepreneur

to represent the interests of an individual entrepreneur - a form issued by one person to another in order to act as a representative to a third and filled out according to the form. In accordance with Russian legislation, it can be drawn up either in simple written form or certified by a notary. There are templates for designing different types of powers of attorney.

This is interesting: Application for early termination of an insurance contract: sample

Power of attorney from an individual entrepreneur

from an individual entrepreneur - an authority formalized in writing, which is the basis for representation before third parties and in various authorities, as well as protection of the rights and interests of an individual entrepreneur by an authorized person.

The scope of powers of a representative issued by an individual entrepreneur can vary greatly: from completing one specific transaction or a one-time receipt of financial resources to independent and permanent representation on behalf of the individual entrepreneur during the conclusion of all kinds of contracts accepted in the field of entrepreneurial activity (the so-called commercial representation).

Power of attorney from individual entrepreneurs and legal entities

In the process of economic activity, most business units simply cannot do without transferring any of their powers to other persons on the basis that a rare head of a legal entity or an individual entrepreneur is able to manage to perform absolutely all legally significant actions in relation to counterparties, consumers, government agencies and municipal authorities.

Power of attorney from an individual entrepreneur to an individual: sample

One way or another, many were faced with the need to have a representative of their interests in public or private structures.

To receive a letter, certificate, money, buy a car, sell an apartment, shares in our absence for some reason, you must entrust this action to your representative.

This trust is formalized into a document - a power of attorney.

Power of attorney from individual entrepreneur

Running a business, even the smallest one, takes a lot of time. Very often situations arise when an entrepreneur needs to perform several important actions simultaneously. And you can’t do it without helpers. This problem can be easily solved with the help of a power of attorney from an individual entrepreneur.

This document is drawn up by a notary; no other power of attorney options are accepted.

How to properly issue a power of attorney from an individual entrepreneur. Form and sample filling

Power of attorney is widely used in business practice.

Starting from the moment a citizen registers as an individual entrepreneur and ends with filing an application to terminate activities as an entrepreneur, a power of attorney is a necessary tool for entrusting another person with performing any actions. Receipt and transfer of goods, submission of tax returns, representation in court and there are many other situations in which it is an irreplaceable document.

Learning to draw up a power of attorney from an individual entrepreneur

Sample power of attorney

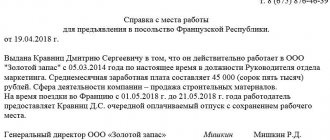

If the document is drawn up independently, it contains the following data:

- Full name of the individual entrepreneur.

- Individual entrepreneur's address, his certificate, TIN data, current account details.

- Date and place of drawing up the power of attorney.

- Name and number of the document (if necessary).

- Full name and passport details of the two parties - the entrepreneur and his representative, who must be an adult, capable citizen of the Russian Federation.

- Description of actions/powers that the individual entrepreneur entrusts to his representative. This is the most important part of the document, so special attention is paid to its preparation. They prescribe a specific list of actions and, if necessary, refer to internal documents - for example, a price list, contracts with contractors, etc.

- The document must indicate its validity period - otherwise the power of attorney will be considered to be valid for 1 year.

- You can also note whether the right of subrogation is provided. If a representative can also entrust part of his powers to another person, then he has the right of subrogation. As a rule, this option is not provided for security reasons.

- Date, seal, signature of the individual entrepreneur. A note about certification by a notary (if the parties turned to him for signature).

When drawing up a power of attorney, you can rely on such samples.

Nuances related to the power of attorney

There are several important nuances that all entrepreneurs should know. This will help prevent difficulties. Can such paper be issued to hired employees? It is considered that a special power of attorney is a document certified by the employer. It may be required for the employee to receive mail in his name.

For example, an employee wants to issue a power of attorney to another person to perform certain work. Then the person as an individual entrepreneur cannot certify this paper. It will be invalid. None of the individual entrepreneur’s employees has the right to certify the document with the individual entrepreneur’s signature, since the owner is an individual. This can only be done by a legal entity on behalf of the boss.

A power of attorney may be required depending on the specifics of the organization’s work. If an individual entrepreneur performs intermediary services, then a power of attorney must be issued permanently. To draw up a simple document, you need the signature of the manager. But there are times when printing is required. If it is not available, you must contact a notary. Typically, transaction partners do not trust unstamped forms, so this detail should be ordered.

All powers of attorney involve the transfer of powers to another person. But it should be borne in mind that responsibility still remains with the manager. If the representative made a gross mistake or violated the rights of a third party, the entrepreneur will have to answer. Therefore, it is important to choose competent specialists for these purposes. Authority must be clearly stated.

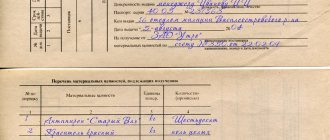

A power of attorney requires only the signature of the principal. There should be no other notes. It is imperative to keep a log of the issuance of intangible assets. You must include the form number, expiration date, information of the reporting party, and the name of the third party. This will allow you to control the procedure for issuing powers of attorney and revoke them in a timely manner.

Document validity period

As a general rule, a power of attorney from an individual entrepreneur is valid for the entire period specified in it, but no more than 3 years from the date of signing. After this time, the power of attorney must be renewed - i.e. draw up a new paper. However, even if the period is not specified for some reason, the power of attorney is still considered valid for 12 months from the date of its preparation.

Termination is determined by the revocation of the power of attorney on the part of the individual entrepreneur (he applies to the same or another notary) or the termination of the specified period. In this case, you should focus on the following rules:

- If an end date is specified, the document expires on that day before midnight local time.

- If a period is specified (for example, 2 years), the paper ceases to be valid the next day, also at midnight.

- If an event is specified as the end (for example, the transfer of documents to the tax service) - immediately after the occurrence of this event.

When you need notarization: 5 cases

The power of attorney does not have to be certified by a notary. An entrepreneur just needs to check the document data (his passport and the representative’s passport), sign and seal (if used in his work). However, the paper can be certified voluntarily at your own request. And in some cases this must be done without fail:

- If the representative will participate in a transaction that requires notarization. For example, assignment of the right of claim, rent agreement, mortgage, etc.

- If the representative performs actions that must undergo mandatory state registration. For example, any real estate transactions, registration of an individual entrepreneur or termination of its activities in this status, etc.

- If a general power of attorney is drawn up, certification is required when transferring all powers.

- If such a requirement is made by the organization itself, a partner or a client. For example, tax authorities often require a notary's signature on a document.

- A power of attorney may also be needed to open a bank account and manage the funds stored on it. In this case, it can be certified by the bank representative himself in the presence of the individual entrepreneur and his representative.

It is important to understand that if individuals decide to have the document certified by a notary, then they do not need to draw it up themselves. The notary will print out his own form, clarify the purpose of drawing up the document and draw it up in accordance with the requirements of the parties.

The document can also be certified in other ways. If an individual entrepreneur is studying or is officially employed, he can certify a power of attorney, respectively, at the place of study or work.

Thus, although in some cases certification is not a mandatory procedure, it is advisable that the power of attorney be signed by a notary. Then partners and potential clients will not have any doubts about the authenticity of the document.

Hello! In this article we will tell you in what cases an individual entrepreneur will need a power of attorney.

Today you will learn:

- What transactions require a power of attorney from the individual entrepreneur;

- In what forms can a power of attorney be drawn up?

- When the participation of a notary is mandatory when drawing up a document.

In what cases is it necessary to notarize a power of attorney?

Notarization of a tax power of attorney from an individual entrepreneur will be required in cases where there is interaction with the Federal Tax Service:

- when sending an application by courier;

- when sending registration papers by mail;

- upon delivery of the application and documents to the tax office through an authorized employee.

If a notarized power of attorney does not contain the date of its signing or the period of validity, it is considered illegal and loses its force. Other options that require notarization:

- carrying out transactions that require a specialist’s certificate - representing interests in the arbitration court, the Federal Tax Service, the Pension Fund of the Russian Federation;

- carrying out by an entrepreneur actions that are subject to mandatory state registration - opening or liquidating a business;

- opening an account in a banking institution, monetary transactions;

- when drawing up a general power of attorney;

- if another company requires notarization.

When ordering the services of a specialist, you do not need to bring an A4 sheet, he will issue a ready-made form. If a businessman is engaged in activities, also studies or is employed in any educational institution, he has every right to certify a document for receiving funds from these organizations to his authorized persons at the place of work or study.

An entrepreneur does not always and not everywhere have time to cope with many things. He can transfer part of his official duties to an employee, another citizen. A power of attorney does not have a strict form; sometimes it is drawn up in free form. It is necessary to put the date of its signing and the signatures of the parties, otherwise the paper is not considered legal.

* Prices are valid as of July 2020.

Source: samsebeip.ru

What is a power of attorney

When opening an individual entrepreneur, you must be prepared for the fact that you will need the help of other people. And here we are talking not only about hired workers. They carry out their activities in accordance with the employment contract. But sometimes they can be involved in other work that is not related to their direct responsibilities.

For example, you are in another country, and the buyer in the city where the business operates decided to transfer money for previously shipped goods. You personally will not be able to receive funds, and therefore for these purposes you need to have a reliable person.

For the buyer to be convinced that the representative you sent came from you, a verbal word will not be enough. For these purposes, there is a document called a power of attorney.

A power of attorney is a special document, the existence of which is enshrined at the legislative level. With its help, you can transfer part of your own rights to another person. And he will already represent your interests to the other side. The document is drawn up in writing.

A power of attorney to represent interests may be needed in some cases:

- If you are absent from work (sick leave, vacation, business trip, family celebrations, etc.);

- If you do not have time to cope with the volume of work (to save time, it is better to get an assistant).

When can you trust an assistant?

Let's decide whether an individual entrepreneur needs a power of attorney. The document may be needed under a variety of circumstances. There are cases of its use established by law, and those that are directly related to the intricacies of the work of your enterprise.

Main cases of using a power of attorney:

- To represent an individual entrepreneur to the tax office (for registration, liquidation, filing a declaration, obtaining certificates, consultations, etc. For example, a power of attorney to close an individual entrepreneur will allow you to liquidate the enterprise without your participation);

- To manage bank accounts (banks have developed power of attorney forms, in which you only need to enter information about the individual entrepreneur and the representative. The document allows you to withdraw money, make transfers, open or close accounts);

- Upon receipt of postal items;

- To contact local authorities;

- Receipt of goods and other valuables (such a power of attorney has a unified form of a recommendation nature, that is, it is not obligatory to use);

- To represent an individual entrepreneur in court (this can be done on a regular basis by a full-time lawyer);

- Carrying out transactions with partners (receiving money, drawing up and signing contracts);

- Buying, selling real estate or cars and other things.

As you can see, the list of operations is quite impressive. Therefore, the question of the unnecessaryness of a power of attorney in the activities of an individual entrepreneur disappears.

Types of powers of attorney

There are three main types of document:

- One-time – compiled for one operation. It can only be used once. Once the purpose of drawing up a power of attorney has been achieved, the document will be invalid. For example, you sent an employee to a buyer to receive an advance payment from him. Such a power of attorney is common among transactions of a small nature. It can also be issued to any employee if your main assistant cannot currently cope with the assignment;

- Special – a power of attorney that is aimed at carrying out activities in a particular area. Let's say you want a lawyer in your firm to always represent your interests in court. Special ones include the type of bank power of attorney, a document for representation in the tax authorities. You can give a power of attorney to the company’s accountant so that he will receive money for you all the time. If the company has a forwarder, then he is also able to make purchases on your behalf);

- A general power of attorney is the most important power of attorney. It must be registered with a notary. Its reliability is always easy to check through a special registry. The document is entered into the official database and is almost impossible to falsify. A power of attorney is required if you give broad powers to another person. For example, you sell a building, a car through a representative, or give the right to manage your own business (power of attorney for running an individual entrepreneur).

What else could a power of attorney be?

Powers of attorney are divided not only by scope, but also by form of preparation.

In this regard, there are two types:

- Simple - compiled by the individual entrepreneur himself. It does not have any strict template for filling out. Compiled in free form. Such a document has limited validity. Not all authorities and business partners accept such a power of attorney. Most often it is one-time in nature. Certifies the power of attorney of the individual entrepreneur with his signature;

- Notarized - such a power of attorney is more reliable than the first option. It inspires the trust of others, and in some cases its use is subject to legal restrictions. In other words, when performing a certain list of operations, you cannot neglect drawing up a notarized power of attorney. For example, you can close an individual entrepreneur only with a notarized power of attorney.

Power of attorney from the individual entrepreneur to the tax office

To represent his interests in the tax authorities, an individual entrepreneur must issue his representative a power of attorney, executed by a notary, since, as mentioned above, for the Tax Inspectorate, an individual entrepreneur is an individual.

This position is supported not only by numerous information letters from the Ministry of Finance of Russia and the Federal Tax Service of Russia, but also by the Plenum of the Supreme Arbitration Court of the Russian Federation. The need to use a notarized power of attorney for entrepreneurs in tax legal relations is confirmed by its Resolution No. 57 of July 30, 2013.

Thus, an individual entrepreneur who, for example, entrusts accounting and preparation of tax returns and other documents for the tax inspectorate, must take care in advance of preparing a notarized power of attorney.

Why contact a notary

In some cases, the law regulates the relations of the parties through a notarized power of attorney.

This document is required if:

- Applying to the tax office (opening and closing a business);

- Drawing up a lease agreement and further actions related to it;

- Signing a mortgage agreement;

- Transfer of rights to dispose of property and some others.

This means that if your representative comes to the tax office without a power of attorney to liquidate the individual entrepreneur, he will be denied registration. This is a legal basis. All government bodies must be contacted through a representative with a notarized power of attorney.

Such a document is drawn up on a special generally accepted form with an arbitrary listing of the rights transferred to a third party. A power of attorney is issued for a fee established by legislative acts.

Reasons for contacting a notary

In several situations, the law establishes the relationship of the parties using a notarized power of attorney. This paper is required during:

- Appeals to the tax service.

- Drawing up a rental agreement.

- Signing a mortgage.

- Transfer of rights to dispose of property.

To apply to all government agencies you need notary paper. A sample power of attorney from an individual entrepreneur to an individual will help you draw up the document correctly. A mandatory item will be a list of rights that are transferred to a third party.

Validity periods

Any power of attorney must indicate the date of its preparation. Otherwise, the document is considered invalid, and the rights transferred under it are not valid. If the other party to the transaction did not notice the absence of a date on the power of attorney and drew up an agreement on the basis of the latter, it is also invalid.

The power of attorney may have a validity period specified by you. For example, you can delegate powers to another person for two weeks or 1.5 years. This period must be indicated in the power of attorney. If the period is not indicated in the document, then the power of attorney continues for a year.

Previously, the document could have a maximum period of 3 years. Today it is not installed. Such a power of attorney is considered unlimited. Its end date will be considered the day on which you yourself revoke the document. Such a power of attorney is often used for representatives located in other countries.

What is stated in the power of attorney

As such, there is no generally accepted unified form for filling out a power of attorney. But there are details whose inclusion in it is mandatory.

The document must contain:

- Document number (usually indicated with a notarized power of attorney. If you are drawing up a simple form, you can also record its number and indicate it in the internal reporting of the individual entrepreneur);

- Date of preparation (mandatory details, without which the document will not be accepted by a third party);

- Information about the principal (about the individual entrepreneur transferring powers. Indicate TIN and registration number);

- For whom the form was issued (indicate the name of the government body, the name of the company or the full name of the person);

- To whom the document was issued (his passport details);

- Validity period (if necessary);

- Place of registration (locality);

- Rights vested in the representative (specific actions. Phrases must clearly describe each power. Their meaning cannot be understood in two ways);

- Compiler's signature;

- IP stamp (if necessary).

Some subtleties associated with a power of attorney

There are several important points that every individual entrepreneur should know. They will avoid many difficulties and misunderstandings on the part of third parties and representatives.

Let's find out whether an individual entrepreneur can issue a power of attorney to hired employees. It is generally accepted that a special power of attorney refers to a document certified by the employer. It may be needed, for example, when an employee receives mail in his name. That is, your employee wants to grant a power of attorney to another person to carry out some personal matters.

In this case, you, as an individual entrepreneur, do not have the right to certify such a power of attorney. It will be considered invalid. None of the employees working for the individual entrepreneur can certify the document with the signature of the individual entrepreneur, since the owner of the enterprise here is an individual. Only a legal entity on behalf of the manager can certify such forms.

Perhaps at some point one of your relatives will need to issue a power of attorney for you. This is not forbidden. Drawing up a power of attorney with your participation may be necessary due to the specifics of the enterprise. If your individual entrepreneur provides intermediary services, then a power of attorney will often be issued in your name.

A simple power of attorney form for an individual often requires only your signature. But there are cases in which printing is necessary. If your company does not have one, then you will have to contact a notary to draw up a power of attorney. Sometimes transaction partners may not trust unstamped forms, so if possible, order this information.

Each power of attorney transfers some powers to another person. But you must understand that all responsibility for the consequences of the transaction falls on your shoulders. If the representative made some serious mistake or violated the rights of a third party, then you will have to answer in court.

By the way, they can assign you a term, but the representative will go unpunished. Therefore, always choose competent and reliable assistants. Clearly indicate your credentials and do not write anything unnecessary. Any entry may result in an abuse of your own rights.

A power of attorney requires only the signature of the principal. There should not be any notes from the representative in it.

Be sure to keep a log of the issuance of intangible assets. Indicate the number of the issued form, its validity period, details of the accountable person and the name of the third party. This way you can control the process of issuing powers of attorney and revoke them in a timely manner.

Correct formation of a power of attorney from an individual entrepreneur to conduct business

According to legislative norms, an individual entrepreneur is an individual who has the right to engage in entrepreneurial activities, which means the form of the power of attorney is identical to documents drawn up on behalf of individuals.

A power of attorney to represent the interests of an individual entrepreneur to an individual must contain the following columns:

- Full name of the principal and his details;

- Registration number as an individual entrepreneur;

- Full name, address and passport details of the trusted individual;

- An exact list of acceptable actions on the part of the trustee;

- Duration of the power of attorney;

- Date of preparation;

- Signature of the principal;

- Print if available.

Important: when drawing up a power of attorney, the principal of the individual entrepreneur must understand that responsibility for all actions falls on his shoulders, since the proxy will act on his behalf.

Most of the powers of attorney from individual entrepreneurs issued to an individual are drawn up in simple written form, however, if the need arises, it is permissible to use a standard form for such a power of attorney and fill out the necessary fields.

How to draw up a power of attorney

The process of drawing up a simple document form consists of several stages:

- You understand that you will not be able to carry out any actions on behalf of the individual entrepreneur in the near future and are looking for a trusted person;

- It is necessary to collect information about the third party and take the representative’s passport;

- Fill in information about the parties to the transaction;

- Indicate a list of actions that can be carried out by an authorized representative of an individual entrepreneur;

- Enter all required details;

- Put your personal signature and seal (the latter is optional).

If a notarial form is drawn up, for example, to open an individual entrepreneur by power of attorney, then the steps will be as follows:

- Together with your representative, go to any notary company (you must have documents for the individual entrepreneur and the passport of the authorized person with you);

- The notary will enter all information about the parties into the form;

- Further, from your words, credentials are entered;

- After entering all the data, you check the form for errors;

- Give the documents and stamping forms to the notary for signing (you can also draw up several powers of attorney)

- The notary enters the power of attorney number into a special register;

- The form is immediately given to you (you can also ask for a certified copy of the power of attorney).

The document comes into force immediately after its certification. From now on, your representative can perform some operations on behalf of the individual entrepreneur.