Rate this post

When dismissing an employee, it is important to promptly and fully issue him the documents required by law. One of such documents are extracts from SVZ-M reports. Failure to provide them threatens the employer with serious consequences. However, avoiding troubles is not difficult - all you need to do is take a few simple steps.

One of the main elements of social protection of the population upon reaching a working age is pension payments. At the same time, the mere fact of reaching a certain age is not the basis for granting a pension. One of the essential conditions is the presence of the required insurance period, during which pension insurance payments were made to the employee.

Why do you need a SZV-M certificate when dismissing a worker?

SVZ-M is a report submitted monthly by the employer to the Pension Fund of Russia, confirming that the persons indicated in it received income subject to insurance contributions during the specified period.

Having such documents with an employee will help him in the future prove his insurance experience when controversial issues arise when determining the amount of his pension.

Extracts from the document

Upon dismissal, the employee is given extracts from reports for the entire period of his work starting from April 2020 (the first reporting period on this form).

Since the report for the period in which the employee is dismissed will be submitted to the Pension Fund only next month, a separate report is prepared for the employee for the month of his dismissal.

The statements must contain information only about the dismissed employee. Including other persons or providing copies of full reports would be a violation of personal data.

Example of filling and sample

The SZV-M report form is unified and approved by Pension Fund Resolution No. 83p dated February 1, 2016. The form consists of 4 sections:

When filling out reports, the question often arises: should dismissed employees be included in the report? The company terminates the employment relationship with the employee on the day of dismissal. In the month in which a person is fired, he must be included in the report, but not in the next month.

Here is an example of step-by-step filling out the SZV-M form.

Sidorov I.I. expelled on June 22, 2020. The accounting department sends the report to SZV-M for the month of June, including Sidorov I.I.

Section 1 . Here you fill in information about the enterprise: registration number in the Pension Fund of the Russian Federation, name of the enterprise, INN, KPP.

Section 2 . This section displays the reporting period for which the report is being compiled.

Section 3 . The form type from the suggested codes is displayed. In this option, the code “source” is written

Section 4 . Here the data is displayed in a table in the form of a list of insured workers enrolled in the enterprise, displaying their personalized information, SNILS and INN.

In the next report for the month of June 2020, the accounting department of the enterprise will no longer include Ivan Ivanovich Sidorov.

Below is a completed sample of the SZV-M form.

To learn in more detail how to fill out the SZV-M form, you are invited to watch the video

https://youtu.be/4qJgynIFB80

( Video : “We compose and present the new SZV-M form”)

You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.

The round table will focus on the All-Russian medical examination of the adult population and control over its implementation; popularization of medical examinations and medical examinations; universal vaccination, etc.

The program was developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form.

How to properly prepare a report (step by step)

The rules for filling out the SZV-M form for issuance to an employee generally correspond to the requirements for filling out the SVZ-M form when it is submitted to the Pension Fund.

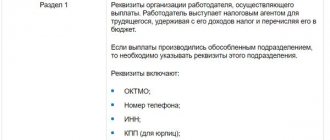

Section 1 indicates the registration number of the employer in the Pension Fund of the Russian Federation, its short name (last name, first name, patronymic of the individual entrepreneur), TIN and KPP, in section 2 - the month and year corresponding to the reporting period, in section 3 - the type of form “iskhd” (original ).

Section 4 is filled in with information about the employee - last name, first name, patronymic, SNILS and INN. In the first column of the table “P/n” the employee number must correspond to the number in the general report for this period.

The data provided must be certified by the head of the organization, individual entrepreneur or authorized person.

Sample form SZV-M for an employee upon dismissal

Form SZV-M for an employee upon dismissal can be found here.

Issuance of the completed form

It is very important for the employer not only to correctly fill out the SZV-M report, but also to issue it to the resigning employee on time.

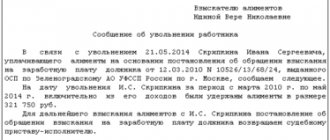

This will help avoid various disagreements and conflicts that could escalate into litigation. The resigning employee must be given a completed SZV-M form. However, situations may arise in which a former employee will deny the receipt of such a document. In order to avoid such conflict situations, it is necessary to document the issuance of the report. You can do this in several ways:

- Issue several identical copies of the statement at once. In this case, the resigning employee is required to put his signature on the document that will remain in the custody of the manager. This will confirm that the report was received, and if necessary, the employer will be able to prove it without any problems.

- Ask the employee to write a receipt indicating the fact that the document was issued. In the future, it can be used if any conflict situations or disputes arise.

- Create an appropriate journal in which employees will sign upon receipt of any documents.

An employer that complies with the law is obliged not only to provide all information about employees to the Pension Fund, but also to issue statements to all employees, including those resigning. However, such behavior by a leader is rather an exception to the rule. Most unscrupulous owners of firms and companies neglect this responsibility and rarely issue the necessary statements. The main reasons for this are:

- There is no need to obtain it. An extract can be useful only in cases where it is necessary to show it to a third party and prove the fact of work for a certain period.

- Absence of administrative and criminal penalties for failure to fulfill such obligations. The only exception is the failure to issue the necessary documents to leaving or retiring employees.

An employee can at any time demand that the manager provide him with all the necessary documents and extracts. If he refuses an employee without well-founded reasons, then you can safely turn to law enforcement agencies and the courts for help.

The SZVM report upon dismissal of an employee is prepared quite quickly and simply. In this case, the manager must correctly fill out all sections of the document and register the necessary details. If everything is done correctly, you can significantly speed up the paperwork process and leave your place of work as soon as possible.

When an employee is dismissed, the SZV-M is drawn up in the usual form; the report contains 4 sections.

Section 1

The first section contains information about the policyholder, i.e. about your company. The section is subject to mandatory completion; it indicates the registration number in the Pension Fund of Russia, short name, checkpoint and tax identification number of the company.

Section 2

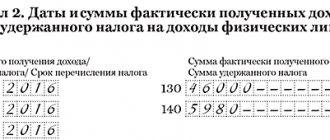

The second section contains information about the period for which the form is being compiled.

As mentioned above, the report is compiled for all periods of work, thus, 1 report – 1 period.

If an employee is dismissed in the middle of the month, issue him a SZV-M report, indicating in section 2 the reporting period code corresponding to the month of dismissal.

For example, if you resign in August 2020, indicate the reporting period is 08, the calendar year is 2020.

Section 3

In the third section, enter the code “ref”.

Section 4

In the fourth section, indicate the information of the dismissed person - full name of the employee, SNILS number, and TIN.

See below for an example of filling out a report.

When dismissing an employee, should I issue SZV-M or not? A common question that arises from employers. In April 2020, an innovation appeared - upon dismissal, in addition to 2-NDFL certificates and average earnings, the accountant must provide SZV-M. This is mandatory, as it is prescribed by law (Federal Law No. 27).

SZV-M upon dismissal of an employee This document indicates the employee’s length of service, and it does not matter what type of agreement was signed with him. The point is that the employer (the policyholder) pays contributions for the employee even for 1 day worked. In the future, this certificate will be needed for the correct calculation of pension payments.

Responsibility for failure to issue SZV-M

If an employer does not provide the required information within the prescribed period or provides incomplete or unreliable information, he may be subject to a fine of 500 rubles for each violation.

If an employee files a complaint with regulatory authorities or a court, failure to issue a certificate may be regarded as a violation of labor laws. A person who commits such a violation may be given a warning. Also, an administrative fine may be imposed on an individual and legal entity, the amount of which (when imposing a penalty for the first time) is from 1 to 5 thousand rubles for officials and individual entrepreneurs, from 30 to 50 thousand rubles for organizations.

The legislative framework

- Article 11 “Providing information on insurance premiums and insurance experience” of the Federal Law of 01.04.1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system.” Establishes a requirement to provide the employee on the day of his dismissal with the information necessary for the correct assignment of insurance and funded pensions to him (clause 4), and a list of such information (clauses 2-2.3).

- Article 17 “Responsibility of bodies and officials of the Pension Fund of the Russian Federation, policyholders and insured persons, writing off bad debts due to fines.” Determines the amount of financial sanctions if such information is not provided within the prescribed period, is presented incompletely or does not correspond to reality.

- Article 62 of the Labor Code of the Russian Federation “Issuance of work-related documents and their copies.” Establishes requirements for the procedure for issuing copies of documents.

- Decree of the Presidium of the USSR Armed Forces of August 4, 1983 No. 9779-X “On the procedure for issuing and certification by enterprises, institutions and organizations of copies of documents relating to the rights of citizens.” Establishes authorized persons who have the right to certify copies of an organization’s documents, as well as the procedure for their actions when certifying a copy.

- Article 5.27 of the Code of Administrative Offenses “Violation of labor legislation and other regulatory legal acts containing labor law norms.” Establishes liability for violation of labor laws.

Online magazine for accountants

SZV-M, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p):

- employment contracts;

- GPC agreements for the performance of work and provision of services;

- other types of contracts listed in clause 2.2 of Art. 11 of Law No. 27-FZ.

Copies of SZV-M information are transferred by the policyholder to the insured person no later than 5 calendar days from the date of his application, and in case of dismissal - on the day of dismissal of the insured person or on the day of termination of the civil contract (clause 4 of article 11 of Law No. 27-FZ) . The SZV-M form is submitted by the employer to the Pension Fund of Russia on a monthly basis no later than the 15th day of the month following the reporting period - month (clauses 1, 2.2 of Art.

11 of Law No. 27-FZ). Consequently, the issuance of information to the insured person reflected in the SZV-M is not linked in Law No. 27-FZ to the deadlines for its submission to the Pension Fund of Russia. In paragraph 4 of Art. It said that a copy of the SZV-M had to be given to employees within the time limit established for submitting the SZV-M. That is, employers were required to issue copies no later than the 10th day of the month following the reporting month.

- performers (contractors) - it was necessary to issue a copy of the SZV-M on the day of termination of the civil contract;

- for those who quit – on the day of dismissal;

- for those who retire - within 10 calendar days from the date when the employee submits an application that he requires documents to be submitted to the Pension Fund.

What were the difficulties? The obligation to issue copies of SZV-M to employees and contractors caused many complaints from accountants.