The concept of targeted financing

Targeted financing is the allocation of funds for the implementation of strictly defined goals with the ability to control expenses. It could be:

- conducting scientific research;

- capital construction;

- organization of events;

- development of a new line of activity, etc.

According to the sources of funds received, financing is distinguished:

at the expense of the budget (state):

- subsidies - for example, to compensate for housing and communal services costs;

- transfers – for the construction of capital construction projects;

- grants – for carrying out research work.

at the expense of non-governmental organizations:

- scholarships;

- grants;

- investments.

If the financing conditions are met, the funds received become their own, otherwise they will have to be returned, “getting into” accounts payable.

Account 86 in accounting

An important aspect of accounting for these funds is the competent determination of their purpose and purpose in accordance with the agreement.

Sources of financing activities (funds for special purposes) are reflected in credit 86 of the accounting account, and their use itself is reflected in debit:

Subventions are funds from the budget that are provided on the condition of shared financing of targeted expenses to a legal entity (in order to reduce production costs) or to an individual, or to the budget of another level of the RF BS.

Analytical accounting of target funds is carried out according to their purpose and sources of income.

Attention! It is prohibited to use designated funds for other purposes.

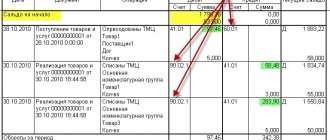

Postings to reflect target financing on account 86

In general, accounting entries for account 86 in commercial organizations look like this:

- Dt76 – Kt86 – reflects the receipt of targeted funds;

- Dt86 – Kt98 – target money is reflected as prospective income;

- Dt60 – Kt51 – payment has been made to the supplier for materials or goods;

- Dt10 – Kt60 – materials or goods delivered to the receipt;

- Dt20 – Kt10 – materials are written off;

- Dt91 – Kt20 – expense account is closed;

- Dt98 – Kt91 – targeted funds are reflected in the line of other income.

Records of the movement of received amounts depend on the nature of the activity of the economic entity. Thus, non-profit organizations can directly reflect the receipt of materials by posting Dt86 - Kt20 .

How to close account 86 at the end – Lawyer

Categories Account 86 reflects information on receipts and expenditures:

- State assistance and amounts provided in a similar manner by other persons in the form of subsidies and subventions.

- Non-repayable loans.

- Amounts for events.

- Various resources.

Subventions are cash receipts intended for strictly defined purposes. If they are not realized, then the amounts must be returned. Subsidies can be either in-kind or cash payments. If they are not used for the intended purpose, they are usually not returned.

State assistance should be understood as direct actions of an economic nature aimed at increasing benefits for the enterprise. They involve issuing subsidies to the company, subventions, direct financing of certain activities, as well as providing non-repayable loans.

86 in the form of receivables of the entity or budget that has undertaken the obligation to provide it.

https://youtu.be/LZbG5HSGfmU

In this case, the receipt of amounts will be shown in correspondence with the account. 76, summarizing data on settlements with creditors/debtors aimed at fulfilling previously fulfilled obligations.

Meanwhile, it must be remembered that the reflection of financing at the time of provision can only be carried out when there are formal and clear obligations, the repayment of which can be demanded in court.

The question of benefits Often, specialists have difficulties with reporting.

Account 86: targeted financing. example, wiring

Direct financing is the covering by government or other bodies of the costs of an enterprise that it might have incurred if it had not received such assistance. Key areas of spending Targeted funding is used for:

- Paying off costs or covering losses.

- Maintaining the financial position of the company, replenishing its capital.

- Asset acquisitions.

What does the balance show and how is account 86 closed?

The credit part of account 86 displays the amount of funds allocated to the company under the terms of targeted financing. Its debit part reflects the unused balance, which will be spent in the future or returned to the investor.

In a standard situation, when the funds received under the contract were spent on the implementation of contractual goals in full, no additional entries are required to close the account. If the funds remain, then the accountant will have to reflect their further movement:

- if the balance can be used by the company at its own discretion, then posting Dt86 - Kt90 (sales) or Dt86 - Kt91 (other income) will be required;

- if the balance must be returned to the “sponsor”, then the posting looks different - Dt86 - Kt51 (non-cash payment), Dt86 - Kt50 (cash payment), Dt86 - Kt52 (payments in foreign currency).

Explanations

Targeted financing is the gratuitous receipt of money, which can only be spent according to the program provided by the entity that allocated it. Simply put, the ability to spend the received amounts is limited by certain conditions. When fulfilled, the funds become the property of the enterprise. If the established conditions are not met, the company must return all amounts received. In this case, they will be classified as accounts payable.

Key spending areas

Targeted funding is used for:

- Paying off costs or covering losses.

- Maintaining the financial position of the company, replenishing its capital.

- Asset acquisitions.

- Help received in the form of benefits, tax credits, exemptions and holidays.

- Acceptance of loans and other repayable loans.

- Expenses on operations related to the management of state property and state participation in the company’s assets.

The indicated amounts are not included in account 86.

Video lesson “Accounting for target financing”: postings, examples

Video lesson about accounting in an organization using account 86 “Targeted financing”. Practical examples with accounting entries are analyzed. The lesson is taught by the teacher of the “Accounting and Tax Accounting” website, chief accountant Gandeva N.V. ⇓

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Conditions

Accounting for targeted financing is carried out in the following cases:

- There is reasonable confidence that the procedure for providing assistance will be followed by the enterprise.

- The company has every reason to believe that the amounts will be received.

The fulfillment of the first condition will depend on the capabilities and intentions of the company's management to use assistance. Confidence in compliance with the procedure for its provision is determined in the process of analyzing relevant public decisions, contracts, design estimates and technical and economic documents. Reasons to believe that amounts will actually be received depend on receiving reliable information about the transfer of assets, repayment of debts, notifications of appropriations, and so on.

Account 98 in the Chart of Accounts

According to the order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, which approved the Chart of Accounts for the financial and economic activities of organizations and the Instructions for its application, accounting account 98 is the so-called deferred income.

They resort to using count 98 to summarize information about:

- income received (accrued) in the reporting period, but relating to future reporting periods;

- upcoming receipts of debt for shortfalls identified in the reporting period for previous years;

- the differences between the amount to be recovered from the guilty parties and the value of the valuables accepted for accounting when shortages and damage are identified.

If we talk about whether account 98 is active or passive, then the correct second answer is: it has a balance at the beginning of the period or its end only on credit .

In the balance sheet, the credit balance of account 98 as of the reporting date is reflected on line 1530.

The use of account 98 is especially relevant in relation to:

- accounting for fixed assets and other property received free of charge;

- accounting of budgetary funds;

- expected revenues under the leasing agreement.

Also see “Features of cost accounting under a leasing agreement.”

Question about benefits

Often, specialists have difficulties with reporting. They are due to the ambiguity of the moment regarding the beginning of receiving benefits. In particular, it is not clear whether this happens when the amounts are received, or when they begin to make a profit? In the first case, the benefit arises when the right to financing appears, or the funds have already been received. This will depend on the chosen company policy. If the second option is accepted, then it is considered that the money is used not when it is received, but when the enterprise begins to make a profit. In this case, the following entries will be made:

- db sch. 51

- Kd sch. 86.

This is how the receipt of money is reflected. For simplicity, you can skip the intermediate article 76:

- db sch. 08.4 (“Acquisition of OS”)

- Kd sch. 51 (“Current accounts”).

This is how payment for purchased fixed assets is shown. Their posting is reflected below:

- db sch. 01

- Kd sch. 08.4.

It should be noted that all acquisitions of fixed assets through assistance do not reduce its volume. During the operation of objects, depreciation is accrued:

- db sch. 26

- Kd sch. 02.

Only after reflecting all these operations does the enterprise begin to absorb the assistance received:

- db sch. 86

- Kd sch. 91.1.

In this case, funding will decrease not during the process of spending funds, but throughout the operation of the OS facility. As mentioned above, assistance can be provided not only in cash, but also in kind. For example, materials were provided free of charge. In this case, the wiring will be like this:

- db sch. 10

- Kd sch. 86.

After the materials are written off, a new record is made. It will be as follows:

- db sch. 20 (“Main production”)

- Kd sch. 10.

- db sch. 86

- Kd sch. 91.1.

Features and tasks of accounting in non-profit organizations

In the NPO, the receipt of computers will be reflected by the posting: Date Account Dr Account Kt Amount Contents of the transaction Document 10/15/2014 10/ “Property for free transfer” 86 200000 Free receipt of computers Invoice, invoice Use of earmarked funds The use of earmarked funds is carried out strictly in accordance with the estimate NPO to finance the costs of its maintenance and implementation of its statutory activities. Example 4 - purchase of a car On October 15, 2014, the NPO, according to the approved estimate, partially allocated targeted funds for the purchase of a car in the amount of 600,000 rubles. for management purposes of the organization.

Accounting in non-profit organizations (examples)

Attention

These transactions were reflected as follows: Date Account Dr Account Kt Amount Contents of the transaction Document 10/15/2014 60 51 250000 The invoice issued by the seller for children's clothing was paid Invoice 10/15/2014 10 60 250000 Received children's clothing was accepted for accounting Accounting certificate 10/15/2014 8 6 10 250000 Transfer of children's clothing to an orphanage Agreement 10/15/2014 60 51 1500000 Payment for building repairs Agreement, invoice 10/15/2014 86 60 1500000 Write-off of the repair amount from earmarked funds Accounting statement Example 6 - paid services of non-profit organizations In this example, we will look at how to write off financial result of the commercial activities of the NPO.

Let’s say an NPO provides paid services, the income for which in 2014 amounted to 600,000 rubles.

At the same time, the costs of carrying out this type of activity amount to 400,000 rubles.