Staffing is a staffing plan. Some companies neglect it, but the State Tax Inspectorate may consider this a violation.

In practice, staffing is necessary and helps the employer both for internal control and management, and when communicating with inspection authorities. Today we understand the aspects of preparing and maintaining the document: we draw up the staffing schedule for 2020 in accordance with all the rules.

It is worth noting that when drawing up all internal company documents, it is important to correctly indicate the names of positions, professions and specialties of employees. As noted in part 2 of Art. 57 of the Labor Code of the Russian Federation, if work in a certain position is associated with restrictions or involves the presence of benefits, the name of this position (specialty, profession) must strictly correspond to the name contained in the professional standard or qualification directory.

Accuracy in the job title is very important for an employee when applying for preferential pension benefits. The most important condition for the provision of pension benefits is the exact correspondence of the entries on the names of positions and professions indicated in the work books of employees and the staffing table, with Lists No. 1 and No. 2 of production, work, professions, positions and indicators that give the right to count on preferential pension provision, which are approved Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10.

What are the consequences of lack of staffing?

Since this form is only advisory, many employers are wondering how mandatory it is. The answer is simple. Organizations are usually asked to provide this internal document to labor and tax inspectors during inspections. Despite the fact that there is no direct indication of its mandatory nature in the Labor Code, there is a mention in Articles 15 and others of the Labor Code of the Russian Federation, and from this the State Tax Inspectorate draws a conclusion that the document is mandatory. Its absence is interpreted as a violation of labor and labor protection legislation. For such a violation, the official is fined 1000-5000 rubles, the organization - in the amount of 30,000 to 50,000 rubles (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

This document helps to justify the dismissal of employees due to staff reduction when considering a case in court. Without this document, it is difficult for the employer to prove that the dismissal is justified. It is also impossible to prove that at the time of dismissal there were no vacancies in the organization that needed to be offered to laid-off employees (the employer is obliged to offer other jobs during layoffs under Article 179 of the Labor Code of the Russian Federation; for this they must be indicated on the staff).

Is it necessary to indicate the salary amount?

How much an employee will receive for a specific position will depend on the rules established in the remuneration system of a given employer (Article 135 of the Labor Code of the Russian Federation). This issue is given a separate paragraph in the TD.

In Art. 57 of the Labor Code of the Russian Federation states that information about the amount of an employee’s earnings must be entered into the TD , including the size of the tariff rate or salary of the official, as well as all other additional remunerations. Thus, the document must clearly indicate the amounts of payments that are due to the employee for the performance of his work duties.

Drawing up a TD indicating an incorrect amount of earnings with reference to internal regulations is a violation of the law.

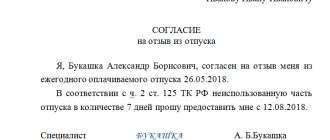

Does the contract include information about allowances?

The enterprise may establish various additional payments for employees (additional payments, allowances, bonuses). Their size can be indicated:

- in TD between the employee and the employer;

- in the form of a link to an internal regulatory document in the organization or a collective TD that establishes them.

If the salary amount must be indicated in the TD, then the amount of incentive payments can only be contained in local regulatory documents (Rostrud Letter No. 428-6-1 dated March 22, 2012).

The employee must be familiar with the types and amounts of incentive payments against signature (Article 68 of the Labor Code of the Russian Federation).

To solve your problem, contact our lawyer via online chat. #Stay home and good health to you!

Ask a Question

Who compiles and maintains the staffing schedule and how?

Generally speaking, drawing up documentation of this kind is the function and sacred duty of a labor economist from the department of organization and remuneration (Qualification reference book for positions of managers, specialists and other employees, Resolution of the Ministry of Labor of Russia No. 37 of 08/21/1998). This specialist will be helped in his work by a sample of filling out the staffing table 2020: it clearly shows the procedure for maintaining and filling out the document.

However, in fact, personnel records are kept by accountants, personnel officers and lawyers, who have to figure out how to calculate the number of rates. Since the staffing table is a regulatory document of the organization approved by the top management, which formalizes the structure and number of employees, indicating the amount of salary depending on the position held, the head of the company and the chief accountant are officially responsible for the document, since they sign it.

An important question is when is the staffing schedule for the next year approved? This form is drawn up for any period, but usually it is done for a year and is reviewed each time at the beginning of the year. In order for this procedure to go smoothly every time, it is worth describing it in the office work instructions and indicating:

- terms and rules for developing and introducing changes;

- form of order for staff approval;

- persons responsible for the formation and signing;

- the composition of the legal and local regulations of the employer on the basis of which the document is created;

- employees with whom it is necessary to coordinate the draft document and changes to it.

Enter the site

RSS Print

Category : Labor legislation Replies : 13

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev.1 Next → Last (2) »

| Olga [email protected] Minsk Wrote 172 messages Write a private message Reputation: | |

| The situation is this: The chairman of the joint venture enters into an employment contract with the director and specifies in it the amount of wages (for example, 100,000 rubles). A little later, the staffing table is approved, where wages based on the unified technical system are much higher. The same situation is with an accountant. The employment contract was not brought into line with the staffing schedule, i.e. This is how the labor contract states one amount, and the regular amount is different. At the same time, the salaries of the director and accountant were calculated according to the staffing table. At the moment, the founders are accusing the director and accountant of the amounts accrued and paid in excess (the discrepancy between the amounts and the employment contract) and demanding that the difference be returned. Having looked at Article 1 of the Labor Code, which states that an employment contract is an agreement between an employee and an employer, according to which the employee undertakes to perform work in a certain one or more professions, specialties or positions of appropriate qualifications in accordance with the staffing table and comply with internal labor regulations...... .. there would be no doubt that the accrual of salary must be carried out according to the standard. But does it matter that this commercial organization belongs to an organization with foreign investment, and should they necessarily apply the UTS? In this case, will it be possible to recover the excessively accrued and paid salary from the guilty persons? Thanks in advance. | |

| I want to draw the moderator's attention to this message because: Notification is being sent... |

| Mr. Dismantler [email hidden] Belarus, Minsk Wrote 17763 messages Write a private message Reputation: 2234 | #2[68475] March 23, 2009, 10:49 pm |

; to repay an unspent and not timely returned advance issued for a business trip or transfer to another location, for business needs, unless the employee disputes the grounds and amount of the withholding. In these cases, the employer has the right to make a deduction order no later than one month from the date of expiration of the period established for the return of the advance payment, repayment of the debt, or from the date of the incorrectly calculated payment; 2) upon dismissal of an employee before the end of the working year for which he has already received labor leave, for unworked vacation days. Deductions for these days are not made if the employee quits on the grounds specified in paragraphs 1, 2, 4 and 5 of Article 35, paragraphs 1, 2 and 6 of Article 42, paragraphs 1, 2 and 6 of Article 44 of this Code, at his own request in connection with training or retirement, as well as if upon dismissal the employee is not accrued any payments or if the employer, having the right to do so, did not make deductions when paying the settlement or withheld only part of the employee’s debt; 3) in case of compensation for damage caused by the fault of the employee to the employer in an amount not exceeding his average monthly earnings (part one of Article 408).

Wages overpaid to an employee by an employer, including due to incorrect application of the law, cannot be recovered from him, except in cases of accounting error.

The employer, in cases provided for by law, is obliged to make deductions from the employee’s wages upon his written application for non-cash payments. I want to draw the moderator's attention to this message because:

Notification is being sent...

EVERYTHING WILL BE FINE! AND VERY SOON! INCLUDING WITH US!| Olga [email protected] Minsk Wrote 172 messages Write a private message Reputation: | #3[68866] March 24, 2009, 15:40 |

Notification is being sent...

| VyacheslavV [email hidden] Belarus, Vitebsk Wrote 9692 messages Write a private message Reputation: 1077 | #4[68877] March 24, 2009, 3:47 pm |

Notification is being sent...

| Mr. Dismantler [email hidden] Belarus, Minsk Wrote 17763 messages Write a private message Reputation: 2234 | #5[68939] March 24, 2009, 21:41 |

Olga wrote:

Parkhim, from your post it follows that if the labor contract specifies a salary that does not correspond to the staffing table, but the staffing schedule is drawn up taking into account the requirements of the UTS, then the labor contract applies in any case? And since when did accounting use the basis for calculating salary? are employment contracts? I thought that staffing was the basis for accruals.

Vyacheslav wrote:

the official salary in the contract should be the same as it is established in the staffing table. After all, before hiring, you must first enter the position into the staffing table with the establishment of the official salary. And it turns out you took the salary at random, wrote it in the contract and that’s it

It has never been (and should not be) and no regulatory documents stipulate that the staffing table is the basis for the accounting department for calculating wages! I waged this “war” with accounting in many organizations and, in most cases, successfully. Another thing is that it is more convenient for accounting departments to carry out calculations in their accounting programs, based on data from a detailed staffing table. Or better yet, a regular book. She always became a stumbling block between me and the payroll accountants. I never get “greedy” and provide a detailed staff book to accountants, realizing that it’s easier for them to work (in one organization it got to the point where payroll accountants began to simply transfer the numbers from the staff book into the program and calculate wages for the actual time worked! ), but when complaints against me begin that on the first day of the month following the reporting month, I have not yet presented this document to them, and already on the 5th the salary must be closed (all this is correctly drawn up in a report addressed to the director with angry demands to punish the insolent ), then I just turn into a mad bull in the bullfight! This, to what extent it is necessary to discredit oneself and one’s professional level (did it exist?!) in the eyes of the public, in order to show that calculating wages on the basis of the standards prescribed in labor agreements, orders and time sheets is no longer in condition?!!!! So, calm down... You have now touched unhealed wounds... The basis for calculating wages for an accountant has always been and is - orders of the head of the organization, the norms of the labor agreement, as a result of an agreement between the employer and the employee, time sheets and other local documents. A staffing table is a document that reflects the organization’s need to have a certain number of employees with a certain level of qualifications and in specific areas of activity. In the staffing table (ideally), it makes sense to indicate only the tariff rate of the hired employee without taking into account increases, depending on the assigned rank. However, this is also problematic today, since the tariff rate includes a differentiation coefficient from 0.93 to 1.07, which is often applied to a specific employee, and not a position. Therefore, it turns out that in the staffing table, to complete the picture, all the norms are prescribed: both those provided for this position (profession), and those that the employer establishes for a specific employee, encouraging his certain characteristics in performing the work. I absolutely agree with Vyacheslav on this issue (from me - plus!;)), who expressed the assumption that in your case, the staffing table was already made for the employee, yes, apparently, something was “not finished”. In principle, the employer hires an employee based on the vacancies available in the staffing table, regardless of whether the vacancy was created the day before the employee was hired. And only then, having accepted a worker for this vacancy, in addition to the standards provided for this position, the employer sets certain standards for the employee, assessing his quality as a specialist, and not according to the position held (promotion according to Decree No. 29, promotion according to the norms of Resolution No. 1748, promotion according to the norms of paragraph 33 of the Instructions on the procedure for applying the UTS, etc., etc.). So, I repeat: when calculating wages, a payroll accountant is obliged to be guided strictly by the norms of the employment agreement concluded with the employee, orders and the time sheet of actual time worked!

I want to draw the moderator's attention to this message because:Notification is being sent...

EVERYTHING WILL BE FINE! AND VERY SOON! INCLUDING WITH US!| Olga [email protected] Minsk Wrote 172 messages Write a private message Reputation: | #6[68952] March 25, 2009, 0:04 |

Vyacheslav wrote:

the official salary in the contract should be the same as it is established in the staffing table.

Of course, if I had prepared these documents, this is exactly what I would have done, but unfortunately (and apparently fortunately) it was not my omission. But this is the situation and we must proceed from what we have. Let me pose the question differently then, if the contract has an advantage in terms of salary. before the staffing schedule (in case of data discrepancies), is this fixed somewhere in the regulations. If the employee’s official salary (no matter what) specified in the contract does not correspond to the calculation rules established by Instruction 123, and the regular salary is accordingly correct, does this change this situation. I would also like to note that often in orders for l / s they do not indicate the official salary (tariff rate) at all, but are prescribed with wages according to the staffing table, as well as in the same budget organizations where the rate is 1 rub. is established in accordance with the law and is regularly (previously changed) changes are not made to employee contracts.....

I want to draw the moderator's attention to this message because:Notification is being sent...

| Mr. Dismantler [email hidden] Belarus, Minsk Wrote 17763 messages Write a private message Reputation: 2234 | #7[68959] March 25, 2009, 7:36 |

Olga wrote:

I would also like to note that often in orders for employees they do not indicate the official salary (tariff rate) at all, but are prescribed with wages according to the staffing table.....

I (like most specialists from various departments, including the Ministry of Labor) consider such an entry, at a minimum, not correct and does not reflect the essence of labor legislation. The remuneration of an employee is based precisely on an agreement between the employee and the employer, the results of which are enshrined in the employment agreement and are displayed in specific values, and not with references to other local documents. Such references are acceptable only for those norms that cannot be displayed in a constant value initially. For example, a bonus. In this case, a reference in the employment agreement indicating that the amount of bonuses is determined in accordance with the regulations on bonuses for employees of the organization or other local document is appropriate. As for the essence of your question, my personal opinion is that it doesn’t matter who made the mistake - a previous employee or a current one - the current employee will correct it. In my understanding, the norms of the labor agreement are primary. And if the norms of other local regulatory legal acts and the wages actually paid do not comply with the norms provided for in the labor agreement, then it is necessary to bring the norms of the LLA into compliance and recalculate wages, unless this violates the norms of labor legislation.

I want to draw the moderator's attention to this message because:Notification is being sent...

EVERYTHING WILL BE FINE! AND VERY SOON! INCLUDING WITH US!| Olga [email protected] Minsk Wrote 172 messages Write a private message Reputation: | #8[68995] March 25, 2009, 8:52 |

Notification is being sent...

| Mr. Dismantler [email hidden] Belarus, Minsk Wrote 17763 messages Write a private message Reputation: 2234 | #9[68999] March 25, 2009, 9:03 |

Notification is being sent...

EVERYTHING WILL BE FINE! AND VERY SOON! INCLUDING WITH US!| s._max [email hidden] Wrote 1 message Write a private message Reputation: | #10[292857] June 21, 2011, 12:35 |

Notification is being sent...

« First ← Prev.1 Next → Last (2) »

In order to reply to this topic, you must log in or register.

Document form

Having dealt with the question of what a staffing table is, let’s move on to the question of its form. This document is a local regulatory act that describes the organizational structure of the company and contains information about the number of its personnel. It is drawn up according to form No. T-3 (Resolution No. 1 of the State Statistics Committee of the Russian Federation “On approval of unified forms of primary accounting documentation for recording labor and its payment” dated 01/05/2004), but there are no strict requirements to use it - the form is advisory. Each company adapts it to its own needs. We recommend using Form No. T-3 in its usual form, since it contains all the necessary data. This is what the staffing form for 2020 looks like, approved by the State Statistics Committee.

Labor Code of the Russian Federation on remuneration in the contract

Labor legislation, headed by the relevant Code, prohibits avoiding or somehow concealing information about income in a contract with an employee. Since this is stated in Article 57 of the Labor Code, no other documents can cancel the requirement.

Under this article there are an indispensable number of conditions, which are indicated:

- salary or rate (by type of payment system);

- composition of additional payments, allowances and incentives in the form of bonuses, incentive payments and other remuneration.

Additionally, Article 135 establishes the contract as the primary source for payment of wages, and not any other documents of the company. Other documents related to the payment system affect the content of the agreement, but do not replace it.

The article does not directly say, but implies that it is the contract that is intended to determine the form of remuneration. Economists identify three main salary models:

- salary;

- piecework;

- hourly.

But the Labor Code itself allocates, in fact, only two basic parts of the salary: salary or piece rate. They are required to be included in the employment contract.

Important ! A salaried employee must have a stated salary, and temporary workers and piece workers must have a tariff rate.

As we can see, according to the law, the amount of the official salary is necessarily included in the employment contract. This can and should be written in the contract.

How to correctly fill out form No. T-3

Let's look at a step-by-step example of the LLC staffing table for 2020. We fill out the form details as shown in the example.

The name of the organization must fully correspond to that enshrined in the constituent documents, including an abbreviated name and a name in a foreign language. If there is an abbreviated name, it is indicated in the form in parentheses, following the full name.

Organization code - eight code characters according to the All-Russian Classifier of Enterprises and Organizations (OKPO).

The document number and date of preparation are written in the format HH.MM.YYYY

Validity. It indicates how long the document is valid and from what date it comes into force.

Fill in the fields, there are 10 in total.

The name of the structural unit is indicated without abbreviation in accordance with the classifier of units approved by the employer. If there is no classifier, then in alphabetical order or in descending order of the number of department employees. If the provision of benefits to employees depends on the name of the division, we indicate the name of the division in accordance with industry classifiers of hazardous industries and other relevant documents.

We fill out the code of the structural unit in the document in accordance with the classifier in which they are arranged by functional importance. If there is no classifier, codes can be assigned to divisions arranged in alphabetical order or according to another principle.

Position (specialty, profession), rank, class (category), qualifications in the staff are indicated without abbreviations in the composition of the structural unit, starting from the manager, ending with the technical performer. Attention: for workers - professions, for employees - positions (paragraph 7 of article 144 of the Labor Code of the Russian Federation).

The number of units is indicated for each position or profession. If part-time work is envisaged, it is indicated in the appropriate shares (for example, 0.5; 2.75, etc.).

The tariff rate and salary are indicated in the amount of the monthly salary, depending on the remuneration system (tariff, salary, percentage of profit, labor participation rate, etc.). The salary amount must be indicated in rubles or as a percentage, coefficients, etc. The practice of indicating salaries in dollars has almost become obsolete. The Law on Currency Regulation directly prohibits this, and the Labor Code of the Russian Federation talks about the employer’s obligation to pay wages in rubles.

Allowances. Columns 6-8 indicate incentive and compensation payments established by law or at the initiative of the employer.

In the “Total” section, the total amount of columns 5-8 (salary and allowances) is indicated, multiplied by the number of staff units.

A note is filled in if the information in the form columns is ambiguous and requires clarification.

In the “Total” line indicate the total number of staff positions and the total amount of payments at all rates, taking into account all allowances, which will amount to the monthly payroll.

The draft order is signed by the personnel manager and the chief accountant.

Don't forget to put the document number in the appropriate box on the form.

Is it possible to indicate in the employment contract: “Salary according to the staffing table”?

To contents

In accordance with Article 129 of the Labor Code of the Russian Federation, salary and tariff rate have a fixed value, therefore, these indicators must be entered in numbers in the employment agreement. But the amount of allowances, bonuses, other incentives or benefits can be entered in the contract document in letter form according to the wishes of the employer. It is also possible to provide a link to a regulatory act confirming whether there are in fact grounds or conditions for payments.

It is allowed to write in the contract: “Wages according to the staffing table” only when a regulatory act itself is attached to the agreement, detailing how, when and how much the employee will receive. In general terms, such an inscription in a TD is illegal.

From personnel and salaries in the staff schedule - on video:

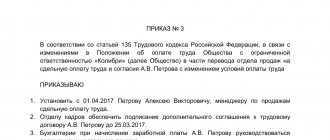

We are preparing an order for approval

The draft document is ready, what next? To introduce staffing, it is approved by the appropriate order for the main activity. The staffing order for 2020 is mentioned in the upper right corner of the form as follows.

The text of the order indicates the fact of approval of the staffing table, the total number of staffing units and the date for putting the document into effect. The order is signed by the head of the company or another authorized person, and then registered in the journal for registering orders for the main activity. The registration number is stamped on the order. Then the order and schedule are sent for storage, as a rule, together with other documents on the main activity (the schedule is for permanent storage, and the order is for 75 years, see paragraphs 19 and 71 of the list approved by order of the Ministry of Culture of Russia dated August 25, 2010 No. 558 ).

Three types of retention

Now let's look at what types of wage deductions there are and who pays them.

The legislation provides for three types of deductions from wages:

- mandatory;

- at the initiative of the employer;

- at the request of the employee.

The first ones are established by law and cannot be changed by the parties to the employment contract. The other two are related to any situations regarding remuneration, advance payment, and so on and must be initiated either by the organization or the employee.

Mandatory include, in particular, the withholding of personal income tax from wages . The organization acts as a tax agent and transfers tax to almost all of its employees (with the exception of those who received a tax deduction). Thus, the organization pays personal income tax.

The position of the Ministry of Finance on the question of whether it is necessary to indicate the withholding of personal income tax in an employment contract is clear: it is not necessary, since the procedure for its payment is regulated by law and is the same for everyone.

The Labor Code does not contain requirements to include any clauses on deductions from wages in the text of the contract.

How to reflect the following surcharges?

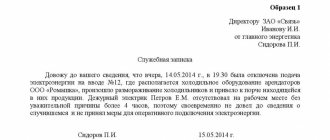

One-time

If bonus payments in an organization are one-time in nature, it is not necessary to reflect them in the staffing table or other documents recording the conditions of labor relations.

On a note. When using Form T-3, the employer indicates only those compensation payments (bonuses, allowances, additional payments, etc.) issued to the employee on a regular basis. There is no need to indicate a one-time bonus there.

If the employer has decided to award bonuses to a specific employee, an entire department, or the entire staff, then he can do this with the help of his order, issued in the form of an order. The document is drawn up in form T-11 or using a form approved by the enterprise.

An order may look, for example, like this: “To award Pyotr Semenovich Ivanov, a repairman at the repair shop of Fortuna LLC, a bonus in the amount of 10,000 (ten thousand) rubles for conscientious work and initiative. Reason: presentation of the head of the repair shop of Fortuna LLC, T. S. Sidorov. General Director of Fortuna LLC, S. M. Petrova.”

Constant

In the same case, when the bonus is not a one-time payment for a one-time work accomplishment in the workplace, but is regular, it should be issued in other ways. In this situation, it can be reflected in one of the columns relating to payments and allowances in the staffing table. Examples of what can be written in the line for registration of permanent bonuses:

- “Bonus in the amount of 10% of salary, subject to fulfillment of the established plan.”

- “A bonus in the amount of 6,000 (six thousand) rubles, subject to the absence of disciplinary sanctions within a month.”

- “Bonus in accordance with clause 3.24 of the Regulations on bonuses, approved by order of the General Director of Fortuna LLC No. 128-k dated May 14, 2015.”

Important! The choice of a specific option remains with the employer and depends on the remuneration system adopted at the enterprise - provided that it does not contradict the current norms of the Labor Code of the Russian Federation and other labor legislation. On our website you can also familiarize yourself with other information about the staffing table, namely, how it is compiled, approved and changed, as well as how long it is valid and stored.

The staffing table is an important document in all respects relating to labor interaction between the employee and the employer. And although after 2013 it is no longer necessary to indicate the payment procedure in general and the bonus in particular, in practice such an indication is often made. The main thing is not to violate the requirements of the law.

Social package

It is sometimes difficult to attract a good specialist only with a competitive salary. He wants something more. And then companies include such a form of additional payment as a social package.

Each company has its own idea of its content. Some people mean by a social package only the fulfillment of the provisions of the Labor Code: registration of a work book, “white” salary, payment of sick leave, vacations. Others, in addition to the above, compensate for the costs of mobile communications, food, training, transportation costs, organize New Year's gifts for children of employees, and so on. Moreover, this kind of compensation is offered not only by large Russian companies, but also by mid-level companies.

The content of the social package varies depending on the position, length of service of the employee, etc. It can be wider for those departments that earn money for the company, for example, the sales department, and narrower for those who spend this money, for example, for office employees.