How and when was the UN created?

The year of the end of the last world war and the year of the creation of the UN coincide - it is 1945. Then representatives from fifty countries around the world gathered in San Francisco to create a special organization. This conference was preceded by a meeting in Dumbarton Oaks - then representatives of Great Britain, China, the United States and the Soviet Union developed proposals for the charter of this organization. The meeting at Dumbarton Oaks took place from April to October 1944, and on June 26, the draft charter was signed by representatives of 50 powers. This day is considered the date of the creation of the UN.

Rice. 1. Signing ceremony of the UN Charter.

Poland was not present at the signing ceremony, but later also signed the document and became one of the founding states, which thus became 51.

The main reason for the creation of the United Nations is to prevent another world war, which could lead to even greater human casualties than the first and second.

The organization was created at the end of the year. Features of reporting

In particular, in paragraph

2 of Art. 55 of the Tax Code of the Russian Federation states: if an organization was created after the beginning of the calendar year, the first tax period for it is the period from the date of its creation to the end of that year. In this case, the day of creation of the organization is recognized as the day of its state registration.

When an organization is created on a day falling within the time period from December 1 to December 31, the first tax period for it is the period from the date of creation to the end of the calendar year following the year of creation.

4 tbsp. 55 of the Tax Code of the Russian Federation).

In particular, in paragraph

This rule does not apply to those taxes for which the tax period is established as a calendar month or quarter. In such cases, when creating an organization, changes in individual tax periods are made in agreement with the tax authority at the place of registration of the taxpayer (Clause 4 of Article 55 of the Tax Code of the Russian Federation)

In particular, in paragraph

2 tbsp. 55 of the Tax Code of the Russian Federation states: if an organization was created after the beginning of the calendar year, the first tax period for it is the period from the date of its creation to the end of that year.

In this case, the day of creation of the organization is recognized as the day of its state registration.

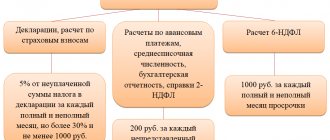

If an organization fails to fulfill the obligation to submit the report in question on the number of employees, then, regardless of whether it had hired employees, it will face adverse consequences in the form of a fine in the amount of two hundred rubles (clause 1 of Article 126 of the Tax Code of the Russian Federation). This will be preceded by the tax authorities drawing up a report on the identified violation and the standard procedure for making a decision by the management of the tax inspectorate with consideration of the case materials and objections (if any).

In addition, tax authorities will draw up a protocol on the head of the organization under Part 1 of Art. 15.6 of the Code of Administrative Offenses of the Russian Federation and will send the case materials on the identified violation to the magistrate’s court for prosecution in the form of a fine, the amount of which will be determined by the magistrate in the range from 300 to 500 rubles.

Thus, the question of when to submit the average headcount of a newly created organization becomes very relevant for any organization immediately after its creation. If this problem is not resolved in time, then the organization and its leader will face adverse consequences in the form of tax and administrative fines, respectively.

Goals of the United Nations

They are enshrined in the Charter and mainly concern issues of maintaining peace and security. That is, the main goal of the UN is to resolve conflicts on an international scale exclusively by peaceful means and prevent threats to peace.

In addition, the UN deals with issues of cooperation on an international scale and in a variety of areas, from social and economic to cultural.

TOP 4 articles that are read along with this

- 1. Versailles-Washington system

- 2. The First World War - briefly about the main thing

- 3. Reasons for Russia's participation in the First World War

- 4. Reasons for the formation of the Old Russian state

Rice. 2. UN meeting.

To date, 193 states have already received UN membership. The last state to date to be admitted to the organization was South Sudan (July 14, 2011).

The importance of correctly determining the legal address

An incorrect choice of the registration address of a legal entity can lead to negative consequences for the founders and head of the company.

In the current legislation there is no precise definition of such a term as the legal address of an organization. It is generally accepted that the legal address. person is the place of his permanent location.

In the case when the organization’s property or rented premises are used to carry out activities, the scheme for entering information about the legal address is simple:

- location of the new legal entity persons are indicated in the Charter;

- information from the Charter is transferred to the registration card;

- The registrar enters into the Unified State Register of Legal Entities the data that is entered into the registration card and confirmed by the Charter.

But what if the legal entity the person does not plan to be at the registration address and the information included in the Charter, and then in the Unified State Register of Legal Entities, is just a formality?

Based on current legal realities, such a situation should not arise. Any organization that intends to officially operate is required to have its active office at its registered legal address.

In addition, if for organizational reasons the address has to be changed, the Federal Tax Service must be notified of this within three working days.

Structure of the United Nations

The main body of the UN is the General Assembly, in which all member states are represented (strictly 1 vote each).

But the main responsibility for maintaining peace lies with another body - the Security Council. It includes five permanent representatives - from Russia, China, America, Britain and France, as well as 10 non-permanent ones, which change every two years. They are elected by the General Assembly. Thus, there are fifteen members of the Security Council in total.

It also has a number of other bodies and a Secretary General. This person is elected for five years and can be re-elected an unlimited number of times, but to date no Secretary General has held this position for more than 10 years. The first UN Secretary General was the British Gladwin Jebb, who served for less than a year. After that, representatives from Norway, Sweden, Burma, Austria, Peru and Egypt, as well as Ghana, were elected to office. Today, the duties of UN Secretary General are performed by Ban Ki-moon from South Korea.

Rice. 3. Ban Ki-moon.

The headquarters of the United Nations is located in New York.

When to submit the average headcount of a newly created organization

Determining the number of employees for the reporting period and the need to send information about this number to the tax inspectorates are responsibilities imposed by the state not only on legal entities operating for more than a year, but also on new organizations.

The provision obliging newly created organizations to submit information on the number of employees is contained in paragraph. 6 clause 3 art. 80 Tax Code of the Russian Federation.

The deadline for submitting this report is no later than the 20th day of the month following the month of making an entry on the creation of a legal entity in the Unified State Register of Legal Entities.

Paragraph 8 of Article 51 of the Civil Code of the Russian Federation connects the creation of an organization with the date of recording information about it in the Unified State Register of Legal Entities. Consequently, the deadline for submitting the average headcount for new organizations is calculated precisely from the date of entry about them in the Unified State Register of Legal Entities.

The form for filling out information is contained in the appendix to the Order of the Tax Service dated March 29, 2007.

All organizations must submit information, regardless of the average number of employees (Letter of the Tax Service dated July 9, 2007).

The report must contain an indicator of the number of employees on a certain date. In this case, this date is not the date of creation of the organization, but the 1st day of the month in which the information is submitted.

For example, if an entry about an organization was made in the Unified State Register of Legal Entities on January 31, 2017, then:

- the corresponding indicator is given in the report as of 02/01/2017;

- Information must be submitted to the tax office no later than 02/20/2017.

Judging by the name, only employers must submit information about the average number of employees. But the Ministry of Finance believes that all companies must report, including newly organized ones that do not yet have employees.

From the letter of the Ministry of Finance of the Russian Federation dated February 4, 2014 No. 03-02-07/1/4390: “... there is no provision for exemption of organizations that do not have employees from submitting information on the average number of employees to the tax authorities within the prescribed period.”

Let's list who is required to submit a report on the average headcount:

- newly registered legal entities, regardless of the availability of personnel;

- individual entrepreneurs-employers;

- organizations that have entered into employment contracts;

- organizations that do not have employees on staff.

Thus, only individual entrepreneurs without employees have the right not to submit this information; all other businessmen are required to report.

Free accounting services from 1C

What have we learned?

When and for what reasons was the United Nations created, that is, the history of the creation of the UN was briefly outlined. We learned what goals this organization pursues - it was created in order to maintain peace and promote the resolution of conflicts between states through peaceful means. We learned what its structure is: that the two main bodies are the General Assembly and the Security Council, and the important figure is the Secretary General. Where is the headquarters of this organization and what other important international issues does it deal with?

Rules for determining the tax period when creating and liquidating an organization

Article 55 of the Tax Code of the Russian Federation establishes that at the end of the tax period, the tax base is determined and the amount of tax payable to the budget is calculated. In this case, the tax period may consist of one or several reporting periods. As an analysis of judicial arbitration practice shows, when creating or liquidating an organization of accountants, questions arise regarding the determination of the tax period.

In Art. 55 of the Tax Code of the Russian Federation establishes the following rules for newly created or liquidated (reorganized) organizations:

1) tax period for newly created organizations (clause 2 of article 55 of the Tax Code of the Russian Federation). If an organization was created after the beginning of the calendar year, its first tax period is the period from the date of its creation to the end of that year. In this case, the day of creation of the organization is recognized as the day of its state registration.

For reference. As established in Part 2 of Art. 51 of the Civil Code of the Russian Federation, a legal entity is considered created from the date of making the corresponding entry in the Unified State Register of Legal Entities. By virtue of clause 2 of Art. 11 of the Federal Law of August 8, 2001 N 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”, the moment of state registration is recognized as the entry by the registering authority of the corresponding entry into the relevant state register.

Thus, on the day the corresponding entry is made in the Unified State Register of Legal Entities, the legal entity is considered created. From this day the first tax period begins for the organization. However, when an organization is created on a day falling within the period from December 1 to December 31, the first tax period for it is the period from the date of creation to the end of the calendar year following the year of creation;

2) tax period for liquidated (reorganized) organizations (clause 3 of article 55 of the Tax Code of the Russian Federation). If an organization was liquidated (reorganized) before the end of the calendar year, the last tax period for it is the period from the beginning of this year until the day the liquidation (reorganization) was completed.

If an organization created after the beginning of a calendar year is liquidated (reorganized) before the end of this year, the tax period for it is the period from the date of creation to the day of liquidation (reorganization).

For reference. According to paragraph 1 of Art. 61 of the Civil Code of the Russian Federation, the liquidation of a legal entity entails its termination without the transfer of rights and obligations in the order of succession to other persons.

Liquidation of a legal entity can be voluntary or forced.

As established by Part 8 of Art. 63 of the Civil Code of the Russian Federation, the liquidation of a legal entity is considered completed, and the legal entity is considered to have ceased to exist after making an entry to this effect in the Unified State Register of Legal Entities.

Article 57 of the Civil Code of the Russian Federation provides for five forms of reorganization of a legal entity: merger, accession, division, separation, transformation. Moreover, a legal entity is considered reorganized, with the exception of cases of reorganization in the form of merger, from the moment of state registration of newly emerged legal entities. When a legal entity is reorganized in the form of the merger of another legal entity with it, the first of them is considered reorganized from the moment an entry on the termination of the activities of the merged legal entity is made in the Unified State Register of Legal Entities.

If an organization was created on a day falling within the time period from December 1 to December 31 of the current calendar year, and was liquidated (reorganized) before the end of the calendar year following the year of creation, the tax period for it is the period from the date of creation to the day of liquidation ( reorganization) of this organization;

3) exceptions to the rules established by Art. 55 Tax Code of the Russian Federation:

- as stated in paragraph. 4 p. 3 art.