Order on bonuses for employees (form T-11 and T-11a) - an administrative document from the management of the organization on awarding a bonus to an employee of the organization. During the work activity of an employee, he may be awarded by management for any special merits; as a bonus, he may be given a certificate, gratitude, monetary or material reward. The employee's remuneration is formalized by drawing up an order on bonuses for employees. The order can be drawn up in free form on the company’s letterhead, or you can use the convenient unified form T-11 and T-11a. The first form is intended to reward one employee, the second - for a group of employees. Let's look at how to correctly draw up an order for bonuses using the T-11 form as an example.

Order on bonuses for an employee, form T-11, sample filling

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Before the personnel service draws up an order, the head of the department in which the employee works must formalize a proposal for incentives, on the basis of which the order will be issued. This representation is indicated in the text of the order as the basis for its preparation.

An order is an administrative document, it is drawn up on behalf of the management of the enterprise.

The text of the order must indicate the basic information of the employee: position, department, full name. After this, the achievements and merits of the employee for which he is nominated for encouragement are reflected.

The last point is to indicate the type of bonus (incentive). This may be a cash bonus, in which case it is indicated in words in the order. If this is some kind of material thing, a gift, then its name is also indicated in the order. In addition, the employee may be awarded a certificate and expressed gratitude.

The essence and difference between the unified forms T-11a and T-11

Each employer faces situations when it is necessary to reward one of their employees for achievements in their work activities. To do this, it is necessary to draw up and approve an order (instruction) to reward the employee, using the form of organizational and administrative document accepted by the employer. Including, it is possible to compile it using the unified T-11 form, which has ceased to be mandatory for use since 2013, but continues to be used by many employers. At the same time, you should know how to correctly draw up this document and what is the difference between forms T - 11 and T - 11a. You can download the unified form T-11 on our website.

Orders on unified forms T-11 and T-11a are distinguished by the fact that in form T-11 an order will be given to reward only 1 employee, and form T-11a is used to reward several employees.

The unified form T-11a can also be downloaded on our website.

Memorandum on bonuses - basis for remuneration

The basis for awarding an employee a bonus may be a memorandum to management about the employee’s labor success. The figure below shows an example of filling out a memo from the production director addressed to the general director.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Details of payment of the “state duty” for an extract from the Unified State Register of Legal Entities

A request for a paper extract from the Unified State Register of Legal Entities can be submitted to any tax office or MFC (clause 1, clause 22 of Order of the Ministry of Finance dated January 15, 2015 No. 5n).

However, the fee must be paid according to the details of the registering tax authority. Information about it can be found on the Federal Tax Service website in the “Payment of state duty” section. There you can also generate a receipt for payment.

Please note that the BCC will depend on whether the request is submitted directly to the tax office or through the MFC.

READ MORE: Rights of collectors under the new law of 2020

When submitting a request for an extract to the tax office, the KBK when paying the fee should be 18211301020016000130, and when contacting the MFC, the KBK will be 18211301020018000130.

Urgent or non-urgent provision of a statement affects only the amount paid, and not the payment details.

Recipient – UFK for Moscow (Interdistrict Inspectorate of the Federal Tax Service of Russia No. 46 for Moscow)

INN/KPP of the payee – 7733506810 / 773301001

Main Directorate of the Bank of Russia for the Central Federal District

Account: 40101810045250010041

BIC: 044525000

OKTMO code – 45373000

KBK 18211301020016000130

Purpose of payment “Fee for urgent provision of information from the Unified State Register of Legal Entities”

Details for paying state tax duties can be found on the Federal Tax Service website. Better yet, use a special service to generate a payment document. Since the Federal Tax Service website automatically displays its data for each region, it will be quite difficult to make a mistake when filling it out.

The “universal” requisite for the entire country is the budget classification code (BCC), although sometimes, for some regions, they may differ.

The details of the payer must be indicated - not the one who goes to Sberbank and deposits money, but the applicant (one of the applicants) for the provision of a public service. His full name, registration (stay) address, and Taxpayer Identification Number (if available) must be indicated.

- KBK - 182 11300 130 (fee for providing information and documents contained in the Unified State Register of Legal Entities and in the Unified State Register of Individual Entrepreneurs).

- The recipient's account number is 40101810045250010041.

- Recipient bank - Main Directorate of the Bank of Russia for the Central Federal District of Moscow (abbreviated name - Main Directorate of the Bank of Russia for the Central Federal District).

- BIC of the recipient's bank - 044525000.

- Recipient of the Federal Tax Code for Moscow (MIFTS of Russia No. 46 for Moscow).

- INN and KPP of the recipient - 7733506810/773301001 (MIFTS of Russia No. 46 for Moscow).

- OKTMO code - 45373000.

Please note that the KBK is of particular importance when paying the state fee for obtaining an extract from the Unified State Register of Legal Entities. It is its numbers that are responsible for the implementation of which procedure the payment is directed to. And if the procedure code does not coincide with its purpose, this leads to an official refusal.

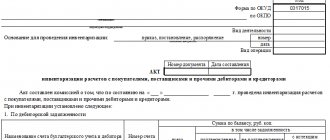

Order on employee bonuses. Filling example

The figure below shows an example of rewarding an employee with a monetary reward based on an order from management.

In addition to monetary remuneration, an employee can be encouraged with a valuable gift. The figure below shows this sample order.

| ★ Collection and directory of all personnel documents (forms and documents in word format) > 1200 books purchased |

To organize personnel records in a company, beginner HR officers and accountants are perfectly suited to the author’s course by Olga Likina (accountant M.Video management) ⇓

| ★ Author's course “Automation of personnel records using 1C Enterprise 8” (more than 30 step-by-step video lessons for beginners with instructions) purchased > 2000 practical courses |

For what purpose does the employer encourage employees?

Personnel bonuses are regulated by a number of articles of the Labor Code of the Russian Federation (Articles 135, 191 of the Labor Code of the Russian Federation). But labor legislation does not say anything about the amount and frequency of payment of monetary remuneration, as well as the method of payment. The incentive motive in a bonus order may be as follows:

- conscientious performance by the employee of the duties assigned to him;

- increasing labor efficiency;

- high achievements in work;

- long and impeccable work in the company, etc.

Also, the motivation for the order may be related to labor achievements in a certain industry or professional holidays. For example, an order to reward a teacher may contain the wording “for efficiency in methodological work and high performance indicators”; bonuses for builders may be made “in connection with high performance indicators and a professional holiday - Builder’s Day”, etc.

Art. 191 of the Labor Code of the Russian Federation provides not only for the payment of cash bonuses to employees, but also for other incentive options: awarding a certificate of honor, presenting a valuable gift, declaring gratitude, nominating for the title “Best in the Profession.” It is desirable that the process of rewarding employees be public and carried out in a solemn atmosphere. Thanks to this, other employees will have a motive to increase their work efficiency.

The procedure for issuing incentives must be specified in the internal documentation of the organization (“Regulations on Bonuses”, Internal Rules, etc.).

Download the order on bonuses for employees. Sample and form

Download samples of the organization's personnel documents : Form T-1 and T-1a. Employment order Form T-3. Staffing table of the organizationForm T-6 and T6-a. Vacation orderForm T-7. We draw up a vacation scheduleForm T-8. Order of dismissalForm T-9 and T-9a. Business trip orderForm T-10. Travel certificateForm T-10a. Business trip assignmentForm T-13. Working time sheetForm T-49. Payroll Form T-51. Payroll for calculating and calculating wagesForm T-53. Payroll for salary paymentsForm T-53a. Payroll register Form T-54. Employee's personal account Form T-60. Note-calculation on granting leaveForm T-61. Calculation note upon dismissal

Drawing up promotion documentation

From January 1, 2013, it is not necessary to use the forms of documents approved by law contained in the “Albums of Unified Forms” (with the exception of some primary documents). There is also no ban on their use. In this regard, non-governmental organizations have the right to decide whether to use unified forms or use document forms developed independently (Information of the Ministry of Finance of Russia No. PZ-10/2012).

The order of encouragement is an important accounting document, therefore it must indicate the details established by law, in accordance with Art. 9 of Law No. 402-FZ of December 6, 2011 “On Accounting”.

The grounds for incentives are collective agreements, labor agreements and internal regulations of the enterprise. This form of remuneration may be provided:

- in labor rules;

- wage regulations;

- a separate award document.

The documentation setting out the rules of the incentive system must contain the following information:

- types of awards;

- conditions, procedure and indicators for issuing the additional amount;

- bonus amounts;

- payment procedure;

- the frequency with which additional payments may occur;

- a list of cases of reduction in the amount of the bonus or its deprivation.

Also see “Deprivation of bonuses for employees: approaches and design.”

Let us remind you once again that it is imperative to specify the incentive motive in the order. An example is an increased number of sales or manufactured products over a certain period of time.

Time sheet (form T-12 and T-13): filling out in 2020

1010 – Dividends

1011 – Interest (except for interest on mortgage-backed bonds issued before 01/01/2007, income in the form of interest received on bank deposits and income received upon repayment of a bill), including discount received on a debt obligation of any type

1110 – Interest on mortgage-backed bonds issued before 01/01/2007

1120 -Income of the founders of the trust management of mortgage coverage received on the basis of the acquisition of mortgage participation certificates issued by the mortgage coverage manager before 01/01/2007

1200 – Income received in the form of other insurance payments under insurance contracts

1201 – Income received in the form of insurance payments under insurance contracts in the form of payment for the cost of sanatorium and resort vouchers

1202 – Income received in the form of insurance payments under voluntary life insurance contracts (except for voluntary pension insurance contracts) in the case of payments related to the survival of the insured person to a certain age or period, or in the event of the occurrence of another event (except for early termination of contracts), in terms of the excess of the amounts of insurance premiums paid by the taxpayer, increased by the amount calculated by sequentially summing the products of the amounts of insurance premiums paid from the date of conclusion of the insurance contract to the day of the end of each year of validity of such a voluntary life insurance contract (inclusive), and the average annual rate in force in the corresponding year refinancing of the Central Bank of the Russian Federation

1203 – Income received in the form of insurance payments under voluntary property insurance contracts (including civil liability insurance for damage to the property of third parties and (or) civil liability insurance of vehicle owners) in terms of excess of the market value of the insured property in the event of loss or destruction of the insured property, or expenses necessary to carry out repairs (restoration) of this property (if repairs were not carried out), or the cost of repairs (restoration) of this property (if repairs were carried out), increased by the amount of insurance premiums paid to insure this property

1211 – Income received in the form of amounts of insurance premiums under insurance contracts, if these amounts are paid for individuals from the funds of employers or from the funds of organizations or individual entrepreneurs that are not employers in relation to those individuals for whom they make insurance premiums

1212 – Income in the form of cash (redemption) amounts paid under insurance contracts (except for voluntary pension insurance contracts), subject, in accordance with the insurance rules and terms of the contracts, to payment upon early termination of insurance contracts in terms of excess of the amounts of insurance contributions paid by the taxpayer

1213 – Income in the form of cash (redemption) amounts paid to the taxpayer upon termination of the voluntary pension insurance contract, reduced by the amount of insurance premiums paid by the taxpayer, in respect of which the social tax deduction provided for in paragraphs. 4 paragraphs 1 art. 219 Tax Code of the Russian Federation

1220 – Income in the form of cash (redemption) amounts paid to the taxpayer upon termination of a non-state pension agreement, reduced by the amount of pension contributions paid by the taxpayer, in respect of which the social tax deduction provided for in paragraphs. 4 paragraphs 1 art. 219 Tax Code of the Russian Federation

1240 – Amounts of pensions paid under non-state pension agreements concluded by organizations and other employers with Russian non-state pension funds, as well as amounts of pensions paid under non-state pension agreements concluded by individuals with Russian non-state pension funds in favor of other persons

1300 – Income received from the use of copyright or other related rights

1301 – Income received from the alienation of copyright or other related rights

1400 – Income received from the rental or other use of property (except for similar income from the rental of any vehicles and communications equipment, computer networks)

1530 – Income received from transactions of purchase and sale of securities traded on the organized securities market

1531 – Income received from transactions of purchase and sale of securities not traded on the organized securities market

1532 – Income received from transactions with financial instruments of futures transactions, the underlying asset of which is securities or stock indices calculated by the organizers of trading on the securities market

1533 – Income received from the sale and redemption of investment units of mutual funds

1535 – Income received from transactions with financial instruments of futures transactions, the underlying asset of which is not securities or stock indices calculated by the organizers of trading on the securities market

1536 – Income received from transactions of purchase and sale of securities not traded on the organized securities market, which at the time of their acquisition met the requirements for traded securities

1540 – Income received from the sale of participation shares in the authorized capital of organizations

1550 – Income received by the taxpayer upon assignment of rights of claim under an agreement for participation in shared construction (an investment agreement for shared construction or under another agreement related to shared construction)

2000 – Remuneration received by the taxpayer for the performance of labor or other duties; salary and other taxable payments to military personnel and equivalent categories of individuals (except for payments under civil contracts)

2001 – Directors’ remuneration and other similar payments received by members of the organization’s governing body (board of directors or other similar body)

2010 -Payments under civil contracts (except for royalties)

2012 – Amounts of vacation payments

2201 – Author's fees (rewards) for the creation of literary works, including for theatre, cinema, stage and circus

2202 – Author's fees (rewards) for the creation of artistic and graphic works, photographic works for printing, works of architecture and design

2203 – Author's fees (rewards) for the creation of works of sculpture, monumental decorative painting, decorative and applied and design art, easel painting, theatrical and film set art and graphics, made in various techniques

2204 – Copyright royalties (rewards) for the creation of audiovisual works (video, television and cinema films)

2205 – Author's fees (rewards) for the creation of musical works: musical stage works (operas, ballets, musical comedies), symphonic, choral, chamber works, works for brass band, original music for cinema, television and video films and theatrical productions

2206 – Royalties (rewards) for the creation of other musical works, including those prepared for publication

2207 – Author's fees (rewards) for the performance of works of literature and art

2208 – Royalties (rewards) for the creation of scientific works and developments

2209 – Royalties for discoveries, inventions, industrial designs

2210 – Remuneration paid to the heirs (legal successors) of the authors of works of science, literature, art, as well as discoveries, inventions and industrial designs

2300 – Benefits for temporary disability

2400 – Income received from the rental or other use of any vehicles, including sea, river, aircraft and motor vehicles, in connection with transportation, as well as fines and other sanctions for idle time (delay) of such vehicles at loading points ( unloading); income received from the rental or other use of pipelines, power lines (power lines), fiber-optic and (or) wireless communication lines, and other means of communication, including computer networks

2510 – Payment for the taxpayer by organizations or individual entrepreneurs for goods (work, services) or property rights, including utilities, food, recreation, training in the interests of the taxpayer

2520 – Income received by a taxpayer in kind, in the form of full or partial payment for goods, work performed in the interests of the taxpayer, services rendered in the interests of the taxpayer

2530 – Payment in kind

2610 – Material benefit received from savings on interest for the taxpayer’s use of borrowed (credit) funds received from organizations or individual entrepreneurs

2620 – Material benefit received from savings on interest for the taxpayer’s use of borrowed (credit) funds for new construction or the acquisition on the territory of the Russian Federation of a residential building, apartment, room or share(s) in them (for income received before 01/01/2008)

2630 – Material benefit received from the acquisition of goods (work, services) in accordance with a civil contract from individuals, organizations and individual entrepreneurs who are interdependent in relation to the taxpayer

2640 – Material benefit received from the acquisition of securities

2710 – Material assistance (with the exception of material assistance provided by employers to their employees, as well as to their former employees who resigned due to retirement due to disability or age, material assistance provided to disabled people by public organizations of disabled people and one-time financial assistance provided by employers to employees ( parents, adoptive parents, guardians) at the birth (adoption) of a child

2720 – Cost of gifts

2730 – The cost of prizes in cash and in kind received at competitions and competitions held in accordance with decisions of the Government of the Russian Federation, legislative (representative) bodies of state power or representative bodies of local government

2740 – The cost of winnings and prizes received in competitions, games and other events for the purpose of advertising goods, works and services

2750 – The cost of prizes in cash and in kind received at competitions and competitions held not in accordance with decisions of the Government of the Russian Federation, legislative (representative) bodies of state power or representative bodies of local government and not for the purpose of advertising goods (works and services)

2760 – Financial assistance provided by employers to their employees, as well as to their former employees who resigned due to retirement due to disability or age

2761 – Material assistance provided to disabled people by public organizations of disabled people

2762 – Amounts of one-time financial assistance provided by employers to employees (parents, adoptive parents, guardians) at the birth (adoption) of a child (starting from 2008 income)

2770 – Reimbursement (payment) by employers to their employees, their spouses, parents and children, their former employees (age pensioners), as well as disabled people for the cost of medications purchased by them (for them), prescribed to them by their attending physician

2780 – Reimbursement (payment) of the cost of medications purchased by the taxpayer (for the taxpayer), prescribed by the attending physician, in other cases not falling under clause 28 of Art. 217 Tax Code of the Russian Federation

2790 – The amount of assistance (in cash and in kind), as well as the value of gifts received by veterans of the Great Patriotic War, disabled people of the Great Patriotic War, widows of military personnel who died during the war with Finland, the Great Patriotic War, the war with Japan, widows of deceased disabled people of the Great Patriotic War war and former prisoners of Nazi concentration camps, prisons and ghettos, as well as former minor prisoners of concentration camps, ghettos and other places of forced detention created by the Nazis and their allies during the Second World War

2791 – Income received by employees in kind as wages from organizations - agricultural producers, determined in accordance with paragraph 2 of Article 346.2 of the Tax Code of the Russian Federation, peasant (farm) farms in the form of agricultural products of their own production and (or) works (services) ), performed (rendered) by such organizations and peasant (farm) farms in the interests of the employee, property rights transferred by these organizations and peasant (farm) farms to the employee

2800 – Interest (discount) received upon payment of a bill presented for payment

2900 – Income received from foreign exchange transactions

3010 – Winnings paid by organizers of lotteries, sweepstakes and other risk-based games (including using slot machines)

3020 – Income in the form of interest received on deposits in banks

3021 – Income in the form of interest received on time pension deposits in banks made for a period of at least six months (for income received before 01/01/2008)

4800 – Other income

Employee bonuses: 6 risks for the employer

Since issuing a bonus is a financial transaction, there are certain risks on the part of the inspection inspectors. They concern, first of all, tax inspectors, but often come from representatives of the labor inspectorate.

Risk 1. Incorrect wording in the employment contract

Often, an employer indicates that its employee with whom the contract is concluded is entitled to a monthly or quarterly bonus in a set amount, for example 15% of his salary. In this case, the bonus in fact becomes an integral part of the salary, since the employer pays it within the agreed terms and in the established amounts, the obligations of which he himself has assumed. It is more correct to reflect the fact of payment in the category of “right” rather than “obligation” of the employer - otherwise, in essence, it is no longer a bonus, but a salary.

Risk 2. Payments of “13 salaries”

A bonus at the end of the year in the amount of the entire average salary or a significant part of it is traditionally called the “13th salary.” There is no such concept in the law; accordingly, such a bonus is the exclusive goodwill of the employer. But again, it is important to correctly reflect it in the employment contract (individual and collective), as well as in the local internal acts of the enterprise. At the same time, only references to these acts can be indicated in contracts, and the payment procedure must be spelled out in as much detail as possible in the acts:

- connection between salary payment and employee performance indicators;

- the possibility of non-payment of this type of premium with a detailed description of the entire list of reasons, including due to an economically unfavorable situation;

- It is especially important to pay attention to the procedure for payment upon dismissal: should the employee work the whole year or not, how to pay if the dismissal occurs due to layoffs, liquidation of the company, etc.

Risk 3. Holiday bonuses

Such payments are considered by most managers as symbolic gifts in the amount of 500-1000 rubles. Therefore, attention is often not paid to this point, and everything comes down to the wording “The employer pays each employee a bonus of 1000 rubles annually by March 22 – the company’s Founding Day.”

Risk 4. Bonus amount and working hours

One should also take into account the important point that not all employees work the standard/quarterly/monthly hours due to various circumstances - vacations at their own expense, sick leave, maternity or child care leave, etc. Therefore, the amount of the bonus, as well as the very possibility of its payment, should be closely and unambiguously linked to a certain norm: for example, at least 180 working days.

Risk 5. Deduction of bonuses and deprivation of the right to a bonus

These concepts are widely present in real labor practice, however, confusion often arises with the interpretation both in documents and at the level of oral explanation by management of company standards for employees. In an employment contract, collective agreement and other documents, it is important to clearly distinguish both concepts. If deprivation of bonuses is a measure that is legally taken by the employer in the event of a significant mistake made by an employee while performing his duties, then deprivation of the right to a bonus may also have purely economic, objective reasons. Usually all these nuances are spelled out in detail in local acts.

Risk 6. How to properly develop premium reduction mechanisms

Both the grounds for accrual/non-accrual of the premium and the grounds for its justified reduction should be specified in the local act in great detail. It is best to give not specific numbers (a reduction of 500 rubles, etc.), but percentages - for example, “if an error is made when servicing a client, which leads to his refusal to cooperate, the monthly premium is reduced by 10% from the initially established amounts."

Thus, it is better to foresee all the key points given in advance. The main criterion for the correct procedure for awarding bonuses to an employee is drawing up orders and contracts in such a way that he himself can calculate the amount of payment at any time. Those. The calculation of the premium must be extremely transparent, and the grounds for payment or non-payment must be extremely clear.

T-11

Home \ CHETRA BULLDOZERS \ T-11

Characteristics of the bulldozer CHETRA T-11.01

The YUKON company is ready to present you the Chetra T-11.01 Tractor, which has high productivity and is designed for earth-moving work in oil and gas, industrial and road construction, suitable for use in mining quarries and the development of frozen soils. Depending on the engine installed on the T-11.01 tractor There are two modifications: T-11.01 K - four-stroke six-cylinder Cummins diesel engine with in-line cylinders, turbocharged.

T-11.01 I - four-stroke six-cylinder V-shaped diesel engine without turbocharging YaMZ-236 DK-7.

The Chetra T-11.01 gearbox provides three forward gears and one reverse gear. The gearbox is combined into a single power unit with a main gear and a matching gearbox.

| Broadcast | Forward travel T-11.01, km/h | Reverse gear T-11.01, km/h |

| 1 | 3,7 | 5,0 |

| 2 | 6,8 | 9,0 |

| 3 | 11,0 | 14,4 |

Onboard clutches are multi-plate clutches that are hydraulically actuated. The brakes are multi-disc clutches closed by springs. Cooling of brakes and clutches is oil, under pressure.

The two-stage final drive consists of an external gear and a planetary gear with a stopped ring gear. Thanks to the bolted fastenings, the drive sprocket is easily replaceable.

The suspension has high traction and grip properties thanks to a three-point semi-rigid design with a remote bogie swing axis.

The tracks of the T-11.01 bulldozer are prefabricated with one load hook, and a seal is provided in the hinge to retain the lubricant.

The cabin of the T-11.01 tractor has double glazing, is upholstered with noise-absorbing upholstery, and is equipped with a vibration-proof seat. The T-11.01 bulldozer is easy to operate. Control is completely carried out from the driver's seat: the bulldozer and ripper are controlled by separate levers, two levers control the onboard clutches, one lever changes gears and selects the direction of movement. The pedals control the crankshaft rotation speed and braking.

The blade has maximum pressure force and is as close as possible to the tractor hood thanks to the diagonal thrust when transmitting lateral forces from the blade to the left side member of the frame.

| Blade | Blade length × Blade height, H × H, mm × mm | Dump capacity, m3 | Lifting height above ground, mm | Blade depth, mm | Maximum tilt adjustment (skew), degrees | Weight, kg |

| SU blade | 3311×1462 | 5.8 | 1000 | 550 | ±9 | 2350 |

Depending on the working conditions, from one to three teeth are mounted on the ripper.

| Ripper type | Number of teeth | Weight, kg | Max. lifting height, mm | Max. depth, mm | Max. pullout force, T | Max. penetration force, T |

| Non-adjustable, multi-tooth | 3 | 1885 | 500 | 530 | 17,158 | 6,14 |

| Fixed, single prong | 1 | 1000 | 540 | 640 | 16 | 5,7 |

The hydraulic system consists of a gear pump with a capacity of 163 l/min and a four-section distributor. The distributor consists of a single-valve and three-spool section.

| Spool sections | Distributor spool positions | Number of cylinders | Cylinder diameter, mm |

| Blade lift | lift, neutral (hold), lower, float | 2 | 110×1200 |

| Blade misalignment | right, neutral, left | 1 | 160×310 |

| Raising the ripper | lift, neutral, lower | 2 | 160×530 |

Standard equipment of the T-11.01 tractor includes a cabin heating fan, decelerator, hour meter, engine protection, power transmission protection, front tow hook and other equipment.

- spare parts for CHETRA T-11

bulldozer21.ru

Sample filling

The form performs two main functions:

- Consolidation of the annual vacation schedule for employees of the enterprise and changes made to it.

- Informing all employees of the enterprise indicated in the schedule of the start date of the vacation.

The procedure for filling out the vacation schedule

Information data

Data is entered into the fields located above the table in accordance with the proposed queries.

The organizational and legal structure of the enterprise (organization, institution) is entered in deciphered form, the name - in full, without abbreviations.

The field “Opinion of the elected body” is filled in with the word “Taking into account” if the enterprise has a trade union committee or other elected body. If there is none, a mandatory note about this is required. Indication of the union's opinion in the document is mandatory.

The date the form was compiled and the year of validity are entered in the fields to indicate the details.

Columns 1-6

To approve the T-7 form by the head of the enterprise, it is necessary to fill out columns from the first to the sixth. All names, full name and the positions of the company's employees are filled in completely, without reductions. The planned number of calendar days of vacation (Article 5) is entered in numerical terms. Column 6 indicates the date of the first day of vacation in the new year.

If vacation is to be divided into periods, their start date is entered in a separate line in column 6. It is possible to indicate the duration of the period instead of its start date

The completed T-7 form is certified by the head of the enterprise’s personnel service.

Another approval option is to issue a separate order for the enterprise. The form of the document is not unified, so it is compiled in any form. To familiarize employees with the vacation schedule and the order for its approval (if one is drawn up and signed by the manager), a separate statement is drawn up. It must be signed and dated by all employees of the enterprise included in the vacation schedule drawn up for the next year.

Columns seven to ten are filled in by the responsible employee of the personnel service as the date of departure of one or another employee of the enterprise arrives. Column 8 serves to indicate the details of the order, in accordance with which the start date of the vacation is postponed to another date. Column 9 indicates the planned date of the employee’s first day of vacation. Column 10 is filled in informationally: if the reason for transferring the vacation to another date, recall of the employee, or other significant comments and reasons for changing the data is indicated.

If you contact an agency...

If you need an extract urgently without visiting the tax office, it makes sense to contact a consulting agency. In this case, the cost of the service provided by the company’s employees will also be added to the amount of the state fee for an extract from the Unified State Register of Legal Entities. Therefore, before placing an order, you should clarify whether the state duty for an extract from the Unified State Register of Legal Entities is included in the final cost of the order.

- Schengen insurance Sberbank

- VSK insurance house hotline

- how to pay for troika card online

- how to top up a troika card remotely via bus

- how to check balance on troika

- Ingosstrakh insurance policy online personal account

- how to top up the troika app