Payroll taxes in 2020: example of calculating the tax burden

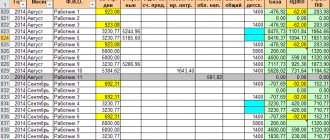

LLC "Clean List" for January 2020 accrued to the director of the company Feotisov A.M.

salary in the amount of 120,000 rubles. Feotisov is a tax resident. The Company applies a contribution rate to the Social Insurance Fund of 0.4%. The amount of income tax to be withheld for January is 15,600 rubles. (RUB 120,000 x 13%). In total, a person is due 104,400 rubles for payment in person (minus calculated and withheld personal income tax). (RUB 120,000 - RUB 15,600).

Contributions due for this month to the Federal Tax Service:

- for pension insurance - 26,400 rubles. (120,000 x 22%);

- social — 3480 rub. (120,000 x 2.9%);

- medical — 6120 rub. (120,000 x 5.1%).

Let's check it out. The total amount should be 36,000 rubles. (120,000 x 30%). This is true. Equality is maintained: RUB 26,400. 3480 rub. 6120 rub.

The Social Insurance Fund accrued 480 rubles. (RUB 120,000 x 0.4%).

All fees are paid at the expense of the society.

Tax agents are any organizations or entrepreneurs that pay wages and other remuneration to individuals. The tax agent, when paying wages to employees, is obliged to calculate the amount of tax, withhold it and transfer it to the budget.

It must be remembered that according to paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, the tax agent must withhold personal income tax from the income of employees upon their actual payment. But at the time of payment of the advance, no income tax is paid.

Reflection in accounting

Accounting and tax accounting of wages provide for the reflection of accrued amounts in the appropriate accounts (Order of the Ministry of Finance 94n). Thus, to reflect calculations for wages and the accrual of other remunerations for labor, account 70 is used in correspondence with the corresponding accounts of the production costs group. For example, the entry for payroll for key personnel: Dt 20 Kt 70.

Read more about the preparation of accounting records in the article “Salary entries”.

Taxes and fees are reflected in other accounts. Thus, to register transactions with the budget regarding personal income tax, account 68 is used. Moreover, special sub-accounts are opened for it in order to detail information on each type of tax and fee. Insurance coverage is reflected in accounting account 69, to which subaccounts must also be created.

We described how to record entries for the accrual and payment of taxes in the article “Entering entries for taxes and fees.”

Payroll taxes in 2020: rates, table of contributions

Insurance agents pay monthly contributions to extra-budgetary funds to the payroll of their employees. This ensures that the insured persons have the right to receive pensions, medical care, disability benefits, and maternity benefits.

Companies and entrepreneurs pay contributions from their own funds, not from employees. Reporting on contributions to extra-budgetary funds is submitted quarterly and annually.

To pay any payroll tax in 2020, you need to know:

- payer;

- tax base;

- tax rate;

- formula for calculating the amount to be paid.

Let's consider these questions regarding taxes and contributions from salaries in 2019.

Only individuals have the obligation to pay personal income tax, therefore, in the case of salaries, employees are considered personal income tax payers. However, they do not remit their own payroll taxes in 2020, since this responsibility is assigned to the agent - the employer. It calculates and withholds personal income tax from the taxable income of employees, and also transfers it to the budget. It is prohibited to transfer personal income tax at the expense of the employer.

As for contributions to compulsory health insurance, compulsory medical insurance and compulsory social insurance, employers are considered payers, not employees. Therefore, contributions are considered expenses of employers and are transferred at their expense.

The Tax Code provides for several rates for contributions: basic, reduced and additional for compulsory pension insurance. The basic rates for contributions to compulsory health insurance and compulsory social insurance for sick leave and maternity leave depend on the annual payments for each employee. These are the so-called contribution limits. They are subject to change annually.

Read more about contribution limits in Table 2.

Table 2. Annual payment limits for contributions

| Year | Limits on employee payments for the year | ||

| on OPS | on OSS | on compulsory medical insurance | |

| 2019 | RUB 1,150,000 | RUB 865,000 | — |

| 2018 | RUR 1,021,000 | RUB 815,000 | — |

| 2017 | 876,000 rub. | RUB 755,000 | — |

| 2016 | RUB 796,000 | RUB 718,000 | — |

| 2015 | RUR 711,000 | 670,000 rub. | — |

| 2014 | 624,000 rub. | 624,000 rub. | 624,000 rub. |

| 2013 | RUB 568,000 | RUB 568,000 | RUB 568,000 |

| 2012 | 512,000 rub. | 512,000 rub. | 512,000 rub. |

| 2011 | RUB 463,000 | RUB 463,000 | RUB 463,000 |

For medical contributions and payments for OSS “for injuries”, the rates do not depend on the annual payments for the employee. Read all the details on the main contribution rates in Table 3.

Table 3. Payroll taxes in 2020: rates, table of contributions

| When is the tariff applied? | Insurance | Limit value of the base for calculating insurance premiums (rub., per year) | Tariff rate |

From payments:

| Pension | Up to RUB 1,150,000 inclusive | 22,0 |

| Over 1,150,000 rub. | 10,0 | ||

| Social | Up to 865,000 rub. inclusive | 2,9 | |

| Over 865,000 rub. | |||

| Medical | Not installed | 5,1 | |

| From payments to foreigners and stateless persons) temporarily staying in the Russian Federation and not being highly qualified specialists In addition to citizens from the EAEU countries | Pension | Up to RUB 1,150,000 inclusive | 22,0 |

| Over 1,150,000 rub. | 10,0 | ||

| Social | Up to 865,000 rub. inclusive | 1,8 | |

| Over 865,000 rub. | |||

| From payments to foreigners and stateless persons permanently and temporarily residing in the Russian Federation and being highly qualified specialists | Pension | Up to RUB 1,150,000 inclusive | 22,0 |

| Over 1,150,000 rub. | 10,0 | ||

| Social | Up to 865,000 rub. inclusive | 2,9 | |

| Over 865,000 rub. | |||

| Insurance premiums do not need to be charged on payments to foreigners and stateless persons temporarily staying in the Russian Federation and who are highly qualified specialists. They are not recognized as insured persons under any type of compulsory insurance. In addition to highly qualified specialists from the EAEU with temporary residence status. Charge them only contributions for social (at a rate of 2.9%) and health insurance (at a rate of 5.1%). Do not make contributions to pension insurance. They are not insured in the compulsory pension insurance system. | |||

The organization charges insurance premiums for three types of insurance on the employee’s income:

- pension,

- medical,

- social.

The general rate is 30%. The company will pay these contributions to the Federal Tax Service of Russia. There are also contributions for traumatism. They are paid to the FSS of Russia. See table with percentages below.

Note that legislators had plans to raise the tariff on pension contributions from 22 to 26% from 2021. But now the Duma has adopted a law that permanently fixed the “pension” rate at 22%.

Preferential rates for contributions for simplified workers, as we already announced at the beginning, disappear from 2020. Thus, simplifiers in 2020 applied a reduced rate of 20% instead of 30% to 61 types of activities (subclause 5, clause 1 and subclause 3, clause 2, article 427 of the Tax Code). From January 1, this benefit is canceled and the rate increases to a total of 30%. There is currently no draft of new benefits for single tax payers under the simplified tax system.

Attention, criminal penalties have been introduced for accountants for contributions. Experts from the magazine “Salary” contacted sources in the Ministry of Finance and found out that the amount of salary of 5,000 rubles, which the company hides from the calculation of contributions, can lead to the dock.

How can an accountant protect himself?

From the beginning of each year, the maximum base for insurance contributions traditionally grows by 10-15%. This means that the larger amount must be paid to the Federal Tax Service. 2020 is no exception. Thus, at the same salary level, the business will transfer more money to the tax office.

READ MORE: Receipt for payment of transport tax: where to get it and how to fill out the form?

The Government traditionally announces specific limits in the fourth quarter of the outgoing year (November-December). The current values for 2020 are, let us remind you, for social insurance - 815,000 rubles, for pensions - 1,021,000 rubles. (Resolution of the Government of the Russian Federation dated November 15, 2017 No. 1378). There are no income limits for medical and accident contributions. Such amounts are accrued, so to speak, unlimitedly - on all income.

| Tax name | Rate, percentage (%) | Note, link to legal acts |

| Personal income tax of a tax resident | 13 | The rate does not vary in any way depending on the level of income (clause 1 of Article 224 of the Tax Code) |

| Personal income tax of a non-resident of the Russian Federation | 30 | The rate does not vary in any way depending on the level of income (clause 3 of Article 224 of the Tax Code) |

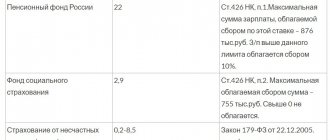

| Insurance contributions to the Federal Tax Service for compulsory pension insurance* | 22 | At the 22% tariff, contributions are calculated on payments not exceeding the maximum base established for the year. In addition to exceeding this base and indefinitely, a reduced tariff of 10% applies to all employers (subclause 1, clause 2, article 425 of the Tax Code as amended from January 1, 2019)** |

| Insurance contributions to the Federal Tax Service for compulsory social insurance in case of temporary disability and in connection with maternity | 2,9 | Contributions at the specified rate are calculated from payments within the maximum base established for the year. Contributions are not accrued in excess of such a base (subclause 2, clause 2, article 425 of the Tax Code) |

| Insurance contributions to the Federal Tax Service for compulsory health insurance | 5,1 | Contributions are calculated on all payments regardless of the amount of income during the year. That is, the maximum base has not been established (subclause 3, clause 2, article 425 of the Tax Code) |

| Insurance contributions to the Social Insurance Fund for compulsory social insurance against accidents at work and occupational diseases | The rate of “unfortunate” contributions is set by the social insurance fund based on the class of professional risk, which, in turn, depends on the main type of activity of the insured. At the same time, the Social Insurance Fund has the right to apply discounts/surcharges to the tariff. The FSS informs the newly registered organization of the assigned tariff in a notification. These, by default, are now sent exclusively in electronic form and only on special request - on paper (Clause 2, Article 6 of Law No. 125-FZ of July 24, 1998). Organizations operating for more than a year annually confirm their main type of activity in order to maintain or change their tariff (Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55). Rates vary from 0.2 to 8.5%, depending on the class of profit. That is, the least dangerous types of business are assigned the lowest tariff. For payments to disabled employees, contributions to the Social Insurance Fund are calculated at 60% of the insurance rate for the main type of activity. That is, at a discount. All policyholders have the right to the benefit, regardless of their main type of activity (Law dated December 22, 2005 No. 179-FZ) | |

* For some categories of employees engaged in harmful and dangerous work, additional contributions to pension insurance are established, taking into account the results of a special assessment of working conditions (Article 428 of the Tax Code). See a separate table with additional tariffs in percentages.

** Article 426 of the Tax Code, which currently sets out general tariffs for the period until 2020, will become invalid as of January 1, 2020. You need to refer to Article 425 of the Tax Code in the new edition.

Taxation of the self-employed

The self-employed will have to legalize their income next year and transfer fiscal payments to the budget. The law regulating the taxation of self-employed persons has become one of the most resonant this year.

In 2019, deductions from the income of self-employed people were carried out on an experimental basis in four constituent entities of the Russian Federation: Moscow, Moscow region, Tatarstan, Kaluga region. At the end of the year, the experiment ends - a tax regime is introduced for all Russians who fall under the category of self-employed.

A special tax regime allows you to work without registration and pay preferential rates on the fees received:

- 4% - if the income is received from an individual;

- 6% - in case of receipts from individual entrepreneurs and legal entities.

Often, freelancers, bloggers, legal advisers and other categories of self-employed citizens provide services to individuals and legal entities - in such situations, differentiated rates are applied for each category.

Initially, legislators planned to introduce taxes for such taxpayers until 2029, but now the time frame has been shortened.

Tax reduction

For this purpose, the Tax Code specifies specially applied deductions:

- standard (applied when there are children of a certain age);

- social (applies to the provision of documents for treatment or education);

- property (applied when purchasing housing).

The above deductions are issued to the Federal Tax Service or the employer on the basis of a notification issued by the tax authority. A deduction for children is provided upon application from the employer accompanied by the necessary documents.

At the end of the year, reports 2-NDFL and 3-NDFL are submitted.

How can I view my pension contributions?

It is possible to monitor the fulfillment of the obligation to make payments towards a future pension in a number of institutions.

- MFC;

- a bank, if it has an agreement with the PF and the citizen is its client;

- Pension Fund;

- customer service;

- NPFs, if a person has invested a savings portion in them.

If you are registered on the websites of State Services or the Pension Fund, you can check it via the Internet.

Creating a personal account in State Services automatically entails registration on the Pension Fund website.

The procedure is simple; it consists of entering minimal information about the user and confirmation.

Verification algorithm. Opening tabs:

- pension;

- benefits and allowances;

- notification of the status of the personal account.

On the Pension Fund website like this:

- Ministry of Health and Social Development;

- Pension Fund;

- information about the status of personal accounts;

- notice.

When applying in person, you need to find an authorized department and contact a specialist with documents. Mandatory list:

- SNILS;

- passport;

- statement.

At the bank, an employee will accept and register the application. After this, settings will be made in the client’s personal account to allow requesting data from the pension account.

Having received a coupon at the MFC terminal with a number in the electronic queue, you need to wait for a notification that the specialist is ready to accept the application. The further procedure is carried out similarly.

The customer service provides information in writing within 10 days by registered mail. You can receive an extract in person at the service office.

The procedure for obtaining data from non-state funds is not universal. It depends on the procedure for issuing such information to clients by a specific organization. However, this should not cause any difficulties. By providing the above documents, the client has the right to receive information about the status of his accounts.

Control of accruals in a private fund consists only of familiarizing yourself with the amounts. The client cannot influence their size. The conclusion of an agreement involves the transfer of funds for the full management of the company, freedom in choosing management decisions. Familiarization with the operations being carried out and agreement with the pensioner is not provided.

Which accounts are used to pay salaries and taxes?

The chart of accounts establishes the following accounts, with the help of which wages are calculated and paid to employees working in the company under employment contracts:

- Accounts for recording costs by place of their occurrence - 08, 20,23,25,26,28,29,44, 86, 91, 96, 99 - are used to pay salaries to company employees employed in various structural divisions of the company.

- Account 50 – to reflect the payment of wages from the company’s cash desk.

- Account 51 - to reflect the transfer of remuneration to employees to their bank accounts.

- Account 68 “Personal Income Tax” – is used when the employer fulfills the duties of a tax agent to withhold and transfer wages.

- Account 69 - used to calculate benefits included in the employee’s salary, but paid from social insurance funds; this account is also used when a company, within the framework of compulsory social insurance, accrues wage contributions to the Pension Fund of the Russian Federation, the Compulsory Medical Insurance Fund, and the Social Insurance Fund.

- Account 70 – used when calculating and issuing earnings to employees. This account collects information about payroll settlements with the employee.

- Account 73 - applies when there are other relationships with the employee that involve deductions from his salary. First of all, this is the return of loans provided, compensation for damage caused to the organization, calculation of compensation for the use of personal transport, etc.

- Account 76 - applies in case of deduction on writs of execution received by the company in favor of third writs, as well as on the basis of a voluntary application by the employee. Salary deposits are also reflected in this account.

- Account 84 - is used when calculating amounts due to an employee, the source of which is the company’s profit.

Personal income tax must be withheld from the employee's salary. In addition, contributions to social funds and injuries are assessed for the entire amount of earnings.

Contributions are accrued to the same cost accounts as the employee's salary. Transfer of such obligatory payments occurs only by non-cash method within the time limits established by law.

| Debit | Credit | Operation designation |

| 70 | 68 | Personal income tax has been removed from earnings |

| 73 | 68 | Personal income tax is withheld from material assistance (if its amount is more than 4,000 rubles) |

| 68 | 51 | The tax was transferred to the budget |

| 20, 23, 25, 26 | 69/PF | Contributions to the pension fund have been accrued |

| 20, 23, 25, 26 | 69/SOC | Social security contributions accrued |

| 20, 23, 25, 26 | 69/MED | Health insurance premiums accrued |

| 20, 23, 25, 26 | 69/TRAUMA | Contributions to the Social Insurance Fund for injuries have been accrued |

| 69/PF | 51 | Contributions to the pension fund have been transferred |

| 69/SOC | 51 | Social security contributions transferred |

| 69/MED | 51 | Medical insurance contributions listed |

| 69/TRAUMA | 51 | Contributions to the Social Insurance Fund for injuries have been paid |

The base for personal income tax and contributions is mainly labor payments to employees. Such payments include:

- Remuneration, including:

- salary - that is, monetary and non-monetary payments at salaries, tariff rates or other rates directly for time worked or work done;

- incentives – cash bonuses, gifts and other material rewards for high production results;

- production bonuses and additional payments to wages - for example, for special working conditions, for harmful climatic conditions, for shift work, for working at night, overtime, on weekends or holidays, etc.

- Vacation pay:

- payment of basic, additional and educational leaves;

- compensation for unused vacation.

- Average salary for days not worked:

- sick leave;

- days off for donors during blood donation days;

- breaks in work during downtime, etc.

READ MORE: Amount of unemployment benefits for 2020

Bets, which include mandatory and additional

As we have already found out, a 22 percent rate of transfers from wages to the Pension Fund is mandatory for everyone except beneficiaries. Persons who are employed in harmful and dangerous jobs can count on special pension provision, which means early retirement. Therefore, special rates are established for such citizens.

Such tariffs are accepted according to certain lists regulated by Federal Laws No. 400 and No. 426, which were adopted on December 28, 2013. In 2020, they also remain unchanged. The more dangerous the job, the higher the additional rate, which ranges from 2% to 9%, and is added to the basic rate of 22%.

Payroll taxes for employees

In relation to personal income tax, the employer acts not as a taxpayer, but as a tax agent. In essence, the employee receives a salary (or other income) minus income tax. The interest rate depends on whether the specialist is a resident of the Russian Federation or not. In the first case, 13% of earnings are withheld, in the second – 30%.

Personal income tax amount = (Employee income – Personal income tax deduction (if used)) x Personal income tax rate in %.

In addition to income tax, when paying wages, the employer will have to charge mandatory insurance contributions from the payroll. This is the most significant part of mandatory payments depending on staff income. In general cases, the amount of insurance amounts is 30%. In addition to this, contributions to the Social Insurance Fund for “injuries” are paid, the rate of which, depending on the level of danger of the work, can be from 0.2% to 8.5%.

So, what tax does the employer pay for the employee in 2018:

- Personal income tax – the tax rate is 13% (30% for non-residents).

- Contributions for compulsory pension insurance – the rate is 22%.

- Compulsory medical insurance contributions - the tariff is set at 5.1%.

- Contributions to the Social Insurance Fund - the rate is 2.9%.

- Contributions for “injury” – rate from 0.2% to 8.5%.

Note! The interest rate on contributions for “injuries” is approved by the territorial branch of Social Insurance. The amount of the payment is affected by the main type of activity according to OKVED for the previous year (calendar). The employer is required to confirm the main activity for the Social Insurance Fund annually.

- According to OPS – RUB 1,021,000.00. for each employee, after exceeding the rate of “pension” contributions is 10%.

- According to the Social Insurance Fund in case of illness and maternity - 815,000.00 rubles. for each employee, after exceeding the limit, the employer does not have to pay contributions.

Personal income tax at a rate of 13% is paid by resident taxpayers, 30% by non-residents.

Insurance contributions to extra-budgetary funds are calculated and transferred at the following rates:

- in the Pension Fund of Russia - 22%

- in the Social Insurance Fund - 2.9%

- in the Federal Compulsory Medical Insurance Fund - 5.1%

- for injuries - from 0.2 to 8.5%

In jobs with difficult working conditions, in underground work, in hot shops, female tractor drivers and drivers of locomotive crews are provided with additional tariffs for insurance premiums.

Contribution rates are set out in Chapter. 34 Tax Code of the Russian Federation.

The main part of the contributions is transferred to the Federal Tax Service. Only contributions for injuries are sent to the Social Insurance Fund. It is necessary to use the new BCC for insurance contributions to extra-budgetary funds of the Russian Federation.

Having studied all the taxes, let's calculate how much you need to pay per employee per month.

If the salary under the employment contract is 20,000 rubles. per month, then for the year it will be 240,000 rubles.

Let's calculate personal income tax: 20,000 x 13% = 2,600 rubles.

The employee receives 17,400 rubles. (20,000 - 2,600).

Every month, under the same conditions, you will need to pay fees:

- for compulsory medical insurance: 20,000 x 5.1% = 1,020 rubles.

- for OPS: 20,000 x 22% = 4,400 rubles.

- on OSS: 20,000 x 2.9% = 580 rubles.

- “for injuries”: 20,000 x 0.2% = 40 rubles.

The total amount is 6,040 rubles. per month and 72,480 rubles. in year.

Total: costs per employee will be 26,040 rubles. per month or 312,480 rubles. in year.

In addition to wages, it is also necessary to take into account the employer’s costs for equipping each employee’s workplace. And in this case, those who transfer employees to remote work save significantly.

Responsibility for non-payment of tax and deadlines

The taxes described above are one of the main ones, so they must be submitted on time and there is serious responsibility. Thus, all payroll taxes are paid monthly. They are accrued no later than the day when all employees receive their salaries for the month. The contribution must be made at the place of registration, however, if the company has divisions separate from each other, then payments for their employees are made to the attached branches of the Federal Tax Service.

Sometimes it happens that the employer, when calculating insurance premiums:

- Reduced the computing base, not including quarterly bonuses and other similar payments.

- Incorrectly calculated the contribution amount. For example, you used the wrong tax rate.

- Made illegal manipulations with insurance premiums or did not take them into account at all.

This leads to the fact that there is a shortfall in the insurance premium - it is either incomplete or there is none at all. Based on this, tax authorities demand to pay not only the amount required by law, but also a penalty or fine.

The fine will be 20% or 40% of the contribution amount, depending on whether the error was intentional or not. If all the documentation is filled out correctly, but the payment is late, this is not punishable by a fine, but a penalty will be imposed. For each overdue day - 1/300 of the Central Bank key rate. As of October 2020, it is 7.5%. From the 31st day of delay in payment, penalties are calculated as 1/150 of the unpaid amount daily.

All salary deductions in 2020 as a percentage: table

| Working conditions* | Additional insurance premium rate, percentage (%) | |

| Class of working conditions | Subclass of working conditions | |

| Dangerous | 4 | 8 |

| Harmful | 3.4 | 7 |

| 3.3 | 6 | |

| 3.2 | 4 | |

| 3.1 | 2 | |

| Acceptable | 2 | |

| Optimal | 1 | |

* If labor assessment was not carried out, the additional rate is 6% - in relation to payments for work specified in paragraph 1 of part 1 of Article 30 of the Law of December 28, 2013 No. 400-FZ and 9% - in relation to payments for work from subparagraphs 2-18 Part 1 of this article.

So, let’s summarize all salary taxes existing in Russia into a single table and find out the minimum and maximum percentage that is withdrawn from our actually earned wages by the state.

| Type of tax | Min. bid | Max. bid |

| Income tax (NDFL) | 13% | 30% (for non-residents) |

| Contributions to pension plans |

| |

| Contributions for temporary disability and maternity |

| |

| Contributions for injuries | 0,2% | 8,5% |

| Health insurance | 5,1% | 5,1% |

If such contributions in your case are maximum, then you pay in the form of taxes and social contributions more than half of what you actually earned.

The Tax Code provides for several personal income tax rates: 13%, 30%, 35%, 9%. At what rate should an employer calculate personal income tax and withhold it from employee income depends on:

- The employee's status as a resident of Russia for tax purposes.

- Type of taxable payments to the employee.

For details on personal income tax rates, see Table 1.

Table 1. Payroll taxes in 2020: rates, personal income tax table

| Pay | Bid |

| If the employee is a tax resident of the Russian Federation | |

| All types of salary payments received from sources in the Russian Federation and abroad | 13% |

| Material benefit from saving on interest for using borrowed funds, if the loan is received from the employer and if saving on interest is actually financial assistance. Withhold tax on the difference between the amount of interest calculated based on the terms of the contract and the amount of interest calculated based on: 2/3 of the refinancing rate on the date of interest payment - for credits (borrowings) in rubles; 9% per annum – on credits (loans) in foreign currency. There are exceptions. Benefit received: during the period of interest-free use of the loan under the agreement for transactions with bank cards; for funds for new construction or purchase of housing, land with a house and for the construction of a house, if an individual has the right to receive a property deduction; for borrowed funds to refinance the above purposes. | |

| If the employee is not a tax resident of the Russian Federation | |

| Income of foreigners - highly qualified specialists | 13% |

| Income of an employee hired under a patent (Law dated July 25, 2002 No. 115-FZ) | |

| Income of crews of ships flying the Russian flag | |

| Income of participants in the program for the voluntary resettlement to Russia of compatriots who have moved for permanent residence in the Russian Federation | |

| Income of refugees who received temporary asylum in the Russian Federation | |

| All other income, except for situations provided for by international agreements on the avoidance of double taxation | 30% |

In 2020, all employers are required to transfer personal income tax (personal income tax) and insurance contributions for mandatory pension, social and health insurance from wages and other income paid to employees.

Personal income tax is the main tax on wages. Personal income tax rates and the procedure for its payment depend on the tax status of the income recipient, that is, on whether the employee is a tax resident of the Russian Federation or not:

- If an employee has been in Russia for more than 183 calendar days over the past 12 calendar months, he is a resident.

- If the period of stay of an employee in Russia is less than 183 calendar days, then he is not a tax resident.

The amount of payroll tax depends on the status, i.e. the corresponding rate used in the calculations. The income of residents is taxed at a rate of 13 percent, non-residents - at a rate of 30 percent. Therefore, the employee’s tax status should be clarified at the end of the year and, if necessary, the tax should be recalculated at the appropriate rate.

It should be taken into account that the period of stay in Russia is not interrupted if the employee leaves the country for short-term (less than six months) treatment or training. If the status has changed, then the amount of payroll taxes that the employer has to pay also changes, up or down.

MORE: Transport tax return (2019). Transport tax (Chapter 28 of the Tax Code of Russia): form, format and procedure for filling out a tax return

| Personal income tax rate | Recipient of income (salary) |

| 13 % | — Residents of the Russian Federation (with the exception of payments taxed at other rates); — Citizens of EAEU countries; — Highly qualified foreigners. |

| 30 % | Non-residents of the Russian Federation |

Also, contributions must be calculated and transferred from wages, which are not tax, but are a mandatory payment for employers.

Insurance premiums from salary in 2020 as a percentage: table

| Contributions | Bid | Income limit | Above the limit value |

| Pension insurance | 22 % | 1,150,000 rubles | 10 % |

| Social insurance | 2,9 % | 865,000 rubles | — |

| Health insurance | 5,1 % | — | 5,1 % |

When is it introduced?

The bill has been prepared, but has not yet been considered by State Duma deputies and has not been signed by the president, so the Ministry of Finance does not give an exact date. The likelihood of introduction in 2020 is high.

There is no final mechanism for transferring employed citizens to the new taxation scheme - specialists from the relevant ministry are considering various options, including automatic transfer.

There is no single decision regarding the mandatory nature of the fiscal contribution; the possibility of refusing to pay it is being considered on the basis of a written application from the employee.

The transition to the new pension contribution algorithm will be gradual, with an annual increase in contributions by 1%. The new payroll tax table will look like this:

| Year | % |

| 2020 | 1 |

| 2021 | 2 |

| 2022 | 3 |

| 2023 | 4 |

| 2024 | 5 |

| 2025 | 6 |

In total, the transition will take 6 years. Experts doubt that the introduction of an additional fiscal contribution will solve the problem of pension payments. Employers often deliberately reduce official salaries in order to reduce mandatory contributions from them.

Not all employees will agree to have an additional 6% of savings withheld from their salaries. Many will refuse if the state gives them such an opportunity.

The Russian authorities are going to motivate the working population to make additional contributions by providing tax benefits to payers. Which ones exactly are not yet clear.

Mandatory contributions for individual entrepreneurs in 2020

Under any tax regime, an individual entrepreneur is required to make systematic deductions for himself. Often, an individual entrepreneur does not have an employer and does not pay wages; in this case, fixed payments are calculated from income. The amount of contributions to the funds depends on the amount of income received.

Since 2020, the insurance burden of individual entrepreneurs has been decoupled from the minimum wage, and the amount of contributions has become fixed. Federal Law No. 335-FZ of November 27, 2017 specifies the amounts of insurance contributions for compulsory pension insurance (OPI) and compulsory health insurance (CHI) until 2020.

As a general rule, individual entrepreneurs are required to pay insurance contributions to extra-budgetary funds:

- for your own compulsory medical insurance and compulsory medical insurance;

- for compulsory social insurance (OSS) of employees, if the entrepreneur has them.

Also, individual entrepreneurs can voluntarily pay insurance premiums to OSS for themselves if they want to receive benefits from the Social Insurance Fund (for example, maternity benefits, child benefits, temporary disability benefits). To do this, you need to register with the Social Insurance Fund yourself. How to do this is described in the article “Sick leave for individual entrepreneurs without employees.”

In accordance with paragraph 1 of Art. 430 of the Tax Code, insurance premiums for compulsory health insurance are calculated as follows:

- if the income of an individual entrepreneur falls within the limits of 300,000 rubles, then the fixed amount is 29,354 rubles;

- if the income of an individual entrepreneur exceeds 300,000 rubles, then the fixed amount is 29,354 rubles. 1% of the amount of income exceeding the limit of 300,000 rubles, but not more than an eightfold increase in the fixed payment - 8 x 29,354 rubles. Thus, the maximum contribution to compulsory pension insurance in 2020 is 234,832 rubles.

Insurance premiums for compulsory medical insurance for individual entrepreneurs in 2020 amount to 6,884 rubles.

Reduced rates for contributions to the Pension Fund

The rate for contributions to the Pension Fund may vary depending on the type of activity of the company. For example, IT companies pay pension contributions at a rate of 8% in 2020. The full conditions are in Article 427 of the Tax Code of the Russian Federation.

The rate for contributions to the Pension Fund may vary depending on the type of activity of the company. For example, IT companies pay pension contributions at a rate of 8% in 2020. The full conditions are in Article 427 of the Tax Code of the Russian Federation.

But that is not all. You also need to pay contributions for compulsory health insurance, in 2020 it is 6884 RUR.

If the income of an individual entrepreneur exceeds RUB 300,000, you will have to pay an additional 1% of the excess amount. But there is a maximum limit for insurance pension contributions - 234,832 RUR. That is, even if an individual entrepreneur earns significantly more than three hundred thousand rubles, he will still pay only 234,832 rubles in taxes.

For example, an individual entrepreneur earned 350,000 RUR. This is what he must pay:

- mandatory contributions: 29,354 R 6884 R = 36,238 R;

- additional contributions: (350,000 RUR − 300,000 RUR) × 1% = 500 RUR.

Every year the mandatory amount of contributions for individual entrepreneurs changes; check the current one on the Federal Tax Service website. In 2020 it will be like this:

- insurance premiums for compulsory health insurance - 32,448 RUR;

- insurance premiums for compulsory medical insurance - 8426 RUR.

Lawyers, notaries, arbitration managers, appraisers, patent attorneys pay fees for themselves according to the same scheme.

Amendments to the legislation do not imply changes in the tariffs for contributions to the Pension Fund. How much is withheld from salary to the Pension Fund? This is still 22% within the annual limit, 10% if exceeded, as well as 5.1% for compulsory health insurance, 2.9% for deductions for temporary disability and in connection with maternity.

Those who pay contributions to their future pension, namely individual entrepreneurs, lawyers in private practice, notaries and so on, as before, have a fixed contribution equal to 26% of the minimum wage (minimum wage) per month. The minimum wage is set at the beginning of the year and multiplied by 12 months, i.e. at the beginning of 2020 it was approved in the amount of 7,500 rubles, respectively, the annual contribution will be 23,400 rubles.

Everyone should know how much is contributed to the pension fund from their salary.

This amount to be paid is finite, unless the annual income of an individual entrepreneur - a lawyer in private practice, a doctor, a notary, etc. - is no more than 300,000 rubles. In the case of a larger annual income, the Pension Fund is required to pay an additional tax amount in the amount of 1% of the amount exceeding the threshold of three hundred thousand, but not more than 163,800 rubles.

If the limit on pension contributions is exceeded, you are entitled to a reduced rate. If we compare it with 2020, it has increased and now amounts to 876,000 rubles (in 2020 it was 796,000 rubles). In addition, new limits on contributions for daily travel allowances in Russia and abroad have been established. On the territory of the Russian Federation they amount to 700 rubles per day, when traveling outside the territory - 2,500 rubles per day.

The most important difference compared to 2020 is the new forms of reporting insurance fees for the Federal Tax Service. According to the new rules, the “Unified Social Insurance Tax” (USSI) is provided, and for the Pension Fund of the Russian Federation a new reporting is “Report on Insurance Experience” or SZV experience. Also, according to the new rules, the requirements for enterprises that wish to pay at a reduced rate have increased, and also established new deadlines for submitting some reports.

We invite you to familiarize yourself with Bankruptcy of a liquidated debtor - simplified procedure, features, cost, term

The category of citizens who control timely enrollment in the Pension Fund of the Russian Federation can be sure that their future pension will not be affected. Such a check can be carried out every three months, requiring the accounting department to provide information about the payment of contributions in writing.

Sometimes employees feel embarrassed in front of their superiors, so they do not require this kind of confirmation from the accounting department and do not exercise their legal right, according to Art. 14 Federal Law “On individual accounting of compulsory pension insurance”.

— a report is submitted to the Social Insurance Fund on injuries at work and on the issue of special certification of workplaces;

- in the Pension Fund of the Russian Federation - the old type of reporting according to SZV-M and new reporting according to the CMEA-experience form.

— ESSS — until the 30th day following the reporting period of the month;

— FSS – until the 20th day in paper format and until the 25th day on electronic media following the reporting month;

— SZV-M – until the 15th;

- CMEA experience - by March 1, 2020.

Despite the fact that changes are constantly being made to the legislative framework in the pension sector, the general tariff for contributions to the Pension Fund does not change. For 2020, it is the same 22% of wages, provided that payments cannot exceed the annual limit.

Those individuals who pay contributions on their own will also pay fixed contributions to the Pension Fund, which amount to 26% of the minimum wage. In this case, this amount is multiplied by 12 months.

Additional tariffs for contributions to the Pension Fund are introduced for those employers who have jobs in hazardous industries. In other words, if they make contributions in favor of those persons who are entitled to receive a preferential pension.

The tariff must be determined in accordance with the given assessment of working conditions, as well as the assigned class.

See when

pension payments stop and how to restore them

.

Will there be an additional payment to the pension after 80 years of age in 2020? Find out in this article.

What is the procedure for paying fees and submitting reports?

The calculation and payment system is established by Art. 431 Tax Code of the Russian Federation. The percentage of the salary to the Pension Fund is calculated based on the results of each calendar month. We multiply the base for insurance pension contributions for the period from the beginning of the year to the end of the billing month by the corresponding tariff and subtract the amount of insurance contributions calculated for each previous month. Insurance premiums are calculated in rubles and kopecks.

Calculated insurance contributions for pension insurance must be paid to the tax office no later than the 15th day of the month following the reporting month. If the 15th falls on a weekend or holiday, the deadline is shifted to the next working day after the 15th.

Reporting related to calculated and paid pension contributions - calculation of insurance premiums. It is submitted by the taxpayer to the tax authority quarterly, no later than the 30th day of the month following the reporting period. Taxpayers with an average number of people on the payroll for the previous reporting period of 25 people or less have the right to submit calculations for insurance premiums both on paper and through TCS. Those whose average headcount exceeds 25 people are required to report only electronically.

IMPORTANT! From 2020, policyholders whose average number of employees for 2020 was more than 10 people will have to report under the TCS. See here for details.

Privileges

There are relaxations when paying taxes - the corresponding cases are listed in Article 427 of the Tax Code of the Russian Federation. Who can count on preferential rates and is exempt from payments:

- Companies in special economic zones: 13% pension rate, social – 2.9% and medical – 5.1%.

- Individual entrepreneurs with a patent do not pay anything.

- LLC in special economic zones - Vladivostok, Kaliningrad region, Crimea and others.

The full list can be found in the specified article of the Tax Code of the Russian Federation.