What is commission trading?

Trading can be done in different ways. You can create products and then sell them to the end consumer. You can act as an intermediary, in other words, purchase products from a supplier and then resell them to a retail buyer. Or you can sell something that doesn't belong to you.

The essence of commission trading is that a company makes transactions on its own behalf, but at the expense of the counterparty. The important thing is that the right to own the product does not transfer to the selling company. Such concepts as agent, principal, commission agent, and principal appear. In all this, the selling company calls itself a commission agent, and the company transferring the product for sale is a principal.

For his services, the commission agent receives a commission in the form of a percentage or amount established by the contract. The costs associated with the execution of the order are reimbursed by the principal. All these aspects are reflected in a special way in accounting, special accounts and postings are used, primary documents are also drawn up differently than in classical trading.

Goods on commission - keeping records with the commission agent and the consignor

Anastasia Gerasimova, auditor, methodologist at FinExpertiza LLC

The use of a commission agreement in trade relations is currently very common, since it gives the parties many advantages compared to classical sales and purchases, in particular, they allow the commission agent to enter into trade at low costs, the principal to expand markets for their products, and also significantly optimize the costs of both.

Commission agreements have many nuances and different options for building relationships, therefore, despite their widespread use, commission relationships never cease to raise questions among accountants.

This article will examine in detail one of the aspects of the commission agreement - accounting for goods on commission, in particular, the procedure for reflecting transactions in the accounting records of the principal and the commission agent, document flow, as well as some features of the taxation of these transactions.

The regulation of relations under a commission agreement is carried out by the Civil Code of the Russian Federation, in particular, Chapter 51 “Commission” is devoted to this.

In accordance with paragraph 1 of Art. 990 of the Civil Code of the Russian Federation, under a commission agreement, one party (the commission agent) undertakes, on behalf of the other party (the principal), for a fee, to carry out one or more transactions on its own behalf, but at the expense of the principal.

The commission agent, on his own behalf, enters into contracts with third parties, acquires rights and obligations under a transaction concluded with a third party, even if the principal was named in the transaction or entered into direct relations with the third party for its execution. Thus, all documents related to the transaction are drawn up on behalf of the commission agent, and he is not obliged to indicate that he is acting on the instructions of the principal.

The legal status of things that are the subject of the commission is enshrined in Art. 996 of the Civil Code of the Russian Federation, which states that things received by the commission agent from the principal or acquired by the commission agent at the expense of the principal are the property of the latter.

From the beginning to the end of the fulfillment of his obligations, the commission agent disposes of the goods, but is not its owner.

Commission agreements, according to which the principal transfers the right to the commission agent to dispose of his property, can be of two types:

1. A commission agreement for the sale of goods, upon conclusion of which the principal instructs the commission agent to sell his goods on agreed terms for a certain remuneration.

2. Commission agreement for the purchase of goods, in which the commission agent undertakes, for a fee, to purchase goods for the principal on the agreed terms.

When selling goods, ownership of the goods passes from the principal directly to the buyer, and when purchasing, from the seller to the principal.

The procedure for recording business transactions under a commission agreement in accounting is largely determined by the provisions of the agreement concluded between the parties, for example, whether or not the commission agent participates in the settlements between the principal and the buyer (seller).

Let us consider the accounting of transactions under a commission agreement in the context of both types of agreements. And since the parties to the commission agreement are the principal and the commission agent, therefore, the accounting of transactions should be considered for each of the parties.

Commission agreements for the sale of goods

Accounting with the principal

When shipping goods to a commission agent for sale under a commission agreement, the principal uses account 45 “Goods shipped.”

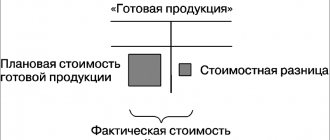

Shipped goods are reflected in accounting at the actual or standard (planned) full cost, which includes, along with the production cost, costs associated with the sale (sale) of products, works, services, reimbursed in the price of the goods.

When transferring goods for sale, an invoice or an act of acceptance and delivery of goods (acceptance certificate) is drawn up, which indicates the price of the goods agreed upon by the parties.

When selling goods or finished products through an intermediary, the principal carries out entrepreneurial activities in the sale of goods or the production and sale of finished products, the proceeds from which are subject to reflection on the credit of account 90 “Sales”. According to clauses 5 and 12 of PBU 9/99 “Organizational Income”, revenue from the sale of goods (products) is income from ordinary activities and is recognized in accounting when the goods are shipped to the buyer based on the commission agent’s report.

To reflect in the accounting accounts settlements with the commission agent, the committing organization can use account 76 “Settlements with various debtors and creditors” subaccount “Settlements with the commission agent”.

The principal must charge and pay VAT on the cost of goods transferred to the commission agent on the date of shipment of the goods by the commission agent to the buyer. The tax base for VAT is determined based on the price of the goods specified in the agreement between the commission agent and the buyer.

Notify the principal of the date of sale of the property by the commission agent in accordance with paragraph. 5 tbsp. 316 of the Tax Code of the Russian Federation is obliged within three days from the end of the reporting period in which such implementation occurred. According to clause 24 of the Rules, the principal is obliged to register in the sales book invoices that reflect the indicators of invoices issued by the commission agent to the buyer (which means the principal must be aware of these indicators).

In order to timely charge VAT by the principal, it is necessary for the commission agent to submit monthly reports to the principal with information on the dates of shipment of goods to customers, confirmed by primary documents.

The accounting entries for the principal under a commission agreement for the sale of goods may be as follows.

| Account correspondence | Contents of operation | Primary document | |

| Debit | Credit | ||

| 45 “Goods shipped” | 41 "Products" | The cost of goods shipped to the commission agent is reflected | Invoice or act of acceptance and transfer of goods |

| 76 “Settlements with commission agent” | 90-1 “Revenue” | Sales of goods to the buyer are reflected | Notice from the commission agent about the shipment of goods to the buyer (posting is made on the date of receipt of the notice) |

| 90-2 “Cost of sales” | 45 “Goods shipped” | Cost of goods sold written off | |

| 90-3 "VAT" | 68 "VAT" | VAT is charged on sales turnover | Invoice issued |

| 44 “Sales expenses” | 76 “Settlements with commission agent” | Commission accrued to the commission agent | Commissioner's report (with attached supporting documents) |

| 90-2 “Cost of sales” | 44 “Sales expenses” | Commission expenses written off | |

| 19 "VAT" | 76 “Settlements with commission agent” | VAT charged on commission fees | Invoice received from the commission agent |

| 68 "VAT" | 19 "VAT" | Submitted for deduction of VAT on commission fees | |

| 51 “Current account” | 76 “Settlements with commission agent” | Received funds from the commission agent for goods sold minus commission* | Payment order |

* The situation with the participation of the commission agent in the calculations is considered.

Accounting with a commission agent

Since things received by the commission agent from the principal are the property of the latter, goods received on commission are not reflected on the commission agent’s balance sheet, but are accounted for in off-balance sheet account 004 “Goods accepted on commission.” Goods accepted for sale under a commission agreement are written off from off-balance sheet account 004 upon sale or upon return of goods to the principal.

Subsequently, the commission agent makes transactions with buyers of products (goods), concluding purchase and sale agreements on his own behalf. Based on clause 3 of PBU 9/99 “Income of the organization”, receipts from legal entities or individuals in favor of the principal are not recognized as income of the commission agent. Accordingly, the disposal of assets under commission agreements, agency and other similar agreements in favor of the principal is not recognized as expenses of the commission agent (clause 3

PBU 10/99 “Expenses of the organization”).

It should be taken into account that since the commission agent makes transactions with third parties on his own behalf, then all the necessary documents must be drawn up on his behalf: agreement, invoices, invoices and others.

Invoices received by the commission agent from the principal for goods transferred for sale, as well as for the amount of payment received, partial payment for upcoming deliveries of goods are not registered in the purchase book. Organizations carrying out business activities in the interests of another person under commission agreements, when selling goods on their own behalf, store invoices for goods and for payment, partial payment for future deliveries of goods received from the principal in the journal of received invoices.

When the goods are shipped to the buyer, the buyer's accounts receivable for payment for goods and accounts payable to the principal are reflected in the commission agent's accounting. To account for settlements with the principal, an organization can use account 76 “Settlements with various debtors and creditors”, for example the subaccount “Settlements with the principal”.

The commission agent must submit to the principal a report with the necessary documents attached (copies of contracts, invoices, invoices, etc.) confirming the fact of sale of goods to customers.

Simultaneously with the report, the commission agent issues an invoice to the principal for the amount of his remuneration. The commission agent registers this invoice in the sales book in accordance with clause 24 of the Rules.

In accordance with clause 5 of PBU 9/99 “Income of the organization”, the amount of commission for the commission agent is income from ordinary activities. In accounting, revenue from ordinary activities is recognized if the conditions provided for in clause 12 of the same PBU 9/99 are met; in this case, these conditions are considered met when goods are sold to the buyer.

The reflection of the accrual of commission in the accounting of the commission agent depends on whether the intermediary is involved in the settlements between buyers and the principal or not.

In the accounting records of a commission agent, transactions when selling goods under a commission agreement can be reflected as follows.

| Account correspondence | Contents of operation | Primary document | |

| Debit | Credit | ||

| 004 “Goods accepted for commission” | Goods received under commission agreement | Invoice or act of acceptance and transfer of goods | |

| 62 “Settlements with buyers and customers” | 76 “Settlements with the principal” | The buyer's debt for goods shipped to him is reflected | Invoice in the form TORG-12 |

| 004 “Goods accepted for commission” | Goods accepted for commission are written off from the off-balance account | ||

| 51 “Current account” | 62 “Settlements with buyers and customers” | Received funds from the buyer for shipped goods | Payment order |

| 76 “Settlements with the principal” | 90-1 “Revenue” | Income recognized in the form of commissions | Commissioner's report |

| 90-3 "VAT" | 68 "VAT" | VAT is charged on the commission amount | Invoice |

| 76 “Settlements with the principal” | 51 “Current account” | Funds transferred to the principal minus commission* | Payment order |

* The situation with the participation of the commission agent in the calculations is considered.

Purchase returns

As noted earlier, when concluding a commission agreement, ownership of the goods until the moment of its sale remains with the principal, who has the right at any time to demand the return of the goods and compensate the commission agent for losses caused. In turn, the commission agent has the right to refuse the order if he is unable to sell the goods within the prescribed period.

In addition, it is possible that a low-quality product may be identified. In accordance with clause 2

Art. 475 of the Civil Code of the Russian Federation, in the event of a significant violation of the requirements for the quality of goods, the buyer has the right to refuse to execute the sales contract.

Under a transaction concluded by a commission agent with a third party, the commission agent acquires rights and becomes obligated. Consequently, the buyer has the right to return the defective goods to the commission agent (unless other conditions are established by the contract).

If the buyer refuses to fulfill the purchase and sale agreement due to a discrepancy in the quality of the delivered goods, in the accounting records of the commission agent, the buyer's debt to pay for the goods returned by him is reduced, and the commission agent's debt to the principal for settlements for the goods sold is also reduced. At the same time, the commission agent reflects the returned goods as a debit to off-balance sheet account 004 “Goods accepted on commission”, since the ownership of it still belongs to the principal.

If the shipment of low-quality goods and its return by the buyer occurred within one month, before the commission agent’s report was approved, then the commission agent makes reversal entries for sales in the report. If the goods are returned by the buyer after approval of the report, then the principal will compensate the commission agent for the amount returned to the buyer.

The principal transfers the returned goods from account 45 “Goods shipped” to the debit of account 41 “Goods”. After returning a defective product, the consignor can also return the product to the supplier. In accounting, this operation is reflected in the credit of account 41 “Goods” in correspondence with the debit of account 76 “Settlements with various debtors and creditors” subaccount “Settlements for claims”.

In addition, upon receiving a notice from the commission agent about the return of the goods by the buyer, the principal, in order to record the real amount of revenue received in the reporting period from the sale of goods and the value of the cost of sales, must reflect their adjustment in accounting by making corrective entries in the relevant accounts.

Commission agreements for the purchase of goods

Accounting with the principal

Accounting for settlements with the commission agent can be carried out using account 76 “Settlements with various debtors and creditors” subaccount “Settlements with the commission agent”.

To reflect the receipt of goods purchased for further resale, the principal should use account 41 “Goods”. If material assets are acquired for other purposes, in particular for use in economic needs, the corresponding account is determined on the basis of the Chart of Accounts and instructions for its use.

The procedure for recording transactions with the principal when purchasing goods under a commission agreement may be as follows.

| Account correspondence | Contents of operation | Primary document | |

| Debit | Credit | ||

| 76 “Settlements with commission agent” | 51 “Current account” | Funds transferred for the purchase of goods | Payment order |

| 41 "Products" | 76 “Settlements with commission agent” | Goods accepted for accounting | Invoice or act of acceptance and transfer of goods |

| 19 "VAT" | 76 “Settlements with commission agent” | VAT charged on goods | Invoice received from the commission agent (for goods) |

| 68 "VAT" | 19 "VAT" | Submitted for deduction of VAT on goods | |

| 41 "Products" | 76 “Settlements with commission agent” | Commission accrued to the commission agent | Commissioner's report |

| 19 "VAT" | 76 “Settlements with commission agent” | VAT charged on commission fees | Invoice received from the commission agent (for commission) |

| 68 "VAT" | 19 "VAT" | Submitted for deduction of VAT on commission fees | |

| 76 “Settlements with commission agent” | 51 “Current account” | Remuneration was transferred to the commission agent and expenses were reimbursed (if any)** | Payment order |

** The situation is considered without the participation of the commission agent in the calculations.

Accounting with a commission agent

Since goods that are the property of the organization are accounted for separately from the goods of other legal entities held by this organization, goods purchased by the commission agent for the principal are reflected by the intermediary on off-balance sheet account 002 “Inventory assets accepted for safekeeping” at the price indicated in the shipping supplier documents. Materials are written off from off-balance sheet accounting at the time of their transfer to the principal.

The commission agent does not have the right to reimbursement of expenses for storing the principal's property in his possession, unless otherwise provided in the law or the commission agreement.

Since the commission agent makes transactions with third parties on his own behalf, all documents from the supplier are drawn up in his name: agreement, invoices, invoices and others, while he is not obliged to indicate that he is acting on the instructions of the principal.

Invoices received by the commission agent from the seller of goods, issued in the name of the commission agent for goods, for the amount of payment, partial payment for upcoming deliveries of goods are not registered in the purchase book.

After executing the order under the commission agreement, the commission agent, in accordance with Art. 999 of the Civil Code of the Russian Federation, must submit a report to the committent and transfer to him everything received under the commission agreement. If the principal has objections to the report, then he must notify the commission agent about them within thirty days from the date of receipt of the report, unless another period is established by the agreement. Otherwise, the report is considered accepted.

Since the form of the commission agent’s report is not established by law, the commission agent can draw up such a report in any form. The main requirement is that it meets the requirements for the primary document in Art. 9 of the Federal Law of November 21, 1996

No. 129-FZ “On Accounting”.

Despite the fact that in Art. 999 of the Civil Code of the Russian Federation there are no requirements to submit, along with the report, documents confirming the data reflected in the report; in paragraph 14 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 17, 2004 No. 85 “Review of the practice of resolving disputes under a commission agreement” it is stated that the commission agent’s report is not evidence the commission agent fulfills his obligations under the commission agreement without confirming it with other evidence.

And such documents should be copies of contracts, invoices, invoices, acceptance certificates, etc., attached to the report.

In the accounting of a commission agent, transactions for the acquisition of goods under a commission agreement may be as follows.

| Account correspondence | Contents of operation | Primary document | |

| Debit | Credit | ||

| 51 “Current account” | 76 “Settlements with the principal” | Received funds from the principal | Payment order |

| 60 “Settlements with suppliers and contractors” | 51 “Current account” | Payment transferred to the supplier | Payment order |

| 002 “Inventory and materials accepted for safekeeping” | The receipt of goods from the supplier is reflected on the off-balance sheet account | Invoice in form TORG-12 from the supplier | |

| 76 “Settlements with the principal” | 60 “Settlements with suppliers and contractors” | Reflects the transfer of ownership of the goods | Invoice or act of acceptance and transfer of goods |

| 002 “Inventory and materials accepted for safekeeping” | Goods transferred to the principal are written off from the off-balance account | ||

| 76 “Settlements with the principal” | 90-1 “Revenue” | Income recognized in the form of commissions | Commissioner's report |

| 90-3 "VAT" | 68 "VAT" | VAT is charged on the commission amount | Invoice |

| 51 “Current account” | 76 “Settlements with the principal” | Commission amount received | Payment order |

** The situation is considered without the participation of the commission agent in the calculations.

Purchase returns

In the event of a significant violation of the quality requirements for the goods, the consignor has the right to refuse it. The commission agent has the right, in turn, to return the defective product to the seller.

If the principal refuses to account for the commission agent, the debt of the principal to pay for the goods returned by him is reduced, and the debt of the commission agent to the seller for settlements for the purchased goods is also reduced. At the same time, the commission agent reflects the returned goods as a debit to off-balance sheet account 002 “Inventory and materials accepted for safekeeping.”

If the shipment of low-quality goods and its return to the seller occurred within one month, before the commission agent’s report was approved, then the commission agent makes reversal entries in the report. If the goods are returned by the principal after approval of the report, then the commission agent compensates the principal for his expenses.

When returning the goods, the principal makes an entry on the credit of account 41 “Goods” in the debit 76 “Settlements with various debtors and creditors” subaccount “Settlements for claims”.

Upon receipt of a notice from the consignor about the return of the goods, the commission agent may make quality claims to the seller in the prescribed manner.

Chart of accounts for accounting financial and economic activities of organizations and instructions for its application, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

Clause 61 of the Regulations on accounting and financial reporting in the Russian Federation, approved. By Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n.

Accounting Regulations “Income of the Organization” PBU 9/99, approved. By Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 32n.

Rules for maintaining journals of received and issued invoices, purchase books and sales books when calculating value added tax, approved. Decree of the Government of the Russian Federation dated December 2, 2000

№ 914.

Chart of accounts for accounting financial and economic activities of organizations and instructions for its application, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

Accounting Regulations “Income of the Organization” PBU 9/99, approved. By Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 32n.

Accounting Regulations “Organization Expenses” PBU 10/99, approved. By Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n.

Clauses 3, 11 Rules for maintaining logs of received and issued invoices, purchase books and sales books when calculating value added tax, approved. Decree of the Government of the Russian Federation dated December 2, 2000 No. 914.

Rules for maintaining journals of received and issued invoices, purchase books and sales books when calculating value added tax, approved. Decree of the Government of the Russian Federation dated December 2, 2000

№ 914.

Chart of accounts for accounting financial and economic activities of organizations and instructions for its application, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n.

Clause 2 of Art. 8 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.

Paragraph 2 art. 1001 Civil Code of the Russian Federation.

Clause 11 Rules for maintaining logs of received and issued invoices, purchase books and sales books when calculating value added tax, approved. Decree of the Government of the Russian Federation dated December 2, 2000 No. 914.

Commission contract and agency contract

The essence of the contract is that one party, for a fee, enters into transactions with third parties on its own behalf, but acts in the interests of the second party. Receives the discussed remuneration for the work done.

Such a contract is classified as an intermediary one. In other words, the commission agent (agent) enters into an agreement with the principal (principal) to sell products. There are agency contracts and mandate contracts. What is the difference between them?

In a commission agreement, the commission agent acts on his own behalf. In a contract of agency, the attorney acts not on his own behalf, but on behalf of the principal.

The difference from an agency contract is that the agent does both legal and actual acts, and the commission agent does only legal ones.

Features of the commission agreement by country

Russia

The commission agreement on the territory of Russia is governed by the provisions of the Civil Code of the Russian Federation. In accordance with the terms of the Civil Code of the Russian Federation, the features of certain types of commission agreements may be provided for by another law (except for the Civil Code of the Russian Federation) and other legal acts (decree of the President of the Russian Federation, decree of the Government of the Russian Federation, other legal acts).

France

A commission agent in France is a legal or natural person who acts on his own behalf, or exclusively on behalf and in the interests of a legal entity. According to the French Commercial Code, the rights and obligations of the commission agent and the principal are similar to the rights and obligations of the parties to the agency agreement, and therefore the commission agreement is classified as one of the types of agency agreement in trade turnover.

Germany

Article 383 of the German Commercial Code defines a commission agent as a person who, in his own name, but at the expense of another person, as a business activity, undertakes the purchase and sale of goods and securities.

What does “committent”, “principal” mean?

This is how the party initiating contractual matters is called within the framework of intermediary agreements. The concept seems to be the same, but the names are different. Does this mean that the concepts are identical? Committent, principal - who is it?

Principal – a person who acts with an order to perform any acts for a fee. A principal is a person who authorizes a second person to act as an agent. The concepts are close. An agent and a principal exist in an agency agreement. The principal and the commission agent are in the commission agreement. As follows, the committent (principal) - who is this? This is the person who initiates the relationship, assigning certain tasks to be done for a fee.

Can we say that the principal and the principal are the same thing? Despite the fact that the concepts are close in meaning, it cannot be said that they are identical. They exist in various agreements. This means that there is a difference between the concepts of “principal” and “committent”.

The principal may instruct the agent to act both on his own behalf and on behalf of the principal. The principal can instruct the commission agent to act only on his own behalf. We can say that the principal and the principal are one and the same, only under certain criteria. In general, the second concept is somewhat broader.

What does “agent”, “commission agent” mean?

Let's look at the second side of the contractual relationship. An agent can act both on his own behalf, then the contract will be similar to the commission contract model, and the concepts of agent and commission agent will become identical, and on behalf of the principal, then the concepts of agent and commission agent can no longer be identical. We can say that the concept of “agent” is broader than the concept of “commission agent” and includes it. Now it should be clearer what a principal (principal) is and what a commission agent (agent) is.

Advantages of commission trading

The first tangible advantage is that you don’t have to pay for a commission product. It is sold for sale and is kept in safe custody. The transfer of proceeds for a sold product occurs only at the moment when this revenue is actually received.

Thanks to this advantage, it is easier to start a new business; you do not need huge sums for the initial investment. After all, what is a committent (principal)? This is the person providing their products for trade.

A subsequent benefit is the ease of return design. If it turns out that the product is defective, its sales period has expired, or for some reason it “did not go,” then it is easy to return it, because it does not belong to you, but to the consignor. In traditional trade, returning a product creates many complexities, from document design to taxation. Within the framework of a commission contract, subcommission agreements can be concluded.

Also, great advantages will be that the accounting and taxation of an intermediary is much simpler than that of someone who trades their product.

Payment methods

Commission trading provides two possible options. The commission agent may or may not participate in payments for the product between the principal and the buyer.

If a scheme is chosen without the role of a commission agent in settlements, then payment from the end buyer goes directly to the principal’s bank account, bypassing the intermediary. The commission agent only receives his remuneration based on the results of his work.

The scheme with a role in settlements assumes that buyers pay the commission agent for the product, and then the accumulated amounts are transferred to the principal’s account. With all this, the commission agent has the opportunity, without the help of others, to withhold the amount of his own remuneration, and also to compensate for the expenses incurred in the process of executing the order.

Accounting for a commission agent with participation in calculations

1. The commission agent sells the property of the principal.

Debit 004 – property received from the principal is reflected off the balance sheet.

Debit 51 (50) Credit 62 – money received from the sale of goods.

Debit 62 Credit 76 ac/account “Settlements with the principal” - reflects the sale of goods by the commission agent.

When selling property, its value must be written off from the off-balance sheet account:

Loan 004 – the property is transferred to the buyer.

Debit 76 Credit 51 – the commission agent’s expenses related to the sale were paid.

Debit 76 of the account “Settlements with the principal” Credit 76 – reflects the debt of the principal for expenses.

Debit 76 s/ac "Settlements with the principal" Credit 90 - the commission agent's remuneration has been accrued.

Debit 90 Credit 68 – VAT is charged on the commission agent’s remuneration.

Debit 76 ac/account “Settlements with the principal” Credit 51 – proceeds from the sale minus the commission agent’s remuneration and compensation of expenses are transferred to the principal.

2. The commission agent acquires property for the principal.

Debit 51 Credit 76 s/ac “Settlements with the principal” - money was received to the current account for the purchase of goods.

Debit 76 ac/account “Settlements with the principal” Credit 62 ac/account advances on remuneration - an advance was received under a commission agreement.

Debit 76 Credit 68 – VAT is charged on the advance payment for the commission agent’s remuneration (on the advance amount).

Debit 60 Credit 51 – goods paid to the supplier.

Debit 002 – goods purchased for the principal have been capitalized.

Debit 76 “Settlements with the principal” Credit 60 – reflects the debt for purchased goods.

Credit 002 – purchased goods were transferred to the principal.

Debit 62 Credit 90 – commission agent's remuneration accrued.

Debit 90 Credit 68 – VAT is charged on the commission agent’s remuneration.

Debit 62с/сч advance on remuneration Credit 62 – advance on commission agent's remuneration credited.

Debit 68 Credit 76 – accepted for deduction of VAT accrued on the advance payment for the commission agent’s remuneration.

Debit 76 “Settlements with the principal” Credit 51 – unspent funds were returned to the principal.

Debit 51 Credit 76 “Settlements with the principal” – compensation for expenses received on the current account.

In this case, the commission agent issues an invoice in two copies, indicating in it all the data from the invoice received from the seller. Such a document must be registered in the journal of issued invoices from the commission agent, and one copy must be handed over to the principal.

Accounting

Keeping records under commission trading is easier. All incoming product is reflected in the off-balance sheet account 004. All movements in the product are also reflected in the off-balance sheet account.

Only the amounts of commission fees are reflected in accounting; they are included in the income of the commission agent. To reflect them, account 62 is used in correspondence with account 90. If the company is a VAT payer, then it also needs to be highlighted. Expenses include those costs that the company incurred in the process of executing the order.

If the commission agent does not participate in the calculations, then his accounting is even simpler. If participating, the amounts received and transferred must be shown using account 76.

If an enterprise trades not only commissions, but also its own product, accounting for these transactions must be kept separately.

The commission agent issues documents for the sale of the product to customers on his own behalf. The commission agent has the right to use any taxation system, both traditional and lightweight.

Accounting under a commission agreement with a commission agent

The commission agent's accounting reflects only the revenue from the sale of intermediary services - commission. Accounting is usually kept on account 76 “Settlements with various debtors and creditors”, to which various sub-accounts can be allocated. Since the goods purchased by the commission agent on behalf of the principal do not belong to him, they are reflected on the balance sheet in account 002 “Inventory assets accepted for safekeeping.” In addition, if the principal transfers goods to the commission agent for subsequent sale, then when accounting for sales under a commission agreement, they are taken into account in account 004 “Goods accepted on commission.”

The commission agent's remuneration is reflected in account 62 “Settlements with buyers and customers”. For a commercial representative, it is the basis for calculating VAT, as well as the income that is taken into account when calculating income tax.

All intermediaries pay VAT based on the amount of their remuneration. Exceptions to this rule are the sale of the following goods (work, services) exempt from taxation (clause 2 of Article 156 of the Tax Code of the Russian Federation):

- for leasing premises to foreign citizens and organizations accredited in the Russian Federation;

- for the sale of medical goods according to the list approved by the government (clause 1, clause 2, article 149 of the Tax Code of the Russian Federation);

- for the sale of funeral supplies (according to the list approved by the government) and related services (clause 8, clause 2, article 149 of the Tax Code of the Russian Federation);

- for the sale of folk arts and crafts products (with the exception of excisable goods), samples of which are registered in the manner established by the government (clause 6, clause 3, article 149 of the Tax Code of the Russian Federation).

When calculating income tax, the company's expenses are subtracted from the commission agent's income (excluding VAT). The amounts reimbursed by the principal when accounting for transactions under a commission agreement cannot be included either in income or in expenses (clause 9, clause 1, article 251 of the Tax Code of the Russian Federation, clause 9, article 270 of the Tax Code of the Russian Federation). Also, VAT is not charged on amounts received from the principal as payment for goods (work, services) purchased by an intermediary; tax on the cost of products purchased for the principal is not deductible.

Principal and commission agent - the essence of the concepts

An act of provision of services and an invoice must be issued for the remuneration.

For the rest, the commission agent uses standard, unified forms of primary documents.

The commission agent may deduct the commission from the amount that he received for the product sold. There is another option. The principal himself transfers the commission within the terms established by the contract. Taxes are paid only on commission amounts.

The commission agent purchases goods for the principal

The essence of the deal is as follows. The principal instructs the commission agent to find a suitable supplier and negotiate with him to ship the goods for the principal. Thus, there are three participants in the transaction. The first is a third-party supplier, the second is the principal (aka the buyer), the third is the commission agent, who is an intermediary between the supplier and the principal.

Document flow of the commission agent

When purchasing goods, the intermediary acts in the interests of the principal. However, according to the agreement concluded between the supplier and the commission agent, all rights and obligations fall on the commission agent (clause 1 of Article 990 of the Civil Code of the Russian Federation). Consequently, in all primary documents, including the invoice, the commission agent is listed as the buyer.

Having received such an invoice from the seller, the intermediary must register it in part 2 of the log of received and issued invoices (clause 11 of the journal rules). There is no need to make an entry in the purchase book, since the goods belong to the consignor, and the commission agent has no right to deduct.

Then the commission agent needs to re-issue the invoice in the name of the principal. The new rules for filling out an invoice describe in detail how to fill out lines 1, 2, 2a, 2b and 5 (see table below). As for the columns of the reissued invoice, they should duplicate the data from the columns of the invoice issued by the supplier in the name of the commission agent.

The reissued invoice must be registered in part 1 of the journal of received and issued invoices (clause 7 of the journal rules). No entry is made in the sales book because the commission agent has no obligation to charge VAT.

What information should be included in the invoice reissued to the principal-buyer?

| Invoice field | What to indicate |

| Line 1 (number and date) | Serial number in accordance with the individual chronology of the commission agent Date of the invoice issued by the seller in the name of the commission agent |

| Line 2 (seller) | Information about the third-party supplier: full or abbreviated name of the organization, or full name of the entrepreneur |

| Line 2a (seller's address) | Location of the third-party supplier: legal address of the organization, or place of residence of the entrepreneur |

| Line 2b (TIN and KPP of the seller) | TIN and PPC of a third-party seller |

| Line 5 (details of the payment document) | Numbers and dates of payment and settlement documents for the transfer of money from the commission agent to a third-party supplier and from the principal to the commission agent |

In addition, the intermediary is obliged to draw up a commission agent’s report (Article 999 of the Civil Code of the Russian Federation). The report must describe what goods and at what price were purchased for the principal, when the payment took place, and what the intermediary’s remuneration is.

Document flow of the principal

The principal receives the invoice re-issued by the commission agent and registers it in part 2 of the journal for recording received and issued invoices (clause 11 of the journal rules).

Then the principal registers the re-issued invoice in the purchase book, and receives the right to accept VAT for deduction.

The principal must keep a copy of the original invoice issued by the supplier in the name of the commission agent for four years. If this document is drawn up in paper form, the intermediary must certify it, and the committent must file it in a folder. If the invoice is issued in electronic form (for example, using the Diadoc system), the commission agent must simply transfer it to the principal via electronic communication channels (subparagraph “a”, paragraph 15 of the journal rules; for the transfer of electronic invoices, see “How will the exchange of electronic invoices take place?”

Please note that the committing party does not need to record a copy of the original invoice in either the journal, purchase ledger, or sales ledger.

If there was an advance payment

When transferring an advance, the supplier issues an invoice in the name of the commission agent. He registers the document in part 2 of the journal, but does not register it in the purchase book.

Then the commission agent reissues the “advance” invoice in the name of the principal, registers it in part 1 of the journal, but does not register it in the sales book.

The principal registers the re-issued invoice for the advance payment in part 2 of the journal, makes an entry in the purchase book and receives the right to deduct VAT from the advance payment. Subsequently, when the products are shipped, the principal will restore the deduction in the usual manner.

Plus, the principal is obliged to file a copy of the “paper” invoice for the advance payment, issued by the supplier in the name of the commission agent and certified by the latter. If the advance invoice is issued in electronic form, the principal must receive it from the commission agent via electronic communication channels. In both cases, the document must be kept for four years.

Commission remuneration

Having completed the transaction, the intermediary receives a reward from the principal. This amount is the commission agent's revenue.

The commission agent issues an invoice for the amount of the remuneration and registers it in part 1 of the log of received and issued invoices. After which the intermediary makes the appropriate entry in the sales book (clause 20 of the rules for maintaining the sales book) and charges VAT for payment to the budget.

The principal registers the same invoice in part 2 of the journal and makes an entry in the purchase book (clause 11 of the rules for maintaining the purchase book). As a result, the principal receives the right to deduct “input” VAT on the services of the commission agent.

Commissioner's report

The commission agent must frequently provide a report to the principal (principal) about the goods sold. The deadlines for submitting the report are not fixed by law, but they are prescribed in the contract. If the product volumes are huge, then it is convenient to report every month; in addition, the principal is interested in monthly reports in order to calculate VAT on time and correctly. If the principal is not a VAT payer, then any period for reporting can be established.

You can create a report form yourself or use a ready-made one, for example, from the web.

At first glance, mediation agreements may seem a little confusing. There are many characters: agent, principal, principal, commission agent, buyers. But if you look at it, it turns out that working under a mediation agreement is much simpler and more convenient, it’s easier to keep records, and there are even more advantages than disadvantages. This explains the popularity of this type of business activity. Now you have figured out what a committent and a principal are, and you will no longer confuse these concepts with each other.

COMMISSIONER

a party to a commission agreement who undertakes, on behalf of the other party (the principal), for a fee, to conclude a transaction with a third party on his own behalf, but in the interests and at the expense of the principal.

Rate the definition:

COMMISSIONER

in civil law, a party to a commission agreement who undertakes, on behalf of the other party (the principal), for a fee, to enter into a transaction with a third party on his own behalf, but in the interests and at the expense of the principal.

Rate the definition:

COMMISSIONER

fr. commissionnaire from lat.

Sales report to the consignor

For the convenience of settlements and in order to reduce document flow at the end of the month, the commission agent draws up the document “Report to the Principal”, accessible from the full interface, section “Purchases”. The document contains several tabular parts, since it solves the problems of informing the principal about the goods sold, about calculating the amount of remuneration, and about mutual settlements with buyers and the principal.

On the “Home” page, information about the counterparty, the agreement, and the method of calculating remuneration is entered. The program can calculate the amount automatically, but only after information about the goods and services sold is entered.

Fig.5 Calculating the amount

The “Products and Services” tab can also be filled out automatically by clicking “Fill” based on sales results. In addition to the list of goods sold and prices, information about buyers must be entered.

Fig.6 Entering data

“Cash” displays data on received payments.

Fig.7 Data on received payments

“Settlements” shows the accounts of settlements with customers and the principal, as well as the method of calculation - deduction from revenue, or direct receipt from the principal.

Often for such calculations they take the account 76.09. The “Report to the Principal on Sales” records the debt owed to the principal for remuneration and reflects the commission agent’s revenue under the relevant agreement.

Fig.8 Sales report to the consignor

To analyze the status of settlements with the principal, you can use standard accounting reports, which are available from the full interface, section “Reports”.

The balance sheet for account 76.09 in the context of the counterparty and the agreement shows the status of the debt until the moment of transfer of the DS to the principal.

Fig.9 Balance sheet

Agency agreement, commission agreements and assignments. Similarities and differences

comissio - commission) - in civil law - a party to a commission agreement, which undertakes, on behalf of the other party (the principal), for a fee, to conclude a transaction with a third party on its own behalf, but in the interests and at the expense of the principal.

Rate the definition:

Commissioner

Party to the trade commission agreement (see). On behalf of the other party (the principal), the commission agent, for a certain commission, undertakes to carry out one or more transactions on his own behalf for the principal and at his expense. In transactions made by the commission agent with third parties, rights and obligations arise between the commission agent and the third party, however, the commission agent, unless otherwise established by agreement of the parties, is not responsible to the principal for the execution by a third party of the transaction made by the commission agent at the expense of the principal.

Rate the definition:

Commissioner

Party to the trade commission agreement (see). On behalf of the other party (the principal), the commission agent, for a certain commission, undertakes to carry out one or more transactions on his own behalf for the principal and at his expense. In transactions made by the commission agent with third parties, rights and obligations arise between the commission agent and the third party, however, the commission agent, unless otherwise established by agreement of the parties (see del credere), is not responsible to the principal for the execution by a third party of the transaction made by the commission agent at the expense of the principal.

Rate the definition:

These are, roughly speaking, agreements called intermediary agreements. In all of these contracts, someone does something on behalf of another person. In a contract, someone also does something on behalf of someone (digs a hole...), but the result is different - the result of the actions of an attorney, agent, commission agent will have legal consequences, changes in rights and obligations. Someone does something to create certain legal consequences on the instructions of the other party.

If the contract is a mandate, the attorney acts on behalf of the principal. That is, everything he does is the actions of the guarantor. And when looking at the guarantor, you need to see not him, but the principal.

Commission agreement - the commission agent himself becomes a party to the agreement, but then he transfers his rights and obligations to the issuer (the second party to the agreement). Let's say a thrift store.

Under an agency agreement, the agent acts either on behalf of the principal or on his own behalf (this is a symbiosis of an assignment and a commission). Accordingly, under an agency agreement, the rules apply either orders or commissions.

These three treaties differ not only in how

they act, but also by

what

they do.

The narrowest subject in the commission agreement. The commission agent undertakes only to carry out transactions - on his own behalf, but in the interest of the issuer.

In the agency agreement, the attorney undertakes to perform legally significant actions. For example, he writes statements, and in general... In general, not only a transaction, he can also perform other actions aimed at legal consequences. The subject matter is broader than in the commission agreement.

The broadest subject matter in an agency agreement. The agent performs not only legally significant actions aimed at obtaining certain results, but also performs actual actions.

In all three agreements, the party acts at the expense of the issuer, principal or agent.

Let's say an employer needs to sell cotton candy. Contract of assignment - you just stand there with a sour expression and make an offer to everyone - “Buy cotton wool. One hundred rubles". In general, you can even write a sign - and nothing else can be done (even if sales are not going well). And within the framework of the agency agreement, you can assign responsibilities to him: dress him up with cotton candy, make him flutter like a butterfly, pretending to be airy, smile sweetly and slurp charismatically (because this is necessary according to the role), as well as dance and generally perform certain actual actions so that buyers buy this cotton candy (and they will be there - as long as you stay behind).

All three of these agreements are consensual (from the moment an agreement is reached). They are all bilaterally binding (only about the agency agreement the question is whether it is unilaterally binding or bilaterally binding, but it is also bilateral).

As a general rule, an order is a gratuitous

.

Form and main terms of the commission agreement

The commission agreement does not require notarization, but is concluded in simple written form, which saves the parties from additional financial costs for paying for notarial services.

The main terms of the contract include:

- commission amount . Often it is set as a percentage of the amount of the transaction, but by agreement of the parties it can also be set as a fixed amount;

- contract term . It can be either urgent or indefinite. Without setting specific deadlines for the execution of the contract, the principal bears the risk of the commission agent’s unilateral refusal of the contract;

- rights and obligations of the parties . They are determined both by the Civil Code and by joint agreements of the parties, and define a clear structure of relationships between counterparties;

- liability of the parties for non-fulfillment or improper fulfillment of the terms of the contract. One of the most important points of the contract, always stimulating both parties to perform it properly;

- force majeure (at the request of the parties) – natural, natural and other factors, the occurrence of which relieves the parties of liability for complete or partial failure to fulfill the terms of the commission agreement;

- details and signatures . Accurate data, including personal and contact information of those who sign the contract.

Amendments to the contract can only be made with prior bilateral agreement on such changes in the same form in which the contract itself is concluded, that is, changes to the commission contract can be made by signing an additional agreement to the contract in simple written form.

A party to the contract may notify the other party of an actual change in details by sending a written notice.

The principal and the commission agent are the parties to the commission agreement

The remaining contracts are paid. An assignment is a fiduciary

contract

Of all these three, only the agency agreement has a fiduciary characteristic - agency agreements and commission agreements are not such.

From the signs of fiduciary assignment it follows: the ability at any time for any party to refuse to fulfill the contract without any motivation (simply because I no longer trust you). And the fact that it is (as a general rule) free of charge.

Therefore, an agency agreement was created, where in many respects the subject of the assignment was simply expanded. But the agency agreement is for compensation and not fiduciary. Therefore, the rules on assignment must be applied with reservations to an agency agreement, since they have a different nature.

Date added: 2014-01-07; ; Copyright infringement?;

Recommended pages:

Termination of the commission agreement

Any transactions can be terminated based on mutual agreements of the parties.

So, in this case, the customer himself is vested with the authority to cancel his assignment.

To do this, it is only necessary to warn the other party in the prescribed manner, incurring the costs of compensating the contractor for losses associated with the termination of this contract.

At the same time, the commission agent himself has the right to refuse to fulfill his obligations.

The commission agent is endowed with this opportunity only if an open-ended contract is concluded, and the losses incurred by the principal as a result of the commission agent’s refusal to fulfill the contract will still have to be compensated.

In addition, an obligation arises to notify the principal in writing of refusal to fulfill the contract no less than 30 days before the actual termination of its execution.

What's new for agency agreements in Accounting 8.2

IIn the latest update: Accounting for procurement transactions under a commission agreement (agency agreement) has been automated. Anyone who understands this, please tell me what exactly is automated.

Try the new free service for quick code analysis of typical configurations 1c-api.com

ATTENTION!

If you have lost the message input window, press

Ctrl-F5

or

Ctrl-R

or the Refresh button in your browser.

The topic has not been updated for a long time and has been marked as archived. Adding messages is not possible.

But you can create a new thread and they will definitely answer you!

Every hour there are more than 2000

people on the Magic Forum.

Who is the committent and the principal?

Examples of the use of the word committent in literature.

Under a transaction made by a commission agent with a third party, the commission agent acquires rights and becomes obligated, even if the principal was named in the transaction or entered into direct relations with the third party for the execution of the transaction.

Before the termination of the commission agreement, the principal has no right, without the consent of the commission agent, to enter into direct relations with the sub-commissioner, unless otherwise provided by the commission agreement.

If the commission agent bought property at a price higher than that agreed upon with the principal, the principal who does not wish to accept such a purchase is obliged to notify the commission agent of this within a reasonable time upon receipt of notification from him about the conclusion of a transaction with a third party.

If the commission agent has indicated that he accepts the difference in price at his own expense, the principal does not have the right to refuse the transaction concluded for him.

A commission agent who has not insured the principal's property in his possession is liable for this only in cases where the principal has ordered him to insure the property at the principal's expense or the insurance of this property by the commission agent is provided for by the commission agreement or business customs.

Reimbursement of expenses for the execution of a commission order The principal is obliged, in addition to paying the commission, and, in appropriate cases, additional remuneration for the del credere, to reimburse the commission agent for the amounts spent by him on the execution of the commission order.

If a commission agreement is concluded without specifying its validity period, the principal must notify the commission agent of the termination of the agreement no later than thirty days in advance, unless a longer notice period is provided for in the agreement.

In this case, the principal is obliged to pay the commission agent remuneration for transactions made by him before the termination of the contract, as well as reimburse the commission agent for the expenses incurred by him before the termination of the contract.

In case of cancellation of the order, the principal is obliged, within the period established by the commission agreement, and if such a period is not established, to immediately dispose of his property under the jurisdiction of the commission agent.

If the principal fails to fulfill this obligation, the commission agent has the right to deposit the property at the expense of the principal or sell it at the most favorable price for the principal.

At the same time, the principal has the right to demand the renewal of the commission agreement for a new term or the return of the goods without paying the costs of storing them.

A commission agreement can be concluded for a certain period or without specifying the period of its validity, with or without indicating the territory of its execution, with or without the obligation of the principal not to grant third parties the right to carry out transactions in his interests and at his expense, the execution of which is entrusted to the commission agent. obligations, with or without conditions, regarding the range of goods that are the subject of the commission.

If the commission agreement was not fulfilled for reasons depending on the principal, the commission agent retains the right to a commission, as well as to reimbursement of expenses incurred.

Execution of a commission order The commission agent is obliged to execute the commission accepted on the terms most favorable to the principal in accordance with the instructions of the principal, and in the absence of such instructions in the commission agreement - in accordance with business customs or other usually imposed requirements.

The commission agent has the right to deviate from the instructions of the principal if, under the circumstances of the case, this is necessary in the interests of the principal and the commission agent could not first request the principal or did not receive a response to his request within a reasonable time.

| SunFox | |

| SunFox | According to the definition of a commission agreement (Article 990 of the Civil Code of the Russian Federation), a commission agent in a purchase and sale transaction can represent the principal not only as a seller (traditional commission trading), but also as a buyer. In this case, the commission agent (agent) finds a supplier of the necessary goods and services, makes purchases with funds received from the principal (principal) and in the interests of the principal (principal). After completing the purchase order, the commission agent (agent) submits a report to the committent (principal) and issues an act for remuneration for the execution of the order under the commission (agency) agreement. The question is how is this implemented? |

| Pippi | https://its.1c.ru/db/metod81#content:4932:1 |

| SunFox | (2) there is no access to the ITS Internet |

| SunFox | (2) I wouldn’t ask here |

| SunFox | I’ll answer myself: Directory "Contracts" To reflect transactions under a commission agreement (agency agreement) for sales on the principal (principal) side, the type of agreement “With a commission agent (agent) for sale” is used. On the side of the commission agent (agent), the type of agreement “With the principal (principal) for sale” is used. To reflect transactions under a commission agreement (agency agreement) for purchases on the side of the principal (principal), the type of agreement “With a commission agent (agent) for purchase” is used. On the side of the commission agent (agent), the type of contract “With the principal (principal) for purchase” is used. Document “Receipt of goods and services” Acquisition by the commission agent (agent) of goods and services in the interests of the principal (principal) “The acquisition of goods and services in the interests of the principal (principal) is formalized by a document with the transaction type “Purchase, commission”. The supplier is selected as the counterparty and the agreement with the supplier is indicated. One document can be used to purchase goods for one’s own needs and goods for different principals. To reflect the purchase of goods for the principal (principal), on the “Goods” tab, the columns “Committent”, “Agreement with the principal” and “Account for settlements with the principal” must be filled in. To display the specified columns, you must select the appropriate checkboxes in the “List Settings” form, called from the context menu of the “Products” table (click the right mouse button). Goods purchased under a commission agreement (agency agreement) for purchases are accounted for in off-balance sheet account 002. Services purchased for the principal (principal) under a commission (agency agreement) are filled in on the tab “Agency Receipts to the principal (principal) of goods and services, purchased through a commission agent (agent) The receipt of goods and services purchased through a commission agent (agent) from the principal (principal) must be reflected under an agreement with the form “With a commission agent (agent) for purchase.” Document “Report to the principal” Procurement report If the commission agent (agent) made purchases in the interests of the principal (principal), the type of transaction “Purchase report” is indicated. The document indicates the goods and services purchased under the commission agreement, separately for each supplier and receipt document. Using the “Fill in purchased under contract” command, you can automatically fill in the tables of suppliers and goods purchased from them. For those deliveries for which there is a supplier invoice, the “Received SF” checkbox is checked. In this case, when posting the document, the corresponding invoices will be generated.” Document “Invoice issued” Issuance by the commission agent (agent) of an invoice for goods and services purchased under a commission agreement After receiving an invoice from the supplier, the commission agent (agent) providing intermediary procurement services issues an invoice on his own behalf to the committent (principal). An invoice is created automatically when posting the “Report to the Principal” document. In the “Counterparty” field, the principal (principal) is indicated, in the contract field, an agreement with the form “With a commission agent (agent) for purchase” is indicated, in the “Drawn up on behalf of” field, the supplier is indicated. Issuance by the commission agent (agent) of an invoice for the advance payment transferred as part of the execution of the commission order for the purchase After receiving the invoice for the advance payment from the supplier, the commission agent (agent) providing intermediary services for the purchase issues an invoice for the advance payment to the principal (principal) . In the invoice type field, indicate “For advance payment by the principal.” The “Seller” field indicates the supplier to whom the advance was paid. The “Principal” field indicates the Principal (principal) in whose interests the purchase is being made. It is recommended to create a document based on an invoice received from the supplier. |

Rights and obligations of the parties

The rights and obligations of the parties to the agreement are mutual.

The main responsibility of the commission agent is to conclude a transaction on the most favorable terms in the interests of the principal.

The contractor’s interest in concluding the most profitable contract is also manifested in the fact that the difference between the transaction price planned by the parties and its actual price will be divided in half between the principal and the commission agent.

Upon fulfillment of the terms of the contract, the contractor must prepare a report to the principal in writing.

He, along with all the property acquired during the execution of the agreements, is obliged to present it to the customer.

The legislator gave the committent the opportunity to submit his comments on the report, if any, within 30 days.

If such comments on the reporting were not sent to the contractor within the time frame established by the contract or legislation, the report will be considered accepted and the agreements executed.

The parties can increase or decrease the period for filing objections to the report by discussing them and including such a period in the terms of the contract.

At the time of acceptance of the results of the contract, the customer must inspect the material assets transferred to him, acquired by the contractor.

If any defects are discovered in the property, the executor should be immediately notified of this fact.

In addition, it is necessary to release the performer from all obligations to other persons arising as a result of fulfilling the terms of the commission agreement.

Payment for the service of storing property provided by the contractor for the purpose of proper execution of the contract must be made by the customer only when the storage obligation is assigned to the contractor by the contract.

You will probably be interested in looking at the “Contract (work) agreement” mental map, which describes in detail how to engage a subcontractor

Or HERE you will find out who is entitled to special breaks during work

How to make changes to the work book: