The accounting reflection of the activities of an intermediary in the sale of goods under a concluded commission trade agreement is carried out in the following sequence:

- receiving products from the owner for the purpose of further resale (without transfer of ownership of the property), posting goods on off-balance sheet accounts;

- sale of goods and receipt of funds from the buyer (without recognition of revenue);

- issuing closing documents to the principal in order to receive a commission and submitting a report on the results of the transaction;

- transfer of funds received from the buyer;

- recognition of revenue in the form of commissions received.

Commission trading is regulated by Chapter 51 of the Civil Code of the Russian Federation, according to which a legal entity - a commission agent - undertakes to act as an intermediary between the property owner and buyers for a separate monetary remuneration. He assumes obligations to sell assets on behalf of the principal on his own behalf, but at the expense of the owner.

All terms of the agreement are reflected in writing in the commission agreement concluded. It also specifies the amount of monetary remuneration for completed transactions, the procedure for calculating it, and the procedure for reimbursing the commission agent’s costs for selling the owner’s products (with the exception of costs for storing property, if the contract does not stipulate the conditions for their reimbursement).

Note from the author! In order to prevent questions from the tax service, the commission agreement must be concluded before the purchase and sale agreement with product buyers; in this case, the incoming funds will not be the seller’s revenue.

Since, according to the concept of commission trade, the ownership of goods sold passes directly from the owner of the property to the final buyer, but are sold on behalf of the commission agent, in his accounting, assets accepted under the contract should be accounted for in off-balance sheet account 004.

When completing a transaction, the commission agent issues an invoice to the buyer on his own behalf and receives money for the goods.

Note from the author! Under the simplified tax system, the issued invoice is not recorded in the sales book.

No later than 3 days after the end of the reporting period in which the transaction was completed, the commission agent submits a report on the transactions performed. Based on the received report, the owner of the product issues an invoice in the name of the commission agent, who subsequently has the right to accept it for deduction.

Something to keep in mind! The date of the invoice issued by the commission agent must coincide with the date of the invoice issued by the commission agent to the buyer.

The funds received from the buyer are transferred to the principal, and closing documents for their own intermediation services are issued. The amount of the commission is recognized as the commission agent's revenue. Also, in accordance with the Civil Code of the Russian Federation, the commission agent has the right to withhold his own remuneration from the funds received from buyers, the amount of which is pre-agreed in the contract.

Something to keep in mind! When a commission agent withholds a commission from funds received from buyers, the principal's creditors, who enjoy an advantage in satisfying their own claims, do not lose the right to satisfy these claims from the withheld funds.

Commission trading concept

Commission trading means trading activities in which the relations of the parties are regulated by a commission agreement. At the same time, the seller sells goods transferred to him for sale by other persons. The participants in such relations are:

- principal (gives instructions to conclude purchase and sale transactions for a fee);

- commission agent (seller who carries out accepted orders for a certain percentage - commission).

New and used (used) non-food products, antiques, and art objects are accepted for commission. In addition, the commission can accept confiscated and ownerless property, as well as that which, by a court decision, became the property of the state.

Report to the committent (principal) on sales in 1C

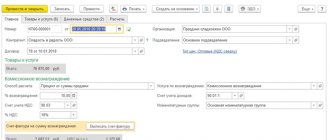

To create a document, you need to go to: “Purchases” - “Reports to principals”. There are two ways to create it. In the first case, through “Create” the document is created manually. In the second case, through “Receipts (acts, invoices)” the process is largely automated.

If you go to the receipt document, you can click on “Create based on”, and then select “Report to the committent” from the list provided. In this case, the main part of the details entered into the header will be automatically taken from the base document.

The following describes the procedure for determining remuneration. Let's assume that its value is determined as 5% of revenue. Taking into account the fact that the company acts as a full-fledged VAT payer, the corresponding invoice 90.03 is indicated.

Taking into account the fact that remuneration is considered as income, the “Income Account” is indicated - 90.01.1. The selection of commission is carried out from the nomenclature and sub-account “Services”. The completed report looks like this:

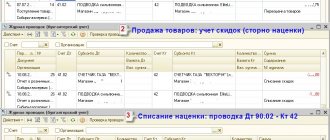

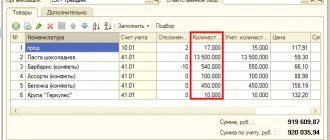

There is no reflection of the amounts on the “Main” page, since the goods were not specified. To enter them, you need to go to the “Goods and Services” tab. Here you enter information on the goods sold, their quantity and selling price. If you use the “Fill in upon receipt” option, the information will be added automatically. You only need to select the required document from the proposed list.

After this, the “Main” tab will take on a different appearance.

After the document is posted, the system will generate transactions reflecting the processes associated with calculating remuneration to the commission agent.

https://youtu.be/UlujCzjy6I0

What will be the OKVED encoding “Commission trade” in 2019

The OKVED code “Commission trade” in 2020 must be taken from the current edition of the OKVED2 directory (approved by Rosstandart, order No. 14-st dated January 31, 2014, as amended on July 10, 2018). The official name of this classifier is “OK 029-2014 (NACE Rev. 2)”. The OKVED2 directory is very convenient to use, since similar types of activities are grouped in it into separate sections.

The OKVED code “Commission trade in non-food products” is selected as follows:

- We are looking for section “G” (wholesale and retail trade).

- We move to class “47” (wholesale trade, except motor vehicles).

- Next, we move to subclass “47.7” (trade in specialized stores of other goods).

To trade used goods, select the required code in the “47.79” group. This group includes activities related to retail trade:

- antiques (47.79.1);

- second-hand books (47.79.2);

- other used goods (47.79.3);

- activities of auction houses (47.79.4).

Group 47.79 does not include some types of commission trading. These are the following types of activities:

- sale of used cars (code 45.11);

- thrift store services (code 64.92);

- services of online auctions and other auctions (code 47.91, 47.99).

You can select several OKVED codes. But only one of them will be primary, and all other encodings will be additional. When registering with the Federal Tax Service, in a special application you must indicate the type of activity code, which will consist of at least 4 digital characters.

Postings for the sale of goods in the accounting of the commission agent

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 004 | Receipt of goods from the consignor | Purchase price | Packing list | |

| 004 | Shipment of goods to the buyer | Cost of goods | Packing list | |

| 44 | 02, , , 69, 76 | Reflection of expenses for the provision of intermediary services | Cost amount | Accounting certificate-calculation |

| 62.01 | 90.1 | Accrual of commission rewards | Reward amount | Invoice, certificate of completion of work |

| 90.03 | 68 | Calculation of VAT on transferred remuneration | VAT amount | Invoice, certificate of completion of work |

| 90.02 | 44 | Write-off of commission agent's expenses when providing intermediary services | Amount of expenses | Accounting certificate-calculation |

| 62.01 | Crediting the amount of remuneration from the principal | Reward amount | Bank statement, payment order | |

| 90.9 | 99 | Reflection of the financial result from the provision of services | Net profit amount | Accounting statement, Sales book |

Commission trade in clothing

Trade in used clothing is in very high demand among the population. An item that is unnecessary for one person may be a necessary acquisition for another. Sometimes in such stores you can buy high-quality and rare (unique) things.

If you decide to open your own store for such trade, the following OKVED codes “Commission trade in clothing” will suit you:

- “47.79.3” – trade in other used goods;

- “47.71” – sale of clothing in specialized stores;

- "47.72" - sale of shoes.

Commission trade in jewelry

Commission sale of jewelry is an alternative to pawnshop activity. Legal entities and individuals can engage in this type of activity.

The OKVED code “Commission trade in jewelry” can be selected from the following codes:

- “47.79.1” – trade in antiques;

- “47.79.3” – sale of other used goods;

- “47.99” – other trade outside shops and markets;

- “47.77” – sale of watches and jewelry (in specialized stores).

Commission trade in cars

Many citizens of the Russian Federation refuse to buy used cars from private individuals in favor of proven and reliable organizations. The demand in this area is quite high, so the business of selling used cars can be very profitable. Before accepting a car for consignment trade, you should have it diagnosed at a service center.

The OKVED code “Commission trade in cars” is not included in the group “47.79”; it refers to a different type of activity. The code is selected as follows:

- In section “G” of the classifier we move to class “45”, then to subclass “45.1” “Trade in motor vehicles”.

- We are looking for the grouping “45.11”, this will be the required code for commission trade in motor vehicles.

The coding “45.11” is suitable for trading in both new and used cars and light-duty trucks. The sale of SUVs weighing no more than 3.5 tons also applies here.

As an additional code to OKVED “Commission trade in motor vehicles”, you can specify the code “47.99”.

Possible codes for commission trading are presented in our table.

Read also: Changing OKVED codes: step-by-step instructions

Enter the site

RSS Print

Category : Accounting Replies : 143

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev. 5 Next → Last (15) »

| Natalia [email hidden] Belarus, Novopolotsk Wrote 665 messages Write a private message Reputation: | #41[667709] May 25, 2014, 9:15 |

Anastasia wrote:

Please help me in the following situation. But as for commission trading when selling physical goods. persons?????

Online conference Simplified tax system in 2013: https://www.belta.by/ru/conference/i_289.html Is the tax rate applied under the simplified tax system without VAT in the amount of 3% by a commission agent applying the simplified tax system without paying VAT for retail sales of goods through commission departments? Irina Luferchik: The tax rate under the simplified tax system of 3% is established for proceeds from the sale of purchased goods in retail trade. Under a commission agreement, the commission agent provides a service for the sale of goods. Revenue from the sale of services includes commission fees and additional benefits (if any). The tax rate in this situation is 5%. Edited by the moderator according to the forum rules (subclause 4.9.)

I want to draw the moderator's attention to this message because:Notification is being sent...

| Anastasia [email protected] RB, Vitebsk Wrote 175 messages Write a private message Reputation: | #42[667768] May 26, 2014, 10:32 |

Notification is being sent...

| doctor_net [email hidden] Wrote 8 messages Write a private message Reputation: | #43[669767] June 9, 2014, 15:20 |

Notification is being sent...

| Lerya [email hidden] Belarus, Minsk Wrote 621 messages Write a private message Reputation: | #44[669772] June 9, 2014, 15:34 |

Notification is being sent...

| doctor_net [email hidden] Wrote 8 messages Write a private message Reputation: | #45[669934] June 10, 2014, 12:17 |

Valeria wrote:

No, the tax will be on the commission amount.

Where can you even read about this? It’s just that everyone says differently, but with the simplified tax system, you pay from the incoming amount.

I want to draw the moderator's attention to this message because:Notification is being sent...

| natali [email hidden] Belarus Wrote 1393 messages Write a private message Reputation: | #46[687441] September 18, 2014, 12:45 |

doctor_net wrote:

Valeria wrote:

No, the tax will be on the commission amount.

Where can you even read about this? It’s just that everyone says differently, but with the simplified tax system, you pay from the incoming amount. So this problem affected me, should I include revenue or just remuneration? If anyone knows, please respond. It would be nice to have a link to the regulations

I want to draw the moderator's attention to this message because:Notification is being sent...

| Margusha [email hidden] Belarus, Grodno Wrote 8334 messages Write a private message Reputation: 1104 | #47[687442] September 18, 2014, 12:48 |

Notification is being sent...

Fight and search, find and hide! If you want to be a happy person, don’t rummage through your memory.| natali [email hidden] Belarus Wrote 1393 messages Write a private message Reputation: | #48[687444] September 18, 2014, 12:53 |

Margusha wrote:

you must provide a report to the principal every month, where your revenue will be divided into amounts - the amount of the principal, your remuneration, the total amount of revenue. Tax is paid on the remuneration

So it turns out that commission trade is more profitable than wholesale, do we save on tax under the simplified tax system?

I want to draw the moderator's attention to this message because:Notification is being sent...

| Margusha [email hidden] Belarus, Grodno Wrote 8334 messages Write a private message Reputation: 1104 | #49[687456] September 18, 2014, 1:11 pm |

other similar civil law contracts, as well as when providing services under transport expedition contracts with a commission agent (attorney), another similar person and a forwarder –

the amount of remuneration, as well as additional benefits; I want to draw the moderator's attention to this message because:

Notification is being sent...

Fight and search, find and hide! If you want to be a happy person, don’t rummage through your memory.| tarachek [email hidden] Belarus, Minsk Wrote 138 messages Write a private message Reputation: | #50[737171] April 16, 2020, 9:14 am |

Notification is being sent...

« First ← Prev. 5 Next → Last (15) »

In order to reply to this topic, you must log in or register.