Basic filling rules

Filling out a TTN is a rather complex procedure that is subject to many different rules.

When checking the validity of a VAT deduction, most tax inspectors first try to confirm the fact of the transaction, requiring that they submit a bill of lading. It is also worth noting that if a reduction in income tax is used due to expenses spent on transportation, for this you will also need to submit the necessary transport documents, and in particular the TTN. This is one of the most important requirements. That is why it is necessary not only to have such a document, but also to fill it out correctly in accordance with the norms of current legislation.

TTN form No. 1-T was approved by the current resolution of the State Statistics Committee No. 78, and to date no significant changes have been made to it. There is nothing difficult about filling out such a TTN. This is done in four copies, two of which are used by the shipper and the recipient, and the remaining two are transferred to the transport company.

After the cargo has been delivered to its destination, an additional copy is sent to the payer, and an invoice for payment and a completed certificate of work performed are also attached to it. One of the mandatory documents required for reporting by the carrier is also a waybill, which must be attached to the last copy of the invoice.

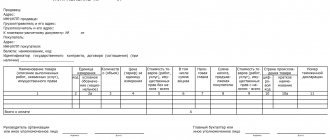

The sample filling out of the TTN includes two main sections – transport and commodity. In this case, the responsibility for filling out the second one rests entirely with the sender of the goods, while the transport part must be compiled by the carrier.

Purpose of the waybill and TTN

Why do you need a waybill? The document is intended to record the movement of inventory items and payments for their transportation by road. It confirms the conclusion of an agreement for the carriage of goods, records data on the cost of services of the motor transport company and the procedure for calculating freight charges. The presence of a consignment note gives an organization the opportunity to reduce the income tax base.

TN is an important document in the field of civil legislation, confirming the conclusion of a transportation contract, as well as in tax accounting - the invoice confirms the costs of transport services when determining the tax base, for this it must be drawn up in accordance with all legal requirements.

The TTN serves to record the movement of inventory items, write them off from sellers and capitalize them from consignees, and in the field of alcohol circulation, only the TTN acts as a mandatory accompanying document confirming the legality of the production and circulation of alcohol-containing products (Explanation of the Federal Service for Alcohol Regulation of 07/08/2011).

https://youtu.be/Y1kI7h2oEeg

How to fill out the TTN for the sender?

A sample of filling out the TTN for the shipper must include the serial number of the document received, the exact date of its preparation, full details of both parties, as well as the necessary information about the shipment of the goods, including its quantity, name, type of packaging, cost, total number of pieces and cost of the shipment.

In the line “Sender” and “Recipient” you must indicate the full names of the parties, identical to those recorded in the constituent documentation, as well as their telephone numbers and exact legal addresses. Opposite these lines you need to indicate the registration numbers of each enterprise in the tabular section. It is worth noting the fact that, in accordance with Resolution 78, there is no exact definition of how to correctly compile a sample of filling out the TTN, and what exactly needs to be written in the lines “Recipient” and “Sender”, so everyone decides for themselves what exactly to indicate there. Some prefer to rely on the interlinear hints that are present in the standard 1-T template, while other taxpayers also indicate tax numbers there.

In the “Payer” column, which most often becomes the sender of the goods, it is necessary to indicate his bank details. The product section indicates any available information about the consignment. The quantity, price, name, as well as the total amount in the consignment note in most cases are then duplicated in standard invoices. For this reason, the parties do not have the opportunity to issue additional invoices if initially all information was filled out in the TTN, and there will also be no need to separately allocate VAT.

There are also cases in which the product section indicates that the TTN sample has been supplemented with a specialized form TORG-12. In this case, it will act as an integral element of the consignment note.

If the invoice is prepared on several sheets, then information about this should be indicated under a separate tabular part of the corresponding section. Next, you need to indicate in words the total number of items of goods, as well as the weight of the cargo and the cost of shipment.

Instructions for filling out the bill of lading form

- First, you need to indicate in the document its number (according to the internal document flow of the company issuing the invoice), enter the date of completion, then in the “Shipper” line enter information about the company sending the goods - here you need to indicate its full name, actual address and telephone number.

- After this, in exactly the same way, you should enter information about the addressee in the “Consignee” line.

- Opposite the designation “Payer” you must indicate the company that pays for the carrier’s services.

- Opposite each company in the appropriate box you need to indicate its OKPO code (All-Russian Classifier of Enterprises and Organizations).

Filling out the first section of form 1-T

The first section of the invoice must be filled out almost completely by the shipper. First, detailed information about the product is entered into the table.

The item number of the product is entered in the first column (but only if such an accounting system is used by the enterprise), in the second and third - the price list number and article number (also only if available). The fourth column “Quantity” must be filled in - a figure corresponding to the number of goods transported for each item separately is placed here. Columns that go further cannot be skipped either: they include -

- price per unit of goods,

- his name,

- unit of measurement (kilograms, meters, cubes, etc.),

- type of packaging (boxes, crates, barrels, bags, etc.).

Then the number of pieces, weight (in tons) and total cost for each type of product separately are entered there. If there is a markup for volume or storage or transportation costs, this should also be indicated in the table. The next step is to enter the total cost of the goods for all items and in the last column the number of the goods according to the shipper’s warehouse card is entered.

If the waybill has a continuation, then you need to note the number of additional sheets in the corresponding cell (in words) and also the total number of types of goods and places (the values are duplicated from the first table).

Next, the weight of the cargo is entered in words and figures, and after that it is necessary to indicate all available attachments (number of sheets) and below, in words, the total cost of the goods released from the warehouse.

At the bottom of the product section on the left there should be signatures with transcripts of representatives of the shipper: the person authorized to release the goods (indicating his position), the chief accountant, as well as the storekeeper who directly carried out the shipment.

On the right side, the driver’s data is entered, including information about the power of attorney that the carrier company issued for him.

Later, here below is the signature of the representative of the consignee (usually this is also a storekeeper), who, with his autograph in this part of the document, certifies the fact of acceptance of the goods after transportation safe and sound.

Filling out the second section of form 1-T

The second section of the bill of lading includes transportation information. First it is indicated here

- cargo delivery time,

- information about the carrier company is provided, including its full name, contact details (address and telephone number),

- enter information about the car (make and state number),

- in the far right column the numbers of the invoice and waybill are written.

The “Payer” line includes information about the company that ordered the transportation (its name, address, telephone number and bank details), the driver’s last name, first name, patronymic and his license number.

The lines “License card”, as well as its “Registration number” and series, can be skipped, since licensing is not currently carried out, but the box about the type of transportation must be filled out (commercial).

Next, information about loading and unloading (actual addresses for delivery of goods) and other additional information (forwarding, route, trailers - if necessary) are entered.

Below is the table again. All data is entered into it similarly to the product section. In the column “Method of determining mass” scales are indicated - automatic, manual or commercial (if weighing is done on scales), but if weighing is not done, then you must indicate either “standard” or “according to labeling”.

On the right under the table you must enter the documents accompanying the cargo (quality certificate, passports, acts, etc.), and on the left you must enter the signatures of the direct participants in the loading-delivery-shipment process.

The next part of the document, entitled “Loading and unloading operations,” includes a table in which information about loading and unloading is entered (name of the sender and recipient of the cargo, method of operation, date of departure, arrival of the goods and signature of the responsible employee).

Next, the driver enters all other information into the penultimate plate (kilometres, cost of travel, fines for incorrectly completed documents, downtime, etc.) and finally the carrier’s accountant enters the latest data in “Cost calculation” and “Taxation”.

Other Features

The carrier must issue a specialized power of attorney for the authorized driver, and the sender of the cargo must fill out all the information in the appropriate place on the TTN. The lower left part of the first section of the TTN must include the signatures of all authorized persons of the consignor, that is, those people who authorized and carried out the shipment, as well as the full name of the chief accountant, while the driver’s signature is indicated on the right, which confirms the fact of entrustment he is responsible for the further safety of the accepted cargo.

After the cargo is delivered to the final point, the recipient must make a note on the same side of the invoice in the goods section about the existing claims for delivery, and then he puts his signature. Also here there must be a signature of the financially responsible person who personally accepts the delivered cargo (often we are talking about the storekeeper).

How is the document filled out by the carrier?

The carrier's responsibilities also include filling out the transport section of the second waybill.

The sample TTN must include basic company data, namely:

- legal address;

- full name;

- Bank details;

- contact number.

All this information must also be provided regarding the payer. You also need to indicate the registration information of the vehicle transporting the cargo and the full name of the driver, whose signature is included in the invoice. The TTN, among other things, must include information about the place of loading and unloading of the vehicle.

The tabular part should contain basic information about the cargo. In particular, you need to write its exact name, gross weight, number of places occupied, as well as a complete list of documentation accompanying the cargo. It is mandatory to fill out the lines related to the method of determining the exact mass of the cargo. Under this part information about the seals is written, the exact number of places is determined, as well as the total gross weight.

Registration of the TTN involves duplicating the signatures of all financially responsible persons of the sender on the same side (they must be indicated next to the word “Passed”) and the recipient (next to the word “Accepted”). The driver must sign in two places - first with the sender in the process of accepting the cargo for transportation, and then at the time of unloading, when the goods are transferred to the recipient.

The table “Loading and unloading operations” during loading and unloading of goods must include notes about the performer, the type of operation performed, the person in charge, the chosen method of carrying out the procedures, as well as the time of their implementation. The lower lines must be filled out by the carrier’s accounting department, since it is on the basis of the information specified here that the driver’s salary will be calculated.

Gross weight in the delivery note

Good afternoon. Question: The buyer of the goods requests that the lines “Cargo weight (gross)” and “Cargo weight (net)” be filled in the consignment note (TORG-12, 1-T). The seller's invoices indicate the unit of measurement - pcs., OKEI code - 796. Is the buyer's demand justified? Answer: If the goods named in the invoices are taken into account in pieces, then such details as “gross weight”, “quantity (net weight)”, “cargo weight (net)”, “cargo weight (gross)”, expressed in weight indicators are not mandatory. The buyer's requirement to indicate in the invoice, in addition to the quantity of goods expressed in pieces, the quantity of goods expressed in weight units of measurement, is unreasonable. Justification: In paragraph 2 of Art. 9 of the Federal Law of November 21, 1996 N 129-FZ “On Accounting” (hereinafter referred to as Law N 129-FZ) lists the mandatory details that the primary document must contain. One of the mandatory details of primary accounting documents is a business transaction meter in physical and monetary terms. However, Law No. 129-FZ does not include “gross weight”, “quantity (net weight)”, “cargo weight (net)”, “cargo weight (gross)” among the mandatory details of waybills required for filling out. In our opinion, if the consignment note has all the necessary information to establish the content of a business transaction, then the presence in the consignment note of the lines “Cargo weight (gross)” and “Cargo weight (net)” is not mandatory, since the company sells the goods as a unit of measurement which is the quantity expressed in pieces. This position is confirmed by the Resolutions of the FAS of the East Siberian District dated July 22, 2007 N A19-27327/06-15-F02-5514/07, the Ninth Arbitration Court of Appeal dated September 27, 2007 N 09AP-12652/2007-AK. Thus, in the situation under consideration, the buyer’s demands are unreasonable. E.A.Emelyanenko CJSC "Spline-Center" Regional information center of the ConsultantPlus Network 05/30/2011

Conditions and nuances of registration of TTN

A separate form must be filled out for each individual case. Filling out the TTN is carried out only in two situations:

- a hired organization was hired to transport this or that cargo;

- Transportation is carried out using rented or own transport.

If the buyer or recipient decides to independently organize the removal of the ordered cargo, then in this case the seller is completely relieved of the obligation to prepare accompanying documentation. The new sample CTN must be filled out when transporting cargo through the countries of the Customs Union, as well as throughout the CIS, if the goods are transported by road or international transport. If transportation is organized together with representatives from non-CIS countries, in such situations it is already necessary to issue international class CMR invoices.

Starting from 2011, the procedure for writing off products from the company’s balance sheet does not provide for recording the information used to work with the TTN. What does it mean? This confirms the fact that a transportation agreement was concluded between the parties, and if necessary, the carrier has the opportunity to present this document to police officers. The corresponding ATS form must accompany the cargo along the entire route. Its presence helps to regulate relations between all involved parties to the transaction, since the consignment note is the primary document.

Links[ | ]

- [6pl.ru/transp/pp_ppgat.htm Decree of the Government of the Russian Federation of April 15, 2011 N 272 On approval of the Rules for the transportation of goods by road]

- [6pl.ru/docum/pgks_78_1.htm Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 N 78 On approval of unified forms of primary accounting documentation for recording the work of construction machinery and mechanisms, work in road transport]

| This is a draft article on economics. You can help the project by adding to it. |

| Some external links in this article lead to sites listed as spam. These sites may infringe copyright, be considered non-authoritative sources, or be otherwise banned from Wikipedia. Editors should replace such references with references to compliant websites or bibliographic references to printed sources, or remove them (perhaps along with the content they support). List of problematic links

|

How to provide details?

All specified details must be written in the appropriate order. Before loading, the sender must put in the header section the number of the document drawn up, the date it was completed and the series, after which the necessary information is entered in the columns. As an example, we can consider the main list of data that Novaya Poshta uses when compiling the TTN. What kind of data is this?

- In the “Customer” column, the exact name of the company or individual who orders the transportation service is indicated.

- “Sender”: indicates the company shipping the goods.

- “Recipient”: the individual or company receiving the shipment.

- “Loading point”: the exact place (address) where the goods are shipped for further transportation.

- “Unloading point”: the final point of the route.

- “Cargo information”: code and name. The total quantity and price of the goods are not indicated here.

- “Vacation Authorized”: the name of the employee responsible for filling out the delivery note and loading the goods, as well as his signature.

According to current legislation, a consignment is considered to be one or more items of cargo, the transportation of which is carried out in accordance with one shipping document. In this regard, the TTN is a document of strict reporting, which must correspond to the total number of vehicles transporting a particular shipment.

Filling after loading

After the download is completed, the following information is recorded:

- The “Car” column indicates the make, exact number, as well as any other necessary information about the vehicle used for transportation.

- “Automobile enterprise”: the name of the enterprise organizing cargo transportation.

- “Driver”: all personal data of the driver.

- "Trailer": numbers that belong to the attached trailer.

- “Cargo information”: a complete list of accompanying documentation, type of container, the total number of places occupied by each individual type of cargo, as well as a method for determining its weight.

- “Indicated load”: the seal imprint is determined.

- “Gross weight”: the exact weight is indicated, as well as the stamp and signature of the employee who is responsible for carrying out the weighing procedure.

- “Accepted by the driver”: personal data of the driver, who confirms the information entered earlier in the invoice, securing everything with his own signature.

- “Loading”: all the necessary data on loading capacity and time, work code and other information.

- “Transport services”: the entire list of additional services that were provided by the driver (including packaging, strapping and others).

The consignment note will accompany the cargo throughout the entire route, and its registration should be approached as responsibly as possible, since filling out the consignment note is not as simple as it seems to many at first glance.

Features of document execution according to the TORG-12 form

Despite the fact that many consider the question of the need for the consumer to print on a consignment note drawn up in the TORG-12 form as quite simple, in reality this is not the case. The recommendations of the current legislation state that the invoice must be signed by financially responsible persons who deliver and accept the goods, after which the document is certified by the round seals of the recipient and the supplier.

This TTN form itself, in addition to the others, also includes the “MP” requisite.

It is believed that there is no need to put a stamp on TOPG-12 if the authority of the buyer’s representative has not been fully confirmed. The power of attorney already bears the company seal, as this requirement is established by current legislation. The power of attorney also includes all the necessary details of the invoice, according to which the goods are accepted by the representative. In this regard, it can be attached to the issued invoice. Any tax sanctions cannot be imposed in the absence of a stamp on the invoice.

To indicate the exact details of the power of attorney in TORG-12, you need to fill in the appropriate lines. In particular, the authorized representative must put a personal signature in the line “The cargo was accepted”, and if the products are accepted by the head of the company, he must sign in two lines – the indicated one and “The cargo was received by the consignee”. Since the head of the company, as the sole executive body, can accept goods without the need to present a power of attorney, you just need to leave dashes in the lines where the details of this document are indicated.

Sellers of goods should also take into account that if the buyer of certain products is an individual, then in this case, during transportation, in principle, there is no need to fill out the TORG-12 form, since in accordance with Resolution of the State Statistics Committee No. 132, the use of this form of invoice is used when registering the sale of any or inventory items to third parties.

When and how do you fill out TORG-12?

If you are a buyer and decide to pick up the goods from the supplier’s warehouse using your own transport, you do not need to draw up an agreement with the carrier and, accordingly, deal with the peculiarities of filling out the TTN.

If you are a supplier and are engaged in independent delivery of goods from your own warehouse, using your own transport, then you will only need to formalize the shipment of goods using the TORG-12 invoice form, but you are not required to fill out other documents, including the CTN number. What kind of TORG-12 this is and what are the main features of its compilation were discussed above.

It happens that the buyer, under the terms of the contract, must pay the supplier the total cost of delivery of the ordered products. At the moment, there is no unified document form used to reflect such services, therefore a special act is drawn up for the total amount of cargo delivery services. In this regard, it is necessary to carefully understand the features of each individual case.

Filling out a bill of lading is by no means an overwhelming task. The main thing when filling out is to be careful, maintain clarity and relative literacy. If this condition is met, there will be no problems using the document.

Everything is fair

Even before anyone goes to pick up the cargo, the seller is informed about this. He prepares technical specifications for cargo transportation in advance. What can you write in advance? Almost everything that has to do with the first part of this white paper. Plus, they indicate who is responsible for shipping the goods, the name of the driver who will accept and transport this luggage, and the number of his car. As a rule, a price list is also attached to the purchased cargo. In short, all the information has already been prepared and entered in advance. This reduces the time it takes to ship goods.

And upon receipt, data such as weight, volume of shipped and sold will be entered. The driver or forwarder controls everything, so as not to be guilty later, and enters information about his upcoming services into the official document.

A designated person is responsible for everything. He signs all forms of the consignment note. The person sending the goods seals the document. The driver or forwarder who accepted the purchase also signs. They, of course, first check what is written and what is in reality. Because they are now responsible for the values entrusted to them.