Legal basis for combination

What is combination?

Even if you have to perform related duties during your main shift, such employment is not consistent with the normal conditions outlined in the set of labor laws.

Article 151 of the Labor Code of the Russian Federation considers the types of possible overtime employment during the main shift and provides for remuneration for overtime workload.

Here is the exact text of the article: “When combining professions (positions), expanding service areas, increasing the volume of work, or performing the duties of a temporarily absent employee without release from work specified in the employment contract, the employee is paid additionally. The amount of additional payment is established by agreement of the parties to the employment contract, taking into account the content and (or) volume of additional work.”

To properly understand the article, you need to understand the definitions.

The main concepts of this document are the following:

- combination of professional activities;

- expansion of the scope of activity;

- increasing the volume of production tasks;

- performing the duties of a colleague who is temporarily absent.

Basic concepts are necessary to understand the essence of a legal document.

https://youtu.be/MJMFfok-TWo

What is a combination of professions (positions)?

Article 151 of the Labor Code of the Russian Federation defines what it is to replace an absent employee.

According to the code, such a process represents the performance of the functional duties of an absent person by another person.

This procedure has its own distinctive features:

- The duties of an employee who is not dismissed, but only temporarily absent, must be performed. At the same time, the latter must retain his position.

- The substitute performs additional work during the main working hours.

- The interim not only retains his position. He is obliged to perform additional work without interrupting the main one.

- The replacement must be paid additionally, which must be commensurate with the increased volume.

- Functioning of this kind ceases when the main employee leaves, that is, when the circumstances that served as the reason for the replacement ceased - the person recovered, returned from a business trip, or completed his studies.

Load registration

Additional work time must be paid.

Article 151 of the Labor Code provides for additional payment for “extra labor.” Here the interests of the worker diverge from the interests of the employer.

The worker wants to receive a decent salary for the excessive stress. The administration's interests boil down to savings.

An employee needs to know how additional types of work are properly documented. This will help him maintain his interests and avoid friction.

The hired worker monitors the registration of additional work and does not begin it until he is convinced of the correctness of this action. Otherwise, it will be very difficult for him to further prove his rights.

It should not be forgotten that all three types of activities described above must be carried out during regular working hours. If the work is done after a shift, then this is a different type of part-time job. It is regulated in Article 60.

An employee should always remember the following important points:

- Combination and substitution are different terms. A vacancy is filled and the activities of a temporarily absent colleague are combined;

- The combined work is done at the same time as the main one. Any work activity carried out after the work specified in the contract is part-time work. These types of overtime work should not be confused. They are paid differently;

- Combined labor operations must be feasible. The employee is not sure that he can cope with new responsibilities? He has the right to refuse. For example, a cleaner is asked to clean 150 meters instead of 100 and do it during her shift. But she is physically unable to handle it. In this case, the person has the right to refuse. The employee must formalize his refusal in writing and submit it to management three days before the start of a new activity;

- If the combination is associated with financial responsibility, then this is discussed additionally. For example, a methodologist who is not financially responsible is offered to temporarily take on the responsibilities of a caretaker. The employer must conclude an agreement on the employee’s new obligations in writing. If there is no such agreement, then the part-time employee does not bear any responsibility;

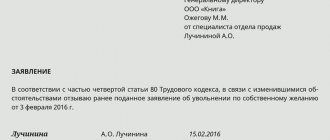

- Any additional duties are assigned to the employee only with his consent. Consensus is formalized by a written statement from the employee. Another form of consent is a written proposal from the employer, which is signed by the employee.

The requirements for documenting overtime employment of employees do not end there. Additional labor obligations assigned to an employee require the administrator to draw up a new labor contract.

This document clearly describes the types of activities, their volume, the duration of the new employment relationship, and the amount of remuneration. One copy of the document remains with the administration, the second is given to the employee.

Next, the employer is obliged to issue an order listing the points specified in the agreement.

Only after this the employee calmly begins to perform new duties - his interests are legally protected.

Part-time and combination

Legal regulation of labor relations of persons working part-time is carried out in accordance with the norms of Chapter 44 of the Labor Code of the Russian Federation. Part-time work is the performance by an employee of other regular paid work under the terms of an employment contract in his free time from his main job.

Concluding employment contracts for part-time work is allowed with an unlimited number of employers.

unless otherwise provided by federal law. Part-time work can be performed by an employee, both at the place of his main job and with other employers. In other words, the work performed by an employee is considered part-time if: - an employment contract is concluded with an employee who is already in an employment relationship; under this employment contract, other work is performed in addition to the main one, and the work is regular and paid; This work is performed by the employee in his free time from his main job.

What is the difference?

Some categories of citizens are not suitable for combination.

Combination and part-time work are different terms. A person must combine the implementation of another type of activity at his place of work. Part-time work involves engaging in other activities after the first job.

For example, a singing teacher can combine art lessons. If he first leads the singing and then the drawing, then this is a part-time activity.

Moreover, he can teach drawing classes at another school. A teacher who performs the functions of a nanny combines another type of activity, because the whole process takes place at the same time and in the same place.

Every employee of an enterprise can combine different types of activities. There are no restrictions in the law for citizens on the possibility of combining.

The attitude towards part-time work is different. Part-time work is unacceptable for minors, prosecutors, civil servants, members of the Board of Directors, and judges.

The combination takes place exclusively within one enterprise and under the leadership of one single administrator. Part-time work is acceptable anywhere.

When combining, an additional agreement is signed. Part-time work can be compared to a second job. As with employment, a contract is drawn up.

A record of part-time employment is made in the work book. Part-time work is not celebrated that way.

To terminate the combination, a written refusal of the part-time partner is sufficient. The combination ends with the cancellation of the contract.

Part-time work is paid in accordance with the regular salary. The remuneration for the combination is determined by agreement of the parties.

The hired worker needs to know this. Only knowledge of the law will help you competently defend your rights and avoid groundless demands on your employer. The employer needs knowledge of the law to competently regulate relationships with employees.

Wage

These recommendations are taken into account by the Government of the Russian Federation, executive authorities of the constituent entities of the Russian Federation and local governments when determining the volume of financial support for the activities of state and municipal institutions, including in the field of healthcare, education, science, and culture.

We recommend reading: Documents for obtaining a tax deduction when purchasing an apartment (mortgage)

If the parties to the Russian Tripartite Commission for the Regulation of Social and Labor Relations have not reached an agreement, these recommendations are approved by the Government of the Russian Federation, and the opinion of the parties to the Russian Tripartite Commission for the Regulation of Social and Labor Relations is communicated to the constituent entities of the Russian Federation by the Government of the Russian Federation. Local regulations establishing remuneration systems are adopted by the employer, taking into account the opinion of the representative body of employees. The terms of remuneration determined by the employment contract cannot be worsened in comparison with those established by labor legislation and other regulatory legal acts containing labor law norms, collective agreements, agreements, and local regulations.

The terms of remuneration determined by the collective agreement, agreements, local regulations cannot be worsened in comparison with those established by labor legislation and other regulatory legal acts containing labor law norms. Information about changes: Federal Law of July 3, 2020

Overtime pay

Payment is made for actual time worked.

Each entrepreneur can independently develop a tariff schedule for his enterprise. If he is not able to do it himself, then third parties, lawyers and economists are brought in to do it for him.

Workers and employees of the enterprise, represented by their elected representatives, can take part in the development of the remuneration system.

The tariff schedule is not born from the imagination of the employer. It is based on existing payment standards, but takes into account the special conditions of a given enterprise.

The size of tariffs is influenced by the seasonality of work, the demand for employed employees in the labor market, the qualifications of workers and even the speed of order execution.

Article 135 of the Labor Code provides for the coordination of the tariff schedule with representatives of the labor collective. Selected representatives get acquainted with the standards, study them, and, if necessary, consult with specialists. After this, they express their consent by signing a collective bilateral agreement.

One side is the administration of the enterprise, the other side is the workforce.

It may seem that the workers of the enterprise are opposed to the administration. But that's not true. A good owner is always interested in the results of his enterprise.

And they are directly related to the atmosphere in the work team. All conflicts have a negative impact on work. Such an agreement excludes mutual dissatisfaction.

Part-time payment is also based on internal tariffs and is regulated by a bilateral agreement with the workforce, although it is the result of an agreement between the owner and the worker.

The law does not specify either a maximum or a minimum for overtime pay. But there are indications that the fee may be a percentage of the basic salary.

Payment for overtime work may be a certain amount of money. It should be noted that these provisions are a recommendation rather than a requirement.

There is such a thing in law as minimum wage. The meaning of this abbreviation has long been known to everyone. The monthly salary of any employee cannot be less than the amount determined by the state as the minimum.

Wages are calculated either for time worked or for the amount of work performed. Time wages cannot be applied to overtime work described in Article 151.

These activities are carried out during regular working hours. The main criterion is the actual amount of work performed by the employee.

But there are some nuances here. If a person performs work beyond the norm, then the determining factor is precisely the amount of work by which the main labor activity was increased.

But, a person can combine the duties of another specialty. This approach would be inappropriate here.

Combination is defined as work outside the norm. The combination fee belongs to the category of compensation. All increases available in the region are credited to this part of the salary.

From the above it is clear that there is no consensus on overtime pay. Remuneration is the result of an agreement between the employee and the employer.

What to do if the amount of the surcharge is not specified in the agreement?

It happens that a combination agreement has been concluded, but the specific amount of the additional payment is not indicated there. In this case, the company has the right to calculate the amount of additional payment based on the provisions of any internal document (for example, regulations on remuneration).

If the employee does not agree with the amount of the additional payment and claims a larger amount, he can challenge the amount, but in this case the specialist must be ready to provide evidence that he is due an additional payment in the specified amount (determination of the Supreme Court of the Republic of Sakha (Yakutia) dated July 22. 2013 No. 33-2629/2013).

Article 151 of the Labor Code of the Russian Federation

Article 151 of the Labor Code allows a specialist of any organization the opportunity to earn additional income. This happens, in particular, if a person who permanently occupies one position in the company, in addition, on an internal basis, occupies another position.

For more information about internal combination, see the article “Registration of combining positions in one organization.”

The following specialists can count on a similar additional payment, except for the specified case, in 2020:

- in respect of which there was an expansion of service areas;

- who have taken on additional work responsibilities/work;

- replacing temporarily absent specialists, while still continuing to perform their main job.

Replacing an absent person: is it necessary to perform all work functions in his place?

In Art. 151 of the Labor Code of the Russian Federation stipulates that if a specialist not only works on the staff of a company in his main position, but also simultaneously replaces a temporarily absent employee, then he must also be given a certain additional payment.

The difficulty here is that the full-time position of each specialist involves a wide range of functions/responsibilities. And when a full-time employee is absent, the specialist replacing him can be assigned only part of the duties of the absentee. Therefore, additional payment will be established only for that functionality that is temporarily transferred by the company to another employee.

This means that if an employee, without written instructions from the company, performs the entire range of functions for the position he replaces, he has no right to count on a full additional payment (equal to the regular salary of the absent person) (decision of the Arkhangelsk Regional Court dated August 28, 2013 No. 33-4979/2013).

For information on the procedure for registering a replacement, for example, during a vacation, see the article “Order for substitution during a vacation - form and sample.”