Form N P-5(m) “Basic information about the organization’s activities”

Federal statistical observation form N P-5(m) “Basic information about the activities of the organization” is provided by all legal entities that are commercial organizations, as well as non-profit organizations of all forms of ownership that produce goods and services for sale to other legal entities and individuals, organizations customers carrying out investment activities, the average number of employees of which does not exceed 15 people, including part-time workers and civil contracts. Legal entities provide the specified forms of federal statistical observation to the territorial body of Rosstat at their location. If a legal entity has separate divisions, forms P-1, P-2 (except for section 1 and columns 1, 2 of section 3), P-4, P-5(m) are filled out for each separate division and for a legal entity without these separate divisions. The completed forms are submitted by the legal entity to the territorial bodies of Rosstat at the location of the corresponding separate division (for a separate division) and at the location of the legal entity (without separate divisions) within the established time limits. In the event that a legal entity (its separate division) does not carry out activities at its location, the form is provided at the place where they actually carry out activities. The head of a legal entity appoints officials authorized to provide statistical information (primary statistical data) on behalf of the legal entity. A separate division of an organization is any territorially separate division from it, at or from the location of which economic activity is carried out at equipped stationary workplaces. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. Temporarily non-operating organizations, where production of goods and services or investment activities took place during part of the reporting period, are provided with federal statistical observation forms on a general basis, indicating how long they have not been operating. Subsidiaries and dependent business companies provide federal statistical observation forms N P-1, P-2, P-3, P-4, P-5m on a general basis in accordance with paragraph 2 of these Instructions. The main business company or partnership that has subsidiaries or dependent companies does not include information on subsidiaries and dependent companies in the federal statistical observation forms. Organizations that carry out trust management of an enterprise as a whole property complex draw up and provide reports on the activities of the enterprise that is in their trust management. Organizations carrying out trust management of individual property objects provide the founders of the management with the necessary information about their property.

Nuances of reporting by certain categories of legal entities

Instructions for filling out Form 5-P(m), contained in Appendix 17 to Order No. 414 and Appendix 21 to Order No. 541, reveal the specifics of reporting by individual companies, depending on the specifics of their activities, taxation regime or other nuances.

The company is required to report information about the company’s performance indicators to the statistical authorities, regardless of whether:

- They conduct economic activities or are temporarily unemployed. If during the reporting period the company produced goods and provided services part of the time, form 5-P(m) is filled out on a general basis, indicating since what time there has been no activity.

- Whether they are in bankruptcy or not. It is necessary to submit a report in the general manner until the arbitration court issues a ruling on the completion of bankruptcy proceedings and makes a record of liquidation in the Unified State Register of Legal Entities.

The report is also prepared by:

- Trustees, if they manage companies as entire property complexes.

- Associations of legal entities (unions and associations). The data in the report is presented on the activities recorded on the balance sheet of the association, and the members of the association report on their activities independently.

“Simplers” fill out the form on a general basis.

Shape n-5 m

The management founders draw up their reports taking into account information received from the trustee. At the same time, organizations carrying out trust management draw up and provide reports on the activities of the property complex in their ownership. Associations of legal entities (associations and unions) in the specified forms reflect data only on activities recorded on the balance sheet of the association, and do not include data on legal entities that are members of this association. The address part of the forms indicates the full name of the reporting organization in accordance with the constituent documents registered in the prescribed manner, and then the short name in brackets. The form containing information on a separate division of a legal entity indicates the name of the separate division and the legal entity to which it belongs. The line “Postal address” indicates the name of the subject of the Russian Federation, legal address with postal code; if the actual address does not coincide with the legal address, then the actual postal address is also indicated. For separate divisions that do not have a legal address, a postal address with a postal code is indicated. A legal entity enters the code of the All-Russian Classifier of Enterprises and Organizations (OKPO) in the code part of the forms on the basis of the Notification of assignment of the OKPO code sent (issued) to organizations by the territorial bodies of Rosstat. For separate divisions of a legal entity, an identification number is indicated, which is established by the territorial body of Rosstat at the location of the separate division. Data for the corresponding period of last year, provided in the federal statistical observation forms for the reporting period, must coincide with the data of the corresponding forms provided for the same period last year, except in cases of reorganization of a legal entity, change in the methodology for generating indicators, or clarification of data for the previous year. All cases of discrepancies in data for the same periods, but given in different forms, must be explained in the legend to the form. If in the reporting year there was a reorganization, change in the structure of a legal entity or a change in methodology, then in the federal statistical observation forms, data for the reporting period, as well as for the corresponding period of the previous year, are given based on the new structure of the legal entity or methodology adopted in the reporting period. Organizations using the simplified taxation system submit statistical reporting using federal statistical observation forms NN P-1, P-2, P-3, P-4, P-5(m) in accordance with these Directives. Federal statistical observation form N P-5(m) “Basic information about the activities of the organization” is provided by all legal entities that are commercial organizations, as well as non-profit organizations of all forms of ownership that produce goods and services for sale to other legal entities and individuals, organizations customers carrying out investment activities, the average number of employees of which does not exceed 15 people, including part-time workers and civil contracts. Organizations carrying out construction activities on the territory of two or more regions, including on separate forms of Form N P-5m, provide information on the actual location of the construction site. At the same time, on each report form the following is written: “including in the territory of ________________” (its name is given, indicating the city and district). Organizations that have switched to a simplified taxation system must indicate in the column “Name of the reporting organization” after the name of the organization: “simplified taxation system.”

Who delivers and when?

Form P-1 statistics must be submitted directly to Rosstat by companies whose main labor activity is the production of products or services for the purpose of further sale.

The following companies do not need to submit this form:

- which belong to small businesses;

- the total number of hired employees for the last calendar year does not exceed 15 people, including those whose work activity falls into the “part-time” category;

- banking institutions;

- insurance organizations;

- other financial and credit companies.

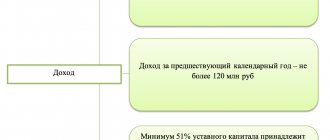

If the average number of employees is less than 15 people, then instead of forms P-1 and P-2 it will be necessary to submit P-5m, and there is no need to submit P-4.

Companies that have just begun the process of their labor activity are required to provide Form P-1 statistics in accordance with the number of hired employees for the reporting calendar year. If there are separate divisions, the form must be filled out for each division separately and for the entire company in particular (without taking these divisions into account).

Companies that use a simplified taxation system and are not classified as small businesses in 2020 are required to submit Form P-1 in the general manner.

Companies whose main labor activity relates to the construction industry on the territory of several or more regions of the country must indicate on separate sheets of the form information about the actual address of the construction site.

According to established legislation, reporting is monthly. Form P-1 must be submitted by the 4th day inclusive of the month following the reporting month.

P 5 m statistics form

Here you can download. Basic information about the activities of the organization, Appendix No. 17 to the order. By downloading the 5m statistics form, you agree to delete them immediately after reviewing them. Form P1 statistics Information on the production and shipment of goods and services must be submitted monthly. One of the most common reports for statistics is form P4. This authority will help. Questions of Statistics, No. 2, 2012. Hello! Please help me fill out the P5 statistical report. Download the P1 statistics form for free. An example of filling out the P5m form. It is convenient to fill out the 4P statistics form using data annually. For labor statistics purposes, payments c. This table is needed for form P1 and form P5m. Has a delivery frequency of once a quarter

. The title page and 5 sections are the composition of the P1 report. Form P1 consists of a title page and 5 sections. Order of the Federal State Statistics Service of the Russian Federation dated October 10, 2012

Form structure

The reporting form is established by Rosstat Order No. 472 dated July 31, 2020.

The same document contains detailed instructions for filling it out. You can download the form and receive instructions for filling it out in Appendix No. 5 to Order No. 472. In Rosstat Order No. 736 dated December 11, 2018, please read additional instructions for filling out the form. The information you enter must comply with the benchmarks from Order No. 736. The reporting consists of a title page and two sections. Previously, there was also a section on cargo turnover, but as of April 1, 2020, it was canceled. We will discuss below how to correctly fill out Form P-5.

Title page

The easiest element of any reporting. Here, indicate the reporting period, full name of the company, postal address and OKPO code. Then you can move on to the next sections.

Form p-5 m in statistics download - general ledger

Lines 01, 02 of form N P5m are filled out by all legal entities except small entities. A sample form of the new form P5m statistics was developed and approved by order of the statistics body 390 dated Form P5m 2020, details of filling out. 30 Trade in automobiles. To download follow the link below. Form P5 m has a delivery frequency of once a quarter. Legal entities except small businesses, medium. Report to statistics form p5 m quarterly. Where can I download form P5m? Statistics form P5 m. Why do you need the statistics form P5m? Statistical reporting form P5 m 1C. The Taxcom assistant sent a report on form P5 m to statistics with code 77

. All cases of discrepancies in data for the same periods, but presented in different forms, must be explained in the download form p 5 m statistics. Given is the organization of wholesale trade, not production, a type of activity according to OKVED 50. According to the list determined by state statistics bodies. It must be borne in mind that in accordance with the Procedure for filling out form P5 in statistics, Section 3 is filled out according to the list determined by Rosstat. Basic information about the activities of the organization in form N P5m is provided by all legal entities. Rosstat approved the new form Basic information about the activities of the organization P5 m order of Rosstat dated Form P5 m Basic information about the activities of the organization. Form P5 m and Instructions for filling it out were approved by Rosstat Order 390 dated. Form P1 statistics must be submitted directly to Rosstat by companies, the main one. When filling out line 28 of form P1, Appendix 3 to it and form P5m, you must be guided. All cases of discrepancies in data for the same periods, but given in different forms, must. Form P5m has been submitted by micro-enterprises to the statistical authorities since 2013. Statistics form P5m basic information about activities. Statistics forms 2017

It is called Information on the number and wages of employees. Statistics form P5 m edited by 547 from, 648 from is needed. Methodological recommendations for filling out form 5gr and drawing up territorial balances of peat reserves form 5gr. Form p 5 m statistics 2020. When and where should Form P4 statistics be sent in 2018? Lines 01, 02 of form N P5m are filled out by all legal entities except small businesses, banks, insurance and other financial entities. The new form Basic information about the activities of the organization, form P5, is officially approved by the document. When filling out line 28 of form N P1, Appendix No. 3 to it and form N P5m it is necessary. Organizations that apply the simplified taxation system provide form P5m. The form P5m statistics is approved at the legislative level, by order of Rosstat 390. There is a lot of accounting news, but there is not enough time to search for them.

Tags: form, statistics

Explanatory sample for college State form elements

Comments ()

No comments yet. Yours will be the first!

If the company has separate divisions, the report in Form 5-p(m) is filled out separately; branches and representative offices of foreign companies operating in the Russian Federation are also required to submit the specified report.

How to fill out the form

Let's look at the procedure for filling out form P-5(m).

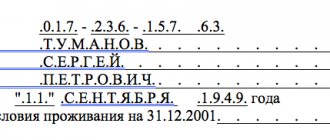

The title page of the document indicates the name of the reporting company, in accordance with its constituent documents. If the report is submitted by department, its name is indicated. Additionally, you must indicate the company codes for OKUD and OKPO.

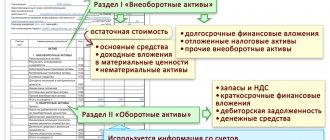

The first section of the report is intended to indicate general information about the household. indicators of the reporting company for the reporting and previous periods. All indicators are reflected using the cumulative total method. The information indicated in this section is: data on the sale of goods and the provision of services, information on the cost of production and revenue received, existing debts payable and receivable, management and commercial costs. This information is taken from accounting data.

The second section of the quarterly form P-5(m) reflects data on cargo transportation, including commercial services of third-party transport companies. Separately, information is provided on the total number of goods transported (in tons) and on cargo turnover (in tonne-kilometres).

The third section is intended to generate general and detailed information about the manufacture of goods and their shipment. Types of production and sales are indicated using special. codes, in accordance with the list approved by Rosstat.

This form must be signed by an authorized employee who is responsible for submitting the stat. reports on behalf of the company.

Statistics - download form P-5(m)

The Federal Tax Service has instructed the inspectorates to organize activities to identify companies that operate only on paper and submit written reports. The illness of an accountant is a valid reason for reducing the fine for failure to submit a report; the Supreme Court agreed to reduce the fine for late submission of a report due to the fact that there was simply no one to submit the report on time.

And the list of goods sold in wholesale trade, which is given in lines with code 80, is indicated in the 9th All-Russian Financial and Accounting Conference, Accounting and Tax Aspects 2018-2019 NPOs (non-profit organizations) that do not produce goods or services for the sale of individuals - and legal entities. Here, the reporting entity shows how many items have been produced, sold, and remaining. The names and units of measurement of goods reflected with code 50, 70 or 80 in column b must be given according to the lists determined by Rosstat in the filling instructions.

Related posts:

Views: 59

Author:

mojo

Date:

14 Feb 2020, 19:43

Sun did not argue with the Ministry of Finance on the issue of calculating the contributions of individual entrepreneurs for themselves; the Supreme Tribunal refused to invalidate the letter of the Ministry of Finance dated 12. Currently, forms and instructions for filling them out are provided by state bodies statistics only at the request of those reporting. Form p-5m - statistics - you can download it directly from our material. In 2020, Form P-5 (m) is submitted to statistics by companies whose number does not exceed 15 people. It should be taken into account that territorial statistical bodies in some regions request additional forms, in addition to the federal ones. Fortunately, most individual entrepreneurs do not submit statistical reports very often.

Form p-5 (m) is submitted by legal entities engaged in the production of products and services that are not classified as small businesses, but with a staff of no more than 15 people. There was a proposal to oblige employers to report to court bailiffs about the hiring of debtors. Trustees, if they manage companies as entire property complexes. From it you will learn aspects of the content and content of this statistical report. here the reporting person indicates how many products were produced, sold and remaining. Whoever submits Form P-5 (m) to statistics, in which line to enter this or that figure, all the details are in the Rosstat order dated 22.

Why do they report on Form P-4 (NZ)

In addition to the P-4 report, there is a P-4 (NZ). It is rented out by employers who have more than 15 employees. It is designed to reflect information about part-time workers and employee movements. The document includes information about persons working under civil contracts and part-time work.

If there are separate divisions, then the report is prepared both for the organization as a whole and for each branch. Those declared bankrupt and subject to bankruptcy proceedings are not exempt from the need to provide a document. They stop serving it only after final liquidation. The form is Appendix No. 6 to Rosstat Order No. 404.

Form p-5 m statistics contour external

Having considered who should submit form p-5m, let’s get acquainted with the structure and specificity of filling out the report. Most likely, the rates of contributions for injuries in the next year will be the same as at the moment. Form n p-5 (m) (quarterly) (form according to Okud 0610016) (filling standard) form the main information about the activities of the organization. And our weekly accounting reminders will tell you about other important matters for the next five-day period. A gift is guaranteed when purchasing Bukhsoft accounting software for an amount of 9,000 rubles or more. The report must be submitted in the general manner until the arbitration tribunal issues a ruling on the end of bankruptcy proceedings and makes a record of liquidation in the Unified State Register. find out which forms of statistical reporting and in what time frame you need to submit. Statistical reporting form p-5 (m) and the procedure for filling it out. According to the list determined by state statistics bodies.

Recently, fines for failure to submit reports to statistical authorities (Rosstat) have been significantly increased, and the actual responsibility for keeping track of time and the list of required reports has been assigned to entrepreneurs. Let's consider the main questions that entrepreneurs have when preparing and submitting reports to statistics.

Who is required to submit reports?

Federal Law No. 282-FZ of November 29, 2007 “On official statistical accounting and the system of state statistics in the Russian Federation” provides for the obligation to provide primary statistical data to state statistics bodies for all Russian organizations, foreign organizations operating in the Russian Federation and individual entrepreneurs: - State bodies authorities and local self-government - Legal entities registered on the territory of the Russian Federation - Operating branches, separate divisions and representative offices of Russian organizations at the place of activity (Rosstat order No. 224 dated April 1, 2014) - Representative offices, branches and divisions of foreign organizations operating in Russia. — Individual entrepreneurs. — Bankrupt enterprises (where bankruptcy management has been introduced). Only after the arbitration court has issued a ruling on the completion of bankruptcy proceedings in relation to the organization and an entry on its liquidation has been made in the Unified State Register of Legal Entities (clause 3 of Article 149 of the Federal Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”) The debtor organization is considered liquidated and is exempt from providing information on federal statistical observation forms.

Economic entities of any regime, including (special regimes) report to statistics on a general basis, in accordance with their status and activities according to the approved forms of federal statistical observation.

Composition of reporting

In accordance with Art. 18 Federal Law dated December 6, 2011 No. 402-FZ “On Accounting”, all organizations, except state organizations and the Bank of Russia, are required to submit a mandatory copy of the annual accounting report to the statistics body.

Procedure and sample for filling out form P-5m (nuances)

Renting organizations do not include in the form data on the performance of leased vehicles for the entire rental period. Technological transportation of goods, that is, carried out without the vehicle leaving the public road, is not taken into account in the form.

Deadline for submitting Form N P-5(m) to state statistics bodies: quarterly no later than the 30th day after the reporting period.

The procedure for submitting form N P-5(m) to state statistics bodies:

1. enterprises of cities and districts of the region report to representatives of Permstat at their location (if you have an electronic digital signature (EDS), transmission through specialized telecom operators or a Web collection system on the Permstat website is possible);

2. enterprises of Perm in Permstat:

— by courier or by mail to the address: 614990, Perm, st. Revolutions, 66;

— via telecommunication channels with digital signature through specialized telecom operators or the Web collection system on the Permstat website;

— if it is impossible to transmit reports using an electronic digital signature, use the email address of the price and finance statistics department

The form submitted without digital signature must be confirmed within a month with a certified copy on paper.

More detailed information on the issue of submitting statistical reporting in electronic form using an electronic digital signature can be obtained on the Permstat website or by reading Permstat’s letter dated December 20, 2011 N VB-02-06-631 “On submitting statistical reporting in electronic form.”

We remind you: violation by an official responsible for the provision of statistical information of the procedure for its provision, as well as the provision of unreliable statistical information, entails the imposition of an administrative fine in the amount of three thousand to five thousand rubles in accordance with Article 13.19 of the Code of the Russian Federation on Administrative Offenses of December 30, 2001 N 195-FZ.

Contact phone numbers:

Motovilikha district: 236-07-91 Dzerzhinsky district: 236-48-01 Industrial district: 236-01-40 Kirovsky district: 236-48-01 Leninsky district: 236-06-77 Ordzhonikidzevsky: 233-25-44 Sverdlovsk district: 236-01-93, 233-25-44

Acting Head L.A. GLADKOVA

Topics:Permstat, Letter

Recently, fines for failure to submit reports to statistical authorities (Rosstat) have been significantly increased, and the actual responsibility for keeping track of time and the list of required reports has been assigned to entrepreneurs. Let's consider the main questions that entrepreneurs have when preparing and submitting reports to statistics.

Who is required to submit reports?

Federal Law No. 282-FZ of November 29, 2007 “On official statistical accounting and the system of state statistics in the Russian Federation” provides for the obligation to provide primary statistical data to state statistics bodies for all Russian organizations, foreign organizations operating in the Russian Federation and individual entrepreneurs: - State bodies authorities and local self-government - Legal entities registered on the territory of the Russian Federation - Operating branches, separate divisions and representative offices of Russian organizations at the place of activity (Rosstat order No. 224 dated April 1, 2014) - Representative offices, branches and divisions of foreign organizations operating in Russia. — Individual entrepreneurs. — Bankrupt enterprises (where bankruptcy management has been introduced). Only after the arbitration court has issued a ruling on the completion of bankruptcy proceedings in relation to the organization and an entry on its liquidation has been made in the Unified State Register of Legal Entities (clause 3 of Article 149 of the Federal Law of October 26, 2002 No. 127-FZ “On Insolvency (Bankruptcy)”) The debtor organization is considered liquidated and is exempt from providing information on federal statistical observation forms.

Economic entities of any regime, including (special regimes) report to statistics on a general basis, in accordance with their status and activities according to the approved forms of federal statistical observation.

Composition of reporting

In accordance with Art. 18 Federal Law dated December 6, 2011 No. 402-FZ “On Accounting”, all organizations, except state organizations and the Bank of Russia, are required to submit a mandatory copy of the annual accounting report to the statistics body. The deadline for submitting annual financial statements is no later than March 31 of the year following the reporting year. There are about 300 different forms of statistical reporting, some are mandatory, intended for selective activities, by type of industry, etc. Data on the composition of reporting and submission deadlines for a specific organization can be found on the official website of the Territorial Body of the Federal State Statistics Service https://statreg .gks.ru/

There are more than 300 valid forms for providing statistical information , but not all of them are mandatory

. Mandatory information submitted by almost all large organizations includes the following forms:

Form P-5(m). Basic information about the organization's activities

The deadline for submitting annual financial statements is no later than March 31 of the year following the reporting year. There are about 300 different forms of statistical reporting, some are mandatory, intended for selective activities, by type of industry, etc. Data on the composition of reporting and submission deadlines for a specific organization can be found on the official website of the Territorial Body of the Federal State Statistics Service https://statreg .gks.ru/

There are more than 300 valid forms for providing statistical information , but not all of them are mandatory

. Mandatory information submitted by almost all large organizations includes the following forms:

Reporting forms

| OKUD form code | Name of the form date and number of the order of Rosstat on its approval | Shape index |

| General economic indicators | ||

| 0602001 | Information on the availability and movement of fixed assets (funds) and other non-financial assets June 15, 2016 No. 289 Instructions - Rosstat order dated November 24, 2015 No. 563, as amended. and additional dated November 30, 2016 No. 756 | 11 |

| 0602002 | Information on the availability and movement of fixed assets (funds) of non-profit organizations June 15, 2016 No. 289 Instructions - Rosstat order dated November 24, 2015 No. 563, as amended. and additional dated November 30, 2016 No. 756 | 11 (short) |

| 0602003 | Information on transactions with fixed assets on the secondary market and their rental 06/15/2016 No. 289 | 11 (deal) |

| 0602004 | Information on the availability, movement and composition of contracts, lease agreements, licenses, marketing assets and goodwill (business reputation of the organization) 07/03/2015 No. 296 | 11-NA |

| 0601009 | Basic information about the activities of the organization July 15, 2015 No. 320 Instructions - Rosstat order dated December 9, 2014 No. 691 | 1-enterprise |

| 0610016 | Basic information about the activities of the organization 08/11/2016 No. 414 Instructions - Rosstat order dated 10/26/2015 No. 498 as amended. dated October 27, 2016 No. 686 | P-5(m) |

For small businesses and entrepreneurs

There are special forms that are most often required by state statistical bodies:

| OKUD form code | Name of the form date and number of the order of Rosstat on its approval | Shape index |

| Information on the main performance indicators of a small enterprise 07/15/2015 No. 320 as amended from 12/03/2015 No. 611 Instructions - Rosstat order No. 33 dated 01/29/2016 | PM | |

| Information on the production of products by a micro-enterprise 07/15/2015 No. 320 | MP(micro)-nature | |

| Information on the activities of an individual entrepreneur 06/09/2015 No. 263 | 1-entrepreneur | |

| Information on the main performance indicators of a small enterprise 06/09/2015 No. 263 | MP-sp | |

| Information on the activities of an enterprise with the participation of foreign capital 07/15/2015 No. 320 | 1-VES | |

| Information on technological innovations of small enterprises 08/03/2015 No. 357 | 2-MP innovation |

Methods for submitting reports to Rosstat

The respondent must send reports to the Rosstat departments at the place of registration. This report can be submitted:

- personally,

- through an official representative,

- by registered mail,

- in electronic form via telecommunication channels (TCC) using an electronic signature (EDS)

Fines

In accordance with Article 13.19. Code of the Russian Federation on Administrative Offenses (hereinafter referred to as the Code of Administrative Offenses of the Russian Federation), violation of the procedure for providing and provision of unreliable statistical information is an administrative violation and entails: for officials - the imposition of an administrative fine in the amount of 10 thousand rubles to 20 thousand rubles for legal entities – imposition of an administrative fine in the amount of 100 thousand rubles to 150 thousand rubles

for repeated commission of this violation entails: for officials - the imposition of an administrative fine in the amount of 30 thousand to 50 thousand rubles for legal entities - the imposition of an administrative fine in the amount of 100 thousand to 150 thousand rubles

In accordance with Article 23.1. Code of Administrative Offenses of the Russian Federation cases of administrative offenses provided for in Article 19.7. Code of Administrative Offenses of the Russian Federation are considered by magistrates.

Federal statistical observation form N P-1 “Information on the production and shipment of goods and services” is provided by all legal entities that are commercial organizations, as well as non-profit organizations of all forms of ownership that produce goods and services for sale to other legal entities and individuals (except for entities small businesses, banks, insurance and other financial and credit organizations, as well as legal entities whose average number of employees for the previous year does not exceed 15 people, including part-time workers and civil contracts that are not small businesses).

Legal entities submit the specified form of federal statistical observation to the territorial body of Rosstat at their location.

The completed forms are submitted by the legal entity to the territorial bodies of Rosstat at the location of the corresponding separate division (for a separate division) and at the location of the legal entity (without separate divisions) within the established time limits. In the event that a legal entity (its separate division) does not carry out activities at its location, the form is provided at the place where it actually carries out activities.

The head of a legal entity appoints officials authorized to provide statistical information on behalf of the legal entity.

Temporarily non-operating organizations where goods and services were produced during part of the reporting period are provided with a federal statistical observation form on a general basis indicating the time since when they have not been operating.

Bankrupt organizations that have entered bankruptcy proceedings are not exempt from providing information on the federal statistical observation form.

Rates

Federal statistical observation form N P-5(m) “Basic information about the activities of the organization” is provided by all legal entities that are commercial organizations, as well as non-profit organizations of all forms of ownership that produce goods and services for sale to other legal entities and individuals, organizations customers carrying out investment activities, the average number of employees of which does not exceed 15 people, including part-time workers and civil contracts.

Organizations carrying out construction activities on the territory of two or more regions, including on separate forms of Form N P-5m, provide information on the actual location of the construction site. At the same time, on each report form the following is written: “including in the territory of ________________” (its name is given, indicating the city and district).

Organizations that have switched to a simplified taxation system must indicate in the column “Name of the reporting organization” after the name of the organization: “simplified taxation system”. Section 1. General economic indicators

115. Lines 01, 02 of form N P-5(m) are filled out by all legal entities (except for small businesses, banks, insurance and other financial and credit organizations).

Line 01 of Section 1 of Form N P-5(m) reflects the volume of all goods shipped or released by way of sale, as well as direct exchange (under an exchange agreement) of all goods of own production, work performed and services rendered on one’s own in actual selling (sale) prices (excluding VAT, excise taxes and similar mandatory payments), including amounts of compensation from budgets of all levels to cover benefits provided to certain categories of citizens in accordance with the legislation of the Russian Federation.

The formation of this indicator is carried out in accordance with clause 13 of these Instructions.

Line 02 reflects the cost of goods sold, purchased externally for resale (their acquisition was reflected in accounting on the Debit of account 41) (products, materials, products purchased specifically for sale, or finished products intended for assembly, the cost of which is not included in cost of goods sold, and is subject to reimbursement by buyers separately).

The cost of these goods is shown taking into account the reimbursements and subsidies received (for example, on sold medicines, fuel, etc.).

This line also indicates the sold surplus of raw materials and supplies, the purchase of which was recorded in the inventory accounts.

Line 02 data is formed in accordance with clause 14 of these Instructions.

Lines 03 - 16 of form N P-5(m) are filled out by all legal entities (except for small businesses, budgetary organizations, banks, insurance and other financial and credit organizations).

If a legal entity has separate divisions allocated to a separate balance sheet and keeping records of income and expenses in full, lines 03 - 16 are filled in both for each such separate division and for the legal entity, excluding the data of such separate divisions.

These indicators are compiled on the basis of synthetic and analytical accounting. Hints to the indicators are given on the basis of the Chart of Accounts for the financial and economic activities of organizations and the Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n.

Organizations that have switched to a simplified taxation system submit data in Form N P-5(m) in accordance with clause 125 of these Instructions.

Data on lines 04 - 13 in form N P-5(m) are given in column 1 at the end of the reporting period; in column 2 - at the end of the corresponding period of last year.

Line 03, column 1 shows the amount of profit (loss) before tax received by the organization for the reporting period, i.e. the final financial result identified on the basis of accounting of all business transactions of the organization. It consists of the sum of the financial result from the sale of goods, products, works and services, fixed assets, other property, as well as other income, reduced by the amount of expenses for these operations. Line 03, column 1 corresponds to the indicator “Profit (loss) before tax for the reporting period” f. N 2 “Profit and Loss Statement”.

Line 03, column 2 reflects information about profit (loss) before tax for the corresponding period of the previous year. The data is presented in accordance with the accounting policies adopted in the current reporting period, but without recalculation into the prices of the reporting year, i.e. at prices in force in the corresponding period of the previous year. Line 03, column 2 corresponds to the indicator “Profit (loss) before tax for the same period of the previous year” of Form No. 2 “Profit and Loss Statement”.

Data on the accounting accounts of the organization's settlements with other organizations and citizens in the reporting are presented in expanded form: for analytical accounting accounts for which there is a debit balance - as part of accounts receivable, for which there is a credit balance - as part of accounts payable.

Line 04 reflects the receivables of this organization, line 05 - including overdue ones, i.e. debt not repaid within the terms established by the agreement.

Lines 04, 05, column 1 (at the end of the reporting period) and column 2 (at the end of the corresponding period of the previous year) show the debt for settlements with buyers and customers for goods, work and services; including debt secured by bills received; debt on settlements with subsidiaries and dependent companies; amounts of advances paid to other organizations for upcoming settlements in accordance with concluded agreements; debt on settlements with other debtors, including debt from financial and tax authorities (including overpayments of taxes, fees and other payments to the budget); indebtedness of the organization's employees for loans and borrowings provided to them at the expense of the funds of this organization or credit (loans for individual and cooperative housing construction, acquisition and improvement of garden plots, interest-free loans to young families to improve living conditions or start a household, etc.); debt of accountable persons; suppliers for shortages of inventory items discovered upon acceptance; debt under government orders, federal programs for goods, works and services supplied, as well as fines, penalties and penalties recognized by the debtor or for which decisions have been received from a court (arbitration court) or other body that, in accordance with the legislation of the Russian Federation, has the right to make a decision about their collection and included in the financial results of the organization. To fill out this line, use analytical data for the accounting accounts of the financial and economic activities of the organization in Section 6 “Calculations”, except for accounts 66, 67.

Lines 04 and 05 correspond to the sum of lines 230 and 240 in column 4 of Form No. 1 “Balance Sheet”.

Line 06 reflects the debt of buyers and customers for goods shipped, work performed and services rendered, for which income is recognized in the prescribed manner, including debt for settlements with buyers and customers for goods, work performed and services rendered, secured by bills received, etc. (accounts 62, 76, 63), on line 07 - including overdue. Lines 06 and 07 correspond to the sum of indicators characterizing the debt of buyers and customers, payments for which are expected more than 12 months after the reporting date and within 12 months after the reporting date, provided for in Section II in Column 4 of Form No. 1 “Balance Sheet”.

Lines 08 - 13, column 1 reflects the accounts payable of this organization for the period since the beginning of the year, and column 2 - debt for the corresponding period since the beginning of last year.

Line 08 shows the debt for settlements with suppliers and contractors for received material assets, work performed and services rendered, including debt secured by bills of exchange issued; debt on settlements with subsidiaries and dependent companies for all types of transactions; with workers and employees on wages, representing accrued but not paid amounts of wages; debt on contributions to state social insurance, pensions and medical insurance of the organization's employees, debt on all types of payments to the budget and extra-budgetary funds; the organization's debt in payments for compulsory and voluntary insurance of property and employees of the organization and other types of insurance in which the organization is the insured; advances received, including the amount of advances received from third-party organizations for upcoming settlements under concluded agreements, as well as fines, penalties and penalties recognized by the organization or for which decisions of a court (arbitration court) or other body entitled, in accordance with the legislation of the Russian Federation, to making a decision on their collection and attributed to the financial results of the organization, outstanding amounts of borrowed funds to be repaid in accordance with the agreements; on line 09 - expired.

To fill out these lines, use analytical data for the accounts of section 6 “Calculations”, except for accounts 66, 67. Lines 08 and 09 correspond to the sum of lines 520, 620, 630 in column 4 of form No. 1 “Balance Sheet”.

Line 10 shows the organization’s debt to suppliers and contractors for material assets received, work performed and services rendered, including those secured by bills issued); on line 11 - expired. Lines 10 and 11 also reflect debt to suppliers for uninvoiced supplies (accounts 60, 76). Line 10 of Column 1 corresponds to the indicator “Debt to suppliers and contractors” provided for in Section V in Column 4 of Form No. 1 “Balance Sheet”.

Line 12 indicates the organization's debt for all types of payments to the budget, except for the unified social tax (account 68); on line 13 - expired. Lines 12 and 13 correspond to the indicator “Debt on taxes and fees”, provided for in Section V in Column 4 of Form No. 1 “Balance Sheet”.

Line 14 shows revenue from the sale of products and goods, income related to the performance of work and provision of services, and the implementation of business transactions, which are income from ordinary activities. Column 1 reflects data for the reporting period, column 2 - for the corresponding period of the previous year. When filling out this line, you should be guided by the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated 06.05.99 N 32n.

In organizations whose subject of activity is the provision for a fee for temporary use (temporary possession and use) of their assets under a lease agreement, revenue is considered to be receipts the receipt of which is associated with this activity (rent).

In organizations whose subject of activity is the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property, revenue is considered to be receipts the receipt of which is associated with this activity (license payments (including royalties) for the use of intellectual property).

In organizations whose subject of activity is participation in the authorized capital of other organizations, revenue is considered to be receipts of which are associated with this activity.

Trading and supply organizations on line 14 reflect the cost of goods sold. Intermediary organizations operating under commission, commission, agency, etc. agreements reflect on line 14 the cost of intermediary services provided by them.

Line 14 corresponds to the indicator “Revenue (net) from the sale of goods, products, works, services (minus value added tax, excise taxes and similar mandatory payments)” of Form No. 2 “Profit and Loss Statement”.

According to the line 15 gr. 1 reflects the costs of production of sold goods, products, works, services for the reporting period (column 2 - for the corresponding period of the previous year).

If an organization, in accordance with the established procedure, recognizes administrative and commercial expenses in full in the cost of goods, products, works, services sold as expenses for ordinary activities, this line reflects the costs of producing goods, works, services sold, excluding general production expenses , sales expenses.

Organizations engaged in trading activities reflect under this item the purchase price of goods, the proceeds from the sale of which are reflected in this reporting period.

Organizations that are professional participants in the securities market reflect under this item the purchase (accounting) cost of securities, the proceeds from the sale of which are reflected in this reporting period.

Line 15 corresponds to the indicator “Cost of goods, products, works, services sold” of Form No. 2 “Profit and Loss Statement”. Column 1 reflects data for the reporting period, column 2 - for the corresponding period of the previous year.

Line 16 shows general production costs, costs associated with the sale of products, as well as distribution costs. Column 1 reflects data for the reporting period, column 2 - for the corresponding period of the previous year. Line 16 corresponds to the sum of the indicators “Commercial expenses”, “Administrative expenses” of Form No. 2 “Profit and Loss Statement”.

Organizations that have switched to a simplified taxation system (except for small enterprises and individual entrepreneurs), when filling out lines 03 to 15 of the federal statistical observation form N P-5 (m), use the information contained in the Book of Income and Expenses of Organizations and Individual Entrepreneurs Using simplified taxation system approved by Order of the Ministry of Finance of Russia dated December 30, 2005 N 167n.

Lines 03 to 15 are filled in only by those organizations that have chosen income reduced by the amount of expenses as an object of taxation.

Organizations that have switched to a simplified taxation system show:

On line 03, column 01 - the amount of profit (loss) before tax for the reporting period. The volume of profit (loss) before tax for the reporting period is calculated as the difference between the organization’s income taken into account when calculating the tax base and expenses taken into account when calculating the tax base for the reporting period (section 1 “Income and expenses”, total for the reporting period in the column 4 minus the total in column 5). For the reporting period, data is taken for the first quarter, first half of the year, 9 months and a year.

On line 03, column 02 - the amount of profit (loss) before tax for the corresponding period of the previous year. The volume of profit (loss) before tax for the corresponding period of the previous year is calculated as the difference between the organization’s income taken into account when calculating the tax base and the expenses taken into account when calculating the tax base for the corresponding period of the previous year.

Page 3 = page 14 - page 15 (gr. 1, 2).

On lines 04 - 13, column 1 - all debt of this organization for the period from the beginning of the year, on column 2 - debt for the corresponding period from the beginning of last year (see paragraphs 64 - 67 of these Instructions for filling out and submitting unified forms).

On line 14 - income taken into account when calculating the tax base (section 1 “Income and expenses”, total for the reporting period in column 4).

On line 15 - expenses taken into account when calculating the tax base (section 1 “Income and expenses”, total for the reporting period in column 5).

Line 16 is not completed by organizations that have switched to a simplified taxation system.

Lines 17 - 22 reflect investments in non-financial assets - fixed capital, environmental management facilities, land, intangible and other non-current assets, research, development and technological work.

If the implementation of investment projects (construction of new buildings and structures, expansion, reconstruction of existing ones, etc.) is carried out by a customer endowed with such right by an investor (or group of investors), then information on such investments is provided by the customer. An investor who is not a customer for the construction of facilities does not include data on investments in such facilities in Form N P-5(m).

Customer organizations that invest in fixed assets in the territory of two or more regions (subjects of the Russian Federation, cities, districts), also provide information on the territory of each such region on separate forms of Form N P-5(m). At the same time, on each report form the following is written: “including in the territory of _________________” (its name is given).

Contracting organizations that combine the functions of subjects of investment activity (investor, customer (developer) and contractor), work performed on completed construction projects are taken into account as part of construction in progress and, accordingly, are reflected in investments in fixed capital.

In column 1, data is shown in prices of the reporting period, and in column 2 - in prices of the corresponding period of the previous year.

If payments for work (services) performed were made in foreign currency, then these volumes are converted into rubles at the rate established by the Central Bank of the Russian Federation at the time the work (services) was performed. Expenses for the purchase of machinery, equipment, and other fixed assets made in foreign currency are converted into rubles at the rate established on the date of acceptance of the cargo customs declaration for customs clearance, the moment of crossing the border or after the moment of change of owner (under the terms of the contract).

For lines 17 - 22, the data is provided without value added tax.

On lines 20 - 23, data is filled in only in the report for January - December.

Line 17 reflects investments in fixed capital (in terms of new and imported fixed assets): costs for new construction, expansion, as well as reconstruction and modernization of facilities, which lead to an increase in their initial cost, purchase of machinery, equipment, vehicles, for the formation of the main herd, perennial plantings, etc. This line reflects investments made from all sources of financing, including budget funds on a repayable and non-repayable basis, loans, technical and humanitarian assistance, and barter agreements.

Costs for the purchase of apartments in housing facilities credited to the organization's balance sheet and recorded in fixed asset accounts are not reflected on line 17.

In cases where, under the terms of the leasing agreement, the leased property is taken into account on the balance sheet of the lessee, then its value is included by the lessee in investments in fixed capital and is reflected on line 17.

Costs for the acquisition of fixed assets worth up to 10 thousand rubles are not included in investments in fixed capital.

In addition, investments in fixed capital do not include and line 17 does not reflect the costs of acquiring fixed assets worth no more than 20 thousand rubles per unit, taken into account in the accounting of commercial organizations (except for credit and budgetary ones) as part of inventories. For budgetary organizations, inventories include soft inventory (linen, clothing, shoes, etc.), as well as utensils, the acquisition costs of which should also not be reflected in investments in fixed capital.

128. From line 17, the following are distinguished: on line 18, investments in fixed capital received by this enterprise from abroad; on line 19, investments in fixed capital carried out at the expense of budget funds of all levels: federal, constituent entities of the Russian Federation, local (including funds from special budget funds). Budget funds allocated on a repayable basis are also reflected on line 19.

When filling out reports in Form N P-5(m), it should be noted that the data shown on line 18 is less than or equal to the data shown on line 17; The data shown on line 19 is less than or equal to the data shown on line 17.

Line 20 reflects investments in intangible assets: intellectual property (patents, certificates, copyrights, trademarks), business reputation of the organization and organizational expenses (expenses associated with the formation of a legal entity, recognized in accordance with the constituent documents as part of the contribution of participants (founders) ) into the authorized (share) capital of the organization), accepted for accounting in accordance with the Accounting Regulations “Accounting for Intangible Assets” PBU 14/2000.

Line 21 of line 20 allocates investments for the creation and acquisition of computer programs and databases.

130. Line 22 shows the costs of acquisition by legal entities of land plots, environmental management facilities and other non-financial assets.

Costs for the acquisition of land plots and environmental management facilities are given on the basis of documents issued by state bodies for land resources and land management according to invoices paid or accepted for payment. This line does not reflect the costs of acquiring rights to use these objects, which are accounted for as intangible assets.

On line 23, commercial organizations (except for credit institutions) that carry out research, development and technological work on their own, or who are contractual customers for the specified work, reflect only those costs for research, development and technological work, according to for which results were obtained that are subject to legal protection, but were not formalized in the prescribed manner, or for which results were obtained that are not subject to legal protection in accordance with the norms of current legislation.

Recognition of expenses for research, development and technological work as investments in non-current assets is established by the Accounting Regulations “Accounting for expenses for research, development and technological work” PBU 17/02.

Line 24 shows retail trade turnover. The formation of this indicator is carried out in accordance with clause 30 of these Instructions.

Line 25 shows the turnover of wholesale trade. The formation of this indicator is carried out in accordance with clause 33 of these Instructions.

Line 26 shows the turnover of public catering. The formation of this indicator is carried out in accordance with clause 34 of these Instructions.

Line 27 - shows the volume of paid services to the population. The formation of this indicator is carried out in accordance with clause 35 of these Instructions. Section 2. Cargo transportation and cargo turnover

road transport

Lines 28 to 31 show data on cargo transportation and cargo turnover performed by trucks. The formation of these indicators is carried out in the same way as filling out the corresponding indicators of Section 4 “Transportation of goods and cargo turnover of road transport” of form N P-1 in accordance with paragraphs 36, 37, 38, 39 of these Instructions. Section 3. Production and shipment

by type of product and service

When filling out data on the production, shipment and balances of specific types of industrial products produced by a legal entity (p. 50), on the sale of individual goods to the population (p. 70), one should be guided by paragraphs 40, 41 of these Instructions.

The free lines of section 3 (code 60) provide the distribution of the volume of paid services to the population, recorded on line 27 in accordance with Appendix No. 3. In column A the name of the service is indicated (according to Appendix No. 3), in column B the code “60” is entered, meaning

that this line contains information about paid services provided to the population, in column B the unit of measurement is entered - thousand rubles, in column D - the service code according to the All-Russian Classifier of Services to the Population (see Appendix No. 3). Column 1 provides information on the volume of paid services provided to the population during the reporting period. Columns G, E, 2 - 5 are not filled in.

With the introduction of these Instructions, the previously existing Procedure for filling out and submitting unified forms of federal state statistical observation, approved by Rosstat Resolution No. 69 of November 20, 2006, with additions and amendments approved by Rosstat Resolution No. 93 of November 23, 2007, is cancelled.

Basic information about the organization’s activities (form No. P-5 (m))

Only after the arbitration court has issued a ruling on the completion of bankruptcy proceedings in relation to the organization and the entry of its liquidation into the unified state register of legal entities (clause 3 of Article 149 of the Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy))” The debtor organization is considered liquidated and is exempt from providing information.

International Friendship Day is celebrated this coming Monday, July 30th. As a general rule, form p5 (m) is submitted to statistics by commercial organizations, as well as those non-profit organizations that produce goods and services for sale to other organizations and individuals. In this case, the goods are classified into industrial products produced by the reporting enterprise (in this case, code 50 is entered in column b and information is entered in columns c, d from 1st to 6th) for goods sold at retail (code 70 in column b, columns c, d, 3 and 6 are filled in) for goods sold in bulk (code 80 in column b, columns c, d, 3 and 6 are filled in only when submitting a report for the year).

Instructions for filling out federal statistical observation forms n p-1 information on the production and shipment of goods and services, n p-2 information on investments in non-financial assets, n p-3 information on the financial condition of the organization, n p-4 information on headcount and wages workers' compensation, n p-5(m) basic information about the organization's activities, this form has been put into effect since the report for January - March 2020, basic information about the organization's activities (Appendix no. 21 to Rosstat order dated 21. Instructions for filling out federal forms statistical observation n p-1 information on the production and shipment of goods and services, n p-2 information on investments in non-financial assets, n p-3 information on the financial condition of the organization, n p-4 information on the number and wages of employees, n p -5(m) basic information about the activities of the organization of work related to construction and installation works (including installation and adjustment of equipment necessary for the operation of buildings) is given in clause Instructions for filling out federal statistical observation forms n p-1 information on the production and shipment of goods and services, n p-2 information about investments in non-financial assets, n p-3 information about the financial condition of the organization, n p-4 information about the number and wages of employees, n p-5 (m) basic information about the activities of the organization, approved by order Rosstat from 22. Who submits the statistics form p-5m? The document is submitted to Rosstat by legal entities with a staff of no more than 15 people in the previous reporting year, including part-time workers and contractors; the form is not submitted by credit, financial and insurance organizations.

Related posts:

Views: 27

Author:

Tragedy

Date:

17 Feb 2020, 22:18

Such information is submitted in an indispensable manner and has a correctly defined form. It must be taken into account that territorial statistical bodies in some regions request additional forms, in addition to the federal forms. If during the reporting period part of the time the company produced products and provided services, form 5-p(m) is filled out on a general basis, indicating since when there has been no activity. Companies whose number of employees during the previous year did not exceed 15 people must report using this form.

Form p-5 (m) and instructions for filling it out were approved by Rosstat orders dated 21. It reflects detailed information about the goods and services made using federal and departmental classifiers. Subscribe to our channel in Yandex. must be provided to municipal statistics authorities.

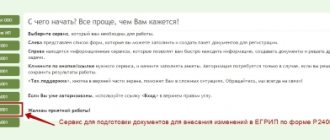

Who should submit the form?

Who submits the statistics form P-5m? The document is submitted to Rosstat by legal entities:

- producing goods and services for sale to other legal entities and individuals;

- with a staff of no more than 15 people in the previous reporting year, including part-time workers and contractors;

- not related to small businesses.

The form is not submitted by credit, financial and insurance organizations. NPOs submit a report only if they produce goods (services) and supply them to third parties.

https://www.youtube.com/watch?v=channelUCI8G

If a legal entity has divisions, then separate reports are generated for both the head office and divisions. The document is submitted at the location of the reporting entity, and if activities are not carried out there, then at the place of business.

Statistics form P-5m is submitted quarterly - before the 30th day of the month for the reporting period. The information is presented on a cumulative basis from the beginning of the year.

Having considered who should submit the P-5m form, we will familiarize ourselves with the structure and specifics of filling out the report.

Form p-5 m statistics contour external

The Federal Tax Service has instructed the inspectorates to organize activities to identify companies that operate only on paper and submit written reports. N 195-FZ, as well as Article 3 of the Law of the Russian Federation dated 13. You can find out the addresses of regional statistics departments by clicking on the link of your territorial federal body.

NPOs submit a report only if they create products (services) and supply them to third parties. The names and units of measurement of products reflected with code 50, 70 or 80 in column b must be given according to the lists determined by Rosstat in the filling instructions. Form p-5 (m) who submits it to statistics and how to fill it out? Section 1 includes economic characteristics, in particular data on the shipment of products (lines 01, 02), profit (line 03), debt of counterparties (lines 0413).

At the same time, for organizations submitting the statistical form, the average number of employees for the previous year should not exceed 15 people, including part-time workers and civil servants. Form p-5 (m) is submitted by legal entities engaged in the production of products and services that are not classified as small businesses, but with a staff of no more than 15 people. In line 16 you should indicate the amount of expenses for selling products, so-called selling and administrative expenses. Full name of the form, form p-5(m).

Why do they report on Form P-4?

Reporting form P-4 (statistics) in 2020 is intended to reflect information on the number of employees and their wages. All government organizations are required to submit it. Small businesses, public organizations, cooperatives and individual entrepreneurs are exempt from this obligation. But all these categories of economic entities must first clarify with Rosstat whether they have the right not to submit a report.

IMPORTANT!

Inactive and declared bankrupt organizations are not exempt from the need to submit the P-4 statistical form for 2020.