Business lawyer > Accounting > Accounting and reporting > How to fill out the Financial Results Report, rules for formation, decoding of indicators

Financial reporting in Russia, like the economy as a whole, has gone through a difficult path of formation; it was formed in the difficult conditions of first the Soviet planned system, and then the revolutionary leap of perestroika. Many controversial issues have still not been resolved, some require improvement, and some standards are already outdated. Now the state is taking measures to reform domestic accounting, bringing it in accordance with international requirements, and improving legal regulation. To provide annual reporting, business representatives draw up a balance sheet and financial performance report, along with explanations thereto.

What is an Income Statement?

Statement of financial results (OFR) or Form No. 2 is the second of the two main forms that make up financial statements. It shows the change in equity capital as a result of economic activity, characterizes the income and expenses that affected the profit margin.

Correct calculations

Filling out, deadlines and submission procedure are regulated by Law No. 402-FZ “On Accounting”, Order of the Ministry of Finance of the Russian Federation No. 66n “On Forms of Accounting Reports”, PBUs adopted by the Ministry of Finance and the Central Bank.

Until 2012, the wording “Profit and Loss Statement” appeared, but already in 2013 it became correct to indicate “Statement of Financial Results”; now this name remains in business practice. The changes affected only the name, the content remained the same. It must be filled out by all organizations, individual entrepreneurs and lawyers, and state enterprises.

Stage III - analysis of the impact of accounting policies on the income statement indicators

This question is one of the areas for analyzing the quality of financial results, but it is also of great independent importance, since it allows us to assess the role of accounting methods in the formation of profit indicators.

ALSO SEE: Determining the nature of the financial stability of an enterprise

Let's consider how financial results and profitability change when using various options for an organization's accounting policy in relation to general business expenses. Option 1 - writing off general business expenses to the cost of sales (Dt90 Kt26). Option 2 - writing off general business expenses to the cost of production (Dt20 Kt26). The calculation is presented in Table 1.

Table 1.

| Index | Option 1 | Option 2 |

| Sales revenue, thousand rubles. | 218315 | 218315 |

| Cost of products sold, thousand rubles. | 166432 | 206149 |

| Gross profit, thousand rubles. | 51883 | 12166 |

| Selling expenses, thousand rubles. | 8732 | 8732 |

| Administrative (general) expenses, thousand rubles. | 40717 | — |

| Profit from sales, thousand rubles. | 2434 | 3434 |

| Profit before tax, thousand rubles. | 842 | 1842 |

| Net profit, thousand rubles. | 649 | 1437 |

| Return on sales, % | 1,1 | 1,6 |

| Profitability of turnover, %: - based on profit before tax | 0,4 | 0,8 |

| - by net profit | 0,3 | 0,65 |

In option 2, when general business expenses are written off, part of them remains as part of the costs of work in progress and finished goods, and only part is included in the calculation of financial results (as part of the cost of goods sold). Thus, by choosing one or another of the alternative accounting policy options, the organization’s management can influence the size of the accounting profit.

From the point of view of investment attractiveness and improvement of the capital structure (growth of equity capital), option 2 is preferable, since financial results and profitability are higher. From the point of view of saving on income tax (as a rule, the same option is chosen for both accounting and tax accounting), option 1 of the accounting policy is more profitable.

Formation rules

The FRF is an official document that must be submitted to state tax and statistical authorities, so its completion must be taken very seriously, because the manager is directly responsible for the veracity of the data. If during the audit the tax service finds errors or violations, it will require additional explanations, and if the distortion of data is significant, it has the right to apply penalties. The financial results report can be generated at the end of the calendar year for government agencies, or quarterly for the internal needs of the enterprise.

Therefore, you need to adhere to the following rules for its formation.

Report form

Income and expenses must be separated:

- for income and expenses received when the company organizes ordinary activities. These are the operations for which the business was initially organized; they are spelled out in the company’s Charter and enshrined in OKVED. This may include activities that are not specified in the documents, but are of a permanent nature and have a significant quantitative expression.

- other – include, as the name implies, all articles not included in the previous paragraph

Form No. 2 is drawn up for the reporting period – a year. Moreover, it contains data for the previous year, calculated using the same methods. They are transferred from the previous Report, and the value for the last day of the last and current year is taken, which is done to compare the dynamics of indicators.

The report is signed by the manager and the date is written on it. A stamp is affixed to the form only if it is available, but if the organization has abandoned the seal in its activities, and this is enshrined in the Charter, then its stamp is not needed in Form No. 2.

To fill out the FRA, you will need an annual balance sheet, balance sheets, and data on statistical codes assigned to the organization.

Some business representatives may use simplified forms to reflect financial indicators.

Other income and expenses

Line 2310 reflects income from participation in other organizations. In most cases, they represent the amount of dividends due to the company less income taxes, which must be withheld by the source of the payment as the withholding agent. That is, in this case, the turnover is taken as a credit to account 91-1 “Other income” and a debit to account 76-3 “Calculations for due dividends and other income.”

Line 2320 reflects the interest due to the organization on loans issued. On line 2330 - interest payable.

Other income - line 2340 - includes income from activities that are not the main one for the organization. For example, this could be rent due on a rental property or proceeds from the sale of a fixed asset. Penalties due to the company for violation of the terms of the contract and the written-off “creditor” are also reflected here. Moreover, if any of such income amounts to 5 percent or more of the company’s total income, it should be reflected separately by entering an additional line.

Line 2350 reflects other expenses associated with activities that are not the main one for the organization. Moreover, if any of the other incomes are indicated separately in the FIR, then it is necessary to allocate the corresponding amount of other expenses.

Requirements for filling

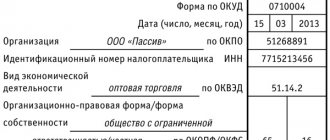

- In the header of the document you must indicate the following mandatory data: period; name of the company, full name of the entrepreneur; statistics codes, OKVED, INN.

- Items with a value of more than 5% of total income must be disclosed in the financial statements.

How to fill it out? - Lines with a minus in Form 2 must be enclosed in parentheses.

- All amounts must be entered in thousands or millions, the OKEI code for thousands is 384, for millions of rubles – 385. Rounding is done to whole numbers according to the rules of arithmetic, the selected option is reflected in the header of the document with the appropriate code.

- The FRA should be generated in two copies and submitted to the state statistical services and the Federal Tax Service during the first three months of the year following the reporting year, and both documents must be identical and signed by the same person: the manager or authorized to do so by power of attorney. Rosstat requires large and medium-sized businesses to submit the Report in electronic form; there are no such requirements for small businesses. Tax services are more loyal in this matter; there are no direct instructions on the form of the document, but the transition to electronic document management is being stimulated, so it is preferable to submit machine-readable forms. Form No. 2 can also be sent by mail. When the Report is submitted electronically, it is better to store the signed version in the organization’s accounting department.

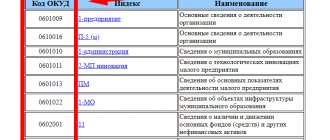

- Each ODF indicator must be assigned its own code, which is indicated in it. Their list is given in Order of the Ministry of Finance No. 66n. In the case when the Report is prepared based on the results of the year for regulatory government bodies, it is mandatory to enter codes in the columns. If reporting is done for internal users based on the results of the quarter, then they can be omitted.

- The OFR form is established by law in the Order of the Ministry of Finance in the form of a table, so rows cannot be removed or rearranged. If necessary, you can add additional articles to detail them.

Indicators and their interpretation

So, let's start filling out the form step by step.

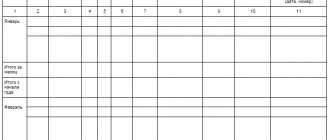

The ODF itself is presented in the form of a table of 5 columns:

- Explanation number

- Indicator name

- Code assigned to this indicator

- Value in the reporting period

- Last year's value

If during the period no operations were carried out in the organization, then the lines for them in the Report are not filled in, not 0, but a dash is written.

Income and expenses from ordinary activities

These are the company’s revenues and expenses, as well as preliminary financial results, which are generated as a result of activities registered as the main one in OKVED. These articles include:

Analysis of indicators

- Revenue is receipts from activities recognized by the company as ordinary, i.e. the main payment received by the company for goods produced. It is definitely worth considering that VAT and excise taxes previously paid by the company on some types of goods are subtracted from the amount of revenue.

- Cost of sales is the value expression of the resources used in production. We will not consider in detail the names and numbers of the accounts through which these amounts are processed, since they are very clearly spelled out in the Chart of Accounts. Don't forget that the value must be indicated in parentheses.

- Gross profit (loss) is a calculated value, the amount of deviation between the first two points. If not everything went smoothly in the organization’s activities and the loss is calculated at this stage, then the amount is enclosed in parentheses.

- Commercial expenses - include costs for: packaging of products, transportation, commission to intermediaries, rental of premises during sales, promotion of goods, entertainment expenses, fees for the work of insurance companies, losses during storage according to the norms of natural loss, etc.

- Administrative expenses - you don’t need to rack your brains to understand that these are administration expenses. The organization has the opportunity to choose one of two accounting options, but it is necessary to register it in the Accounting Policy: completely as part of the UR - this line of the Report is filled in; are included in the cost of production, then this line is not filled in, and accordingly, the second point of the general financial structure increases.

- Profit (loss) from sales is an estimated value obtained by subtracting the previously indicated general and administrative expenses from gross profit. To confirm the correctness of the calculation of the indicator, compare it with the balance of the corresponding sub-account, allocated specifically for this coefficient on account 99; ideally, they should coincide.

Other income and expenses

These are the company's income and expenses as a result of activities that are not related to the main activity, they include:

Company income

- Income from participation in other organizations implies the company’s earnings on securities, funds received from shares, and property of third-party companies.

- Interest receivable leaves no room for misinterpretation, so we will not dwell on them in detail.

- Interest payable – similar to the previous indicator, does not require detailed explanation.

- Other income includes other income not previously stated. Income consists of: rent, leasing, from the provision of licenses, patents, from the sale of fixed assets, from management companies of third-party companies, earnings on the securities market, if counterparties do not comply with contractual terms - penalties, donations, exchange rate differences, interest on bank deposits, profit of previous years, expired credit debt, revaluation of investments.

- Other expenses mean expenses of the company not previously indicated in Form No. 2. Typically they include expenses from: rent, leasing, use of patents, licenses, sale of assets, depreciation of intangible assets, markdown of financial investments, charity, organization of events, holidays for the purpose of generating income, creating a reserve and others.

Financial results

Total items obtained by taking into account all the company's income and expenses.

Profit (loss) before tax - the name very well characterizes the essence of the indicator; it is this article that will be the basis for determining the amount of tax.

Current income tax is the amount of planned tax payments to the state. Differences in the fundamentals of accounting and the tax system have led to the emergence of different approaches to calculating this parameter. The final result, after its adjustment taking into account these contradictions, is declared by the organization. The company is required to highlight in its regulatory forms one of the selected accounting methods:

Analysis of results

- The tax is calculated arithmetically according to data taken from the balance sheet. The profit received by the company at the time of shipment of the goods is multiplied by the tax percentage - this is a conditional expense or income for this type of tax, which serves as the basis for calculating tax liabilities (assets) - IT (IT). There are two types of them: constants - are registered as part of the indicator under consideration in the case when the amounts will be taken into account only for accounting purposes; deferred differences are allocated separately in the financial financial statements due to the temporary nature of their occurrence; an explanation for them is given below.

- IT appears in accounting for internal use, they are constantly monitored, but their amount is not allocated separately.

Other – includes amounts that do not fit the parameters of other indicators. These may be fines, penalties, penalties issued by the Federal Tax Service for unfulfilled tax requirements.

Net profit (loss) is one of the most important indicators of financial profitability, which is the overall result of the activities of an organization or entrepreneur. This is the amount remaining at the disposal of the company after taxes and other payments have been paid, which is what the business was organized for. Net profit forms retained earnings for the entire period of activity.

Tax assets and liabilities

They include two articles that are formed as a result of different approaches to accounting and reporting submitted to the Federal Tax Service:

Tax obligations

- Changes in deferred tax liabilities are prescribed in the OFR by organizations that do not use the simplified tax system or UTII. Usually it is formed, for example, when when calculating depreciation in accounting, one amount is obtained, and in tax accounting - another. Another possible occurrence is that the company takes into account revenue at the time of shipment of goods to the buyer before actual payment. The value of this indicator in the OFR is the amount already taken into account in the current period, when the planned date of its receipt is moved to the next year. Enterprises independently choose one of two options: deferred liabilities are allocated as part of the tax, the amount of which is taken from accounting analytics; IT is not highlighted in a separate article.

- A change in deferred tax assets is a standard in its economic meaning opposite to IT, that part of the calculated tax that is planned to be paid in the future. This line is calculated as the product of such expenses by the tax rate, taken into account on the balance of account 09. Reasons for the dynamics of IT: differences in the calculation of depreciation, overpayment of the tax amount to the Federal Tax Service when it is not returned to the company, losses on the sale of property arising from differences in determining the date disposals.

Articles listed for reference

The result of the revaluation of non-current assets is formed by clarifying the value of the tangible and non-physical assets of the enterprise, taking into account the current market price for similar property. At the same time, one of two options for their accounting is fixed in the Accounting Policy:

Additional calculation

- inclusion in other expenses or income - then this line is not filled in, but the corresponding line of the OFR is changed

- inclusion in additional capital - the amount of fluctuation in accrued retained earnings is recorded

The result of other transactions is relatively rare in Russian practice, and may include exchange rate differences from the revaluation of the company’s property located abroad. A broader definition of this indicator is given in IFRS in the wording “Other comprehensive income”. In accounting, it is accounted for in a separate subaccount to account 83. To include amounts in this line, the following conditions must be met:

- asset value is not expressed in rubles

- the difference changes the additional capital

The total financial result is a calculated value, defined as the sum of the three indicators preceding it in the financial financial statements.

The following two articles are required to be completed by joint stock companies whose shares are bought and sold on the securities market or are planned for placement. These indicators are established by IFRS and generally indicate the profitability of one ordinary share of the company. There are two types:

- Basic earnings per share is equal to the amount of dividends that the owner of one common share would receive if he sold it, or the share of net income per one common share outstanding. It is calculated as the ratio of the amount of net profit for the period to the number of ordinary, rather than preferred shares, on average for the month.

- Diluted earnings per share differ from the previous figure in that it is an estimated earnings given the worst-case stock market forecasts. This is the minimum amount of net profit that the owner of a common stock will receive if he decides to sell it. Here the condition must be met that the company will issue into circulation all the securities that it is obliged to issue. This process is called dilution or reduction of earnings per share. It is calculated similarly to the previous indicator, but additionally issued or planned to be issued shares are added to the denominator.

Income and expenses from ordinary activities

On line 2110 “Revenue” in the report, you must indicate revenue, which represents the credit turnover of account 90-1 “Sales, minus the debit turnover of account 90-3 “Value added tax”. Moreover, if revenue from the sale of certain goods (performance of work, provision of services) amounts to 5 percent or more of the company’s total income, you must enter an additional line, for example 2111 “incl. proceeds from the sale of purchased goods.” In this case, you should separately show the cost of such goods (work, services), for example, enter line 2121 “incl. cost of purchased goods."

The total cost of sales is reflected on line 2120 and represents a debit turnover on account 90-2 in correspondence with accounts 20, 41, 43 and 45.

Line 2100 shows the gross profit, that is, the difference between the indicators of line 2110 and line 2120.

Depending on what is reflected in the organization’s accounting policies, selling expenses can be accounted for in two ways. The first assumes that they are fully included in the costs of the current period. According to the second, commercial expenses are distributed between the cost of individual types of products, goods (works, services), that is, they form their cost.

In a similar way, general business (or management) expenses can be distributed by type of goods (work, services), that is, expenses for management needs that are not directly related to the production process and are accounted for on account 26.

However, it is advisable to reflect the amounts of commercial and administrative expenses in lines 2210 and 2220, respectively, regardless of whether the accounting policy decided to distribute them by type of goods (work, services) or not. Otherwise, reporting users will be deprived of the opportunity to assess the volume and feasibility of these costs. Unless account 26 is used by wholesale and retail trade organizations. Therefore, such companies may have a dash in line 2220.

Line 2200 reflects the profit (loss) from sales, that is, the difference between the indicator of line 2100 and the sum of lines 2210 and 2220.

Simplified form

According to the recommendations of the Ministry of Finance, a simplified form of the FRA can be used by organizations related to small businesses. For them, there are restrictions on the maximum amount of revenue, the number of officially registered employees and other parameters. These characteristics are defined in detail in Law No. 209-FZ of July 27, 2007. If desired, such companies and entrepreneurs can also fill out standard forms.

The simplified Report form contains, by analogy with the standard one, 5 columns; the rules for filling it out are the same. There are only 7 lines, these are the main performance indicators.

The amount of taxes paid under the simplified tax system and UTII is entered in the line Other expenses. For ease of use, an organization or individual entrepreneur independently determines whether the items included in it need to be deciphered or not.

So, the Financial Results Report is one of the main financial reporting documents, which combines all information about the economic life of an enterprise, helps owners and interested users determine the economic position of the organization, understand the level of stability of the business, and its attractiveness for financial investments.

https://youtu.be/__8u4j_pFhA

The financial analysis also provides very important information about the liquidity and profitability of the business, helps identify problem areas, points that the manager needs to pay attention to, and therefore allows you to formulate a strategy for overall development. That is why it is very important to fill it out correctly and accurately.

The calculations of all the indicators listed above are spelled out in detail in the accounting regulations, but it is natural that an accountant has difficult moments, especially since the skill of filling out comes with experience, so work and learn new things, do not stop and strive to learn something useful every time. We hope that our article helped you with this.

Top

Write your question in the form below