Why do you need the statistical form P-4 of Rosstat?

The form in question is a source of statistical reporting, which in general, every month, before the 15th day of the month following the established reporting period, must be submitted to Rosstat by all legal entities that are not classified as small enterprises.

Some organizations, instead of submitting form P-4 to the department every month, can send there another reporting document - form T-1, and only once a year. Such entities include:

- companies employing no more than 15 people;

- public associations;

- country houses, garage cooperatives, housing cooperatives.

IMPORTANT! Submission of form T-1 to Rosstat instead of P-4 is possible only upon instructions from the department. If a company employs less than 15 specialists and Rosstat has not directly provided it with the opportunity to use Form T-1, Form P-4 must be submitted, but quarterly - before the 15th day of the month after the reporting period.

Form P-4 is used to inform Rosstat about the composition of the staff, as well as the salaries of the employees of the reporting company. If a company has separate structures, information on each of them, as well as on the head office, is submitted to Rosstat.

P 4 nz

By Oleg Perov / June 19th, 2020 / Financial law / No Comments

Statistical form P-4 for 2020 was approved by Rosstat order No. 566 dated July 1, 2017. The same normative act contains its form and procedure for filling it out. Despite the fact that the order describes in some detail the entire procedure for filling out and other details of submitting reports, employers often have difficulties preparing this document.

What is form P-4 statistics in 2020

This reporting form is intended to reflect information about the number of employees and their wages. All government organizations are required to submit it. Small businesses, public organizations, cooperatives and individual entrepreneurs are exempt from this obligation.

Instructions: prepare a report to the statistical authorities in form P-4

However, all these categories of business entities must first clarify with Rosstat whether they really do not have to submit this type of reporting.

Deadlines and methods for submitting P-4

Depending on the average number of employees, the P-4 report can be quarterly or monthly. That is, if the company has less than 15 people, then the report must be submitted quarterly by the 15th day of the month following the previous quarter.

If the company employs more than 15 employees, then the form is submitted monthly by the 15th day of the month following the reporting month. If this date falls on a weekend or holiday, the filing date is moved to the next business day.

Stat form P-4 can be presented in one of the three listed ways:

- In person or through a representative in the regional office of Rosstat.

- By registered letter with a list of documents.

- Via the Internet using an electronic signature.

Companies with separate divisions must submit a report for the company as a whole and for each division. The document is submitted at the place of registration of the company, except in cases where the activity is carried out at a different address. Then it is served at the place of work of the enterprise.

What is form P-4 (NZ)

Form P-4 (NZ) is quarterly, it is submitted by all employers who have more than 15 employees. It is designed to reflect information about part-time workers and employee movements. The document includes information about persons working under civil contracts, as well as part-time work.

If there are separate divisions, then the report is prepared both for the organization as a whole and for each branch. Those declared bankrupt and subject to bankruptcy proceedings are not exempt from the need to provide a document. They can only stop serving it after final liquidation.

Deadlines and methods for submitting P-4 (NZ)

P-4 (NZ) is submitted quarterly by the 8th day of the month following the reporting period. If the eighth falls on a weekend or holiday, the filing date is moved to the next business day.

You can submit the document:

- in person at the regional office of Rosstat;

- send by registered mail;

- via telecommunication channels TOGS;

- through the Web collection system on the official TOGS website.

Responsibility for violation of deadlines

Part 1 of Article 13.19 of the Code of Administrative Offenses of the Russian Federation provides for penalties for late submission of a report. In particular, the organization will have to pay for late payment from 20,000 to 70,000 rubles. Officials face a fine of 10,000 to 20,000 rubles. The same liability is provided for failure to submit a document, as well as for entering false data.

Form P-4: instructions for filling out

The detailed procedure for filling out is in Rosstat Order No. 566 dated July 1, 2017. The form in question consists of two pages. On the first of them there is a title page, where you must indicate in the appropriate columns:

- reporting period;

- name of company;

- mailing address;

- OKPO code.

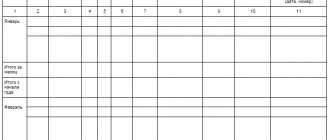

On the second page there are two tables dedicated to the reflection of data regarding the number of employees, accrued wages and hours worked. In column “A” of the first table, in lines 02 to 11, the types of activities carried out are entered, indicating the code according to OKVED2. In column “1” the sum of the values of columns 2, 3 and 4 is entered.

Column “2” is intended to indicate the average number of employees. To find out this indicator, you need to add up the number of employees for each calendar day of the month, and then divide by the number of days in the month.

Column “3” indicates the average number of external part-time workers. The average number of employees carrying out activities under GPC agreements is entered in column “4”.

In the second table, columns “5” and “6” indicate the number of man-hours actually worked.

In this case, only the time when the employee was on vacation, on off-the-job training courses, or was temporarily disabled is not taken into account.

Columns 7 to 10 are intended to indicate information about the accrued wage fund. Social payments are reflected in column “11”.

Form P-4 (NZ): instructions for filling out

P-4 (NZ), like the previous form, consists of two pages and has a similar structure. On the first page there is a title page, on which you must indicate the same information as in the P-4 report. The cells are arranged in the same order.

There is a table on the second page. It contains data relating to underemployment and movement of workers. The table consists of three columns and 22 numbered rows. Each row of the last column contains data corresponding to the information in the first column.

Form P-4: deadlines for submission to statistics in 2020

Federal statistical observation form N P-4 (NZ) is filled out by legal entities - commercial and non-profit organizations (except for small businesses), the average number of employees exceeds 15 people (including part-time workers and civil contracts), all types of economic activity and forms of ownership.

If a legal entity has separate divisions, this form is filled out both for each separate division and for a legal entity without these separate divisions.

For the purposes of filling out this form of federal statistical observation, a separate subdivision is understood as any territorially separate subdivision from the organization, at or from the location of which economic activity is carried out at equipped stationary workplaces, while the workplace is considered stationary if it is created for a period of more than one month .

A separate division is recognized as such regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division.

A separate report must be provided for each organization (institution) of education, healthcare, and culture; the provision of multiple reports by educational, healthcare, and cultural authorities of the constituent entities of the Russian Federation, municipal districts, urban districts and intracity territories of federal cities is not allowed.

The federal statistical observation form is also provided by branches, representative offices and divisions of foreign organizations operating on the territory of the Russian Federation in the manner established for legal entities.

Bankrupt organizations that have entered into bankruptcy proceedings are not exempt from providing information in Form N P-4 (NZ).

Only after the arbitration court has issued a ruling on the completion of bankruptcy proceedings regarding the organization and entry into the unified state register of legal entities of its liquidation (Clause 3 of Article 149 of the Federal Law of October 26.

2002 N 127-FZ “On Insolvency (Bankruptcy)”), the debtor organization is considered liquidated and is exempt from providing information in Form N P-4 (NZ).

Source: https://obd2bluetooth.ru/p-4-nz/

https://youtu.be/bK20K1q-H1w

How to fill out form P-4 in 2020

The main information block of form P-4 is a table. It consists of two parts.

The first part reflects the average number of specialists of the reporting company (all employees of the company, part-time workers, workers under civil contracts) in relation to the types of economic activity (for each of them the OKVED2 code is also recorded).

How to calculate the average number of employees, read this article.

The second part, also in correlation with the types of activities of the company, reflects the following indicators:

- man-hours (separately worked by full-time specialists and external part-time workers) based on the results of the company’s activities for the 1st quarter, half of the year, 9 months, year;

- the amount of the accrued salary fund (for all specialists: full-time, part-time, and those who have entered into civil law agreements);

- social benefits (for all categories of specialists).

It will also be useful to pay attention to some of the nuances of filling out the form in question, which are determined by Rosstat regulations.

We fill out form P-4 “Information on the number and wages of employees”

Let's find out who should report to Rosstat in form P-4. Let's figure out how to fill out and submit the report. We will add filing deadlines to the calendar to avoid fines.

Since February 2020, all organizations have provided “Information on the number and wages of employees” according to Form P-4, approved by Order No. 566 dated September 1, 2017. Rosstat has not introduced anything new to the form, it has only clarified the procedure for filling it out and submitting it.

Let us remind you that organizations submit statistical data free of charge. It is not possible to make changes to the forms developed by Rosstat. When filling out the report, you need to carefully check the data, because... Arithmetic and logical errors are considered false information and are subject to a fine.

Rosstat employees may not accept your report for various reasons: they did not fill out the required details, did not answer clarifying questions when submitting the report, or they made a mistake in the data.

For mistakes, the company will have to pay a fine, and you will be blamed. To avoid this, use our detailed instructions.

Find out how to submit a report on part-time employment P-4 (NZ) without stress and calls from Rosstat.

Don't miss: major changes in HR

Which was adopted and came into force this month.

Find out details

The Code of Administrative Offenses in Article 13.19 establishes a fine for failure to provide or untimely provision of a report, as well as for false information:

- for officials from 10 to 20 thousand rubles,

- for organizations from 20 to 70 thousand rubles.

Legal entities are required to report in Form P-4, regardless of the type of activity and form of ownership. The frequency of providing statistics depends on the number of employees based on the results of the previous year. If there are more than 15 people, the form must be submitted monthly. If there are fewer than 15 people, they report quarterly.

Individual entrepreneurs and small businesses are exempt from submitting information on the number and wages of employees.

Note! In case of bankruptcy, the organization provides P-4 statistics throughout the bankruptcy proceedings.

Several structural divisions are shown as one separate division if they are located within the same federal city, municipal district or urban district.

Instructions for filling out Form P-4 are contained in Rosstat Order No. 772 dated November 22, 2017 “On approval of the Instructions for filling out federal statistical observation forms” (hereinafter referred to as the Instructions). Let's look at what information is included in each column of the report.

The cover page of the form contains information about the reporting organization.

In addition to the name of the organization, you must indicate OKPO and its postal address. If the legal address is different from the actual one, both must be noted.

All indicators are distributed by type of activity according to OKVED.

The average number of employees is equal to the sum of the number of employees for each calendar day of the month, divided by the number of calendar days of the month.

The average number of employees for a quarter is equal to the sum of the average number of employees for each month of the quarter, divided by three.

The payroll number is all employees indicated in the timesheet, with the exception of some categories (clause 77 of the Instructions for filling out form No. P-4).

Columns 5 and 6 of the table include man-hours worked since the beginning of the year. This time includes all hours actually worked, even overtime. There is no need to count sick leave, vacations, etc. (clause 82 of the Instructions for filling out form No. P-4).

The accrued wage fund is indicated in columns 7–10 (clause 83 of the Instructions for filling out form No. P-4).

In column 11, organizations need to reflect social payments (clause 88 of the Instructions for filling out form No. P-4).

Detailed instructions for filling out P-4

This form refers to strict reporting documentation, therefore all employers must submit it, namely:

- small firms and large companies of any form of ownership (LLC, PJSC);

- public associations that formed a legal entity (charitable organizations, religious, educational);

- local and federal authorities, government departments.

Thus, form P-4 is submitted by all legal entities, regardless of whether they conduct commercial or non-commercial activities. However, individual entrepreneurs and self-employed people do not fill out or submit such a form.

As is customary, filling out the P-4 form for statistics starts with the title page. Here the company needs to reflect:

- its full and short name according to the charter (or other constituent document);

- postal address of the location of the main office/production (especially when it does not overlap with the legal one);

- code according to the All-Russian Classifier of Enterprises and Organizations - OKPO) (it can be found in the notification from Rosstat about the assignment of this code).

The following is entered into the table:

- average number of employees;

- average number of external part-time workers;

- the average number of people with whom civil contracts have been concluded;

- average number of employees for the entire company.

Please note: if a company conducts several types of activities at once (each has its own code), then the listed positions must be filled out for each of them. This is necessary for Rosstat to see a more or less objective picture.

Let us remind you that paragraph 3 of Article 80 of the Tax Code obliges you to send data on the average number of personnel to your territorial tax office no later than January 20. Therefore, in our opinion, filling out form P-4 for statistics in this part should not cause any hassle. We will just give two main rules (see table).

| Index | How to count |

| Average number of external part-time workers | According to the rules for the average number of those who worked part-time |

| Average number of people with whom civil legal relations have been formalized | According to the rules for calculating the average number of employees |

Next, filling out form P-4 for statistics requires you to indicate the time worked and the wage fund. This is the following table.

It shows the hours people have worked since the beginning of the year. This indicator includes:

- actual time worked;

- overtime;

- work on official holidays and weekends;

- the period of being on a business trip, on an official assignment.

However, this does not include the following periods:

- stay on main or additional vacation;

- on study leave;

- temporary illness;

- just me;

- strike events.

The full list can be found in paragraph 84 of Rosstat order No. 428 dated October 28, 2013.

In positions 8 – 10 of the table, you need to enter the salary fund indicator for all three categories: payroll employees, external part-time workers and persons on civil contracts.

The seventh column is used to reflect the total amount of payroll. It includes:

- direct remuneration (in non-monetary form too);

- payment of vacation days;

- various workers' compensation;

- allowances, surcharges, etc.;

- bonuses, one-time incentive amounts.

Next in the table are the so-called social payments (note that they may not exist at all). What is behind this concept? Let's give the main ones. This:

- severance payments that occur upon termination of employment contracts;

- one-time payments upon retirement;

- when a company pays for employees and their family members to travel for treatment or vacation.

And these are not all social payments. The full list contains paragraph 90 of Rosstat order No. 428 dated October 28, 2013.

Below you can see an example of filling out form P-4 for statistics for the third quarter of 2020.

Instructions for filling out form P-4: instructions from Rosstat

When working with form P-4, you need to keep in mind that from 2020:

- the average headcount should include those who are on “children’s” leave if they work part-time or at home while maintaining their right to benefits;

- in the average number, it is necessary to take into account stateless persons performing work and providing services under the GPA.

In addition, in form P-4:

- there should be no indicators with minuses, only positive values;

- indicators in columns 5, 6 and 11 for the first half of the year, 9 months and a year must be greater than or equal to the corresponding indicators for the previous period (new control ratio).

Who submits form P-4 and when?

Legal entities that are not classified as small businesses report on the number and salaries of employees.

The number of employees in a company is important. If there are more than 15 employees in the organization, then reports are submitted monthly. If less than 15 - quarterly on an accrual basis. The deadline for submitting the form is 15 working days after the end of the month. In 2019, companies with more than 15 employees adhere to the following schedule:

- for January - February 15;

- for February - March 15;

- for March - April 15;

- for April - May 15;

- for May - June 17;

- for June - July 15;

- for July - August 15;

- for August - September 15;

- for September - October 15;

- for October - November 15;

- for November - December 16.

For quarterly reporting, there are four dates: April 15, July 15 and October 15.

If there are separate divisions, you need to report separately for the branch and the parent organization - in two reports. Form P-4 is filled out even if the legal entity did not pay wages.

The form is submitted to the territorial statistics body in paper or electronic form.

What is the statistics form P-4 (NZ)

Along with form P-4, another type of statistical reporting, similar in name, is also presented - form P-4 (NZ). For 2020, it was approved by the same Rosstat order No. 404.

Through this report, Rosstat is informed about part-time employment, as well as the movement of specialists of the reporting company. This form and the P-4 statistics form are not interchangeable. These are documents of different purpose and structure.

Form P-4 (NZ) must be sent to Rosstat at the end of each quarter - before the 8th day of the month following the reporting period, by enterprises with more than 15 employees, including part-time workers, as well as specialists who work in civil law contracts.

Form P-4 NZ in statistics: sample filling

Almost every business entity must provide Rosstat with a certain set of statistical reports. This list often includes Form P-4 NZ, which is presented by enterprises regardless of their form of ownership and type of economic activity. It contains information on the movement of employees, as well as their employment.

Who should submit Form P-4 NZ in 2020

The legislation establishes that the P-4 statistics form is compiled by a legal entity. persons in accordance with Order No. 349 of August 29, 2013, if the average number of employees is more than 15 people.

It is necessary to take into account that the report reflects information not only on those working under labor contracts, but also on persons engaged under civil contracts. Part-time employees are also taken into account.

In this case, this report must also be submitted to separate divisions, branches and representative offices of organizations.

The obligation applies not only to domestic companies, regardless of their form of ownership, but also to foreign companies operating in Russia.

When a company is subject to bankruptcy proceedings, its officers must continue to file reports and submit them to statistics.

Form P-4 NZ may not be submitted only by organizations classified as small businesses.

To find out exactly whether you need to submit reports to statistics in 2018, the list of forms and deadlines for submission, you can use a special service on the Rosstat website.

Attention! Bankrupt organizations for which bankruptcy proceedings have not been completed are not exempt from submitting this report. Entrepreneurs do not prepare or submit these reports.

Form P-4 refers to quarterly reporting, therefore business entities must submit it at the end of the quarter no later than the 8th day of the following month.

If the final reporting deadline falls on a weekend or holiday, it is postponed to the next business day.

Thus, form p-4 NZ statistics in 2020 should be submitted:

- for 4 sq. 2020 - January 08, 2020;

- for 1 sq. 2020 - April 09, 2020;

- for 2 sq. 2020 - July 09, 2020;

- for 3 sq. 2020 - October 08, 2020;

- for 4 sq. 2020 – January 08, 2020.

Where are the reports submitted?

The order of Rosstat establishes that Form P-4 NZ must be submitted by organizations to the territorial body of Rosstat at their location. This can be either the address indicated in the registration documents or the actual location of the company if the activity is carried out in another area.

Front side

Filling out form P-4 must be performed on the basis of the instructions that were put into effect by order of Rosstat.

On the front side of the form, you must write down the name of the company, its postal address, as well as the OKPO code assigned by Rosstat. It can be found in the assignment notice.

In the event that the form P-4 NZ is issued by a branch, then it is necessary to indicate its OKPO code, as well as the identification number of the division. The latter code is also assigned by Rosstat.

Attention! The form must be filled out separately for each designated division or branch, as well as separately for the head division, excluding all branches.

The document contains information about the period for which information on the movement of employees in the company is reported to the government agency.

Reverse side

The reverse part looks like a large table. It indicates line by line various indicators about the number of employees of different categories, as well as an empty column for entering values. The numbers in it must only be integers. All information is provided as a whole for the entire company, without division into individual internal divisions or types of activities.

bukhproffi

Important! If any employee during the reporting period falls under the definition of several lines at once, then he must be counted as one unit and shown in the line in which he spent the maximum amount of time.

For example. The employee did not work all day for some time by agreement with the administration, then took a vacation without pay, and then went on a full day - it must be shown once in the line that in total takes up a greater number of days or hours.

Line 01 records the number of workers who perform their duties on a shortened working day. Moreover, such a short day is established at the initiative of the employer. This value must be lower than or equal to the sum of lines 08 and 13.

Line 02 indicates how many employees do not work for the company full time in accordance with the provisions of the employment agreement. This should also include workers who are on maternity leave to care for a child up to 1.5 years old, but at the same time do not work for the company all day. The value of this line must also be less than or equal to the sum of lines 08 and 13.

Declaration 3-NDFL: sample filling for individual entrepreneurs on OSNO

Line 03 records the number of employees who experienced downtime at work during the reporting period due to the fault of the company or for reasons beyond the control of the parties.

Such reasons include the lack of tools, materials, shift assignments, an accident at the enterprise, interruptions in the supply of heating, water, electricity, etc.

The value of this line must be less than or equal to the sum of lines 08 and 13.

Line 05 records the number of employees who were granted leave without pay during this period. The row value must be less than or equal to the sum of rows 08 and 13.

In addition, after filling out line 05, another control ratio is checked - the sum of lines 01, 02, 03 and 05 must be lower than or equal to the sum of lines 08 and 13.

Lines 06 and 07 include the number of workers who were hired by the company during this period in total, and for newly created jobs. In this case, the instructions state that if information is entered in line 07, then line 06 must also be filled in. In addition, the total for line 07 must be less than or equal to line 06.

bukhproffi

Important! If the organization has just been created, then the number of employees on lines 06 and 07 should be equal to each other.

Line 08 indicates the total number of workers who left the enterprise during the specified period. Moreover, further, in lines 09-12, it is necessary to decipher this number for the reasons for dismissal - agreement between the parties, layoff, personal desire of the employee.

After filling out this block, you need to check lines 08-12 for the control ratio - the sum on lines 09, 10, 12 should be lower than or equal to line 08.

Line 13 records the total number of employees of the company as of the end of the reporting period. This includes all employees who currently have a valid employment agreement. People who work as part-time workers, as well as those performing work under a civil contract, are not included in the report.

bukhproffi

Important! If an employee quits on the day the reporting period ends, then he is not shown in line 13, but is taken into account when filling out line 08.

Line 14 indicates the number of employees who need to be hired by the company to fill vacant positions as of the end of the period. This number must be lower than or equal to the value in line 13.

Line 15 records how many employees plan to quit in the next reporting period. This number does not need to include employees whose fixed-term contracts are ending or who are retiring. The value of this line must be lower than or equal to line 13.

Lines 16 and 17 include the number of employees who are on maternity leave for up to 1.5 years and on leave from 1.5 to 3 years during the reporting period. If the responsible employee does not have the opportunity to divide all female employees with such leaves into groups, then only line 17 is filled in.

If an employee is on two vacations at the same time - up to 1.5 years with one child and up to 3 years with another, then she needs to be shown only in line 17.

At the same time, employees who are on vacation and at the same time working part-time are not shown here - they must be reflected in line 02. The value of each of these lines must be less than or equal to line 13.

Line 20 records the number of employees who perform duties on a rotational basis.

Lines 21 and 22 indicate the number of workers who, according to agreements concluded between organizations, are provided by other companies and sent to work for third-party companies.

After filling out the P-4 NZ form, it is signed by the person who is authorized to provide statistical data. It indicates your position, full name, date of filling, contact phone number and email.

Penalties for failure to submit a report

Responsibility for failure to submit a statistical report is established by the Code of Administrative Offenses. In this case, a document not submitted at all, sent at the wrong time, or filled with inaccurate data is considered a violation.

The fines are set as follows:

- For all types of violations, the organization may be subject to a fine of 20-70 thousand rubles. If such a violation is committed again in the future, the amount of sanctions may be increased to 100-150 thousand rubles.

- A fine in the amount of 10-20 thousand rubles may be imposed on the person responsible for sending the form P-4 NZ. If repeated violations of a similar nature are detected, it can increase to 30-50 thousand rubles.

Attention! The statistical authorities must decide whether to impose a fine on the perpetrator. At the same time, they are given a period of 2 months from the moment the violation is discovered.

Source: https://buhproffi.ru/otchetnost/forma-p-4-nz-v.html

Results

Conducting routine statistical observations, Rosstat collects information about staff and salaries in employing companies operating as legal entities. For this, form P-4 is used. Information on it is submitted to Rosstat monthly or quarterly (depending on the number). The P-4 form for 2020 is new, approved by Rosstat order No. 404 dated July 15, 2019. For the first time, you need to report on this form for January 2020.

You can learn more about reporting to Rosstat from the articles:

- “Procedure and sample for filling out form No. 1-Enterprise”;

- “Form P-service - filling out and submission procedure.”

Sources:

- Order of Rosstat dated July 15, 2019 No. 404

- Order of Rosstat dated November 27, 2019 No. 711

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.