Home / News and changes

Back

Published: 05/22/2020

Reading time: 5 min

0

270

Quarterly form P-2 and annual form P-2 (invest) are mandatory documents for submission by all legal entities, except small businesses, to the Federal State Statistics Service (Rosstat), according to Rosstat order No. 772 dated November 22, 2020, as amended on 29 December 2020, Rosstat order No. 414 dated July 18, 2020. If the organization has separate branches, then the necessary data is submitted for each of them, with the exception of this information in the main report for the legal entity.

It is worth noting that according to the new rules, credit institutions are allowed to provide a report on investment activity in general for the constituent entities of the Russian Federation.

- The importance of quarterly and annual reporting forms

- Filling out the P-2 form in 2020 Section No. 1

- Section No. 2

- Front page

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

As for bankrupt enterprises, they are exempt from the need to provide this reporting form after entering information about their liquidation into the register of legal entities (Federal Law of the Russian Federation No. 127 of October 26, 2002).

Features of filling out a report in form No. P-2 (quarterly)

The basis for filling out information on investments in fixed capital for commercial organizations

is the turnover of account 08 “capital investments” and account 07 “equipment requiring installation”;

for budgetary organizations

the turnover of account 106 “capital investments”.

Acquired property of organizations worth up to 40,000 rubles not taken into account

in investments in fixed capital -

if reflected as part of inventories.

Taken into account

in investments in fixed capital in the following cases:

-no changes were made to the accounting policy and the number “20,000” was not corrected to “40,000”. Thus, property worth from 20,000 to 40,000 rubles inclusive is taken into account as part of fixed assets;

—

for budgetary organizations - fixed assets worth over 3,000 rubles;

-in the accounting policy there is no limit for fixed assets. All property that meets the conditions for recognition as fixed assets (in particular, the period of use exceeds 12 months) must be taken into account, regardless of their value, as fixed assets.

Investments are reflected at the expense of all sources of financing, without value added tax, on an accrual basis in thousands of rubles.

Please note:

starting from 2013, section 1

does not reflect:

—data on the funds of organizations and the population invested in the construction of objects on the basis of agreements for participation in shared construction, drawn up in accordance with Federal Law of December 30, 2004 No. 214-FZ “On participation in shared construction of apartment buildings and other real estate”.

Let's sum it up

- Since 2020, statistical observation form No. P-4 “Information on the number and wages of employees” is presented: on a new form, approved. By Order of Rosstat dated July 15, 2019 No. 404;

- according to the updated rules, approved. By Order of Rosstat dated November 27, 2019 No. 711.

If you find an error, please select a piece of text and press Ctrl+Enter.

Form P-2: instructions for filling out

This information is reflected in section 3, lines 47, 48.

On line 04

the costs of purchasing machinery, vehicles, equipment, production and household equipment, as well as the costs of installing equipment are reflected

.

This line also takes into account the cost of machines, equipment, and vehicles received free of charge (from higher organizations, as technical and humanitarian assistance, at the expense of federal target programs) (in terms of new and imported), accepted in accounting as basic funds.

This line also reflects the costs of purchasing furniture

.

Line 06 reflects other investments:

— costs of exploration and production drilling;

— costs of planting and growing perennial crops;

- capital costs for land improvement;

— costs for the formation of a working, productive and breeding herd;

— costs of acquiring library collections,

bodies of scientific and technical information, archives, museums, and similar institutions.

On lines 10-12

a complete breakdown of investments in fixed capital shown on line 01 is provided, by type of activity in accordance with the All-Russian Classifier of Types of Economic Activities (OKVED), based on the purpose of fixed assets, i.e. the sphere of economic activity in which they will operate.

For example, if a workshop for the production of bricks is being built, then data on such an object is reflected in type of activity 26.40 “production of bricks, tiles and other building products from baked clay”, construction of residential buildings - in type of activity 70.32.1 “management of the operation of housing stock” , construction of secondary schools - by type of activity 80.21.2 “secondary (complete) general education”, etc.

The acquisition of ships is reflected by type of economic activity 61 “water transport activities”, airliners – 62 “air and space transport activities”, cars, trolleybuses, buses, construction of pipelines, oil pipelines – 60 “land transport activities”, road construction by type of activity 63.21 .22 “operation of public roads”.

The construction of public utility facilities is reflected by type of activity 40.22.1 “distribution of gaseous fuel”, 40.30.2 “distribution of gas and hot water”, 40.30.5 “activities to ensure the operability of heating networks”, 41.00.2 “distribution of water”, 90.01 “ wastewater collection and treatment.”

According to OKVED codes 45.11- 45.50

the costs of creating and further developing the material and technical base of divisions involved in construction are shown.

Organizations that do not belong to OKVED 45.11-45.50

and that do not have construction divisions

should not reflect the volume of investments according to OKVED -45

On line 13

are shown:

— costs for the acquisition of equipment, buildings and structures that were previously included in fixed assets (funds) from other organizations, as well as objects not completed construction;

— the cost of newly constructed fixed assets purchased from the developer;

— costs for the purchase of apartments in residential buildings, credited to the organization’s balance sheet and recorded in fixed asset accounts

On line 01

these costs are not taken into account.

The cost of fixed assets transferred from the balance sheet of one organization to the balance sheet of another organization does not apply to investments in fixed capital and is not reflected in lines 13 and 14.

Line 01, column 1 does not include the data reflected in lines 13, 15, 19, 21. These lines are independent.

Budgetary organizations cannot have a source of investment “own funds”, therefore line 31 in columns 1,2,3

not filled in.

Pay attention to filling out line 42 - funds from extra-budgetary funds

(pension fund, health insurance, social fund), and not

extra-budgetary funds.

Section 3 reflects information about the funds of organizations and the population invested in the construction of objects on the basis of agreements for participation in shared construction, drawn up in accordance with Federal Law of December 30, 2004 N 214-FZ “On participation in shared construction of apartment buildings and other objects real estate."

Line

47

reflects the total amount of funds of organizations and the population.

Line 48

from line 47 allocates funds from the population for the construction of residential buildings and apartments in multi-apartment residential buildings.

This section does not include funds from budgetary organizations invested in the construction of facilities without drawing up agreements for participation in shared construction.

The data given in

lines 47 , 48 are not included in line 01 of section 1 .

When filling out a report for January-December

It should be noted that data for the corresponding period of the previous year (columns 3 and 4) must be taken from the annual report

P-2 (invest) for the previous year

.

Attention!

Organizations investing in fixed capital in two or more districts of the Omsk region and other constituent entities of the Russian Federation

, highlight on separate forms Form No. P-2 information separately for the city of Omsk, for each district of the Omsk region and each constituent entity of the Russian Federation where the facility being created will operate after its commissioning or fixed assets are acquired.

A summary report in Form No. P-2 is not submitted. Reports for the city of Omsk and districts of the Omsk region are submitted to Omskstat, and reports for other constituent entities of the Russian Federation are sent independently to the territorial body of state statistics on whose territory investments in fixed capital are made.

Do you need to take P-4?

Statistical surveillance form No. P-4 “Information on the number and wages of employees” is required to be submitted by 2 groups of legal entities:

- commercial companies (except for small businesses);

- non-profit organizations (NPOs).

It doesn’t matter what form of ownership you have or what types of activities you engage in.

You will have to submit P-4 to the statistics even if the company’s activities are temporarily suspended or you are in bankruptcy proceedings as a bankrupt enterprise.

If you have separate divisions, you will need to fill out P-4 separately for each of them and for the parent company.

The form is also provided by branches, representative offices and divisions operating on the territory of the Russian Federation of foreign organizations in the manner established for legal entities.

Companies using the simplified tax system submit P-4 on a general basis (clause 10 of the Instructions, approved by Rosstat order No. 404 dated July 15, 2019).

Form P-4 from 2020

Download the employee’s personal card (form p-2) in .doc and .pdf format

General information

Personal information, passport details, information about education, previous place of work, etc. are indicated here. These data are filled in on the basis of supporting documents: passport, work book, diploma, etc.

In table 10 we indicate the composition of the family. These include:

- parents;

- spouses;

- children;

- guardians.

The place of actual residence is indicated according to the employee.

Gazette about military registration

The second section is filled out if the employee is liable for military service or a conscript, according to which verification is carried out with military commissariats. The basis for filling out this section is a military ID or a temporary certificate issued instead of a military ID for those liable for military service, for conscripts - a certificate of registration for conscription activities.

For persons who have reached the end of conscription age (currently 27 years old), the data on military registration is crossed out and a registration is made.

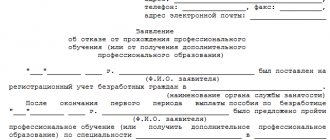

Vocational education in production

The section “Vocational education at work” is filled out if the employee receives education at the expense of the enterprise.

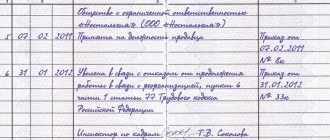

Assignments and transfers

In this section, be sure to immediately record your appointment.

Zero P-4

If during the reporting period you did not have indicators that are included in P-4, you are allowed to submit to the statistics body (clause 3 of the Instructions, approved by Rosstat Order No. 711 dated November 27, 2019):

- or a P-4 signed in the prescribed manner with blank values of indicators (“blank” report on the P-4 form);

- or an official information letter about the absence of indicators presented in P-4 in the reporting period.

If you decide to submit a blank P-4, you only need to fill out the title section of the form. The remaining sections should not contain any data values, including zeros and dashes.

The concept of non-financial assets

Non-financial assets refer to investments in instruments that do not involve cash. They mean fixed capital and non-productive assets.

Investment in fixed assets is extremely important. They are the ones who move the business forward, help the organization develop and not stand still.

Investments in fixed capital

Tax legislation regulations clearly define what can be classified as fixed capital. Let's list its components:

- construction;

- production machines;

- reconstruction;

- equipment;

- machines;

- vehicles;

- application programs;

- production equipment;

- breeding herd on a farm;

- technological lines;

- perennial crops in agriculture;

- intellectual property;

- scientific developments;

- works of art;

- programs;

- information bases;

- inventions;

- utility models and industrial designs;

- Research and Development.

Investments in fixed capital are accounted for in accounting, as a rule, without VAT.

Investments during construction

Organizations can invest in non-financial assets during the construction of non-residential buildings or structures. Then they will include the costs of various construction works.

The main ones are the correct design of the building, construction, costs of materials used and operation of the building. To properly design a building, you need to know all the initial data, you need to do the geology of the soil, you need to understand the climatic features of the area, you need to be a professional in design. Construction costs include compliance with technology and quality of materials. Compliance with technology, first of all, means the qualifications of the builders themselves and tireless control over their work.

The second part is the cost of building materials, which must meet their declared characteristics necessary for the construction of the building for which it will be designed.

To summarize, non-financial investments in construction include the costs of obtaining permits, preparing the project, all transportation costs, accommodation and wages of workers, overhead costs, purchasing materials, manufacturing all building structures, laying the foundation and subsequent installation of the building before commissioning, as well as commissioning into operation.

Investments in intellectual property

Intellectual property is the most complex non-financial asset. Intellectual property and copyright existed back in the Soviet Union. Writers, poets, artists, songwriters, performers, musicians, composers and scientists had author rights. There were special organizations that paid royalties. For example, in the USSR, the highest royalties were awarded to composers, so bards—poets, songwriters, and composers—received the maximum rate.

Today in Russia, copyright compliance is monitored by the Russian Authors Society (RAS). It assigns rights to authors and determines royalties. Authors have two rights: the right to authorship and the right to income from their work. If an author, for money, has completed any work related to intellectual property for a fee, then he loses the right to income, but the right of authorship is not alienable.

In modern Russia, trademarks and brands have appeared, which also belong to intellectual property. Their registration and protection are managed by the Patent Bureau. Any citizen or legal entity can apply for registration of a trademark name, verbal spelling, including font, color, size, etc., as well as a visual image. Each category of goods and services is assigned its own class, so a trademark must be registered for each class separately. This means that you can use someone else's brand, but in a different class. For example, (cakes and pastries) can be used for furniture or cargo transportation. Common names are not subject to registration as a brand. For example, “bed” as a furniture brand, but the same word “bed” can be used to register a clothing brand.

Registration at the patent office is carried out by patent attorneys. They provide information about the applicant, class of product or service, name, and patent term. The trademark is also checked to see if it matches existing ones.

Other objects of intellectual property that can also act as an investment project include:

- computer programs;

- information bases;

- movies;

- paintings;

- sculpture;

- graphic arts;

- design;

- literary works;

- musical compositions;

- comics;

- domains;

- Internet sites.

What are investments in non-produced and produced NFAs?

Non-financial assets or NFA include:

- fixed assets;

- material working capital

- non-produced assets;

- intangible assets.

Fixed assets can be represented by:

- buildings, structures;

- machines, equipment;

- computer technology;

- production and household equipment;

- library collection;

- other fixed assets.

Material current assets include:

- stocks;

- raw materials;

- work in progress objects;

- finished goods produced by an economic entity;

- goods purchased from third-party business entities for the purpose of subsequent resale.

Non-produced assets include natural resources (land, subsoil) and other non-produced assets (the radio frequency spectrum is given as an example of such assets in paragraph 79 of Instruction No. 157n).

Intangible assets include:

- objects of copyright;

- objects of related rights;

- trademarks and service marks;

- production secrets.

The main characteristic of investments in non-financial assets is their feasibility from the point of view of solving management problems at the enterprise.

Relevant investments may be:

- regular, systemic - for example, as the purchase of certain assets as part of current business operations (purchase of raw materials, materials for production needs);

- situational (based on decision-making by competent persons) costs for the formation of production infrastructure, its expansion (purchase or construction of fixed assets);

- situational or regular (again, depending on management priorities) purchases of NFA in order to preserve the purchasing power of the enterprise’s capital (for example, through the acquisition of inventories that are sensitive to inflation - fuel, food raw materials);

- as a rule, situational expenses for own scientific research, the ultimate goal of which is the development of products and solutions that are valuable non-financial assets or allow the production of valuable non-financial assets.

Information about an enterprise's investment in NFA is the subject of statistical reporting by Russian enterprises. Let's study its features.