Where and when to take SZV-M in 2020

This is due to the fact that they are still registered with the company.

Thus, when an employer has a question as to whether it is necessary to include a particular employee in the SZV-M reporting form, he must proceed from the following:

- It does not matter whether the person received a salary or other kind of remuneration under this contract, as well as the fact whether insurance premiums were paid.

- Whether this document was valid or not during the reporting period. If it was active for at least one day, inclusion in the report is mandatory.

- What kind of contract is concluded with a person.

The official name of the document is “Information about the insured persons”.

Its main function is to transmit information to regulatory authorities about hired specialists, for whom the organization transfers insurance contributions to all extra-budgetary funds.

please tell me where to send reports on SZV-M and SZV-STAZH of a separate structural unit “Branch” located in Moscow, if the parent organization is located in Kazan. Branch - without forming a legal entity

If you are submitting information about employees for the reporting period for the first time, then enter the code “source”. Indicate the code “additional” if you need to supplement the data in the SZV-M form previously submitted and accepted by the fund or correct incorrect data if the Pension Fund returned them for revision.

If you want to completely cancel previously submitted information, then enter the code “cancel”.

At the same time, in the supplementary and canceling form, fill in only the information about those employees or performers under the GAP that need to be supplemented or canceled. In the “Information about insured persons” section, indicate the following information about employees and performers under the GPA: insurance number of an individual personal account (SNILS); last name, first name and patronymic; TIN, if available.

Therefore, if an individual does not have a TIN or it is unknown to the employer, then put a dash (clause 2.2 of Article 11 of the Law of April 1, 1996 No. 27-FZ)

Submission of SZV-TD reports without errors

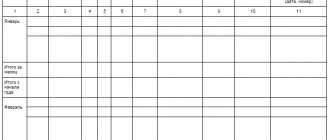

In February 2020, companies will have to begin submitting another personnel report to the Pension Fund of Russia - a report on the employee’s work activity (SZV-TD), this report was needed due to the transition to electronic work books. We offer recommendations for filling out this report in our article.

It is worth immediately drawing your attention to the fact that the STD-R and SZV-TD forms are forms for different purposes and one does not replace the other. The report in the form SZV-TD is submitted to the Pension Fund; this form is seen only by the employer and specialists of the Pension Fund. We can say that this reporting will essentially replace work books for employers. In this case, there is no need to issue a copy of the submitted SZV-TD report.

But a document in the STD-R form, which contains information about the employee’s work activity in the company, will be issued by the personnel officer to the employee upon written application or upon dismissal of the employee. This document will replace paper work books and will be issued to those employees who, after switching to electronic work books, took the original of their work books.

The STD-R form will need to be issued only to those employees who do not have work records on paper. To do this, the employee must refuse the paper work in writing. Every employee has this right, but only until December 31, 2020.

Using the SZV-TD form, the organization submits a report to the Pension Fund in the following cases:

— hiring an employee;

— transfer of an employee to another permanent job;

— dismissal of an employee;

- if the employee has been assigned a second or subsequent profession or other qualification;

- if the court has prohibited the employee from holding a position;

— the name of the organization has changed;

— the employee brought an application to the HR department with a decision on the work book.

It is worth noting that there is no need to submit zero reporting for SZV-TD; SZV-TD is submitted to the Pension Fund only if some change in the monthly reporting occurred, as indicated above.

Deadlines for submitting SZV-TD reports?

The first time you must submit reports in the SZV-TD form before February 17, 2020, during this period you will submit information for January 2020.

| Which month of 2020 do you need to report for? | By what date should the report be submitted? |

| January 2020 | until February 17, 2020 |

| February 2020 | until March 16, 2020 |

| March 2020 | until April 15, 2020 |

| April 2020 | until May 15, 2020 |

| May 2020 | until June 15, 2020 |

| June 2020 | until July 15, 2020 |

| July 2020 | until August 17, 2020 |

| August 2020 | until September 15, 2020 |

| September 2020 | until October 15, 2020 |

| October 2020 | until November 16, 2020 |

| November 2020 | until December 15, 2020 |

| December 2020 | until January 15, 2021 |

The SZV-TD must be submitted monthly no later than the 15th day of the month following the month in which there were personnel changes or the employee submitted an application that he wants to keep the paper work record in the personnel or, on the contrary, plans to take it away. If the deadline for submitting the report coincides with a weekend or non-working holiday, you have the right to report on the next next working day. Since the 15th of February falls on a Saturday, the last day you can submit your report is moved to Monday, February 17th.

Where to submit the SZV-TD report?

The SZV-TD form is submitted to the territorial office of the Pension Fund at the place of registration of the individual entrepreneur or organization. It is important to take into account that organizations with 25 or more employees must submit reports to the Pension Fund only in electronic form, signed with an enhanced qualified digital signature.

If the organization has less than 25 people, reporting can be submitted on paper or electronically, whichever is most convenient for you. In this case, information on paper can be submitted in person or through a representative, as well as sent by registered mail or a letter with a declared value and an inventory of investments.

How to fill out information about the company in the SZV-T report?

The first part of the report contains information about the organization; this can be done using a current extract from the Unified State Register of Legal Entities.

Registration number in the Pension Fund of Russia. Write 12 numbers in the column, using them the Pension Fund specialist will determine the region and specific area in which the company is registered, and will also understand which organization reported.

Employer (name). Rewrite the company name from the articles of association. Write the words in full; nothing can be abbreviated in the report. Write instead of “Limited Liability Company “Romashka”, LLC “Romashka”, you will make a mistake.

TIN. This 10-digit number can be found in extracts from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs, as well as in the certificate of TIN assignment.

Checkpoint. In the tax certificate, next to the TIN number, there is a checkpoint code, it contains nine digits.

Filling out information about an employee in SZV-TD

Please note that the SZV-TD form is individual and is submitted separately for each employee.

SNILS. His number for each employee can be taken from their electronic database or copied from the employee’s personal T-2 card. If it turns out that the organization does not have an employee’s SNILS, ask him to bring a paper SNILS or download the notification from his personal account on the Pension Fund website.

Full name of the employee. Information regarding the employee’s full name in the SZV-TD form is indicated in the nominative case. You cannot replace your first name and patronymic with initials or abbreviate anything. The last name and first name of the employee are always filled in, but if the employee does not have a middle name in the SNILS certificate, leave this column empty.

Please note that the Pension Fund employee checks the information not with the employee’s passport data, but with information in the Pension Fund system, that is, compares the employee’s full name with his data in SNILS.

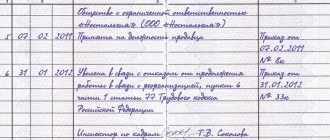

When you fill out the SZV-TD form for the first time for an employee in 2020, simultaneously with personnel changes, provide information about his work activity as of January 1, 2020. That is, about the last personnel event for this date

Which employees should be included in the SZV-TD report?

From January 1, 2021, you will have to submit, along with information about the dismissal of an employee, information about personnel activities regarding him in the reporting period.

How to fill out the section with notes on employee statements and the reporting period

Every time you submit a form to the Pension Fund of Russia, check which of the employees in the reporting month brought statements to the staff with a decision to leave a paper labor report in the company or make do with only an electronic one.

To make this task easier for yourself. use the register of notifications and statements that we have prepared for you. With one click you can sort those who submitted such an application and indicate when.

If an employee has brought an application and wants the work record to continue to be maintained in the usual format, in the line “An application has been submitted to continue maintaining the work record book,” indicate the date of submission of the application in the format DD.MM.YYYY.

If an electronic work record is sufficient for the employee, then indicate the date when you received the application from him in the line “An application for provision of information about work activity has been submitted.”

Fill out the section with the reporting period if you report to the fund every month. The record format will be as follows: month number in MM format, and year in YYYY format. If the company's first personnel event in 2020 occurred in March, leave the reporting period field blank.

How to cancel or correct information in the SZV-TD report

If you find an error in the report or cancel a personnel event, send another SZV-TD form to the fund. In it, duplicate the initial information that was filled out incorrectly or canceled, but in column 2 do not forget to put the “X” sign.

An employee can change his mind about picking up a paper work record at any day and withdraw his application. In such a situation, fill out a new SZV-TD form. In it, in the line “an application has been submitted to continue maintaining the work record book,” write down the date that you indicated earlier and in the “Sign of OH” field.

If you need to correct the incorrect date when the employee submitted the application, then fill out a new SZV-TD form and in the line “An application to continue maintaining the work book has been submitted,” fill in the new date when the application was submitted. Proceed in the same way when you need to cancel or adjust an application for providing information about work activity.

Where to submit SZM in 2020 by separate divisions

The deadline for submission is the 15th day following the reporting month. On a quarterly basis, registers of employees who are insured are submitted to the Pension Fund if additional insurance premiums were paid for them in accordance with Federal Law No. 56 of 2008, the deadline is until the 20th day after the end of the quarter.

Information is provided, inter alia, about persons who have entered into GPC agreements, for which insurance premiums are calculated. Only errors in already accepted information can be corrected without a fine. For example, in your full name, SNILS, etc. In this case, the policyholder has the right to clarify the information himself or at the request of the fund within five working days, and this will exempt you from the fine for an error (clause 39 of the Instructions). But if you forgot to submit information for the physicist, then this is information for this insured person that was not submitted on time.

Who is required to take SZV-M and SZV-STAZH? What should you pay attention to when filling out these forms? How can judicial practice help reduce the fine?

We must not forget that late submission of data to the Pension Fund of Russia imposes penalties on the organization. One fine is 500 rubles (for each employee), and if a company has a large number of employees, this will result in a huge fine.

By Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p On approval of the form “Information about insured persons”, a new reporting form has been introduced since April 2016 - SZV-M. All organizations and individual entrepreneurs with employees must submit reports, provided that there are concluded labor or civil contracts.

In our material today we will consider such important issues as the conditions for applying UTII, types of activities possible for this taxation regime, and calculation of UTII for an LLC. We will also find out which regulatory organizations and in what period LLCs must submit reports.

Who needs to submit information on the SZV-M form

Information is submitted to:

– each employee with whom an employment contract was concluded in the reporting month, continues to be valid or has been terminated;

– for each person with whom a GPA for the performance of work and provision of services was concluded/continues to be valid/terminated in the reporting month (author’s order agreements, agreements on the alienation of the exclusive right to works of science, etc.). Information is provided on such persons if the remuneration paid to them is subject to insurance premiums in accordance with the legislation of the Russian Federation.

Where to submit SZV-M in 2020 (information about insured persons)

Territorial conditions, special working conditions, calculation of length of service, conditions for early assignment of an insurance pension are filled in provided that the employee worked in conditions giving the right to early retirement.

If a separate division does not have its own account or salaries are calculated at the head office, then data about the employees of such a division must be included in the general report for the “head”. Using the same principle, draw up reports for separate divisions located outside of Russia.

So who should take the SZV-M? There is only one answer - all employers who have signed an employment contract with at least one person.

Balance, account, salary. Your unit meets all three conditions. Submit SZV-M to the Pension Fund of Russia at your place of registration. Specify the checkpoint of the separate unit (Part 11, Article 15 of the Federal Law of July 24, 2009 No. 212-FZ).

see also

Creation of a separate division of LLC

Does a separate division on a separate balance sheet, which has a current account, need to pay insurance premiums on its own?

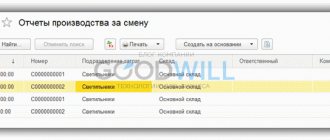

Compilation of information about insured persons according to the SZV-M form in 1C programs

Reply from 02/15/2017:

SZV-M is one of the mandatory forms of personalized reporting for compulsory pension insurance (OPI), which is submitted to the territorial bodies of the Pension Fund of the Russian Federation.

In accordance with the legislation on persuance accounting, the SZV-M form must be submitted by policyholders (clause 2.2 of Article 11 of Federal Law No. 27-FZ of April 1, 1996, hereinafter referred to as Law No. 27-FZ). Insurers in accordance with Art. 1 of Law No. 27-FZ recognizes both organizations and separate divisions.

In accordance with the legislation on compulsory health insurance, only organizations are insured (Article 3 of Federal Law No. 167-FZ of December 15, 2001, hereinafter referred to as Law No. 167-FZ). They are the ones who register with the Pension Fund of the Russian Federation at their location (clause 1, clause 1, article 11 of Law No. 167-FZ).

If there are separate divisions that have a separate current account and pay payments to individuals, the organization must additionally register as an insurer in the fund branch at the location of each such division (clause 3, clause 1, article 11 of Law No. 167-FZ).

Summarizing the provisions of Law No. 27-FZ and Law No. 167-FZ, we come to the following conclusion.

When an organization has separate divisions that have a separate current account and pay payments to individuals, SZV-M submits:

- organization at its location in relation to employees of the parent organization;

- a separate division at its location in relation to the employees of the division. In this case, in the “Insured Details” field, the TIN of the parent organization is indicated (since the division does not have its own TIN) and the division’s checkpoint.

If an organization has separate divisions that pay payments to individuals, but do not have their own bank account (or vice versa), then the SZV-M is submitted by the parent organization at its location for all employees (including employees of the division).

Section updated July 26, 2020

Common mistakes when filling out SZV-M

| Error | It should be | How to fix |

| There is no information about the insured person | When filling out the form, you must indicate all employees with whom an employment contract or civil service agreement has been concluded (even if the person worked for only one day). Information must also be submitted if there have been no accruals or payments to the employee at the Pension Fund of the Russian Federation, but he has not been fired. | Supplementary reporting is submitted, which indicates those employees who were not reflected in the original form. In the third section we put the form code “ADP”. |

| There is an extra employee present | The presence of records of redundant employees (for example, fired) is equivalent to false information. | A cancellation form must be provided indicating only the excess employees. In the third section we put the form code “OTMN”. |

| Incorrect employee tax identification number | Although the absence of the TIN itself when filling out the form will not be an error, nevertheless, if it is indicated, enter it correctly. |

What is contained in the document and why is it needed?

The official name of the document is “Information about the insured persons”. Its main function is to transmit information to regulatory authorities about hired specialists, for whom the organization transfers insurance contributions to all extra-budgetary funds.

Such reporting helps government officials track citizens who have reached retirement age but continue to work. Current legislation establishes that the pensions of such persons are not subject to indexation, which is annual for other pensioners.

The SZV-M form displays the data of all insured persons; by law, they include all persons for whom the employer makes the transfer of pension contributions. It does not matter how they were hired (based on the Labor or Civil Code), or what age they are.

Composition of SZV-M and filling procedure

With a small number, all data can easily fit on one page of the SZV-M form.

Form SZV-M contains minimal information, but at the same time allows the Pension Fund to keep records of insured persons.

In the first section of the form, policyholders indicate their details: name, registration number assigned by the Pension Fund of Russia, INN, KPP.

The second section includes only the reporting period, encrypted with a special code. The codes are indicated directly on the form.

Instructions for filling out section I of the SZV-M report

The form consists of 4 sections, each of which is required to be completed. The filling instructions will help you figure it out. In section 1 the following details of the policyholder should be indicated:

- registration number in the Pension Fund of Russia. It is indicated in the notification from the Pension Fund received upon registration. You can also find it out at the local branch of the Pension Fund of Russia, the tax office, or on the website nalog.ru;

- name (short);

- in the “TIN” field, you should indicate the code in accordance with the received certificate of registration with the tax authority;

- Individual entrepreneurs do not fill out the “Checkpoint” field. When filling out the form, organizations indicate the checkpoint that was received from the Federal Tax Service at their location (separate units indicate the checkpoint at their location).

Sample of filling out section I

Penalty for late submission of SZV-M

It is better not to violate the deadlines for submitting the SZV-M. With a large number of employees, this is fraught with huge fines.

The uniqueness of this form is that the fine will depend on the number of insured persons. Moreover, the penalties are the same for violation of deadlines and for incomplete and unreliable data in the report.

Let’s assume that Smena LLC employs 376 people. The company's accountant forgot to submit the report on time. The Pension Fund has the right to fine Smena LLC 188,000 rubles (500 rubles x 376 people). As can be seen from the example, the fine for each employee is 500 rubles (Part 4 of Article 17 of Law No. 27-FZ).

Is it necessary to report if there are no employees or persons working under GPC agreements?

The SZV-M form is also required to be provided by those companies that do not have a single employee registered. According to current legislation, the general director is also an employee.

In accordance with the new requirements of the Pension Fund of Russia, even if the manager is the only founder of a legal entity, even if he is the only employee, reports must be submitted to him. Such clarifications are contained in the message of the Pension Fund of the Russian Federation.

Sample of filling out section I

After changes to the Unified State Register of Legal Entities / Unified State Register of Individual Entrepreneurs, report to the new tax office

Ideally, it should be like this: you write an application to change your legal address, you are deregistered with the old tax office and the card for settlements with the budget is transferred to the new inspectorate. From now on, you pay and report there only.

The procedure for filling out 6-NDFL states that organizations indicate the OKTMO code of the municipality where the organization or its separate division is located. Formally, the presence of separation is the only reason when you need to submit reports with different OKTMOs for one period.

But in practice it happens differently. Sometimes, due to a move, tax officials are asked to submit two sets of reports.

☎️ Call the new tax office and ask how to submit 6-NDFL and 2-NDFL for the period of moving.

If they say “submit one report with the new OKTMO”, change the details in Elba and send the reports to the new tax office. Correct payments and reports will be generated automatically. You don't need to do anything else.

⚠️If during the moving period you are asked to submit two reports with different OKTMOs, follow the instructions below.