Act on the established discrepancy in quantity and quality when accepting imported goods Torg-3.

In section 2, lines 06 – 82 in columns 4 and 5, a breakdown of the data in line 01 of section 1 on retail sales by product groups (goods) in value terms is provided; in columns 6 and 7 - decoding of the data on line 05 of section 1 on inventories by product groups (goods) in value terms, filled out in accordance with the explanations given on line 05 of section 1.

Line 06 reflects data on retail sales and inventories of fresh, chilled, frozen or canned animal meat, poultry, meat products and canned food, meat of animals and birds that are hunted (game meat), offal from animal meat, poultry, game.

The data on line 06 in all columns must be greater than or equal to the sum of the data on lines 07, 08, 09, 10.

Line 07 reflects data on retail sales and inventories of beef, pork, veal, lamb, goat meat, horse meat, rabbit meat and other types of animal meat. Data on sales and inventories of animal meat by-products are not reflected on line 07, but are shown only on line 06.

Line 08 reflects data on retail sales and stocks of meat from chickens, chickens, guinea fowl, geese, ducks, turkeys and other poultry. Data on sales and inventories of poultry by-products are not reflected on line 08, but are shown only on line 06.

Line 09 reflects data on retail sales and inventories of meat and poultry products, which include boiled, semi-smoked, hard smoked and other sausages, frankfurters and sausages, smoked meats, meat snacks, semi-finished products (meat cutlets, meat and vegetable cutlets and with other fillings, dumplings , pancakes and pies with meat, meatballs, minced meat and more), quick-frozen semi-finished products (with and without garnish), culinary products made from meat, including our own production, meat bouillon cubes.

Line 11 reflects data on retail sales and stocks of fish, live, chilled, frozen, salted, spiced, pickled, smoked, dried, dried, balyk products, caviar (weight and canned), crustaceans, mollusks and other seafood, canned fish in oil, tomato sauce, natural canned fish, canned fish and vegetables, preserved fish from herring, sprat, mackerel and other types of fish and seafood.

The data on line 11 in all columns must be greater than or equal to the data on line 12.

Line 13 reflects data on retail sales and inventories of animal and vegetable oils, margarine products, mayonnaise, and mayonnaise sauces.

The data on line 13 in all columns must be greater than or equal to the sum of the data on lines 14, 15, 16.

Line 14 reflects data on retail sales and inventories of butter (salted, unsalted, Vologda, amateur, peasant, dietary), ghee, butter with fillers (cheese, chocolate).

Line 15 reflects data on retail sales and stocks of refined and unrefined vegetable oils: sunflower, peanut, mustard, soybean, corn, sesame, flaxseed, olive, rapeseed, salad and others.

Line 16 reflects data on retail sales and inventories of margarine products (dairy, cream, dairy-free margarine, confectionery and cooking fat).

Line 17 reflects data on retail sales and stocks of drinking milk, milk drinks without fillers and with fillers, fermented milk products and drinks (yogurt, fermented baked milk, kefir, curdled milk, kumiss), cream, sour cream, cottage cheese, curd cheese, curd mass, curd semi-finished products (dumplings, cheesecakes), cheeses, canned milk, freeze-dried canned milk powder, condensed and concentrated milk.

The data on line 17 in all columns must be greater than or equal to the sum of the data on lines 18, 19, 20, 21.

Line 18 reflects data on retail sales and stocks of whole draft, pasteurized, sterilized drinking milk.

Line 19 reflects data on retail sales and inventories of pasteurized, sterilized milk drinks (reconstituted milk), made from whole cow's milk powder, without fillers.

Line 23. Sugar

Line 23 reflects data on retail sales and inventories of sugar, powdered sugar, xylitol, sorbitol, and other sweeteners.

Line 24 reflects data on retail sales and inventories of flour and sugar confectionery products.

Line 25 reflects data on retail sales and stocks of tea, coffee, cocoa, as well as herbal teas, children's teas, coffee drinks, capsules for coffee machines, chicory (with and without additives), tea and coffee gift sets (with cups, spoons, sweets and others).

The data on line 25 in all columns must be greater than or equal to the data on line 26.

Line 28. Flour

Line 28 reflects data on retail sales and stocks of flour, flour product concentrates for making cakes, pastries, muffins, cookies, buns, pies, dumplings and other flour dishes, as well as baby flour nutritional formulas.

Line 29. Cereals

Line 29 reflects data on retail sales and stocks of cereals, as well as porridges for baby food, infant formula with cereal decoctions.

Line 31 reflects data on retail sales and inventories of bakery products (bread of all types, bakery, bagel products, pies, pies, donuts and others), as well as crackers, croutons, crispbreads.

Line 35 reflects data on retail sales and inventories of alcoholic beverages, including beer and beer drinks.

Line 36 reflects data on retail sales and inventories of vegetable and fruit juices, mineral water, bottled drinking water and other non-alcoholic drinks.

Line 38 reflects data on retail sales and inventories of chewing gum, food additives, dietary supplements, herbs, spices and other food products not included in other lines of the form.

Line 40 reflects data on retail sales and inventories of cosmetic and perfumery products, except soap.

Line 42 reflects data on retail sales and inventories of refrigerators and freezers, dishwashers, household washing machines and dryers, household cooking equipment and heating devices, sewing machines, vacuum cleaners and other electrical household appliances.

The data on line 42 in all columns must be greater than or equal to the sum of the data on lines 43 and 44.

Line 45 reflects data on retail sales and inventories of audio equipment, televisions, VCRs, video cameras, and home theaters.

The data on line 45 in all columns must be greater than or equal to the sum of the data on lines 46 and 47.

Line 46 reflects data on the retail sale and inventory of audio equipment, which includes tape recorders, tape recorders, decks, stereos, players, radios, tuners, amplifiers, equalizers, speakers, voice recorders, car audio equipment, players with a laser optical reading system for compact audio devices. discs, record players.

Line 47 reflects data on retail sales and inventories of plasma, projection, CRT TVs, LCD TVs, etc.

Line 49 reflects data on the retail sale and inventory of ski equipment, water sports equipment, equipment and equipment for physical education, athletics, other sports or for outdoor games, special sports shoes (ski boots, football boots, boots with attached skates). In line 49, sales and inventories of sportswear and shoes such as sneakers are not reflected.

Line 50 reflects data on retail sales and inventories of fully equipped computers, including tablets (iPads), laptops, and netbooks.

Line 51 reflects data on retail sales and inventories of monitors, printers, speaker systems, mice, keyboards, touchpads, touch screens, microphones, scanners, web cameras, video capture devices, TV tuners, devices used to accumulate information processed computer (HDD, HDD, USB flash drive).

Line 52 reflects data on retail sales and inventories of cameras, lenses, flashes, memory cards, tripods, filters, digital photo frames, batteries, chargers, and film.

Line 53 reflects data on retail sales and inventories of mobile phones, including iPhones and smartphones.

Line 54 reflects data on retail sales and inventories of bicycles and motorbikes, including children's bicycles.

Line 55. Books

Line 55 reflects data on retail sales and inventories of books.

Line 60 reflects data on retail sales and inventories of men's, women's and children's coats, short coats, raincoats, jackets, overalls, suits, jackets, jackets, trousers, dress items, skirts, blouses, vests, trouser sets and other outerwear, including outerwear. On line 60, sales and inventories of sportswear and leather clothing are not reflected. Information on the listed product items is shown on line 82.

The data on line 60 in all columns must be greater than or equal to the data on line 60.1.

Line 61 reflects data on the retail sale and inventory of underwear: panties, pantaloons, long johns, nightgowns, pajamas, bathrobes and dressing gowns, slips, petticoats, negligees, T-shirts, sweatshirts and other underwear, including knitwear.

The data on line 61 for all columns must be greater than or equal to the data on line 61.1.

Line 62 reflects data on retail sales and inventories of fur clothing, including accessories (muffs, collars, etc.), except for products in which fur is trimmed (collars, lapels, cuffs, etc.), as well as hats, shoes , gloves, toys made of natural fur.

The data on line 62 for all columns must be greater than or equal to the data on line 62.1.

Line 64. Shoes

Line 64 reflects data on retail sales and inventories of men's, women's and children's shoes made of any material and for various purposes, except for special sports shoes (ski boots, football boots, boots with attached skates, rollers).

The structure of the report and the procedure for filling it out

Instructions for filling out the form are given in the same Rosstat orders that approved their forms. There are no fundamental updates in the instructions due to changes in the form.

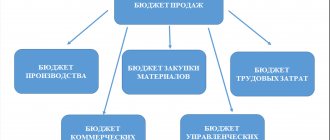

The report consists of:

- from the organizational (introductory) part, filled in with a standard set of information about the reporting company;

- 3 main sections.

Section 1 “Retail trade turnover”

The section is represented by a table of 4 columns and 5 lines. It provides data as of the reporting date in comparison with the same period last year.

Retail trade volume is reflected in actual sales prices, which include:

- trade margin;

- VAT;

- similar mandatory payments.

Data in the report should not include retail trade turnover:

- in the form of the cost of goods sold at retail to firms and individual entrepreneurs;

- catering turnover

The retail turnover reflected in the report includes those transactions that are confirmed by a cash receipt or a document replacing it.

The section contains data:

- on retail trade turnover with detailed data on food products and methods of sale (via the Internet or by post);

- on the stock of goods for sale to the public at the end of the period.

The article “Distribution trade on UTII: features of legislation” will tell you about the tax nuances of one of the types of retail trade.

Section 2 “Retail sales and inventories of goods by type”

The second section of the report explains the figures from section 1 on retail turnover and product inventories. Explanations are given in lines 06–82 at the cost of certain types of food and non-food products sold to the population and in stock at the end of the reporting period (meat, fish, dairy products, fresh fruit, vacuum cleaners, refrigerators, televisions, shoes, building materials, medicines, etc. ).

Each product group in the report is listed under the corresponding code from the classifier of products by type of economic activity (OKPD2).

Section 3 “Number of gas stations”

Lines 83–85 of the third section of the report are filled out once a year - only in reporting for the 1st quarter. It includes information on the number of gas stations with details by type of gas station:

- multi-fuel (MTZS);

- gas filling stations (CryoGZS, CNG filling stations, AGZS).

Read about the nuances of using modern cash registers for the retail sale of gasoline in the material “Online cash registers for gas stations from 2020 - explanations.”

Sample report on retail turnover

| Report line | Name of product | Product group details |

| Dairy | Data on retail sales and inventories of dairy products | |

| Of them: Drinking milk | Retail and Inventory Data:

| |

| Dairy drinks | Sales value and inventory data:

| |

| Fat cheeses | Information about retail sales of cheese | |

| Canned milk powder, freeze-dried | Cost of sold powdered and freeze-dried milk and its balance at the end of the quarter |

See below for a sample report filled out using this data.

If a small business company retails certain types of food and non-food products, it must report quarterly on the volume of retail turnover and inventory of goods at the end of the reporting period. Form 3-TORG PM in 2017–2018 is submitted to the territorial statistics body no later than the 15th day of the month following the reporting quarter.

Section 1. Retail trade turnover

The preparation of the report is regulated by a special document-appendix to the order of Rosstat dated 08/04/2016 No. 388 - Instructions for filling out. In accordance with it, filling begins with the title, where it is necessary to indicate general information about the company:

- full name of the organization providing the report;

- company address. If the legal address does not coincide with the actual one, it is necessary to indicate the actual one;

- OKPO code.

The 1st section of form 3-TORG (PM) 2020 “Retail trade turnover” operates on the overall results for the quarter: line 01 shows the results of retail turnover for the reporting quarter in comparison with the same period last year. This provides a visual analysis of absolute turnover indicators, which is defined as revenue from the sale of goods to the public, including all payment methods. Those.

these values combine the total cost of goods, incl. sold on credit or at a discount. The cost is indicated in selling prices, i.e. including both the trade markup/markup and other components, for example, VAT. From the total amount of trade turnover, the sale of food products, drinks and tobacco products is distinguished (line 02).

Separate lines record information about the cost of goods sold through online sales (p. 03), by post (p. 04) - according to catalogs, samples, etc.

The cost of goods sold to companies, entrepreneurs, and catering establishments is not taken into account in retail turnover. This is required by the procedure for filling out 3-TORG (PM), since the form was created for statistical processing of data indicating retail sales turnover exclusively to the public.

At the end of the reporting period, line 05 displays the remaining inventory of goods for subsequent sale, also in comparison with the data of the previous period. Based on the instructions on how to fill out form 3-TORG (PM), the cost of inventories is also indicated in sales prices based on the average sales prices for a similar assortment in the reporting and previous periods.

- full name of the organization providing the report;

- company address. If the legal address does not coincide with the actual one, it is necessary to indicate the actual one;

- OKPO code.

The 1st section of form 3-TORG (PM) 2020 “Retail trade turnover” operates on the overall results for the quarter: line 01 shows the results of retail turnover for the reporting quarter in comparison with the same period last year. This provides a visual analysis of absolute turnover indicators, which is defined as revenue from the sale of goods to the public, including all payment methods. Those.

these values combine the total cost of goods, incl. sold on credit or at a discount. The cost is indicated in selling prices, i.e. including both the trade markup/markup and other components, for example, VAT. From the total amount of trade turnover, the sale of food products, drinks and tobacco products is distinguished (line 02).

Separate lines record information about the cost of goods sold through online sales (p. 03), by post (p. 04) - according to catalogs, samples, etc.

Wholesale trade for the purpose of filling out the main indicator in line 01 of the PM-trading form is considered to be:

- the cost of goods shipped with the obligatory completion of an invoice;

- proceeds from goods sold purchased for subsequent sale to legal entities and individual entrepreneurs for further use or resale;

- if the turnover includes the sales price with a markup, VAT, excise tax, customs duty, and all mandatory payments;

- for commission agents (agents) - remuneration if they carry out activities in the interests of another person (principal, principal) is reflected with value added tax at the actual cost;

- for principals - the turnover of trade carried out by the principal (principal) on the basis of commission agreements or agency agreements is indicated at the cost of goods sold.

Turnover on line 01 is indicated in thousands of rubles with one decimal place after the decimal point.

The following is not considered a wholesale sale for the purpose of completing this statistical report:

- sales of products to the public, since this is retail trade;

- revenue from the sale of fuel cards, telephone cards, communication services, as well as from the sale of lottery tickets;

- the cost of utilities provided to the population and enterprises (gas, water supply, electricity).

Statistical reporting in the PM-torg form is mandatory for small wholesale businesses (except micro-enterprises). Retail trade organizations do not submit this report. When completing the main indicator, you must include turnover, which is considered wholesale only for the purpose of completing this report form. This information is submitted to Rosstat monthly on the 4th of the previous month.

The Federal State Statistics Service collects information on the turnover of small enterprises engaged in wholesale trade. To collect such information, Rosstat Order No. 321 dated July 16, 2015 (as amended on August 28, 2017) approved the monthly PM-torg form. Data is filled in for the organization as a whole, that is, for all “isolations” (branches and structural divisions), regardless of their location.

PM-trading – who submits this report? This form is submitted by all legal entities - small businesses (with the exception of micro-enterprises) engaged in wholesale trade. provide information on trade turnover on a general basis. If the organization is temporarily not operating, but trade was still carried out for part of the reporting period, it is necessary to submit information about turnover in the general manner (indicating the date of suspension of activity).

PM-bargaining – due date: until the 4th day of the month following the reporting month (inclusive). The organization fills out the current form for providing information and submits it to the territorial body of Rosstat at its location. If the activity is not carried out at the location, then the form must be submitted to the place where the activity is actually carried out.

Under the name of the form, you must indicate the month and year for which information is being submitted. Under the general information (deadlines for submission, who should provide information, etc.), the name of the reporting organization is entered. The name is indicated in the following order: the full name is entered as indicated in the constituent documents, and the abbreviated name is indicated in brackets.

Next, in the PM-Trading (statistics) report, the postal address of the organization is filled in. In this line you must indicate the legal address (with postal code). If the actual and postal addresses are different, the actual address is also indicated. In the code part of the table it is necessary to indicate the OKPO code.

Filling out the PM-torg form should not cause any difficulties - the form is not voluminous. In fact, the form contains only one main indicator - wholesale trade turnover for several periods. This information is reflected in a small table of five columns.

- Indicator name – wholesale trade turnover;

- Line number;

- Turnover for the reporting month;

- Turnover for the previous month;

- Turnover for the same month last year.

If PM-trading is filled out by a commission agent or agent (one who acts in the interests of another person), then only the amount of the remuneration received is indicated.

There is no need to indicate income from the sale of goods to the public - this turnover does not apply to wholesale trade. Wholesale trade turnover also does not include the cost of lottery tickets, telephone cards, cards for express payment for communication services, and fuel cards.

Turnover is given in actual sales prices, including trade margins, VAT, excise taxes, customs duties and other mandatory payments.

How to fill out 3 TORG PM? Let's start with the title page. It is filled out according to the general rules. Here you must indicate (clause 5 of the Instructions):

- full name of the organization and a short name in brackets next to it;

- address. If the legal address does not coincide with the actual one, then the actual one is indicated;

- OKPO code.

Section 1 shows summary information on retail trade turnover for the reporting period, as well as for the same period of the previous year, which provides a clear comparison of indicators. Retail trade turnover is defined as revenue from the sale of goods to the public for personal consumption, regardless of the method of payment.

At the same time, the full cost of goods is included in the turnover, even if they were sold at a discount, on credit, at preferential prices (as in the case of the sale of drugs by pharmacies to certain categories of the population). The cost of goods is taken into account in sales prices, which include trade margins and mandatory payments such as VAT.

The cost of goods sold to legal entities and individual entrepreneurs, as well as the turnover of the public catering sector, are not taken into account in retail trade turnover (clause 6 of the Instructions).

Separately, Section 1 reflects information on the cost of goods sold through online stores, as well as those sold by mail - according to catalogs, samples, etc. (clauses 7.8 of the Instructions).

Also, section 1 should contain information about the stocks of goods already purchased and intended for sale to the public. At the same time, in accordance with the procedure for filling out 3 TORG PM, the value of inventories must be assessed based on the average selling prices for similar goods in the reporting period and the corresponding period of the previous year (clause 9 of the Instructions).

Special instructions for filling out form 3 TORG PM are provided for commission agents, attorneys, and agents (clauses 4, 9 of the Instructions).

Section 2 of the form provides a breakdown of the data for section 1 by product group (clause 10 of the Instructions).

Monthly PM-torg form - how to fill out? The report “Information on wholesale trade turnover of a small enterprise” is easy to fill out; it contains only one indicator - wholesale trade turnover, which is indicated for several periods:

- for the reporting month;

- for the past month;

- for the same month last year.

When filling out information for the reporting company, you must indicate:

- the full name of the organization and write a short name next to it in brackets;

- index and legal address of the company, if the location differs from registration, then note the actual address;

- OKPO, assigned by statistics, this code can be “seen” in the form of a balance sheet in the organization’s code line.

How to prepare a commodity magazine TORG-23

Initially, the chief accountant or other responsible representative of the organization begins to draw up the journal. Entries are made on the cover of TORG-23.

The following fields must be filled in on the cover:

- The name and details of the organization that transfers goods for sale to stalls, kiosks and other small retail facilities, including the address and telephone number for contacts;

- The name of the division of the organization through which small retail trade is carried out;

- OKVED activities;

- Full name of the seller of the kiosk, stall - that is, the employee to whom the goods are transferred for sale;

- Information about this employee - residential address, contact details, passport details;

- Name of the place of small retail sale of goods;

- Address of the location of the retail facility;

- Date of conclusion of the contract with the seller;

- The date of issue of the goods magazine to him;

- Position, signature and transcript in relation to the person who filled out the title section and issued the magazine to the seller;

- Registration details are assigned during the registration of a commodity journal - the name of the document in which the registration was carried out, as well as the date of this operation;

- Start date of logging;

- End date – filled in upon completion of maintaining the product journal. At the stage of issuing the TORG-23 form to the seller, this field is not filled in.

After the specified fields of the cover of the product magazine are filled in, it is registered in a document specially designed for this purpose, after which it is issued to a small retail dealer for further maintenance and filling in the process of carrying out trading activities.

Every day or as income and expense transactions are completed, entries about the transfer of goods and proceeds from its sale are made in the tabular part of the commodity journal. Several such recordings can be made during the day, there are no restrictions. At the end of the working day or shift, the balance of goods for sale is summed up. The tabular section can reflect not only the transfer of goods and revenue, but also the return of goods back to the organization’s warehouse.

Detailed filling of table columns:

| Column number | Explanations for filling |

| 1 | The date the information was entered into the table; several entries can be specified for each date. |

| 2 | Number of the document on the basis of which the entry is made - to fill out each line, a documentary justification is required in the form of an incoming or outgoing document. The column is not filled in for entries displaying the balance at the end of the day. |

| 3 | The content of the record is the essence of the recorded operation (release of goods from the warehouse, delivery of revenue, return of goods, withdrawal of balance). |

Drawing up the TORG-3 act

The TORG-3 form is filled out in almost the same way as the TORG-2 form. It consists of three parts.

The first page is the “header” and is filled out similarly to the TORG-2 form. It indicates the organizations participating in the transaction, their details, dates of shipment and receipt of goods, etc. At the bottom of the page there must be the signature of the head of the consignee organization.

The second page contains a list of the goods received and reflects the discrepancies between the accompanying documents and the actual quantity and quality of the goods. The remaining empty lines are crossed out.

The third page contains the commission's conclusion. If discrepancies are identified in quality, an examination must be carried out, the results of which are certified by a seal; in this case, the commission’s conclusion is not necessary.

Who should sign the act in form TORG-3:

- the head of the recipient of the goods;

- chairman and members of a specially created commission;

- expert or representative of a disinterested organization.

The act will have legal force only if independent participants take part in the product acceptance process. These may be representatives of the Chamber of Commerce and Industry, an expert or other organization. The supplier's representative may not be present, but the management of the supplier company must give their consent to the drawing up of the act without his presence.

Application and purpose

In any organization where the movement of goods takes place, it is imperative to register their receipt and decrease. For this purpose, in accounting, documentation of the receipt and release of goods is formed in special registers.

Reconciliation of balances and the reliability of the availability of shipping documentation is carried out on the basis of commodity reports submitted to the accounting department in the TORG 29 form. In it, the reporting employee summarizes all the information on the papers about the arrival and departure of his commodity mass. Thus, the report is, in its own way, a register of invoices, compiled into separate lists according to the documents received.

This form of report easily allows you to control the turnover of a separate area for which the responsible person is responsible. The main thing in this matter is not to make mistakes and carefully fill out the form, then everything will be in order at the enterprise.

Errors in filling out the TORG-23 journal

All responsibility for the correct maintenance of the product journal lies with the employee of the small retail outlet to whom the TORG-23 form was issued. In fact, the product journal is quite simple to fill out, so it usually does not cause any special problems in design. The simplicity of the form minimizes possible errors in filling it out. The main thing is to correctly enter information about the seller who will sell the goods being sold. It is this person who has the right to make entries in the commodity journal.

In turn, the seller should carefully analyze the amounts entered into the table, check their compliance with receipt and expenditure documents, calculate at the end of his shift how much the goods are left for, correctly recording the cost in the required column of the journal. You also need to ensure that the signatures of the responsible persons are affixed. In order to avoid problems, the seller needs to make sure that there is a signature of the materially responsible person releasing the goods from the warehouse, as well as the person accepting money for sold valuables.

Registration procedure

For convenience, this report is used in companies engaged in the sale of goods at retail, and accounting of activities upon their receipt and departure is carried out using the sales price. Convenient for those enterprises that use the cost method of accounting for goods, called the balance method.

The requirements for this document are:

- How many copies are made? It is submitted in two copies, one of which remains in the accounting department with the original documents attached to it, and the second remains with the responsible person.

- Which employees should report? The obligation to draw it up applies to financially responsible persons who receive and release goods. This employee submits the report to the accountant for verification. If everything is in order, then one copy of the two forms is endorsed by the inspector and returned to the responsible person.

- How is data entered into the report? Filling out the parameters from the turnover documentation received during the reporting period is done both electronically and manually using a pen with blue or black ink.

- What should this document confirm? All information reflected in the TORG 29 form is confirmation of the movement of goods: how much arrived and left, as well as what balance is available at the end of the reporting period.

- Grounds and procedure for using the TORG 29 form. The form is filled out by the financially responsible person, based on the availability of documents for the reporting period, approved by the chief manager of the organization. All documents are divided into 2 tables about the receipt and consumption of goods in accordance with the chronological order of their creation.

- The storage location for each copy of completed TORG 29 forms. One of them is stored in the archives of the accounting department of the trade organization, and the other is kept by the financially responsible person.

Now let's move on to filling out the report form itself.

Sample of filling out a product report (TORG 29 form). Page 1

Sample of filling out a product report (TORG 29 form). Page 2

Who signs the TORG-11 product label

The label is signed by the persons who filled out the document and checked the correctness of filling out the document, this could be:

- A manager of a warehouse or other place where goods and materials are located (warehouse manager, store manager);

- A warehouse employee, for example, a storekeeper, financially responsible for a given product;

- Accounting representative.

The signature is placed after checking that the materially responsible person has filled out the TORG-11 form for the goods received at the storage location.

The signed product label is not submitted to the accounting department; the document is needed solely for warehouse accounting of inventory items at storage locations, so the verified and signed document remains in the warehouse.

The product label can be filled out manually, or can be generated using an automated document accounting system, if one is used in the enterprise’s warehouse. The use of special document automation programs allows you to speed up the registration process, making the work of warehouse employees easier.

The instructions for completing this form state that you need to fill out a product label for each item. This means that information on each item of inventory material available at the storage location must be reflected in the label.

It is permissible to enter information on several items in one TORG-11 form if they are stored together in one cell (on one shelf) in a warehouse. The total number of valuables stored in a particular location is indicated in the results of the completed table of the TORG-11 form.

All issued product labels are registered in a special accounting journal. Each document has its own unique number, which is affixed in accordance with this journal. The number is entered in a special field in the “header” of the TORG-11 form, and the date of formation of the document is placed next to it.

At the top of the product label, the traditional information about the owner of the goods and materials is filled in:

- Name of the company, its address, OKPO;

- The name of the structural unit where incoming valuables are stored;

- Activities according to the OKVED classifier;

- Inventory date.

In the tabular part of the TORG-11 form, information about inventory items is filled in:

| Column number | Information to be filled in |

| 1 | Name of the product (usually labels are filled in for long-term storage items) |

| 2 | Product code according to the all-Russian product classifier |

| 3 | Unit name |

| 4 | Unit code according to the classifier |

| 5 | Product code |

| 6 | Variety, if this concept is applicable to the specified product |

| 7 | Dimensions, height - if required |

| 8-14 | Characteristics of the specified name, depending on the type of product, the corresponding distinctive parameters characterizing the object are indicated |

| 15 | Quantity according to the specified unit of measurement |

| 16 | Price – goods can be accepted at sales or purchase prices. |

If there are several items in one storage location, then all of them are listed sequentially in the table of the TORG-11 form; based on the results of the table, the quantity data is summarized. Below the table, the total quantity of goods is written in words.

After filling out the product label by the financially responsible person, the document is sent for verification to higher authorities, for example, the warehouse manager. This person checks the correctness of filling out, after which he puts his signature, thereby confirming the presence of the specified items in this storage location.

Filling rules

The following step-by-step instructions will help you fill out the report:

- Product report forms are filled out and submitted within the period specified by the manager, which cannot be more than 10 days. It is possible to prepare a report twice during the reporting period approved by management, for example, when conducting an inventory.

- The document must be drawn up in 2 copies by the financially responsible employee who is entrusted with the management and storage of the products sold.

- All product reports must be numbered consecutively, starting from the beginning of the year. An exception is the case when a new financially responsible person is appointed. In such circumstances, the numbering begins anew from the moment he takes office.

- The most often used is a unified form for a commodity report under No. TORG-29, consisting of two pages separately for incoming and outgoing papers. In chronological order, each document is recorded in a separate line, first from the receipt documents, and on the next page, in the same order, the consumables are recorded.

- Before you start entering data from invoices and cash (receipt and expense) orders, you need to fill out the information in the header of the form. In this part, you must enter the full name of the organization, for example, “Limited Liability Company “Alexandria”. Below you enter data about the structural unit, for example, a warehouse.

- After information about the organization and department or site, enter information about the materially responsible person: his individual data, position, personnel number.

- Start filling out the table from where you indicate the balance at the beginning of the check. The balance at the beginning of the period must be the same as the balance at the end of the previous product report form. Then enter line by line in chronological order the data from receipt documents and invoices: name, date, number, amount of goods, cost of packaging. Please note that all parameters of each document are entered separately. Even if invoices are from the same supplier and goods are delivered on the same day, they cannot be summed up. After filling out all receipt documents, the total receipt amounts for the reporting period are displayed at the end.

- We move on to the next stage of reporting: fill out page two, in which you need to reflect all the information about the expense. The tabular data in the expenditure form is filled out in the same way as the receipt register of documents on the first sheet. At the end, the total expense amounts are indicated. Note! Don’t forget to also include information about goods returned to suppliers in your expense list.

- They finish filling out the form by indicating in the “Appendix” section the number of shipping papers and in the indicated place the financially responsible person puts his signature.

- The completed TORG 29 form is submitted to the accounting department, where it is checked immediately on the day of submission. If the report coincides with the accounting data, then after reconciling them, the accountant must put his marks in columns 6 and 7, as well as his signature.

What is TORG-23 magazine used for?

The use of the TORG-23 commodity magazine is relevant for those companies that issue commodity valuables to their employees for their subsequent sale through small retail outlets, for example, kiosks, stalls, that is, their own remote retail outlets located separately from the organization. The journal confirms the fact of transfer of goods for small retail sales, as well as the subsequent receipt of proceeds from sales.

The product journal is kept in a single copy and is kept by the person who carries out small retail trade in goods received from the organization.

Entries in the TORG-23 form are made each time goods are transferred to an employee for sale, as well as each time they receive money from the employee. The algorithm for using the log is as follows:

- The responsible employee of the organization, transferring goods for small retail trade, fills out the cover of the magazine and puts his signature on it;

- The journal is handed over to the employee who sells the received goods; throughout the entire period of maintenance, the journal is kept by this person;

- When transferring goods and materials for sale to a small retail trade employee, a financially responsible representative of the organization makes entries in the journal confirming the fact of acceptance and transfer. This operation is performed on the basis of invoices.

Responsibility for the absence of these reports

Taxpayers will have to answer for the lack of reporting documentation under Article 120 of the Tax Code of the Russian Federation. This fact is a case of gross violations of the points specified in the rules for accounting for income and expenses when taxing organizations.

The law stipulates that the employee appointed responsible for recording the facts of the economic life of a retail facility is obliged to ensure the issuance of primary documentation for the timely entry of data into accounting.

But punishment can only be incurred for the following violations:

- errors made due to failure to comply with accounting rules;

- late submission of reports to the accounting department;

- failure to comply with the procedure or failure to maintain the established period for storing accounting documentation.

Only persons holding responsible positions in the organization are subject to punishment. This is described in Art. 15.11 Code of Administrative Offenses of the Russian Federation.

Please note that the Code of Administrative Offenses of the Russian Federation does not provide for punishment for the absence of primary documentation.

Who fills out the commodity journal TORG-23

Several persons are involved in filling out the document:

- An authorized representative of the organization from which a small retail trade employee receives goods for sale (for example, a chief accountant) fills out the cover of the product magazine, certifying its delivery to the employee;

- Financially responsible persons who transfer the goods for sale and accept the proceeds from the sale;

- An employee who sells goods received from an organization displays balance indicators at the end of each working day (seller of a stall, kiosk or other small retail outlet). If salespeople work in shifts, then each of them can make entries in the journal based on the results of their shift.

The person responsible for storing and correctly filling out the TORG-23 journal is indicated on the cover of the document. This is a seller of a small retail chain who sells goods through the organization’s remote retail outlets.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |