What does the company request from the Federal Tax Service and why?

Each enterprise is registered in the tax office database; registration provides owners or authorized persons with the right to draw up and send requests to the tax office for the purpose of:

- evidence of due diligence;

- protecting yourself from unprofitable deals;

- determine whether the counterparty is recognized as a bona fide person.

List of requests that a company can send to the tax office:

- for tax calculation;

- providing individual tax advice;

- submission of information about existing bank accounts of a company, firm, organization (read about how to make a request for reconciliation with the tax office here);

- an idea of the presence or absence of current accounts (for details about what a certificate of open accounts is from the tax office and how to issue a letter of request, read this article);

- interpellation about the good faith of the counterparty.

After the completed request in written format is sent to the fiscal service, inspection staff are required to consider the request within 30 calendar days from the date of its registration. The period for consideration of the request may increase to 60 days by decision of the tax inspector, but in this case the fiscal service must notify the taxpayer of the lengthy consideration of the request and indicate the reason.

We wrote about the features of drawing up a request to the tax office about the taxation system in a separate article.

Who draws up the document and how is it drawn up?

A request is a document intended for business communication, its purpose is to obtain reliable and interesting information to the person who compiled it.

The following have the right to make a request:

- authorized persons;

- entrepreneurs;

- accountants.

the request must be stated in a formal style;- it can be provided to fiscal service employees in electronic and printed form;

- the document must contain information of an individual and legal entity;

- references to legal laws related solely to the essence of the request are allowed;

- the document must be endorsed by a representative of the tax office and an authorized person of the company.

General writing rules

There are four types of request:

- about tax debts;

- about providing information;

- about the integrity of the counterparty (read about how to make a request to the Social Insurance Fund about the status of settlements and to receive a reconciliation report with the counterparty here);

- about the status of settlements.

Despite their different internal contents, they have common rules for compilation:

- full spelling of the name of the executive or municipal authority to which the request will be sent;

- indicate the personal data of the individual who will receive the request: full name, address (ideally, email and signature of the official);

- indicate the applicant’s details: name of the company, its TIN, address, full name and signature of the management, telephone or email for feedback.

The request can be made on the company's letterhead or on a sheet of A4 format (the header will be written in the upper left corner).

What is the content?

When making a request, the authorized person must concisely and clearly formulate: for what purpose, on what basis he needs to obtain information from a legal entity (INFS), referring to legal and federal laws. Below we will look at the content of each request.

About tax debts

A statement about the presence of debts on taxes, fees and fines is written in order to obtain information about the financial debts of a company or entrepreneur to the state. Filling out is possible in two ways: manually and electronically.

There is no regulated form for filling out the request, but there is a recommended example for filling out the certificate, approved on July 2, 2012 by the Administrative Regulations, Order No. 99, Appendix No. 8.

Contents of the tax debt request:

- name of the body where the company or entrepreneur is registered;

- information about the legal entity: full name;

- full name of the applicant’s organization or his personal full name;

- legal address of the company or individual entrepreneur + INN/KPP.

- the purposes of your request: to receive a certificate of the status of payment or fulfillment of the obligation to pay taxes;

- stating the date when the applicant needs to receive a statement of tax arrears;

- details of the company or individual entrepreneur, and the method of receiving a response to the request;

- signature and endorsement of the document with a seal, if any.

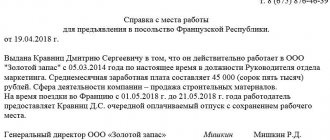

- requesting a certificate from the tax office regarding tax arrears/fulfillment of the obligation to pay taxes

- request to the tax office about tax debts

About providing information

The document is drawn up on a blank sheet or form; the contents of the “header” include the following information:

- the name of the government body or municipal organization to which the request will be sent;

- Full name of the person providing information to the applicant;

- Full name of the applicant (IP) or organization that needs to indicate: the name and location of the enterprise;

- phone number and email for feedback.

Main part of the request:

appeal to an official;

- link to legal documents, for example: according to Article 51 of the Constitution of the Russian Federation as amended in 2020 and Article 8 of the Law of the Russian Federation “On Information, Information Technologies and Information Protection”, I ask you to provide me with information...;

- description of the essence of the request;

- an indication of the request that the recipient must make, for example: I ask you to respond to a request for information in the manner prescribed by law.

The final part: endorsement of the document (signature with transcript and date of preparation).

On the good faith of the counterparty

Contents of the certificate: the city where the document was drawn up and the date are recorded in the left corner.

Main part:

- name of the counterparty and full name of the executing person;

- a description of the document on the basis of which the contract was concluded;

- the name of the agreement and the companies that entered into the transaction;

- list of registration of the counterparty at the place of registration: regional INFS number, date of registration, TIN/KPP of the company;

- reference to the applicable taxation system of the supplier company;

- indication of purpose + reference to legal or legislative documents;

- a list of obligations fulfilled by the counterparty to the tax authority of the Russian Federation;

- listing the powers that the counterparty has;

- clarification of the obligations with which the supplier agrees, based on the concluded agreement with the applicant;

- a clause obliging the supplier to draw up a written explanation if he does not provide a complete package of documents;

- list of required documents accompanying the application;

- approval of the request by authorized persons: signature with transcript, seal of the organization.

- request to the tax office about the integrity of the counterparty

- request to the tax office about the integrity of the counterparty

What types exist and what are their characteristics?

All varieties of this document can be divided into two types:

- A positive response to a request for information expresses the organization's agreement to provide the information that was originally requested.

- A negative answer means a motivated refusal to provide data or rejection of a proposal.

The main feature, as well as the difference between these types of response letter to a request for information, lies in its content.

So, when composing a positive letter, it is necessary to give the most complete and comprehensive answer to the question posed. Ultimately, the applicant organization should have no questions regarding the substance of the information provided.

When drawing up a negative response to a request for information, it is imperative to provide a reasoned reason for refusing to provide data or rejecting the proposal.

https://youtu.be/FfzOhizh5Ww

IMPORTANT. It is also recommended that the negative letter indicate under what conditions the organization that sent the request will be able to obtain the requested information.

Tags: request, information, sample, letter, provision

« Previous entry

https://youtu.be/1eRuRI6-5O4

How to send?

You can send a request to the tax office:

Through the Internet site www.nalog.ru. Algorithm of actions:

- Having gone to the website, click “Contact the Federal Tax Service of Russia”, a page with instructions will open, scrolling to the bottom of the page, you will need to click the “Legal entity” button;

- then on the page that opens, you must mark the recipient, then fill in the required fields: place of work, position held, full name, telephone, email;

- choose the method of receiving a response from the fiscal service by Russian mail or electronic mail;

- Enter the verification code from the picture and click the “Submit” button.

- On a personal basis.

- By mail.

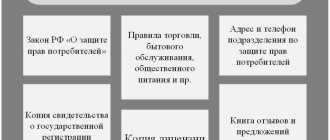

What papers are included?

List of required documents attached to the request:

- internal charter of the organization;

- a document confirming the inclusion of a legal entity in the Unified State Register;

- for an LLC, it is necessary to submit a document confirming the registration of a legal entity entered into the Unified State Register in accordance with the Federal Law of December 30, 2008. No. 312-FZ;

- TIN;

- decision of the governing body on the appointment and assumption of office of an executive body;

- power of attorney issued to an official;

- lease agreement for the organization's premises at the legal address;

- license;

- a document confirming the absence of tax arrears in the original;

- documents confirming the legality of the use of exclusive rights, if any;

- documents confirming the use of non-standard tax regimes.

The information presented revealed in detail the content of requests for tax arrears, the provision of information, the integrity of the counterparty and the status of settlements. By following the described instructions, there will be no difficulties in creating a request and saving your own time.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (Moscow) +7 (St. Petersburg)

G.N. Khimich, expert of the Russian Tax Courier magazine

The publication was prepared with the participation of specialists from the Consolidated Analytical Directorate of the Federal Tax Service of Russia

Often taxpayers need to obtain information or clarification from official sources, such as financial or tax authorities. How to determine where to go? How to make a request correctly and what documents should be attached to it?

Details of the response letter

It is not customary to indicate the type of letter in a response to an official letter. To complete it, a standard form with a certain set of details is used. The letter form contains two details that are not used in other types of forms:

- reference information about the organization;

- link to the registration number and date of the received document.

The presence of these details is the main sign of an official letter. In addition, in accordance with GOST R 7.0.97-2016, the following mandatory details must be filled in the response letter:

- name of company;

- organization code;

- main state registration number (OGRN) of the legal entity;

- taxpayer identification number/reason code for registration;

- date of;

- registration number;

- destination;

- title to the text (when writing a letter on A4 format);

- signature;

- information about the performer.

Read about the new Methodological Recommendations of Rosarkhiv for GOST-2016 in the journal “Secretary's Handbook”.

Where and with what questions to contact

Tax authorities, in accordance with paragraph 1 of Article 21 of the Tax Code of the Russian Federation, provide taxpayers with free information:

— about current taxes and fees;

— legislation on taxes and fees and normative legal acts adopted in accordance with it;

— the procedure for calculating and paying taxes and fees;

— rights and obligations of taxpayers;

— powers of tax authorities and officials.

In addition, taxpayers have the right to receive tax reporting forms and explanations on the procedure for filling them out from the tax authorities.

from the Russian Ministry of Finance on the application of federal legislation on taxes and fees. For clarification of regional tax legislation, you must contact the financial authorities of the constituent entities of the Russian Federation, and for regulatory legal acts of local significance - to local government authorities. Taxpayers receive answers to their questions free of charge.

Many taxpayers ask the question of how information on the procedure for calculating taxes and fees provided by tax authorities differs from clarifications on the application of tax legislation, for which they need to contact financial authorities. In fact, in order to correctly calculate tax, you need to correctly apply tax legislation.

Tax authorities provide information that is directly contained in the Tax Code and regulations adopted in accordance with it. For example, about how to correctly determine the tax base and calculate taxes (fees), about tax and reporting periods, payment deadlines, benefits, etc.

EXAMPLE 1

I.I. Ivanov sent an appeal to the tax inspectorate with a question: does the taxpayer have the right to a social tax deduction in the amount of the cost of a comprehensive course of treatment for burns of 30% of the body surface?

The inspection informed I.I. Ivanov that the taxpayer has the right to apply the specified deduction subject to the requirements of Article 219 of the Tax Code of the Russian Federation, taking into account that the specified course of treatment is included in the List of expensive types of treatment, approved by Decree of the Government of the Russian Federation of March 19, 2001 No. 201. In addition, the inspectorate explained the procedure for providing a social tax deduction , including the requirements listed in Article 219 of the Tax Code of the Russian Federation.

However, quite often in practice non-standard situations and questions arise to which the Tax Code and accompanying documents do not contain answers. Subjects of tax relations may also encounter contradictions in legislative acts. Then for clarification you should contact the Ministry of Finance of the Russian Federation or the relevant regional (local) authorities. Financial authorities clarify inaccuracies, ambiguities and thus eliminate gaps in the legislation on taxes and fees.

Note that many taxpayers, according to established tradition, turn to tax inspectorates with controversial questions about the application of tax legislation. The motive is simple: taxpayers believe that it is more important to know the position of the body that actually conducts tax audits.

However, this opinion is wrong. Tax inspectors do not have the right to provide explanations on these issues. In such cases, they must forward the request to the Russian Ministry of Finance, financial authorities of the constituent entities of the Russian Federation or local government bodies within 5 days. In this case, the taxpayer must be notified that his request has been forwarded.

EXAMPLE 2

State Unitary Enterprise "Vostok" turned to the tax office with a request to clarify the following issues.

1. At what rate of VAT is taxed on the implementation of work directly related to the transportation of goods that are placed under the customs regime of international customs transit?

2. Are investments received during investment competitions taken into account when determining the tax base for corporate income tax, if they are not taken into account separately in the reporting?

3. What is the procedure for taxing corporate income tax on the income of a state unitary enterprise from the sale of gratuitously transferred property, taking into account the fact that Article 43 of the Budget Code establishes that funds received from such sales are credited to the relevant budgets in full?

Sample letter of request

A letter of request is written to obtain any official information or documents. A very similar topic is the request letter. So take a look at the article with sample request letters, there may also be some useful examples for you. Well, of course, you will find a sample request letter in this article.

Like any business letter, the request is drawn up on official letterhead. To write a letter of request correctly, you must also know the basic rules for formatting document details (such as addressee, signature, title to the text, etc.). A letter of request must be sent a letter of response.

Typically, the text of a request letter begins with an explanation of the reasons and motives for your application. Examples - “In accordance with the concluded agreement...”, “In order to implement previously reached agreements...”, “Based on a telephone conversation...”, “To resolve controversial issues...”, etc.

You can also refer to the necessary legislative and other regulations. Then the link should be formatted like this:

“In accordance with paragraph X of Art. XX Federal Law No. 208-FZ “... full title of the document.”

You can skip an indication of a specific point or article, but then the sequence is always followed - the type of document (resolution, order, etc.) + the author of this document + date + its number + its title.

However, if the reason for the request is obvious, then it is permissible to immediately proceed to presenting the essence of the request without any explanation. And vice versa, if there is a need, you can describe the situation in detail without limiting yourself to one phrase.

The request itself formulates specific questions of concern to the author of the letter - “Please inform us about...”, “Please send...”, “We will be grateful if...”, etc. It is permissible to tactfully indicate the desired time frame for receiving the requested information.

Letter of request – sample format in doc format.

Another example of a request letter

We ask you to inform us about the possibility of supplying combined racks (catalog code SKP-325-0942) in the amount of 50 pieces by November 10, 2014, and also inform us about the terms of payment and delivery.

At this point, I consider the topic of drawing up a request to be sufficiently covered. The following sample request letters will help you. Don’t forget to look at the article on writing a request letter (link at the beginning of the article), there are also examples of requests.

Evgeniya Polosa

There are 561 comments on this post

Source:

How to submit a request correctly

EXAMPLE 3

Individual entrepreneur A.A. Sidorov sent an appeal to the tax office at his place of registration. In it, he announced that he intended to start activities on the foreign exchange market “Internet Currency Exchange”. In this regard, he asked for clarification on how this activity would be taxed and what taxes he would have to pay.

The tax inspectorate, having considered the appeal of A.A. Sidorova, sent him a response refusing to clarify his question. The inspection justified this by the fact that currently A.A. Sidorov is not recognized as a taxpayer for the activities that he intends to conduct.

Another recommendation for taxpayers. If the appeal contains a reference to various documents (for example, court decisions or decisions of tax authorities), it is advisable to attach their originals or copies to the request. Mere indication of the contents of these documents is not enough. To draw up a comprehensive answer, tax and financial authorities need to familiarize themselves with the document itself. After all, it is possible that the taxpayer in his request may not accurately reflect the essence of the document.

| BY THE WAY |

| Follow the signature |

The answers received from the Russian Ministry of Finance must be treated very carefully. Confirmation that the explanations set out in the response are the official position of the ministry is the signature of the Minister of Finance of the Russian Federation, his deputies, the director of the Department of Tax and Customs Tariff Policy and his deputies. This is indicated in the letter of the Ministry of Finance of Russia dated 05/06/2005 No. 03-02-07/1-116.

EXAMPLE 4

The head of Yenisei CJSC sent an appeal to the Moscow Department of the Federal Tax Service of Russia. The appeal indicated that the tax inspectorate, as a result of an on-site tax audit, made an unlawful decision regarding tax liability against Yenisei CJSC.

The head of Yenisei CJSC asked a higher authority to cancel this decision. At the same time, the disputed tax inspectorate act and the taxpayer’s objections were not attached to the request.

The Federal Tax Service of Russia in Moscow sent a response to Yenisei CJSC refusing to consider the complaint. The basis for the refusal was that the documents necessary to consider the complaint were not available.

| BY THE WAY |

| Appeals via electronic communication channels |

Today, telecommunication technologies have become widespread. Therefore, taxpayers often contact the tax authorities either by email or by leaving their question on the website. Naturally, in this case it is impossible to confirm the authority of the person who signed the request. In such situations, tax authorities are guided by the Procedure for receiving and considering applications to the Federal Tax Service of Russia in electronic form. The procedure is posted on the website of the Federal Tax Service of Russia www.nalog.ru.

Applications with incomplete or inaccurate sender information will not be considered. Applications that contain issues that are not within the competence of the Federal Tax Service of Russia or that require, in accordance with the established procedure, the presence of certifying details (signatures, seals, etc.) are also not accepted for consideration.

Documents transmitted electronically without using electronic signature technology in the prescribed manner have no legal force. This method can be used to transfer documents that do not require authentication.

Thus, if a taxpayer’s appeal sent to the tax authority’s website raises a question about a specific economic situation that arose in the course of business, the answer may not contain the necessary information. Indeed, in this case, to resolve the issue, identification details (signature, seal, etc.) are required. Therefore, it is better to state the issue in a general form in your appeal, rather than touch upon a specific situation.

And one last thing. Taxpayers must contact the tax authorities at their place of registration. An appeal to higher tax authorities is possible only if the taxpayer doubts the correctness of the answer or if the answer is not received at all. Moreover, the taxpayer’s request and the authorized person’s response can be either oral or written. As for the request to the financial authorities, it must always be in writing.

When to respond to an official letter

Not all incoming correspondence that comes into an organization requires a written response. For example, a response to an information letter, as well as to letters of guarantee and advertising, is not required. Already at the stage of reception and initial processing, incoming letters are sorted in order to promptly familiarize the manager with them. He writes letters requiring a response to the performers.

A response to a letter is required if it contains:

- order;

- request;

- request;

- invitation.

Note! The request or order may also contain accompanying letters.

Letter of order

Such letters are sent, as a rule, by higher and parent organizations, line ministries and departments, control and supervisory authorities and executive authorities.

The response to the letter containing the order must be prepared by the deadline specified in the incoming document. The letter of instruction after the introductory part may contain the phrases: “In connection with the above, I propose...”, “Taking into account this, before .... 2020 must be prepared and sent to us ....”, “In pursuance of the provisions of the law .... ensure by… 2020…”.

Letter of request

This letter contains a request addressed to the addressee. Typically, the purpose of the document is to obtain specific information, goods or services that the author of the letter needs. This category of incoming documentation is drawn up on letterhead. It contains the following phrases: “We ask you to notify about...”, “We ask you to inform...”, “We ask you to take action...”, etc.

In some cases, a business paper may contain not a direct request, but a wish. For example, “We hope to consider your appeal...”. In this case, the document must contain the appeal itself or a description of the situation that requires taking certain measures.

Request letter: sample

There are also situations when one letter of request contains several requests. In this case, the design rules require that each of them be described in a separate paragraph. In this case, each subsequent paragraph containing a request should begin with the words “We also ask you to take measures...”, “At the same time, we ask you to pay attention...”, “At the same time, we ask you to consider...”, etc.

A response letter to the request must be sent. Although letters of request and letters of request are very similar in style and content, the request has one distinguishing feature - the document's rationale.

Letter of request: sample

View sample in magazine

Request letters refer to official letters that are sent to the addressee in order to obtain certain information, documents and business papers. This document has a justification, which is indicated by the author of the request. As a justification, he may indicate a reference to a government document, regulation or law, according to which the author has the right to familiarize himself with information or business papers. Also justified by reference to organizational and legal documents that allow you to familiarize yourself with certain information. And precisely because there is a legal justification, a response letter to the request must be prepared and sent without fail. Below we provide an example of a response to a request letter.

Letters of invitation

Although invitations to various events do not require the addressee to send a response letter, in many cases such a need is dictated by business etiquette. In this case, it is advisable to issue a response message as early as possible. If this is not possible, you can notify the inviting party of the decision.

Who has the right to sign the request?

An authorized representative of an organization acts on the basis of a power of attorney issued in accordance with civil law. Therefore, a request to financial or tax authorities must be signed by either the manager or an authorized representative. The latter attaches to the request a power of attorney or a copy thereof certified by the head of the organization.

If the request was signed not by the manager, but, for example, by the chief accountant or legal adviser, and documents confirming his authority are not submitted, the tax authority will refuse to consider such a request. The reason for this is the lack of grounds for consideration. Only a legal or authorized representative of the organization has the right to receive information or clarification.

Please note : appeals from founders who are not legal or authorized representatives will also not be considered.

Employees of auditing, consulting and law firms can be authorized representatives of the taxpayer organization. Therefore, if they have a power of attorney, they can also make requests to the competent authorities, but on the condition that they do this on behalf of their clients. Tax and financial authorities are not required to explain tax legislation to firms specializing in the provision of consulting services in connection with the problems of their clients. At the same time, such firms can apply to government bodies as taxpayers.

Letter of request to the bank

Letters to the bank help in resolving many controversial issues and clarifying the necessary information. Required formalities:

- correct indication of the details of the author of the letter;

- clear statement of the problem;

- if possible, links to documentary or legislative evidence of your words;

- An online request to the bank should be sent only if you have an electronic signature; in other situations, a paper version with a handwritten visa is preferable.

Open and download online

FILES of the letter of request to the bank .doc

In JSCB "Mosbank" 123790 Moscow, st. Vysokaya, 78 from Dmitry Yakovlevich Linchevsky, living at the address: 123908, Moscow, Oktyabrskaya St., 90, apt. 213, tel. 222-66-88 e-mail:

About debt restructuring

between me, D.Ya. Linchevsky, and JSCB Mosbank, a loan agreement No. 5609/13 dated was concluded on the following terms: loan amount: 500,000 rubles, for a period of 2 years (date of final repayment of the loan ), interest rate 17%, intended use - buying a car.

According to clause 5.6 of the Agreement, it is possible to change the interest rate or loan repayment period either by agreement of the parties or unilaterally out of court.

Over the past year, my financial condition has deteriorated. This is due to my serious illness, which is confirmed by temporary disability certificate No. AO 1507285.

During the validity of this Agreement, I promptly paid the Bank for all obligations, including the loan amount, interest and commission. As of the date of today's appeal, I have no overdue debt.

Taking into account the above, I ask you to restructure my debt under this Agreement: lower the interest rate to 15% per annum or extend the amount of the debt for a period of 1 year.

Please notify me of the results of the consideration of the application in writing and by e-mail to the addresses indicated above.

/Linchevsky/ D. Ya. Linchevsky

If the explanation is wrong

No you can not. The execution of written explanations on the application of tax legislation, if they are given by financial authorities (other authorized state bodies) or their officials within their competence, is a circumstance that excludes the guilt of the taxpayer. This is stated in subparagraph 3 of paragraph 1 of Article 111 of the Tax Code of the Russian Federation. If the explanation goes beyond the powers of the relevant government body, the taxpayer’s fault is not excluded.

EXAMPLE 5

As a result of an on-site inspection of Berezka LLC, tax officials revealed a gross violation of the rules for accounting for income and expenses of the organization. In this regard, the taxpayer was given a tax audit report, which indicated the confirmed fact of the offense.

Head of Berezka LLC N.N. Petrov pleaded not guilty, saying that he was guided by the explanations of the tax authority. However, the inspection letter referred to by N.N. Petrov, contained clarification on accounting issues. And since accounting and reporting issues fall within the competence of the Russian Ministry of Finance (and not the Federal Tax Service of Russia), inspection officials brought Berezka LLC to tax liability for the offense committed.

Another situation is also possible. The erroneous response was publicized in the media and exploited by another taxpayer. This also resulted in a tax violation.

How to correctly write an application to the tax office for the provision of information?

To collect debt from a debtor, you need to prepare two documents:

- An application to the tax authorities about the availability of funds in the bank from the borrower.

- Application to the bank for debt collection using a writ of execution.

There are no rules regarding requests to obtain information about the debtor's accounts. Therefore, the application is processed in a free format. The main thing in this declaration is that the information entered about the debtor is sufficient to identify him. And of course, the request must be drawn up in a business style, like any official letters of this kind.

In an application to the Federal Tax Service, when displaying data on the availability of funds in the debtor’s bank, the following must be indicated:

- Information about the applicant (full address with postal code, full name, contact telephone number).

- Content section. Here you need to display data about when and by what structure the executive decision was issued, indicating the details in a separate line.

- Motivated section. It is required to provide all information about the availability of funds in the debtor's bank.

- Request section. This indicates what needs to be done by the applicant.

- Information about the debtor, displaying information about: TIN, full name, legal address, name and OGRN.

- At the end of the application the date and personal signature of the applicant are placed.

You can additionally inform the appeal about the form in which it is desirable to send a response.

As additional arguments, you can present your passport along with the original executive act, which will increase the chances of receiving a positive response.

When accompanying additional materials, you need to make sure that at the time of contacting the Federal Tax Service, the total deadline for the documents presented has not expired.

To send such an application, you need to prepare materials in 2 copies. When accepting materials, the inspector checks the compliance of the original with the provided photocopies and, if there are no comments, returns the original to the owner and puts a mark on the applicant’s copy to accept the papers for consideration.

Compilation rules

The law does not define a single form for a letter of request, therefore a document is drawn up in any form in compliance with a number of rules. It must contain:

- “Header”, which indicates information about the sender and addressee (full name of the structure, legal and actual address, contact information).

- The date and place of its compilation.

- The registration number of the letter under which it is noted in the journal of sent correspondence.

- Title of the document.

- Addressing the addressee. As a rule, addresses by name and patronymic with the prefix “respected” are used. The exception is letters to official government agencies.

- The main essence of the request.

- Signatures of authorized persons and seal of the organization.

The “body” of the document, i.e. It is advisable to start the request itself with justification of the reason. There is no need to describe it in great detail, one phrase is enough. For example, “based on a previously concluded agreement on...” or “in accordance with regulatory act No...”, etc.

The request should state only one specific request or proposal in a concise form. Of course, if the sender has several small requests, it is not worth sending multiple requests to one recipient. If the situation that led to the need to make a request is non-standard, you need to describe it in more detail. So that the addressee has no questions about this.

Any request initially requires an answer. If the sender needs it urgently, this fact must be indicated separately. For example, “a response to this request must be provided within five working days” or “in order to avoid misunderstandings, please respond as soon as possible”, etc.

At the end of the letter, it is advisable to indicate the desired method of response. This could be a request to send:

- Paper registered letter to the designated postal address.

- Email to email.

- Fax message.

- Letter with courier delivery.

https://youtu.be/YtZ4NRMinno

First of all, you should remember that the answer should be written by the exact employee of the enterprise to whose name the initial letter was written. Exceptions are possible only in cases where this employee is absent for some reason (sick leave, business trip, dismissal) - then the answer can be written by the one who replaces the currently absent person.

The language and presentation of the message should mirror the request letter. In other words, it is advisable to use in the text the same form of address that the sender of the request used, the same vocabulary, terminology, linguistic expressions and sequence of presentation, of course, provided that the author of the initiative message has proven himself to be a competent and correct person.

It is necessary to indicate a link to the number and date of the incoming message, but you must not repeat the mistakes made by the author of the request and it is undesirable to indicate them in the response letter (only if this does not relate to the specific activities of the company).

The answer to the request can be either positive or negative.

- A positive answer should be as detailed as possible,

- and the negative one is justified and extremely correct.

In addition, if a request is refused, it would be good practice to provide the author with information about under what circumstances the answer may be positive.

In any case, the response letter should be written in the most polite manner possible. It is advisable to avoid empty replies, and even in the absence of the necessary information, you must write a response with restraint, politely and respectfully towards the author of the request. Rudeness, as well as deliberately false information, are completely unacceptable.

Procedure for notification of accounts (legal entities, individual entrepreneurs, individuals)

The resident is obliged to notify the tax office at the place of registration about the opening (re-registration) of accounts (deposits) and about bank details in banking facilities located outside the Russian Federation no later than one month according to the template established by order of the Federal Tax Service of the Russian Federation No. ММВ-7-6/ [email protected] dated 09/21/2010 and registered with the Ministry of Justice of the Russian Federation on 10/18/2010, registration number 18746. This template (KND 1120107) can be downloaded from the link, xls.

In addition, by order of the Federal Tax Service of the Russian Federation No. ММВ-7-14/ [email protected] dated November 14, 2013, taking into account the amendments that were included in the order of the Federal Tax Service of the Russian Federation No. ММВ-7-14/ [email protected] dated December 20, 2013 , recommended forms for submitting reports on accounts and deposits in foreign banks via the Internet.

According to Article 319 of the APC (arbitration procedural code) of the Russian Federation, the execution form is handed over to the lender, or, at his request, sent by the arbitration court for collection.

To execute a court ruling, the creditor submits a request to the tax authority for the release of data on the availability of money in the borrower’s bank. At the same time, the lender needs to take into account that clause 2 of Art. 102 of the Tax Code of the Russian Federation states that the tax authority does not have the right to disclose data on the names of banks and other credit institutions, and the borrower’s current accounts. Therefore, such data must be requested on the basis of legal norms, the essence of which is that the claimant has the right to receive the required information about the availability of funds in bank settings and deposits of debtors within the limits imposed by the court.

Taking into account the above, tax authorities can issue a response to the claimant’s request for the availability of funds in the borrower’s bank only if they provide the original or a notarized photocopy of the writ of execution, the validity of which has not expired.

After the tax officer checks the availability of the original enforcement form and other materials on the petition, the original documents are returned to the claimant, and the claimant’s declaration is accepted for consideration.

Methods for submitting documents

To send notices on the debtor's accounts, the collector can contact any territorial structure. Of course, it is more convenient if the claimant contacts the territorial authority at the place of registration. When delivering materials in person, you must present the original writ of execution for verification by a tax inspector. When sending papers by another method, it is necessary to attach a copy of the writ of execution certified by a notary to the message.

At the same time, you must make sure that the collection time has not expired.

You can send a request to purchase data about the borrower in the following ways:

- Submission to the tax office in person.

- By registered mail with acknowledgment of receipt.

- Via the Internet using an electronic signature

Having sent the request, the Claimant must wait for a response to his application. In this case, the tax structure is obliged to send a response within 7 days from the date of registration of the letter (Law No. 229-FZ, Part 10, Article 69). At the same time, on the basis of the same Law, the tax authority may refuse to provide data on the availability of funds in the borrower’s bank to the creditor in the following moments:

- In the absence of a writ of execution in the claimant's request.

- Upon presentation of an executive act with expired validity.

The Law does not provide for other grounds for refusing to respond to a request.

Sample request to the tax office for information

Below is one of the options for a sample application for obtaining data on the availability of funds in the debtor's bank.

Registration of the form

For the legality of submitting a request to the tax office, the creditor must have a positive court decision to return the debt. A copy of the writ of execution or court order is attached to the appeal. The duplicate is certified by the court. For bailiffs, the substantiation of the application will be enforcement proceedings, for arbitration managers - bankruptcy proceedings.

To provide information about the accounts of a particular defaulter, the applicant has the right to contact any territorial department of the Federal Tax Service. This position was confirmed by the tax office in letter No. GD-4-14/7818. All information about taxpayers is digitized and stored in a single database. Therefore, preparing a response for inspectors in any area will not be difficult. Information is provided free of charge; payment of a budget fee is not required.

An application for the provision of information about the defendant’s accounts opened by the bank is drawn up on paper or in electronic form, depending on the method of sending it to the addressee. There are no strict requirements for the content of the document. It is important to justify the legitimacy of the request and the purpose of using confidential information.

When submitting an application, the main thing is to draw it up in accordance with the rules

An example of an appeal can be downloaded via the Internet, drafted yourself, or use the services of a practicing lawyer. The header of the document must indicate the name of the organization to which the application is being sent. Next, contact information about the applicant is written down: full name, passport details for individuals, full details for organizations.

In the descriptive part of the form, the claimant sets out the factors that allow such requests to be made. At the next stage, you need to describe the basis document in detail. For example, a citizen will write the number of the trial, information about the writ of execution. In the petition part, the applicant asks to provide information in a certain way: by mail, through a personal account, State Services, etc.

The main point of filling out an application to the tax office is to provide contact information about the debtor. For legal entities, you must indicate the full name, INN, KPP for identification in the system. For citizens, you will need a name, passport details, preferably an INN. The final moment is affixing the date, personal signature, and seal for organizations.

When sending an application by mail, it is recommended to prepare two sets of documents and make an inventory of the contents in the envelope. Requests are submitted in the same way through the office of the Federal Tax Service: on the second copy of the application, the secretary of the service will affix the appropriate acceptance stamp. Claimants should take into account that upon expiration of the deadline for presenting a writ of execution for satisfaction, information about the accounts will not be provided.

Information about the availability and status of the defaulter’s current accounts opened with a credit institution helps the creditor predict the likelihood of repayment of claims. Based on the amount of the balance of funds and valuables in storage, the claimant is determined with the place of presentation of the writ of execution. Such actions allow you to achieve maximum efficiency in recovering debt from an unscrupulous borrower.

Sample request to the tax office about the debtor's open current accounts

The accounts and their arrest will be discussed in the video:

https://youtu.be/HQmmXi-PGRU

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

Free consultation with a lawyer Request a call back Still have questions? Call the number and our lawyer will answer all your questions for FREE