Home / Labor Law / Vacation

Back

Published: 05/09/2017

Reading time: 8 min

0

5580

It is a rare person who can boast of absolute health; Not only workers, but also their relatives get sick.

In cases where an employee needs to take care of a sick relative, he can issue a sick leave certificate. At the same time, the receipt (or non-receipt) of social compensation depends on the correctness of its registration.

- Legislation

- Conditions for taking this type of vacation

- When can leave be denied?

- Vacation period

- How to apply correctly?

- Payment

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

The procedure for granting sick leave to care for a sick relative

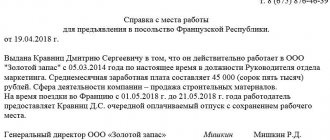

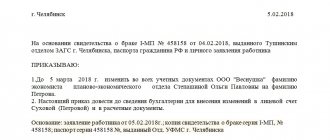

The social insurance system in the Russian Federation guarantees that an employee will retain his average earnings in the event of his own illness or the incapacity of his family members. If an employee’s relative falls ill and the employee is forced to care for him, the medical institution issues a certificate of incapacity for work, which can be brought to work and received temporary disability benefits during absence from the workplace.

The employer is not obliged to find out who the employee’s sick relative is (Part 5, Article 13 of Law No. 255-FZ of December 29, 2006). To indicate a family relationship on a sick leave for caring for a sick relative, there is a special field where the doctor enters one of the following codes:

38 - mother,

39 - father,

40 - guardian,

41 - trustee,

42 - another relative (clause 58 of the Procedure for issuing certificates of incapacity for work, order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n).

The legislation establishes a ban on paying sick leave to care for a sick relative in the following cases:

- if a chronic patient is in remission;

- if the employee is on maternity leave or to care for a child under three years old and does not work part-time. If an employee works from home or for several hours a day, then she is paid sick leave according to the general rules;

- if the employee was on study leave or leave at his own expense;

- if health problems with an employee’s family member arose during downtime.

Should I pay for sick leave to care for a sick child if the employee works remotely and can work despite the child’s illness? The answer to this question is in ConsultantPlus. If you don't already have access to the system, get a free trial online.

If a relative falls ill during an employee’s vacation, the vacation is not extended by the number of days of illness, except in cases where the extension is provided for by a local act of the employer. The benefit is paid for the period of sick leave that coincides with the days of vacation, but is not paid. Only days of illness of a relative falling on the days after the vacation are subject to payment (Article 124 of the Labor Code of the Russian Federation, letter of the Ministry of Labor of Russia dated October 26, 2018 No. 14-2 / OOG-8536).

For more information about calculating disability benefits during vacation, read the article “How to extend vacation for sick leave during vacation.”

IMPORTANT! The benefit calculated for a full calendar month, calculated for periods of incapacity for work from 04/01/2020 to 12/31/2020, cannot be lower than the minimum wage. For details, see the material “How to calculate sick leave from April 1, 2020 under the new law.”

The doctor will issue sick leave to care for sick parents or other relatives for the entire period of their illness, but there is a limit on the number of days that must be paid.

How is sick leave issued to a relative if an adult family member requires care?

The concept of an adult relative means that a family member has reached the age of 15. If the patient is treated in a hospital, then there is no time limit for caring for him. When a patient is undergoing outpatient treatment, sick leave is paid to the person caring for a sick relative within 7 days. Regardless of whether the sick leave is extended or not, the state enterprise or private employer will not make any payments.

A certificate of incapacity for work justifies the absence of an employee from the workplace. In accordance with Russian laws, this document gives the right to receive a certain amount of money. However, there are situations when the local pediatrician refuses to issue sick leave. If the patients have recovered, then the attending physician does not have the right to extend the certificate of incapacity for work for the caregiver.

Caring for an adult family member involves sharing a hospital stay with him or her. A certificate of incapacity for work can be issued to citizens of the Russian Federation who have health insurance. It can be obtained by stateless persons or foreigners if they are individual entrepreneurs or government employees.

Leave to care for a sick relative is provided for Russians and foreign citizens on the same basis. To get it, you need to know which medical institutions to contact. Compulsory social insurance gives the right to receive benefits for temporary disability. Payments are governed by federal laws. A prerequisite for receiving them is the payment of taxes and insurance premiums. The employee's salary may or may not be retained.

If a woman is on maternity leave, she will not be given sick leave so that she can care for a sick relative. Caring for a chronically ill patient when he or she is not experiencing an exacerbation of the disease is not a sufficient basis for issuing sick leave. It is issued only on the basis of a passport or other identification documents.

The nuances of paying sick leave for child care

But providing sick leave for childcare has many nuances. First of all, the limit of paid days depends on the age of the child and his illness.

Important! Children are recognized as children of an employee (including non-relatives - stepsons and stepdaughters, as well as wards and adopted children), grandchildren, minor brothers and sisters.

If the child is under 7 years old, then the entire duration of illness is paid, but not more than 60 calendar days per year (90 days for some diseases).

Read about changes in the procedure for issuing sick leave to care for young children from April 10, 2018 here.

To care for a child over 7 years old but under 15, 45 calendar days per year are given. Social insurance will not pay the employee for the following days. Each sick leave can be no more than 15 calendar days, unless the medical commission recognizes the need to treat the child longer.

For a child over 15 years of age, the following rules apply: 7 calendar days of illness are paid; the annual limit on paid days of incapacity is 30 calendar days.

Attention! Limits for sick days for children are calculated based on age at the time of illness.

For some diseases from the list of orders of the Ministry of Health and Social Development of the Russian Federation dated February 20, 2008 No. 84n, the number of paid days increases. Such diseases include malignant tumors, severe developmental disorders and diseases of the nervous system, asthma, tuberculosis, meningitis, serious limb injuries, burns and some other diseases. In such cases, sick leave for caring for a patient can be paid for all days of illness.

Attention! Care for disabled children until adulthood is paid in full for the entire period of illness, but not more than 120 days a year (Clause 5, Article 6 of Law No. 255-FZ of December 29, 2006).

What other payments are due to disabled people, read the material “Compensation payments under the social security system.”

To account for the number of paid days of incapacity for work of a relative, the company counts only those days when the patient was cared for by an employee of the company. That is, a child could be sick 90 days a year, of which 20 days he was cared for by his mother, a company employee, another 20 days by his father, who works in another organization, and the remaining 50 days by his retired grandmother. You take into account only 20 days of mother's sick leave.

You can also take care of a child during the mother’s leave to care for him - she herself does not have the right to receive payment for a certificate of incapacity for work, but the father caring for the child or any other relative can claim payment for sick leave.

The first 10 days of illness of a child (regardless of his age) during treatment at home are paid taking into account the insurance experience of the caring worker. Starting from the 11th day you need to pay 50% of average earnings. If a child is being treated in a hospital, then payment for all days is based on the insurance period (Part 3, Article 7 of Law No. 255-FZ).

If an employee’s several children were sick at once, then a common sick leave certificate is issued (clause 38 of the Procedure for issuing certificates of incapacity for work, order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n). But the limits on paid days for each child must be taken into account separately. The certificate of incapacity for work does not have a field to indicate how long each child was sick, so we recommend that you ask the employee for a certificate from a medical institution about the periods of illness of each child.

If you want to check whether you have correctly calculated the allowance for caring for a sick child, use the advice of ConsultantPlus experts. Go to the Ready Solution with a free trial access to the legal system.

Calculation of the number of paid days

Sick leave for caring for a sick relative is subject to payment for different periods, depending on the category of the sick family member.

When caring for a child aged 7-15 years, the maximum paid period does not exceed 45 days during the calendar year. For parents whose children are over 15 years old, such sick leave does not exceed 7 days.

Family members can apply for sick leave for up to 60 days when caring for a child under 7 years of age. The limit on the paid period increases to 90 days if a child is diagnosed with a pathology included in the register of the Ministry of Health and Social Development of the Russian Federation. Details of the extension are specified in Order of the Ministry of Health and Social Development of Russia No. 84n.

120 calendar days is the paid limit when caring for a child under 18 years of age with a disability.

The law provides for the removal of limits on the number of paid days for family members caring for an HIV-infected child under 18 years of age. The same is true for children under 18 years of age who have complications after vaccination. Sick leave is paid for the entire period of stay of a relative with a patient undergoing inpatient treatment in a medical institution.

For reference. Exceeding the established limits does not entail dismissal. Since absenteeism is due to a valid reason, the employee retains the job. However, these days are not paid.

Sick leave to care for a sick adult relative undergoing outpatient treatment is issued for a period not exceeding 7 days. The benefit is paid regardless of the pathology.

In accordance with Article 6 “Conditions and duration of payment of benefits for temporary disability” of Federal Law No. 255-FZ, the total period of the paid period for all cases of illness can be up to 30 days within one year.

Is it possible for a grandmother to take sick leave to care for her grandson?

If a child becomes ill, in some circumstances there is no choice but to provide care with the help of the grandmother. This is allowed by law, and a grandmother should be provided with sick leave to care for her grandson if she works.

Sometimes employers require proof that they live at the same address. However, such a request is unlawful, since it is not legally defined and can be ignored.

Payment of sick leave to the grandmother is made in the usual manner on the basis of the norms contained in paragraph 5 of Art. 6 Federal Law dated December 29, 2006 No. 255-FZ.

Common mistakes

Error: The employee demands that the employer issue sick leave for him to care for a relative on the grounds that he was given a sick leave.

Comment: Receipt of sick leave by a relative does not guarantee that the employee will also receive the opportunity from the employer to go on sick leave - there must be good reasons for this, for example, a threat to the life of a loved one who is left without care from third parties.

Error: An employee demands sick leave to care for a disabled relative of group 1.

Comment: Sick leave is not issued for caring for disabled people, since they constantly need care, and the absence of an employee at the enterprise threatens the business of the company owner. Disabled people receive a disability pension, part of which can be spent on paying for the services of a nurse.

How to apply for sick leave to care for a disabled person

When issuing and paying sick leave certificates to employees who need to care for a disabled person, the following rules apply:

- To care for a disabled child under 18 years of age ( from 04/10/2018 ), sick leave can be issued for the full period of treatment, however, no more than 120 days in a calendar year must be paid at the expense of the Social Insurance Fund. This period may include different types of treatment (outpatient and inpatient) and various types of diseases. Sick leave is paid according to the following scheme:

- for inpatient treatment, the average monthly salary is paid;

- for outpatients - 100% payment for the first 10 days of illness, 50% payment for all subsequent days.

- Caring for disabled adults is accompanied by sick leave issued for the same periods as sick leave for caring for a parent or caring for sick relatives - 7 calendar days for each disease. You cannot be on sick leave for more than 30 calendar days per year.

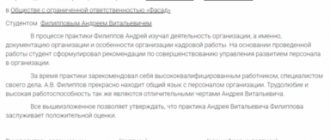

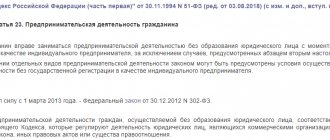

Features of obtaining sick leave for individual entrepreneurs

An entrepreneur who is officially engaged in individual business transfers funds to the Pension Fund and the Social Insurance Fund. Therefore, as a participant in the insurance system, he has the right to sick pay. To receive benefits, an individual entrepreneur must:

- Contact a doctor at the clinic and apply for a sick leave certificate.

- Submit an application to the local branch of the Social Insurance Fund, which contains a request to pay for the period of incapacity for work and transfer the funds to the specified account.

- Prepare copies of receipts confirming the availability of contributions to the Social Insurance Fund.

- Submit documents to the local FSS office.

Sick leave payment amount:

- depends on the individual entrepreneur’s work experience;

- determined by the minimum wage.

The benefit amount is calculated as follows:

Example 2. Individual entrepreneur G. Yu. Belova received an exemption from work to care for her sick mother from April 3 to April 7 of this year. She regularly paid funds to the Social Insurance Fund. Belova has three years of insurance experience.

Payment is made in the amount of 60%, since Belova has less than five years of experience. In the part of the sick leave form that is filled out by the employer, the following is written in the line for the place of work: Individual Entrepreneur and Last Name. Below: registration number, TIN, SNILS.

Important! Individual entrepreneurs should conclude an agreement with the Social Insurance Fund in advance and make regular payments. Then getting sick leave to care for your father or mother will not be difficult.

Results

Many companies are afraid to hire women with children because they believe that the cost of paying average wages during sick leave will fall on the employer - this is not the case. Payment for certificates of incapacity for work is reimbursed by the Social Insurance Fund. The state regularly reviews the rules for paying sick leave and expands the list of diseases for which days of incapacity for work are paid in full. In order not to miss important changes in the rules of social insurance for employees, read our “Salaries and Personnel” section.

Sources:

- Labor Code of the Russian Federation

- Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n

- Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 N 255-FZ

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.