How is the dismissal of employees due to liquidation carried out?

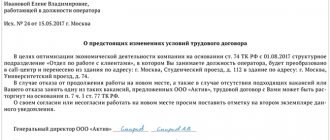

An important point in successfully fulfilling the legal requirements regarding the dismissal of employees in connection with liquidation is the mandatory notification that is sent to each employee of such an organization two months before the date of its official final liquidation.

Such a written personal warning is prepared in any form. It does not have a fixed form. In most cases, a special form of the organization is used.

This notification requires the following information:

- About the reasons for the proposed dismissal and its date

- About the guarantees that an employee will be provided upon dismissal

Important: The fact of familiarization with the notification can only be confirmed by his personal signature.

Such notices are sent to each employee 2 months in advance, with the exception of those hired for seasonal or temporary service.

Next, the liquidated company and its personnel services should take the following actions:

- Inform the employment center about the emergence of new unemployed personnel in production

- If there is a trade union organization at the production site, notify its managers of the upcoming dismissal

- Calculate all mandatory payments to each employee that will need to be made directly on the date of dismissal or earlier than the date of dismissal

- Prepare appropriate orders

- Make appropriate entries in the work books of each employee

An important difference between dismissal due to liquidation of production is the need to formalize the termination of relations with each employee enrolled in the staff, regardless of the social guarantees that apply to him.

Including, as a general rule, relationships are terminated with such representatives of socially protected groups as:

- pregnant women;

- parents on maternity leave to care for a child;

- single parents;

- minor workers;

- those who were on vacation or had sick leave at the time of notification of liquidation.

All representatives of these categories on the established date of liquidation .

Upon dismissal, each employee receives an increased payment , calculated on the basis of average monthly earnings. Further, the average earnings are retained for two months, including severance pay, and can be retained for a period of 3 months by decision of the employment service authority.

True, the latter is assumed only in the case when the employee is registered with the employment service within two weeks after the date of official liquidation of production. This amount is paid if there is no information about acceptance to a new duty station.

Payments and compensations

Liquidation of an enterprise is impossible without full settlement with employees.

You need to know some features related to the calculation of money due to the head of an organization.

As a hired employee, the manager has the right to receive all those guaranteed in Art. 279 and 178 of the Labor Code of the Russian Federation of payments.

These include:

- Basic salary for actual hours worked.

- Severance pay equal to three average monthly earnings.

- Compensation for unused vacation days in the current year.

The amount of benefit for three months cannot be less than the amount established by the legislator. If the employment contract provides for other payments or an increased amount of compensation, the clauses of the contract are subject to mandatory execution.

If the director, who is also the founder of the organization, has not written a letter of resignation of his own free will, which implies the absence of compensation, and will be dismissed precisely in connection with liquidation, it is necessary to keep in mind:

- Art. should be applied. 181 Labor Code of the Russian Federation;

- Compensation payments must be issued within the time limits specified by law.

Important: the lack of funds for compensation payments in the LLC budget creates the need to write a letter of resignation of one’s own free will.

If bankruptcy proceedings are initiated by a decision of the Arbitration Court, the director is subject to dismissal within three days. The legislation does not provide for monetary payments and compensation to the manager in this case.

It is important to understand that if the director had nothing to do with financial documentation and did not sign lending documents, the bankruptcy procedure will not affect him. In cases where the general director certified the company's guarantee obligations and signed loan agreements, he may be held liable in court for actions that led the company to bankruptcy.

The figure of the director of the company is important and responsible. The position presupposes the presence of not only rights, but also responsibilities for conducting activities. Upon liquidation of the enterprise, the manager is subject to dismissal. However, the procedure differs for persons who are employees or who are founders of an LLC.

This fact plays a decisive role in the dismissal procedure and the calculation of compensation payments. The employer has no right to force employees to terminate their employment relationship at their own request. However, their right to dismissal on their own initiative or by agreement of the parties is not disputed.

What regulatory documents should be used?

When formalizing such termination of an official relationship, the following are used:

- the first part of Article 81 of the Labor Code of the Russian Federation (LC RF);

- Article 176 of the Labor Code of the Russian Federation;

- Federal Law of November 14, 2002 No. 161-FZ “On State Municipal and Unitary Enterprises,” which defines the procedure for liquidating production for various legal reasons;

- Article 140 of the Labor Code of the Russian Federation, which determines the terms of settlement with dismissed employees

- Article 142 of the Labor Code of the Russian Federation assumes the employer’s liability for violating the terms of payment of wages and severance pay of the country’s Civil Code and some other regulatory and legislative documents.

Legal acts governing the dismissal procedure

The fundamental legal act here is the Labor Code of the Russian Federation. In particular, it establishes that:

- an entry must be made in the work book indicating that the contract has been terminated (Article 66);

- provides for termination of the contract by the employer if the organization or individual entrepreneur ceases its activities (clause 1, part 1, article 81).

The rules directly governing the entry of notes into an employee’s personal document during the liquidation of an enterprise are contained in the “Rules for maintaining and storing work books,” which were established in 2003 by Government Resolution No. 225.

These Rules contain information that:

- the reason for dismissal is indicated as it is stated in the article of the Labor Code of the Russian Federation;

- if the contract was terminated at the initiative of the employer, then when filling out the line it is necessary to provide a reference to one of paragraphs 81 of Article of the Labor Code of the Russian Federation;

- any entry must be certified by: the employer’s seal;

- signature of the employee who is responsible for filling them out, or an individual entrepreneur;

- owner's signature.

Information

Another important legal act is Resolution of the Ministry of Labor No. 69, adopted in 2003. It contains Instructions for filling out work books, which describe in detail the process of maintaining them.

Competently compiling an entry in the work book

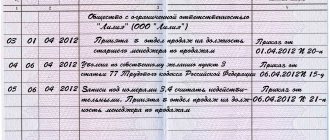

The basis for such a record is the Order on liquidation of proceedings. On its basis, an entry is made in the work book.

In this case, information about the reason for dismissal is traditionally entered in column 3.

It states “dismissed due to the liquidation of the organization, paragraph one of part one of Article 81 of the Labor Code of the Russian Federation.”

Column 4 indicates the date and number of the dismissal order.

Sample entry in the work book for dismissal due to liquidation of the enterprise

Arbitrage practice

Most often, cases of non-payment of compensation in connection with the liquidation of an enterprise end up in court. Claims regarding unpaid wages and benefits are in most cases successful and oblige to pay not only the standard amount of compensation, but also moral damages, as well as reimbursement of money spent on litigation.

It is quite possible to obtain unpaid severance benefits through legal action.

Remember that when liquidating an enterprise, it is important to carry out the procedure for dismissing employees correctly and step by step. This is the only way you can protect yourself from further litigation. First of all, notify the city employment service, trade unions and employees in writing no later than 2 months in advance that the organization will be liquidated after some time and its employees will be fired. Then correctly calculate the amounts of payments and compensation to employees, issue the appropriate orders and enter all the information in the work books. On the last working day, give employees their work books, make all required payments and make sure that the dismissed employees have signed all financial and personnel documents. Only after this the issue with the dismissed employees will be finally closed.

Liquidation procedure

An organization may be liquidated in accordance with:

- with the decision of the founders;

- with a court decision in the event of actions prohibited by law on the part of the enterprise or in the event of its being declared bankrupt.

Civil legislation (Articles 62.63 of the Civil Code of the Russian Federation) determines the procedure for liquidation.

The legislation also provides for the necessary measures:

- written notification of the Rosreestr authorities about the decision made and the beginning of the liquidation procedure;

- organization of a liquidation commission with the transfer of powers to manage the company for the period of liquidation;

The liquidation procedure provides for the mandatory resolution of issues regarding the termination of employment relations with the company’s personnel. As a rule, 2 months before the start of the dismissal of the first employee, it is necessary to notify the employment service in writing about the implementation of relevant measures, indicating the number of workers to be released, their professions, positions, qualifications and information about the working conditions of each.

Video about liquidation of enterprises

Each employee should be notified in writing personally about the prospects of dismissal 2 months before the planned layoff against signature. If an employee refuses to sign on the notification form, HR department specialists draw up a report with a mandatory indication of the date of notification; Then it is necessary to issue a dismissal order, calculate the necessary labor benefits and make their payment. A HR specialist enters records of dismissal due to the liquidation of the company into the work books.

Voluntary and forced liquidation of an enterprise

Whatever the reason for liquidation, it is an equally difficult process for both the employer and the organization’s personnel. However, the decision to terminate activities by the founders of the organization gives employees certain guarantees upon dismissal, since settlements with the personnel must be made first.

Forced liquidation, including bankruptcy, can significantly affect the interests of employees in terms of the completeness of payments established by law during liquidation measures.

This form of liquidation involves violations of the law or the insolvency of the company, i.e., insufficient funds to make all payments. But there is no legislative difference for the dismissal procedure for any type of liquidation.

Payments upon dismissal due to liquidation: procedure and amount

On the day of dismissal, the employee must be issued a work book and a full payment must be made, which includes the following payments:

- salary for hours worked and unpaid until the issuance of a dismissal order;

- vacation compensation;

- severance pay.

Terms and amounts of payments

The deadlines are strictly defined by law - on the day of dismissal.

The amount of severance pay varies depending on the conditions of employment of the employee:

- full-time employees and part-time workers receive severance pay in the amount of average monthly earnings;

- employed in seasonal work - 2 weeks' average monthly earnings;

- An employee hired for a period of up to 2 months is not entitled to payment of benefits.

For those who pay child support

Alimony payers are provided with a special procedure for calculating compensation payments. Alimony is collected without fail from wages and compensation for unused vacation (minus personal income tax).

The deduction of alimony from the amount of accrued severance pay depends on the age of the recipient.

If the child is a minor, alimony is withheld, but if the recovery is directed at an adult, alimony is not deducted from the allowance.

If you are on sick leave

An employee has the right to receive payment for a certificate of incapacity for work if he manages to submit it to the accounting department of the enterprise before the date of actual liquidation of the company. If it is impossible to submit sick leave, the employee will not be paid for days of incapacity for work.

Vacation compensation upon liquidation of a company

Vacation compensation is mandatory for each employee. Even if an employee has worked for the company for less than 6 months, he has the right to compensation for unused vacation.

If the employee has used the vacation in advance, then the administration does not have the right to withhold vacation pay from the payments due. Calculation of compensation upon dismissal is made at the rate of 2.33 days for 1 month of unused vacation, rounding the number of months according to mathematical rules.

Opening a notary office has its own characteristics. Read about all the nuances of the work here.

What do you know about breeding chinchillas for business? Full information and secrets of the organization are in this article.