What is queuing

The organization sends the payment order to the banking institution. The bank is obliged to execute this order within 24 hours (based on clause 2 of Article 60 of the Tax Code of the Russian Federation). However, the company’s account may simply not have enough money to cover all payments. In this case, the order of payments becomes relevant. It is on this basis that the bank will execute payment orders. Write-off is carried out in the manner specified in Article 855 of the Civil Code of the Russian Federation. The priority varies depending on whether payments are voluntary or forced.

FOR YOUR INFORMATION! To establish the sequence of payments, there is a separate detail in the payment slip. It is placed in field No. 21.

The importance of the order of payments

Field No. 21 is practically not used when the organization has enough money for all payments. The banking institution makes payments in the order in which payment orders are received. That is, in calendar order. If there is not enough money in the account, they are written off in the sequence specified by law. That is, the principle of priority becomes relevant only under certain circumstances.

The order of payments must be indicated in the order by company representatives. The information provided in field No. 21 cannot be changed by the bank. If the order is recorded incorrectly, the banking institution simply does not accept the order.

That is, to prevent problems and delays, the accountant needs to know about the priority specified in the law.

How to fill out a payment order correctly?

A payment order (PP) is drawn up in form 0401060, approved by Bank of Russia Regulation No. 383-P dated June 19, 2012, but it is not mandatory for use.

To fill out the order correctly, it is recommended that you familiarize yourself with the rules and information about what information is indicated in a specific field:

- Field 21: order of payment. The number “1” is put here, because alimony is considered a priority. First, write-offs are made for them, then for other obligations.

- Field 17: Recipient's current account. The account details of the ex-wife are indicated where the money should be transferred.

- Field 19: payment term. Remains empty.

- Field 24: purpose of payment – “alimony”.

- Field 60: Payer's TIN. For individuals – 12 digits, for legal entities – 10.

How to collect alimony for previous years?

In total, there are about 110 fields in the order, but the above ones are the most important when paying alimony.

Important! Payments for the maintenance of a minor must be transferred monthly no later than 3 days from the date of payment of wages. For failure to meet deadlines, you will have to pay a penalty - 0.1% of the debt for each day of delay.

Legislative justification

From December 14, 2013, the priority is established on the basis of Federal Law No. 345 of December 2, 2013 “On making adjustments to Article 855 of the Civil Code of the Russian Federation.” The sequence of payments must be indicated in each order. Central Bank Regulation No. 383-P dated July 19, 2012 states that field No. 21 must be filled in when creating these documents:

- Payments.

- Collection order.

- Requirements.

- Payment order.

In field No. 21 there is no need to indicate the order in words. It is enough to enter one number. There are 5 numbers in total, each of which indicates a specific order. Sometimes this figure is not indicated. However, this is only possible if there are appropriate instructions from the Central Bank.

FOR YOUR INFORMATION! There are currently 5 queues. Accordingly, in column No. 21 one of 5 digits is indicated. Previously, there were 6 of these designations. But the sixth order was canceled by Federal Law No. 345 of December 2, 2013.

Sample payment to bailiffs for non-tax payments

One of the ways to pay debts is the sums of money that the defaulter’s employer transfers from his official income from production activities. The bailiffs, in turn, are obliged to submit to the accounting department of the enterprise where the debtor works, all documents that may serve as the basis for the implementation of court orders. These include a writ of execution. They must indicate all the necessary details for cash payments. A sample payment order for a writ of execution to bailiffs can be viewed on the Internet.

A payment order from the bailiff service is a special document containing detailed information on the purpose of payment. This payment order has the force of a judicial writ of execution. There are several different formats for a sample payment order to bailiffs:

Sequence of payments

Let's look at all the sequences and their digital designations:

| Code in column No. 21 | Type of payment | Approximate grounds for payment |

| 1 |

| Availability of orders from bailiffs, agreements on the payment of alimony, certified by a notary. |

| 2 |

| Availability of collection orders received by the banking institution. |

| 3 |

| There are settlement documentation, collection orders from various government agencies: Social Insurance Fund, Pension Fund and so on. |

| 4 | Other payments made on the basis of resolutions. | Availability of relevant court orders. |

| 5 | All other payments made by order. | Availability of invoices, agreements, contracts. |

The first priority payment is alimony payments. This priority is due to the need to protect family rights. Payments under the numbers 1, 2, 3, 4 can be made without the consent of the organization. This is due to the fact that payments are made on the basis of writs of execution.

The order of payment according to the writ of execution to bailiffs

- Initially, the total amount of income (earnings) of the employee must be calculated. After this, you need to make sure that deductions are allowed from the recorded income;

- Taxes are the first to be deducted from earnings. Personal income tax is a fixed rate of 13%;

- you need to calculate the total amount of liabilities;

- check whether this or that amount can be withheld from earnings. At the same time, do this so that it does not exceed the permissible value;

- draw up a table of penalties in proportion, observing their order.

In order to correctly execute the payment according to the writ of execution received by the employer for his subordinate, he must transfer this matter to his accountant, and he must draw up a payment order. The essence of the payment order to the bailiffs is determined based on the reason that led to such action (alimony, loans, etc.).

Features of using codes 3 and 5

If all payments are made by the company within the specified time frame, code 5 is written on the payment slip. It is relevant for taxes of any type: simplified tax system, income tax, property tax.

Code 3 becomes relevant when there is a demand for debt payment. For example, this could be a collection order in which there is a sequence.

IMPORTANT! If the debt was identified by the organization itself, the number 5 is indicated on the payment slip.

Sequence under different circumstances

In some circumstances, the accountant may have difficulty indicating the priority code. Let's consider typical situations.

Budget classification codes according to the writ of execution of the joint venture in 2020

One of the ways to pay debts is the sums of money that the defaulter’s employer transfers from his official income from production activities. The bailiffs, in turn, are obliged to submit to the accounting department of the enterprise where the debtor works, all documents that may serve as the basis for the implementation of court orders. These include a writ of execution. They must indicate all the necessary details for cash payments. A sample payment order for a writ of execution to bailiffs can be viewed on the Internet.

The enforcement system in Russia is structured in such a way that all debts that are collected due to the actions of UFSSP employees, according to the latest orders, initially go directly to the Service’s account. Reporting in this system must be consistent with current legislation. The CBC on the writ of execution of bailiffs in 2020 requires knowledge of all legal changes that have occurred to date.

Insurance premiums

Since 2020, responsibility for insurance premiums has been assigned to the tax authorities. Previously, it was carried by foundations. But the changes in question did not change the queuing code. If a scheduled payment is made, code 5 is indicated. If the payment is made on the basis of a collection request, a fine is imposed, code 3 is indicated. If the contribution for the company is made by a third party, code 5 is indicated.

Penalties and fines

What to do if the tax office has received demands regarding the payment of fines and penalties? Tax payments are made according to code 3. But the regulations do not say anything regarding penalties and fines. What to do? There is a letter from the Ministry of Finance No. 02-08-12/22232 dated May 8, 2014. It states that fines and penalties transferred on the basis of a tax order are assigned to code 3. If the company pays fines voluntarily, code 5 must be entered.

Payments upon account blocking

The account may be blocked by decision of the tax office. In this case, almost all calculations are suspended. However, some payments will continue. In particular, these are the following payments:

- Taxes paid on the basis of a collection order.

- Current payments of taxes, penalties.

Tax payment code is 3. Even when the account is blocked, requirements with codes 1-3 are fulfilled.

The account has run out of money

An organization can send orders to the bank for an amount that exceeds the amount in the account. It works like this: a banking institution receives an order from a company and then checks the amount of money in the account. Is it enough to carry out the assignment? If the money runs out, these are the possible ways the situation could develop:

- Orders with order 5 are immediately rejected (cancelled).

- Orders with a different order are placed in the queue.

Payments are executed as money arrives in the account. It must be borne in mind that the organization can at any time withdraw a payment in the queue.

Sample payment order

As mentioned earlier, the payment order form is approved by law, but you can deviate from it and use your own samples.

The document must contain the following information:

- number and date of registration of the PP;

- amount to be received by the bank and written off;

- payment type;

- information about the payer. Individuals indicate their full name and registration address, legal entities - name and address;

- recipient's name;

- recipient's account number;

- name of the payer's bank;

- name and address of the recipient's bank, BIC, subaccount number;

- payment queue – 1;

- code, signature and seal of the payer;

- bank marks - stamp and signature of employees. If the form is electronic – the date of execution of the order;

- date of receipt and debit from the bank. To be completed by authorized employees of the financial institution;

- checkpoint between payer and recipient;

- KBK, code OKTMO.

It is important to take into account that the order is drawn up in 4 copies:

- the first one remains in the bank after debiting,

- the second is kept in the documentation for the recipient bank,

- the third is attached to confirm the bank transaction to the recipient’s account statement,

- the fourth is returned to the payer to confirm the transaction.

Sequence of salary payments to employees

Payments to employees may have different priorities. Let's look at it:

- If this is a salary payment under normal circumstances, code 3 is entered. It is also relevant for payments under the BiR and vacation pay.

- If the employer has a debt to the employee, payments for it receive code 2.

- If an employee works for a company on the basis of a civil law agreement, code 5 is relevant.

Why is code 5 used in the latter case? Money paid to an employee on the basis of a civil contract will not be considered salary. Therefore, these payments are not considered a priority.

Sample alimony payment to bailiffs

payment order to bailiffs. Results, payments to the FSSP archive are a transfer there of funds withheld by the employer from the employee’s salary according to the writ of execution. Non-tax and tax-qualified debts can be paid in this way. In the second case, the payment document will be drawn up according to the rules applied for budget payments, but taking into account some of the features of entering data into certain fields. Latest messages from the forum. A sample payment order to bailiffs may be required by an employer who makes deductions from an employee’s salary.

Good afternoon, dear reader. As you know, not all motorists pay fines and transport taxes on time. Restriction of travel abroad The bailiff has the right to use such a punishment as restricting the debtor from traveling abroad. In fact, this is a very effective measure. Agree, a person will not be very pleased if he is turned away at customs and the paid tour disappears. In this case, the travel agency will not return the money for the trip, since the trip was canceled due to the fault of the tourist. Previously, the law did not say anything about the amount of the fine, after which the bailiff could impose a restriction on not leaving. And there were cases when people were not released due to a minimum fine of one hundred or three hundred rubles. The person might not even be aware that he is in default of payment. And he learned this unpleasant news only at the airport, realizing that he could say goodbye to his vacation. Now the situation has improved. According to paragraph 1 of the article. Client-bank - payment to bailiffs in 2020 using the program has several nuances. Let's consider. 2. Methodological principles for the formation of indicators of tax accounting registers. Calculation of the tax base. Tax accounting of income from sales. Tax accounting of non-operating income. Tax accounting of organization expenses. 1. Grouping of expenses in tax accounting. 2. Accounting for costs associated with production and sales. A. Material costs. B. Labor costs. C. Depreciation expense. D. Other costs associated with production and sales. 3. Accounting for non-operating expenses. Tax calculation rates. Terms and procedure for making advance payments of income tax. Declaration on corporate income tax. You can find out more about this course by calling: St. Petersburg: 7(812), 7(909), 7(812) Moscow: 7(495) (Mon-Fri, 10 a.m. to 8 p.m.) Cost. Application for leave due to a wedding

We recommend reading: Check the cadastral number at the address

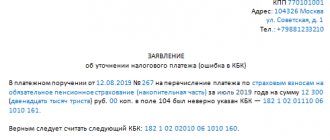

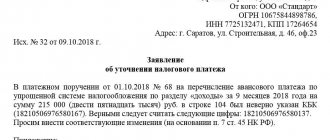

Actions if the order is incorrectly specified

If there are enough funds in the current account for the transfer, then in principle it does not matter what order the client indicated. The payment will be executed in accordance with the procedure of the Tax Code.

Important! The bank does not have the right to refuse to execute a payment if this item is indicated incorrectly.

To correct this error, the bank may ask you to edit the payment order, or correct it yourself in the order it should be.

Maximum possible amount of deductions

Sample application to bailiffs for a writ of execution

According to the provisions of Article 138 of the Labor Code of the Russian Federation, the maximum amount for all possible compensation from wages from an employee, as prescribed by the court, cannot be more than 20%. Even if the court’s order consists of several documents, then for all compensation the employee must retain at least 50% of the entire salary for his use.

Note! Separately, it is worth noting that these restrictions do not apply to correctional labor, collection of alimony, compensation for damage caused to third parties, or the death of third parties during the course of a crime. In the above cases, the amount of deductions from wages should not exceed 70%.

How to correctly indicate this detail in a payment order

The order of payment in the payment order is indicated in field “21”. In the payment form it is called “Payment order”. This field must always be filled out, regardless of where exactly the money is sent. The props are indicated by a number from 1 to 5.

Can a bank employee refuse to accept a payment order if the order of payment is incorrectly stated in it? The letter of the Ministry of Finance of Russia dated January 20, 2014, 02-03-11/1603, states that the presence of an error when specifying this detail cannot be a reason for refusing to accept a payment. If such a situation occurs, the bank client must contact the Central Bank for clarification.

Grounds for collection

For the payer, the basis for collection is the payment order for the enforcement fee issued by the bailiff service. Such a request can be sent by bailiffs:

- at the payer’s place of work, to pay off the debt by deducting from wages;

- at the payer’s place of residence (for unemployed persons).

The bailiff issues a financial claim as part of enforcement proceedings, on the basis of a court decision on the repayment of tax or non-tax (alimony, fines, utility bills, loans, etc.) debts. Such an order has the force of a writ of execution.

When deducting the claim amount from the payer's salary, the accountant fills out a payment slip to the bailiffs, a sample of which, indicating the recipient's details, must be provided to the employer by the responsible representative of the FSSP in charge of the proceedings. A transfer is made in favor of the bailiffs, who, in turn, having registered the payment, send it to the address of the individual, government agency or organization in whose favor the enforcement proceedings have been opened.

What you shouldn't forget

The executor of the bailiff's claim, regardless of whether he is directly the debtor or the entity holding the debt and transferring it to the FSSP, should remember two important aspects of liability for failure to comply with the bailiff's decision.

The debtor, or a business entity that ignored the request of the bailiff service for forced repayment of the debt, bears liability, the limits of which are established by Article 17.14 of the Code of Administrative Offenses of the Russian Federation.

If the employer maliciously evades the execution of the order, his actions may be interpreted as a criminal offense under Art. 315 of the Criminal Code of the Russian Federation.

Watch our video on filling out a payment order to bailiffs.

https://youtu.be/vonlCDSqQ9c