After the adoption of the Federal Law, employees have the right to change banks to receive wages at their discretion. In 2020, a number of amendments were adopted that make it possible to impose liability on the employer in the form of penalties for non-compliance with the law or obstruction of an employee. The changes being made to Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation place such violations in a separate category.

In accordance with all amendments, any employee can, using a completed application, change the form of payment in the form of transferring funds to the required commercial structure.

Article 5.27 of the Code of the Russian Federation on Administrative Offenses “Violation of labor legislation and other regulatory legal acts containing labor law norms”

What prevents you from getting rid of “wage slavery”

There are several main factors that interfere. Among them:

- financial and legislative illiteracy of citizens;

- increased trust in large banking organizations that have government participation;

- a large number of financial institutions with instability.

Important! For almost any large institution, transferring employees to other banks is a time-consuming issue. In addition, enterprises often have an agreement with a specific banking organization. In exchange, the company receives preferential terms. The loss of such positive aspects is not desirable for the employer, so he often prevents his employee from moving to another bank.

Is it possible to choose a bank for salary transfers?

Any organization - both budgetary and commercial - cannot legally refuse an employee to choose a bank other than the one that services the majority of employees. Any demands with threats of penalties, deprivation of bonuses or other measures of influence are absolutely illegal. If this happens, you can complain to higher authorities (including the labor committee).

In large organizations, it is usually more difficult to come to an agreement, but you can always find certain compromises if the credit organization is not completely satisfied.

Main provisions of the new law on salary cards

Due to private violations of the law, several amendments were introduced. Key provisions include:

- administrative liability for violators;

- the established procedure for switching to another salary card at least 5 days before the funds are transferred. In the future, this period is planned to be increased to 15 days;

- the impossibility of preventing an employee from transferring funds to a new type of payment, that is, each employee has the right to choose his own bank.

With the advent of changes, the employer can be held accountable by contacting the labor inspectorate or the prosecutor's office.

Is it possible to choose a bank for salary transfers?

According to the law, refusing an employee to choose a banking organization that is different from the standard used in the organization is impossible.

Important! The type of organization is not important, that is, the institution can be public or private. The legislation does not provide for any exceptions.

Independent choice cannot be accompanied by the employer’s demands or deprivations of certain required funds, for example, bonuses.

Can they force me to change my salary card?

The reason for changing the salary card may be the management’s requirement to switch to a bank that is used by all other employees, or the manager has entered into an agreement with a new organization that has offered preferential conditions.

There are several nuances here:

- if a person works in a budget organization, then the card is changed to MIR. At the same time, the bank itself does not change, that is, the person chooses the institution himself;

- the choice of a credit institution remains with the citizen in any case;

- an exception to the choice is the presence of a collective signed agreement, according to which all employees participate in any salary project at the discretion of management.

Read also: Punishment for driving while intoxicated

According to the last point, if there is an agreement between employees and the employer, the choice of bank remains with the organization. If there is no agreement, then imposing your financial organization is impossible.

Text of the explanatory note

EXPLANATORY NOTE

to the draft federal law “On Amendments to Article 5.27 of the Code of the Russian Federation on Administrative Offenses”«

According to part three of Article 136 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code), wages are paid to the employee, as a rule, at the place where he performs the work or is transferred to the credit institution specified in the employee’s application, on the terms determined by the collective agreement or employment contract. The employee has the right to change the credit institution to which wages should be transferred by notifying the employer in writing about the change in the details for transferring wages no later than 5 working days before the day of payment of wages.

The employer does not have the right to oblige the employee to receive wages by transferring them to a credit organization with which the employer has entered into a service agreement, and to refuse the employee to transfer wages to another credit organization upon receipt of a corresponding application from the employee.

The inability to receive wages from a credit institution convenient for the employee may hinder the exercise of his right to receive wages.

Thus, the Constitutional Court of the Russian Federation has repeatedly noted that part three of Article 136 of the Labor Code is a guarantee of the implementation of the employee’s right to timely and full payment of wages, enshrined in the Labor Code (Articles 2, 21, 22 and 56), and is aimed at ensuring coordination interests of the parties to the employment contract in determining the rules for the payment of wages and creating conditions for the unhindered receipt of wages by the employee in a manner convenient for him, which corresponds to the provisions of ILO Convention No. 95 “Regarding the Protection of Wages” (ratified by the Decree of the Presidium of the Supreme Soviet of the USSR of January 3, 1961) ( rulings of the Constitutional Court of the Russian Federation dated April 21, 2005 No. 143-O and April 26, 2020 No. 769-O).

In accordance with Part 3 of Article 37 of the Constitution of the Russian Federation, everyone has the right to remuneration for work without any discrimination and not lower than the minimum wage established by federal law. This right is inextricably linked with the right of a particular citizen to dispose of the funds to be paid to this citizen as wages, including by placing them in a bank account in a credit institution.

At the same time, a citizen, by virtue of the principle of freedom of contract arising from the Constitution of the Russian Federation, has the right, independently assessing the terms of a bank deposit agreement offered by various banks and the risks associated with them, at his own discretion to choose a bank as a counterparty to the agreement. Otherwise, it would mean, incompatible with the requirements of Part 3 of Article 35 of the Constitution of the Russian Federation, a restriction of the right of employees to freely dispose of the funds due to them by placing them in bank accounts in banks of their choice.

The draft federal law “On Amendments to Article 5.27 of the Code of the Russian Federation on Administrative Offenses” (hereinafter referred to as the bill, Code of Administrative Offenses) is aimed at preventing the employer from interfering with the employee’s exercise of the right to change the credit organization to which wages should be transferred.

According to a survey conducted by the National Agency for Financial Research in May 2020 as part of research work commissioned and methodology of the Bank of Russia, 84.4% of the adult population have payment cards, including 29.81% who have only a bank card for receiving wages. Thus, in many cases, the “salary card” is the only one for a citizen and, therefore, the organization of non-cash payment of wages to the bank cards of employees within the framework of “salary projects” may determine the acquisition by the employee of other services in the bank serving the “salary project”, for example services for the transfer of payments, including for payment for various goods, as well as credit services, taking into account the fact that such a bank has the ability to offer individual lending conditions due to the availability of information on the relevant client.

Creating obstacles for citizens to change credit institutions to receive wages may create conditions for the credit institution servicing the “salary project” to receive advantages not only when attracting funds to bank accounts, but also when carrying out other types of banking activities, which in some cases can lead to restriction of competition, in particular if such an organization has a dominant position in the relevant market.

According to Rostrud, the total number of violations identified regarding wages for 2020 amounted to 81 thousand violations, of which about 10% were violations of part three of Article 136 of the Labor Code.

An analysis of judicial practice also shows a violation by employers of the right of employees to receive wages in a manner convenient for them.

Taking into account the above, the bill proposes to amend Part 6 of Article 5.27 of the Code of Administrative Offences, adding to it a separate offense consisting of preventing the employer from exercising the employee’s right to change the credit institution to which wages should be transferred.

The bill complies with the provisions of the Treaty on the Eurasian Economic Union, as well as the provisions of other international treaties of the Russian Federation.

Wage delays under the Labor Code in 2020 are the employer’s responsibility

Instructions for changing your salary card to a card from another bank

If the number of employees is more than 10 people, the enterprise most often already has a certain selection of banks that can provide the necessary conditions.

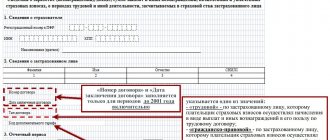

If a person is not interested in choosing a company, he can independently change the bank. Procedure:

- an application is drawn up indicating the new bank and its details;

Sample application

- the paper is signed by the boss and chief accountant;

- the necessary data is entered into the employment contract or an additional agreement is attached to it indicating the new structure;

- the new salary goes to the new account.

Important! The application can be sent by post, for example, by registered mail. This method will not allow the authorities to refuse to sign the document.

You also need to remember that individual service for staff is difficult for a company, so you can compromise with your boss, for example, service will be provided at personal expense.

If management disagrees, it is necessary to collect all data on the refusal and contact the regulatory authorities.

Reader comments

GOOD AFTERNOON! WE HAVE A SALARY PROJECT. AS IN THIS CASE, THERE ARE MORE THAN 150 PEOPLE IN THE COMPANY. WHAT TO HAPPEN IF EVERYONE STARTS CHANGING CREDIT INSTITUTIONS. 0 0

Transfer to all employees in separate payments (you reduce the salary of all employees by 500 rubles and use the freed funds to hire a person who will be responsible for filling in payment orders)))) 0 0

In our “collective farm” there are about three hundred thousand workers and everyone is satisfied with the salary project; those who want changes will pay for the “services of creditors” themselves 0 0

It’s funny when these are not tax residents, the bank simply delays the transfer of money for 3-4 days. The employee himself comes running to change the bank. Although I'll be honest. Who cares ? It takes 30 minutes to get an electronic visa, they give it to you right away, you receive a pin with activation of your account the next day, verified by 4 banks. 0 0

When an inconvenient Internet bank in a salary bank constantly glitches, it’s a quiet horror. Then there is a desire to change it to a more friendly one. 0 0

Please tell me if the chief accountant refuses to pay salary. through the bank of my choice, what should I do then? 0 0

Please tell me if the chief accountant refuses to pay salary. through the bank of my choice, what should I do then?

That’s the whole logic, if you don’t want to force it, the country has suffered. 0 0

The logic is to collect more money. For a salary project, the percentage is 0.5% of the amount, and for individual payments - from 1% and higher, not counting additional work from the accounting department. Money out of thin air, or rather from the employer’s pocket (the head of the Central Bank has a very telling surname). What is the problem with withdrawing from an ATM or transferring to your account in another Bank? A sea of useless work, the country is a soap bubble. 0 0

In some cases, when changing jobs or moving to another department, an employee may be asked to change his salary card to a card from another bank. Sometimes the employer does not even ask the employee’s opinion - he simply issues a “plastic” to a certain credit organization and, by order, offers to receive a salary on it. How legal are such actions and can the employee himself choose the bank in which it is convenient for him to be served?

Responsibility for the employer for imposing a bank

According to the federal legislative acts that have entered into force, changes have occurred in the Code of Administrative Offenses of the Russian Federation. Amounts of fines for management’s refusal to transfer a current account to another bank:

- manager - 10,000-20,000 rubles;

- Individual entrepreneur - 1000-5000 rubles;

- legal entity - 30,000-50,000 rubles.

Additionally, paragraph 7 of Article 5.27 indicates increased sizes for repeated violations, that is, for repetitions:

- manager - 20,000-30,000 rubles;

- Individual entrepreneur - 10,000-30,000 rubles;

- organization - 50,000 - 100,000 rubles.

Previously, violations were often recorded due to the short transfer period of 5 days. Now the accounting department must promptly change the current account. For this purpose, the deadlines have been increased to 15 days.

Actions and possible compromises

If the employee(s) wishes to remain employed by the same bank, there are several possible solutions that are commonly used:

- deducting from the salaries of these employees the amount necessary to maintain the salary project in the original bank;

- employees themselves bear the costs of transferring salaries to the card.

The load on the accounting department increases, since it is necessary to make transfers to two different banks, and the company’s expenses increase due to two existing salary project agreements. If employees are satisfied with this option with the deduction of part of their salary, then many employers will accommodate them in resolving the issue.

Regulatory framework

When an employer wants to force him to change his salary card, it is worth telling him about some articles of the Civil Code of the Russian Federation and the Labor Code of the Russian Federation and reminding him that specialists have the right to contact the State Labor Inspectorate if their rights are not respected.

This may ruin relations with management, but at least you won’t have to change the institution where the client was initially served. Sometimes it is important to work with a specific credit institution.

Here are the laws that protect the rights of employees in this matter:

- Art. 1 Clause 2 of the Civil Code of the Russian Federation states that coercion on the part of the employer is unacceptable, specialists themselves can exercise their civil rights;

- Art. 846 Clause 1 of the Civil Code of the Russian Federation confirms the employer’s right to open a bank account for an employee, but the latter is not obliged to use it;

- Art. 136 Part 3 of the Labor Code of the Russian Federation confirms that money must be transferred to the salary account specified by the employee.

The notice period for changing the bank for paying wages will be extended to 15 calendar days.

The legislator is thinking about increasing the period for notifying an employer of an employee’s change of credit institution for the purpose of transferring wages. The fact is that, given the legal requirements for the payment of wages every six months, the settlement services of large enterprises with a large number of employees do not always have time to process applications received from employees. Therefore, increasing the notice period from 5 working days to 15 calendar days will eliminate the risk of the employer’s failure to comply with labor legislation.