How to fill out a payment order for income tax

All basic details have not undergone any changes.

Thus, the procedure for filling out payment orders for income tax in 2020 will not differ from filling out payment orders for previous tax and reporting periods. The payment slip must include information about the taxpayer (name, INN, KPP, account number, bank information, etc.), as well as indicate information about the recipient (name of the Federal Tax Inspectorate, name of the inspection, its INN, KPP, bank details). It is best to check the current data on the official website nalog.ru, using the “Addresses and payment details of your inspectorate” service, or obtain the data directly from the inspectorate at the place of tax registration.

Let's briefly look at filling out the remaining details.

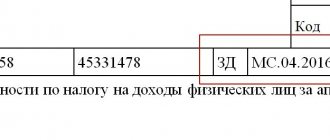

To avoid possible confusion with the receipt of tax, it is important when filling out column 107 to correctly indicate the tax period for which income tax is paid. If an organization pays monthly advance payments in 2020, it is necessary to indicate, for example, MS.01.2017, MS.02.2017, if quarterly, then KV.01.2017, KV.02.2017. In field 106 you must indicate “TP”, which means the current payment. We do not fill in the UIN (universal payment identifier) in field 22, since it is not available when paying current payments. In field 21 you must indicate payment priority 5 (also means current payments). Field 110 is not filled in, leave it blank.

In column 109 you must enter the date of signing the income tax return. If monthly payments are made, “0” is indicated. OKTMO is specified at the location of the Federal Tax Service where the taxpayer is administered. The procedure for filling out the remaining details is given in the sample payment order for income tax 2020.

What to do if the KBK code was entered incorrectly?

What if, instead of the KBK code for personal income tax penalties, the KBK according to which the tax itself is paid was indicated?

If the identified error did not lead to non-transfer of tax to the budget, then the taxpayer needs to act in accordance with clause 7 of Art. 45 of the Tax Code of the Russian Federation.

In this situation, he has the right to submit to the tax office at the place of payment of the tax an application outlining the mistake made and attach to it a copy of the incorrectly executed order confirming the fact of making the payment. Based on the application received, the tax authority will decide to clarify the payment or contact the taxpayer with a proposal to reconcile mutual settlements.

Tax payment date

The tax period is a calendar year.

Reporting periods:

- quarter;

- 6 months;

- 9 months.

The tax return is submitted to the Federal Tax Service inspectorate after the end of the year and reporting periods. For companies that calculate advance payments every month, reporting periods are 1, 2 or 3 months. Advance monthly payments are made on the 28th of each month.

Quarterly payment is assigned to organizations:

- with quarterly revenue of no more than 15 million rubles for 4 consecutive quarters;

- NPOs that do not make a profit;

- foreign companies with official representatives in Russia;

- organizations financed from the state budget.

Quarterly payment is due on the 28th day of the month following the end of the quarter. To pay the fee, 2 payment orders are created to different budget levels. Payment is distributed to the following budgets:

- federal level - 3%;

- regional level - 17%.

The tax rate is 20% of profit.

Tax payment date 2020

The deadline for filing returns and paying taxes is the 28th after the end of the reporting period.

Firms that pay advances once a quarter are divided into 2 types:

- those who pay calculate the amount monthly, divided into 3 equal parts;

- those who pay an advance once at the end of the quarter.

Thus, the payment deadline is the 28th for all taxpayers.

Tax payment date 2020

The tax payment date for 2020 has not changed and falls on the 28th after the end of the reporting period.

Deadlines for paying the simplified tax system “income” in 2018

Tax for 2020 - no later than:

Advance payments for 2020 are paid no later than:

Tax for 2020 - no later than:

- for organizations - 04/01/2019 (postponed from Sunday, 03/31/2019);

- IP - 04/30/2019.

The principles for filling out a payment order for 2020 are the same as in 2020.

You can check whether you are ready to submit annual reports under the simplified tax system using our checklist.

Updated BCC for income tax

BCCs were approved by Order of the Ministry of Finance No. 132n dated June 8, 2018. Separate BCCs have been introduced for different budget levels:

- to the federal level - 18210101011011000110;

- to the regional level - 18210101012021000110.

If the payment deadline is not met, the Federal Tax Service will charge penalties for the overdue day. Penalties for income tax in 2020 are transferred to KBK:

| Income tax | Tax | Penalty | Fine |

| To the federal budget (except for KGN*) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| To the budgets of the constituent entities of the Russian Federation (except for the KGN) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| To the federal budget (for KGN) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| To the budgets of the constituent entities of the Russian Federation (for KGN) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| When implementing production sharing agreements before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From dividends from foreign organizations | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From interest on state and municipal securities | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

| From interest on bonds of Russian organizations | 182 1 0100 110 | 1 0100 110 | 1 0100 110 |

| From the profits of controlled foreign companies | 182 1 0100 110 | 182 1 0100 110 | 182 1 0100 110 |

* KGN is a consolidated group of taxpayers.

A separate payment order is created for payment. The BCC for penalties on income tax has not changed since 2020.

Responsibility for failure to pay taxes on time

Tax authorities distinguish between the types of violations for which penalties are provided. Thus, if the tax is not paid in full or if there is no payment, the organization will be issued a fine in the amount of 20% of the amount not received to the corresponding budget. The fine will be issued on the basis of clause 1 of Art. 122 of the Tax Code of the Russian Federation.

If Federal Tax Service employees discover an understatement of the base for calculating payments between interdependent companies, the fine will be 40% of the underestimated tax amount, but not less than 30,000 rubles. Grounds - clause 1 of Art. 129.3 Tax Code of the Russian Federation.

If an organization forgets to include income from a controlled foreign company in the tax base, it will be fined 20% of the unaccounted tax liability, but not less than 100,000 rubles (Article 129.5 of the Tax Code of the Russian Federation).

For deliberate understatement of income, a fine will be issued under paragraph 3 of Article 122 of the Tax Code of the Russian Federation, in the amount of 40% of the unpaid tax.

The tax agent will also be fined for failing to withhold and transfer tax to the budget, for example, on dividends. A fine will be issued on the basis of Article 123 of the Tax Code of the Russian Federation in the amount of 20% of the amount of the non-withheld tax liability.

gosuchetnik.ru

KBK tax for types of payments in 2019

Income tax is charged:

- from profit from sales;

- from the amounts of dividends received;

- % of state municipal securities;

- from certain types of companies.

Profits of consolidated groups of taxpayers

A consolidated group of taxpayers (CGT) is a voluntarily created society of legal entities that remit income taxes on the basis of an agreement. A member of the KGN is a company that is a party to the agreement on the formation of an association in accordance with the fixed parameters.

A privilege for KGN partners is a reduction in the tax burden. The profit and loss indicators of the members of the consolidated group are subject to addition.

The tax base of the group members is added up (consolidated). Group member companies gather without forming a legal entity. BCC in table. in Appendix No. 1.

Dividends received from Russian companies

The tax withheld by the tax agent on dividends paid to residents of the Russian Federation is calculated at a 13% rate. It is calculated from the total amount of dividends minus the amounts withheld by the tax agent.

The amount to be distributed includes payments:

- non-residents;

- at a rate of 0%.

Dividends are excluded from the tax agent's amount at a rate of 0%. The amount is taken minus the tax deducted from it. Requirements for using a 0% rate on taxation of dividends from Russian companies: ownership of a share of at least 50% in the authorized capital of the company that is the source of payment, for at least 356 calendar days.

BCC are reflected in table. in adj. No. 1.

Dividends received from foreign companies

When purchasing dividends from a foreign company or through a diplomatic mission in Russia, tax is levied using a special method. The tax on foreign2 dividends of the company is calculated personally. The rate is 15% of the dividend amount.

The tax base includes dividends, regardless of tax withholding in the state of the non-resident company that paid the income.

A credit for tax paid outside Russia is provided to the beneficiary in the Russian Federation upon signing a protocol on double taxation with the state whose company paid the income.

The tax offset is carried out in an amount not exceeding the amounts calculated for payment in Russia. Amounts are deducted upon presentation of receipts confirming payment of tax outside Russia.

Interest on state and municipal securities

Interest income from securities is classified as non-sale income. Interest is recognized as payments accrued on bank deposits and promissory notes.

Tax on income from interest received on state (municipal) securities is paid by the owner of the security.

CFC income tax

When calculating income tax, the list of income includes profit from a controlled foreign company (CFC). The tax rate on CFC profit is 20%. Paid to the federal budget.

Dividends paid by a foreign company in the year following the year of preparation of the financial results statement are deducted from the CFC's profits.

When calculating profits, CFCs do not take into account dividends paid by organizations in the Russian Federation.

Payment order for income tax

Create 2 payment orders:

- to the federal budget - 3%;

- to the regional budget—17%.

For two levels, the BCC has been approved, which is written in field 104 of the payment invoice. Payments are made according to previously existing rules, as well as the BCC for income tax to the federal budget in 2020, which has not been changed for the current year 2020. Payments are made until March 28, 2019.

Useful tips for filling out a payment form

Our recommendations will help you prepare a payment order quickly and without errors:

| Stages of preparation and execution of payment orders for the transfer of income tax for 2020 | Completion tips and additional information | |

| 1. Preparatory stage | ||

| Calculate income tax based on the results of 2020 (NP2018) | The materials in our section will help you understand the nuances of forming the tax base (TB). | |

Divide NP2018 into two parts:

| Find out what legal acts set the percentage of tax distribution from the message | |

Make 2 payments for each part of the payment:

| When you still need to issue a separate payment when paying income tax, we’ll tell you | |

| 2. Executing a payment order | ||

| Fill in the basic payment details for payment orders | Download the payment form and find out what to enter in its fields | |

Indicate KBK on your payments for:

| Find out which KBK you need to indicate in the payment order for the transfer of fines from the publication | |

In field 24, decipher the purpose of the payment - “Income tax for 2018, credited:

| How to clarify the erroneous wording in field 24 in non-tax payments, we tell you | |

| In field 106 (basis of payment) indicate “TP” - payment for the current year | Find out how fields 106 and 108 of a payment order are interconnected from the publication | |

| In the (tax period) field, enter GD.00.2018 | Find out the definition of the term “tax period” from the material | |

| Indicate the date on the payment no later than 03/28/2019 and pay NP2018 no later than this day | When tax payment deadlines may be delayed, we will tell you | |

| In field 101 (payer status), enter “01” if you are transferring NP2018 for yourself | Find out about all the codes for field 101 of the payment order at | |

| 3. Control stage | ||

| Please check that the payment details entered into the payment fields are correct before sending it to the bank. | Find out what errors in the payment order will not allow the tax to go to the budget from the material | |

Our experts have prepared a sample for filling out an income tax payment form for 2020.

Download a sample income tax payment form for the year from the link:

Sample payment order 2019: filling rules

Example

An on-site inspection was carried out at Zvezda LLC. Based on the audit report, a decision was made that the organization underpaid income tax. Based on the decision that has entered into force, the organization sent a demand No. 18-52/45678 dated 02/07/2019 for payment of arrears, penalties and a fine. UIN specified in the request: 12345678912345678912.

"Alpha" (TIN 7708123456) is registered with the Federal Tax Service Inspectorate No. 43 for Moscow.

On April 17, Alpha transferred 1/3 of the VAT to the budget (KBK 18210301000011000110) for the first quarter in the amount of 17,000 rubles.

In the payment order, in field 101 “Payer status”, the accountant indicated code 01.

In field 109 “Document date” – the date of signing the declaration for the first quarter – 04/17/2016.

In field 107 “Tax period” – the period for which the tax is paid is the first quarter of 2020 (KV.01.2016).

An example of filling out a payment order when transferring an advance payment for transport tax

Moscow LLC "Alfa" (TIN 7708123456) has a car on its balance sheet, which is registered at the location of a separate division in Kursk. A separate division of Alpha is registered with the Federal Tax Service of Russia in Kursk.

Checkpoint of a separate unit - 463201001.

On July 10, Alpha transferred to the budget an advance payment for transport tax (KBK 18210604011021000110) for the second quarter in the amount of 400 rubles.

READ MORE: Construction expertise in the Adviser cheat

In field 109 “Document date” – the value is “0” (since the payment relates to the current period, and the Tax Code does not provide for the preparation of transport tax calculations).

In field 107 “Tax period” – the period for which the tax is paid is the second quarter of 2020 (KV.02.2016).

An example of filling out a payment order when transferring the minimum tax during simplification

Alpha LLC (TIN 7708123456) is registered with the Federal Tax Service Inspectorate No. 43 for Moscow. The organization applies a simplification and pays a single tax on the difference between income and expenses. At the end of 2020, the amount of the accrued single tax was less than 1 percent of the amount of income. Therefore, the organization pays minimal tax. Taking into account advance payments transferred to the budget during the year, the amount of the minimum tax to be paid was 14,000 rubles.

On March 31, 2020, Alpha submitted a tax return and transferred the minimum tax to the budget. When filling out the payment order, in field 101 “Payer status” the accountant indicated code 01, in field 107 “Tax period” - the period for which the minimum tax is paid - GD.00.2015. BCC for the minimum tax under simplification – 18210501050011000110.

An example of filling out a payment order when transferring a single tax under simplification (object of taxation “income”)

On April 25, Alpha transferred to the budget an advance payment for the single tax under simplification (KBK 18210501011011000110) for the first quarter in the amount of 6,000 rubles.

When filling out the payment order in field 101 “Payer status”, the accountant indicated code 01, in field 107 “Tax period” - the period for which the advance payment is paid - KV.01.2016.

An example of filling out a payment order when transferring penalties for the minimum tax during simplification

Alpha LLC (TIN 7708123456) is registered with the Federal Tax Service of Russia Inspectorate No. 43 for Moscow. The object of taxation is “income”.

On October 16, Alpha transfers penalties for the 2015 tax to the budget based on the tax inspection report dated October 1, 2016.

When filling out the payment order in field 104, the accountant indicated the KBK for transferring penalties for the minimum tax (182 1 05 01011 01 2100 110), in field 106 - the code of the tax audit act of the AP, in field 107 - 0 (clause 8 of Appendix 2 to the order of the Ministry of Finance Russia dated November 12, 2013 No. 107n).

An example of filling out a payment order when transferring personal income tax by a tax agent

"Alpha" has account number 40702810400000001111 in JSCB "Nadezhny", account number 30101810400000000222, BIC 044583222.

On April 5, Alpha transferred personal income tax to the budget (KBK 18210102010011000110) for March in the amount of 39,000 rubles.

When filling out the payment order, the accountant indicated code 02 in field 101 “Payer Status”.

An example of filling out a payment order when transferring personal income tax by an individual entrepreneur

A.A. Ivanov (TIN 771314996321), living at the address: Moscow, st. Mikhalkovskaya, 20, apt. 41, registered with the Federal Tax Service Inspectorate No. 43 for Moscow.

On July 10, Ivanov transferred personal income tax to the budget (KBK 18210102020011000110) for 2020 in the amount of 30,000 rubles.

Ivanov Andrey Andreevich (IP)//g. Moscow, st. Mikhalkovskaya, 20, apt. 41//.

In field 101 “Payer status” code 09 is indicated.

In field 60 “TIN of the payer” the 12-digit TIN code of Ivanov is indicated. In field 102 “Payer checkpoint” 0 is indicated.

An example of filling out a payment order when transferring income tax to a consolidated group of taxpayers. The tax is transferred by the responsible member of the consolidated group

Joint Stock Company "Alfa" (registered in Moscow) is a responsible participant in the consolidated group of taxpayers. Other participants in the consolidated group of taxpayers are “Trading” (registered in Moscow) and “Production” (registered in St. Petersburg). The group members do not have separate divisions.

The amount of the advance payment due on April 28 amounted to RUB 3,000,000, of which:

- to be paid to the federal budget – 300,000 rubles;

- payable to regional budgets – 2,700,000 rubles, including:

- to the budget of Moscow at the location of Alpha - 1,000,000 rubles;

- to the budget of Moscow at the location of “Hermes” - 1,000,000 rubles;

- to the budget of the city of St. Petersburg at the location of “Master” - 700,000 rubles.

When filling out payment orders, the name of the responsible group member (“Alpha”) is indicated in the “Payer” field. In the fields intended for indicating the payer’s TIN and KPP, the TIN and KPP of the responsible group member (“Alpha”) are also indicated.

In field 101 “Payer status” the accountant indicated code 21.

For the federal part of the advance payment (300,000 rubles), the Alpha accountant drew up one payment order and transferred the tax to his location.

An example of filling out a payment order when transferring income tax to a consolidated group of taxpayers. For the responsible participant, the tax is paid by another group member

Joint Stock Company "Alfa" (registered in Moscow) is a responsible participant in the consolidated group of taxpayers. Other participants in the consolidated group of taxpayers are LLC "Torgovaya" (registered in Moscow) and LLC "Proizvodstvennaya" (registered in St. Petersburg). The group members do not have separate divisions.

The amount of the advance payment due on April 28 amounted to RUB 3,000,000, of which:

- to be paid to the federal budget – 300,000 rubles;

- payable to regional budgets – 2,700,000 rubles, including:

- to the budget of Moscow at the location of Alpha - 1,000,000 rubles;

- to the budget of Moscow at the location of “Hermes” - 1,000,000 rubles;

- to the budget of the city of St. Petersburg at the location of “Master” - 700,000 rubles.

According to the terms of the agreement on the creation of a consolidated group of taxpayers, if the responsible participant cannot timely fulfill the obligation to pay income tax, the tax is transferred by another participant in the group. By April 28, Alpha did not have a sufficient amount in its current account to transfer the advance payment for income tax. Hermes assumed the responsibility for transferring the advance payment.

When filling out a payment order, the name of the group member (Torgovaya LLC) is indicated in the “Payer” field and next to it in brackets is the name of the responsible group member (“Alpha”). At the same time, in the fields intended for indicating the TIN and KPP of the payer, the TIN and KPP of the responsible group member (“Alpha”) are indicated.

READ MORE: Football goalkeeper training: playing technique and rules for a goalkeeper in football.

In field 101 “Payer status” the accountant entered code 22.

For the federal part of the advance payment (RUB 300,000), the Hermes accountant drew up one payment order and transferred the tax to the location of the responsible group member (“Alpha”).

An example of filling out a payment order for an organization when transferring pension insurance contributions

Joint Stock Company "Alfa" (TIN 7708123456, KPP 770801001) has a registration number in the Pension Fund of Russia - 087-108-044556.

On April 15, Alpha transferred insurance contributions for compulsory pension insurance (KBK 39210202010061000160) for March in the amount of 275,000 rubles. 70 kopecks

In the payment order, in field 101 “Payer status”, the accountant indicated code 08.

In fields 109 “Document date” and 107 “Tax period” the accountant indicated 0.

An example of filling out a payment order for an organization to transfer arrears and penalties for health insurance contributions to the FFOMS

On April 15, the PFR branch handed over to Alfa a demand dated April 15, 2016 No. 3 for the payment of arrears and penalties on insurance premiums for compulsory health insurance to the FFOMS budget. The amount of arrears for January of the current year is 275,000 rubles. 70 kopecks, fines - 6050.02 rubles.

On the same day, Alpha independently transferred the arrears and penalties.

In the payment order for the transfer of arrears, the accountant indicated:

- KBK (field 104) – 392 1 02 02101 08 1011 160;

- payer status (field 101) – 08;

- document date (field 109) – 0;

- tax period (field 107) – 0;

- priority of payment (field 21) – 5.

- KBK (field 104) – 392 1 02 02101 08 2011 160;

- payer status (field 101) – 08;

- document date (field 109) – 0;

- tax period (field 107) – 0;

- priority of payment (field 21) – 5.

An example of filling out a payment order when transferring social insurance contributions in case of temporary disability and in connection with maternity

Joint Stock Company "Alfa" (TIN 7708123456, KPP 770801001) has a registration number in the Federal Tax Service of Russia -7712345678.

On July 2, Alpha transferred insurance premiums in case of temporary disability and in connection with maternity (KBK 39310202090071000160) for June in the amount of 9,000 rubles. 32 kopecks

An example of filling out payment orders for an entrepreneur when transferring contributions for his own insurance

Income tax: payment order (sample 2018)

The form of the payment order (f. 0401060), the names and numbering of the fields of the document are approved by the Regulation of the Bank of the Russian Federation dated June 19, 2012 No. 383-P and are given in Appendix 3. Let's figure out how to fill out the fields of the payment order for the NNP this year.

There were no significant changes in filling out payment orders for NNP in 2018. As in previous tax and reporting periods, the relevant information is entered into the fields intended for information about the payer (company name, TIN, KPP, bank information and account number, etc.).

It is necessary to provide information about the recipient of the payment (UFK, name of the Federal Tax Service, its INN/KPP, bank account details). Before starting to process income tax payments in 2020, it is better for an accountant to check the details with the Federal Tax Service at the place of registration of the company or check the data on the Federal Tax Service website. Let's take a closer look at filling out the remaining fields of the form:

- Field 5 “Type of payment” is filled in depending on the procedure established by the payer’s bank, so it is necessary to clarify it at the branch servicing the company. There are several options for filling out - “urgent”, “electronically”, not filled out;

- Field 21 “Payment order”. If the tax is transferred according to a collection order from the Federal Tax Service, then the priority “3” is indicated when paying the tax.

- Field 22 “Code”. It indicates the accrual code (UIN). Current payment, payment of interest, arrears or fine (if the UIN is not specified in the Federal Tax Service Inspectorate’s request) – “0”. If the inspection indicated the code in the demand for penalty payments presented to the company, then the same number is entered in the payment slip;

- Field 24 “Purpose of payment”. It contains brief information required to identify the payment: name of the tax, payment period, budget where the tax amount is transferred;

- Field 101 “Payer status”. When paying tax for itself, the organization enters “01”, and if it acts as a tax agent – “02”;

- Field 104 "KBK". BCC for NNP in 2020 differ depending on the budget level and type of payment:

| Type of payment according to NNP | KBK | |

| Federal budget (3%) | Regional budget (12,5-17%) | |

| Current payments | 182 1 0100 110 | 182 1 0100 110 |

| Penalties for late payments | 182 1 0100 110 | 182 1 0100 110 |

| Fines for late payments | 182 1 0100 110 | 182 1 0100 110 |

By Order of the Ministry of Finance of the Russian Federation dated 06/09/2017 No. 87n in 2020, KBK 182 1 0100 110 was added, which is applied when paying the current NNP on income received from interest on bonds of Russian organizations issued on the market from 01/01/2017 to 12/31/2021.

- Field 105 “OKTMO” is filled in with the corresponding code specified in the declaration;

- Field 106 “Basis of payment”. The abbreviation of the payment in capital letters is indicated. For example, “TP” means “current payment”, “ZD” means independent payment of arrears, “TR” means payment of arrears based on a demand presented by the Federal Tax Service, etc.;

- In field 107 indicate the tax period of 10 characters, separated by dots. They define:

- the first two characters are the frequency of payment (for example, GD, i.e. annual);

- the next four characters are the month/quarter/year number (01-12 – month number; 01-01 – quarter number; 00 – year number);

- the last four digits are the year for which the company pays tax (2018);

- In field 108 “Document number”, enter “0” if the payment is current or the debt is being repaid at the initiative of the company. When making a payment at the request of the Federal Tax Service, indicate the request number;

- Field 109 “Document date” is filled in as follows: for payments of the current year, indicate the date the payer signed the tax return, and when transferring a payment before filing the declaration, enter “0” in the field;

- Field 110 “Payment type” is not filled in.

We offer samples of registration of payment of income tax to the federal and regional budgets:

Federal budget

Regional budget

Payment of income tax for 2020 must be made by March 28, 2020. The tax return must also be submitted no later than this deadline.

>Sample of filling out instructions for income tax in 2016

Filling out payment orders for the transfer of taxes and fees 2018

Payer status in payment order in 2020

In 2020, it is important to correctly indicate the payer status code in the payment order, in particular in payments for insurance premiums. What to do if banks do not allow payments due to their status, read this article.

In field 101 “Payer status”, the organization enters code “01” if it is a taxpayer. If you transfer tax as a tax agent, you must enter the code “02”.

Taxpayers who are individual entrepreneurs enter code “09” in the field (Appendix 5 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013), for example, when paying the minimum tax on the simplified tax system.

Payment order for personal income tax in 2020: sample

Readers often ask us how to draw up a personal income tax payment order in 2020? Download a sample payment form below, and you will learn about the nuances of filling it out from the article.

Another important detail is the KBK code, for this you need to fill in a special detail in the payment slip - field 104. In 2020, you will need the KBK code for personal income tax 18210102010 011000110. It is the same for paying personal income tax on wages and benefits, and for paying personal income tax on dividends.

Sample of filling out a payment order in 2020

To transfer taxes and contributions to the budget, it is important to correctly fill out the payment order.

After all, errors in it are fraught with the fact that the money either will not arrive at the desired account at all, or will be taken into account as another payment or classified as unclear.

In the article we will tell you how to fill out a payment order for the payment of taxes and contributions; we will provide a sample of filling out a payment order in 2020.

The payment order must be drawn up in form 0401060, given in Appendix 2 to Bank of Russia Regulation No. 383-P dated June 19, 2012.

From November 30, 2020, “another person” (i.e.

anyone). But at the same time, this person cannot demand a refund of the amounts paid.

A payment order or payment document is a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. .

Payment orders for contributions for January

Due to numerous changes in the procedure for paying contributions in 2018 in technical terms. Our company receives a large number of questions related to the execution of payment orders; in this material we will try to answer the most popular questions.

Information on the procedure for issuing payment orders for the transfer of contributions from entrepreneurs can be found in the article Payments for contributions from entrepreneurs for 2020.

To transfer taxes and contributions to the budget, it is important to correctly fill out the payment order.

After all, errors in it are fraught with the fact that the payment either will not go to the required account at all or will be classified as unclear.

We have provided an ideal example of filling out a payment order in 2020 in the article.

Filling out a payment order in 2020, a sample of which you will find below, must be completed on a standard form.

Field 101 “Payer status” in payments for contributions in 2018

Every year the SKB Kontur company holds a competition for entrepreneurs “I am a Businessman”, hundreds of businessmen from different cities of Russia take part in it - from Kaliningrad to Vladivostok.

Since 2020, insurance premiums are paid to the Federal Tax Service. In this regard, many questions arise, for example, when preparing payment orders. Thus, for a long time there was no consensus on how to fill out the “Payer Status” in payment slips for the payment of contributions.

BCC changes for 2020

In June of this year, the Ministry of Finance, by corresponding order, made changes to the budget classification codes for 2018: new BCCs were introduced and a number of previous ones were cancelled. Read more about all the changes to the KBK that will be in effect from 2020 in our material.

By order of June 20, 2020 No. 90n, the Ministry of Finance of the Russian Federation introduced changes to the instructions on the procedure for applying the budget classification of the Russian Federation, approved by order of the Ministry of Finance back in 2013 No. 65n.

Online magazine for accountants

As can be seen from the table above, individual entrepreneurs in 2020, in order to pay insurance premiums as for hired personnel, must indicate the payer status code “14”.

If the individual entrepreneur pays insurance premiums “for himself,” the payer status code should be indicated – 09.

If an organization or individual entrepreneur acts as a tax agent and pays, for example, personal income tax for employees, then code 02 is indicated in the payer status in field 101 in 2020.

Source: https://vigor24.ru/zapolnenie-platezhnyh-poruchenij-po-perechisleniju-nalogov-i-sborov-2017-48275/

Instructions for tax and advance payments of income tax

We provide you with sample options for filling out orders for the transfer of advance payments for income tax, as well as tax arrears. Moreover, two situations are possible for paying debts: voluntary payment and on demand. And in the latter case, the UIN identifier may still be present.

Transfer of advance payments for income tax no later than the established deadline is possible in two options: monthly and quarterly payments. Monthly advance payments, in turn, can be paid based on actual profits or for the current month.

Monthly advance payments

Filling out the tax fields of the document is the same, both when making advance payments based on the actual profit for the last month, and for the current month. The main thing is to correctly indicate the period for which the transfer is made. The only difference when paying advances for the current month is that the date “109” is never entered, since monthly declarations are not submitted.

Basic details of the order form for monthly advances on income tax

| Field no. | Props name | |

| 101 | Payer status | 01 |

| 18 | Type of operation | 01 |

| 21 | Payment order | 5 |

| 22 | Code | 0 |

| 104 | KBK Federal Budget | 18210101011011000110 |

| KBK Regional budget | 18210101012021000110 | |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service Inspectorate is located, to which the income tax return is submitted |

| 106 | Basis of payment | TP |

| 107 | Taxable period | MS.01.2016; MS.02.2016; MS.03.2016, etc. until MS.12.2016 |

| 108 | Document Number | 0 |

| 109 | Document date | 0 (if advance payments are made for the current month; as well as advances based on the profit received before filing a tax return). DD.MM.YYYY - date of signing the declaration (current advance payment based on the profit received after the declaration is submitted). |

| 110 | Payment type | 0 (from March 28, 2020, the value of attribute 110 is not indicated) |

Advance payment for the current month

In field “107” we indicate the current month. The advance must be paid by the 28th of the same month.

Sample payment order for monthly advance payment of income tax 2020 for the current month

For the month based on actual profit

In this case, the advance payment is also transferred no later than the 28th, but it is calculated and paid for the past month. That’s why we put it in the “107” property. In field “109” we put zero (“0”) if the declaration has not yet been submitted, and the date of signature of the declaration if you are transferring the advance after its submission.

Sample instructions for income tax in 2020, monthly advance payment based on actual profit after the declaration is submitted

Income tax for December with monthly advance payments from actual profits

In the tax period, we still indicate the month (December), although we actually pay income tax according to the calculation in the tax return for the year (for 12 months) using a simplified form that has already been submitted. The example presented below concerns monthly advance payments on the actual profit received for the past month. If the declaration has not yet been submitted, and the deadline for paying the advance for December is running out, then in field No. 109 “Document date” we put a zero (“0”).

This procedure is due to the fact that:

“Reporting periods for taxpayers who calculate monthly advance payments based on actually received profits are one month, two months, three months, and so on until the end of the calendar year.”

That is, no exception was made for December, and it is included in the reporting period of 12 months and, therefore, the advance payment based on its results must be paid before January 28. And this despite the fact that the deadline for paying income tax for the year is set on March 28, and the reporting period, in this case, coincides with the tax period. You will submit the declaration for the year again on time, but in full form.

Sample income tax order for December 2020, monthly advance payment from actual profit, after filing a tax return for 12 months

Professional accounting for organizations and individual entrepreneurs in Ivanovo. We will relieve you of the problems and daily worries of maintaining all types of accounting and reporting. LLC NEW tel. 929-553

Quarterly advance payments

Please note that in field “107” we always write the quarter number, even if we transfer the tax at the end of the year. Since this detail should indicate the frequency of payments (quarter), and not the tax period itself (year).

Basic details of the payment form for quarterly advances of income tax

| Field no. | Props name | |

| 101 | Payer status | 01 |

| 18 | Type of operation | 01 |

| 21 | Payment order | 5 |

| 22 | Code | 0 |

| 104 | KBK Federal Budget | 18210101011011000110 |

| KBK Regional budget | 18210101012021000110 | |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service Inspectorate is located, to which the income tax return is submitted |

| 106 | Basis of payment | TP |

| 107 | Taxable period | KV.01.2016; KV.02.2016; KV.03.2016 and KV.04.2016 (tax for the year) |

| 108 | Document Number | 0 |

| 109 | Document date | 0 (if advance payments are made for the 1st quarter, 6 months, 9 months and for the year, before filing a tax return) DD.MM.YYYY - date of signing the declaration (payment after the declaration for the year is submitted) |

| 110 | Payment type | 0 (from March 28, 2020, the value of attribute 110 is not indicated) |

Quarterly advance payments for reporting periods sample

Look at the example of filling out an income tax payment for the first half of 2020 (for the 2nd quarter). In this example, the advance payment is made before filing the declaration.

Sample payment order for income tax for the half year 2016 quarterly payments before filing a declaration

Profit tax for half a year with quarterly advance payments sample

In this example, the income tax advance is transferred after the return is filed.

Sample payment order for income tax for the 2nd quarter of 2016 quarterly payments after submitting the declaration

Income tax for the year with quarterly advance payments sample

We have specifically placed this example of filling out a payment order for income tax in the quarterly payments section in addition to the figures above. The fact is that with this mode of payment of advance payments, the tax reporting period for the 4th quarter has not been established. Because of this, many enterprises put the tax period indicator GD.00.2015 in “107” when paying tax for the year.

However, this is not correct. Here you need to write the period for which the tax is paid, but with mandatory linkage to the frequency of payments. And the last one is a quarter. If the tax were transferred only once per year, then the tax period indicator indicated in the previous paragraph would be correct. Otherwise, the only correct option here would be to write KV.04.2015. Sample in the photo below.

Sample payment order for income tax for 2020 for quarterly payments after the tax return for the year has been submitted

Tax debt paid voluntarily

If you had to make changes to your income tax return for the previous tax period that increased the tax base, a debt arises. The best way out is to voluntarily pay the additional tax assessed before submitting the updated return. Then you will be able to avoid tax penalties.

Since the tax period indicator indicated in detail “107” depends on the reporting period in which accounting changes were made, the corresponding month or quarter must be entered in this field. This is due to the fact that you will have to submit updated declarations for the same periods. If the amendments affected only the last reporting period, then you are paying additional tax for the year. However, in cell No. 107 you do not need to print the value of the year for which the voluntary transfer of debt is made. Write there December or 4th quarter, depending on the advance payment mode you use.

Next point. What to indicate in the details “106” - “ZD” or “TP”? In our opinion, when paying debts for past tax periods, you definitely need to write “ZD” in field 106. If you pay extra or make advance payments for the current tax period, it will not be a mistake to indicate the value “TP” in this detail. All the same, you can only be charged a penalty; there are no other sanctions for late payment of advances.

Basic details of the payment form for income tax debt

| Field no. | Props name | |

| 101 | Payer status | 01 |

| 18 | Type of operation | 01 |

| 21 | Payment order | 5 |

| 22 | Code | 0 |

| 104 | KBK Federal Budget | 18210101011011000110 |

| KBK Regional budget | 18210101012021000110 | |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service Inspectorate is located, to which the income tax return is submitted |

| 106 | Basis of payment | ZD |

| 107 | Taxable period | MS.01.2014 – MS.12.2014; MS.01.2015 – MS.12.2015 KV.01.2014 – KV.04.2014; KV.01.2015 – KV.04.2015 |

| 108 | Document Number | 0 |

| 109 | Document date | 0 |

| 110 | Payment type | from March 28, 2020, the value of attribute 110 is not indicated |

Sample payment order for voluntary payment of income tax debt in 2020 for the 1st quarter of 2020

Income tax debt at the request of the Federal Tax Service

When paying income tax debt at the request of the tax inspectorate, filling out details 106 - 109 is completely different from the sample above. Be careful.

Basic details for payment of income tax debt upon request

| Field no. | Props name |

Rate and purpose of payment

The main tax rate at which most legal entities pay profit on OSNO is 20%, and it is broken down as follows:

- 2% (3% for 2020, 2020, 2020, 2020) – federal budget

- 18% (17% for 2020–20) – budget of the subjects

There may be a lower rate for the following groups of payers:

- residents of special economic zones

- participants in regional investments

- organizations with resident status

More information about beneficiaries can be found in Article 284 of the Tax Code.

When everything is verified, you can make a payment order for income tax 2020, the main thing is to pay everything on time and to the correct BCC. Otherwise, you will have to explain why there is no timely payment and impose penalties. You need to pay every period determined by the legislator. For some companies this is a quarter, and for others a month. The reporting periods for all are quarters, and they “overlap” each other on a cumulative basis. The tax period for everyone is one year.

Tax and reporting periods

At its core, the tax period is nothing more than a regulated period for which the full tax base is calculated. For example, for a company that has been operating for a long time, this will be the full year 2020, and for a company organized in March of this year, the period will be from 01.03. to 12/31/17

However, filling out forms is expected not only for tax periods, but also for reporting periods, which are: quarter, half-year and 9 months. There are no monthly forms, even if you pay advances monthly under legal assumptions.

Procedure for calculating and paying payments

As a general rule, taxpayers make monthly payments. Only businesses with small revenues can pay quarterly. In the payment form you need to indicate the ND or penalty, what exactly you are paying. By the way, the codes for penalties and ND will be different.

Payments must be made strictly on the specified dates to avoid penalties. These milestones are:

- if payment is quarterly - on the deadline for filing the declaration

- if the company pays every month - before the 28th of the next month

IMPORTANT: for payments at the end of the tax period, the deadline for payment of income tax coincides with the date of filing the declaration.

Monthly advances under Art. 286 clause 2 of the Tax Code of the Russian Federation is paid by most companies.

Firms that can pay income tax only 4 times a year are stipulated by the norms of Article 286 of the Tax Code of the Russian Federation in paragraph 3. For quarterly payments, the legislator has provided the following procedure:

- the advance payment for additional payment is determined by the difference in advance payments of the reporting and previous periods

- surcharge is the amount of tax that must be paid at the end of the reporting period

- advances for the reporting period are amounts that were paid based on the calculation data of the previous quarter

- You should pay evenly from month to month in equal shares for each quarter.

- if the taxpayer receives a negative value, there is no need to pay anything

PLEASE NOTE: advance payments in the 1st quarter correspond to actual payments in the 4th quarter.

Who should pay income tax

The payment of income tax, as well as advance payments on it, is regulated by Chapter. 25 Tax Code of the Russian Federation. According to it, taxpayers include Russian organizations and foreign enterprises operating through representative offices in the Russian Federation. Exemption from paying this tax is available to those who apply special tax regimes, such as the simplified tax system, unified agricultural tax, UTII, or pay tax on the gambling business. Some tax regimes can be combined, for example UTII and OSNO. In this case, the taxpayer must keep separate records of income and expenses for activities subject to different taxes. Individual entrepreneurs can also apply OSNO, however, in this case they do not pay income tax, but personal income tax, so our article does not apply to individual entrepreneurs.

If the organization has separate divisions, then income tax and advances on it are paid separately at the place of registration. If there are several separate divisions, you can choose one main one and pay tax at the place of its registration for all divisions, notifying the Federal Tax Service accordingly.

When should you pay tax?

Income tax is paid once a year based on the results of the tax period, which is a calendar year. Advance payments must be made during this year. There are several ways to calculate down payments. They can be calculated and paid monthly or quarterly. There are two calculation options for monthly payments: based on the actual profit received or monthly with an additional payment based on the results of the quarter. Advances are paid quarterly to organizations with an income of up to 15 million rubles. for each of the previous four quarters.

The deadline for paying income tax is the 28th of the month. Monthly advances are paid by the 28th day of each current month or the next one after the reporting month, depending on the method of calculating the advance. Quarterly advances are paid by the 28th day of the month following the reporting quarter. Income tax is due by March 28 of the year following the reporting year.

If this date is a holiday or weekend, then payment can be postponed to the next working day after that.

How to pay income tax

To pay corporate income tax, you must issue a payment order on paper and take it to the bank or do it via the Internet in the Client-Bank system. Recently, the law of November 30, 2016 No. 401-FZ allows third parties to pay taxes for the organization.

There is no difference in the methods of paying income tax and advances on it. The peculiarity of transferring these payments is that it is necessary to issue two payment orders. Income tax is distributed to two different budgets: the federal and the budget of the constituent entity of the Russian Federation. For each of these budgets there is its own BCC, therefore there should be two payments.

Read more about the main BCCs of income tax in 2020 for organizations in our other article.

The main income tax rates are 17% (subject of the Russian Federation) and 3% (federal budget), established for 2017–2020. However, rates may vary for certain categories of taxpayers depending on the region or type of activity.

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

Income tax is paid without taking into account kopecks. The amount is rounded according to mathematical rules to the nearest ruble.

Decoding the fields of a payment order to the budget

Let's take a closer look at filling out the sample income tax payment slip for 2020 in the part related to fields 101–109:

- The upper right field 101 determines the payer status. For income tax, set 01 - legal entity paying taxes.

- Field 104 - KBK, the value of which is the same for all payers. It is this that differs between payments to the federal and regional budgets. In all other respects (except for the payment amount), the payment slips are filled out identically.

- Field 105 - OKTMO of the organization. Determined by territorial location and taken from the company’s statistical data.

- Field 106 - basis of payment. The full list of grounds is given in the order of the Ministry of Finance dated November 12, 2013 No. 107n. To pay a regular advance or tax, we use the TP code - current year payments. The remaining codes are provided for paying various types of debts.

- Field 107 - tax period. Information about the tax period for which payment occurs is encrypted here. The first fields are filled in with letters indicating the period: month, quarter or year. The next fields are the period number, that is, 1st quarter, 2nd month, and so on. Next is a year. When making non-current payments, it is possible to specify a specific date.

- Field 108 - document number. This refers to the document according to which the payment is made, for example a tax demand. For current payments, set to 0.

- Field 109 - document date. This reflects the date of signing the tax return or the date of the demand and other enforcement documents.

- The purpose of payment should indicate in words what tax is paid and for what period.

How to fill out a payment form

Let's draw up a sample payment order for income tax 2020 and consider the features of filling it out, taking into account the fields that should be paid special attention to.

| Payment field number | Meaning |

| 3 and 4 “Document number and date” | Prepare the document no later than the tax payment deadline to avoid penalties from the Federal Tax Service. Set the numbering in a chronological manner, otherwise the bank will return the payment document. |

| 6 and 7 “Document amount” | Enter the amounts in words in field 6 and in numbers in field 7. To transfer tax payments to the Federal Tax Service, follow the rounding rule, in accordance with clause 6 of Art. 52 of the Tax Code of the Russian Federation and letter of the Federal Tax Service dated May 19, 2016 No. SD-4-3/8896. That is, if the amount is less than 50 kopecks, we do not take it into account; 50 kopecks or more, we round up to the full ruble. Example: 1000.49 rubles, payable - 1000 rubles, 1000.51 rubles - payable 1001 rubles. |

| 8–12 “Information about the payer” | Fill in the name of the organization, INN and KPP, current (personal) account, name of the bank (credit organization), details (bank, credit organization). |

| 13–17 “Information about the recipient” | Enter the same data as the recipient, in our case the details of the Federal Tax Service. |

| 21 "Sequence" | Set the value to “5” in accordance with Art. 855 of the Civil Code of the Russian Federation. |

| 22 "UIN" | Record "0" because this is a current payment and there is no special value set for it. |

| 24 “Purpose of payment” | Write down:

|

| 101 “Payer status” | Indicate “01”, since the organization is a direct taxpayer of payments administered by tax authorities (based on Appendix No. 5 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n). |

| 104 “Budget classification code” | In accordance with Order of the Ministry of Finance dated July 1, 2013 No. 65n, set the following indicators:

|

| 105 "OKTMO" | Here, indicate OKTMO, determined by the location of the Federal Tax Service, to which the taxpayer is attached. |

| 106 “Basis of payment” | Reflect the current payment with the code “TP”, determined according to clauses 7 and 8 of Appendix No. 2 of Order of the Ministry of Finance dated November 12, 2013 No. 107n. |

| 107 “Tax period” | Set the indicator, taking into account the method of transferring tax payments:

|

| 108 “Basic document” | Enter "0" as this is a current payment. |

| 109 “Date of foundation document” | For annual calculation, indicate the date of preparation of the declaration; for monthly or quarterly advance payment - “0”. |

| 110 "Information" | There is no data to fill out field 110, leave the field blank. |

Payment of penalties and fines

If the law regarding the payment of income tax or advance payments thereon is violated, as well as if the declarations are not submitted on time, financial sanctions are applied to the organization. These include the accrual of penalties and fines. Knowing about such violations on the part of the company, the accountant can pay them himself or wait until the demand for payment of fines and penalties arrives from the tax office. You can also request a tax reconciliation report from the tax office and take the amount of penalties and fines payable from there.

Payment of penalties and fines is processed in the same way as the tax itself. Filling out payments for interest and penalties for income tax has its own characteristics:

- There are separate BCCs for paying penalties and fines.

- The “Base of payment” field is filled in depending on the basis on which we pay the fine: independently, at the request of the tax office or according to a writ of execution.

- We fill out the “Tax period” if we independently discovered an error in previous periods and make additional tax assessments for this period. Otherwise, you can set a specific date for payment of penalties or fines.

- In the “Document number” field, enter the tax request number or enter 0.

- In the “Document date” field, enter the date of the request or enter 0.

***

When paying income tax, as well as related penalties and fines, a standard type of payment order is used to make payments to the budget. To pay income tax, it is necessary to create two payment orders, since payments are made to two budgets: federal and regional. You need to be especially careful when filling out the KBK field.

If penalties are due

All of the above-mentioned features of payments for penalties now also apply to the payment of penalties for insurance premiums (except for contributions for injuries), which have become payments to the tax office since 2020.

Learn about the procedure for processing payment orders for insurance premiums from this material.

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance. When paying both contributions and penalties on them to the Social Insurance Fund, fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document” are entered as 0 (paragraphs

https://youtu.be/HfMVnkcOems