Who should pay quarterly

Once a quarter, advance payments for income tax must be made by organizations whose sales income over the previous four quarters did not exceed an average of 15,000,000 rubles.

for each quarter (clause 3 of Article 286 of the Tax Code of the Russian Federation). When calculating the average income, take into account the last quarter of the period for which the tax return is filed (letter of the Ministry of Finance of Russia dated September 21, 2012 No. 03-03-06/1/493). For example, take into account the 1st–4th quarters of the reporting year when filing a declaration for the year. Regardless of the volume of revenue, advance payments can be made quarterly by:

- budgetary institutions. The exceptions are theaters, museums, libraries and concert organizations: such budgetary institutions are generally exempt from calculating and transferring advance payments;

- autonomous institutions;

- foreign organizations operating in Russia through a permanent representative office;

- non-profit organizations that do not have income from the sale of goods (works, services);

- participants of simple partnerships in relation to the income they receive from participation in simple partnerships;

- investors of production sharing agreements in terms of income received from the implementation of these agreements;

- beneficiaries under trust management agreements.

This procedure is established by paragraph 3 of Article 286 of the Tax Code of the Russian Federation.

Situation: when does a newly created organization have an obligation to make the first monthly advance payment of income tax? The organization, founded in June, received its first revenue in October. In November, the amount of revenue exceeded 5,000,000 rubles.

The first monthly payment will be due in the second quarter of next year.

Newly created organizations can make advance payments for income tax quarterly until sales revenue exceeds RUB 5,000,000. per month or 15,000,000 rub. per quarter. From the month following the one in which these restrictions are exceeded, the organization must switch to monthly payment of advances on income tax. This procedure is provided for in paragraph 5 of Article 287 of the Tax Code of the Russian Federation.

The first full quarter from the date of registration of the organization is the period from July to September. This means that the organization must begin making advance payments for income tax based on its results (clause 6 of Article 286 of the Tax Code of the Russian Federation). But since the organization did not receive any income this quarter, the amount of the advance payment is zero.

The amount of revenue exceeded 5,000,000 rubles. In November. Consequently, the obligation to switch to monthly transfer of advance payments formally arose for the organization in December. However, you do not need to make your first monthly payment this month. Since the amount of the monthly advance payment in the fourth quarter is 1/3 of the difference between the amount of the advance payment for nine months and the advance payment for six months. The organization had no sales revenue at the end of these reporting periods. Therefore, the amount of the advance payment in this situation is also zero.

You will not have to make advance payments in the first quarter of next year, although there is a potential obligation to pay them. The fact is that the amount of the monthly payment in the first quarter of the next year is equal to the amount of the monthly payment in the fourth quarter of the previous year (clause 2 of article 286 of the Tax Code of the Russian Federation).

Quarter

The meaning of the word Quarter according to Efremova: Quarter - 1. The fourth part of the year, equal to three months. 2. A part of a city bounded by several—usually four—intersecting streets. 3. A plot of woodland, park, vineyard, etc., usually rectangular in shape.

The lowest urban administrative and police unit headed by a quarter warden (in the Russian state until 1862).

The meaning of the word Quarter according to Ozhegov: Quarter - Part of the city bounded by intersecting streets

Quarter

Fourth part of the reporting year

Quarter

Forest area, limited by clearings, roads

Quarter

Lowest urban administrative and police unit included in the police station

Quarter in the Encyclopedic Dictionary: Quarter - (from Latin quartus - fourth) - 1) a quarter of the year (3 months). 2) Part of urban development, limited by streets. 3) In the Russian Empire, the lowest urban administrative and police unit is headed by a quarter warden. It consisted of several streets and was part of a police station. 4) In forestry, an area limited by clearings, roads, etc.

The meaning of the word Quarter according to the Business Dictionary: Quarter is a quarter of the year (3 months).

The meaning of the word Quarter according to the Construction Dictionary: Quarter is a part of the built-up area of a settlement bounded on four sides by streets, presupposing the integrity of the architectural design and compliance with economic fire safety and sanitary and hygienic requirements.

The meaning of the word Quarter according to Ushakov’s dictionary: QUARTER

(

incorrect quarter), quarter, m. (German Quartal from Latin quartus - fourth).

1. part of a city bounded by several intersecting streets. throughout the whole block

.

Griboyedov. In one of the remote quarters of Paris. || collected Population of this part of the city (colloquial). The whole quarter

was keenly interested in the events. || part of the street between two intersections (colloquial). I went to meet her, walked two blocks, but she still wasn’t there.

Calculation of the income limit

The maximum amount of income at which income tax can be paid quarterly is determined by the formula:

| Sales revenues on average for the four previous quarters | = | Income from the sale of goods (work, services, property rights) for the four previous quarters | : | 4 |

Determine sales income without taking into account VAT and excise taxes charged to the buyer (Clause 1, Article 248 of the Tax Code of the Russian Federation).

Situation: when calculating the average income from sales on average for the four previous quarters to determine the possibility of quarterly payment of income tax, is it necessary to take into account income received from the sale of a third party’s bill of exchange?

Yes need.

The sale of a third party's bill of exchange refers to income from the sale, determined according to the rules of Article 249 of the Tax Code of the Russian Federation (subclause 2 of clause 2 of Article 315 of the Tax Code of the Russian Federation). Therefore, when calculating income from sales on average for the four previous quarters, take into account this type of income (clause 3 of Article 286 of the Tax Code of the Russian Federation). This point of view is confirmed by regulatory agencies (see, for example, letters from the Ministry of Finance of Russia dated October 3, 2007 No. 03-03-06/2/188, Federal Tax Service of Russia for Moscow dated March 3, 2005 No. 20-12/14534 ).

Notice of transition to quarterly payment

Situation: is it necessary to notify the tax office about the transition to quarterly transfer of advance payments for income tax? Previously, the organization transferred advance payments monthly based on profits for the previous quarter.

No no need.

The legislation does not contain a requirement to notify the tax inspectorate of the transition to quarterly transfer of advance payments for income tax. An organization is obliged to inform the inspectorate about a change in the method of paying income tax in the only case: if it switches to monthly transfer of advance payments based on actual profit (clause 2 of Article 286 of the Tax Code of the Russian Federation). Thus, an organization can switch to quarterly transfer of advance payments for income tax without notifying the tax office. The main condition is that for the previous four quarters, sales income should not exceed an average of 15,000,000 rubles. for each quarter (clause 3 of Article 286 of the Tax Code of the Russian Federation).

Advice: it is better to notify the tax office about the transition to quarterly transfer of advance payments for income tax (compile an application in any form). Otherwise, tax inspectors may decide that the organization has not submitted a declaration for January of the next tax period (year) and suspend transactions on the accounts. If, before the transition to quarterly tax payment, the organization accrued advance payments based on profits for the previous quarter, the inspectorate may have questions about the reason for non-payment of previously declared monthly advance payments. Similar explanations are contained in the letter of the Federal Tax Service of Russia dated April 13, 2010 No. 3-2-09/46.

Important: before January 1, 2020, the income limit at which companies transferred only quarterly advance payments was 10,000,000 rubles. on average for the quarter. From 2020, this limit has been increased to RUB 15,000,000.

Organizations prepared income tax returns for the nine months of 2020 without taking these changes into account. That is, they declared monthly advance payments for the first quarter of 2020 based on the previous income limit. As a result, in the RSB cards, the tax inspectorates recorded accruals with payment deadlines of January 28, February 28 and March 28, 2020, even for those organizations that have been exempt from monthly advance payments since 2016.

To solve the problem, the tax service recommends that organizations submit updated returns for the nine months of 2020 and declare zero advance payments in them. That is, in subsection 1.2 of section 1, on line 001, indicate the code “21”, and on lines 120–140 and 220–240 – zeros. Place dashes on lines 320–340 of sheet 02 and lines 121 of Appendix 5 to sheet 02.

This is stated in the letter of the Federal Tax Service of Russia dated March 14, 2020 No. SD-4-3/4129.

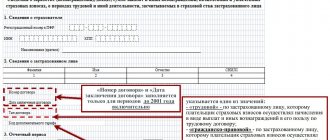

Tax return for individual entrepreneurs using the simplified tax system

Every year, before April 30, individual entrepreneurs using a simplified tax system are required to submit a tax return. Order MMV-7-3/352 of the Federal Tax Service approved the form of the declaration and the procedure for filling it out, for example:

- fill out the declaration in printed capital letters;

- round amounts to the nearest ruble;

- put a dash in empty fields;

- fill out the form again if you made a mistake;

- Declaration sheets cannot be stitched or stapled.

If the entrepreneur had no income during the year, then he must submit a zero declaration.

Advance payment calculation

Determine the amount of the quarterly advance payment for income tax using the formula:

| Advance payment at the end of the reporting period | = | Tax base for the reporting period | × | 20% (or lower if established by regional legislation) | – | Advance payments accrued during the reporting period |

This procedure for calculating advance payments is established by paragraph 2 of Article 286 of the Tax Code of the Russian Federation.

An example of calculating and paying advance payments for income tax. The organization makes advance payments quarterly

JSC Alfa makes advance payments quarterly.

At the end of the first quarter of 2020, the organization received a profit of 100,000 rubles. The advance payment at the end of the first quarter was: 100,000 rubles. × 20% = 20,000 rub.

It was transferred to the budget on April 28, 2020.

For the first half of 2020, profit was received in the amount of RUB 120,000. The advance payment was: 120,000 rubles. × 20% – 20,000 rub. = 4000 rub.

It was transferred to the budget on July 28, 2020.

For the nine months of 2020, profit was received in the amount of RUB 110,000. Taking into account the previously transferred advance payments, the tax amount for this period is subject to reduction: 110,000 rubles. × 20% – 24,000 rub. = -2000 rub.

Since the accrued tax amount for nine months is less than what was actually paid, at the end of this reporting period, Alpha does not transfer an advance payment of income tax to the budget.

Different types of taxes

Transport

Transport tax is paid differently in different regions , and local authorities also set payment deadlines. The law provides for quarterly payments of this type of tax, but administrations may allow legal entities to pay it once a year.

Accordingly, if a decision is made to pay every quarter, then the taxpayer makes an advance payment before the last day of the next month after the reporting period.

The annual payment of this tax is due until February 1 of the following year. Let us explain, the tax is paid for 2020 until February 1, 2020. Other conditions apply to individuals; they pay transport tax for the past year until October 1.

Income tax

Income tax is paid by enterprises that are subject to the general taxation system.

The company is exempt from paying income tax in case of transition to special regimes (imputed and simplified).

The company must pay income tax for the year by March 28 of the year following the reporting period. During the tax period, advance payments are made, the deadline for which is set for the next month after the end of the quarter. The law requires monthly payment of this tax; the amount of the obligation is transferred no later than the 28th.

Property tax

This type of tax is paid by individuals, entrepreneurs and enterprises. Each entity has its own payment procedure and deadlines.

For enterprises, this tax is paid only under the general and imputed regime. Other taxation systems are exempt from this type of tax.

Individual entrepreneurs are not subject to property tax.

This type of obligation to the budget is regional, which means that each region sets its own payment deadlines .

But most adhere to the system of advance payments, which are paid within a month after the end of the quarter and annually.

For individuals, the payment period is given until November 1 of the following year.

Land

Land tax is paid by individuals and enterprises that own land plots. It should be noted that taxes are not levied on leased plots.

Deadlines for payment of land tax are established at the municipal level, and if other regulations are not applied, then the organization must pay an advance payment by September 15 At the end of the completed year, by February 1 .

Individuals, as well as individual entrepreneurs, pay land tax in the period until February 1 of the year following the reporting year.

Water

The water tax is paid to the budget of the region in which the water resource is located.

Taxpayers for this type of tax are enterprises and individuals. A water tax is applied only in cases clearly established by regulations; in all other cases, users pay a certain tariff for water use.

There are no benefits for this type of tax deduction; it is paid every month until the 20th .

When running your own business, an entrepreneur, regardless of the form of his enterprise, has social responsibility to government bodies for paying taxes to the budget, as well as deducting funds from extra-budgetary funds. This process is carefully monitored by the Tax authorities and if payment deadlines are violated, fines and penalties are applied to enterprises, so it is important to understand the deadlines for paying taxes.

The deadlines for paying various types of taxes are described in the following video:

Responsibility

If the quarterly advance payment for income tax was transferred later than the established deadlines, the tax inspectorate may charge the organization a penalty (Article 75 of the Tax Code of the Russian Federation).

If the organization does not transfer the advance payment within the established time frame, the tax inspectorate may recover the unpaid amount of the advance payment from the current account or at the expense of the organization’s property (Articles 46 and 47 of the Tax Code of the Russian Federation).

Failure to fulfill the obligation to make advance tax payments is the basis for sending an organization a request to pay tax (paragraph 3, paragraph 1, article 45 of the Tax Code of the Russian Federation, paragraph 12 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98). This requirement specifies the amount of debt and the period for its repayment (clause 1 of Article 69 of the Tax Code of the Russian Federation).

The inspectorate may make a request for an advance payment of income tax within three months starting from the day following the day the arrears were discovered (Article 70 of the Tax Code of the Russian Federation).

The decision to collect an advance tax payment is made after the expiration of the deadline for its payment specified in the request, but no later than two months after the expiration of the specified period (Clause 3 of Article 46 of the Tax Code of the Russian Federation).

Organizations cannot assess a fine for the amount of unpaid advance payments (clause 3 of Article 58 of the Tax Code of the Russian Federation).