Is it necessary to take into account the area in front of a retail outlet when calculating UTII?

Is the area of the staircase included in the calculation of the “imputed” tax?

How is the area of a hall rented by several merchants taken into account?

Retail trade can be transferred to UTII. Trading activities can be carried out through shops and pavilions with a sales area of no more than 150 square meters. m for each trade facility (subclause 6, clause 2, article 346.26 of the Tax Code of the Russian Federation), or through objects of a stationary retail chain without trading floors, as well as objects of a non-stationary retail chain (subclause 7, clause 2, article 346.26 of the Tax Code of the Russian Federation). In this case, the “imputed” tax will be calculated based on the physical indicator “sales area” or the “trading place” indicator. Let us remind you that if the area of the retail space exceeds 5 square meters. m, then UTII should be paid based on the area.

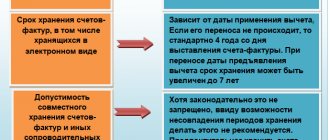

The area of the sales area is determined on the basis of inventory and title documents. These are considered to be any documents available to the individual entrepreneur for the retail chain facility, which contain information about the purpose, design features and layout of the premises, information confirming the right to use the facility. For example, a purchase and sale or lease agreement, a technical passport, plans, diagrams, explanations, permission to serve visitors in an open area.

For the purposes of UTII, the area of the trading floor includes a part of the store, pavilion (open area) occupied by equipment intended for displaying, demonstrating goods, conducting cash payments and servicing customers, the area of cash registers and cash booths, the area of working places for service personnel, as well as aisle area for customers. The area of the trading floor also includes the rented part of the trading floor area. The area of utility, administrative and amenity premises, as well as premises for receiving, storing goods and preparing them for sale, in which customer service is not provided, does not apply to the area of the trading floor on UTII (Article 326.27 of the Tax Code of the Russian Federation).

The law talks about internal passages of buyers, that is, passages between display windows, passages to cash registers, etc. When determining the area of a sales floor (sales place), is it necessary to take into account the area of external passages for customers?

The area of the trading floor under UTII: what is the limit for this special regime

There is no direct formulation of what a trading floor is in the Tax Code of the Russian Federation. However, judging by sub. 2 p. 3 art. 346.2 of the Tax Code of the Russian Federation, then trading floors are part of stationary trade. They are separate and specially equipped premises in which retail trade and customer service are carried out.

In other words, if part of the area in a retail space is allocated for customer service, it is considered that there is a sales area.

Paragraph 14th century 346.27 of the Tax Code of the Russian Federation refers to the objects of a stationary network in which there are trading floors, only shops and pavilions.

The store according to paragraph. 26 Art. 346.27 of the Tax Code of the Russian Federation is considered an equipped building or part of it if it:

- serves for the sale of goods and provision of services;

- equipped with premises intended for trade, storage of goods, their preparation for sale, accommodation of administrative personnel and auxiliary needs.

Pavilion according to paragraph. 27 Art. 346.27 of the Tax Code of the Russian Federation is considered a building that has a sales area and is designed for a small number of jobs (one or several).

When conducting retail trade in a store or pavilion, the taxpayer must keep in mind that the UTII regime will be available to him only until the area of the sales floor exceeds 150 square meters. m. This indicator according to subclause. 6 paragraph 2 art. 346.26 of the Tax Code of the Russian Federation is the limit for this type of activity and such premises.

For more information about the rules for calculating the area of a sales area, read the material “How to calculate the area of a sales area for the purposes of applying UTII?” .

The size of the sales area directly affects the amount of tax.

See this article for the formula for calculating it.

Quite often situations arise in which taxpayers find it difficult to correctly determine the area of the sales floor. But it directly affects the amount of tax payable. You will find explanations for most controversial cases encountered in practice, supported by links to the opinions of officials and judges, in the Guide from ConsultantPlus, gaining free access to this authoritative legal system.

Example

This idea can be illustrated by the following typical example. The taxpayer rents space in a shopping center. Of these, part is utility and storage space, and part is directly used for trade.

The Federal Tax Service insists that the company does not have a sales area, but does have a retail space. Officials justify their position by saying that the partition between the warehouse and retail premises is not permanent. This position assumes that UTII covers the entire rented area, including the corridor and warehouse.

In this case, it is not enough to refer to Art. 346.27 of the Tax Code of the Russian Federation, which indicates the characteristics of a trading floor: (part of a store, pavilion, equipped with special trading equipment, where retail trade is carried out and customers are served). It is necessary to provide documents, for example, a lease agreement, which indicates the purpose of the premises as a retail space. In addition, it is necessary to confirm with appropriate documents the presence of a wall (partition) between the warehouse and the sales area.

Trading place (UTII): features of determining the area

If a retail space with an area of more than 5 square meters is used for retail trade. m, then in accordance with paragraph 3 of Art. 346.29 of the Tax Code of the Russian Federation for UTII, the physical indicator is the area of such premises.

Tax Code of the Russian Federation in Ch. 26.3, dedicated to this type of tax, does not indicate how the area of a retail space for UTII should be calculated. All explanatory information is concentrated in numerous letters from the Ministry of Finance and the Federal Tax Service of Russia and accumulated judicial practice.

Specialists from the ministry and the tax department explain that the area of a retail space must be determined strictly according to title or inventory documents.

These, according to letters of the Ministry of Finance of Russia dated May 19, 2014 No. 03-11-11/23429, dated August 8, 2012 No. 03-11-11/231 and the Federal Tax Service of Russia dated July 27, 2009 No. 3-2-12/83, include technical passports of premises, contracts of purchase and sale, lease of premises or parts thereof, diagrams, plans, explications.

To learn how the closure of a retail outlet affects the calculation of UTII, read the material “How to calculate UTII if a retail outlet is closed?”

Lease agreement: read carefully

Therefore, when leasing premises and using only part of it for trade, make sure that the lease agreement contains clear explanations regarding the actual area being used. The calculation of the imputed tax does not include that part of the trading floor that is leased or subleased. When calculating the area of the sales floor, the so-called auxiliary premises - administrative and household purposes and those used for storing and receiving goods - are not taken into account.

If such premises are physically fenced off from the sales floor, the number of claims in the event of an inspection will immediately decrease by an order of magnitude. If the size of the area changes or its purpose is changed, the manager should document this in order to avoid disagreements with the inspection authorities.

When calculating the physical indicator, is it necessary to take into account premises not used in trade?

In their letters, the regulatory authorities insist that in the previously mentioned Chapter. 26.3 of the Tax Code of the Russian Federation there is no provision according to which it is possible to exclude from the area of a retail space the area that is free from customer service. This refers to utility rooms, warehouses, etc. (letters of the Ministry of Finance of Russia dated March 5, 2012 No. 03-11-11/68, dated December 26, 2011 No. 03-11-11/320, Federal Tax Service of Russia dated June 25, 2009 No. ShS-22 -3/ [email protected] ).

Such actions are permissible only in relation to shops and pavilions, since they have trading floors (paragraph 22 of article 346.27 of the Tax Code of the Russian Federation).

This point of view is supported by arbitration courts at all levels, up to the Supreme Arbitration Court of the Russian Federation (resolution No. 417/11 dated June 14, 2011). As an example of decisions of lower courts, one can cite the decisions of the FAS Volga-Vyatka District dated March 12, 2013 No. A79-7818/2012, the Moscow District FAS dated February 10, 2012 No. A41-31817/10, the FAS Central District dated March 11, 2011 No. A62- 4419/2010).

Finally, the Constitutional Court of the Russian Federation holds a similar opinion regarding trading places, which, in its ruling dated July 16, 2013 No. 1075-O, did not find this a violation of the rights of UTII payers.

In this regard, in order to avoid additional charges during tax inspections, the area of the retail space should include those places and premises where the goods are stored or prepared for sale.

What's the difference

Such a feature, by definition, cannot be inherent in a retail space, which most often looks like a counter or showcase with goods displayed, directly from which sales are made. The Federal Tax Service believes that if the inventory or title documents of the premises do not contain an indication of the status of a store or pavilion or there is no clear definition of part of the premises as a trading floor, then the mentioned object can by default be considered to belong to a stationary retail chain and not have a trading floor.

Sometimes, in the entire retail space market, objects with a sales floor include exclusively shops or pavilions. That is, in the case of sales in a former warehouse, it is necessary to prove the status of the premises as a trading floor. At the same time, in a container-type pavilion, a trading floor is implied by definition, based on the word “pavilion” alone.

How to calculate a physical indicator when a retail facility consists of premises for different purposes

In business practice, there are quite often circumstances when the object of trade consists of warehouse and retail premises, the basis for which is the necessary title or inventory documents.

The Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 417/11, classified such objects as having a trading floor. Lower courts at different times came to a similar conclusion (decrees of the Federal Antimonopoly Service of the Volga District dated 06.28.2012 No. A55-23133/2011, FAS Volga-Vyatka District dated 05.31.2012 No. A11-1487/2011).

It turns out that in such cases the taxpayer must use the area of the trading floor, and not the trading place, to determine UTII.

The logic of the judges is as follows: a trading place should be considered a place where goods are displayed and sold. Warehouse, utility, administrative and household premises should not be included in them. If they appear, then the category of the object is upgraded to a premises with a sales floor.

Which types of premises should be classified as a trading floor and which should not, read the article “The Ministry of Finance explained that it does not apply to the area of a trading floor for UTII purposes .

Example

, engaged in retail trade, rents premises with a total area of 47 sq. m. m. In accordance with the agreement, Sigma has been given a premises consisting of two parts: in one part the goods are directly traded, in the other the goods are stored.

The area where trade takes place is 9.8 square meters. m. In the given circumstances, the indicator “sales area” should be used, equal to 9.8 square meters. m.

In such cases, the taxpayer should keep in mind that when using warehouse and utility premises to serve clients, the indicator can immediately be increased by the amount of these areas.

At the same time, it is the tax authorities, in accordance with Resolution No. 417/11, who must prove that warehouse premises are used to serve customers, based on the fact that the latter have free access to stands and stored goods.

What to do in a situation where you have rented out (subleased) part of the sales area? You can find out the answer to this question by getting trial access to ConsultantPlus.

See also “You cannot “fence yourself off” from the UTII with a shop window.”

Judicial practice shows that arbitrators support the tax service in such circumstances. Confirmation can be found in numerous decisions, in particular, in resolutions of the FAS Volga District dated 02/07/2013 No. A65-23254/2011, FAS Volga-Vyatka District dated 12/24/2012 No. A38-1707/2012, FAS Ural District dated 09/19/2011 No. F09-5821/11.

See also “Retail trade through a warehouse can be transferred to imputation.”

Transition to UTII in retail trade

Local authorities decide what activities to include in the UTII payment. They have the right to choose one or all types at once. The adjustment factor is also set by local authorities.

The company has the right to reduce the amount of tax by the amount of benefits or contributions, but it cannot exceed 50%.

It is important to understand that the company must have no more than 100 employees and no more than 25% participation of other persons. It is also prohibited for those involved in health care and social security to pay such a tax. Also, the company is not large and does not lease gas stations.

There are some peculiarities when switching to this type of tax.

- A prerequisite is trade through stores not exceeding the established area. Those premises where customer service does not take place are not considered trading premises.

- Then, when the object is partially used, the entrepreneur must take into account the sum of the entire area that is used.

- It is prohibited to use UTII if freight transport, medicines with benefits, goods that are made independently, or goods based on a sample are sold.

- You also need to know that an entrepreneur can refuse a cash register if he issues clients a strict reporting form or a document that can confirm the receipt of a sum of money for the goods.

Results

When applying UTII in retail trade, one of the physical indicators in relation to which the basic profitability of the type of activity being carried out is determined is the area of the premises or place in which trade is carried out. It is important for sales conducted through a stationary retail network (with or without sales floors) or in the absence of a stationary network (at retail locations).

The area limits for the use of UTII with the indicator of the size of the sales floor or place are limited by the following figures:

- 150 sq. m for a sales area - exceeding it leads to the impossibility of applying UTII;

- 5 sq. m for retail spaces - the presence of a smaller area requires the use of a different physical indicator.

The size of the area is determined according to documents. However, in a number of cases, certain nuances of classifying premises as retail should be taken into account.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Owners of cafes and bars

If we are talking about a catering outlet, the retail space includes the area where customers eat food and spend their leisure time. The place where meals are served and payment for them is made is considered an auxiliary room.

In the case of retail, it is wise to enter into two different leases for the premises you intend to use. The first of them is for the area related to the sales floor, the second is for the areas for displaying and storing goods. Each of the contracts must be accompanied by a BTI plan, on which it is necessary to divide the space. The room itself is demarcated thanks to partitions, while the room for displaying goods can be designated with an appropriate sign.

In the case of a catering establishment, the BTI plan should highlight areas for serving food and waiting for customers in line. Such a plan will serve as an inventory and title document - the main argument during an audit by the tax authorities. In the room itself, areas not intended for leisure time and eating, it is best to highlight them with beautiful decorative partitions or special screens.