The essence of direct costing and its application

Originating during the Great Depression in the USA, direct costing (DC) received its development and recognition with the onset of the 50s of the last century. It was during this period that many companies increased production capacity, the scale of production of goods and worked to find ways to minimize costs. Lower production costs (c/c) increased their competitiveness and strengthened their position in the external and internal markets.

Questions about how to most accurately determine the cost of individual products, calculate the break-even point, how to find reserves for reducing prices - all this became the basis for the development of DC. The fundamental principle of DC and its distinctive feature is that the cost of manufactured products is planned, and then reflected in the accounts only in terms of variable costs - completely dependent on fluctuations in output volume.

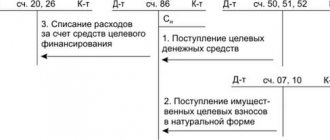

As for fixed expenses, they are accumulated in a separate account.

These costs are written off periodically directly to the debit of the financial statements. Thus, their size relates to the financial outcome of the company. https://youtu.be/https://www.youtube.com/watch?v=GGNaddkCBg4

Direct costing costs

Accounting for company costs is an integral part of direct costing.

All company costs when using direct costing are divided into:

- Direct.

- Indirect.

Moreover, depending on the type of direct costing, they can also be:

- variable - the amount of such costs depends on production.

- constant - costs whose nominal size represents a constant unit each period of time.

In order to accurately divide all costs into variable and constant, methods such as:

- analysis .

- high and low points (also called the absolute increment method, or minimax);

- least squares;

- technological regulation;

- correlations;

Types of accounting according to DC

Domestic practice identifies two variations of management accounting based on DC:

- Simple – separate accounting is organized for financial and management accounts. Direct variable costs are included in the s/s composition.

- Developed - integration of accounting using accounts 20-29 - usual for cost accounting. S/s also includes that part of indirect general economic costs that can be designated as variables (conditionally variable).

Important! The main problem of DC is that it is often difficult to separate variable costs from fixed ones, since in practice they are not easy to classify and unambiguously include in a certain group.

Typical accounting entries for direct costing

The DC system provides for the reflection of business operations with the following records:

| Debit | Credit | Description |

| 90.2 | 25 | general production costs are transferred to sold products |

| 90.2 | 26 | General business costs are included in the cost of shipped products |

| 40 | 23 | Definition of s/s in auxiliary production |

| 40 | 20 | S/s of the main production |

| 90.2 | 20 | C/s of work performed and specified services |

Advanced accounting - in the example.

Example 1. The company keeps records of agricultural products on its account. 40. Closes it monthly. If there are deviations from the normative and actual data, they are transferred to the financial result.

- The amount of general business expenses for the month is 60 thousand rubles.

- Electricity spent – 120 thousand rubles.

Product data:

| Product | Quantity, pcs. | S/s normative | Price |

| A | 2000 | 100,00 | 300,00 |

| B | 2000 | 150,00 | 400,00 |

Actual costs for materials used:

- A – 70 thousand;

- B – 50 thousand

The accounting scheme according to the DC is as follows:

Dt 43 Kt 40 100 thousand (1000·100) capitalized ed. And according to the s/s normative;

Dt 43 Kt 40 150 thousand (1000·150) ed. B according to s/s norms. capitalized;

D 62 Kt 90 300 thousand (1000·300) reflection of revenue from sales of publication. A;

Dt 90 Kt 43 100 thousand normative s/s sold items. A written off;

D 62 Kt 90 400 thousand (1000·400) revenue from the sale of publications. B;

Dt 90 Kt 43 150 thousand s/s ed. B written off;

After the month has come to an end:

Dt 26 Kt 70 (02, 69) 60 thousand general business expenses are reflected;

Dt 90 Kt 26 60 thousand general household. monthly expenses written off;

Dt 25 Kt 76,120 thousand – actual total electricity costs;

Dt 20 Kt 25 51 432 (120 thousand · 0.4286) – electrical power. assigned to A;

Dt 20 Kt 25 68 568 (120 thousand · 0.4286) – electrical power. - to B;

Dt 20 Kt 10 70 thousand materials written off to A;

Dt 20 Kt 10 50 thousand write-off of materials at B;

Dt 40 Kt 20,121,432 (51,432+70 thousand) costs for A;

Dt 40 Kt 20,118,568 (68,568+50 thousand) costs for B;

Dt 90 Kt 40 21 432 (121 432-100 thousand) – write-off of overexpenditure according to A;

Dt 90 Kt 40 31 432 (150 thousand - 118 568) - savings on B are negated.

A separate sub-account is allocated for each product. In this example, the product is completely sold. Balances, if available, should be reflected in accounting according to the abbreviated standard s/s.

Features of direct costing – advantages and disadvantages

The advantages (+) and disadvantages of DC are given in the table:

| Direct costing | |

| + | – |

| The bulk of the costs can be sent to the tax base. This is done due to the fact that general business expenses are written off to the financial result at a time | Ambiguity of expenses of a constant nature. It's not always easy to isolate them |

| Accounting is somewhat simplified, since there is no need to distribute accounts. 26 on account 20 | There is no clear and unambiguous clarity about the manufactured cost of the product, its full cost |

| The level of “s/s management of the company” is always visible. This means that it is quite possible to make adjustments quickly | To determine the full s/s GP or work in progress, one cannot do without additional distribution of costs of a semi-fixed nature |

| S/s GP does not contain “extraneous” costs not related to s/s production | Discrepancy between the results of accounting and management accounting |

| The pricing policy is much more effective. The price allows you to get maximum profit | There is a distortion in the amount of annual profit due to the fact that work in progress balances are assessed taking into account only variable costs |

| Based on the calculation of the s/s unit, you can determine the break-even point | Overhead costs are out of the scope of cost control |

Opponents of business capital express the opinion that fixed costs are involved in production in the same way as everyone else. Why then exclude them from the s/s? After all, the place of fixed costs in it is quite justified. The DC system does not make it possible to determine the total amount of costs. Therefore, it will not be possible to make an error-free calculation. But there is no absolutely ideal calculation system that allows one to calculate the cost of an individual unit of production with 100% accuracy.

Organization of production accounting using the Direct Costing system

In modern market conditions, accounting serves as an executive instrument for the activities of economic entities and includes accounting and management accounting. Moreover, management accounting is a priority in industrial economic entities. In management accounting, there are various cost accounting methods; they are numerous, but each has its own characteristics, which allows them to be classified. One of these signs is the completeness of inclusion of costs in the cost of goods and sales. From this position, two methods are distinguished: the full inclusion of costs in the cost of goods, it is also called traditional accounting of the full cost; incomplete inclusion of costs, limited by any criterion.

One of the management accounting methods, in which costs that depend on the volume of product sales are included in the cost price, is “direct costing”.

To determine the cost of products, limited cost is used, when partial cost is planned and taken into account using cost objects. Partial cost is calculated on the basis of production costs, i.e. and direct and indirect costs, because they are directly related to the production of products (services, works). Using the “direct costing” system to determine the cost of production, only variable costs are taken into account, which are distributed among cost carriers. And fixed expenses are accumulated in a separate account and are not included in the calculation. Indirect costs are taken into account when calculating the financial result for the reporting period and are periodically written off against the results of the financial activities of the economic entity. At the same time, when using the direct costing system, inventories are also estimated based on variable costs, i.e. balances of finished products in warehouses. In modern market conditions, the manager of an economic entity constantly analyzes the activities of the economic entity in order to make effective management decisions. To analyze and make management decisions, initial information is required on a number of indicators, including the cost of manufactured products (work, services). Thus, the cost of manufactured products (work, services) can be calculated using various methods, including the “direct costing” method[1].

Direct costing is often used to make short-term decisions. It involves estimating costs directly related to production. Determining direct costs allows you to more rationally link production and sales activities, as it gives a complete picture of the relationship between costs, production volume and profit. Also, the “direct costing” method helps to identify the relationship between profit and sales volume, while when taking into account full costs, both sales volume and production volume influence profit [1].

The basis of calculations using the “direct costing” method is the method of calculating cost using truncated costs. The direct costing method provides a more objective assessment of the situation than methods based on taking into account full costs. In market conditions, each economic entity focuses on minimizing costs and increasing profits. It is important for a commodity producer to know how fluctuations in production and sales volumes will affect the financial results of the activities of an economic entity. Of course, with a change in production volume, the share of direct costs also changes, and this is reflected in the cost of products (works, services) and, consequently, their profits. Therefore, information about the costs of manufacturing products and their sales, which are not distorted as a result of the distribution of indirect costs and are relatively constant per unit of output at any volume of production, is very important for the commodity producer. Information about incomplete production costs or sold products as a whole is what the “direct costing” system provides. At the same time, this system allows you to track the difference between sales revenue and the partial cost of products, i.e. determine marginal income [2].

The undoubted advantage of the “direct costing” system is that limiting the cost of production by variable costs makes it possible to simplify rationing, planning, accounting and control, and at the same time the number of cost items is sharply reduced. The cost of production becomes more “visible”, and individual costs are better controlled. The more objects under control, the more attention is scattered between them, the weaker control becomes[2]. An important advantage of the system is the limitation of product costs only to variable costs, which makes it possible to simplify rationing, planning, accounting and control of a sharply decreasing number of cost items. Consequently, the more objects under control, the more attention is scattered between them and the weaker control becomes. From this we can conclude that individual costs are better controlled and the cost of products (works, services) becomes more “foreseeable”. It is worth highlighting a number of problems in organizing production accounting using the “direct costing” system. These problems are associated with the peculiarities inherent in this system: firstly, in manufacturing enterprises the costs are mostly semi-variable, and there are not so many purely fixed or purely variable costs. Therefore, difficulties arise in classification when dividing expenses into fixed and variable. And, in addition, in different situations the same expenses may behave differently; secondly, a number of scientists believe that fixed costs are also involved in the production of a given product and, therefore, should be included in the cost of products (works, services) [4].

The use of the “direct costing” accounting method at manufacturing enterprises has a significant impact on the development of production accounting into management accounting. The “direct costing” system focuses the attention of managers of an economic entity on changes in marginal income for the economic entity as a whole and for manufactured products (works, services) [3]. This system makes it possible to better account for products with greater profitability in order to switch mainly to their production, since the difference between the selling price and the amount of variable costs is not obscured as a result of writing off constant indirect costs to the cost of specific products. Thanks to the direct costing system, the analytical capabilities of accounting are expanded, and a process of close integration of accounting and analysis is observed.

Standard costing and direct costing methods – which one to choose?

The standard costing method has been successfully used in accounting for many years. It is defined as a full cost method, since variable costs are included in the cost of a unit of goods.

When using standard costing:

- the bulk of the company's costs are included in the tax base as the products are sold;

- If a company has significant work-in-progress balances, its tax base will increase markedly as expenses are “tracked on the warehouse shelves.”

When using DC:

- The amount of income tax is significantly reduced due to the fact that variable costs are immediately included in the financial result without waiting for the sale of products;

- if there are large balances of GP in the warehouse, the tax base may also increase.

Example 2. Initial data:

- Annual production is 200 units.

- It will be sold quarterly in identical batches (50 units each).

- Price (market) per piece. – 2,500 rub.

Expenses

- permanent – 100 thousand rubles.

- variables – 100 thousand rubles.

We will calculate the financial result and tax (on profit).

1) For the standard costing method, thousand rubles.

| Quarter | S/s units cont. | Implementation | Fin. result | Tax | |||

| Quantity | Price | S/s | Revenue | ||||

| I | 1,00 | 50 | 2,50 | 50,00 | 125,00 | 75,00 | 15,00 |

| II | 50 | 50,00 | 125,00 | 75,00 | 15,00 | ||

| III | 50 | 50,00 | 125,00 | 75,00 | 15,00 | ||

| IV | 50 | 50,00 | 125,00 | 75,00 | 15,00 | ||

2) For the direct costing method, thousand rubles.

| Quarter | S/s units cont. | Implementation | Fin. result | Tax | |||

| Col. | Price | S/s | Revenue | ||||

| I | 0,500 | 50 | 2,50 | 125,00 | 125,00 | 0 | – |

| II | 50 | 25,00 | 125,00 | 100,00 | 20,00 | ||

| III | 50 | 25,00 | 125,00 | 100,00 | 20,00 | ||

| IV | 50 | 25,00 | 125,00 | 100,00 | 20,00 | ||

Calculations show that with DC it is possible to delay payment. But the tax increases in subsequent quarters, and in general for the year its amount does not differ. Most often, companies use a mixed method - production variable costs are distributed, and non-production variables are immediately sent to the financial result.

Standard costing has the following undeniable advantages:

- With sufficiently high accuracy, it allows you to determine the full cost of individual products before their production begins. This is important for the company’s pricing process.

- Allows you to identify types of specific costs that influenced financial results. For example, after the end of the reporting period, it is possible, by comparing the actual prices for spare parts and materials with the planned ones, to establish that it is because of their growth that the costs of repair work have increased.

Involving DC in planning and accounting makes it possible to determine the relationship between the profitability of the company, its expenses, which are under control, and the volume of output. For standard costing, such possibilities are limited.

Vote:

RSS

| Category : Accounting and taxation issues | |

| Replies: 32 |

You can add a topic to your favorites list and subscribe to email notifications.

| Dmitry [email protected] Russian Federation, Yaroslavl Wrote 30 messages Write a private message Reputation: | |

| Gentlemen, economists and accountants, I have the following questions for you: 1. What is the current relationship between the direct costing method and taxation? 2. The fact is that in universities they teach how to place orders with an enterprise that has a loss when distributing indirect costs with the distribution base being the wages of the main production workers, but having additional marginal coverage during direct costing. How will the tax authorities look at this whole matter, since I will essentially underestimate the taxable income tax base? 3. It turns out that before I calculate prices like this, I will have to change my accounting policy? PS Thanks in advance. | |

| I want to draw the moderator's attention to this message because: Notification is being sent... |

| Natalie [email hidden] Russia, Novosibirsk Wrote 1405 messages Write a private message Reputation: | #2[12497] June 3, 2011, 2:48 |

Indirect expenses include all other amounts of expenses, with the exception of non-operating expenses determined in accordance with Article 265 of the Tax Code of the Russian Federation, incurred by the taxpayer during the reporting (tax) period. Moreover, in accordance with paragraph 2 of Article 318 of the Tax Code of the Russian Federation, the amount of indirect expenses for production and sales incurred in the reporting (tax) period is fully included in the expenses of the current reporting (tax) period, taking into account the requirements provided for by the Tax Code of the Russian Federation, at that time how direct expenses relate to the expenses of the current reporting (tax) period as products, works, and services are sold, the cost of which they are taken into account in accordance with Article 319 of the Tax Code of the Russian Federation. Thus, organizations engaged in the production of products (performance of work, provision of services) and using the “direct costing” method in accounting can, for the purposes of calculating taxable profit, take into account production costs in a similar manner. As can be seen from the essence of the “direct costing” method, as well as the rules of accounting and calculation of taxable profit, this cost accounting method can be used by organizations engaged in the production of products (performance of work, provision of services). For organizations engaged exclusively in trading activities, this method is not applicable. It may be necessary to change the accounting policy. I want to draw the moderator's attention to this message because:

Notification is being sent...

Strong people are always a little rude, like to be sarcastic and smile a lot!| U902 [email hidden] Russia, Samara Wrote 617 messages Write a private message Reputation: | #3[12498] June 3, 2011, 7:49 |

Dmitry wrote:

...having a loss when distributing indirect expenses...after all, I will essentially understate the taxable income tax base?

There is a result - profit and there is a way to distribute indirect costs. If the distribution is done correctly, how will this change the result? Whatever the amount of indirect expenses was, it will remain that way, only it will be distributed differently.

I want to draw the moderator's attention to this message because:Notification is being sent...

| Dmitriy [email protected] Russian Federation, Yaroslavl Wrote 30 messages Write a private message Reputation: | #4[12517] June 3, 2011, 16:46 |

U902 wrote:

There is a result - profit and there is a way to distribute indirect costs. If the distribution is done correctly, how will this change the result? Whatever the amount of indirect expenses was, it will remain that way, only it will be distributed differently.

I agree, but they can point at the accounting policy and say, but it’s written differently there. They can check pricing and it turns out that for some product items there will be a large profit, and for some there will be a loss. Consolidated, you get the same amount, but differentiated, the situation will be different. Will the question arise, why are you selling products below cost? Although, on the other hand, who cares how I conduct business, as long as I don’t deceive them. - This is the first moment. The second point is if I enter into transactions based on margin coverage, in other words, I will make products with a lower than usual marginal income, for example, two or three. It will be profitable for my company to fulfill the order, but how will the tax authorities look at this?

I want to draw the moderator's attention to this message because:Notification is being sent...

| U902 [email hidden] Russia, Samara Wrote 617 messages Write a private message Reputation: | #5[12532] June 5, 2011, 12:40 |

Notification is being sent...

| Dmitriy [email protected] Russian Federation, Yaroslavl Wrote 30 messages Write a private message Reputation: | #6[12541] June 5, 2011, 6:42 pm |

Notification is being sent...

| Natalie [email hidden] Russia, Novosibirsk Wrote 1405 messages Write a private message Reputation: | #7[12542] June 6, 2011, 3:43 |

Quote:

In accordance with paragraph 1 of Article 318 of the Tax Code of the Russian Federation, the taxpayer independently determines the list of direct expenses in the accounting policy for tax purposes. Direct costs may include, in particular, material costs; expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as the amount of insurance premiums; the amount of accrued depreciation on fixed assets used in the production of goods, works, and services.

The distribution base can also be defined in it!

I want to draw the moderator's attention to this message because:Notification is being sent...

Strong people are always a little rude, like to be sarcastic and smile a lot!| U902 [email hidden] Russia, Samara Wrote 617 messages Write a private message Reputation: | #8[12543] June 6, 2011, 7:01 |

Dmitry wrote:

U902, during a total check, they can get into the prices, but about the corridor, the fact is of course known to me, but here’s the catch, how competently does this tool work?

And what's in the prices? We lived for 70 years and nothing, and since the end of last year the tax office has been asking for calculations every quarter - hundreds of item items, I still don’t understand why they need them. Along the corridor, relative to the price list, the tool works very clearly, at least here.

I want to draw the moderator's attention to this message because:Notification is being sent...

| Dmitriy [email protected] Russian Federation, Yaroslavl Wrote 30 messages Write a private message Reputation: | #9[12551] June 6, 2011, 16:32 |

Notification is being sent...

| Andrey270 [email hidden] Russian Federation, Tomsk Wrote 608 messages Write a private message Reputation: | #10[12553] June 6, 2011, 5:48 pm |

Dmitry wrote:

Natalie People with conservative views are responsible for our accounting policy; they are accustomed to one thing and do not want to change anything, so we have to look for other solutions. U902 But what about resellers with their own markups? Or, for example, they brought the same product from China 3 times cheaper, but they sell it at 40% cheaper than the market and feel great.

So if you brought goods from China, will there be customs documents? The tax office will probably believe them?

I want to draw the moderator's attention to this message because:Notification is being sent...

| Dmitriy [email protected] Russian Federation, Yaroslavl Wrote 30 messages Write a private message Reputation: | #11[12556] June 6, 2011, 21:30 |

Notification is being sent...

| Natalie [email hidden] Russia, Novosibirsk Wrote 1405 messages Write a private message Reputation: | #12[12557] June 6, 2011, 21:36 |

Dmitry wrote:

Natalie People with conservative views are responsible for our accounting policy; they are accustomed to one thing and do not want to change anything, so we have to look for other solutions. U902 But what about resellers with their own markups? Or, for example, they brought the same product from China 3 times cheaper, but they sell it at 40% cheaper than the market and feel great.

In this case, these people are also responsible for tax risks and disputes!

I want to draw the moderator's attention to this message because:Notification is being sent...

Strong people are always a little rude, like to be sarcastic and smile a lot!| Andrey270 [email hidden] Russian Federation, Tomsk Wrote 608 messages Write a private message Reputation: | #13[12560] June 7, 2011, 5:28 |

Dmitry wrote:

Andrey270 What does this have to do with documents if we are talking about a price difference below 20% of market prices? The documents will show that the purchase price is 3 times less.

I'm just trying to say that all taxes assessed will be justified. I don’t think that with prices lower by 40% and good turnover, the tax authorities will have many questions. You will not deliberately set a markup of 5%; therefore, when distributing “indirect” expenses, you will not incur a loss on this particular item.

I want to draw the moderator's attention to this message because:Notification is being sent...

| U902 [email hidden] Russia, Samara Wrote 617 messages Write a private message Reputation: | #14[12561] June 7, 2011, 8:09 |

Dmitry wrote:

But what about resellers with their own markups? Or, for example, they brought the same product from China at 3 times cheaper, but they sell it at 40% cheaper than the market and feel great.

Andrey is correct. The problem is not the deviation of prices from market levels. The problem is the lack of taxes from the enterprise when the enterprise conducts business activities. Is it normal? Of course, there are different situations: economic downturn and temporary difficulties. But a bad dancer... And greed and tax evasion are the first thing. Do those that were brought from China pay taxes (even if they sell for less than the market level)? What about your company?

I want to draw the moderator's attention to this message because:Notification is being sent...

| Dmitriy [email protected] Russian Federation, Yaroslavl Wrote 30 messages Write a private message Reputation: | #15[12564] June 7, 2011, 11:37 |

Notification is being sent...

« First ← Prev.1 Next → Last (3) »

In order to reply to this topic you need to register.