The procedure for calculations and drawing up an order for the payment of average earnings for the period of feeding a child

The Labor Code guarantees them such a benefit, regardless of what is established at work. The main conditions are that the worker’s working day must exceed 3 hours, and the child must be no more than 1.5 years old.

Resolution of the Plenum of the Supreme Court of the Russian Federation No. 1 of February 28, 2020 explains the following: a woman who cannot combine work in her position with maternal responsibilities, including feeding, must be offered the most suitable place by the employer.

A woman breastfeeding a young child can:

- add a break needed to feed the baby to the main lunch break;

- summarize breaks and move them to the beginning of the working day or shift;

- transfer the accumulated time for breaks to the end of the working day or shift.

Such rights are established by part 3 of article 258 of the Labor Code of the Russian Federation. To use them, an employee of the company must submit a special application at work.

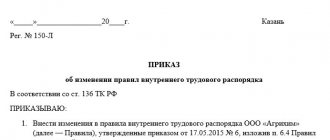

Sample order for payment based on average earnings

Who is assigned a personal allowance and who is not? Additional personal allowances can be assigned to any full-time employee of the organization, since they are added to his salary, often calculated as a percentage of its size.

At the same time, the registration of an employee on the staff does not have much significance; the following may qualify for a personal allowance:

- an employee who has entered into a regular employment contract;

- "conscript";

- part-time worker.

It is not customary to assign personal bonus payments to the following categories of workers: Registration of a personal bonus The employer is not obliged to include the terms of the personal bonus in the employment contract, since this is an incentive payment. It is recommended to include the following details and information in it:

- Name

- registration number under which the order is recorded in the journal of local administrative documents;

- place of compilation;

- publication date;

Payment based on average earnings: practical examples

The company has the right to set any term of the billing period. For example, 3, 9 or even 24 months that will precede the payment.

The main thing is that another calculation period should not lead to a reduction in the amounts due to the employee (that is, to a worsening of his situation in comparison with the twelve-month calculation period). If a decision is made to change the period, the corresponding amendments must be indicated in the labor regulations payment based on average earnings and collective agreements. This calculation is easier to understand using practical examples.

Let's say an employee of a large enterprise is sent on a business trip. For these business trips he is paid an average salary.

If we assume the employee’s departure in the current year, then: February is the calculation period from February 1 of the previous year to January 31 of the current year; March is the calculation period from March 1 of the previous year to

dtpstory.ru

Attention Regulatory framework Correct execution of an order presupposes that it indicates the current provisions of the Labor Code. Articles to pay attention to: Art.

180 – the employer’s obligation to offer another vacancy to an employee dismissed due to layoffs; Art.

77 – dismissal is allowed by mutual agreement of the parties with the accrual of monetary compensation and severance pay; Art. 83 – termination of an employment contract with an employee who has lost his ability to work; clause 1 art. 81 – reduction due to refusal to fill a vacant position when the staffing table changes; Part 2 Art. 178 – maintaining the average salary while looking for a job after layoffs; part 6 art. 81 – restrictions on layoffs of certain categories of workers; h.

4 tbsp. 256, art. 261 – assigning a place to certain categories of employees; h.

3 tbsp.

What does the law say?

The main legal act regulating the reduction procedure is the Labor Code of the Russian Federation. In accordance with it, the employer must make all payments due to employees. This action is carried out after the relevant order is issued.

There is no unified form of the document, but it is the basis for the accounting department to calculate severance pay and compensation to dismissed employees.

What benefits is an employee entitled to?

Employees laid off due to layoffs are paid:

- wages for the last month - in proportion to the hours actually worked;

- severance pay – one average monthly salary for the month following dismissal;

- compensation - for missed vacation, work on holidays, weekends, etc.;

- average earnings for the second and third months - according to the decision of the Employment Service.

Payment order for the second month

If a citizen cannot find a job, he will be paid compensation for the second month after the layoff.

Sample order for payment of severance pay in case of layoff for the second month

Its size will remain unchanged, but to receive the payment you will have to perform the following steps:

- submit an application to your former employer for payment of compensation for the second month;

- submit documents confirming the absence of work - a work book, a certificate from the employment department, etc.;

- indicate bank details for transfer or receive cash at the company's cash desk.

The application must be filled out in any form. The law does not prohibit submitting this document at any time, including 2-3 months after the dismissal has taken place. Moreover, many employers immediately accept two applications or a single document from layoff specialists.

If it is later determined that the citizen was able to find work and lost the right to compensation, the application for the second month will be canceled. It is not prohibited to issue compensation for the second month immediately upon dismissal of a citizen.

However, in the event of possible employment, the company will not be able to return the funds.

Layoffs - what are they?

Dismissal is the termination of the labor relationship between the employer and the person performing the work (employee). In this case, the employment contract is terminated. The regulations for the dismissal procedure are subject to the Labor Code, Article 81. What may cause dismissal:

- Liquidation of the enterprise. In this case, the employee is notified of the upcoming dismissal in advance (two months in advance).

- Dismissal for violation of labor discipline (absenteeism). Absenteeism is considered to be a long absence of an employee from his place of work (more than 4 hours without good reason). According to the law, an employee must notify management within two days of the reasons why he will be absent from work.

- Dismissal by transfer to another company.

- To reduce staff.

- At the initiative of the employer. What can prompt the management of a company to fire an employee: a change in the owner of the company, causing material damage to the company, the employee provided false documents and false information when applying for a job, if the employee did not pass certification and was unable to prove his qualifications, other similar cases provided for by law.

- Upon expiration of the employment agreement.

- At the initiative of the employee.

- By agreement of the parties.

- Other options that do not contradict the Labor Code.

How it happens in practice

Which employees may be laid off depends on the management of the enterprise. But the law also provides for the fact that some of the workers are provided with benefits . This category includes:

- Single mothers or parents of disabled children.

- Employees with disabilities due to participation in hostilities.

- Employees with awards.

- Victims of the Chernobyl tragedy.

- Workers who have suffered an occupational disease or serious injury at this enterprise.

- Workers who are the sole breadwinner in their family.

- Inventors.

- Employees sent to advanced training courses on the initiative of the company's management.

Based on Article 179 of the Labor Code of the Russian Federation, the first to be laid off are those employees who have little experience, as well as employees with weaker qualifications. At the same time, fired people must receive compensation. It is appointed on the basis of an order for the payment of redundancy benefits.

Sample order for payment based on average earnings

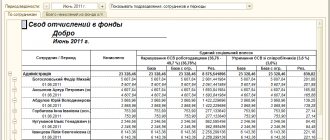

Sample of filling out an order Registration in 1C Today, in many enterprises, work with personnel is carried out in an automated mode. Registration of breaks for feeding children in 1C occurs as follows: Creation of a classifier for the use of working time The legislation does not establish any symbols for breaks. They are introduced in organizations independently.

For example, you can take the letter code “KR”, securing it with an order.

- issuing a redundancy order two months before the upcoming dismissal, indicating the grounds (Article 180, Part 2 of Art.

We recommend reading: Who pays for replacing risers in an apartment

Attention: The “Vacation Accrual” document is intended for calculating wages while on leave of one kind or another. It can be entered through the “Vacation” item in the “Documents” menu or based on the “Vacation Order” document.

CONDITIONS FOR TRANSFER OF A PREGNANT WOMAN

A pregnant woman needs to reduce production or service standards or transfer her to another job that excludes the impact of unfavorable production factors, while maintaining the average earnings for her previous job (Part 1 of Article 254 of the Labor Code of the Russian Federation).

At the same time, an employer can transfer a pregnant woman to another job only at her request, which the employee expresses in a statement, and on the basis of a medical report on the need to transfer to light work[1]. Accordingly, if the employee does not submit these documents, the employer will not be obliged to transfer her.

In addition, a medical opinion may limit the amount of daily work a pregnant woman can do. The employer is obliged to take these restrictions into account when changing the working hours of a pregnant employee.

If the employee refuses a temporary transfer or the employer does not have a job suitable for her, the employee must be released from work while maintaining the average earnings for all working days missed as a result at the expense of the employer (Part 2 of Article 254 of the Labor Code of the Russian Federation).

In addition, during pregnancy, a woman can work part-time if she provides the employer with a certificate of pregnancy and a corresponding statement (Part 2 of Article 93 of the Labor Code of the Russian Federation).

Order for payment of compensation

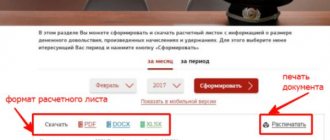

Such deviations are documented in the documents “Sick leave”, “Vacation accrual”, “Absenteeism” and “Order for payment based on average earnings”.^ One of the “deviations” from the normal work schedule is vacations.

To calculate compensation for unused vacations, it can be entered on the basis of the “Dismissal Order” document. Example. The settlement department received an application from employee Potokin D.O.

The 1C: Salary and Personnel program allows you to calculate regular and additional leaves, educational leaves, as well as take into account unpaid leave and partially paid parental leave. The “Vacation Accrual” document is intended for calculating wages while on leave of one kind or another.

It can be entered through the “Vacation” item in the “Documents” menu or based on the “Vacation Order” document.

To calculate compensation for unused vacations, it can be entered on the basis of the “Dismissal Order” document.

Example. The settlement department received an application from employee Potokin D.O. on granting him, in accordance with the vacation schedule for 2002, the next vacation from February 1 for 28 calendar days and an additional period of 5 working days in accordance with the concluded employment contract.

How to issue an order for a director to leave without pay

Labor Code of the Russian Federation);

- Study leave is granted only at the main place of work (Part 1 of Article 287 of the Labor Code of the Russian Federation) based on the employee’s application and a summons certificate.

Moreover, they must be paid in a lump sum - this is important to take into account if the duration of the employee’s absence is more than a month.

There is no need to rely on the annual vacation schedule provided to employees. But you will need to enter information into your personal card, but only after the student returns from the session.

There is too much accounting news and too little time to search for it. We recommend subscribing to the Glavbukh magazine newsletter to keep track of all changes in the work of accountants.

When and how to pay the average wage for lower-paid work

Therefore, the employer can pay the employee a salary for the work performed. Transfer to another job in connection with the suspension of activities or temporary prohibition of activities due to violation of state regulatory labor protection requirements through no fault of the employee.

- written consent* of the employee to the transfer;

- manager's order for transfer

All the time of transfer Transfer to another job due to health reasons

- medical report;

- written consent* of the employee to the transfer;

- manager's order for transfer

During the first month from the date of transfer Transfer to another job due to a work injury, occupational disease or other work-related health injury, until recovery or disability is established

- medical report;

- written consent* of the employee to the transfer;

Cheat sheet for personnel officers: cases of maintaining average earnings for an employee

“HR service and personnel management of the enterprise”, 2009, N 9

Cheat sheet for personnel officers: cases of maintaining average earnings for an employee

All employers, when making payments to employees, most often face questions about the procedure for calculating average earnings. And it’s no secret that for this in different situations it is necessary to use different legal acts. To make it easier for you to navigate the legislation, in this article we will look at what documents regulate the calculation of average earnings, and we will also not ignore the issue of the dependence of payments provided for by the Labor Code of the Russian Federation on the average monthly salary.

Documents regulating the calculation procedure

average earnings

| Type of payment | Legal act |

| Benefits for temporary disability, pregnancy and childbirth for citizens subject to compulsory social insurance in case of temporary disability and in connection with maternity | Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth for citizens subject to compulsory social insurance, approved by Decree of the Government of the Russian Federation of June 15, 2007 N 375 |

| Unemployment benefits and scholarships paid to citizens during the period of professional training, retraining and advanced training in the direction of the employment service authorities | The procedure for calculating average earnings to determine the amount of unemployment benefits and scholarships paid to citizens during the period of professional training, retraining and advanced training in the direction of the employment service, approved by Resolution of the Ministry of Labor of Russia dated August 12, 2003 N 62 |

| Vacation pay, downtime pay, travel allowances, etc. | Article 139 of the Labor Code of the Russian Federation, Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922 |

Dependence of payments provided for by the Labor Code of the Russian Federation,

from average earnings

| Event | Note | Labor Code |

| Temporary transfers, downtime, failure to comply with labor standards, forced absenteeism | ||

| Temporary transfer to another job | When transferring to a job not stipulated by an employment contract, carried out for a period of up to one month, the employee is paid according to the work performed, but not lower than the average earnings for the previous job: - in any exceptional cases that threaten the life or normal living conditions of the entire population or its parts; - in cases of downtime, the need to prevent destruction or damage to property or to replace a temporarily absent employee, if these situations were caused by the above emergency circumstances | Art. 72.2 |

| Transfer of an employee in accordance with a medical certificate to a lower paid job | The average earnings from the previous job are retained for one month from the date of transfer, and in case of transfer due to work-related health damage - until permanent loss of professional ability to work is established or until the employee recovers | Art. 182 |

| Transfer to another job of pregnant women and women with children under the age of one and a half years | Remuneration for the work performed, but not lower than the average earnings for the previous job. Until a pregnant woman is provided with another job that excludes exposure to harmful factors, she is subject to release from work with preservation of average earnings for all working days missed as a result. When pregnant women undergo mandatory medical examinations in medical institutions, they retain the average salary at their place of work. | Art. 254 |

| Baby feeding breaks | To be paid in the amount of average earnings | Art. 258 |

| Failure to comply with labor standards, failure to fulfill labor duties | Failure to comply with labor standards, failure to fulfill labor duties: - through the fault of the employer - remuneration is made in an amount not lower than the average salary of the employee, calculated in proportion to the time actually worked; - for reasons beyond the control of the employer and employee, - the employee retains at least 2/3 of the tariff rate (salary), calculated in proportion to the actual time worked | Art. 155 |

| Downtime | Downtime that occurs: - due to the fault of the employer, is paid in the amount of at least 2/3 of the employee’s average salary; - for reasons beyond the control of the employer and employee, paid in the amount of at least 2/3 of the tariff rate (salary), calculated in proportion to downtime | Art. 157 |

| Time of suspension of work due to suspension of activities or temporary prohibition of activities due to violation of labor safety standards through no fault of the employee | The employee retains his average earnings. During this time, the employee, with his consent, can be transferred to another job with wages for the work performed, but not lower than the average earnings for the previous job | Art. 220 |

| Time of forced absence | Average earnings or the difference in earnings for the entire period of performing lower-paid work are paid | Art. 394 |

| Time of delay by the employer in executing the decision on reinstatement at work | The employee is paid the average salary or the difference in earnings | Art. 396 |

| Passing a mandatory medical examination (examination) | The employee retains his average earnings | Art. Art. 185, 348.3 |

| Donation of blood and its components by an employee | For the days of delivery and the days of rest provided in connection with this, the employee retains his average earnings | Art. 186 |

| Sending athletes and coaches to Russian national sports teams | During the absence of these persons from the workplace in connection with travel to the location of the sports team and back, as well as in connection with participation in sporting events as part of the specified team, their average earnings are retained | Art. 348.6 |

| The period of temporary incapacity for an athlete caused by a sports injury | An additional payment to the temporary disability benefit is made up to the amount of average earnings in cases where the amount of the specified benefit is lower than the athlete’s average earnings and this difference is not covered by insurance payments | Art. 348.10 |

| Guarantees for employees participating in collective bargaining, as well as those elected to trade union bodies and labor dispute commissions | ||

| Persons participating in collective bargaining | Released from their main job while maintaining average earnings for a period determined by agreement of the parties, but not more than 3 months | Art. 39 |

| Guarantees for employees elected to labor dispute commissions | Free time from work is provided to participate in the work of the commission while maintaining average earnings | Art. 171 |

| Members of the conciliation commission, labor arbitrators during participation in the resolution of a collective labor dispute | These persons are released from their main job while maintaining their average earnings for a period of no more than three months within one year. | Art. 405 |

| Guarantees for exempt union workers | After the end of their term of office, these persons are provided with the same job, and in its absence, with their consent, another job of equal value. If it is impossible to provide such work due to the liquidation of the organization or the termination of activities by the entrepreneur or the lack of corresponding work, the all-Russian (interregional) trade union retains for this employee his average earnings for the period of employment, but not more than 6 months, and in the case of study or retraining - for a period up to 1 year | Art. 375 |

| Severance pay and compensation upon dismissal of employees | ||

| Termination of an employment contract due to violation of the rules for its conclusion | If a violation of the rules for concluding an employment contract was committed through no fault of the employee, then he is paid severance pay in the amount of average monthly earnings | Art. 84 |

| Liquidation of an organization or reduction of numbers or staff | Severance pay is paid in the amount of average monthly earnings. Also, the employee retains his average monthly salary for the period of employment, but not more than 2 months. (for regions of the Far North and equivalent areas - no more than 3 months) from the date of dismissal (including severance pay). By decision of the employment service, the average monthly salary can be maintained for the 3rd month from the date of dismissal (for regions of the Far North and equivalent areas - 4, 5, 6 months) | Art. Art. 178, 318 |

| In case of early termination of an employment contract, the employee’s average earnings are paid, calculated in proportion to the time remaining before the expiration of the notice of dismissal period (2 months) | Art. 180 | |

| Seasonal workers are paid severance pay in the amount of two weeks' average earnings | Art. 296 | |

| The employee’s refusal to transfer to another job required by him in accordance with the medical report, or the employer’s lack of appropriate work | Severance pay is paid in the amount of two weeks' average earnings | Art. 178 |

| Calling up an employee for military service or sending him to alternative civilian service | Severance pay is paid in the amount of two weeks' average earnings | Art. 178 |

| Termination of an employment contract in connection with the reinstatement of an employee who previously performed this work | Severance pay is paid in the amount of two weeks' average earnings | Art. 178 |

| Refusal of an employee to be transferred to work in another location together with the employer | Severance pay is paid in the amount of two weeks' average earnings | Art. 178 |

| Recognition of an employee as incapable of working in accordance with a medical report | Severance pay is paid in the amount of two weeks' average earnings | Art. 178 |

| Refusal to continue work due to changes in the terms of the employment contract determined by the parties | Severance pay is paid in the amount of two weeks' average earnings | Art. 178 |

| Termination of an employment contract with the head of the organization, his deputies and the chief accountant in connection with a change in the owner of the property | Compensation is paid not less than 3 average monthly earnings of the employee | Art. 181 |

| Termination of an employment contract with the head of an organization in connection with the decision by the owner of the property to terminate the employment contract | Compensation is paid not less than three times the average monthly salary | Art. 279 |

| Vacations, business trips and advanced training | ||

| Annual paid vacations and compensation for unused vacations | Paid based on average earnings | Art. 114 |

| Study leaves | Vacations with preservation of average earnings (see table 1) | Art. Art. 173 - 176 |

| Business trips | The employee retains his average earnings | Art. 167 |

| Sending an employee by the employer for advanced training while taking time away from work | The employee retains the average salary | Art. 187 |

Table 1

Purpose and duration of study leaves

| Educational institutions of higher professional education | |

| Passing intermediate certification | In the first and second courses: 40 calendar days each. days |

| Starting from the third year: 50 calendar days. days | |

| In the second year, when mastering the basic programs in a shortened time: 50 calendars. days | |

| Preparation and defense of diplomas and passing final state exams | 4 months |

| Passing final state exams | 1 month |

| Educational institutions of secondary vocational education | |

| Passing intermediate certification | In the first and second courses: 30 calendar days each. days |

| Starting from the third year: 40 calendar days. days | |

| Preparation and defense of diplomas and passing final state exams | 2 months |

| Passing final state exams | 1 month |

| Educational institutions of primary vocational education | |

| Exams | 30 calendars days within one year |

| Evening (shift) general education institutions | |

| Passing final exams in grade IX. | 9 calendars days |

| Passing final exams in XI (XII) grade. | 22 calendars days |

M.Kosulnikova

Chief Accountant

LLC "Galan"

Signed for seal

26.08.2009

Payment based on average earnings - business trip

Accounting calculates the average amount that an employee could receive at his place of employment, and then issues it along with an advance or monthly payment.

Average earnings (AE) is the average amount of wages, other payments and remunerations paid by the employer to the employee in the billing period.

The procedure for calculating SZ is also indicated by Government Decree No. 922 of December 24, 2007. Under any labor regime, the calculation of such wages for an employee is made based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the worker retains the average salary.

The average daily salary is determined by the formula: The average salary for a business trip is calculated using a simple formula: the average daily salary is multiplied by the number of days of work outside the main place: Let's give an example: engineer Semyon Nikolaevich Petrov receives a monthly salary of 30,000 rubles.

How to issue an order to pay an employee according to the average

Articles that you need to pay attention to: 180 – the employer’s obligation to offer another vacancy to an employee dismissed due to layoffs; Art.

77 – dismissal is allowed by mutual agreement of the parties with the accrual of monetary compensation and severance pay; Art. 83 – termination of an employment contract with an employee who has lost his ability to work; p. 1 tbsp. 81 – reduction due to refusal to occupy a vacant position when the staffing table changes; h.

2 tbsp. 178 – maintaining the average salary while looking for a job after layoff; h. 6 tbsp. 81 – restrictions on layoffs of certain categories of workers; h.

4 tbsp. 256, art. 261 – assigning a place to certain categories of employees; h. Article 3. Practice shows that the maximum amount of a personal bonus should not be more than 50% of the salary, and the optimal amount is 10-20%. Who is assigned personal

Menu

- issuing a redundancy order two months before the upcoming dismissal, indicating the grounds (Article 180, Part 2, Article 73);

- drawing up a new staffing table or changing the current one;

- written notification to the Employment Center;

- familiarization of employees with signature of the decision made;

- offering each employee another vacancy or giving written notice that no suitable positions are available;

- written consent of the employee to dismissal;

- issuance of a dismissal order indicating the grounds;

- issuing a payment order;

- making entries in work books, paying employees on the day of dismissal;

- payment of additional compensation based on a certificate from the Employment Center.

How to draw up an order for payment of redundancy compensation? The basis for assigning severance pay is the corresponding order of the manager.

Salary order - sample design

> > Tax-tax December 31, 2020 Order on wages - a sample of it may be needed to establish or correct the timing of salary payments.

We recommend reading: Recharging fire extinguishers OU 3 frequency

You will learn everything about how to issue such orders and what the consequences are if the dates for issuing salaries are not recorded in your local documents in our article. According to Art. 136 of the Labor Code of the Russian Federation, employers set the deadlines for paying wages independently, but with the obligatory observance of two conditions: payments are made at least 2 times a month and no later than 15 calendar days from the end of the period for which wages were accrued.

IMPORTANT! If the “payday” day falls on a weekend, the money is issued the day before. All the nuances regarding the terms of payments are prescribed in the employer’s internal documents - internal regulations (IR), an employment contract or a collective agreement. It is these documents for recording salary days that Art. mentions.

136 Labor Code of the Russian Federation. As for the manager’s order, it will not be superfluous, but it is not mandatory.

IMPORTANT! Even if you have a document regulating salary terms, but in reality money is given out when necessary, employees have the right. In addition, it is possible to be held liable under Art.

5.27 Code of Administrative Offenses of the Russian Federation. Details are in the article. The form of this order is developed by the employer independently.

It is recommended to include the following details and information:

- publication date;

- registration number under which the order is recorded in the journal of local administrative documents;

- place of compilation;

- employer's name;

- title of the document (order on the timing of payment of wages);

- The text part of the order itself, which indicates specific dates for payment of wages (for the first and second half of the month), provides a link to the legislation - Art. 136 of the Labor Code of the Russian Federation, and a responsible employee is appointed who will familiarize employees with the approved deadlines;

- manager's signature;

- signature of the designated responsible employee.

You can find a sample salary order here.

Read the article on how to register an order. If this fact is discovered by inspectors, claims and prosecution will definitely follow. Moreover, this applies even to those cases when salaries are issued on the same dates month after month, but they are not specified in local documents.

How to fix the situation? Of course, put the necessary documents in order, and if for some reason they are still missing, do the following:

- If possible, retroactively republish an incorrect document, but only if doing so does not cause any discrepancies with your other documentation. Unfortunately, this is not always possible.

- If changes are made to the collective agreement, it is necessary to assemble a commission consisting of representatives of both parties - both the employees and the employer. The commission formalizes the results of the negotiations in an additional agreement, which includes new terms for salary payments.

- The most time-consuming method is if the salary dates are fixed in the employment contract, since you will have to draw up an additional agreement for each such contract.

- Changes made to the PVTR are formalized by an order, which is familiarized to each employee against signature.

What an order for the payment of wages that changes the terms looks like can be seen here.

An order establishing the timing of payment of wages is an optional, but desirable document. The absence of local acts in which the dates of salary payments must be recorded is considered a violation. The same applies to cases when such documents exist, but the dates indicated in them are contrary to the norms of Art.

136 of the Labor Code of the Russian Federation or do not coincide with the days of actual payments. To avoid penalties, such violations must be corrected urgently.

We advise you to read the latest from the forum

Order to maintain average earnings for the third month of employment

R I C A Z on maintaining the average monthly earnings for the period from August 17, 2010 to September 16, 2010 of the third month of employment for the former employee Kuzina Lyudmila Pavlovna dated “___” ______________ 2010 No. _____ Moscow In accordance with the article 178 of the Labor Code of the Russian Federation, based on the decision of September 24, 2010

No. 148/10, adopted by the Ivanovsky Department of the State Central Employment Center of the Eastern Administrative District of Moscow in relation to Kuzina Lyudmila Pavlovna, who fulfilled the conditions of registration with the employment service authorities within 14 calendar days from the date of dismissal and due to the impossibility of employment within 3 months from the date dismissals, I ORDER: 1.

Save for Kuzina L.P. average monthly earnings for the third month of employment.

3. The accounting department of the enterprise shall make accruals and payments in accordance with this order. Head _____________ Yu.P.

What is the procedure for paying the average monthly salary to a former employee?

Labor Code of the Russian Federation, I ORDER:

- Pay (full name of the employee, his position, personnel number), severance pay in the amount of one average monthly salary.

- Save (employee's full name) the average monthly salary for the period of employment, but not more than two months from the date of dismissal (including severance pay).

- Pay (full name of the employee, his position, personnel number) additional compensation in the amount of average earnings for 2 months.

- The accounting department of the enterprise shall make accruals and payments in accordance with this order.

Reason: employee statement dated 10/09/2016 Manager Full name of the head signature The order has been read by: Full name of the employee “ ” 20 Conclusion Severance pay when staffing is reduced at an enterprise plays the role of a social guarantee for the employee.