The formation of shipping documents for primary documentation is an important stage in commodity-money relations. An agreement and an act of acceptance and transfer are not all that is required when transferring property assets from one person to another (under Article 223 of the Civil Code of the Russian Federation). During the signing of agreements, the participants have the right to determine how, where and to whom the transfer of property will be carried out. A third party may also participate in this process as an intermediate link, transferring objects to the final point (the buyer). All legal entities or individuals participating in the transaction must receive official papers to deliver the cargo and carry out its shipment on the spot. The absence of one of them may be detrimental to one of the parties when controversial issues arise and a claim is filed in court. Filling out such forms requires compliance with the law, since many of these forms are unified at the state level. Moreover, the principles of transfer of inventory items according to the documents discussed here are relevant both within the Russian Federation and during international transportation.

Shipping documents - what are they?

When organizing transportation, an important aspect is the formation of the necessary documentation. The main types of such papers include financial, transport and permitting. The chain of key events is as follows: the conclusion of an agreement between the two parties to the transaction, its execution (that is, delivery of the ordered item on time and to the right place). But at the arrival address it is necessary to carry out delivery and unloading actions, which also requires the availability of specific documents. According to Article 506 of the Civil Code, the supplier is obliged to ship the goods to the buyer or a third party. Therefore, signed agreements and an acceptance certificate will not be enough. Shipping documents required.

Financial papers

This includes invoices and commercial invoices. The formulation and execution of such shipping papers falls on the seller (shipper).

Comaccount or “CI”

The type of goods, their quality and quantity, as well as the unit of measurement and general prices are indicated here. The names and addresses of participants are also included here. Such documents prove that the sale and purchase has been completed. It determines the taxable amount for customs and creates receivables.

Proforma invoice

This is the so-called proforma invoice - a preliminary documented calculation of the transferred items and services provided. It is sent from the seller to the buyer according to the terms of the transaction and does not require payments. It is also used in world practice (in the exchange of goods between countries). It does not have a form standardized by law and does not contain information about prices.

Difference between platforms and commercial accounts

The first ones are usually used when the delivery itself and payment for it have not yet been made. This is not a “check” for payment, since the exporter does not enter a credit in his accounting department, and the importer does not enter a debit. But such forms describe the product and its value, which is similar to the second type of document. The latter are issued to give customs officers maximum information on applicable import duties and rights to import goods and materials abroad. They have legal legitimacy and are significant for tax accounting. Accordingly, they serve as an actual account for making payments.

Consular invoice

Consular invoice is commercial and is registered by the sender (foreign exporter) with mandatory certification from the consulate of the state where the buyer is located. The purpose of the compilation is to provide the competent government agencies in the country of arrival with data on the customs value of delivered products, as well as dumping. And thus implement currency control.

Shipping documents

Not all documentation discussed below is standard. The purpose of their compilation is to identify the product (for all product categories with their properties and number of units). This also includes information about the participants involved, the specifics of the transportation process and payment for delivery. The documentary set is assembled with adjustment for specific inventory and materials products. Additional documents are included at the request of the parties.

Check packing list

The shipment is accompanied by a Packing list, attached to the invoice. This contains the entire list of supplied goods and materials, indicating storage space for everything (boxes, crates, pallets, etc.). There is no standardized form here, so each organization develops its own. So the seller’s form may differ from the copies used by the buyer. But the second one usually accepts the paper sent to him in any form. Logistics companies also need it. It is also required by customs authorities when crossing the border.

Consignment note

Or rather, on the product itself. This means that this is TORG12 for release and transfer. Using this document, the purchaser checks the shipped products (by quantity, volume, quality, etc.) with the information contained in it. The seller and sender, in turn, take into account the property remaining in the warehouse.

Commodity transport

When the issuance of inventory items occurs through pick-up, the documentation discussed here will not be required. They are only needed during transportation to the customer. If a transport and logistics company is involved in this, then the documentary originals are provided to it. They always indicate the details of the carrier, vehicle and forwarder.

Usually delivery is made using road transport. Then two types of forms are used: 1-T and the form attached to PP No. 272 of April 15, 2011 on the rules of transportation by road (Appendix 4k). For air and railway transportation, other unified forms are used: GU-27 / GU-29-O and AWB, respectively.

Waybill

This is a T-bill (different from the TT-bill discussed earlier). It is required according to PP No. 272 dated 11. Often it is issued by the shipper (but it also happens otherwise if this is provided for in the agreements of the parties). It is usually compiled for one batch. For several, if transportation is carried out at the same time by one transport. It differs from the previous one in the absence of a product section.

What shipping documents are used to document the shipment of goods to the buyer’s warehouse using air travel? This is the so-called AWB waybill. But it only describes the property being transported, and does not legitimize this process.

Through bill of lading

Through bill of lading is required when participating in the supply of sea vessels. There may be two or more shipping lines here. That is, transshipment from one vessel to another is often carried out. The document confirms ownership of the shipped goods and materials.

Paper functionality:

- the carrier signs here for receipt of the shipment, describing the visual condition of the goods upon arrival;

- this confirms the fulfillment of the terms of the contract;

- a commodity distribution function is also performed.

Multimodal transport connaissement

In world practice, this is usually called multimodal cargo transportation by several modes of transport. Not only aquatic, but also terrestrial. That is, transportation by sea is only part of the overall journey.

International waybill

CMR is the main document for road freight delivery across the border of another state. It represents an agreement between the sender, the transport company (with ground transport) and the consignee. The CMR invoice is universal in nature, since it contains information that is understandable to a representative of any country. It confirms the legality of the transportation. In the absence of digital materials, law enforcement agencies may seize transported goods and materials. Each stage that occurs with the cargo is noted here. Whether it is transferring it to the forwarder or the final recipient. Accordingly, the financial responsibility of persons at a certain point in time is determined in this way.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Certificate of origin

This is a document about the certification of a product, which also reflects the place of its production. The relevant government agencies enter here notes about production on the territory of a particular state. A description of product characteristics is also included. In the Russian Federation it is issued by the Chamber of Commerce and Industry. Depending on the country of purchase, the marking is affixed here. There is also a general format for some territories.

Certificate Form A

Certificate of Origin form A is a universal international document quoted in many countries. At customs it is used to identify the place of origin of the goods. The acquiring party receives benefits and bonuses during customs clearance.

Several concepts should be distinguished here:

- the country where the goods and materials were manufactured;

- preferential production - if they were produced at different foreign factories (the advantage is determined by who made the largest contribution to the cost of the products - usually more than 50%);

- delivery point means where the order was delivered to the recipient (may differ from the first two).

Destination Control Statement

The Destination control statement is made by the sender and is noted on commercial invoices, bills of lading, air waybills and other export documents. It is necessary to accompany the delivery process to the final destination. It does not have any special form and is compiled to ensure arrival at a specific geological point.

What documents are needed when shipping goods to the buyer regarding its quality?

This documentation is required not only to list the characteristics of the product, but also for reconciliation with what is actually received.

Third Party Acceptance Certificate

Some acquirers want to see a certificate of inspection by a disinterested party. The costs of such procedures are often borne by them (unless otherwise specified in the contract).

Four types of such operations:

- pre-production control to determine the quality parameters of raw materials and individual components that the manufacturer will use in the process;

- taking samples or samples from the production line (helps to find defects before shipment or before the actual receipt of defects);

- control of material assets when loading containers for delivery;

- inspection at the port upon arrival (visually and using instruments).

Certificate of testing or quality of materials

For certain product categories (chemical products and raw materials), their supplier provides chemical certificates indicating indicators of composition, acidity, viscosity, etc. This information is obtained with the assistance of an independent laboratory chosen independently by the parties (before shipment or after). Metal objects are delivered subject to certification of the properties of these materials.

General rules for creating primary documentation

What documents are needed when shipping goods for the buyer is not the only important question. It is also important to follow the principles of their completion and circulation. From the point of view of legislation, it is necessary to take into account Art. 9 Federal Law 402 on accounting from 11th year.

Here are the required sections included in the document:

- Name.

- Date of writing.

- Mention of the person who compiled the specific paper.

- The presence and nature of economic life.

- The size of natural and financial measurements (indicating measurement units).

- Listing the positions of those people who make the transaction and are responsible for its execution and correct execution.

At the end, people’s signatures are placed as standard (from the sixth point). To do this, their surnames and initials or other details identifying them are written down.

Rules for accepting goods by quantity and quality

The type of product, its quantity, completeness, compliance with norms and standards, if they are provided for, are a mandatory clause of the supply contract.

Important!

The rules for accepting products in terms of quantity and quality must comply with regulations, mandatory requirements of legislation on technical regulation or contracts (paragraph 2, paragraph 1, article 474, paragraph 2, paragraph 2, article 513 of the Civil Code of the Russian Federation).

It is also necessary to comply with the Instructions on the procedure for accepting products for industrial and technical purposes and consumer goods by quality (approved by Resolution of the State Arbitration Court of the USSR on April 25, 1966 No. P-7), as well as the Instructions on the procedure for accepting products for industrial and technical purposes and consumer goods by quantity (approved by resolution of the State Arbitration Court of the USSR on June 15, 1965 No. P-6).

The listed instructions are used in legal proceedings (paragraph 2, paragraph 2, article 513 of the Civil Code of the Russian Federation), in cases where the contracts do not include a clause on the rules for accepting products (Resolution 10 of the AAS dated January 23, 2014 in case No. A41-20012/12 , Resolution 17 AAS Court dated June 14, 2013 No. 17AP-5652/2013-GK in case No. A50-18384/2012, Resolution 13 AAS Court dated November 24, 2011 in case No. A56-13517/2011).

According to paragraph 1 of Art. 513 of the Civil Code of the Russian Federation, the buyer is obliged to accept the products, guided by the existing regulations. In this case, the selection and transfer of goods can be carried out at the supplier’s warehouse or the seller delivers the goods to the buyer’s warehouse.

In accordance with the law, there are certain rules for the acceptance of goods in terms of quantity and quality that must be observed.

| Buyer rules | Supplier Rules |

| Visual inspection of products to check quality and quantity according to the contract. | Inform the buyer exactly where he can choose the product. |

| Notify the supplier in writing about the discrepancy in the quantity of goods and make a request for the supply of the missing goods or for the return of the excess. | Check the credentials of the buyer's representative when sampling. |

| Notify the supplier in writing about products of inadequate quality and make a request for its replacement. | Make sure that the buyer has properly formalized the acceptance of the goods and entered the data into the shipping documents and acts. |

| If the product or part thereof has not been accepted, then it is necessary to carry out safekeeping until it is returned to the supplier. | After receiving documents from the buyer about a shortage of goods, excess quantity or poor quality, send your representative with documents confirming identity and authority to resolve problems and draw up appropriate documentation. |

If these rules are not followed, the buyer may receive low-quality products in a volume different from the planned one (resolution of the Autonomous Region of the Moscow Region dated July 28, 2015 in case A40-89393/14), and the supplier may lose revenue, being left without a paid delivery (resolution of the Autonomous Region of the Moscow Region dated September 21, 2015 No. F05-12369/15 in case No. A40-20678/15).

Rules for accepting goods by quantity

First of all, it is necessary to pay attention to the mandatory presence in the contract of information on the name and quantity of products. In the absence of these conditions, the contract is considered not concluded (Resolution of the Supreme Court of the Russian Federation dated 09/03/2015 No. F05-11749/15 in case No. A40-140504/14, paragraph 1 of the information letter of the Supreme Arbitration Court of the Russian Federation “Review of judicial practice...” dated 02/25/2014 No. 165 ).

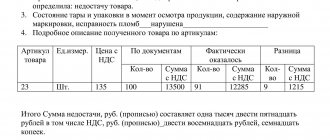

Note! If the supplier delivers goods in smaller quantities (underdelivery), this is a violation of the contract.

If such a situation arises, the buyer has the right:

- Demand delivery of the missing quantity of products. This requirement is made provided that the contract has not expired, otherwise payment for the products must be returned and compensation for losses must be made (Article 393 of the Civil Code of the Russian Federation). In case of partial payment, the buyer may demand delivery of only the paid part of the goods.

- Demand compensation for the costs of purchasing similar products from another supplier (clause 1 of Article 520 of the Civil Code of the Russian Federation).

- Demand payment of a penalty (clause 1 of Article 520 of the Civil Code of the Russian Federation).

- Refuse to accept products of an incorrect quantity if, according to the contract, the goods must be delivered strictly within the specified time frame (clause 2 of Article 457 of the Civil Code of the Russian Federation).

Rules for the acceptance of goods by quality

Before considering questions regarding the rules for the registration of products during acceptance, attention should be paid to checking the compliance of the quality indicators of the goods with the terms of the supply agreement.

Top 3 articles that will be useful to every manager:

- How to optimize income tax: legal schemes

- How to minimize taxes and not interest the tax authorities

- Accounting for an online store: nuances and pitfalls

The interests of buyers when purchasing products of inadequate quality are protected by Art. 475 of the Civil Code of the Russian Federation. Quality requirements are also set out in Art. 469 of the Civil Code of the Russian Federation (determination of the Supreme Court of the Russian Federation dated September 15, 2015 in case A59-1045/14).

Very often it is quite difficult to prove that products do not meet quality. The law does not contain direct instructions by what criteria the condition of the goods is assessed, which leads to certain problems for the buyer (Resolution 11 AAS dated September 24, 2014 No. 11AP-2207/14, determination of the Supreme Arbitration Court of the Russian Federation dated July 31, 2014 No. VAS-10400/14 in case A73-3055, resolution 7 of the AAS dated 04/22/15 No. 7AP-2558/15). You can take into account the existing practice of litigation. If the parties cannot find a compromise solution, it is necessary to turn to the courts.

Evidence may be the following:

- The contract specifies quality characteristics, but the delivered products do not meet them. The quality of the supplied products does not meet the mandatory requirements of the legislation on technical regulation (Resolution of the AS MO dated October 23, 2015 No. F05-14399/15, Resolution of the AS VSO dated June 9, 2015 No. F02-2120/15 in case A33-9943/14);

- conclusion of the expert commission (resolution of the Supreme Court of the Russian Federation dated 07/08/2015 No. F01-2398/15 in case A43-2698/13, resolution of the Supreme Military District Court of August 26, 2015 No. F02-3865/15 in case A78-1831/14);

- recognition by the supplier of inadequate product quality and consent to replacement (Resolution of the Federal Antimonopoly Service of the North-West District dated 04/08/2013 in case No. A56-10929/2012, Resolution 17 of the AAS dated 01/28/2014 No. 17AP-15465/2013-GK in case A60-25333/13).

Who takes part in transport transportation

The main two parties are the shipper and the recipient. But in order to deliver the goods to their destination, full-time drivers or transport companies are involved here. And they, in turn, are also presented with the same original documents as the parties to the transaction. The third party carrier may deliver the goods by sea, air or land. In the first two cases, delivery on your own is usually difficult in principle.

Do you want to implement Warehouse 15? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted!

TORG-12: filling rules

This form was approved by Decree of the State Statistics Committee of 1998 No. 132. It is drawn up by the seller to reflect the fact of write-off and sale of inventory items. For the purchaser, this is a form confirming the purchase, which means it serves as the basis for the future receipt of goods in their warehouses.

Preparation and execution of shipping documents of this type requires the inclusion of sections:

- Data about the participants in the transaction: names, addresses, telephone numbers, bank accounts and codes (OKPO and OKVED).

- Details from the contract and delivery note.

- Number and dating of the T-waybill.

- Information about material assets: name, unit of measurement, quantity, amount of money due for it (including VAT).

- List of applications.

At the end, the signatures of those involved in commodity-money relations are affixed. From the seller, this is the employee who approved the release of the goods, the employee who released it from the warehouse, and the chief accountant. Persons representing the interests of the buyer and consignee also sign here. For this purpose, information on powers of attorney, on the basis of which acceptance is made, can be used. The document is dated. Stamps are also placed on both sides, although according to Art. 9 Federal Law No. 402 is a completely optional initiative.

Is sample TORG-12 required?

It is necessary to take into account the necessary information blocks that are used by the majority of participants in commodity-money relations. In principle, they have the right, by agreement, to add their own sections reflecting some of the specifics of the transaction. In general, a standardized form was available to organizations until 2013. Then the unification was cancelled. That is, now those involved in trade turnover have the right to take the old format for convenience or create their own.

Design features

Shipping documents from the supplier are papers when shipping goods from the warehouse, respectively. The information provided is used to confirm delivery transactions, performed services and transfer of property rights. They need to be prepared in several copies. At a minimum for the shipper, recipient and driver. Plus one copy will be required for the transport company (if hired).

Who is responsible for generating the documentation discussed above? This is a seller or a transport company that works with the former under a transportation agreement. The date stamped corresponds to the day of shipment (Clause 3, Article 9 of Law No. 402-FZ). Invoices are issued at the time of delivery of goods and materials to the customer or the carrier organization. The date in the UPD and in the T-waybill is entered no earlier than the one registered in the TT-waybills. If these conditions are not met, the supervisory authorities will consider the procedure to be fictitious. Then the purchaser is not entitled to deduct VAT. All data in them must also match.

Since the risk of loss and damage to products due to theft, shaking and weather changes is high, it is necessary to determine in advance the person responsible for this. Registration and issuance of a package of primary documents for the shipment of goods when transferring them to the buyer are needed as evidence of the transaction. All points and important nuances must be documented, including so that there is someone to ask for compensation for losses. Software from Cleverence will help simplify all routine procedures with documents. We offer solutions of various types: both individual offers that are personalized specifically for the type of business activity, and packaged solutions for any company.

Number of impressions: 8901

Certificate of acceptance of goods and certificate of acceptance of materials

The final acceptance of the goods in terms of quantity and quality by the buyer is considered to be the signing of the acceptance certificate without comments. When preparing this document, it is worth considering some nuances.

There is no generally required form of acceptance certificates, but these documents must contain the following information:

- Title of the document;

- place and date of compilation (must coincide with the date of transfer of the goods);

- product name, quantity and cost;

- name of legal entities, full names of parties to the act;

- contract number and date;

- signatures of authorized persons, seals.

Any shortcomings and inattention when preparing acts of acceptance of goods can lead to very negative consequences: for example, one of the parties will deny the fact of delivery (resolution of the AS PO dated July 23, 2015 No. F06-26375/15 in case A55-19526/14, resolution 2 of the AAS dated 07/07/2015 in case No. A82-16275/13).

When recording the acceptance of goods, it is better to use standardized forms - this way it is easier to avoid mistakes. There are two forms used when registering goods acceptance:

- Unified form No. TORG-1 (Act of acceptance of goods), approved. Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132;

- Standard intersectoral form M-7 (Act of acceptance of materials), approved. Resolution of the State Statistics Committee of Russia dated October 30, 1997. No. 71a.

We suggest you familiarize yourself with: Income tax advances who pays

Form M-7 is used in case of quantitative and qualitative discrepancies identified upon acceptance of goods or discrepancies in documents. If, for example, there was a fact of under-delivery (this was discussed above), then it can be recorded by drawing up an act of acceptance of materials, including on the form of the standard intersectoral form M-11 (resolution of the AS UO dated April 24, 2017 in case No. 07- 11773/2016).