Why do you need the STD-PFR form?

Against the backdrop of the transition of all employers to maintaining work records in electronic format, the development and approval of additional document forms was required. They are necessary for recording personnel movements, as well as issuing work history to employees. After all, citizens who have switched to the new accounting format will not be able to freely look at the records in their employment records and transfer them to the new employer upon employment.

In turn, one of them was the STD-PFR form. Which is an extract from the Pension Fund for the entire period of a person’s work since the introduction of electronic books. It, in fact, duplicates the functionality of classic labor documents and is provided to various institutions upon request.

The STD-PFR form may be needed for:

- Familiarization of the employee with records of his work activity for the entire period of work;

- Employment;

- Registration of a foreign passport;

- Obtaining a loan or mortgage;

- Registration of social benefits;

- If it is not possible to obtain a similar document from the employer.

What to do if the work experience is not displayed on the ILS in the Pension Fund?

What should you do if, when checking your individual personal account with the Pension Fund of Russia, you discovered that it does not reflect a certain period of your work experience? Don’t delay, you need to contact the Pension Fund and enter the missing information into the ILS, in the event that any information in your work experience is not taken into account or is not taken into account in full (and this happens).

The option of whom to contact in case of non-accounting of work experience depends on whether there were missed periods of work after you were registered in the individual accounting system - then you need to contact the employers directly; or the missed periods of work were before you were registered in the individual (personalized) accounting system - then you must contact the Russian Pension Fund directly with documents confirming your experience.

Who takes STD-PFR and when?

Since several similar forms were approved with the innovations, many people are confused with abbreviated names. The STD-PFR form is often confused with the SZV-TD form, mistaking it for another mandatory report. However, these are different types of documents, and employers do not need to submit a report in the STD-PFR form.

This statement is generated directly by the Pension Fund of the Russian Federation based on citizens’ requests. The document contains information contained in the Pension Fund information base. The sample form was approved and came into force on 03/07/2020. Starting from this date, every citizen has the right to receive information about his work activity from the Pension Fund in electronic or paper format at the choice of the worker.

You can request a document in the following ways:

- Independently at the territorial branch of the Pension Fund of Russia;

- Through your legal representative;

- Through MFC;

- Online on “State Services”;

- Using your personal account at www.pfrf.ru.

How to send a model of a pension file to the Pension Fund (a set of documents required to assign a pension)

Every year, employers submit to the territorial body of the Pension Fund of the Russian Federation lists of people retiring next year and models of pension files for each future pensioner.

The layout includes a set of documents - passport, SNILS, work book, military ID, etc. The full list of documents is published on the Pension Fund website.

In a number of regions, it is possible to transfer layouts of pension files through Kontur.Extern. Below is a list of regions and UPFR codes to which designs should be sent.

- 02 region (002-) Code 002-999

- 03 region (003-) The code for the layouts matches the code where the organization is located

- 05 region (017-) The code for the layouts matches the code where the organization is located

- 08 region (006-) The code for the layouts matches the code where the organization is located

- 09 region (008-) The code for the layouts matches the code where the organization is located

- Region 11 (007-) Code 007-111

- Region 12 (010-) The code for the layouts matches the code where the organization is located

- Region 13 (011-) Code 011-111

- Region 16 (013-) Code 013-111

- Region 17 (018-) The code for the layouts matches the code where the organization is located

- Region 18 (019-) Code 019-919

- Region 19 (014-) The code for the layouts matches the code where the organization is located

- Region 20 (020-) The code for the layouts matches the code where the organization is located

- 21 region (015-) Code 015-1XX*

- Region 25 (035-) Code 035-900

- Region 26 (036-) The code for the layouts matches the code where the organization is located

- Region 27 (037-) Code 037-111

- Region 28 (038-) The code for the layouts matches the code where the organization is located

- Region 30 (040-) Code 040-111

- 31 region (041-) Code 041-9ХХ*

- Region 32 (042-) The code for the layouts matches the code where the organization is located

- Region 33 (043-) The code for the layouts is the same as the code where the organization is located, only the last digit changes to 1.

- Region 34 (044-) The code for the layouts matches the code where the organization is located

- Region 35 (045-) Code 045-9ХХ*

- Region 36 (046-) Code 046-9ХХ*

- Region 38 (048-) Code 048-111

- Region 39 (049-) Code 049-111

- Region 42 (052-) The code for the layouts matches the code where the organization is located

- Region 43 (053-) The code for the layouts matches the code where the organization is located

- Region 44 (054-) The code for the layouts matches the code where the organization is located

- Region 45 (055-) Code 055-200

- Region 46 (056-) The code for the layouts matches the code where the organization is located

- Region 47 (057-) Code 057-057

- Region 48 (058-) The code for the layouts matches the code where the organization is located

- Region 52 (062-)Code 062-100

- Region 54 (064-) Code 064-111

- Region 55 (065-) The code for the layouts matches the code where the organization is located

- Region 56 (066-) The code for the layouts matches the code where the organization is located

- Region 58 (065-) Code 068-111

- Region 59 (069-,023-) Code 069-9XX, 023-9XX

- 61 regions (071-) The code for layouts is indicated at the place of residence of the pensioner

- Region 62 (072-) Code 072-9ХХ*

- Region 63 (077-) Code 077-100

- Region 64 (073-) Code 073-9ХХ*

- Region 65 (074-) The code for the layouts matches the code where the organization is located

- Region 66 (075-) The code for the layouts matches the code where the organization is located

- Region 67 (076-) Code 076-2ХХ*

- Region 69 (078-) The code for the layouts matches the code where the organization is located

- 71 regions (081-) The code for the layouts matches the code where the organization is located

- Region 72 (082-) Code 082-111

- Region 75 (085-) Code 085-901

- Region 76 (086-) Code 086-200

- Region 78 (088-) Code 088-088

- Region 79 (031-) The code for the layouts matches the code where the organization is located

- Region 86 (027-) Code 027-9XX*

* - the code for layouts of pension files differs from the code of the Pension Fund of the Russian Federation, where the organization is registered, by the fourth digit (for example, 21 regions (015-), code for layouts 015-1ХХ: the organization reports to 015-002, sends layouts to 015-102 ; or reports to 015-023, layouts to 015-123).

Peculiarities

To send layouts of pension files, you need to conclude an additional agreement to subscribers in 02, 56, 66, 78, 47 regions and subscribers in Belgorod in 31 regions (all other subscribers in 31 regions do not need to conclude an additional agreement).

For regions 02 and 56: in addition to the additional agreement, it is necessary to pack all files of scanned documents for one insured person into one zip archive, the name of which must be equal to the SNILS number of the insured person.

Subscribers in 78 and 47 regions must enter into an additional agreement with their UPFR before sending a pension file layout. You must contact the pension fund for the agreement form.

To send a design you should

In Kontur.Extern on the main page, select the menu “PFR” > “Sent reports”.

Go to the “PFR Registration Information” section.

Specify the additional UPFR code for sending pension file models and click the “Send registration information” button.

If you specify an additional UPFR code that does not correspond to the list of regions given above, then it will be impossible to send a layout of the pension file.

Next, select the section “Fill out a pension file layout” in the menu.

In the window that opens, you must fill in the UPFR code, SNILS of the employee, the date of retirement, and indicate the type of service - general or preferential. Next, fill out the “Message” field, attach scans of documents and click the “Send” button.

The submitted layout will appear in the list in the “Pension Case Layouts” section.

Back to list of articles

Sample form of the STD-PFR form.

At first glance, the extract form is very similar to SZV-TD. However, the last form is used to submit reports, and STD-PFR is used to provide the results of personnel movements.

The document contains the following information:

- Information about the registered individual;

- Information about choosing an electronic or paper work permit and submitting an application;

- Pension Fund number, as well as the name of the employer;

- Work activity data;

- Position, signature, as well as its transcript of the authorized official.

Download the STD-PFR form.

What documents confirm the length of service and contributions to pension insurance?

Remember that the data from your individual (personalized) accounting (ILS) will be used to calculate your pension; it is the information from the ILS in the Pension Fund that confirms your length of service when calculating the amount of your future pension.

If your ILS for the period before 2002 contains incomplete information about periods of work, or there is no information about individual periods of work under an employment contract, then you can confirm such periods of work before 2002 with a standard work book. But if the work book is lost, or it contains incorrect (inaccurate) or incomplete information about your work experience, then you can confirm it using the following documents:

- written employment contracts;

- employment certificates issued by employers;

- employment certificates issued by government agencies;

- employment certificates issued by municipal authorities;

- extracts from orders of organizations;

- personal accounts and payroll statements.

If you were employed under a civil law contract, then the periods of such work are confirmed by the specified civil law contract, drawn up in accordance with the Civil Code of the Russian Federation and the Labor Code of the Russian Federation, in force on the day the relevant legal relationship arose, and the employer’s document on the payment of mandatory payments, a document from the territorial body The Pension Fund of the Russian Federation or the territorial body of the Federal Tax Service on the payment of mandatory payments, respectively.

Periods of work on the territory of Russia before a citizen is registered as a person insured by the Pension Fund of the Russian Federation can be established/confirmed on the basis of witness testimony, although the nature of the work cannot be confirmed by witness testimony.

Entries on employment in the work book, taken into account when calculating length of service, must be drawn up in accordance with the labor legislation in force on the day they were entered in the work book. Documents confirming periods of work or other activity must contain the number and date of issue, full name of the insured person to whom the document is issued, the day, month and year of his birth, place of work, period of work, profession (position), grounds for their issuance (orders, personal accounts and etc).

The rules for calculating and confirming the length of service for establishing old-age insurance pensions were approved by Decree of the Government of the Russian Federation of October 2, 2014 N 1015 “On approval of the Rules for calculating and confirming the length of service for establishing insurance pensions.” Periods of work after registration as an insured person since 2002 are included in a citizen’s insurance record only if insurance premiums are calculated and paid for him.

Procedure for filling out the form.

Filling out the STD-PFR takes place on the basis of information from the Pension Fund of the Russian Federation according to the following rules:

1 . Section of information about a registered citizen:

Personal information is entered in Russian without corrections or abbreviations. All fields must be filled in, with the exception of the middle name. Because a person may not have it. The date of birth is entered in the form “dd.mm.yyyy”. The SNILS line must contain 11 digits of the corresponding number.

2. Information about the application with the choice of type of work book:

Depending on whether the citizen left his previous book or switched to a digital format for maintaining labor records, the date of filing the application is indicated opposite the corresponding line. The value format is similar to the above in paragraph 1.

3. Information about the employer:

- Name, as in the constituent documents;

- His registration number in the Pension Fund;

4. Section on the citizen’s labor activity:

- Personnel event date;

- Name of the event (dismissal, hiring, transfer, etc.);

- Job title;

- Grounds for dismissal according to the Labor Code;

- Number, names, as well as the date of the corresponding order or instruction;

5. Document certification:

If the extract was requested on a piece of paper, then it is certified by the head of the territorial office of the Fund with a personal signature. In turn, the digital document is signed using the digital signature of the responsible person.

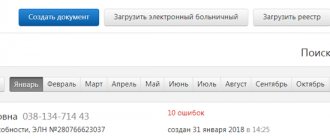

Correction of individual information of the Pension Fund

Within what period does the Pension Fund have the right to demand correction of individual information for an employee?

— the answer is given with reference to the source.

Memo on adjusting personalized accounting information from 01/01/2010.

(prepared jointly by several specialists)

1. General requirements

1.1 Corrective form SZV-6-1 (2), type of information - CORR., is created only for those insured persons for whom the incorrect initial form SZV-6-1 (2), type of information - ORIGIN was previously submitted

(otherwise there is simply nothing to adjust).

The CORR. form completely replaces all data on the personal account previously entered in the ORIGIN form,

therefore CORR. - the form must contain ALL correct information filled in,

and not just the one that was incorrect and is being corrected.

1.2 CORR.-forms for previous reporting periods must be submitted by the policyholder together with ORIGIN-forms of reporting for the current reporting period.

In the current reporting period, you can present adjusting information for several previous adjusted periods.

When creating a CORR.-form, the “Reporting period” is indicated, in which the current reporting OUTCOME-forms are presented, and the “Corrected period” - for which incorrect information is corrected.

In this case, the adjusted period must be earlier than the reporting period.

For example, “Reporting period”: 2012-1, “Adjusted period” - 2010-2.

In this case, along with the ORIGINAL forms for the reporting period of the 1st quarter of 2012, CORR. forms for the 2nd half of 2010 are presented.

1.3 ORIGIN and CORR. forms are accompanied by one common form ADV-6-2, i.e. a general inventory of all submitted packs, which describes: the file name of the pack, the number of HALLS in each pack and the amount of contributions for the packs.

Form ADV-6-2 is divided into two parts:

- the upper part for the OUTCOME information for the current reporting period, all amounts of accrued and paid contributions in the current reporting period are reflected here,

the final line for all OUTCOME packs is compared with the submitted RSV-1 form for the current reporting period;

- lower part - for CORR. information for previous reporting periods, in this part - information about packs with CORR. forms: with the amounts of accrued and before paid contributions for each pack,

the total non-zero amounts of additional accruals and surcharges for all CORR.-packs must be combined with the updated RSV-1 form for previous reporting periods.

1.4 In the ADV-6-2 form, if there are CORR forms, in the part “Information on corrective (cancelling) information” in the columns “Accrued ...”, “Before paid ...” the difference between the amounts of insurance premiums in the incorrect ORIGIN-forms and correct CORR.-forms, and not the sums in packs with CORR.-forms,

To do this, in the compilation program when generating CORR. forms, all SOURCE forms of those reporting periods that are currently being adjusted must be loaded, previously submitted to the Pension Fund Office.

2. Correction of information based on length of service

2.1. If CORR.-forms are submitted only because of a change in length of service, then the CORR.-forms must indicate insurance premiums exactly the same as in the erroneous OUTCOME-information, both accrued and paid,

and the experience is already correct.

In the ADV-6-2 inventory, in terms of information about accrued and pre-paid amounts for batches, the values 0,

because the amount of contributions in the incorrect ORIGIN forms and in the correct CORR forms are the same.

2.2 If CORR forms are submitted according to the Documentary Verification Report, then they must be submitted within the time limits specified in the Report.

If the deadline for submission does not coincide with the submission of the report for the current reporting period, then CORR. forms for registration must be submitted within the period specified in the Act before the start of the reporting campaign without ORIGIN forms.

When generating such CORR.-forms, you need to select the current reporting period as the reporting period, and select the one for which corrections need to be made as the corrected period.

When the deadline for the reporting campaign for the current reporting period arrives, it is necessary to create the current ADV-6-2 inventory taking into account the previously submitted packs of CORR.-forms.

Do not change the numbers of packs with CORR. forms, because they are already registered!

3. “Forgot” to submit individual information for the insured person in previous reporting periods

3.1 In this case, in the reporting campaign for the current reporting period

it is necessary to generate an EXIT - a form for that past period for this one forgotten employee, indicating only the length of service, without the amount of insurance contributions.

Assign a new next number in order to this pack.

This pack is presented without the ADV-6-2 inventory and will be added to the report (form RSV-1) for the reporting period in which they forgot to submit information for this employee.

3.2 When forming a set of ISCHOD forms for the current reporting period

it is necessary to create and submit in a new separate package a CORR form for this forgotten employee, indicating all the correct data: both length of service and insurance premiums.

This CORR.-form will replace the ORIGIN-form, which was submitted only with experience.

In this case, the ADV-6-2 inventory for the current reporting period must be generated in accordance with clause 1.3.

3.3 Along with a set of reports for the current reporting period or earlier, it is necessary to submit updated RSV-1 forms from the past “forgotten” period to the current one,

in which the amounts of payments and accrued insurance premiums will be increased by the amounts of this forgotten employee.

4. Submitted the employee’s individual information to an erroneous “alien” insurance number

4.1 In this case, during the reporting campaign for the current reporting period

generate an OUTCOME form for that reporting period for the correct employee’s insurance number, indicating only the length of service, without insurance contributions.

Assign a new next number in order to this pack.

This pack is presented without the ADV-6-2 inventory and will be added to the report (form RSV-1) for the reporting period in which information was submitted for this employee with an erroneous “alien” insurance number.

4.2 In the current reporting period it is necessary:

— generate a cancellation form SZV-6-1 (2) (OTM.-form) for “someone else’s” insurance number, indicating the correct full name of the person whose insurance number was mistakenly used when submitting the last report;

— generate a CORR form for this employee, indicating all his correct data: length of service and insurance contributions.

The inventory form ADV-6-2 must be generated in accordance with clause 1.3.

At the bottom of the inventory, “Information on corrective (cancelling) information”, in the columns “Accrued ...” and “Before paid ...” the same values of contribution amounts

on OTM.-forms will be indicated with a minus sign (-),

and according to CORR.-forms with a plus sign “+”,

therefore, the totals of this part of the inventory will be equal to zero “0”.

5. Adjustment of insurance premium amounts

5.1 CORR. forms are formed in accordance with section 1.

5.2 The amounts of contributions in the lower part of the ADV-6-2 inventory, “Information on corrective (cancelling) information,” must correspond to the changes in contributions in the RSV-1 form.

In this case, you need to keep in mind:

— if the information is adjusted according to the amounts of contributions accrued for payments to the employee made in the previous reporting period,

those. forgot to tax (excessively taxed) payments accrued to the employee,

then it is necessary to submit updated RSV-1 forms for the erroneous reporting period and further until the current reporting period;

— if in the last reporting period you forgot to accrue payments to the employee or accrued them incorrectly

and all additional salary accruals, including reversals, are carried out in the current reporting period,

then it is not necessary to submit updated RSV-1 forms for previous periods,

because accrual (reduction) of contributions for additional accrual (reduced) now payments will fall into RSV-1 for the current reporting period.

6. Changing the tariff and HALL category code

(For example, you need to change the report category from PED. to HP)

6.1 Submit updated DAM-1 forms with correct accrued and paid contributions according to tariff code 01.

6.2 Create ORIGIN forms for all HALLS with the HP category code for all reporting periods for which it is necessary to change the tariff,

while indicating only the length of service (accrued and paid insurance premiums must be equal to zero (0)).

Submit these bundles with new sequential numbers to the Pension Fund Office, first of all, without the ADV-6-2 inventory.

This information will be added to the corresponding RSV-1 reports.

6.3 Together with the OUTCOME forms of the current reporting period, submit:

a) CORR.-forms with the HP category indicating all the correct data: length of service and insurance premiums - for all variable reporting periods for which the EXIT-packs were generated according to clause 6.1;

b) OTM.-forms with the category PED. for all periods for which the tariff code and HALL category code change.

6.4 Create a general form ADV-6-2 for the EXIT forms of the current reporting period and all those generated according to clause 6.3 OTM. and CORR.-forms.

In this general inventory ADV-6-2 in the part “Information on corrective (cancelling) information” in the columns “Accrued...” and “Before paid...”

different similar values for OTM.-forms will be indicated with a minus sign “-”,

and according to CORR.-forms with a plus sign “+”,

the total amounts will be equal to the amounts of the difference in contributions in the new DAM-1 form with tariff 01 and in the old DAM-1 form with tariff 07.

developer PF-Report plus