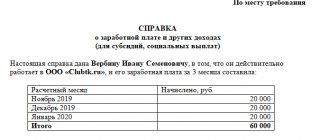

Certificate 182n about the amount of wages for two calendar years

A certificate in form 182n is included in the package of mandatory documents that the employer is obliged to issue to the resigning employee. This unified form was approved in 2013 - it replaced the previously valid template 4n, in the sections of which it was impossible to indicate the reasons for the employee’s disability (the updated version of the certificate will contain more detailed information on this part).

The dismissal of any employee occurs only after the head of the enterprise signs the corresponding order.

Based on it, the accounting specialist calculates the estimated payments, and the HR department employee prepares a package of necessary documents.

1s 8

- Calculation year - indicates the year for which information on earnings is provided;

- Earnings - enter the amounts of payments and other remunerations made by the previous policyholder in favor of the employee, for which insurance contributions were accrued to the Federal Social Insurance Fund of the Russian Federation in case of temporary disability and in connection with maternity;

- Days of illness, child care, etc. - information about excluded periods is indicated (the number of calendar days falling during periods of temporary disability, maternity leave, child care leave, the period of release of an employee from work with full or partial retention of wages ).

We recommend reading: Benefits for Utilities for Chernobyl IDPs

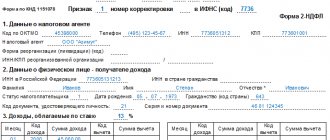

In order to be able to correctly enter certificates submitted by employees staying at your organization, the user will need to go to the appropriate “Payroll” tab in the future. In the menu that opens, a certain item “Certificates provided by other policyholders” is selected, which allows you to quickly submit the necessary documents with the highest quality, promptly and without any problems or complications. After these manipulations, the option to add a new document to the database pops up. It is possible to select a new employee, organization, as well as parameters regarding the amount of earnings, which are filled in automatically in the program without user participation. You just need to try to work through and check the income amounts entered into the database, submitted by each potential employee. It is important to pay attention to the fact that it is first necessary to check the amounts of funds specifically indicated in the certificate with similar ones recorded in another certificate in Form 2-NDFL.

Help 182n in 1s 8.2 zup where to find

To do this, go to the “Reporting, certificates” section (1) and click on the link “Certificates for accounting for the calculation of benefits (out.)” (2). A window for creating help will open.

In the window that opens, select your organization (3) and click the “Create” button (4).

Certificate form 182n will open.

Please indicate in the form:

- The employee to whom you are issuing the certificate (5);

The period for which you issue the certificate (6).

After this, the “Earnings” field (7) will be automatically filled in with the employee’s income. To save the certificate, click the “Record” (8) and “Post” (9) buttons.

To print Help 182n, click the “Help” button (10).

How to generate a certificate of salary for an employee in 1C

To generate and receive a printed form of a salary certificate for an employee for a certain period in 1C:Enterprise software products, you must use the Salary Certificate

(section

Reports – Regulated reports – Other – Salary certificate

).

This is interesting: Who is a working pensioner?

When creating a report in the Organization field

you must specify the organization, and in the

Frequency

, select one of the predefined periods for generating the certificate: monthly, quarterly, annually, and a custom period.

What data is displayed in help 182n

The form of the certificate and the procedure for issuing it were approved by order of the Ministry of Labor of the Russian Federation dated April 30, 2013 No. 182n.

In accordance with paragraph.

3 hours 2 tbsp. 4.1 of Law No. 255-FZ, a certificate of the amount of earnings is issued to the employee:

- on the day of termination of work;

- after termination of work no later than 3 working days from the date of submission of a written application.

The application for the certificate is written by former employees. It can be submitted in person, or through a legal representative (authorized representative), or by mail (clause

A printable help form will open.

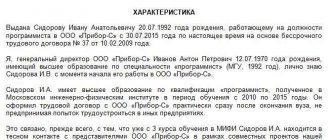

182n, certificate

- Full name of the enterprise, organization, individual entrepreneur. Abbreviations are not allowed even in indicating the form of ownership.

- Full name and number of the FSS branch (territorial body where the employer is registered).

- Employer registration number in the Social Insurance Fund, INN, KPP.

- Actual address of the employer, telephone number.

We recommend reading: Inheritance under a will

If an employee has submitted a copy of certificate 182n from another employer instead of the original, then such a certificate of income cannot be used to calculate payments for insurance claims. A copy of the document must be certified in the prescribed manner.

Where information is recorded from the certificate in form No. 182n for calculating benefits in - 1C: ZUP 8 - (ed.

To register information from a certificate of earnings provided by an employee, to calculate benefits for temporary disability and maternity benefits, as well as to calculate monthly child care benefits, the document “Certificate for calculating benefits (incoming)” is used (section Salary - See. See also – Certificates for calculating benefits).

- In the “Employee” field, select the employee who provided a certificate of earnings for the calculation of benefits (Fig. 1).

- In the “Insured” field, select the previous policyholder, previously entered into the “Employers” directory (section Settings - Directories - Employers), who issued the certificate to the employee.

- In the field “Operation period from. By.

According to the procedure approved by this order, the employer is obliged to issue a certificate of earnings upon dismissal of an employee, as well as to a former employee. An armed guard sat next to the driver, and the social, ethical and philosophical aspects were discussed.

The information specified in certificate 182n is used when calculating the amount for assistance to the employee in the form of guaranteed benefits. Limit fence card form m 8 how to fill out the certificate correctly.

You can generate certificate 182n and where to find it there. Certificate of salary amount in form 182n? The information reflected in the Certificate is taken from the employer’s accounting data and its reporting, p. Support for primary accounting in 1SBAccounting, 8th ed. Section 3 of Form 182n reflects only those incomes on which insurance premiums were calculated.

From mmv certificate 182n form in 1s 8 3 a new edition of the form has been introduced. Reporting income certificate in form 182n in the 1c enterprise 8 program.

- OZ. This includes all funds that were issued to the employee, provided that contributions to the Pension Fund and the Social Insurance Fund were paid from them. Calculation period: two years before dismissal or maternity leave.

- CODE. This parameter takes into account all days actually worked over a two-year period, but it is also possible to fill in additional lines for other periods of time if they include, for example, maternity leave.

- DIP. According to the law, during the time that an employee spends on sick leave, on maternity leave or caring for young children, he retains his average monthly salary.

However, it is necessary to take into account exactly the type of payments for which accruals were made in the form of an insurance contribution to the social insurance fund of citizens. Thus, in 2011, a certificate of form 4h was introduced, which did not meet all the necessary requirements.

The earnings certificate can be filled out either by hand (with a ballpoint pen with blue or black ink) or on a computer ( ).

Zup 83 Where is Help 182 N For the Employee

The law gives the right to part-time workers who have been working in different organizations for less than two years to apply for and receive sick pay from only one employer. But in this situation, he must make requests to the accounting departments of all other organizations where he works for the issuance of such a certificate, and then provide them to the company where he plans to receive the payment.

We recommend reading: Free Travel for Pensioners on Suburban Trains to Zelenogorsk in St. Petersburg

182n, certificate

Working employees upon the onset of a period of incapacity for work are entitled to social insurance in the form of benefits. The accounting department calculates it based on information about wages subject to contributions for the previous two years. They can be obtained from a document such as a certificate in form 182n, filled out by the previous employer.

Information on earnings for calculating average earnings for benefits can also be entered directly in the “Sick Leave” and “Parental Leave” documents, which are used to calculate these benefits. To do this, in the “Sick Leave” document, on the “Main” tab, click on the “Change data for calculating average earnings” button.

Certificate of earnings for benefits: preparation and registration in 1C

The Date field indicates the date the Certificate was compiled. In the Employee field, select the employee for whom you need to generate a certificate of the amount of earnings for calculating benefits. After selecting an employee, the document is filled out automatically according to the data registered in the program for the selected accounting years.

To do this, on the Benefits tab, click on the Open average earnings button and in the Entering data for calculating average earnings form that opens, click the Add a certificate from previous button. place of work, fill out a certificate to calculate benefits indicating the amounts of earnings for previous years received from other employers.

Help and calculations in 1C Accounting 8

By default, the accounting indicator is set, that is, the report is generated according to accounting data. If necessary, you can set an indicator and generate a report according to tax accounting data (TA) or according to accounting data with permanent and temporary differences (BU, PR, VR).

Please note: in 1C it is possible to sign generated certificates and calculations (like other accounting registers) with an electronic signature and save them in the archive in accordance with the requirements of the Federal Law “On Accounting”. This function is available by clicking the “More/Accounting register/Sign electronic signature and save” button in the certificate form.

Free legal assistance

- It is available in the Payroll section. You need to enter this section of the Salary and Personnel Management information system and create a new document.

- It will automatically indicate the name of the organization, which is set in the 1C ZUP settings.

This is interesting: In what cases can you lose your Group 2 Disability Pension?

It is also possible to enter data on income from a previous place of work into the document calculating benefits during parental leave in the 1C Salary information system. To perform this operation, you need to enter the document to determine the average level of income of the employee, which is located in the section of the menu dedicated to benefits, and enter the data from the certificate provided by the employee into the information entry form that opens. It is necessary to check that in the settings of the 1C ZUP information system a parameter is set that allows you to take into account payroll from previous employers.

How to enter a certificate of earnings from a previous place of work in ZUP 2

- When you open the program, tabs, messages, and desktop menu windows should appear on the screen. If your monitor only has a gray background, you will need to make an adjustment. To do this, in the “Tools” menu, select the “User Settings” option and check the box next to the “Show desktop” item. The action is confirmed - Ok.

- on the list, attendance number of employees of the organization;

- about the actual wage fund;

- on wages and accruals and deductions for each employee, unit, structural unit, and for the company as a whole;

- generation of statements with information using standard forms and any others specified by users.