Suppliers of food products strive to ensure that their products are presented on the shelves of chain stores. Getting there is not so easy, since retailers dictate their own rules of the game... But no one wants to lose a tasty morsel, so sellers pay. Accountants can only correctly take into account these payments and minimize tax losses.

It is no secret that becoming a supplier to any retail chain is the dream of most businessmen. Cooperation with chain retailers is a stable and very capacious market for selling products. But according to the customs of established business turnover, such interaction involves payment by suppliers of goods of various premiums, bonuses and rewards.

One of the most popular in this sense are incentive bonuses. The mechanism for providing them is very simple and effective: if certain conditions are met by the buyer, the supplier pays a bonus or makes a discount. In the supply agreement, the parties can stipulate any conditions for bonuses, but usually they are associated with a pre-agreed volume of purchases, early payment for a consignment of goods, or the purchase of a wide range of products.

Taxation of such transactions is one of the most controversial issues. Most often, disagreements with regulatory authorities arise regarding value added tax. This is confirmed by the recent consideration in the Supreme Arbitration Court of Russia of a case regarding the taxation of such premiums.

At the same time, the accounting and taxation of premiums depends on the category of goods supplied - food or non-food. Thus, for suppliers of food products, the Federal Law of December 28, 2009 No. 381-FZ “On the fundamentals of state regulation of trading activities in the Russian Federation” establishes some restrictions, which also affect the taxation of bonuses.

It is important

The restrictions established by the Trade Law apply only to contracts for the supply of food products.

What are premiums in trading?

The bonuses and discounts used in trade are quite varied. The conditions for their provision are negotiated individually by the parties to the transaction, but most often it happens that buyer-retailers dictate their own rules of the game.

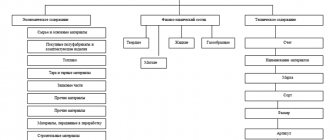

In general, all discounts can be divided into:

- provided at the time of transfer of goods. This leads to the fact that the buyer purchases goods at a lower price (the unit price of the goods changes);

- provided after the goods have been shipped. In this case, the buyer’s debt is reduced by returning part of the funds or setting them off as an advance.

In addition, the concept of retrospective discounts (bonuses) is widespread. These are discounts, the provision of which is preceded by the history of settlements between the supplier and the buyer.

It is worth noting that the concept of “discount” (premium, bonus) is not clearly and unambiguously defined in the legislation. In this regard, controllers often interpret the concept of a discount in their own way, which leads to disputes and greatly complicates their accounting.

Thus, Federal Law No. 381-FZ of December 28, 2009 only mentions a certain remuneration associated with the purchase of a certain amount of food products. At the same time, subclause 19.1 of clause 1 of Article 265 of the Tax Code refers to expenses in the form of a premium (discount) paid (provided) by the seller to the buyer for fulfilling certain terms of the contract, which may include fulfilling the volume of purchases. The Ministry of Finance of Russia, in letter dated July 30, 2010 No. 03-03-06/1/499, expressed the following opinion: the concept of “remuneration” used in Law No. 381-FZ is identical to the bonus (discount) provided for by the Tax Code. Thus, the specialists of the financial department made it clear that for taxation it does not matter how such payments are called in the agreement (premiums, bonuses, discounts or remuneration), but only the very essence, conditions and consequences of their provision are important.

What kind of awards are there?

Production, regulated and provided for by labor, collective agreements or internal wage regulations are:

- For fulfilling the production or sales plan

- For cost reduction

Non-productive – not directly related to the work process:

- For length of service

- For proposed innovations

- For conscientious work

Depending on the frequency of the awards, there are:

- One-time

- Monthly

- Quarterly

Bonuses on food products

When considering the issue of accounting for retro discounts (progressive incentive bonuses) that suppliers provide to buyers for fulfilling certain conditions of the supply agreement, it is necessary to again mention Federal Law No. 381-FZ.

As already mentioned, it contains a number of restrictions on activities in the food trade sector.

Attention

If the price of food products under a supply agreement includes the amount of VAT, the price of remuneration must be calculated from the price of these goods including VAT.

Thus, contracts for the supply of goods may provide for the payment of remuneration.

This reward is paid only for the purchase of a certain amount of food products. In this case, the maximum amount of remuneration should not exceed 10 percent of the price of goods, and should not be taken into account when determining the price for each unit of goods. In other words, when such remunerations are paid, it is the contract price that may change, but not the price of the supplied goods. Example 1

Supplier Alpha LLC entered into an agreement for the supply of food products with Beta LLC. Under the terms of the agreement, Alpha LLC undertakes to supply goods in the amount of 10,000 pieces at a price of 118 rubles. a piece. At the same time, the contract also contains a condition on the payment of remuneration to the buyer if he purchases the entire batch of goods during the quarter and pays for it. The remuneration amount will be 7 percent of the cost of goods if Beta LLC buys 10,000 units, and 10 percent if it buys more than stipulated in the contract. Based on the results of the quarter, it turned out that Beta LLC purchased goods in the amount of 11,000 units, therefore , can count on a maximum incentive bonus of 10 percent. In this case, the initial contract price will be 1,180,000 rubles, with a unit price of 118 rubles. If the bonus conditions are met, the contract price will change and amount to RUB 1,427,800. Of which: RUB 1,298,000. – total cost of goods (11,000 pcs. XX 118 rub.); RUB 129,800 – incentive bonus (RUB 1,298,000 X 10%).

As can be seen from the example, the contract price has changed to the total cost of goods and the amount of remuneration. But at the same time, the price per unit of goods remained unchanged - 118 rubles.

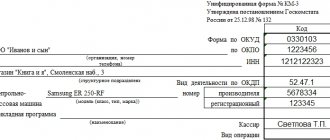

Award issued from cash register transaction

Important

Since salary amounts are involved in cost calculation to bring tax and accounting accounting closer together, the account is provided for correspondence with cost accounting accounts. In this case, the payroll entries look like:

Dt 07, 08, 10, 20, 23, 25, 26, 44 Kt 70

When paying wages, the account will correspond with the accounts of valuables . The name of the account will depend on the payment method: cash or non-cash payment, products, property, dividends.

In this case, the correspondence will look

like this :

Dt 70 Kt 50, 51, 52, 55, 44, 81

Analytics is carried out for each specific employee in accordance with open sub-accounts .

About the amount of remuneration

Law No. 381-FZ establishes only the maximum amount of remuneration paid. However, the procedure for calculating such bonuses is not established by this document. In this regard, the supplier and seller independently develop this procedure and record it in the supply agreement. Experts from the financial department also agree with this (letter of the Ministry of Finance of Russia dated August 18, 2010 No. 03-03-06/1/554).

Well, since financiers left the determination of the procedure for calculating incentive bonuses to the participants in contractual relations, the question becomes quite predictable: the price of which goods should be taken into account when determining the 10 percent limit limiting the amount of remuneration?

In practice, the following situation may arise. Product sellers supply a wide range of goods to retail chains. It is clear that some items are selling like hot cakes, and some, especially new products, are selling less actively. Could the reward be, for example, 20 or 30 percent of the price for unpopular product items, if in the end the amount of the reward as a whole remains within the permitted 10 percent?

This is interesting

Paying remuneration to the buyer in the form of providing a bonus product in the amount of the premium is unprofitable from a VAT point of view. Since the tax authorities recognize such transactions as a gratuitous transfer of goods, VAT will need to be calculated and paid on their market value.

There are no official explanations from relevant departments on this issue. But the Ministry of Industry and Trade noted that the remuneration of the retail chain for certain assortment items may exceed the maximum 10 percent allowed by the Trade Law. That is, different amounts of remuneration may be established for different positions, but in total it should not exceed 10 percent of the total volume (in monetary terms) of goods delivered under the contract. It was also noted that suppliers and retail chains have the right to set lower remuneration for best-selling products and higher remuneration for new products.

However, this approach was not supported by the Federal Antimonopoly Service. They explained that 10 percent is the maximum possible reward for each product line item. It was noted that Law No. 381-FZ is not ideal in this sense and allows for double interpretation. Consequently, disputes on this basis are possible and they must be resolved in the courtroom.

From the above, it is obvious that the option of the Ministry of Industry and Trade will be more profitable for retailers. Indeed, in this case, networkers can receive a higher reward for less-sold goods, which can compensate for lost profits from their sale. On the other hand, suppliers in this case will be able to more precisely influence the demand for new products by setting differentiated incentive bonuses.

If we consider this issue through the prism of tax accounting, we would still advise choosing a less risky option - setting the maximum possible reward within 10 percent for each position.

Income tax

Suppliers of food products may account for remuneration paid to customers as part of non-operating expenses. This was stated in the letter of the Ministry of Finance of Russia dated July 30, 2010 No. 03-03-06/1/499.

It was also noted that in accordance with subclause 19.1 of clause 1 of Article 265 of the Tax Code, non-operating expenses include expenses in the form of a premium (discount) paid (provided) by the seller to the buyer as a result of fulfilling certain terms of the contract, in particular the volume of purchases. In this case, the following condition must be met: the provision of the specified premium (discount) must be carried out without changing the price of a unit of goods.

In addition, keep in mind that expenses in the form of remuneration paid on the basis of a supply agreement and not provided for in paragraph 4 of Article 9 of Law No. 381-FZ are not taken into account for profit tax purposes.

It is also worth noting that the price of a supply contract cannot include other types of remuneration for fulfilling the terms of the contract, except for the volume of purchased products.

So, bonuses for merchandising services, widely used in practice, aimed at increasing the attractiveness of goods (priority display, placement of a full product line, etc.) cannot be taken into account as part of non-operating expenses. The payment of such bonuses can be accepted as expenses only if separate contracts for the provision of paid services are drawn up for these services. Financial department specialists equate them to advertising expenses and allow them to be taken into account only within the limit of 1 percent of sales revenue.

Retrobonus and VAT

The Trade Law distinguishes between concepts such as “unit price” and “contract price”. After all, incentive bonuses for the volume of goods sold increase the price of the supply contract itself, but do not in any way affect the price of goods. Consequently, settlements for the provided retro discounts are associated with settlements under the contract as a whole, and not with settlements for goods sold.

Thus, the amounts of remuneration paid by the supplier to the buyer for achieving a certain volume of purchases are not included in the value added tax base, of course, if the price of the product does not change (letter of the Ministry of Finance of Russia dated July 30, 2010 No. 03-03-06/ 1/499 ).

So for both buyers and suppliers of food products, the provision of retro discounts has no VAT consequences. This means that there is no need to prepare corrective invoices or make changes to the purchase and sales books. But once again we draw your attention to the fact that all this is true only if the unit price of the product does not change.

Accounting

To consider the issue of accounting for the provision of progressive incentive discounts, let's look at examples.

It should be borne in mind that the supplier and buyer can agree to provide remuneration according to one of the following options: – the seller directly transfers the bonus to the supplier’s bank account (option 1); – the seller credits the premium to future deliveries of goods (option 2). Depending on the settlement option chosen, accounting will vary. Example 2

Alpha LLC (supplier) and Beta LLC (seller) entered into an agreement for the supply of food products.

According to the terms of the agreement, when the volume of purchases reaches 1,000,000 rubles. at the end of the quarter, the supplier pays a bonus of 10 percent of the cost of goods shipped. Based on the results of the first quarter of 2012, the cost of all goods shipped and paid for will be 1,200,000 rubles. (including VAT - 183,050 rubles). In the second quarter of 2012, Alpha LLC shipped more goods worth 354,000 rubles. Let's consider what entries the accountant should make, depending on the options for providing remuneration: Option 1.

Remuneration for the volume of goods is determined based on the results of the quarter in which the agreed level of purchases is achieved , and is paid within five days after the end of the quarter.

Payment of remuneration is carried out by transferring funds to the buyer’s current account (see table 1). Table 1

| Explanation of operation | Debit | Credit | Amount, rub. |

| In the first quarter of 2012 | |||

| Sales of goods reflected | 62 | 90-1 | 1 016 950 |

| VAT charged on sales | 90-3 | 68 | 183 050 |

| Payment received from buyer | 51 | 62 | 1 200 000 |

| In the second quarter of 2012 | |||

| Remuneration accrued for the volume of purchases (RUB 1,200,000 X 10%) | 91-2 | 76-5 | 120 000 |

| The reward is transferred to the buyer's bank account | 76-5 | 51 | 120 000 |

Option 2.

The remuneration is determined based on the results of the quarter in which the agreed level of purchases is achieved, and is counted towards payment for future deliveries under the contract. In this case, the accountant makes the following entries (see table 2).

table 2

| Explanation of operation | Debit | Credit | Amount, rub. |

| In the first quarter of 2012 | |||

| Sales of goods reflected | 62 | 90-1 | 1 016 950 |

| VAT charged on sales | 90-3 | 68 | 183 050 |

| Payment received from buyer | 51 | 62 | 1 200 000 |

| In the second quarter of 2012 | |||

| Remuneration accrued for the volume of purchases (RUB 1,200,000 X 10%) | 91-2 | 76-5 | 120 000 |

| The amount of remuneration is credited towards payment for the next delivery | 76-5 | 62 | 120 000 |

| VAT charged on prepayment | 76-6 | 68 | 18 305 |

| Sales of goods reflected | 62 | 90-1 | 354 000 |

| VAT charged on sales of goods | 90-3 | 68 | 54 000 |

| VAT accrued on prepayment is credited | 68 | 76-6 | 18 305 |

In the considered options, the remuneration payable to the buyer is included in other expenses (clause 11 of PBU 10/99 “Expenses of the organization”). In this case, the supplier’s debt to pay remuneration to the buyer is reflected in account 76 “Settlements with various debtors and creditors”, in a special subaccount 76-5 “Settlements for remuneration”.

Such entries help to reflect in accounting two different transactions in relation to the same counterparty, carried out under the same agreement.

Regarding VAT, it is necessary to take into account that in option 1 there is no need to charge VAT on the premium amount. However, in option 2 (payment of remuneration by offset against future deliveries), the seller is obliged to calculate VAT on the received prepayment and subsequently offset it on the date of the next shipment of goods.

Accounting for discounts on goods (services)

Discounts mean a slight reduction in the price fixed in the contract for the goods (products) supplied or services provided. They become reality only when certain conditions are met. Types of discounts:

| Discounts | Characteristic |

| Real | The actual cost of products sold (goods) has already been reduced. Available at time of delivery |

| Future | Delivery of goods in the near future. Provided for future implementation and only when pre-agreed clauses of the contract are fulfilled |

| Retro discounts | Valid after the sale of the goods. It is planned to reduce the buyer's accounts payable. This creates income that is subject to taxation. Numerous adjustments need to be made to the accounting on both sides. |

The following example shows transactions that are relevant when the product has not yet been sold at the time the discount is provided.

Example No. 1. The Computers for Everyone enterprise purchased 20 printers. One of the clauses in the contract with the seller provides for a 2% discount.

- The total cost of the printers is 141,600 rubles. (excluding discount).

- Taking into account the 2% discount: 141,600 · 0.98 = 138,768 rubles.

- VAT = 138,768 · 0.18: 1.18 = 21,168 rub.

- Without VAT: 138,768 – 21,168 = 117,600 rubles.

The following entries must be made in the accounting documents:

| Accounts | Description | Amount, rub. | |

| Debit | Credit | ||

| 41 | 60 | printers are registered (discount taken into account) | 117 600 |

| 19 | 60 | VAT on purchased goods (with discount) | 21 168 |

| 60 | 51 | payment made | 138 768 |

| 68 | 19 | accepted for deduction (reversal) of VAT paid to the seller | 21 168 |

Correspondence is made on the basis of:

- primary accounting documents necessary for the sale of goods;

- adjustment invoice provided by the seller.

The cost of purchased products or goods cannot be changed. Therefore, the discount received by the purchasing company should be included in other income. When receiving a discount after posting the goods in accounting, transactions are recorded differently.