Award according to the Labor Code of the Russian Federation

While performing his duties, a company employee must receive a salary to pay for the work he performs. However, this is not the only type of payment he can count on. Sometimes management considers it right not to limit itself to salary, but to make additional payments, which can sometimes be important.

According to Article 129 of the Labor Code of the Russian Federation, bonus payments are the amount given to an employee in order to motivate employees.

Article 191 of the Labor Code of the Russian Federation describes what incentives can be applied to employees. Can be used: bonus, declaration of gratitude, awarding a diploma or gift of honor, payment of a bonus. The list of rewards can be supplemented by other types, for example, by awarding an honorary title.

The reasons for additional payments and their order are based on the company’s documents. Here are examples:

- inner order rules;

- regulatory acts of the enterprise;

- collective agreement;

- other papers.

There are two types of payments:

Employees receive them for outstanding performance or when they perform their duties conscientiously.

Incentive payments are made to increase employee motivation to be productive.

Incentives are recognition of an employee’s success by management and the workforce. Incentives may count toward career advancement.

According to Article 129 of the Labor Code of the Russian Federation, remuneration for labor consists of three parts:

- Payment for work performed.

- Compensation payments.

- Incentive payments.

Bonus rules are being developed at the enterprise gradually. When talking about labor success, the average values of indicators are taken. Bonuses are usually given based on the numbers received per month.

If an employee is awarded a personal bonus, the payment of incentive amounts is not time-based, but is made in connection with specific successes.

Methods for calculating the annual premium amount

The size of the bonus based on the results of work for the year can be set either as a fixed amount or as a percentage of the employee’s earnings. In the vast majority of cases, the amount of remuneration is calculated as a whole for the enterprise or its divisions. Determining the amount of incentive payment individually for each employee is a very labor-intensive undertaking, and therefore can only be carried out in organizations with a very small staff of employees.

The amount of material incentives is calculated separately for those employees who have worked in the organization not for a full year, but for some part of it. The bonus can be accrued even if the employee has already quit at the end of the reporting period.

What can you give an additional bonus for?

Typically, employees are given bonuses for the following reasons:

- For the high intensity of the work performed.

- For high performance indicators.

- Sometimes bonuses are awarded for the high level of quality of work of a specific person.

- For length of service at this company.

- Incentive payments for achieving planned targets.

These payments are:

- disposable;

- monthly;

- quarterly;

- performed once a year.

Although the final decision on bonuses is made by the head of the enterprise, payments are not made arbitrarily, but in accordance with the rules.

Suppose a bonus was announced, but payment was not made or only partially made. The boss will bear the same responsibility for her delay as for non-payment of wages.

It must be taken into account that labor productivity is not the only reason for bonuses. The reason is recognized as other actions that the company considers as useful for itself. Here are some examples:

- Strengthening market positions in relation to competitors.

- Increasing the number of new clients for the company.

- Actions that led to an improvement in the company's image.

The reasons for such bonuses follow from the specific interests of the company.

Sample order for bonuses

When placing an order for bonuses, the standard T-11 form is usually used. You will need to add the following information to the document:

- Full name of the promoted employee indicating his position.

- The exact wording of the reason for the bonus is given.

- The specific form of bonus (money or valuable gift) is indicated.

- The document justifying the payment is indicated. This could be, for example, an internal memo or an internal regulatory act of the enterprise.

Drawing up an order for bonuses is done in the following order:

- A notice is sent to each department head with a request to collect information. It is necessary to indicate which employees, for what reason, must be included in the list for bonus payment.

- These people conduct a study of the situation and find out which of their employees meet the criteria for receiving the bonus. Then the information is collected and given to the manager.

- He reviews the resulting list, makes changes and sends it to department heads.

- They make their comments and suggestions and together with them the final list is transferred to the boss for drawing up the final version.

- Then an order is issued on the basis of which bonuses are awarded.

Bonuses based on the results of work for the year: the procedure for calculating payments

Payment of bonuses based on the results of work for the year is made in the following order:

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

- The circle of persons to whom the bonus will be awarded is determined.

- The amount of the bonus is set; if necessary, it is reduced for individual employees. The method for determining the amount of material remuneration is regulated by the provisions of internal regulations in force at the enterprise. Sometimes they also indicate the standard size of the bonus accrued at the end of the year.

- An order for bonuses is issued. The document is endorsed by the general director of the enterprise.

- Employees are familiarized with the order against receipt.

- Based on the provisions of the order, accounting staff calculate the amount of the bonus for each employee of the organization and transfer funds to the bank.

Memo for the award

It is important to understand that the payment of the premium must have a basis. In this case, it is necessary to distinguish between regular and one-time bonus payments. In the first case, as a rule, the grounds are provided by a collective agreement or internal regulations adopted by the enterprise.

In the case of one-time payments, there must be a document stating that a certain employee needs to be paid a bonus for a certain reason. One option for such a document could be a memo from the head of the department sent to the management of the enterprise.

The legislation does not regulate a specific form of the document, which in the future will be the basis for payment of the premium. However, this document must contain the following information:

- it is necessary to provide objective indicators that are the basis for receiving a specific type of bonus;

- the wording is given, which indicates exactly what the reward is for;

- registration of the document must be carried out on the basis of current regulatory documents.

If such a memo is written with violations, then in the future, during an audit, this may become the basis for the conclusion that the payment of the bonus was illegal.

How to formulate the reason for the accrual?

Some examples of good wording will help directors justify paying incentives to employees in various situations. So, you can give a salary increase in the following cases.

- For the quality of work. Simply put, you can do something somehow, or you can try and do it at a high level. An example from the cultural sphere: one guide in a museum tells a boring and formal story, while another tells his story so captivatingly that visitors write him thanks. For management, this may be the reason for the accrual of incentive payments.

- For high results and work intensity. An employee does more in the same time and with the same opportunities than his colleagues. For example, he uses other work methods that increase productivity.

- For a long period of continuous work. This formulation is most suitable for an experienced employee who has been looking after the interests of the company for a long time and does not go on vacation at his own expense.

- For hard work. Such a bonus can be a one-time bonus associated with the anniversary of an employee who always conscientiously performs his duties, or it can be accrued, for example, at the end of the year.

- For the timely performance of their work duties. This formulation is especially suitable if the organization is carrying out an important and time-consuming project, and the employee played a significant role in delivering it on time and in proper form.

- For the high-quality execution of an important one-time assignment. For example, an employee successfully took part in decisive negotiations, played a role in them, went on a business trip and concluded an agreement there on behalf of the company, and found a way out of a particular problem.

- For the rationalization proposal, for the long-term plan. The employee's analytical skills and foresight may also be rewarded.

- For saving money. A special talent that can be rewarded is the implementation of a project for less money than was originally budgeted by management.

- Award based on the results of a project that has been successfully implemented and brought to life.

A good employer always remembers that a bonus is a kind of investment in the future of the company, because such motivation to work makes it clear to all team members that each of them is important and valuable to management.

https://youtu.be/va6He3Akeao

Reduction in bonuses

The procedure according to which the bonus is paid must be determined by the internal documents of the enterprise.

However, it must be taken into account that it must be determined in detail in what cases to apply and how exactly to implement:

- deprivation of bonuses;

- deprivation of the right to receive a bonus;

- reduction of the bonus payment due to the employee.

In the first case, we are talking about the fact that this is a punishment in case of failure to fulfill the plan or any other offenses. For this purpose, it was decided that the employee was not entitled to receive this amount.

The second concept - deprivation of the right to a bonus - may have reasons not related to the employee. This could be, for example, the difficult economic situation of the enterprise.

In the third case, only a partial reduction in payment is made. This is usually used as a disciplinary measure.

Bonus systems

Article 135 of the Labor Code of the Russian Federation provides that the grounds for paying bonuses are determined by the enterprise independently. This is done by approving internal company documents, where such things are spelled out in detail.

What is important in this matter is what is said in the collective agreement at a given enterprise. However, if it is desirable to make clarifications or changes in it, then this can become a rather cumbersome procedure. A simpler option is to adopt internal documents on this issue.

Read more: Live-in care agreement for an elderly person

The principles on the basis of which the employee bonus system is organized are usually important. In practice, there are several options in this area:

- The most commonly used option is when bonuses are paid to the majority of employees on a regular basis. It can be deprived of those whose work performance is too low. In this case, the amount of the bonus may depend on the amount of salary, labor results, work experience or other parameters.

- A fundamentally different approach is possible, when the bonus is given to those who have shown outstanding results in their work. In this case, bonuses are given selectively and are aimed at encouraging performance.

- One of the possible forms of organizing bonuses could be holding various kinds of competitions with the payment of bonuses to those who win them.

In the first case, the payment system is aimed to the greatest extent at maintaining the existing level of labor intensity and productivity. However, in practice, the universal nature of incentives does not allow significantly increasing the amount of incentives for specific people.

In the second case, the amount of the incentive can be quite large, but it is possible that this amount will be greater than the salary the employee receives. The system rewards those who demonstrate maximum labor efficiency.

Classification of types of stimulation

In addition to bonus payments, other types of incentives are possible:

- Measures can be divided according to their target nature.

- Inclusion in the standard bonus system or a special bonus.

- Regular or one-time incentives.

- Taking into account the reason for bonuses: whether it is related to labor results or not.

- Participation in the calculation of income tax. Some payments are expensed and reduce income tax. Other payments are made from profits.

Although bonuses to employees are largely an internal matter of the enterprise, registration must nevertheless be carried out in accordance with all legal requirements.

Business coach Anna Bocharova talks about proper motivation and bonuses for employees:

https://youtu.be/d7Os3xaMo9Q

Noticed a mistake? Select it and press Ctrl+Enter to let us know.

Art. 191 of the Labor Code provides that an employer can reward its employees for the conscientious performance of labor duties. How to arrange everything correctly in this case?

The employee should find out what bonuses are paid in the company when applying for a job. Moreover, this applies not only to production bonuses, which can be awarded for fulfilling some obligations, but also to one-time bonuses - for a wedding, the birth of a child, graduation from a university and other events.

In Art. 68 of the Labor Code of the Russian Federation states that before signing an employment contract, the employer is obliged to familiarize the employee, against signature, with the Internal Regulations, other local regulations directly related to his work activity, and the collective agreement, which, among other things, may contain information about bonuses.

If a company enters into a GPC agreement with an employee, that is, hires him as a contractor who performs duties under a contract for the provision of paid services, then there can be no talk of any bonus. Therefore, if an employer uses the word “bonus” when concluding a GPC agreement, he is at great risk - such an agreement can be reclassified as an employment agreement. An employer can encourage a person with whom a GPC agreement has been concluded by writing about a change in the price under the agreement.

The employee must know how the bonus is calculated and what he needs to do to receive it. This is important because Art. 252 of the Tax Code of the Russian Federation states that all accruals are accepted as expenses if they are reflected in labor and (or) collective agreements.

The employer must reflect the bonus in one of the following ways:

- directly in the employment contract;

- make a reference in the employment contract to the collective agreement, which talks about bonuses;

- make a reference to the Regulations on bonuses in the employment contract;

- write in the employment contract that you need to look at the collective agreement, and in the collective agreement make a reference to the Regulations on bonuses.

In any case, one principle applies: having taken a collective agreement into our hands, we must, through the Regulations on Bonuses or through a collective agreement, enter into the procedure for calculating bonuses.

Sometimes the organization stipulates in the employment contract that the bonus is awarded according to the decision of the manager. However, this option is risky, and it does not guarantee that a tax expert will be loyal to such wording.

simplified tax system

Organizations that pay a single tax on income do not reduce the tax base by the amount of annual premiums (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

Organizations that pay a single tax on the difference between income and expenses include annual bonuses stipulated by the labor (collective) agreement as expenses. This can be done if bonuses are paid for labor performance. This conclusion follows from subparagraph 6 of paragraph 1, paragraph 2 of Article 346.16 and Article 255 of the Tax Code of the Russian Federation.

Situation: when is an annual bonus considered stipulated by the employment contract?

An annual bonus is considered stipulated by the employment contract if one of two conditions is met:

- the employment contract specifies the amount and conditions for calculating bonuses (paragraph 5, part 2, article 57 of the Labor Code of the Russian Federation);

- the employment contract contains a link to the organization’s local document regulating the procedure for calculating and paying bonuses (for example, the Regulations on Bonuses).

A link to a local document can be formatted as follows: “The employee is paid bonuses provided for in the Regulations on Bonuses (approved by Order No. ___ dated ______).”

This position is adhered to by the Russian Ministry of Finance in letter dated February 5, 2008 No. 03-03-06/1/81. It is confirmed by arbitration practice (see, for example, decisions of the FAS of the West Siberian District dated April 17, 2006 No. F04-10064/2005 (20874-A27-37), Far Eastern District dated January 25, 2006 No. F03-A51/05 -2/4903).

Include the amount of bonuses based on the results of work for the year into expenses at the time of their payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

An example of taxation of bonuses based on the results of work for the year. The organization applies a simplification, pays a single tax on the difference between income and expenses

Alpha LLC uses simplification. An organization pays a single tax on the difference between income and expenses.

The regulations on bonuses for Alpha and employment contracts with employees provide for the payment of an annual production bonus in the amount of 13,000 rubles. to all employees of the organization who have completed their full working period. The bonus is accrued along with the salary in January of the year following the reporting year. The bonus is paid within the deadlines established for the payment of salaries for January.

In January, storekeeper P.A. Bespalov was awarded an annual bonus. It was paid on February 5th.

The bonus amount will be included in the personal income tax base in February. Bespalov has no rights to deductions for personal income tax.

Personal income tax on the premium amount is equal to: 13,000 rubles. × 13% = 1690 rub.

The organization calculates contributions to compulsory pension (social, medical) insurance according to the basic tariff. Contributions for insurance against accidents and occupational diseases - at a rate of 0.2 percent.

The amount of contributions accrued from the premium for insurance against accidents and occupational diseases was: 13,000 rubles. × 0.2% = 26 rub.

The amount of contributions for compulsory pension (social, medical) insurance is 3900 rubles, including:

- contributions for compulsory pension insurance – 2860 rubles. (RUB 13,000 × 22%);

- contributions for compulsory social insurance - 377 rubles. (RUB 13,000 × 2.9%);

- contributions for compulsory health insurance credited to the Federal Compulsory Medical Insurance Fund - 663 rubles. (RUB 13,000 × 5.1%).

On February 5, the accountant transferred personal income tax, contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases to the budget.

In February, the accountant took into account as expenses:

- bonus amount – 13,000 rubles;

- the amount of insurance premiums is 3926 rubles. (26 rubles + 3900 rubles).

Types of awards

There are two types of awards:

1. Bonuses that are provided for by the remuneration system based on specific indicators and bonus conditions developed in the company.

Such bonuses are part of the material motivation of employees; they are stimulating in nature. They are paid periodically (monthly, annual, quarterly, etc.) and are usually set in a certain amount.

2. One-time bonuses that are not included in the remuneration system.

Paid to an employee for certain achievements, many years of conscientious work, completion of an urgent and important task, or for significant events (for example, anniversaries and professional holidays).

Payment of a one-time bonus is carried out at the unilateral discretion of the employer. The basis is the Order of the head.

Convenient and error-free maintenance of personnel records in a web service

The procedure for calculating the amount of the premium

In general, the calculation of the bonus amount based on the results of work for the year is carried out as follows:

- The results of work in the reporting period are analyzed. The assessment is given after studying the following indicators:

- fulfillment of the specified plan in the reporting year;

- saving resources;

- introduction of new technologies;

- improving the quality of products, etc.

- The source of funding for the bonus is determined. As a rule, incentive bonuses are paid out of the organization’s profits. Much less often (for example, if an employer wants to reward employees even if there are losses), funds are raised from the wage fund and other sources.

- A list of persons or structural units to whom the bonus will be paid in part is established. In some cases, for objective reasons, the amount of remuneration may be reduced. Deprivation of a bonus (or part thereof) is carried out on the basis of an order from the head of the organization for the following reasons:

- systematic violation of labor discipline by an employee in the reporting year: the presence of documented absenteeism, tardiness, appearances at the workplace in a drunken state or reprimands from management;

- failure to complete the tasks assigned to the employee.

- The final amount of the bonus is calculated. Based on the analysis, as well as depending on the availability of free funds, the final amount of the payment is adjusted by members of the enterprise's balance commission (which usually includes senior management, chief accountant and chief economist).

Order for a bonus

The manager's order is drawn up according to unified forms approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1: Form T-11 or Form T-11A (for bonuses to a group of employees).

The Instructions for Application and Completion of Forms state that Form T-11 and Form T-11A:

- used to formalize and record incentives for success in work;

- are compiled on the basis of a proposal from the head of the structural unit of the organization in which the employee works;

- signed by the manager or authorized person;

- are announced to the employee against signature.

Based on the order, an entry is made in the employee’s personal card (Form T-2 or Form T-2GS (MS)) and his work book.

When registering all types of incentives, except for monetary rewards (bonuses), it is allowed to exclude from Form T-11 the requisite “in the amount of ______ rubles. _____ cop.”

When filling out Form T-11, the full name, structural unit, and type of incentive (gratitude, valuable gift, bonus, etc.) are indicated. If we are talking about material assistance and valuable gifts as elements of bonuses, then, according to clause 28 of Art. 217 of the Tax Code of the Russian Federation, personal income tax is not calculated if material assistance does not reach 4,000 rubles. per year, and if it has been reached, then personal income tax is accrued only on the excess and is separately exempted, also in the amount of 4,000 rubles, increasing from the beginning of the year, a gift.

Arbitration practice shows that a gift is not money, but a thing. However, sometimes the tax authorities regard money as a gift. Therefore, you need to be prepared for an ambiguous approach from the tax authorities to such situations.

Premium and taxes

The bonus is income, therefore, there is no reason to cancel the income tax. However, the law provides for some exceptions and limitations. There is no need to pay personal income tax on bonuses at the end of the year if:

- the amount of all additional payments, including bonuses, is less than 4,000 rubles. per year per employee;

- The prize was awarded for outstanding achievements in the field of culture, science, education and other areas listed in the list approved by the Government of the Russian Federation (clause 7 of Article 217 of the Tax Code of the Russian Federation).

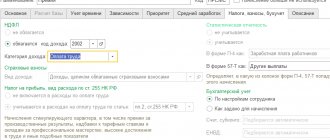

FOR YOUR INFORMATION! The accounting code for calculating personal income tax on annual bonuses is 2000 “remuneration for labor duties.”

Employee bonus algorithm

If an employment contract is concluded with an employee, then several important details need to be taken into account. According to Art. 57 of the Labor Code of the Russian Federation, terms of remuneration, including allowances, additional payments and incentive payments, are mandatory for inclusion in an employment contract.

The employment contract must make it clear under what conditions and in what amount the bonus will be paid.

You can correctly indicate bonus terms in an employment contract in the following ways:

- Specify the bonus in the employment contract.

This option is rarely used, since it does not provide the opportunity to change the text of the employment contract if necessary. The employer can do this only if he is absolutely sure of the employee’s readiness to sign the amended version.

Read more: Who pays for an apartment after the death of the owner

If the employer nevertheless decides to include a bonus in the employment contract, then he must indicate its size: the amount or the procedure for determining it - a formula. This can be an amount that is multiplied by certain coefficients, depending on what work is performed by the employee and where he works (for example, in the Far North).

If the bonus is specified in the employment contract, then the company has no right not to pay it. Otherwise, the employee may go to court.

- State in the employment contract that bonuses are paid in accordance with the collective agreement.

At the same time, the collective agreement specifies who is awarded bonuses, how and for what. However, amending a collective agreement is even more difficult than amending an employment contract. Therefore, most organizations choose the third option.

- Develop Regulations on bonuses.

The document is convenient because it is not two-sided and is signed by one person. But the employment contract must contain a reference to the Regulations.

What documents define the principles of bonuses?

Each organization has its own, their content and principles depend on the specifics of the work carried out by certain employees, the importance of the results achieved, and the capabilities of the incentive fund. The features of the document are also determined by what the enterprise itself is. If it is a budget organization, in most cases it does not have the ability to give bonuses at its own discretion, and managers have limited rights. In private companies, everything depends on the financial situation and the desire of the director to encourage his employees.

Here are a number of documents regulating this issue:

- collective agreement and the bonus provisions attached to it;

- internal labor regulations;

- other governing documents drawn up within the organization.

Regulations on bonuses

The bonus regulations are written for the entire organization and, accordingly, apply to all employees. At the same time, one organization may have several Regulations on bonuses. For example, you can develop a document for each branch of the company.

Contents of the Bonus Regulations:

- general provisions (who is entitled to receive bonuses, by what rules they are distributed, etc.);

- sources of bonuses (if bonuses are paid from special-purpose funds or targeted revenues, then it is necessary to indicate the sources of bonuses, since such bonuses are not taken into account in expenses for the purpose of calculating income tax (clause 22 of Article 270 of the Tax Code of the Russian Federation);

- bonus indicators;

- circle of persons receiving bonuses (accounting, sales department, branch in Samara, repair department, etc.);

- frequency of bonuses (different circles of bonus recipients may have different bonus accrual periods - monthly, quarterly, etc.);

- premium amount or percentage;

- conditions for reduction and non-payment of bonuses (lateness, failure to comply with job descriptions, violation of safety regulations, etc.).

Sometimes the basis for depreciation is written in the Regulations on Bonuses. However, so that the labor inspectorate does not have unnecessary questions, it is better to avoid the word “deduction of bonuses” and use the terms “increasing coefficient” and “reducing coefficient”.

Revocation of bonus for violation of discipline

The Rostrud Information dated December 10, 2018 clarifies that when calculating a bonus, the employer has the right to establish conditions for its complete deprivation or reduction in its size. One of these conditions may be a disciplinary offense.

“Establishing criteria for depriving a bonus or reducing its size falls within the competence of the employer, except in cases where, for example, the terms of the bonus are defined in the agreement,” explains Rostrud.

At the same time, the court may recover an unpaid bonus if it is proven that the employee was brought to disciplinary liability illegally.

Deadlines for calculating annual bonuses

Obviously, when calculating a bonus based on the results of work for the year, it is necessary to evaluate the results of the enterprise’s activities in quantitative and qualitative terms. It is impossible to do this before the end of the calendar year for objective reasons - in most organizations, December 31 is a working day (except for those years when this date falls on a weekend), during which a considerable amount of work can be completed. That is why, in practice, the annual bonus is accrued no earlier than a month after the end of the reporting year.

Such long terms for transferring funds are not a violation of Part 6 of Art. 136 of the Labor Code of the Russian Federation, the provisions of which oblige the employer to pay wages no later than the 15th day of the month following the reporting period. This is evidenced by the explanations given by the Ministry of Labor and Social Protection of the Russian Federation in letter dated September 23, 2016 No. 14-1/OOG-8532. According to the document, the employer has every right to pay incentive bonuses at any time convenient for him.

How are bonuses taken into account when calculating average earnings?

The calculation of average earnings is determined by Art. 139 of the Labor Code of the Russian Federation and Government Decree No. 922 of December 24, 2007. This issue, in particular, is detailed in paragraph 15 of the Decree.

The resolution does not define sick pay, but vacation pay and business trips, since the average salary is calculated during business trips. Therefore, paragraph 15 applies to these two cases.

Paragraph 15 says that when determining average earnings, the following are taken into account:

- monthly bonuses actually accrued in the billing period, but not more than one payment for each indicator for each month of the billing period

If several bonuses were awarded for one indicator in the billing period, then one bonus is included. Let’s say that sales managers are awarded three bonuses depending on sales: 1% of sales volume, 0.5% of sales as an incentive for particularly successful managers, and 5% of sales from the bonus fund. Accordingly, in this case, only one bonus will be included in the calculation, since all listed bonuses are paid on the same basis.

If you have one bonus awarded for sales, and the second for going to work on weekends, then you need to include both bonuses, because these payments are based on different indicators.

- bonuses for a period of work exceeding one month (for example, quarterly), but not more than the billing period (one year)

Such premiums are included if they were accrued for a period of more than a month, but not longer than the billing period. One is included for each indicator (for example, if a bonus was paid based on the results of work for the quarter and there was also a bonus for individual employees for completing urgent tasks).

- premiums for a period greater than the estimated one

Such premiums are included in the calculation in the amount of the monthly part for each indicator for each month of the billing period.

For example, this could be a bonus at the end of a large project that lasted several years. In this case, the annual calculation will be included in the amount of 1/3.

As a rule, such a bonus is awarded in February. In this regard, the question often arises: what to do if an employee quits at the end of January? Should he be given a bonus in this case? The answer to the question is contained in the company's internal documents. If they state that the bonus is paid at the end of the year, then an employee who has worked for 12 months and quits at the end of the year must receive it.

If internal documents state that an employee who quit before the bonus was accrued is not entitled to it, then the employee has no right to claim the payment. The legislation does not provide guidance on this issue.

According to Resolution No. 922, remuneration based on the results of work for the year, accrued for the calendar year preceding the event, is taken into account regardless of the time of its accrual.

Do I need to pay an annual bonus to an employee who quit in October?

The Appeal Ruling of the Supreme Court of the Republic of Karelia dated September 25, 2018 No. 33-3344/2018 considers the situation when the employer, having issued an order for an annual bonus, which was paid taking into account the time worked, did not include in the lists an employee who quit two months before the end of the year.

The court considered that such actions were discriminatory (the employee was placed in an unequal position with others) and collected a bonus from the company.

Advice from practitioners that will help rid bonuses from the suspicions of tax authorities.

In accordance with Art. 129 of the Labor Code of the Russian Federation, wages are remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed. But in addition to salary, many employers want to further stimulate their employees by paying them bonuses.

Often, the manager does not think about the structure and nature of these payments, which can lead to adverse consequences.

The most important thing in determining this payment is that it is calculated in addition to the employee’s salary.

In accordance with paragraph 2 of Art. 255 of the Tax Code of the Russian Federation, bonuses for production results that are paid to employees, the organization has the right to classify as labor costs for profit tax purposes. However, the tax consequences of certain aspects of the bonuses can be very burdensome for the company.

Part of your salary or in addition to it?

Labor Code of the Russian Federation in Part 1 of Art. 135 indicates that remuneration for labor also includes incentive payments, which include bonuses.

If the bonus is not awarded constantly, but depending on the results achieved, then this is no longer part of the mandatory payments, but a form of incentive (Part 1 of Article 129 of the Labor Code of the Russian Federation).

The bonus payment procedure must be documented in the local regulations of the enterprise. These items may contain:

- in the collective agreement (part 2 of article 135);

- in an individual employment contract (part 2 of article 57, 1 paragraph);

- in a specially designated regulatory document, for example, Regulations on bonuses, Regulations on remuneration for labor (part 2 of article 135, part 1 of article 8);

- order for the organization on bonuses for an employee or employees (Part 1, Article 8).

Conditions of annual bonus

Year-end bonus (13th salary) is an incentive payment accrued to an employee if he complies with specific conditions established in legal documents during the working year. Such conditions may be the achievement of certain indicators or the absence of negative aspects. In each organization, bonus conditions are developed individually and approved by management.

The document stipulating bonuses at the end of the year must contain the following information:

- when is this type of bonus awarded?

- requirements for those who count on this payment;

- factors influencing the size of the premium (both increasing and decreasing);

- conditions for the employee's bonus payment.

When is it more and when is it less?

The amount of the annual bonus is almost never fixed. It would be unfair to reward equally a “veteran” and a young specialist who has barely worked his first year, yesterday’s absentee with a disciplinary sanction lifted, and an impeccable employee who brought profit to the company. The employer usually varies the size of the bonus depending on:

- employee qualifications;

- his work experience;

- working conditions;

- complexity of the labor function;

- time of actual employment;

- quality indicators.

For example, the bonus can be increased if the employee saves the organization’s resources, introduces some useful innovation, achieves particularly high performance, etc. The decrease may be due to comments, reprimands, or errors in work.

REFERENCE! It is most convenient to “link” the size of the bonus to the average salary (monthly or annual) and operate with separately established coefficients.

What about the newbies?

If an employee has worked for the company for less than a year, then whether to pay him remuneration or not depends on the conditions specified in the relevant Regulations.

Some entrepreneurs give year-end bonuses only to employees who have worked the entire year.

Others prefer to encourage “green” employees by recalculating bonuses for the months actually worked.

The same practice applies to resigning employees.

They may not give it

The Regulations on the Prize must stipulate the conditions under which the bonus will not be paid. As we have already established. This is not an obligatory part of the salary, and they have no right to deprive or reduce its size on any grounds.

Specific conditions must be provided for depreciation, for example:

- the presence of an outstanding disciplinary sanction;

- loss caused by the fault of an employee;

- errors in work that led to serious consequences (it must be specified which ones - for example, injuries, accidents).

How to develop and what documents to support?

1. Provide this reward. To do this, it is necessary to supplement the regulations on remuneration and labor (collective) agreements with information on bonuses for employees, but it is advisable to issue a new local regulatory act of the organization, namely a regulation on bonuses.

Read more: Contributions for capital repairs of municipal housing

2. It is necessary to identify and consolidate specific and differentiated bonus indicators in personnel documents. This is necessary to comply with the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation. An important criterion when developing bonus regulations is the use of realistically measurable indicators. It is important to avoid vague language.

Thus, in order to take into account the bonuses in question for tax purposes, the employment (collective) agreement, bonus provision or other local regulatory act must contain the following criteria:

- grounds for payment of bonuses, specific measurable performance indicators for bonuses;

- sources of bonus payment;

- amounts of bonuses and the procedure for their calculation.

3. It is necessary to have documents confirming the basis for payment of bonuses (clause 1 of Article 252 of the Tax Code of the Russian Federation). Such documents can be a petition, a memo from the immediate supervisor, supported by actual performance indicators of the employee, etc. Also, in order to document the costs of bonuses to employees, the employer must make these payments on the basis of an order (instruction) on rewarding employees (form T-11, T-11a or according to a form developed by the employer).

An important circumstance is that the bonus should not be paid at the expense of the organization’s net profit, special-purpose funds or targeted income. Payments from these sources are not taken into account for tax purposes (clause 1, 22, article 270 of the Tax Code of the Russian Federation).

Criteria for awarding bonuses based on performance and possible wording

When paying bonuses based on performance (for a year, month, quarter), various criteria may be applied, which are either specified in the Regulations on bonuses or other regulations in force in the organization, or are determined by management.

The criteria may be the following:

| Criterion | Characteristics of the criterion |

| Quantitative | The release of a certain amount of products or the achievement of other quantitative indicators of labor by an employee if the organization is not engaged in production of products |

| Qualitative | The quality of manufactured products or a quality indicator of another materialized result of labor |

| According to performance indicators | Fulfillment of certain indicators that are essential for a particular type of activity. For example, implementation of the plan for all areas of activity in total |

| According to the employee’s employment during off-hours | For example, a bonus may be paid if an employee worked overtime, worked on holidays, etc. |

| For disciplinary action | If an employee comes to work on time, his behavior complies with the Discipline Regulations in force in the organization, then he may be paid a bonus |

| Economic | Saving organizational resources, for example, performing a certain amount of work at lower costs |

| Based on the number of mistakes made by the employee | The absence of errors that led to negative consequences may serve as a basis for the payment of bonuses |

| According to the complexity of the work performed | If an employee performed work of increased complexity relative to other employees, he may be paid a bonus |

| By any other criteria | There are no restrictions on the number of criteria, but they must be somehow related to the employee’s work activity |

The wording can be arbitrary, but its content must correspond to the criterion by which the employee has achieved outstanding performance. For example, “for exceeding the production plan by 100 units for the period from 02/01/2018 to 03/01/2018.”

Have a question? We'll answer by phone! The call is free!

Moscow: +7 (499) 938-49-02

St. Petersburg: +7 (812) 467-39-58

Free call within Russia, ext. 453

How much and what to pay for?

If the number of bonus indicators complicates the calculation of the final bonus amount, you can set a bonus limit with a gradation from minimum to maximum (the amount of the monthly bonus is from 20 to 50% of the employee’s salary).

You can also draw up a crisis sheet, which will indicate all bonus criteria. During the month, the head of the structural unit will evaluate the employee’s performance on a 10-point scale, and at the end of the month issue final grades. However, in such cases, accusations of subjectivity on the part of the employees being evaluated cannot be avoided, which can lead to an unfavorable environment within the team.

Bonus criteria deserve special attention for the reason that precisely due to their absence, ambiguity, and opacity, tax authorities may come to the conclusion that bonus payments are unjustified, which can lead to additional income tax charges.

For employees who are directly involved in the production of products, the following bonus indicators are established: fulfillment of the production plan in a given volume, minimization of defects.

For the commercial department, important performance criteria are clearly: meeting KPI indicators, effective work with current clients, the absence of complaints and claims regarding the quality of products sold and services provided from buyers and customers. But here it is important to take into account that the monthly fulfillment of these indicators does not provide for bonus payments, since they are specified as functional responsibilities in employment contracts with employees of the commercial department. The basis for bonuses can only be exceeding KPI indicators, expanding the client base, etc.

It is important to take into account here that the use of the same bonus criteria for all structural divisions of the company is not applicable, and they must be established based on the job responsibilities of an individual employee.

Indeed, the job responsibilities of these employees do not directly correlate with the main goal of the organization - profit maximization.

However, this does not serve as a basis for refusing bonuses to these categories of employees.

In this case, when developing bonus criteria, it is necessary to take into account job responsibilities and the effectiveness of their implementation.

For example, the basis for paying a bonus to an accounting employee may be:

- improving accounting methods through the effective implementation and use of new software;

- timely and high-quality preparation of reports on personalized data to pension and other funds, the Federal Tax Service and other regulatory authorities;

- absence of comments on the results of various inspections;

- high results when performing complex unscheduled work

- high speed while performing various functions simultaneously

- maintaining financial discipline, etc.

As for the information technology department, the employer can justify expenses here by specifying in the bonus regulations such criteria as: introduction of new technologies in order to increase the company’s information security, uninterrupted operation of infrastructure equipment, high speed of troubleshooting of computers and office equipment, development of new software equipment to improve the efficiency of various structural divisions, etc.

It is not recommended to use wording such as “for a conscientious attitude to work” or “for compliance with labor standards and labor discipline.”

Reason for appointment

The basis for a bonus is an event or a set of certain factors, upon the occurrence or fulfillment of which the employee is entitled to an incentive bonus in the form of a bonus. The list of grounds for bonuses is determined solely by the employer. The decision will have to be enshrined in local regulations for the organization, otherwise problems with the State Labor Inspectorate and disputes with employees cannot be avoided.

Set the grounds for assigning bonuses:

- in the employment contract with the employee;

- in a collective agreement;

- in the wage situation;

- in a separate provision on bonuses;

- in the provision on employee incentives;

- at other disposal of management.

Please note that in addition to monetary incentives, other forms of incentives for conscientious work are provided for workers. For example, an employer has the right to express gratitude or award a distinguished employee with a valuable gift, a certificate of honor, or assign him an honorary title. For special labor services to society and the state, employees are nominated for state awards.

Recommendations for state employees

There is no special procedure for calculating the quarterly bonus in a budget organization. Issues in the area of remuneration for public sector employees are resolved by management independently, but taking into account the recommendations and standards communicated by the founders, higher ministries and departments.

The following grounds are possible for annual, monthly or quarterly bonuses for civil servants and other public sector employees:

- for conscientious performance of labor duties;

- for achieving certain labor indicators;

- in connection with anniversaries;

- in connection with professional holidays, etc.

Please note that for each reason you will have to describe in detail the events and indicators for bonuses. For example, to base an anniversary or holiday date, specific holidays and dates of events should be indicated. Otherwise, workers will demand money for every holiday on the calendar.

With regard to bonuses for achieving labor indicators or conscientious work, it is possible to develop a point system of criteria and factors. For each task completed or goal achieved, a point is awarded. At the end of the quarter, the total amount of accumulated points and their value are determined, depending on the wage fund.

Recommendations for commercial organizations

For commercial structures, bonus rates are somewhat different. Here the employer has the right to establish a direct link with the quantitative or qualitative indicators of the business:

- for quality indicators, for example, employees of the sales department, you can set a quarterly incentive for fulfilling the sales plan by 100% or more;

- for quality indicators, for example, employees of the accounting department and human resources department are often paid a monthly bonus for timely submission of reports, compliance with cash and contractual discipline, and successful completion of inspections.

It is important to describe the terms and principles of accrual in as much detail and clearly as possible. The more detailed the procedure for how the quarterly bonus is calculated, the fewer problems with calculations.

Is everything so simple with bonuses to management?

Let us remind you that when assigning a bonus to employees, a corresponding order from the head of the organization is required. But this rule does not apply when it comes to remuneration for the general director and this is due, first of all, to his special legal status.

In a company where the general director is not its sole founder, payment of a bonus cannot be made only on the basis of his order (Part 2 of Article 135, Article 191 of the Labor Code of the Russian Federation). This is due to the fact that this issue is regulated simultaneously by labor law and the norms of corporate legislation (part 2 of article 145 of the Labor Code of the Russian Federation, paragraph 4 of article 40 of Federal Law No. 14-FZ “On Limited Liability Companies”). Therefore, the amount of remuneration for the general director, including bonuses, is determined by agreement between him and the founders, the board of directors (supervisory board) of the company, and the decision to pay the bonus is made on the basis of the minutes of the general meeting of participants (shareholders) of the company, or on the basis of a decision of the board of directors or supervisory board advice.

In the case of an employment relationship between the general director, who is also the sole founder, and the organization, expenses associated with the payment of wages are taken into account according to the general rule (clause 1 of article 255 of the Tax Code of the Russian Federation, clause 6 of clause 1 of article 346.16 of the Tax Code of the Russian Federation).

But it is important to remember that the bonus was provided for in the employment contract, otherwise such payments do not reduce the taxable base for income tax (letter of the Ministry of Finance of the Russian Federation dated October 13, 2015 No. 03-03-06/1/58416, clause 21 of Article 270 of the Tax Code RF). The criteria for bonuses can be agreed upon jointly with the personnel service based on the activities of the enterprise, and the decision on payment in any case is made on the basis of the minutes of the general meeting of participants (shareholders) of the company, or on the basis of a decision of the board of directors or supervisory board.

It follows from this that the general director of the organization, who is also its sole founder, does not have the right to single-handedly calculate and pay wages, as well as make bonus payments. Consequently, the organization does not have the right to take such expenses into account for tax purposes (letter of the Ministry of Finance of the Russian Federation dated February 19, 2015 No. 03-11-06/2/7790).

Personal income tax and insurance premiums

Regardless of the taxation system that the organization uses, for the amount of the bonus based on the results of work for the year, accrue:

- contributions for compulsory pension (social, medical) insurance (Part 1, Article 7, Article 9 of the Law of July 24, 2009 No. 212-FZ);

- contributions for insurance against accidents and occupational diseases (clause 1 of article 5, clause 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

This rule applies regardless of whether the bonus is provided for in the employment contract or not.

The amount of the annual bonus is included in the tax base for personal income tax (subclause 6, clause 1, article 208 of the Tax Code of the Russian Federation).

Situation: in what month should the amounts of annual bonuses be included in the personal income tax base - in the month of accrual or in the month of payment?

The amount of the premium will be included in the personal income tax tax base of the month in which it was paid.

For the purpose of calculating personal income tax, bonuses accrued for a period of work of more than a month (including annual ones) cannot be classified as labor costs. This conclusion can be made on the basis of paragraph 2 of Article 223 of the Tax Code of the Russian Federation. It states that the date of receipt of income in the form of wages is the last day of the month for which the income is accrued. And these bonuses are accrued for a period exceeding one month. Consequently, in this case, the date of receipt of income is the day of payment (transfer to the employee’s account) of the bonus (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Make an entry for tax withholding at the time of payment of the premium.

The Ministry of Finance of Russia adheres to a similar position regarding determining the date of receipt of income in the form of bonuses (letters dated March 27, 2020 No. 03-04-07/17028, dated November 12, 2007 No. 03-04-06-01/383).

Situation: is it necessary to charge insurance premiums on the annual bonus paid to an employee who has already resigned? The employee has completed the bonus period (year).

Yes need.

The fact is that insurance premiums are levied on payments accrued to an employee within the framework of an employment relationship. An annual bonus accrued to a person for the period that he worked in the organization is considered a payment within the framework of an employment relationship, since during the bonus period such a relationship still existed. Therefore, even though the employee quit, the annual bonus paid to him after dismissal is subject to insurance premiums in the generally established manner .

This conclusion follows from Part 1 of Article 7 of the Law of July 24, 2009 No. 212-FZ, paragraph 1 of Article 20.1 of the Law of July 24, 1998 No. 125-FZ and is confirmed by the letter of the Ministry of Labor of Russia of September 2, 2013 No. 17-3 /1450.

The procedure for calculating other taxes depends on the tax system that the organization uses.