Property tax at cadastral value for legal entities

This year, taxpayers are individuals and legal entities that own property that is subject to tax in accordance with the current legislation of the Russian Federation.

For legal entities registered on the territory of the Russian Federation, the object of calculating property tax will be all property on the balance sheet of a legal entity as fixed assets, regardless of whether this property is movable or immovable.

Attention! At the same time, the tax base includes not only property owned by a legal entity by right of ownership, but also:

- objects of property that a legal entity owns on the basis of a power of attorney,

- objects of property received by a legal entity for temporary use,

- property objects that are part of the joint activities of a legal entity with other persons,

- if a legal entity is a concessionaire, then the tax will be imposed on the property transferred under the concession agreement.

It is worth noting that in accordance with Part 4 of Article 374 of the Tax Code of the Russian Federation, certain property items that are on the balance sheet of legal entities as fixed assets are not subject to property tax.

In addition, legal entities that are payers of the unified agricultural tax are exempt from paying property tax.

This year, in accordance with the norms enshrined in Article 378.2 of the Tax Code of the Russian Federation, legal entities that have certain real estate objects on their balance sheet as fixed assets will have to pay property tax based on the cadastral value of these objects.

Please note! These objects include:

- business, office and shopping centers and equivalent real estate,

- non-residential premises that can be used as offices, retail establishments, as well as catering and consumer services establishments,

- all objects of real estate of foreign legal entities that do not have branches on the territory of the Russian Federation,

- residential real estate owned by legal entities that are not listed on the balance sheet as fixed assets.

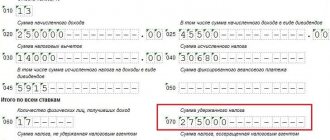

The period for calculating property tax is a quarter. At the end of the reporting period, the legal entity makes the appropriate payment to the budget and submits an advance payment calculation to the territorial body of the Federal Tax Service. At the end of the year, a legal entity submits a tax return.

This year, the form for calculating advance payments and the form of the tax return for property tax was approved by order of the Federal Tax Service dated January 31, 2017 No. ММВ7-21/ [email protected] On approval of forms and formats for submitting a tax return for property tax of organizations and tax calculation of advance payment for property tax of organizations in electronic form and procedures for filling them out.

This declaration displays the property tax based on the cadastral or book value. Property tax is one of the regional taxes. The executive authorities of a constituent entity of the Federation establish a specific property tax rate.

Cadastral value of a land plot by cadastral number

Read about who calculates land tax here.

How to get a double tax deduction, read the link: https://novocom.org/otvety-na-voprosy-chitatelej/mozhno-li-poluchit-dvojnoj-vychet-invalidu-chernobylcu.html

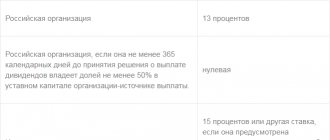

At the same time, the property tax rate approved by the subject of the Federation cannot exceed the maximum rate of this tax established in the Tax Code of the Russian Federation.

This year, the maximum possible property tax rate, calculated based on the cadastral value of this property, is 2%.

In practice, this means that each subject of the Federation can set a property tax rate ranging from 0 to 2% of the cadastral value of this property. The current property tax rate for any subject of the Federation can be found in the reference information section on the official website of the Federal Tax Service on the Internet.

Important! If in the territory of a constituent entity of the Federation there is a practice of paying property tax not quarterly, but once a year, then calculating the amount of tax based on the cadastral value of the property is quite simple.

To do this, you will need to multiply the cadastral value of the property, calculated as of January 1 of the current year, by the tax rate established in the subject of the Federation.

If, on the territory of a constituent entity of the Federation, property tax is levied quarterly, then the calculation will become somewhat more complicated and will be made according to the formula: tax amount for the current year = cadastral value of property as of January 1 of the current year X tax rate advance payments made in the I-III quarter .

The amount of the advance payment for property tax is calculated using the formula: advance payment = cadastral value of the property as of January 1 of the current year X tax rate / 4.

Let's try to understand the procedure for calculating property tax based on the cadastral value of this property using a specific example.

The limited liability company Rog i Kopyta has a small office building on its books as fixed assets. The cadastral value of this building as of January 1 of this year is 15,250,000 rubles. The property tax rate in the subject of the Federation in which this office building is located is 2%.

| Reporting period | Tax calculation | Tax amount, rub. |

| I quarter | 15,250,000 X 2% / 4 | 76 250 |

| II quarter | 15,250,000 X 2% / 4 | 76 250 |

| III quarter | 15,250,000 X 2% / 4 | 76 250 |

| Year | 15,250,000 X 2% 76,250 76,250 76,250 | 76 250 |

If the property has not been on the balance sheet of a legal entity since the beginning of the year, then when calculating property tax based on the cadastral value of this property, it will be necessary to take into account the ownership coefficient.

To calculate the property ownership ratio, the following formula is used: coefficient = the number of full months during which the property is on the balance sheet of a legal entity as fixed assets / number of months in the reporting period.

A month is considered complete only if the property was placed on the balance sheet of a legal entity in the period from the 1st to the 15th of this month. If the balance was placed after the 15th day, then this month is not taken into account.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Example

Limited Liability Company Horns and Hooves acquired a shopping center and put it on its balance sheet as fixed assets on February 3 of this year. The cadastral value of the shopping center is 25,500,000 rubles. In the subject of the Federation on whose territory this shopping center is located, the property tax rate is 2%.

| Reporting period | Tax calculation | Tax amount, rub. |

| I quarter | 25,500,000 X 2% / 4 X 2/3 | 85 000 |

| II quarter | 25,500,000 X 2% / 4 | 127 500 |

Who should pay

Please note! Payers of property tax are legal entities that have movable or immovable property on their balance sheet as fixed assets. A complete list of property items that make up the tax base is contained in parts 1-3 of Article 374 of the Tax Code of the Russian Federation.

Based on the norms enshrined in this article, property can not only be the property of a legal entity, but also be transferred for temporary use, used on the basis of a power of attorney, received under a concession agreement, or included in joint participation.

For foreign legal entities with representative offices in Russia, the tax base consists of movable and immovable property included in the balance sheet as fixed assets, provided that this property is owned by the legal entity or received under a concession agreement.

For foreign legal entities that do not have representative offices in Russia, the tax base consists of real estate objects owned by this legal entity or received under a concession agreement.

How to draw up a general power of attorney to represent the interests of a legal entity?

How to calculate payment

There is a special service on the Federal Tax Service website where you can easily calculate the amount of the fee.

How to use the service:

- Enter the cadastral number of the property. If you don’t know the number, no problem, the link will take you to the Rosreestr portal. You can find out more information there.

- The system will display relevant information about the property.

- Specify information: enter the amount of debt, indicate information about the availability of benefits, indicate the tenure period.

- The system will answer how the contribution is calculated based on the information received.

If you have any questions, please contact the Federal Tax Service.

https://youtu.be/NpM2A5TbloQ

How to calculate

The Federal Tax Service calculates property taxes for individual entrepreneurs and sends out appropriate notifications. Legal entities are required to calculate property tax independently. In most cases, property taxes are paid quarterly, in so-called advance payments.

Calculation for the quarter is carried out using the following formulas:

- based on average annual cost. Advance payment = average annual cost of fixed assets for the reporting period X tax rate / 4,

- based on cadastral value. Advance payment = cadastral value as of January 1 of the reporting year X tax rate / 4.

It should be noted that the calculation of property tax for separate divisions of a legal entity is carried out according to the tax rate established in the subject of the Federation where this separate division is registered.

Property tax for individuals

Remember! Property tax is required to be paid not only by individual entrepreneurs and legal entities, but also by individuals who own:

- residential real estate objects,

- garages or parking spaces,

- various real estate complexes,

- objects of unfinished construction.

It is worth noting that residential real estate also includes buildings intended for seasonal residence and erected on plots intended for dacha or personal subsidiary plots.

Thus, country houses are also subject to property tax. But common property in multi-apartment residential buildings is not subject to property tax.

Watch the video. How is real estate tax calculated based on cadastral value:

https://youtu.be/UUsmvY0r71Y

Tax calculation for individuals based on cadastral value

The calculation of the tax on an individual's real estate property, based on the cadastral value, is made using the following formula: Tax = (cadastral value, tax deduction) X share size X tax rate.

The cadastral value of a residential property can be found in the Federal Service for State Registration, Cadastre and Cartography.

For a residential property such as an apartment, the tax deduction is 20 m2. Let us note that the authorities of municipalities, as well as federal cities, have the right to provide citizens living on the territory of these entities with a larger tax deduction.

In a situation where the cadastral value of a residential property is a negative value, for calculating property tax, the cadastral value of this property is equal to 0.

If a residential property is owned by several citizens on the basis of shared ownership, then for each owner the tax is calculated separately, based on the share owned by him.

If a residential property is owned by several citizens on the basis of joint ownership, then the tax for each of these citizens is calculated in equal shares.

The current legislation of the Russian Federation has established the tax rate on residential real estate owned by citizens in the amount of 0.1% of the cadastral value of these objects.

Attention! Local governments, as well as authorities in federal cities, are given the right to reduce or increase this rate. In this case, the maximum possible rate is 0.3%.

Let's look at a specific example. The object of taxation is 1/2 of the apartment belonging to citizen Ivanov. The area of the apartment is 55 m2. The cadastral value of the apartment is 2,200,000 rubles.

The cadastral value of 1 m2 is 40,000 rubles. The amount of tax deduction will be 800,000 rubles (calculated: 20 X 40,000). In the subject of the Federation where the apartment is located, the property tax rate is 0.1%.

Now let’s calculate the amount of tax for citizen Ivanov:

(2,200,000,800,000) X 0.5 X 0.1%. The tax amount will be 700 rubles.

Challenging the cadastral value of land.

Share of apartment and household property

If apartment or house ownership is registered on a shared basis, then the moment of calculating the apartment tax will be made for each owner separately.

If the share size is not allocated, it will be determined by dividing the total area by the number of owners. For example, an apartment has an area of 55 square meters. It is registered to several owners. The cadastral price is 5 million rubles, and the inventory price is 400 thousand rubles.

First you need to find out the cost from the Cadastral database. For 1 square meter 90909 rubles. Next, you should determine the footage in order to establish the tax base from the price according to the Cadastral base. Reduce the total apartment area by 20 square meters. The calculation is obtained for 35 square meters. Then you need to calculate the tax amount based on the cadastral price. Multiply 35 square meters by 90909, 0.1% and divide everything by 100%. The result will be 3181.82 rubles.

Next, you need to find out the tax calculated from the cost of inventory. Five hundred thousand rubles multiplied by 0.2% and divided by 100%. Equal to 1000 rubles.

Apply the ratio and calculate the property tax. It will be equal to 2745.45 rubles. Divide by several owners and get an amount of 1372.72 rubles. The home owner must pay this amount.

To pay taxes for 2020, you need to remember not to use a reduction factor. Tax transfers must be made in full. Each owner must transfer a tax in the amount of 3181.82 rubles to the budget.

Tax benefits

The current legislation of the Russian Federation has provided tax benefits to many categories of citizens. This benefit is expressed in exemption from taxes on property of individuals. However, tax exemption can only be obtained for one object from each category.

Preferential categories include citizens with disabilities of group I or II, as well as citizens who are disabled from childhood.

In addition, property tax benefits are available to:

- Heroes of the Soviet Union and Heroes of Russia, as well as full holders of the Order of Glory,

- participants in the Civil and Great Patriotic Wars, as well as participants in other military operations aimed at protecting the Soviet Union, from among citizens who served in active military service in the ranks of the active army or were in partisan detachments,

- citizens who, during the Great Patriotic War, belonged to the civilian staff of units and units of the active army, internal affairs bodies and state security,

- citizens who took part in the defense of populated areas during the Great Patriotic War and received the right to a preferential pension,

- citizens who performed international military duty in Afghanistan and other places,

- combat veterans,

- citizens affected by radiation disasters, including the accident at the Chernobyl nuclear power plant,

- citizens who took part in the testing of atomic and nuclear weapons and eliminated the consequences of these tests,

- pensioners,

- citizens who have served in active military service for over 20 years,

- family members of citizens who served in military or civil service and died in the line of duty,

- citizens of creative professions who carry out creative activities in specially equipped premises,

- other categories of citizens.

We emphasize that a citizen must independently declare the right to receive benefits. To do this, you will need to contact the territorial division of the Federal Tax Service and write an application for a benefit, attaching documentary evidence of the right to receive this benefit.

Important! An application for the benefit and, if necessary, for choosing an object to which the benefit will apply must be submitted before the first of November.

Benefits for Russian citizens

Benefits are given to Russian and Soviet heroes, disabled people of the first and second groups, pensioners, WWII veterans and persons equivalent to them. They are also provided to combat veterans, liquidators and victims of the Chernobyl nuclear power plant, active and retired military personnel, families of officers and soldiers.

Who else can avoid paying property taxes? Also included in the preferential category are old-age pensioners and persons who took part in nuclear weapons tests.

https://youtu.be/WKgSESSETj0

Notification from the Federal Tax Service

The Federal Tax Service sends notifications to citizens about the need to pay property tax and the calculation of this tax. This documentation is sent by post to the address at which the citizen is registered.

The documentation contains information about the object of taxation and the tax base. This documentation also provides a calculation of the tax amount and indicates by what time the citizen must pay this tax.

Practice shows that citizens receive tax notices from May to November. The notification must reach the citizen no later than 30 calendar days before the date on which the tax must be paid.

What should a citizen do if he has not received a notification from the Federal Tax Service?

Until recently, such a situation actually exempted a citizen from the obligation to pay taxes. But, unfortunately, such an opportunity to optimize the tax burden was eliminated.

Many citizens still continue to believe that failure to receive a notice exempts them from the obligation to pay tax. This misconception is dangerous and can lead to unpleasant consequences.

Back in April 2014, changes were made to the Tax Code of the Russian Federation, according to which a citizen who has not received a notification from the Federal Tax Service about the need to pay property tax is obliged, no later than December 31 of the year following the year of acquisition of the property, to contact the territorial division Federal Tax Service and declare the property he owns, providing documentation confirming this right.

Property tax for individuals.

Basic moments

Tax officials make calculations and send them to citizens. Notice is sent thirty days before the fee is due. It indicates the tax base, type of real estate, as well as the amount to be paid.

Therefore, you don’t have to do the calculations yourself. The procedure is established by Art. 52 of the Tax Code. But this does not mean that you do not need to know how tax is calculated. After all, the amount indicated in the notice by tax inspectors may be overestimated. Inspectors may overlook important information or make simple calculation errors.

https://youtu.be/oHQCqOgNeKQ

Payment procedure and terms

Property tax for individuals belongs to the category of local taxes and is transferred to the budget of the subject of the Federation in whose territory the property is located.

This year, citizens can pay the property tax for individuals until the first of December. This period is the same for all regions.

A citizen who fails to pay taxes on time will be charged a penalty. For each day of delay in tax payment, penalties will be charged in the amount of 1/300 of the key rate established by the Central Bank on the day the delay occurred.

In addition, the Federal Tax Service can compulsorily collect tax from a citizen by sending a corresponding notification to the employer, banks in which the citizen has accounts, and so on. In addition, the right of a citizen who has arrears in paying taxes to travel outside the Russian Federation may be limited.

Please note! There are many ways to pay property taxes these days. Many of these methods allow a citizen to pay taxes online without even leaving home.

https://youtu.be/DKHUO1U-EeM