Opening an inheritance case to obtain a certificate

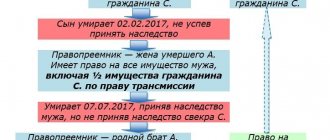

After the death of the testator, an inheritance case must be opened. To do this, the legal successors of the deceased need to notify the notary office at the place where the inheritance was opened. The case is opened at the last place of residence of the testator . Those wishing to accept an inheritance submit an application to accept the inheritance.

Then a six-month period must pass. Before this time, the notary will not issue a certificate of the right to inheritance under a will.

At any moment, other legal successors may appear, the existence of whom the heirs under the will did not know. During this six-month period, you can submit the missing papers, according to which the notary will have time to make inquiries to the relevant authorities regarding the ownership of the property by the deceased.

Important! A deed of title for an inherited estate is issued earlier than 6 months, but if it is known for sure that there are no heirs who can claim their rights (clause 2 of Article 1163 of the Civil Code).

Obtaining a certificate of inheritance

A certificate of inheritance by will is issued on the basis of an application for acceptance of the inheritance and issuance of a title document , which is submitted by the successor. It should be noted that this is a right, not an obligation, of the heir to whom the property is bequeathed.

If there are several heirs, then each of them must submit such an application. Moreover, this can be done either simultaneously or separately at different times. The notary will issue a document only for part of the inherited property.

A certificate of the right to inheritance under a will is a document of title to the property of the testator.

This paper confirms the ownership of the new owner. Without it, a person will not be able to fully dispose of property.

If a property is transferred by will, then the rights to it must be registered with Rosreestr. Based on the deed of title issued by the notary, information about the transfer of ownership is entered into the unified state register of real estate.

Form of certificate of right to inheritance under a will

The form of the document was approved by Order of the Ministry of Justice of the Russian Federation No. 313 on December 27, 2016. In case of issuance of inheritance under a will, the notary issues to the legal successors a notarial deed in form No. 3.2.

The document contains the following information:

- place of performance of the notarial act;

- date of;

- information about the notary;

- information about the existence of a will;

- testator;

- information about inherited property (description of the object and its characteristics, presence of encumbrances, testamentary refusal);

- number of the inheritance file;

- registration number;

- amount of state fees and notary services;

- signature and seal of the notary.

A certificate of inheritance by will is issued on a special notarial form that has certain degrees of protection.

Fee for issuing a certificate of inheritance by order of the testator

The Tax Code (Article 333.24) provides for the payment of a fee for obtaining a notarial deed of title.

The amount of state duty depends on the degree of relationship between the testator and heir.

The payment amount will be:

- 0.3% of the value of property (not more than 100 thousand rubles) - for children, spouse, parents, brothers, sisters;

- 0.6% of the value of the property (no more than 1 million rubles) – for other persons.

To calculate the payment, the cadastral value is taken. Cadastral valuation is carried out every five years, so information about the value of the property may change. Information about it is contained in the real estate register.

The fee is paid before the issuance of a certificate of inheritance under a will. This is a mandatory payment that is made to the state budget. Each heir pays the fee on his own behalf. Additionally, the notary will charge a fee for his services, this amount is determined by the notary office.

When preparing documents with a notary , such categories of citizens as Heroes of the USSR and the Russian Federation, full holders of the Order of Glory are exempt from paying the fee To confirm your preferential category, you must have the appropriate identification with you.

Issuance of documents for inherited property after six months

It is possible to obtain a certificate of the right to inheritance under a will even after the expiration of the period for accepting the inheritance.

There are several options available:

- restore the missed deadline;

- recognize the right to the testator's property in court;

- recognize the heir as having entered into the inheritance by submitting an application to a notary.

If the inheritance has actually been accepted by the heir, you can receive the title document after the established period.

Procedure for issuing a certificate of inheritance

Requirements for registration and issuance of documents, features of the procedure

- a certificate of the right to inheritance is issued at the place of residence of the testator;

- the document must be in writing and notarized. Oral form is not acceptable;

- Errors and inaccuracies in the text of the document are not allowed. If there are errors in the information about the recipient of the certificate or in the information about the inherited property (incorrect indication of the amount of the testator's monetary contribution, his pension, errors in the details of the agreement confirming the right to lease a land plot and other shortcomings), the validity of the document can be challenged in court by the claim of interested parties ;

- the document is issued to the heirs by law or by will after six months from the opening of the inheritance;

- in case of loss of the certificate, the notary issues a duplicate;

- the certificate must contain adequate information about the property;

- the document is issued at the request of interested parties;

- at the request of the heirs, one document may be issued listing the shares of each heir and indicating which objects were transferred to which of them, or several - for each heir separately.

Who and how can obtain a certificate of inherited property

The heir himself can receive a document on the right of inheritance under a will in person or by sending his application by mail.

To confirm your rights to inherited things you must present:

- identification document;

- will.

And if the deceased and the heir were related, then documents are also submitted indicating the presence of a family relationship between the parties.

Thus, in order to issue a certificate, the notary must be provided with indisputable information: about the fact of the death of the testator, the time and place of his death, the grounds for inheritance, the composition of the inheritance mass and the facts of accepting the inheritance in a legal way.

Receive a certificate of inheritance through a representative or by mail

If for one reason or another the heir cannot independently notify the notary’s office and receive a notarial deed, it is possible to do this through a representative or by mail.

First, you need to draw up a power of attorney , which states the powers of the trustee to represent interests in matters of registration of inheritance in the notary authorities and/or other bodies and institutions. If the application is submitted by mail, you must confirm your signature accordingly.

Suspension of the issuance of a certificate to an heir under a will

However, notaries very rarely issue a certificate of the right to inheritance under a will before the due date. On the contrary, in some cases, the issuance of a certificate may be suspended by a notary to request additional documents or by a court decision if there is a dispute between the heirs or if one of the heirs has not yet been born.

The notary is obliged to suspend the procedure for issuing a certificate:

- upon receipt of documents from the court indicating that the judicial authority has received an application from an interested person challenging the right to the inheritance;

- by a court decision if there is such an indication (for example, when making a ruling on securing a claim);

- in the presence of a nasciturus - a conceived but unborn heir.

Thus, the issuance of a certificate is postponed in cases prescribed by law. In addition, receipt of the document is delayed if the notary requires additional information to draw up the title document.

Refusal to issue a certificate of inherited property under a will

In some cases, a notary may refuse to issue a certificate.

The reasons for this may be:

- lack of a complete package of documents;

- unreliability of data in the provided documents;

- missing the deadline established by law for accepting an inheritance;

- the inheritance case has already been opened with another notary;

- the notary was approached by an improper heir (the person is not indicated in the will or is excluded from inheritance);

- there is a dispute between the heirs.

The notary issues a resolution on the refusal to perform notarial acts. The heir has the right to appeal it in court.

Important! An inheritance certificate is not issued if a court decision recognizes the successor as having accepted the testator's property, and the shares of the heirs are determined in a judicial act. In this case, the inheritance case opened with the notary is terminated.

Obtaining a certificate of right to inheritance under a will

Citizens have the right to clarify the rules for issuing and the procedure for registering a certificate, what documents are required, get acquainted with the existing requirements on the website of the Federal Notary Office, study government orders and norms of the Civil Procedure Code. (Art. 1162-63).

Validity

A certificate of the right to an identified inheritance is issued to heirs both by will and to heirs by law. It does not provide for a limited period of validity. In addition, the “burning out” of property rights is impossible, since information on each certificate is displayed in unified registers. When distributing an inheritance, a notary or court must take into account the claims of each person who has the right to receive a share by law and by will.

Deadlines for issuance (not the validity period of the certificate of rights to an established inheritance):

- 6 months from the date of opening of the inheritance;

- before this period has passed, upon presentation of evidence that there are no other applicants for the inheritance other than those who applied.

The issuance of a certificate can be canceled or abandoned by the judge’s resolution, regardless of the deadline (if a claim is initiated), as well as if the fact of the conception of an heir (but not yet born) is revealed. In the latter case, the procedure is postponed until the birth of another heir.

Form

The certificate has a standard form (colored form on an A4 size sheet). It is impossible to issue it yourself (exceptions include cases of fraudulent actions by citizens for forging certificates).

In addition to its unique appearance, unified by law, the certificate includes registration information (numbering consisting of alphabetic and digital designations) and does not imply a validity period.

Heirs should not think about how the certificate is drawn up, since this action is carried out for them by a notary. But in order to avoid mistakes on the part of a legal entity due to non-compliance with established standards, it is still recommended to pay attention not only to the deadlines, but also to the rules of registration and format of the certificate.

Sample

The text of the certificate describes the existence of the specified right of a specific person to a part of the inheritance mass on a testamentary or legislative basis. It also provides information about the notary who drew up the certificate form and the pricing for the actions he performed. The form contains a notarized certificate and an office stamp.

In accordance with the order of the Ministry of Justice of December 2021 No. 313, a sample certificate of civil right to inheritance under number 3.1 presupposes:

- The name is in the middle of the form.

- A text block with the following information: place and date of the notarial act, full name of the notary and his place of work, link to the law, full name of the heir and his type of right, full name of the testator with the date of death of the latter, list of inheritance: apartments, cars, land, etc. . (indicated in the certificate according to the will).

- The certification part includes: the number of the inheritance case and its registration in the register, the amount of the state duty paid, as well as the deadlines for filling out and the signature of the registrar.

The certificate is drawn up on ready-made forms made of thick paper with the image of the coat of arms of Russia at the top of the page. Independent production of such forms is not allowed, as it may be classified by state executive authorities as a criminal act. The rules for forming text should be taken into account when checking for compliance with standards.

Sample certificate of inheritance right

Size: 12 KB

Disposal of inheritance on the basis of a certificate

Often, heirs are faced with the fact that after registering property in their name, difficulties arise in managing and using it. The fact is that the testator could distribute the shares of each heir in the will, or bequeath the entire property to several persons without designating shares.

The following situations are possible:

- if the shares are determined during inheritance, then the property passes to the legal successors as shared ownership. Everyone has the right to dispose of their share at their own discretion;

- if parts of the property are not determined, then the property becomes joint ownership. It can be disposed of with the consent of all co-owners.

The heir has the right to sell, donate, exchange, lease, or pledge his part. However, there are some nuances. In case of shared ownership, the sale of a share of the property is possible subject to the rule of pre-emption . This means that the first thing you need to do is offer to buy it out to the co-owners. If none of them wants to buy a part, then it can be sold to others.

If the property is owned by joint ownership, then all transactions are made with the consent of all co-owners . If only one heir was indicated in the will, then he alone inherits and disposes of everything that remains after the deceased.

Actions of heirs after receiving a certificate of will

When a certificate of the right to inheritance under a will has been received, what the heirs should do next is determined depending on the type of property. It is also necessary to observe the order of inheritance of certain types of property.

Real estate

In accordance with Art. 131 of the Civil Code, the transfer of ownership of real estate to another person must be registered. The body that carries out registration is Rosreestr. The procedure involves entering information about the new owner into the electronic register.

Vehicles

In accordance with clause 4 of the General Provisions of Order of the Ministry of Internal Affairs No. 1001, when changing ownership, vehicles must be re-registered within 10 days. The relevant information is entered into the traffic police register.

Cash deposits, securities

After issuing a certificate of inheritance under a will, you must contact the bank where the deposit is kept or an account is opened in the name of the testator. It is enough to present this document for a bank employee to issue funds.

Please also note that after issuing a certificate of the right to inheritance under a will, the notary will send information to the tax authorities. This information is sent to government agencies no later than 5 days from the date of issuance of the title document.